Port of Memphis

1966 words 8 minute read – Let’s do this!

As the final weeks of winter test freight networks across the country, this week’s market update looks at how weather, inland rail performance, and global routing decisions are shaping import reliability heading into February. From Northeast terminal disruptions and inland rail slowdowns to ongoing uncertainty around global vessel routing and evolving trade policy pressures, the common thread remains execution. Volumes may appear stable on the surface, but operational friction continues to emerge in pockets across the supply chain, reminding importers that proactive planning and flexibility still separate smooth deliveries from costly delays. This week, we break down what the latest weather events mean for port and rail recovery, how global shipping patterns continue to influence U.S. arrivals, and what importers should watch as networks normalize in the weeks ahead. Don’t forget to follow Port X Logistics on LinkedIn for real-time perspective and market commentary — or get our Thursday Market Updates delivered straight to your inbox by reaching out to Marketing@portxlogistics.com.

Market conditions over the past week reinforce a theme that has quietly carried into 2026: reliability—not just cost—is once again the deciding factor for importers. Between winter weather disruptions in key East Coast gateways, continued uncertainty around global vessel routing decisions, inland rail slowdowns, and policy developments influencing sourcing and procurement strategies, supply chains are entering the year with calmer volumes but still plenty of volatility under the surface. For importers, the challenge isn’t necessarily dramatic disruption, but rather a steady stream of operational frictions that compound into higher costs and tighter planning windows.

Weather has been the most immediate operational driver over the past several days. A strong winter pattern across the Northeast led to terminal closures and reduced operating schedules across the Port of New York and New Jersey, creating short-term congestion risks as terminals work through accumulated backlogs. Even when closures only last a day or two, the recovery period tends to stretch longer. Truck appointment systems fill quickly, chassis pools tighten as equipment cycles slow, and rail connections can miss scheduled cutoffs. The result is a familiar ripple effect: import containers sit longer, pickup windows compress, and drayage providers must work through a surge of delayed moves all at once. As terminals resume normal operations, we typically see a brief spike in gate activity followed by slower normalization as supply chains catch up. Looking ahead, forecasts suggest the Northeast may not be finished with winter impacts just yet. Another coastal storm system is expected to bring snow, wind, and potential flooding conditions to portions of the Eastern Seaboard, raising the possibility of additional operational slowdowns. Even when ports remain technically open, hazardous road conditions and cold-weather impacts on inland networks can create friction for truck and rail movements. For importers moving cargo inland from East Coast ports, this means inland transit reliability could remain uneven over the next week. Warehouses, rail ramps, and trucking networks often require extra time to return to full productivity after sustained weather events, meaning delays can continue even after headlines move on.

While port operations often receive the bulk of attention during storms, inland rail networks have also faced meaningful disruption this past week. Major Class I railroads, including BNSF Railway and CSX Transportation, issued advisories warning customers of weather-driven service impacts across central and eastern corridors. Heavy snow, freezing rain, and prolonged cold temperatures forced railroads to adjust operating practices, including speed restrictions, shorter train lengths, and modified routing decisions designed to preserve network safety and reliability under extreme winter conditions. These operational adjustments, while necessary, carry measurable downstream effects for import supply chains. Slower linehaul speeds extend intermodal transit times, missed connections create container bunching at ramps, and restricted capacity makes it harder for railroads to absorb sudden surges of import volume after weather-related port closures. Containers that might normally move fluidly inland instead accumulate temporarily at terminals or rail yards, compressing pickup windows once service resumes at full speed. Importers often feel this impact not as a dramatic shutdown, but as a gradual erosion of schedule predictability.

Rail recovery tends to lag slightly behind highway recovery as well. Clearing tracks, restoring switches, and rebalancing equipment across networks takes time, particularly after systems experience both snow and extreme cold simultaneously. Frozen switches and ice accumulation can slow train assembly and departures long after highways reopen. In practice, this means inland intermodal movements connected to coastal ports may continue experiencing transit variability even after marine terminals resume normal gate operations. This inland friction compounds the operational challenges created by weather disruptions at ports themselves. When terminals reopen following closures, drayage demand typically spikes as importers rush to recover delayed containers. But if rail capacity remains constrained at the same time, inland destinations can quickly become congested. Containers may sit longer at ramps waiting for final delivery, while importers face tighter appointment windows at distribution centers already juggling delayed inbound freight. The net result is that what began as a coastal weather issue can cascade into inland bottlenecks days or even weeks later.

At the same time, global geopolitical dynamics continue to influence container shipping networks in ways that matter directly to U.S. importers. Routing decisions in the Red Sea and Suez Canal region remain unsettled as carriers weigh security concerns against the operational efficiency of returning to shorter transit routes. Some carriers have cautiously tested resumed transits through the region, but renewed threats and ongoing instability make a full, confident return uncertain. For U.S. importers—particularly those relying on Asia-to-East Coast all-water services—this uncertainty translates into schedule variability. When carriers shift between Suez routing and longer Cape of Good Hope voyages, transit times, vessel rotations, and equipment positioning all adjust accordingly. Even modest changes in rotation timing can disrupt container availability or cause bunching of arrivals, impacting terminal productivity and inland capacity planning. For ports and rail ramps already dealing with weather-driven slowdowns, sudden arrival surges from altered vessel schedules can intensify congestion risk.

While volumes themselves are not yet surging in early 2026, schedule consistency remains fragile. The past few years have taught carriers and shippers alike that reliability challenges don’t always arrive as dramatic port shutdowns or massive congestion crises; more often, they appear as incremental unpredictability—late vessel arrivals, rolled cargo, equipment imbalances, or inland delays that slowly add cost and complexity. Importers that built additional buffer time into their planning during peak disruption years continue to benefit from those lessons now, even in calmer market conditions.

Another emerging factor influencing supply chain planning this week involves broader trade and policy developments around strategic materials and controlled commodities. Increased scrutiny around licensing, tariffs, and export controls—particularly in sectors tied to critical industrial inputs—adds complexity for procurement teams sourcing globally. While this doesn’t immediately impact every container shipment, it does shape sourcing decisions, lead times, and compliance processes.

Companies adjusting supply chains to navigate policy changes often create shifts in origin points or shipping patterns, which can gradually alter container flows across U.S. ports. Over time, these adjustments influence which gateways see growth and which lanes experience softening demand. For inland logistics networks, these sourcing shifts can reshape rail and truck flows in subtle ways that accumulate into broader routing adjustments across national networks.

There are also secondary economic impacts tied to weather and energy markets worth noting. Severe cold across large portions of the country has driven volatility in energy demand and pricing, affecting operating costs for logistics providers and warehouse facilities. Higher energy costs can influence everything from warehouse throughput decisions to trucking economics, even if the effects are subtle. Combined with winter weather disruptions, these factors reinforce how interconnected supply chain performance remains, even when demand appears stable. From an operational standpoint, the takeaway for importers remains straightforward. Flexibility and speed of execution are still competitive advantages. Weather-driven disruptions will continue to test port and inland networks throughout the remainder of winter, and geopolitical uncertainties ensure ocean schedules remain vulnerable to change. Importers that stay proactive — monitoring arrival schedules closely, securing drayage capacity early, and maintaining contingency routing options — are best positioned to avoid cost surprises. Inland networks remain generally fluid compared with the congestion peaks of prior years, but localized disruptions still emerge when weather or equipment imbalances occur. This environment rewards coordination across ocean, drayage, and inland providers. Importers working with partners capable of quickly adjusting routing, securing alternate capacity, or accelerating container recovery when windows open can reduce exposure to delay costs and inventory disruption. Another important dynamic to watch over the coming weeks is how quickly rail and port networks clear current weather-driven backlogs before spring cargo flows begin to strengthen. Even modest volume increases layered onto partially recovered networks can create temporary congestion points. Importers should expect some continued schedule variability such as railroads rebalance assets and terminals process delayed container flows generated during January’s winter events.

In short, while early 2026 lacks the dramatic disruption headlines of recent years, the system remains sensitive to shocks. Weather volatility, evolving geopolitical risks, rail network adjustments, and policy-driven sourcing shifts all contribute to a market that looks calm on the surface but still requires disciplined execution underneath. Importers who treat reliability as a strategic priority — not just a cost consideration — are best positioned to navigate the weeks ahead as winter conditions persist and global shipping networks continue to recalibrate. If anything, this week serves as a reminder that in logistics, even quiet markets demand active management. The supply chain may be steadier than in recent years, but it remains ready to pivot quickly — and those prepared to move with it will continue to outperform as 2026 unfolds.

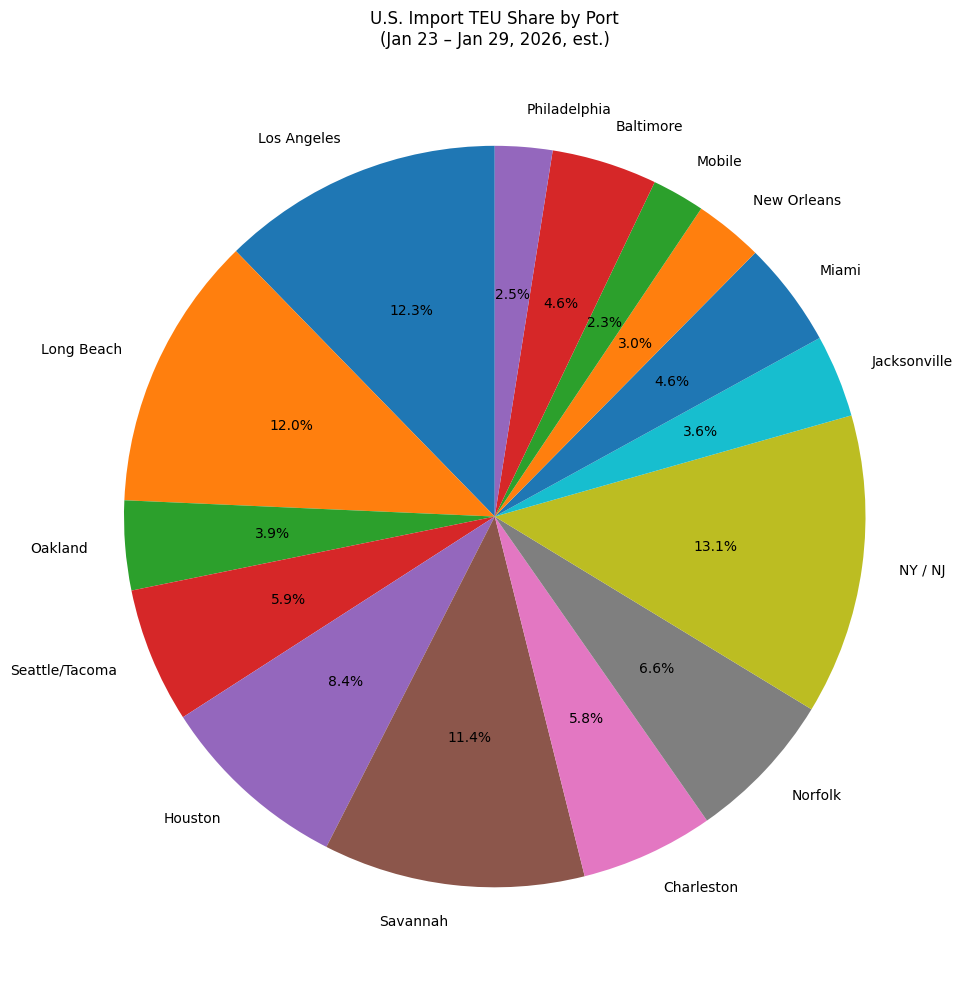

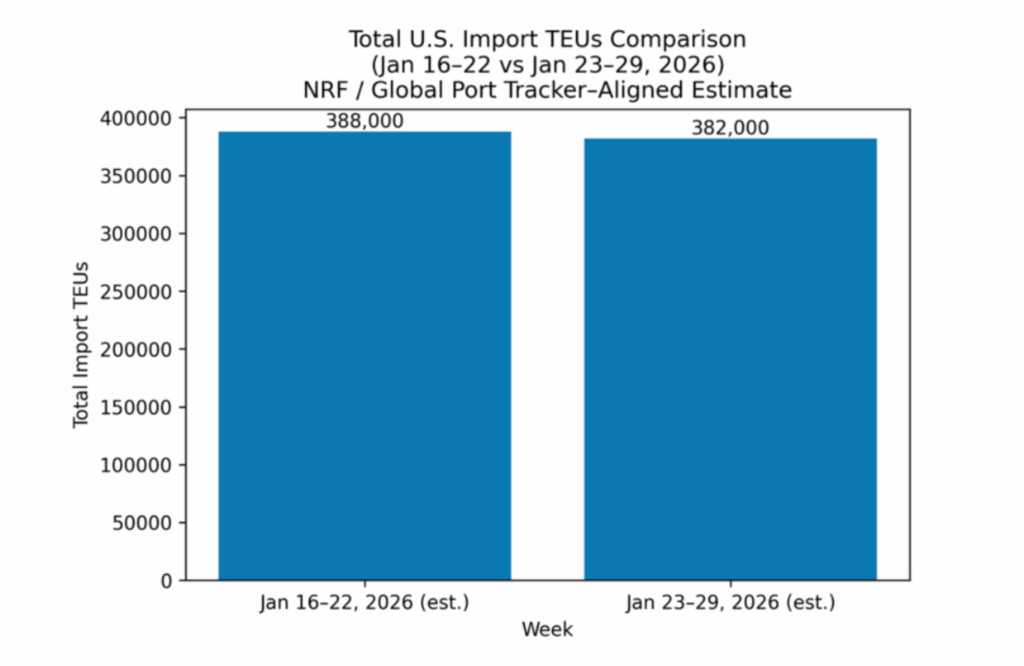

TEU’s are down 1.54% over last week, with majority coming into New York/New Jersey 13.1%, Los Angeles 12.3% and Long Beach 12%.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Memphis: Container rail flows through Memphis are improving after last week’s winter storm, but recovery remains gradual as lingering cold conditions and network rebalancing continue to slow yard productivity and inland transit in some corridors. Terminals are operating, though importers may still see occasional dwell and schedule variability as backlogs clear. As ramps work through stacked containers, Port X’s expanding Memphis fleet and tighter dispatch coordination help customers pull freight quickly, avoid storage and delays, and keep regional deliveries moving. When the network gets tight, our Memphis team steps in to keep cargo flowing. Put our expanded capacity to work: letsgetrolling@portxlogistics.com.

Chicago: Recovery from last week’s winter storm continues, with cold-weather restrictions and equipment rebalancing still slowing portions of the rail network feeding Chicago intermodal ramps. As capacity tightens and containers stack, Port X’s asset-based Chicago fleet — backed by 88 trucks, 150 chassis, specialty equipment, secure yard space, and in-house overweight permitting — helps customers clear freight quickly and avoid storage, demurrage, and missed delivery windows. When weather creates inland bottlenecks, our team keeps cargo moving from dispatch through final delivery. If rail congestion is slowing your freight, reach out to letsgetrolling@portxlogistics.com.

Did you know? Brian (BK) Kempisty will take the stage at Manifest 2026 this February in Las Vegas as part of the AI Slopocalypse panel.

Since founding Port X Logistics in 2017, BK has helped build a nationwide drayage and logistics operation by putting culture, service, and practical technology at the core. At Manifest, he’ll cut through the AI hype and share how logistics companies can apply technology with intention — focusing on real operational results.

Catch him live February 9–11, and to meet with BK during the event, reach out to marketing@portxlogistics.com.

Import Data Images