Port of Long Beach

1906 words 7 minute read – Let’s do this!

After months of muted activity, the U.S. container market will start to show signs of movement as January rolls on — though the path forward remains uneven. Late January is expected to deliver the first month-over-month increase in import volumes in some time, driven largely by Lunar New Year cargo pull-forward rather than a fundamental shift in demand. At the same time, year-over-year volumes remain under pressure, cost dynamics are quietly evolving beneath the surface, and global routing decisions continue to reflect a market balancing efficiency against risk. In this week’s update, we break down what’s driving the short-term volume lift, why a broader recovery is likely delayed until later this spring, how import prices and currency trends are influencing landed costs, and what the latest developments in Red Sea routing really mean for transit times and network planning. Don’t forget to follow Port X Logistics on LinkedIn for real-time perspective and market commentary — or get our Thursday Market Updates delivered straight to your inbox by reaching out to Marketing@portxlogistics.com.

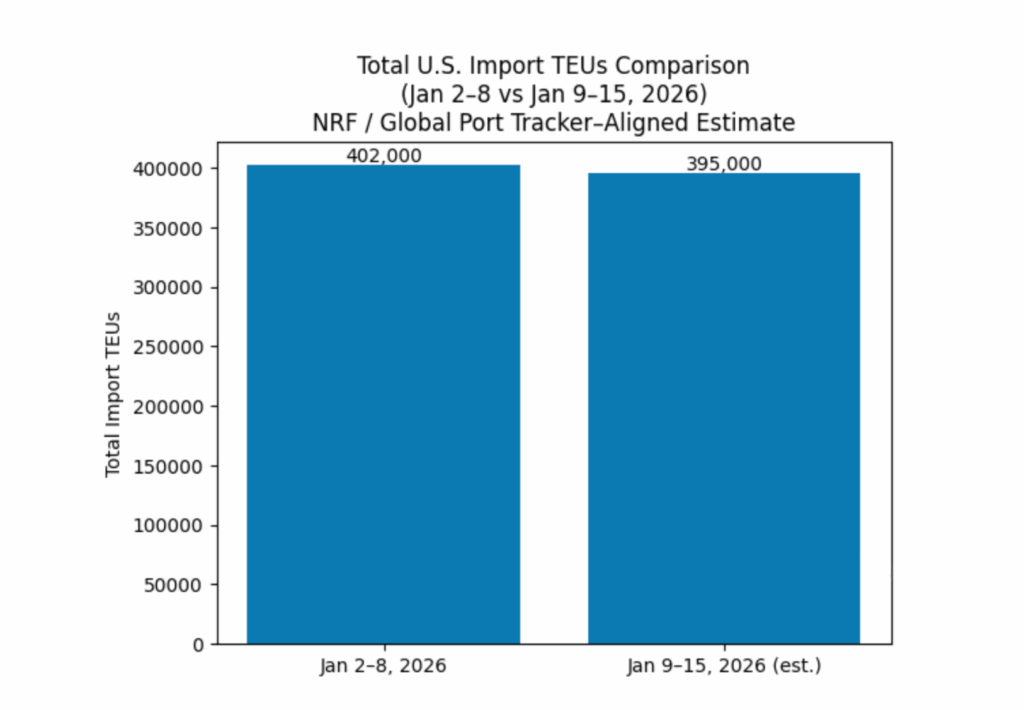

U.S. container ports are expected to record their first month-over-month increase in import volumes this January, according to the latest Global Port Tracker analysis from the National Retail Federation and Hackett Associates. While the uptick marks a shift after several months of decline, overall import levels are still projected to remain below last year’s pace until at least spring. The short-term increase is largely attributed to pre–Lunar New Year shipping activity, which typically pulls some cargo forward ahead of factory shutdowns across Asia, before giving way to the usual post-holiday slowdown.

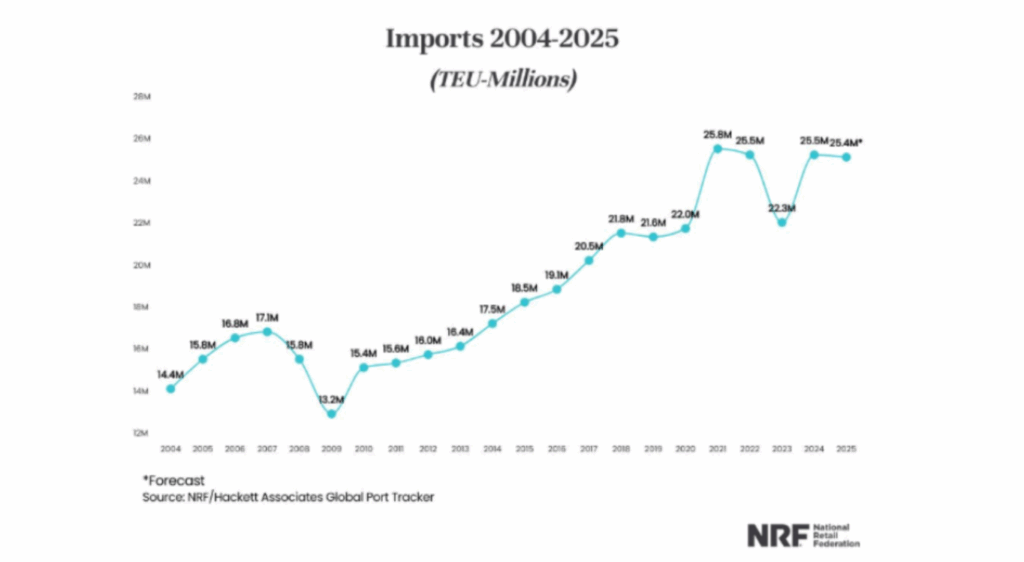

Looking at the broader picture, U.S. containerized imports totaled 12.53 million TEUs in the first half of 2025, representing a 3.7% increase compared with the same period a year earlier. Despite that early-year strength, full-year volumes are now projected to edge slightly lower, with total 2025 imports forecast at 25.4 million TEUs — down marginally from 25.5 million TEUs in 2024. Monthly projections point to continued year-over-year softness through the late winter, with February and March expected to post notable declines before volumes begin to recover in late spring. Specifically, February imports are forecast at approximately 1.94 million TEUs, followed by 1.88 million TEUs in March and 2.03 million TEUs in April, all reflecting year-over-year declines. A meaningful turnaround is not expected until May, when imports are projected to reach 2.07 million TEUs (Woohoo!) — the first month of positive annual growth since late summer of the prior year. Recent actuals underscore the uneven demand environment, as U.S. ports tracked by Global Port Tracker handled 2.02 million TEUs in November, down both from October levels and from the same month last year.

The magnitude of recent year-over-year declines is amplified by unusually strong import activity in late 2024, when shippers accelerated cargo movements in response to potential port labor disruptions and the threat of new tariffs. According to Hackett Associates, ongoing volatility in U.S. import volumes continues to be driven by trade policy uncertainty, particularly as governments place greater emphasis on protecting domestic industries and addressing perceived trade imbalances. That said, there has been some easing of tensions on the maritime front, with the U.S. and China agreeing late last year to temporarily suspend newly implemented reciprocal port fees as part of broader efforts to stabilize trade relations.

What This Means for Shippers

For shippers, the expected January bump in import volumes is less a signal of sustained recovery and more a timing-driven adjustment tied to Lunar New Year cargo pull-forward. Short-term congestion risks may surface at select gateways, but broader capacity conditions remain relatively balanced as the market moves into the typical post-holiday lull. With year-over-year volumes projected to stay soft through early spring, carriers are likely to continue managing capacity carefully, limiting the likelihood of widespread rate pressure in the near term.

At the same time, trade policy uncertainty remains a key variable. Elevated year-over-year comparisons reflect last year’s surge in early imports driven by labor and tariff concerns — a pattern that could re-emerge quickly if new policy actions are announced. Shippers should remain flexible in routing and timing strategies, closely monitor gateway performance, and be prepared to act quickly if geopolitical or regulatory shifts begin to pull demand forward again. While a more meaningful volume rebound isn’t expected until late spring, disciplined planning and visibility across port, rail, and inland networks will be critical to navigating an uneven first half of the year.

U.S. import prices showed a modest upward trend late last year, rising 0.4% between September and November, according to data released by the Bureau of Labor Statistics. The increase was reported on a two-month basis because the extended 43-day federal government shutdown disrupted normal data collection, preventing the agency from publishing standard monthly import price figures for October and November. In place of the usual reports, the BLS released limited estimates based on non-survey data for select indexes. On a year-over-year basis, import prices were up slightly, increasing 0.1% through November. The shutdown also delayed other key inflation measurements, including the Consumer Price Index for October, though Producer Price Index data collection continued with some processing delays. Several components of these reports — including import prices — feed into the Personal Consumption Expenditures Price Index, which is the Federal Reserve’s preferred gauge for tracking inflation relative to its 2% target.

Energy costs provided some offset to broader price pressures, with imported fuel prices declining 2.5% over the two-month period and falling 6.6% compared with a year earlier. Food import prices also softened, slipping 0.7% in November following an increase in October. Excluding both food and fuel, however, import prices rose 0.9% year over year, a trend largely attributed to the weakening of the U.S. dollar. The trade-weighted dollar declined approximately 7.2% over the past year, increasing the cost of goods purchased from foreign trading partners. Despite these mixed signals, inflation remains contained. Businesses have largely absorbed the impact of tariffs, limiting pass-through to consumer prices. As a result, the Federal Reserve is widely expected to leave its benchmark overnight lending rate unchanged in the 3.50% to 3.75% range at its late-January policy meeting.

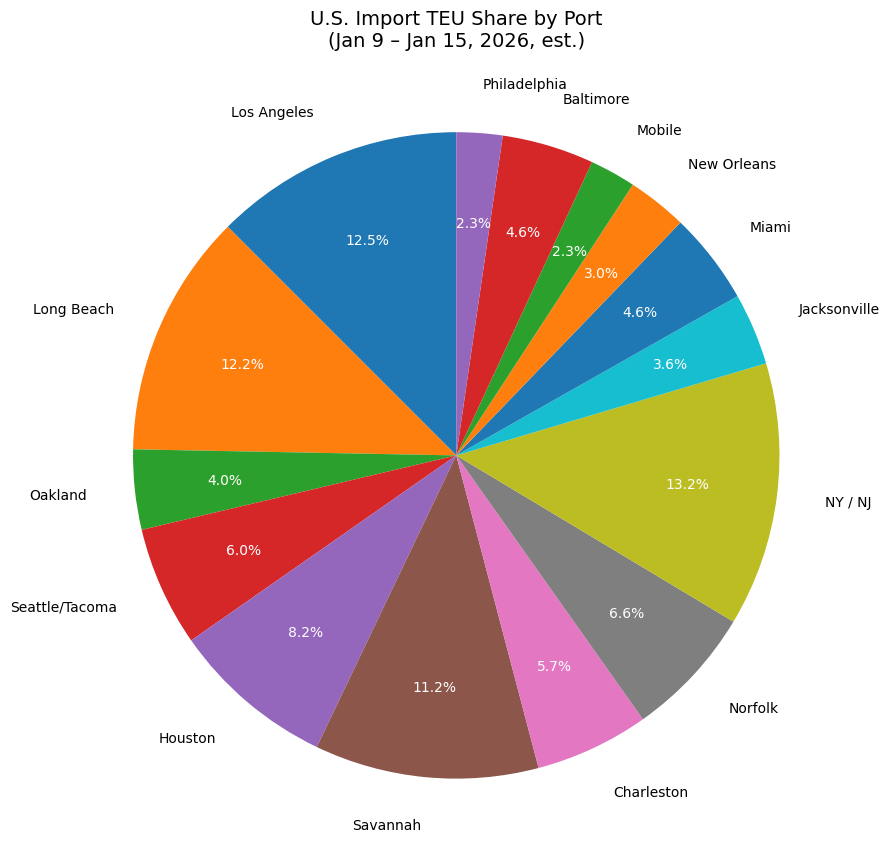

TEU’s are down 1.74% over last week, with majority coming into New York/New Jersey 13.2%, Los Angeles 12.5% and Long Beach 12.2%. Recent headlines around Red Sea routing have appeared contradictory, but the reality is more nuanced. Maersk has begun a measured return to transits through the Suez Canal and the Red Sea, restarting select services after successful test sailings earlier this month. The move reflects improved short-term security conditions and the operational benefits of shorter transit times compared with routings around the Cape of Good Hope. However, this is not a blanket industry return, nor a signal that risks have fully disappeared. Security concerns in the region remain unresolved, which explains why many carriers are still avoiding the corridor or limiting exposure to specific loops. Even Maersk has emphasized that its return is conditional, with routing decisions subject to continuous risk assessments and the option to revert if conditions deteriorate. As a result, the global carrier community is currently split between cautious re-entry and continued avoidance — creating a transitional phase rather than a definitive shift.

For shippers, this means transit times and capacity patterns may become increasingly uneven over the coming months. Some trade lanes could see faster sailings and modest capacity normalization, while others remain constrained by longer routings and conservative network planning. Until security conditions stabilize more broadly, Red Sea routing will likely remain selective, dynamic, and carrier-specific rather than a uniform industry standard.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

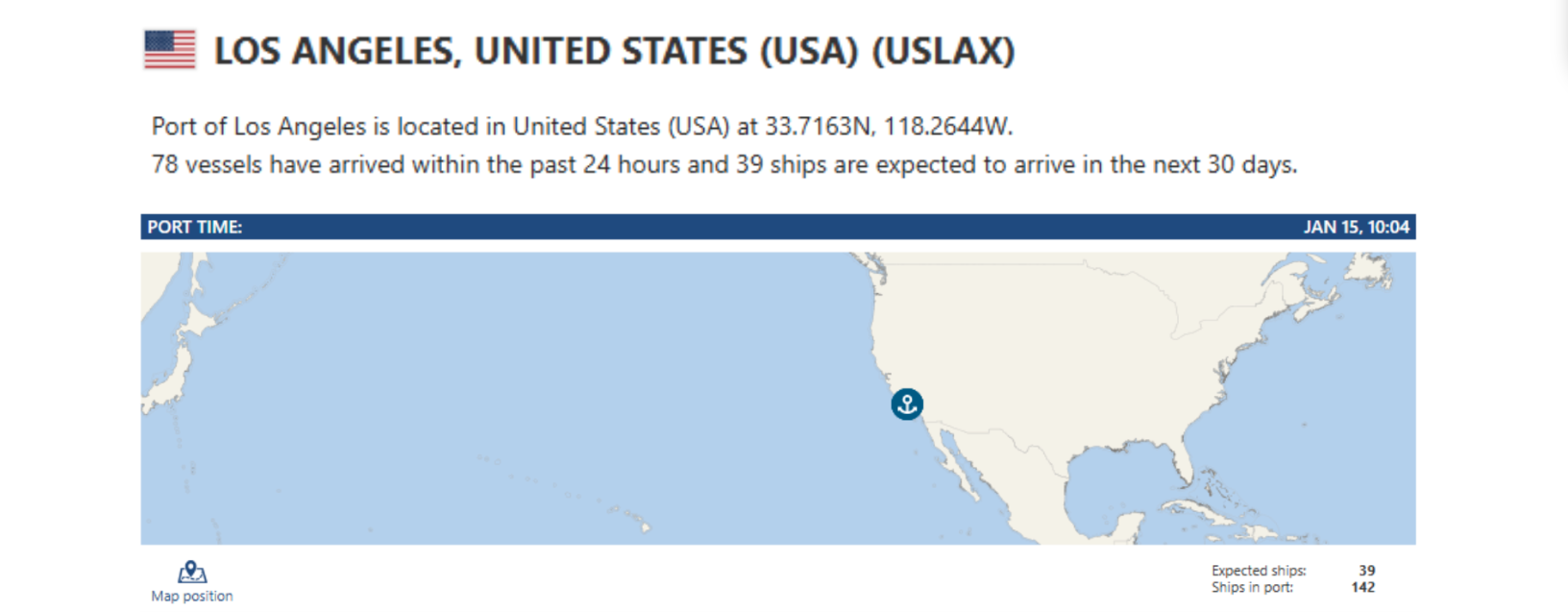

LA/LGB: Recent port bulletins from Los Angeles and Long Beach indicate that new immigration-related enforcement is tightening crew handling procedures, with non-U.S. visa holders no longer permitted to disembark or be repatriated at these ports without additional approvals. Parole, which was previously routine for crew changes, is no longer automatically granted, and medical parole is now reviewed on a case-by-case basis, extending approval timelines. While largely administrative in nature, these changes can have real operational consequences: delayed crew rotations may extend vessel port stays, disrupt sailing schedules, and introduce variability in berth availability. For shippers, the impact shows up as reduced schedule reliability, potential cargo delays, and increased risk of downstream costs tied to demurrage, detention, or last-minute routing adjustments — another reminder that regulatory shifts, even outside cargo handling, can ripple quickly through the supply chain. Another West Coast update: Lower transload rates are live in LA and Long Beach? The benefits haven’t gone anywhere — secure yard access, flexible storage, full OpenTrack visibility, and our No Demurrage Guarantee when you dispatch 72 hours out. Fewer surprises. Smoother moves. Better control at the terminals. Ready to simplify your West Coast freight? Email letsgetrolling@portxlogistics.com and we’ll take the wheel.

Savannah: Seaboard Marine has resumed direct weekly service at the Port of Savannah, reestablishing a key trade link between the Southeast and major markets in Latin America and the Caribbean. The reinstated service began with a northbound arrival on January 7th from Colombia, calling Cartagena, Barranquilla, Santa Marta, and the Dominican Republic, followed by the first southbound departure on January 14th. Operating on a consistent Wednesday schedule, the service is expected to improve transit times and schedule reliability while expanding routing options for both importers and exporters. Georgia Ports Authority officials say the return strengthens regional supply chains, enhances cold-chain capabilities, and provides improved access to transshipment connections serving West Coast South America. Port X Logistics isn’t just showing up in Savannah — we’re lighting up the entire South Atlantic corridor. Our 12-truck drayage fleet keeps Savannah, Charleston, and Jacksonville humming, backed by hazmat-certified drivers, secure yard space, and a full-service transload warehouse that’s always ready for action. Last-minute cross-dock? Rapid-fire transload? Same-day save when everyone else is tapping out? That’s our sweet spot. Fast moves, sharp execution, and pricing that keeps things competitive. When you run freight with Port X, you’re not just moving containers — you’re running with the inside lane. Ready to roll? letsgetrolling@portxlogistics.com

Did you know? New year, new rules? Don’t let urgent freight wreck your 2026.

Carrier 911 is built for the moments when things go sideways — and this year, that’s exactly the energy we’re bringing. While others are still “circling back,” our team is already moving, solving, and recovering the shipments that absolutely cannot miss.

Our Carrier 911 crisis-response specialists are airfreight veterans available 24/7/365, ready to jump on AOG recoveries, hotshots, expedited ground, aerospace, industrial, and automotive moves, plus front- and back-end charters and first/last-mile OBC. If it’s urgent, complex, or mission-critical, that’s our lane.

Need wheels now? Our exclusive-use Sprinters, straight trucks, and dry vans are staged and ready at a moment’s notice — with real-time tracking, zero-guesswork visibility, and instant PODs delivered straight to your inbox. No chasing updates. No surprises. Make 2026 the year urgent freight stops being stressful.

For a free demo, email info@carrier911.com or schedule one here: www.portxlogistics.com/tech-demo/

Import Data Images