Port of Long Beach

1804 words 7 minute read – Let’s do this!

Welcome to February — the month of love… and the month we’d all happily see winter pack it up and head out of the Northeast. While volumes aren’t surging, the U.S. import network is feeling a little more delicate right now. Tighter timing, tariff-driven planning decisions, late-January winter weather, and uneven inland recovery are all testing container reliability just as inventories run leaner. With less room for error, execution is once again the name of the game. This week’s market update breaks down how January wrapped up for U.S. imports, what recent storms mean for port and rail recovery, and why even small disruptions are carrying extra weight as 2026 gets underway. Follow Port X Logistics on LinkedIn for real-time insights — or get our Thursday Market Updates delivered straight to your inbox by reaching out to Marketing@portxlogistics.com

Import conditions this past week underscore an important shift that’s been building quietly since late 2025. Importers are no longer flooding the system with volume to get ahead of uncertainty; instead, they are deliberately pacing freight, managing tariff exposure, and tightening inventory cycles. That change has stabilized overall volumes, but it has also made the network more sensitive to disruption. When freight is scheduled precisely, delays at ports, rail ramps, or inland terminals ripple faster through downstream operations. The challenge for importers today isn’t navigating chaos — it’s managing a system that functions well until something slips out of sequence. That sensitivity was tested again late in January as another major winter system impacted large portions of the Eastern U.S. A rapidly intensifying coastal storm brought heavy snow, high winds, and hazardous conditions from the Southeast through the Mid-Atlantic and into the Northeast. The timing of this event mattered. It arrived just as ports and inland networks were still working through earlier January weather impacts, extending recovery timelines rather than allowing a clean reset. Even where terminals remained open, productivity slowed as wind limits affected crane operations, truck turns lengthened, and appointment systems tightened. The operational effects were familiar but still costly. Short weather disruptions tend to create longer recovery arcs. As terminals resume normal schedules, gate activity often spikes as importers attempt to recover delayed containers all at once. Chassis availability tightens, truck queues grow, and rail cutoffs are missed — not because of sustained shutdowns, but because the system is trying to catch up. For importers moving cargo inland from East Coast gateways, this has translated into uneven pickup windows and inconsistent inland transit times, even as headlines suggest conditions have improved.

Inland rail networks have continued to be a key pressure point. While highways typically reopen quickly after storms, rail recovery takes longer due to cold-weather operating constraints. Throughout the past week, railroads have remained focused on safety-driven adjustments, including reduced train lengths, moderated speeds, and additional equipment repositioning following weather events. These measures protect network integrity, but they also limit short-term throughput. As a result, containers often clear ports faster than rail capacity can absorb them, creating temporary congestion at intermodal ramps. This mismatch is especially important in the current market environment. With imports intentionally spaced and inventory levels leaner, delays that might once have been absorbed now disrupt tightly sequenced distribution plans. Importers feel this as longer dwell at inland facilities, compressed delivery appointments, and increased coordination effort just to maintain baseline service levels. The disruption is incremental rather than dramatic — but it compounds quickly.

Ocean networks have faced their own late-month challenges. Severe Atlantic conditions prompted carriers to slow vessels or adjust sailings to avoid hazardous weather, prioritizing safety but altering arrival patterns. These adjustments don’t eliminate capacity, but they do change when it shows up. Once weather clears, delayed vessels often arrive in closer succession, placing short-term pressure on terminal labor, yard space, and inland connections. In a winter recovery environment, those arrival clusters can amplify congestion risk even when overall volume remains manageable.

Against this operational backdrop, it’s important to recognize how U.S. import volumes finished 2025 — because that context is shaping behavior today. The final months of last year saw imports ease after earlier front-loading tied to tariff exposure and trade policy uncertainty. Rather than signaling weakening demand, this slowdown reflected a normalization phase as inventories were worked down and inbound schedules were recalibrated. Entering 2026, importers are operating with more discipline and less excess — which raises the importance of predictability across the network.

That tariff sensitivity hasn’t disappeared. Even without new policy announcements this week, sourcing decisions and arrival timing continue to reflect caution. Importers are spacing freight, diversifying origins, and planning arrivals with cost exposure firmly in mind. In this environment, reliability becomes more valuable than speed. Missed connections, weather delays, or inland bottlenecks now carry a higher penalty because there is less slack built into the system.

Global uncertainty continues to add another layer of complexity. While some long-haul routes show tentative signs of normalization, confidence remains uneven, and carriers continue to adjust networks cautiously. These shifts influence transit times, vessel rotations, and equipment positioning in ways that can create localized arrival surges or short-term imbalances. For ports and inland networks already dealing with winter recovery, these fluctuations increase the importance of coordination across every leg of the move.

There are also broader macro signals worth noting. Extreme cold across large parts of the U.S. disrupted domestic energy production late in January, leading to unusual shifts in energy flows and reinforcing how weather can simultaneously strain infrastructure, labor availability, and operating costs. While these impacts aren’t always visible in container statistics, they influence the economics of trucking, warehousing, and rail operations in subtle but meaningful ways.

Taken together, this week’s conditions reinforce a consistent takeaway: the supply chain is functioning, but it has little tolerance for error. Volumes are steady, but precision matters. Weather volatility, inland recovery lag, and tariff-driven planning discipline mean that execution gaps surface faster and cost more than they did in looser market environments.

For importers, the most effective response remains proactive coordination. Monitoring vessel arrivals is no longer enough; inland connectivity, rail fluidity, and drayage capacity must be planned in parallel. Securing capacity early, maintaining routing flexibility, and building modest buffers where possible continue to separate resilient supply chains from those forced into reactive mode.

Looking ahead, attention will turn to how quickly January’s weather-driven backlogs clear before seasonal volumes begin to firm. Even modest increases layered onto partially recovered networks can create temporary congestion points. Early 2026 may lack the dramatic headlines of prior years, but the system remains sensitive — and disciplined execution remains the strongest competitive advantage.

In short, this week serves as another reminder that stable volumes do not guarantee smooth operations. The market may look calm on the surface, but winter conditions, policy-driven planning shifts, and inland recovery dynamics continue to test reliability underneath. Importers prepared to manage that complexity — rather than react to it — will remain best positioned as the year unfolds.

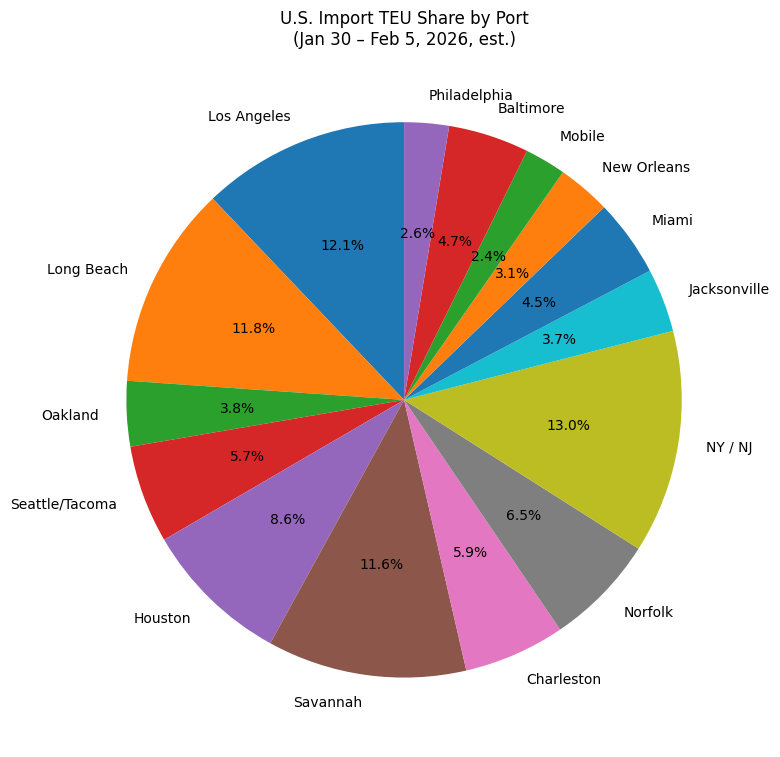

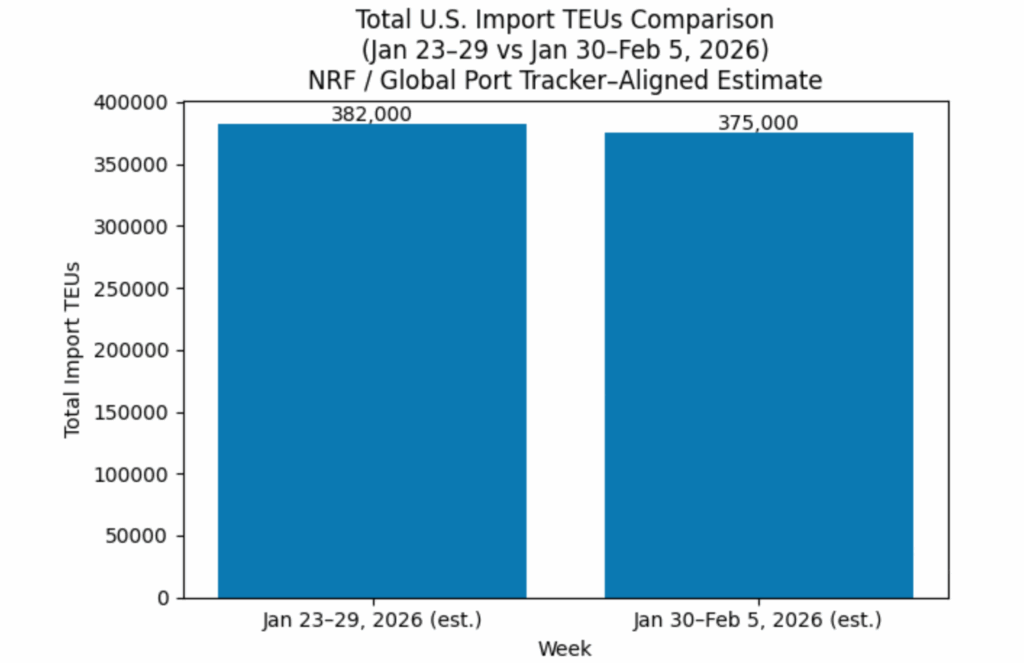

TEU’s are down 1.83% over last week, with majority coming into New York/New Jersey 13%, Los Angeles 12.1% and Long Beach 11.8%.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

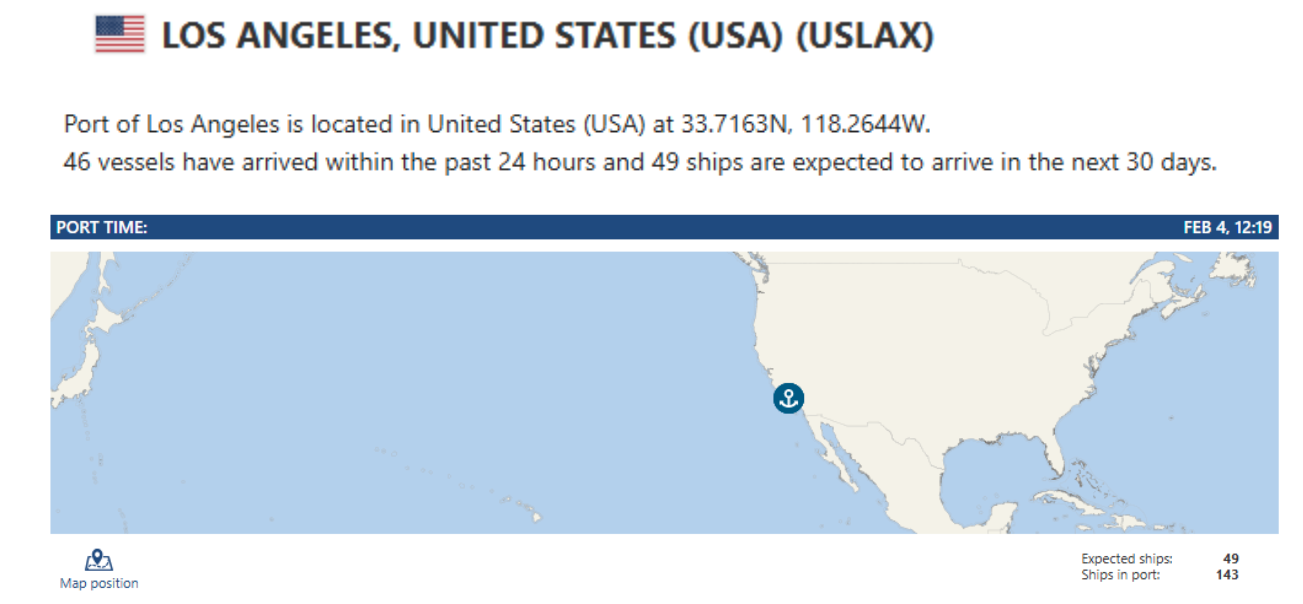

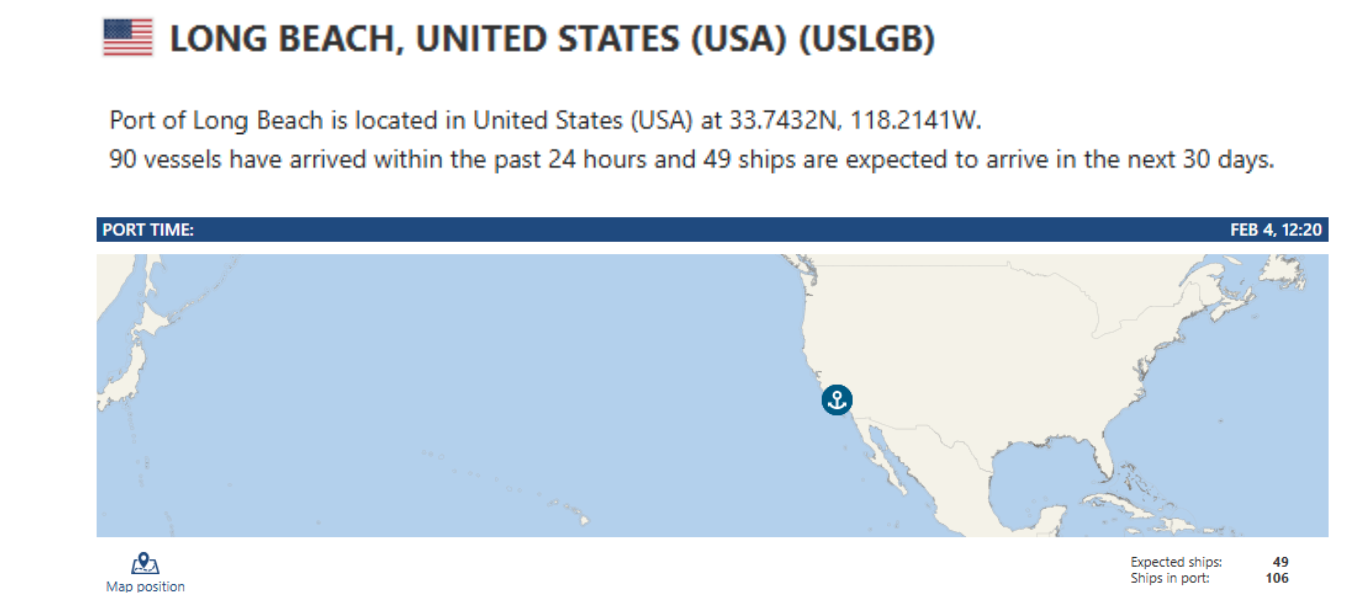

LA/LGB: Recent friction at the Southern California ports is being driven by intermodal flow dynamics, particularly how containers are exiting terminals for inland rail moves. Chassis utilization has tightened at times as containers sit longer awaiting uneven rail connections, slowing equipment cycles and compressing appointment availability. When chassis don’t turn efficiently, truck turn times lengthen and pressure builds unevenly across intermodal ramps, creating the appearance of a slowdown without an actual shutdown. Lingering late-January weather impacts across inland rail networks have amplified this effect, as LA/Long Beach can clear cargo quickly until inland absorption slows and dwell begins to creep up. The system is functioning — but tightly — and when capacity runs close to its limits, small inefficiencies become visible. For importers, this shows up as reduced appointment flexibility, tighter pickup windows, and greater sensitivity to surge days, reinforcing the importance of proactive drayage planning. A quick West Coast note: lower transload rates are now available in LA and Long Beach, and the operational advantages remain strong. From secure yard access and flexible storage to real-time OpenTrack visibility and our No Demurrage Guarantee with 72-hour dispatch, we’re focused on reducing friction where it matters most — at the terminal. Fewer surprises, smoother execution, and better control over your freight. Ready to streamline your West Coast moves? Email letsgetrolling@portxlogistics.com and let’s get rolling.

Savannah: The Port of Savannah closed 2025 with strong momentum, posting its second-busiest year on record at nearly 5.7 million TEUs while also setting a new high for rail container moves, reinforcing its role as a key East Coast intermodal gateway. Rail performance continues to be a differentiator, with faster vessel-to-train transfers supporting inland velocity, and the Blue Ridge Connector inland rail terminal now nearing completion ahead of a mid-2026 opening. Ongoing berth expansion and infrastructure investment signal that Savannah is not only handling current volumes effectively but positioning itself to absorb future growth and shifting trade patterns with added capacity and improved inland connectivity at Port of Savannah. Savannah and the South Atlantic move fast — and so do we. Port X covers Savannah, Charleston, and Jacksonville with a 12-truck fleet, hazmat-certified drivers, secure yards, and transload muscle for when freight gets complicated. No slowdown. Just execution. letsgetrolling@portxlogistics.com

Did you know? You don’t have to wait out rail delays in Canada. When weather, congestion, or extended rail dwell puts your containers at risk, Port X can step in and reroute the plan — fast. We specialize in diverting Canadian import containers for transload, getting freight out of stuck rail situations and back on the road toward final delivery without losing momentum.

Our experienced teams on the ground in Toronto and Vancouver know the Canadian port and rail landscape inside and out. From diversion coordination and cross-dock execution to cross-border moves — including team driver service for time-critical freight — we help customers regain control when schedules start to slip. We cover all major Canadian ports and rail ramps, giving you a reliable alternative when rail dwell stretches longer than your supply chain can afford.

If you have containers slowed by Canadian rail congestion — or want a backup plan before disruption hits — reach out to Canada@portxlogistics.com. We’ll help keep your freight moving when it matters most.

Import Data Images