813 words 5 minute read – Let’s do this!

Well hello there, it’s the 13th of April – 13 is a lucky number and this is exciting news. Our very own founder Brian Kempisty (BK) is a special guest on this weeks’ Logistics of Logistics podcast. I’m a huge fan of the work Joe Lynch puts into his podcasts and for BK and Port X Logistics to be a part of his show is a huge honor. In this weeks’ episode BK talks about is drayage just drayage? I would love to go into details but instead show Joe and BK some listening love while they discuss a little Port X Logistics history and go into depth about drayage and transloading – past, present and future – listen here: https://www.linkedin.com/company/the-logistics-of-logistics-thelogisticsoflogistics-com-/

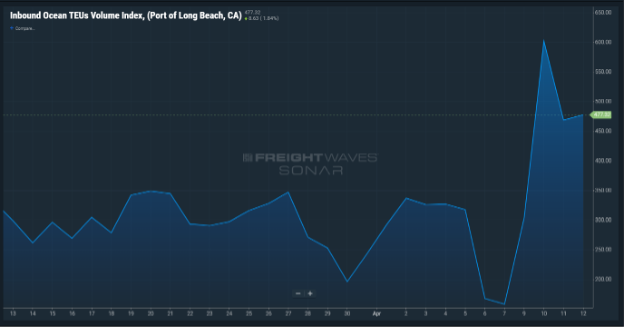

The ILWU called to delay work on Monday at most of the LA and Long Beach terminals after the union insisted ports be closed Thursday night and Friday morning for the Good Friday holiday, which is not recognized as a holiday under the current coastal wide contract. The contract battle is to be continued. By now I know you’ve listened to Joe’s podcast. Did you catch the part about the average salary of a longshoreman? Moving on…

Remember when the word “chassis” basically was the second definition of an internally flawless diamond? Chassis shortages were detrimental and costly and that was until just a few short months ago. The tables are turning – Some port and rail cities are now flooded with chassis. Volumes are slow, extra chassis were ordered to help try to mitigate congestion. Too many chassis can seem like an awesome problem to have. But how can this overabundance have a negative effect on the supply chain? Have you been noticing extra chassis charges lately due to drivers getting turned away by the chassis pool depots? Some Chassis pool depots inventories are at max. Yep, more charges. In a market where costs need to be trimmed and then trimmed down again, these extra chassis charges are a real frustration for shippers. And a little controversial “rumor” for you, chassis providers pay significantly less storage rent to the depot owners per day than they charge back to you. It’s a tough break for shippers that have high volumes in those chassis overflow areas. Steamship lines love money, and they’re pretty savvy at getting it anyway they can!

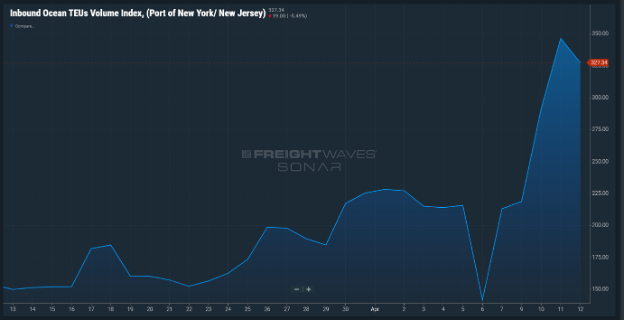

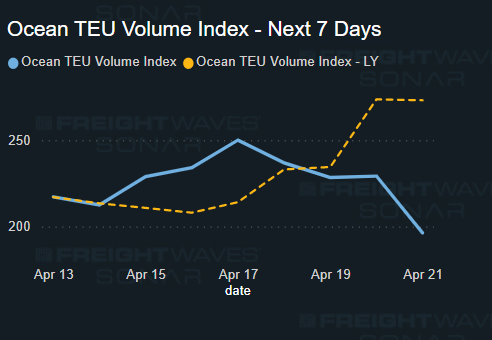

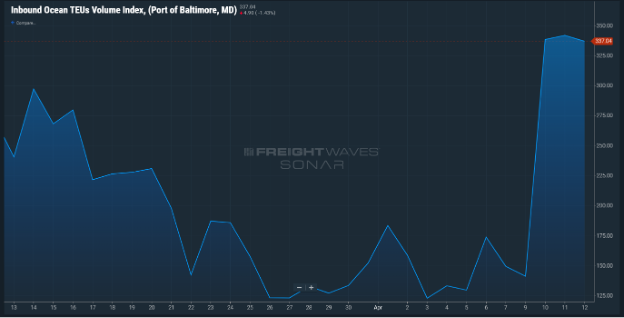

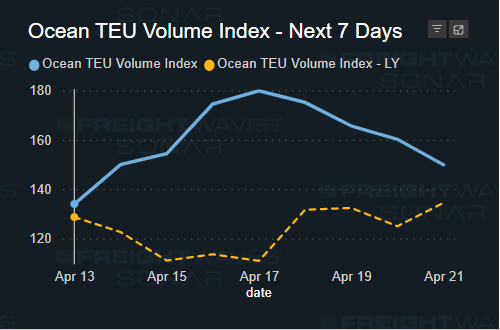

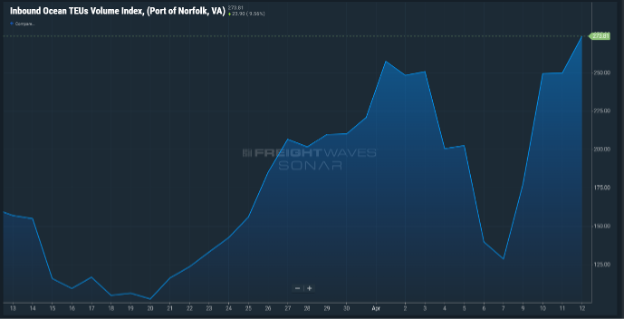

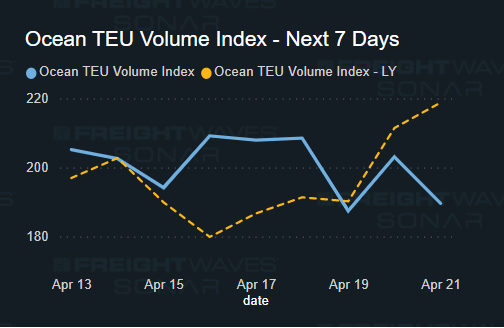

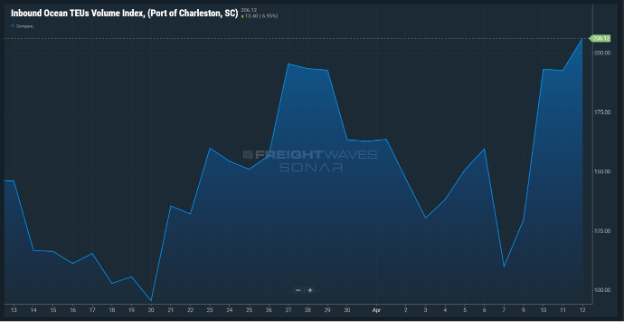

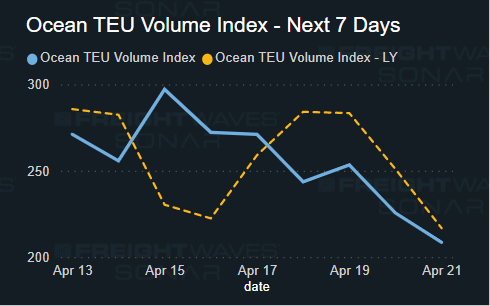

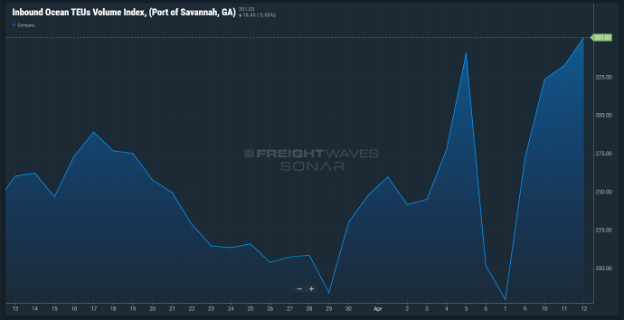

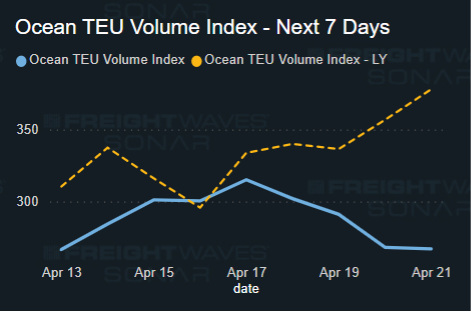

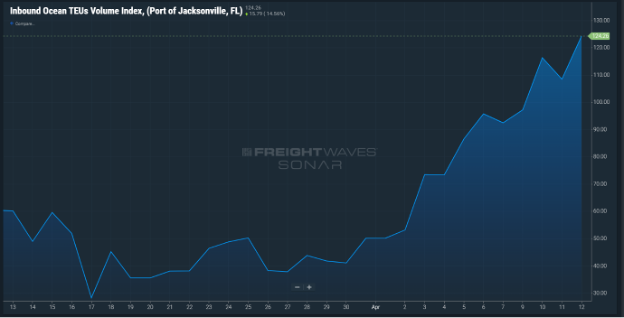

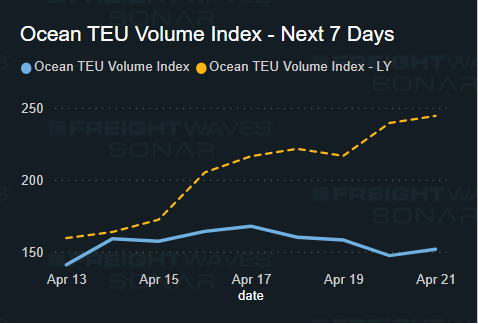

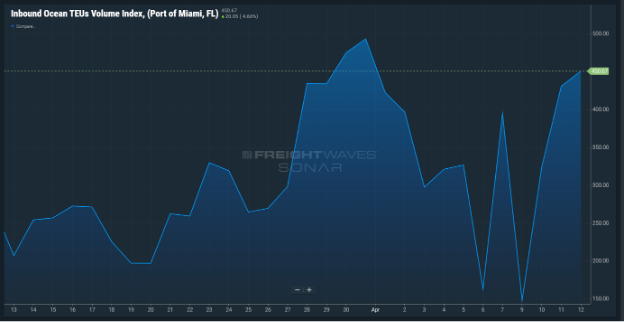

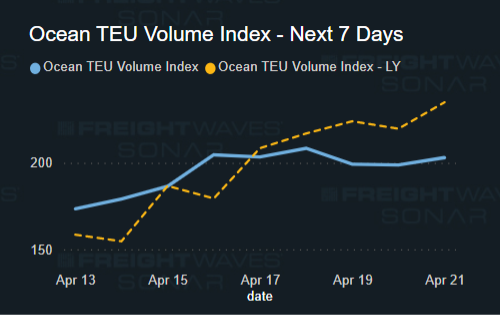

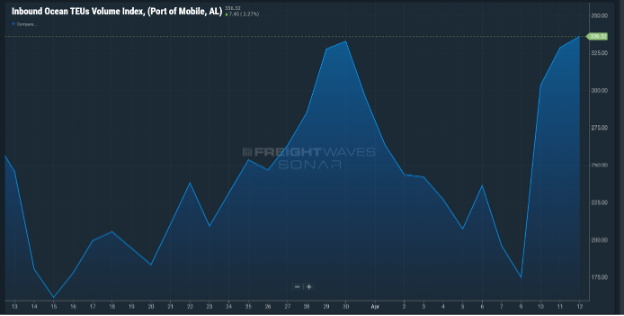

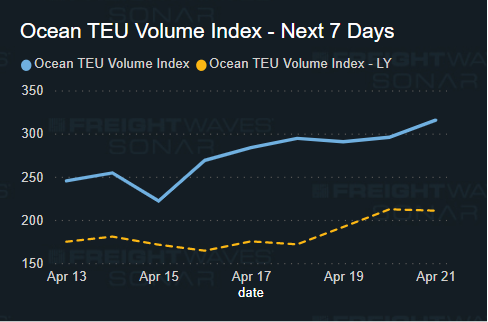

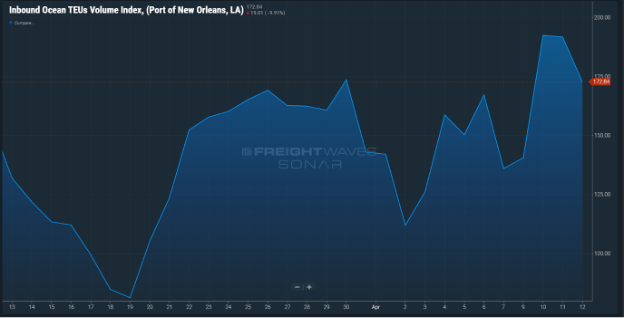

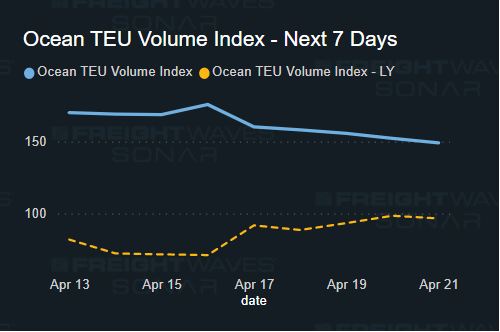

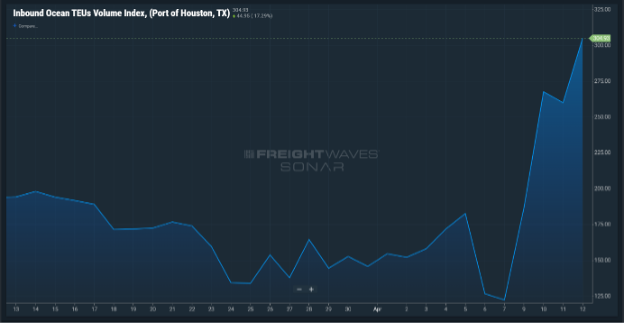

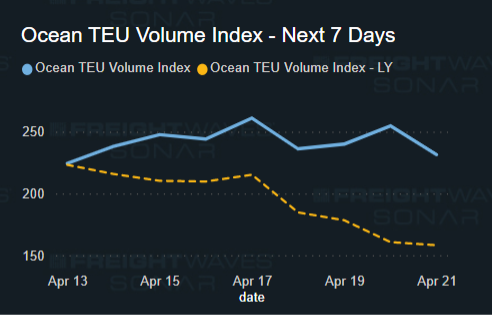

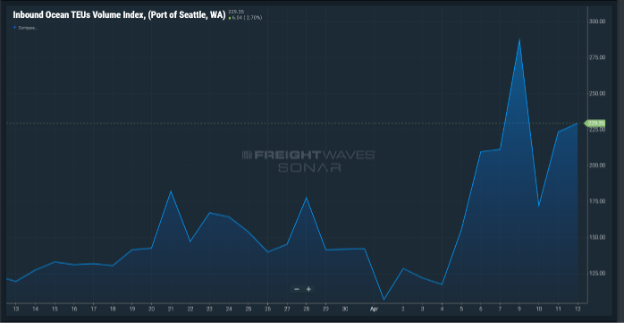

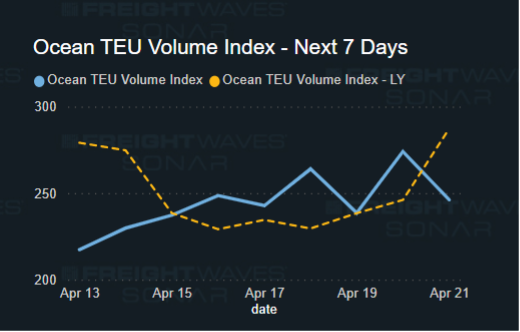

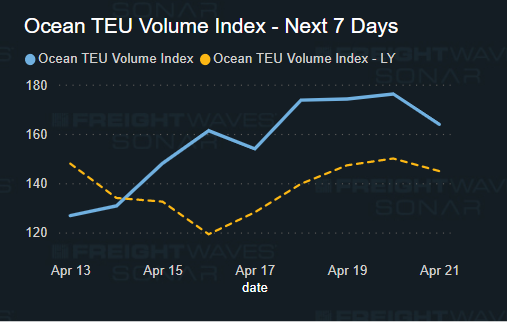

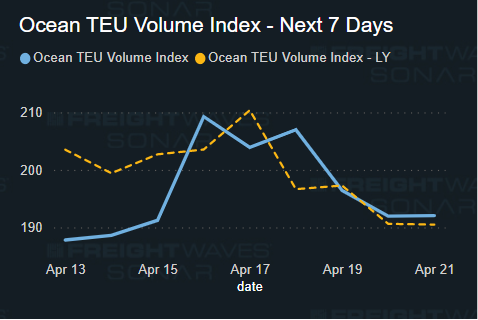

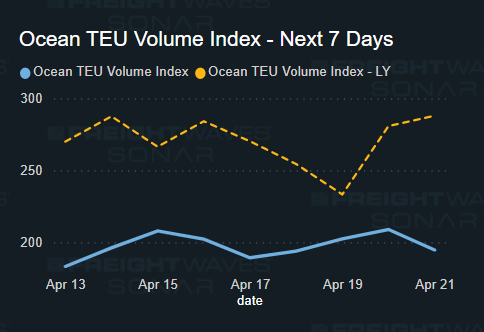

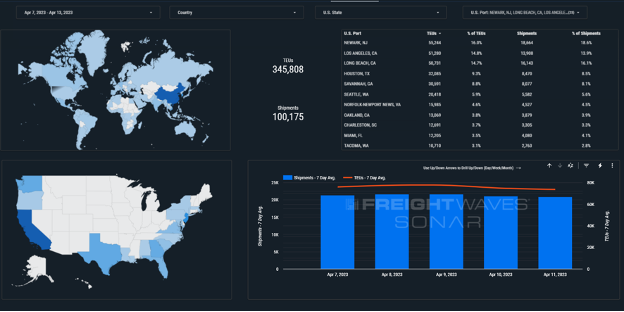

Import TEU volume is up 3.6% this week, it’s a mini win. We are approaching summertime and shippers will start to think about back to school and holiday inventories. What do you think the remainder of 2023 looks like for import volumes? I would love to hear your thoughts and predictions.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads

https://portxlogistics.com/port-rail-updates/

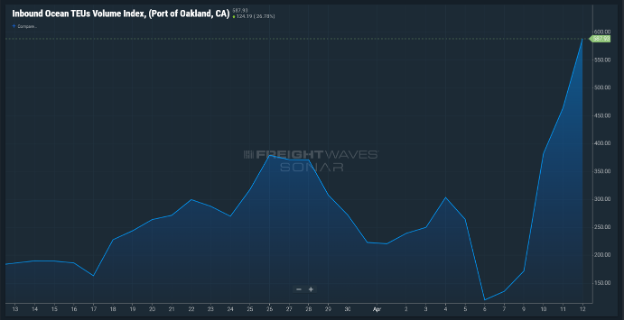

Highlight: A big Oakland headache. Carriers that are stationed within Port property were all served with an eviction notice a couple weeks ago. The notice states that all companies are required to move out within 30 days. We are not sure just yet if they are being strict on the 30-day time frame but it is for certain that carriers will be scrambling to find alternative space, just adding to the current woes of the current California drayage market – like the pending changes/challenges of AB5, and ongoing Labor contract negotiations. Our Oakland team is working through the pain and we are still moving containers daily If you need drayage coverage or have questions about the current state of the Oakland ports email our Oakland team at Oakland@portxlogistics.com

Chicago: Although there is not much exciting to report, I am currently in the ORD airport pulling the rest of the market update together. I hope to get some Chicago knowledge from our Chicago team this week AND we have drayage assets here as well. We can handle all your dry, reefer, non hazmat and hazmat containers in the Chicago area.

Did you know? We basically corner the market on Memphis drayage. Our Memphis operation is elite. Located adjacent to the Union Pacific, we have 50 company trucks, 100 privately owned chassis, a lift on site for grounding containers and 92 acres of secured storage. If you have any upcoming Memphis drayage volume projects we are confident that we will be the best choice for the job in all of Memphis. If you would like additional information or looking for capacity or rates contact letsgetrolling@portxlogistics.com We currently have unlimited capacity in Memphis capacity but there are forecasts for volume projects expecting to hit Memphis by the summertime. Let us show you more of what we got!

SONAR IMAGES