904 Words 4 Minute read – Let’s do this!

Yesterday marked International Women’s Day and I just wanted to give a huge shout out to all the women in Trucking and Logistics. Every day you crush it in one of the most time consuming, energy draining industries and still find time to focus on your home, family and looking awesome. You deserve to buy yourself something beautiful! Thank you for all you do!

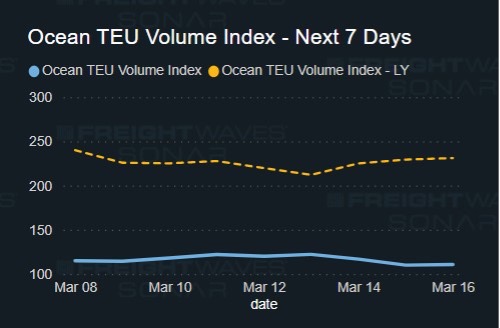

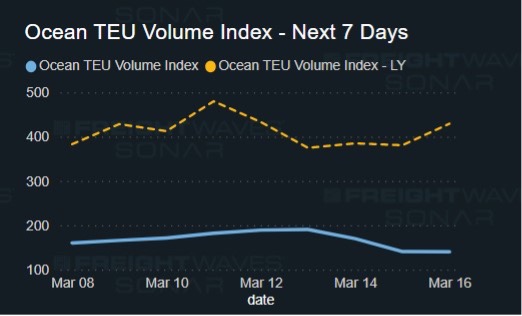

March is well on its way and heading into Q2. How is the market doing? Many experts say they expect a rise in imports starting this month. A JOC article states: US imports will begin to climb this month — after experiencing their lowest level since May 2020 last month — but the year-on-year comparisons will remain well below 2022, a major retail group said Wednesday. https://www.joc.com/article/us-imports-begin-recovery-remain-well-below-2022-retailers_20230308.html

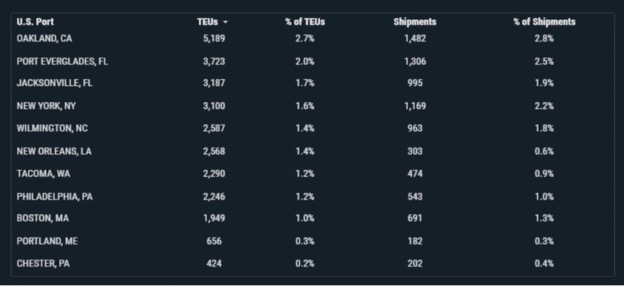

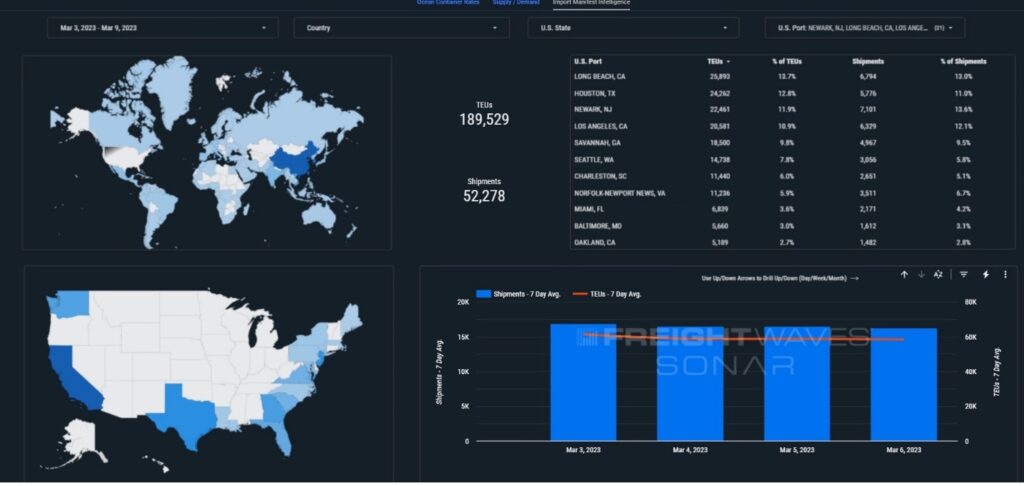

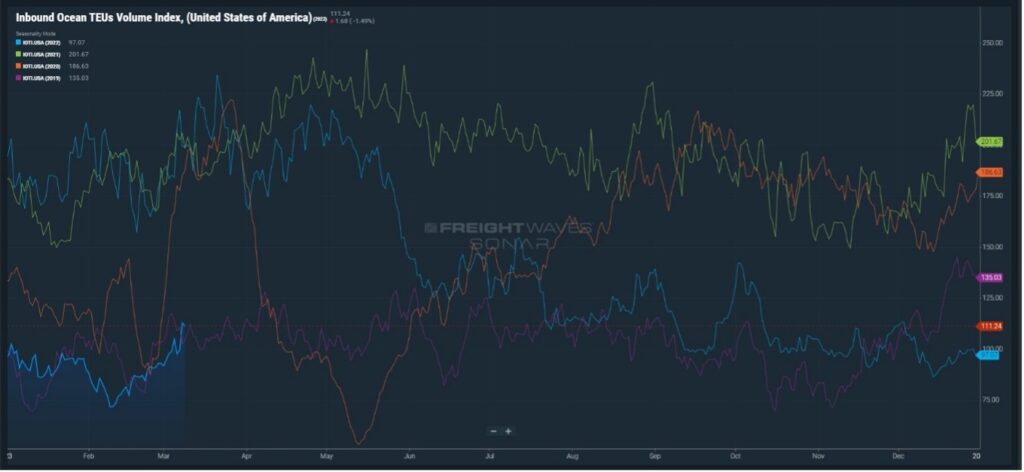

We are still in a questionable economy but supply is still in demand. The below chart compares import TEUs from 2019 (Purple) through 2023. Q1 of 2023 is somewhat similar to Q1 of 2019, back to pre-Covid normalcy – that can be a positive spin. It is now the time for cost cutting and abundant capacity. BUT, the world is a crazy place, what can happen next to rock the supply chain world?

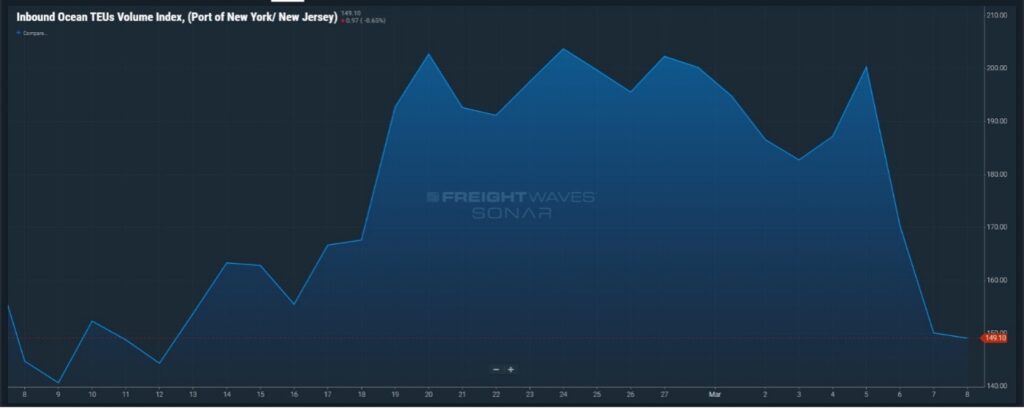

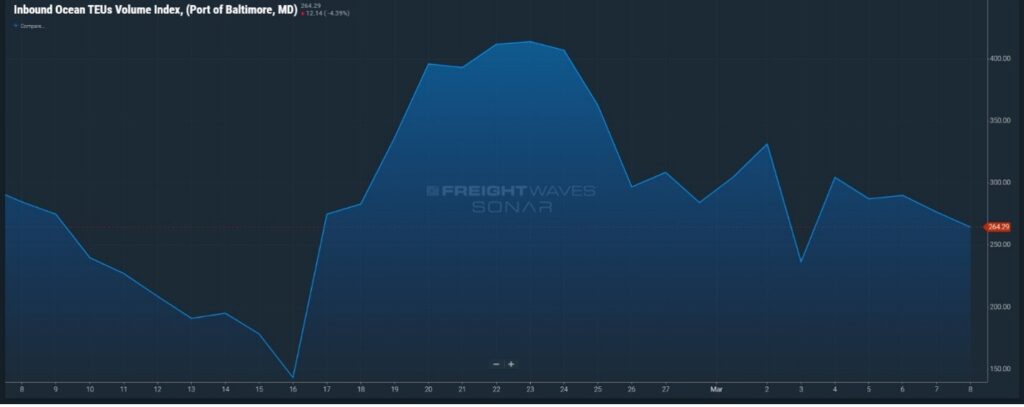

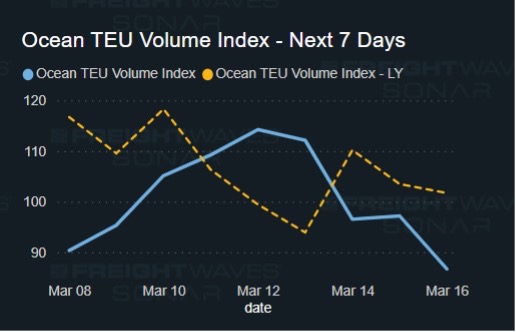

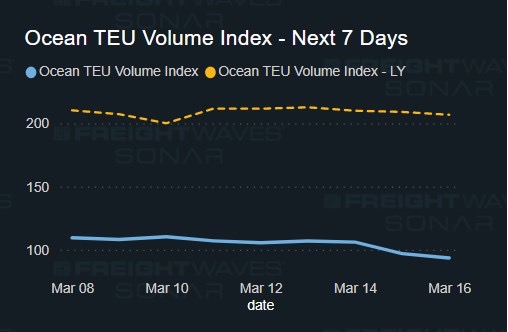

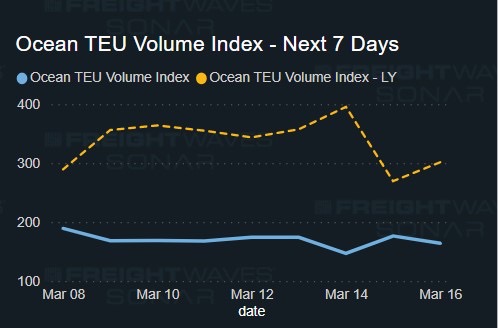

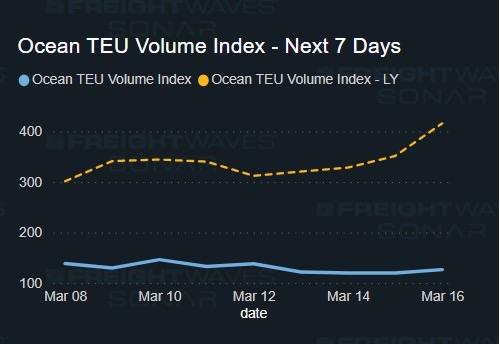

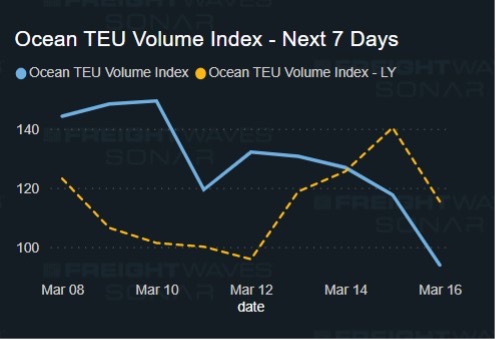

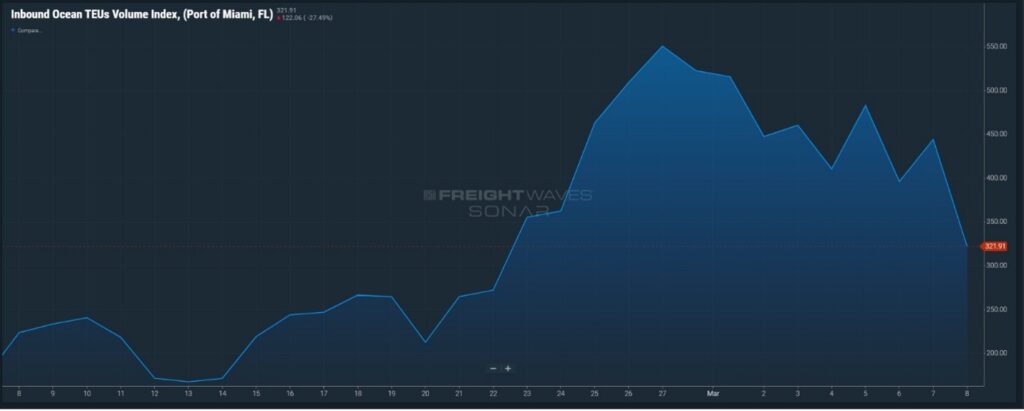

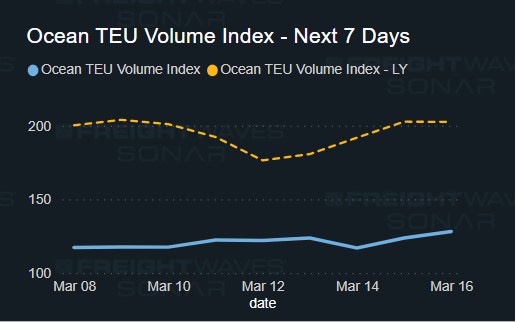

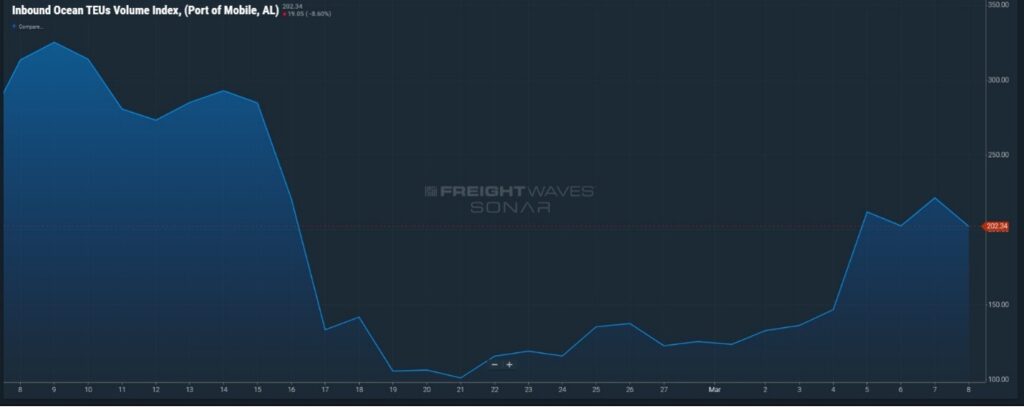

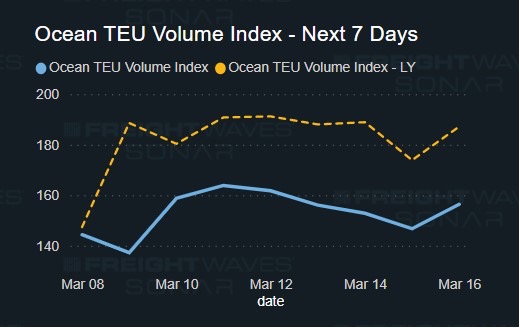

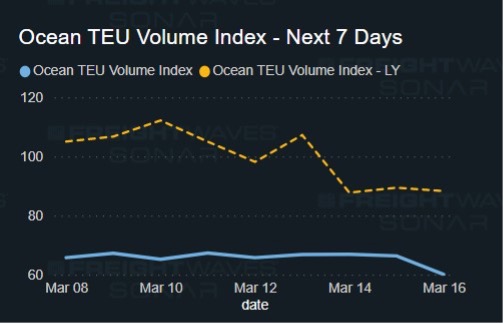

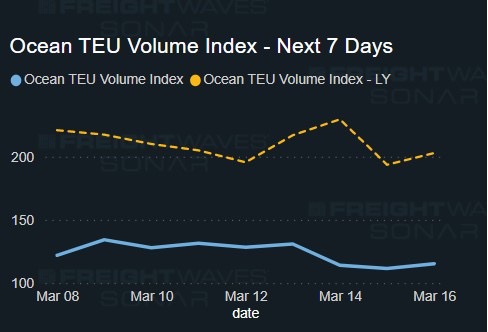

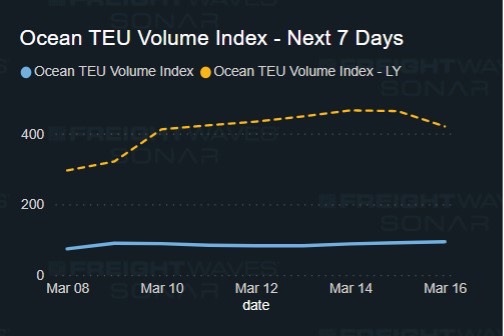

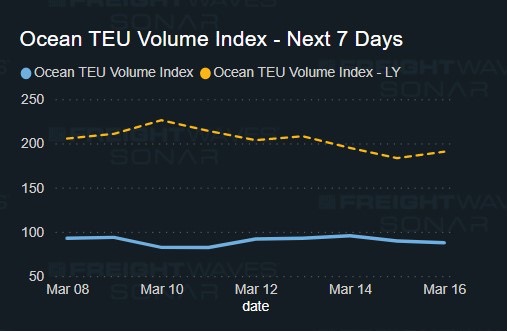

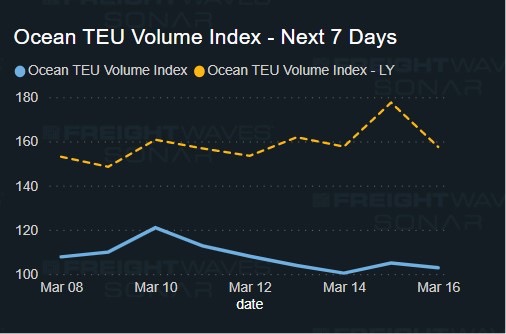

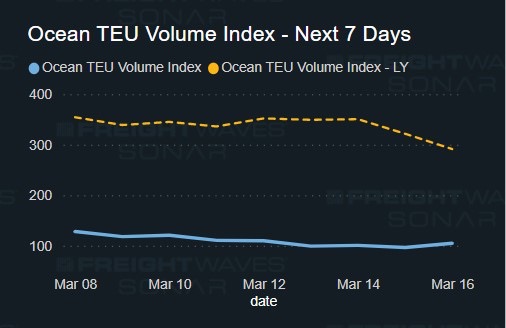

There was a drop in TEU Volume this week, down 31.39% from last week. Spring is on the horizon and summer right behind. Retailers will start to bring in their summer inventories so we can expect some growth from retail supplies and the automotive supply is still on the rise as manufacturers are still working to replenish the auto shortages from the past couple years. Do you need guidance on organizing your automotive shipments? Whether it is hazmat batteries, EV Batteries, auto parts and manufacturing plant projects, Port X Logistics can help make your quotes, trucking, and project management easy for all things automotive. Our EV is EZ team is ready for your questions. Contact us today letsgetrolling@portxlogistics.com.

What is going on at the ports and rails this week?

Even though capacity is good and volumes are low, some locations still have congestion due to different factors:

New York/New Jersey: The ports are cutting personnel and putting very little labor on, which takes more time to get a container as there aren’t many people to help do so. The ports are being very strict on their closing time to avoid overtime for their workers and voiding drivers out at exactly the time they close. For example, just two days ago, we had three drivers inside APM since 1pm waiting at their location for their container, but since the port closes at 5pm and they had not received their box yet, the port told the drivers to void out and come again another day. Three drivers with no recovered containers – that is causing port congestion and fees to cover drivers waiting with no container recovery. Rumors are that terminals are going to continue closing even earlier, cutting more hours. Even with the little volume we have, there is a potential of Port congestion sticking around.

Houston: Bayport is functional. Barbours Cut is still slow. From ingate to crane ops to how long it takes for them to work vessels, Barbours Cut is just slow.

Drivers are encountering issues with both chassis providers in Houston this week. Neither DCLI nor TRAC are being accepted at many of the terminals and have not been providing solutions for returns.

Columbus/Cleveland/Cincinnati: There was another Norfolk Southern derailment on Saturday March 4th about 180 miles northeast of Springfield, one month after the February 3rd Norfolk Southern derailment in East Palestine. There have been four derailments in the past five months in Ohio – there is still chassis shortages and rail congestion at all 3 OH railhead locations. Is there a correlation?

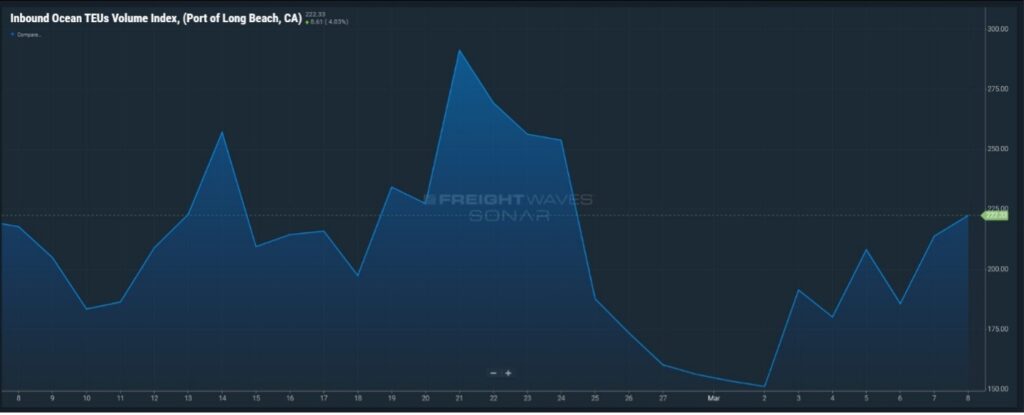

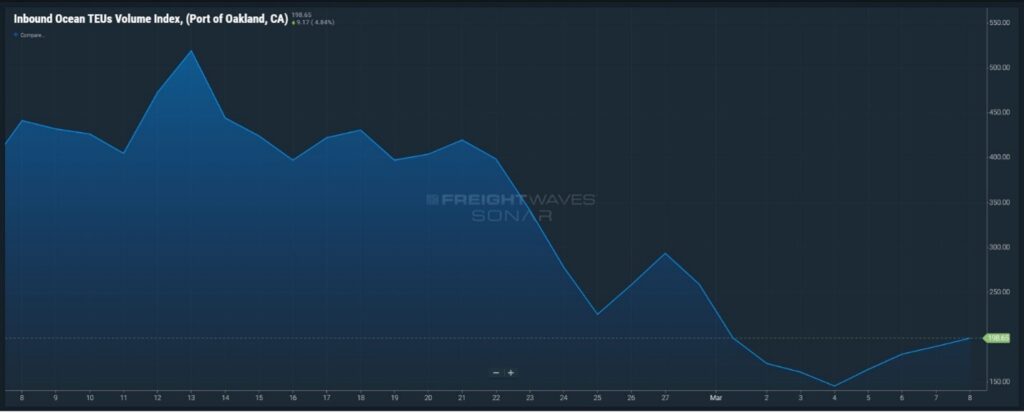

LA/Long Beach After an upward move in January, Chinese imports into the U.S. returned to a downward trend in February 2023. The Port of Los Angeles showed the greatest overall container volume decrease, representing 40% of the overall decrease in TEU quantities. Continued uncertainty regarding labor issues may still be a crucial factor in the lack of import volumes returning to major California ports. Capacity is abundant in all LA ports but labor and hours could decrease as volumes decrease.

Did you know? We brought back our “NO DEMURRAGE GUARANTEE” for import shipments picked up from all coastal ports. If you’re able to send us your work orders at least 5 days prior to the vessel arrival and the container is clear of all holds upon release, we are guaranteeing that there will be NO DEMURRAGE charged back to you. AND chances are if we get your orders even sooner than that, we’ll still be able to get all shipments out within free time! Start sending us your orders today.

On February 23rd we announced our merger with U.S. Multimodal, we now have drayage assets in Oakland, Los Angeles/Long Beach, Denver, Memphis, Chicago, Kansas City, Savannah, with more locations on the way. We now have over 350 trucks, 350 company chassis, over 200 of acres of critical yard space, and various transload facilities. Read more here https://www.linkedin.com/feed/update/urn:li:activity:7034602298966200320

To contact the leadership team, please reach out to letsgetrolling@portxlogistics.com.

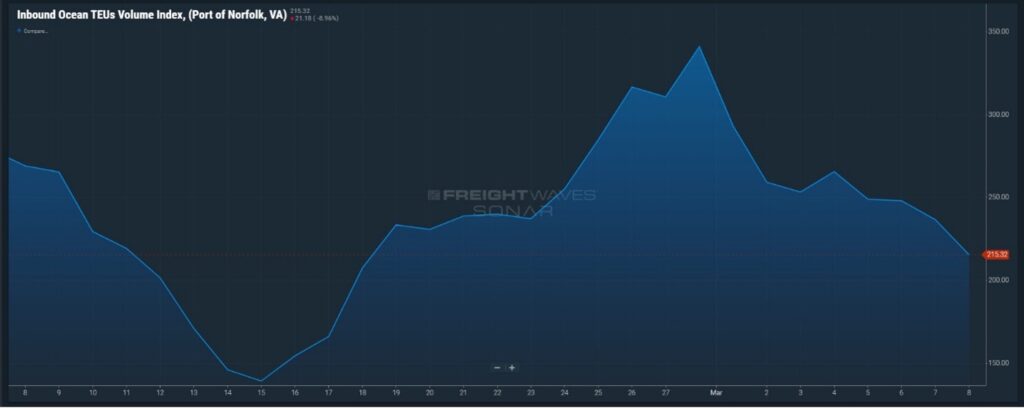

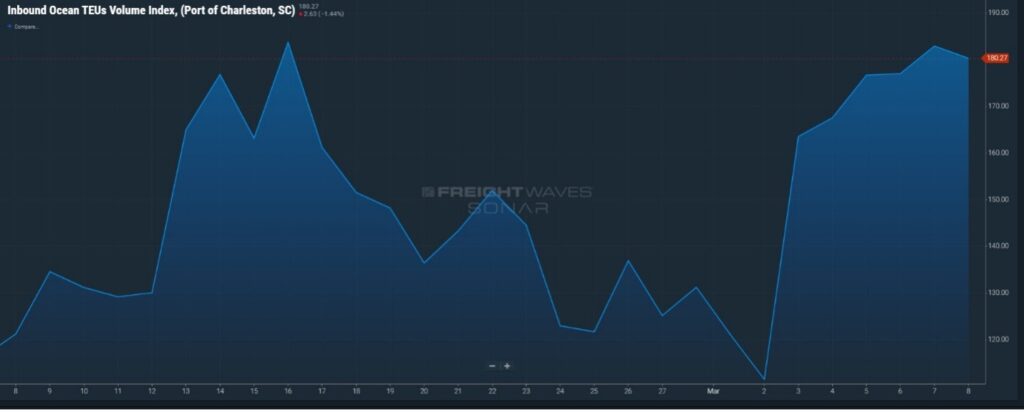

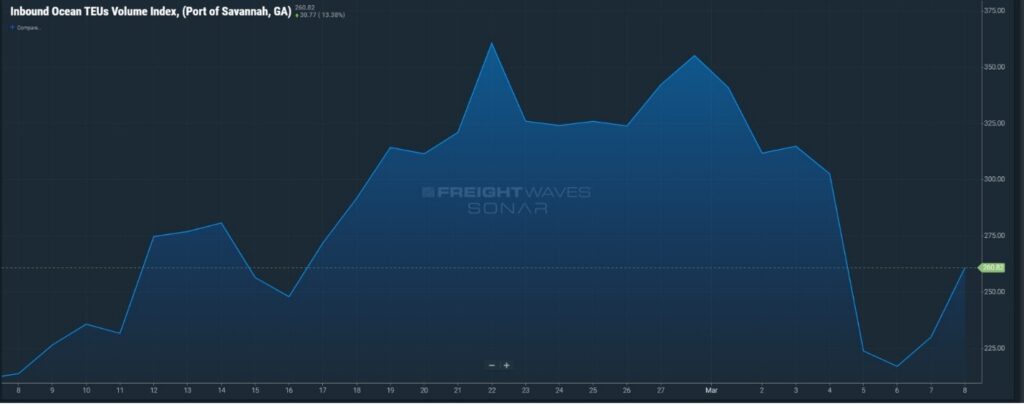

Import Volume Charts