1651 words 5 minute read – Let’s do this!

We are less than one week away until May – A lot of interesting events are going on in Canada. You may think that issues at the Canadian ports or rails may not affect your U.S. bound containers but any port and rail congestion or closures in North American can and will trickle up or down. So take note of today’s topics, you will want to watch over these over the next few months, and remember to follow our LinkedIn page for industry news and email Marketing@portxlogistics.com if you would like these Market Updates sent to your inbox every Thursday.

Canadian Pacific Kansas City Ltd. is preparing for the possibility of a strike by some 3,300 workers next month. In February, CPKC and CN asked the federal labor minister to appoint a conciliator for the bargaining process over a new collective agreement for train conductors, engineers and yard workers. The notice of dispute started the clock on a possible strike or lockout, which could occur as soon as May 22nd. On Wednesday, CPKC reported its first-quarter profit fell compared with a year ago. The Calgary-based operator said it earned net income attributable to controlling shareholders of $775 million or 83 cents per diluted share for the quarter ended March 31. That is down from a profit of $800 million or 86 cents per diluted share a year earlier.

With 6,000 workers at rival Canadian National Railway Co. in talks with their employer as well, there is a possibility of two work stoppages at rail companies this spring, which combined could grind virtually all freight rail traffic in Canada to a halt.

Meanwhile, tense talks between Montreal port employers and the union representing some 1,200 dockworkers have stirred up more fears of yet another possible strike this spring. Longshore workers rejected an offer by management earlier this week, voting more than 99.5 per cent against the would-be deal. Workers have been without a contract since December of 2023 – they could strike as early as mid May.

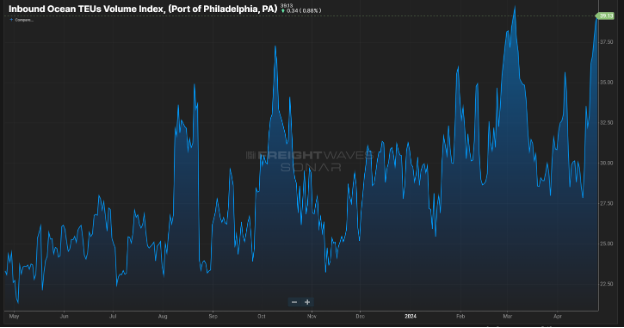

Mid-May (May 17th) is also the deadline given by the International Longshoremen’s Association (ILA) Union president to negotiate local port agreements for the U.S. East and Gulf ports. The current contract expires September 30th and Port disruption is at risk. ILA President Harold Dagget announced last November that union rank and file would not work beyond the contract expiration if a deal is not in place, which would be the first strike for the U.S. East and Gulf ports since 1977. In July, the ILA leadership pointed to the Great Lakes District of the union, which secured a 40% increase in wages and benefits for its new six-year contract. No definitive salary increase target has been made by the ILA.

ILA International president Harold Daggett has said he wants a good economic deal for his members, which includes union opposition to port automation and exclusive port contracts for its members. During a speech before union members in July 2023, Daggett vowed the ILA would not take a back seat to anyone. “It’s time for foreign companies like Maersk and MSC to realize that you need us as much as we need you,” he said.

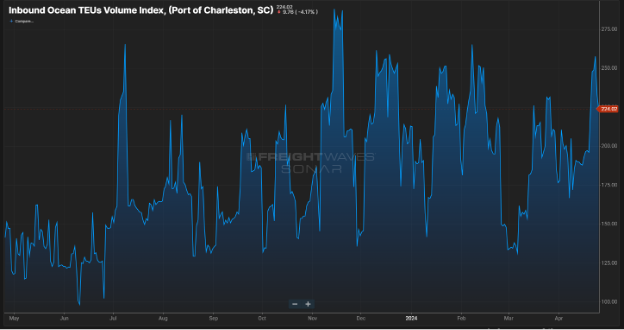

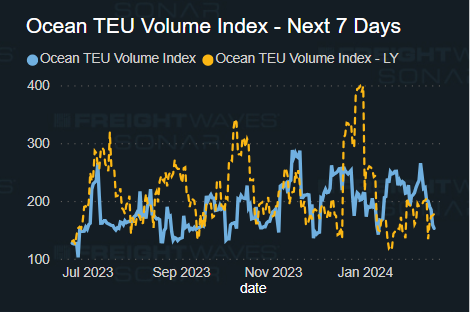

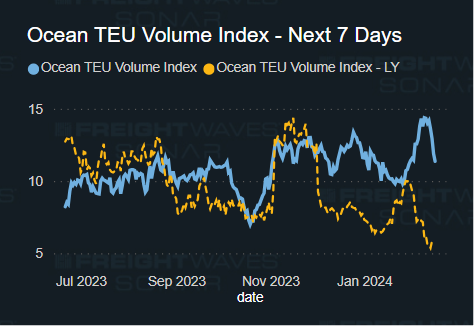

East Coast trade is slowing away from the ports in the meantime as a result of ongoing Panama Canal restrictions due to drought, the Red Sea diversions, and the threat of a strike. One of the strategies being suggested by logistics experts for their East Coast freight customers is to bring in containers for peak shipping season early, starting in June versus July. ILA negotiations in the past have not led to many major disruptions and some experts see no major changes to the normal pattern of West Coast trade. BUT the risk of a strike is always there.

How can you avoid a pending rail or Port strike? Diverting your cargo away from the rail and ports that are in jeopardy of stoppages amongst negotiations and choosing Drayage, transloading and trucking. Port X Logistics is the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com

CBSA (Canada Customs) are in a legal strike position. Plenty of time to divert the strike but nevertheless they have rejected the offers. Picket lines could go up as early as Mid May. Although deemed essential, CBSA cannot completely shut down as it would cripple the economy, but will work to rule and we would see long delays at the borders and paperwork processing delays.

Lastly British Columbia wildfires are already popping up which is affecting the main artery up in Prince Rupert. This is equating to slower than usual service and very limited rail cars at the DP World terminal up there. Similar to last year, fire activity is projected to be higher across Canada. The Canadian wildfire season is expected to be near to above average overall in terms of the number of fires and well above average in terms of the acreage burned. However, the numbers will be much less than those of the record-shattering season of 2023. There are concerns that air quality could be impacted periodically due to larger blazes that may break out.

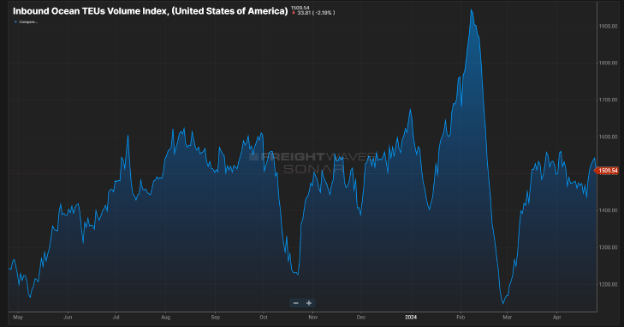

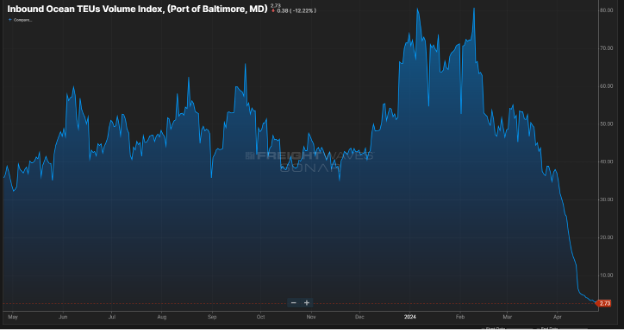

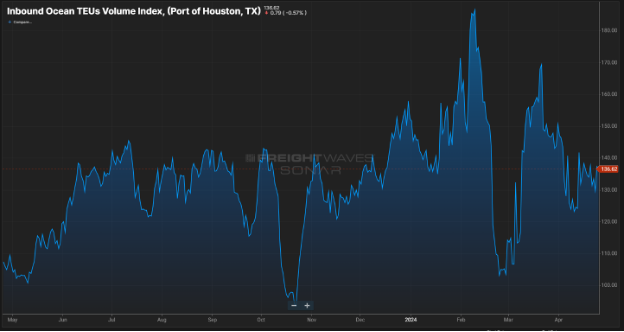

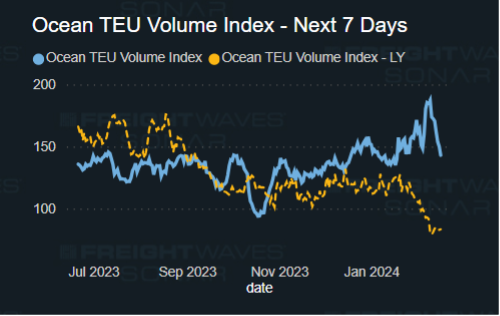

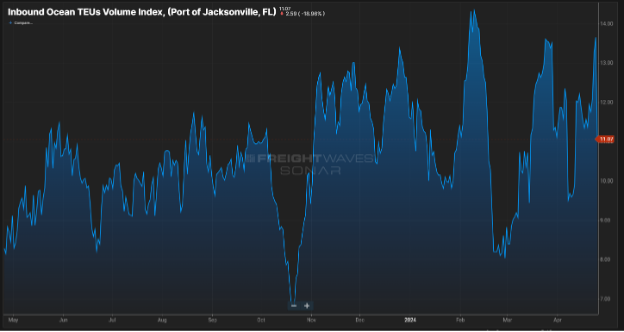

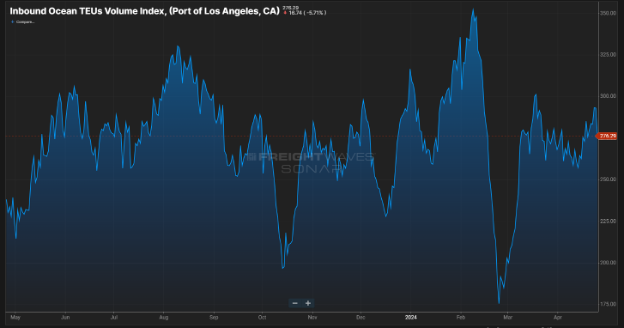

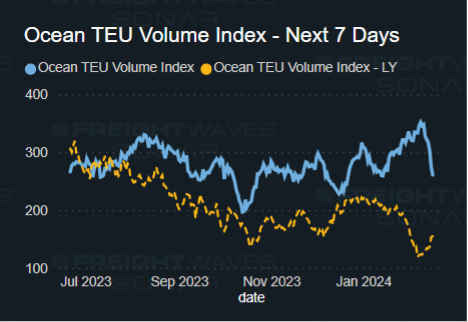

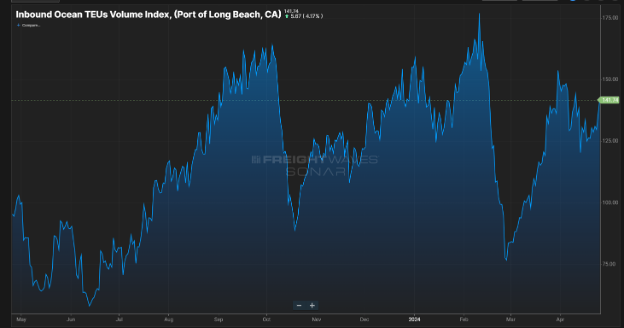

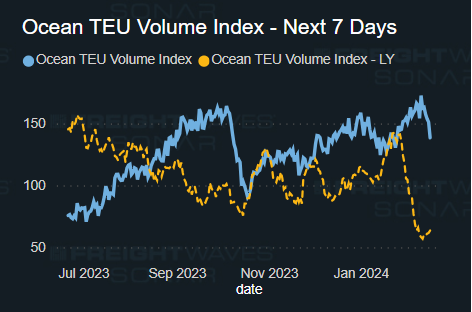

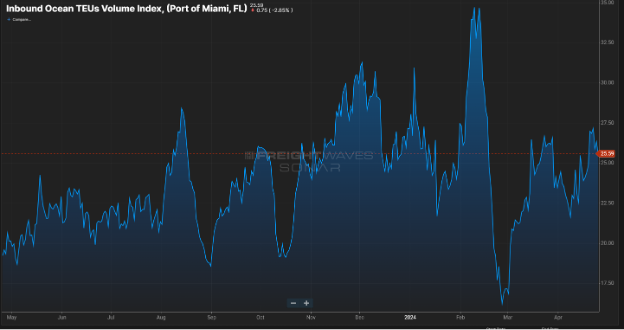

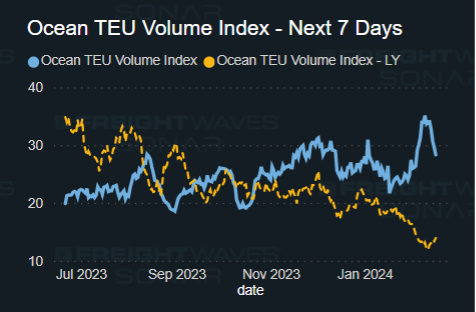

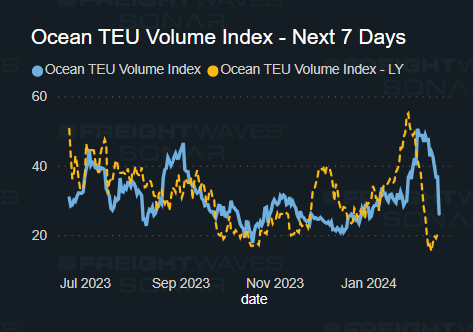

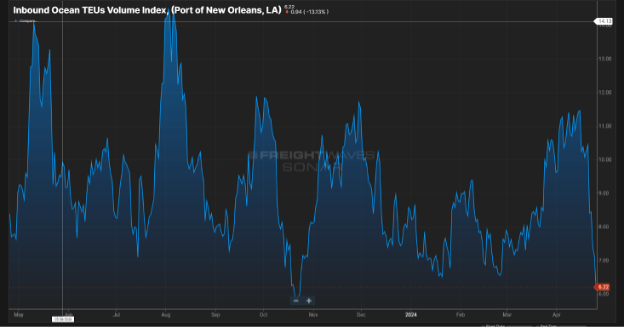

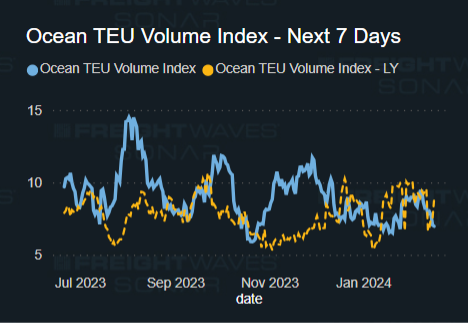

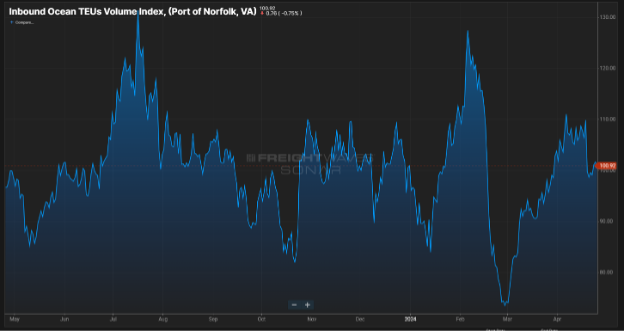

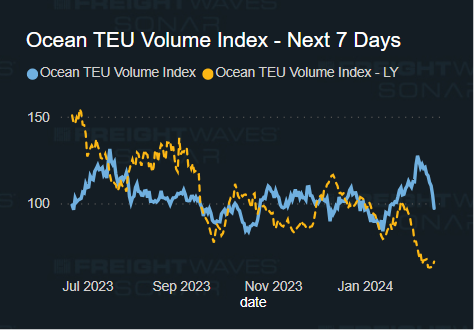

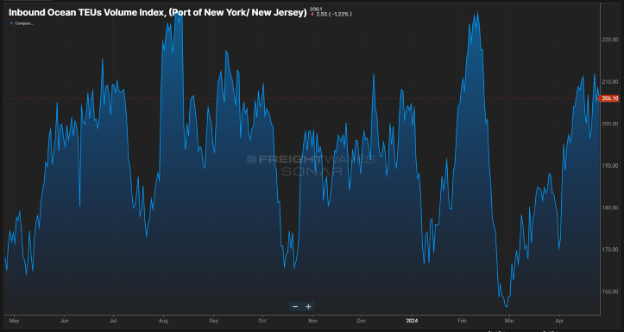

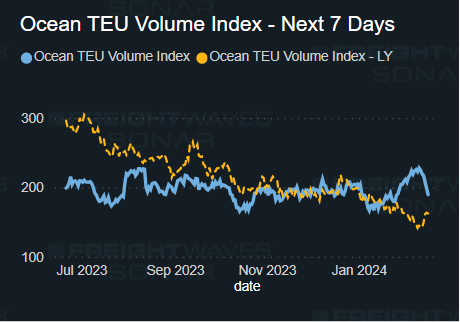

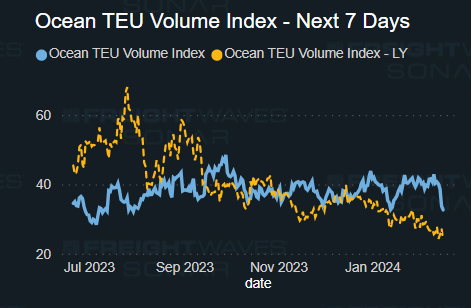

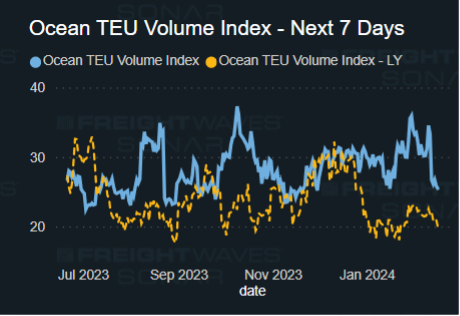

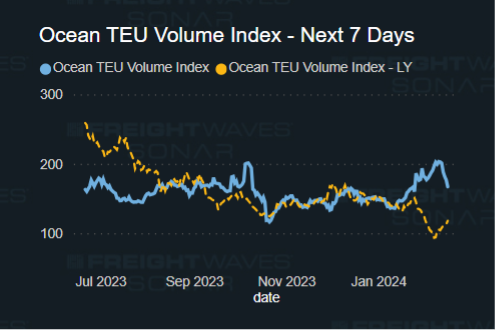

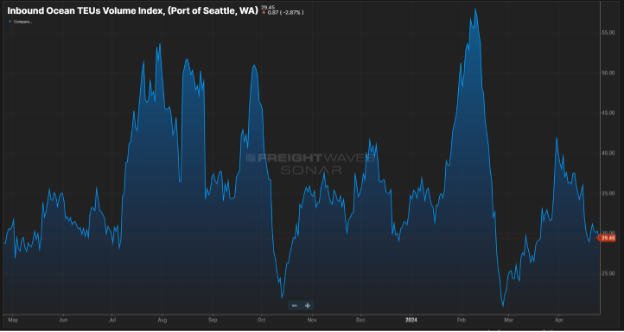

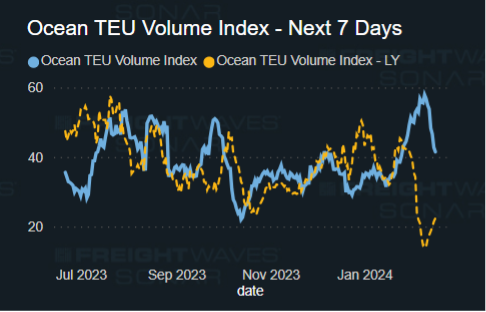

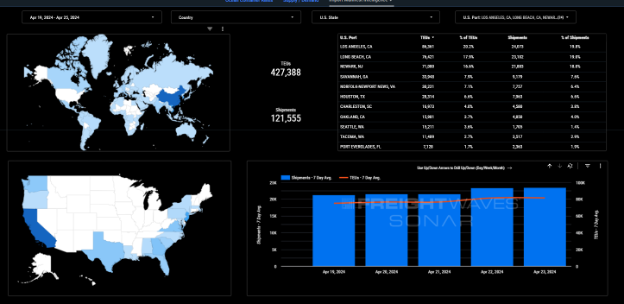

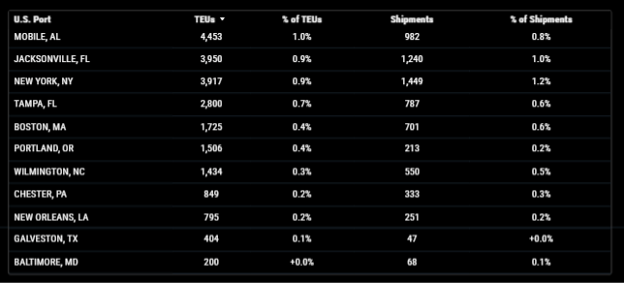

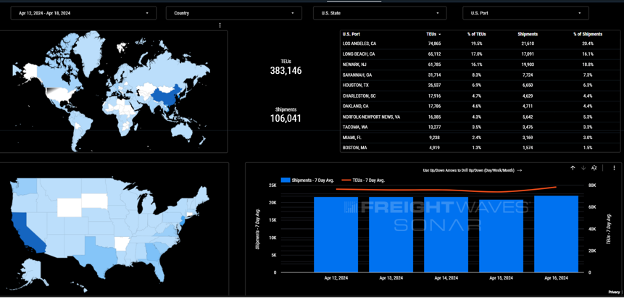

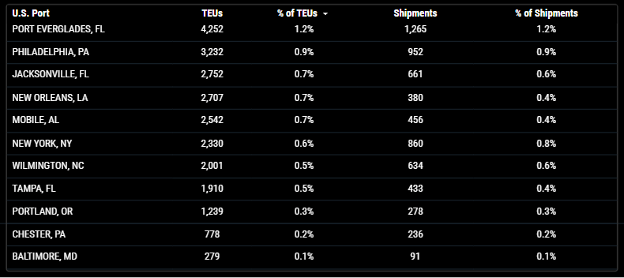

Import TEU volumes are up 11.54% this week from last week, the heaviest volume this week arriving to Los Angeles 20.2% of incoming TEU volume, Long Beach 17.9% of incoming TEU volume and Newark NJ 16.6% of incoming TEU volume. The Port of Portland will no longer have a container service as of October after the local port authority said it could no longer offset growing financial losses at its container terminal and that it has failed to find a third-party operator to permanently take over the business. Portland’s Terminal 6 (T6) will cease serving container ships as of Oct. 1, 2024. The port is forecasted to have a $13.7 million loss in 2024 following a $13.2 million loss in 2023. The losses come as the port has seen a 43% drop in containers handled from July 2023 through February 2024.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Click Here for Port and Rail Updates

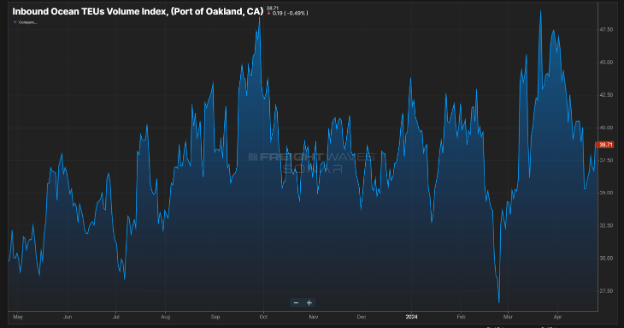

Oakland: Long wait times continue, driver wait times being reported in excess of 5 hours to pull a container this week. If you are looking for capacity, we encourage you to get your orders in early for the most guaranteed capacity. Send all orders and requests to our Oakland team at Oakland@portxlogistics.com

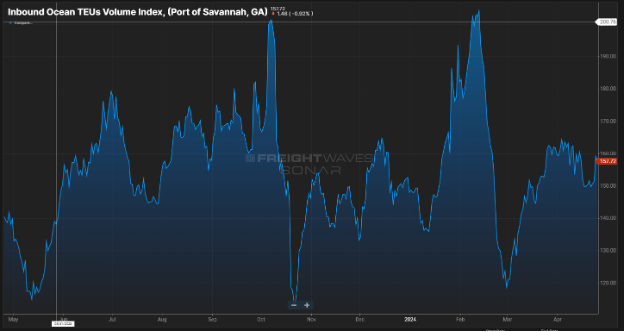

Seattle/Tacoma: The calm before the storm or running smoothly? Seattle and Tacoma ports are looking good and we have plenty of capacity! If you have questions on how shipping through the SEA/TAC ports can benefit your supply chain and if you are looking for an all-star drayage/transload warehouse team, our Seattle operations has plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse space for transloading and storage. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse rates.

Chicago: Norfolk Southern Landers wait times have been improving – Long turn times remain an issue between noon and 6:00 p.m., which accounts for about four out of 10 truck moves per day in the terminal. NS said one of the problems is that there are drivers who are cutting in line to get their container faster, a practice the railroad would like to see stopped. From March 24 to April 17, about 9.5% of truckers who entered Landers between noon and 6:00 p.m. were inside for more than two hours, but less than 1% of drivers waited that long before 10:00 a.m. or after 6:00 p.m. NS recommends more drivers consider picking up or dropping off cargo in the morning or evening. Our Chicago asset drayage team has full capacity to get your Chicago containers moving. We have 80 trucks and secured yard space and we are able to secure permits to haul heavy containers. For Chicago drayage capacity and supreme customer service contact Danny and the team letsgetrolling@portxlogistics.com

Did you know? Road Check 2024 is set for May 14-16 this year. Last year there were over 53,000 inspections and the total vehicle “Out of Service” rate was a whopping 19.3%. This year’s focus is controlled substance/alcohol possession and tractor protection systems. Carriers can be proactive, making sure all company credentials are current, paperwork is up to date and vehicle maintenance has been completed. Expect capacity to decrease and rates to slightly increase during this week – if you have questions about the upcoming DOT Road Check 2024 and how it plays a part in your supply chain, contact letsgetrolling@portxlogistics.com

SONAR Images