Port of Charleston

1729 words 7 minute read – Let’s do this!

Let it snow, let it snow, let it snow! It’s officially the season of twinkling lights, peppermint everything, and pretending we’re not checking shipment statuses from holiday parties. And while the supply chain has gifted us an unusually smooth December — fluid terminals, steady drayage, surprisingly few “urgent alert” emails — the data says this calm might be more like the quiet before the wrapping-paper explosion. Import forecasts show a softer finish to 2025 as retailers burn through their earlier-than-usual inventory builds, but all signs point to a spring surge once shelves start looking bare again. Meanwhile, transportation costs are doing their own version of sneaking holiday surprises into your budget — not from base rates, but from fuel swings, labor pressure, and terminal accessorials that stack up faster than cookies disappearing from Santa’s plate. In this edition, we’re breaking down what’s happening now… and what’s coming next once the New Year’s confetti settles. Spoiler: planning early beats panic later. Get your insights before the rush: Follow Port X Logistics on LinkedIn or subscribe at Marketing@PortXLogistics.com for Thursday Market Updates.

Import Forecast Snapshot — What’s Ahead for Late 2025 & Early 2026

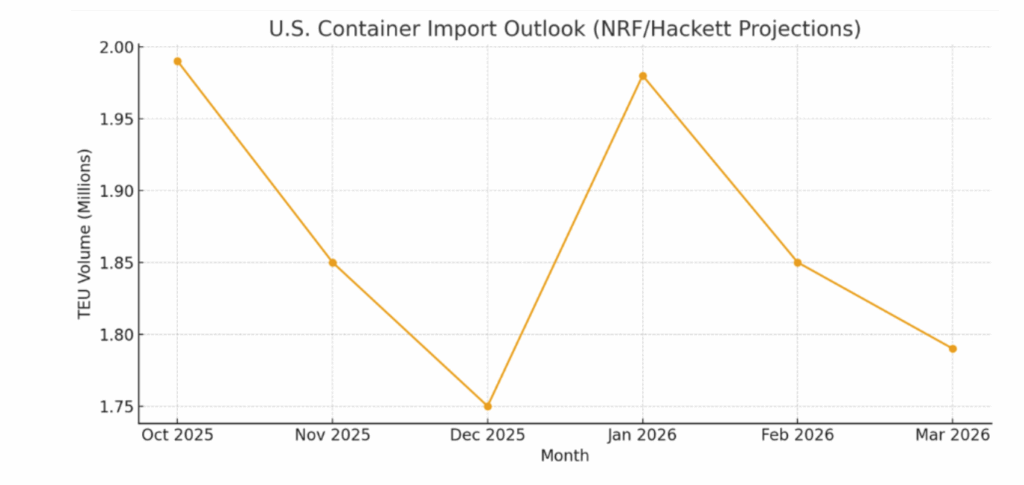

After a strong start to the year — fueled by tariff-driven front-loading — U.S. import volumes are now leveling off. NRF/Hackett’s Global Port Tracker projects that total containerized imports for 2025 will land around 24.9 million TEUs, about 2.3% lower than 2024.

Monthly activity is also expected to soften heading into peak holiday months:

- October: ~1.99M TEUs (–11.5% YoY)

- November: ~1.85M TEUs (–14.4% YoY)

- December: ~1.75M TEUs (–17–18% YoY)

Looking ahead, early 2026 doesn’t point to a quick rebound. Current estimates show:

- January: ~1.98M TEUs (–11.1% YoY)

- February: ~1.85M TEUs (–9% YoY)

- March: ~1.79M TEUs (–16.7% YoY)

In short — the inventory surge has faded, consumer demand is steadier, and seasonality is back in the driver’s seat as we head into the new year.

What’s behind the dip

- Many retailers and importers front-loaded orders in summer 2025 in response to tariff uncertainty, shifting a sizable portion of inventory early rather than later. That temporarily lifted mid-year volumes — but has led to a softer second half of the year and a depressed early 2026.

- Ongoing tariff volatility, trade-policy uncertainty, and cautious consumer demand are prompting importers to slow down new orders and draw down inventory rather than restocking aggressively.

What to watch heading into 2026

- The slow start to 2026 may continue through Q1 unless consumer demand spikes or tariff/stimulus dynamics change.

- The uneven monthly flow — post-front-load slump, followed by potential restocking — creates windowed opportunities for carriers, ports, and inland-logistics partners to capture volume when competitors may be under-committed.

- Buyers who can forecast demand early and maintain flexibility in sourcing and routing are likely to come out ahead in terms of cost, capacity utilization, and inventory positioning.

That combination — quiet operations in the offseason, controlled capacity by carriers, and a likely wave of demand in early 2026 — means the next few months may bring volatility: surges in bookings, tighter sailing windows, chassis and terminal constraints, and increased pressure on inland drayage capacity.

For supply-chain planners, this creates a clear strategic window: now is the time to start planning for spring. Inventory positioning, booking schedules, chassis availability, and inland routing should all be reviewed ahead of the coming uptick. By locking in vessel space, scheduling drayage early, and building contingency plans, companies can avoid being caught off guard by the inevitable Q1 volume surge.

In short: the current calm is an opportunity, not a lull. What looks like “normal” today may quickly flip into the next peak — and early planning will reward those who anticipate it.

As we shift into the 2026 budgeting season, one thing is becoming clear: the total cost of moving freight is increasing, even if headline trucking rates aren’t. That’s because the pressure is coming from multiple places at once — and most of those costs land outside the line-haul charge. Fuel markets remain unpredictable, and carriers are managing expenses tied to diesel volatility, seasonal price swings, and equipment upgrades to meet newer emissions standards.

Labor remains another major factor. Competition for drivers, warehouse workers, and equipment technicians continues to intensify — pushing wages higher and raising the baseline cost of trucking capacity. At the same time, insurance and liability premiums are rising across the industry, influenced by equipment values, legal exposure, and safety requirements.

Then there’s the port side of the equation — where the small fees add up fast. Chassis storage charges, terminal access fees, reefer plug requirements, and demurrage/detention penalties continue to creep upward year over year. These accessorials often turn a budget-friendly shipment into something far more expensive than expected.

Add in the growing layer of carbon-related compliance responsibilities — reporting, emissions monitoring, and the early stages of green program surcharges — and companies are dealing with a cost landscape that looks far different from just two years ago.

Here’s the real takeaway:

The shippers who win in 2026 won’t just chase low rates — they’ll partner with providers who understand how to control the entire cost picture.

Port X Logistics is helping customers:

- Lock in budget-stable trucking capacity through strategic planning

- Avoid surprise charges with proactive container visibility and quick recovery

- Reduce exposure to chassis and terminal fees through owned equipment

- Plan ahead for sustainability-linked requirements before they become costly

Margins are protected in the details — and that’s exactly where we operate. Let’s get your 2026 plan dialed in now while options are still wide open.

Still, with global trade policy turning increasingly uncertain, 2026 may also be a year of significant shifts — and companies that react quickly could gain a competitive edge. The possibility of tariff revisions, renewed trade tensions, or regulatory changes means many importers could respond again by front-loading purchases to beat new duties or restrictions. That kind of behavior often triggers a sharp spike in container volume, particularly TEUs, as supply chains scramble to get ahead of policy deadlines.

Expect volatility: demand surges followed by quieter periods, inventory buildups, and then sudden dips. That rollercoaster makes reliable routing and flexible plans more valuable than ever. In this shifting landscape, firms that adopt a resilient, flexible supply-chain strategy — one capable of absorbing front-load spikes, redistributing volume, and adjusting routes on the fly — are going to navigate 2026 far better than those who stay rigid.

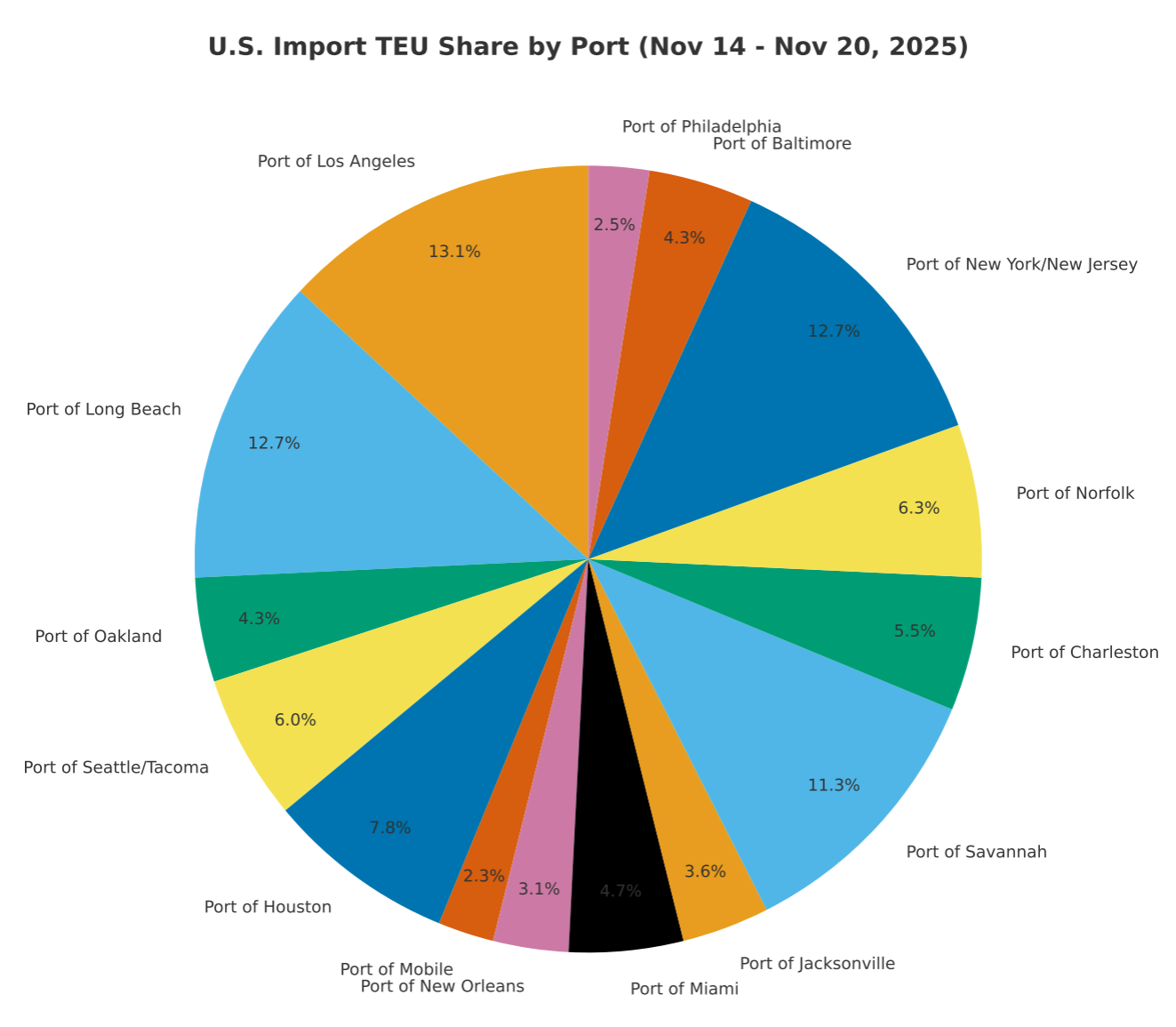

TEU’s are down 3.44% over last week, with majority coming into Los Angeles 13.3%, New York/New Jersey 12.7% and Long Beach 12.6%.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

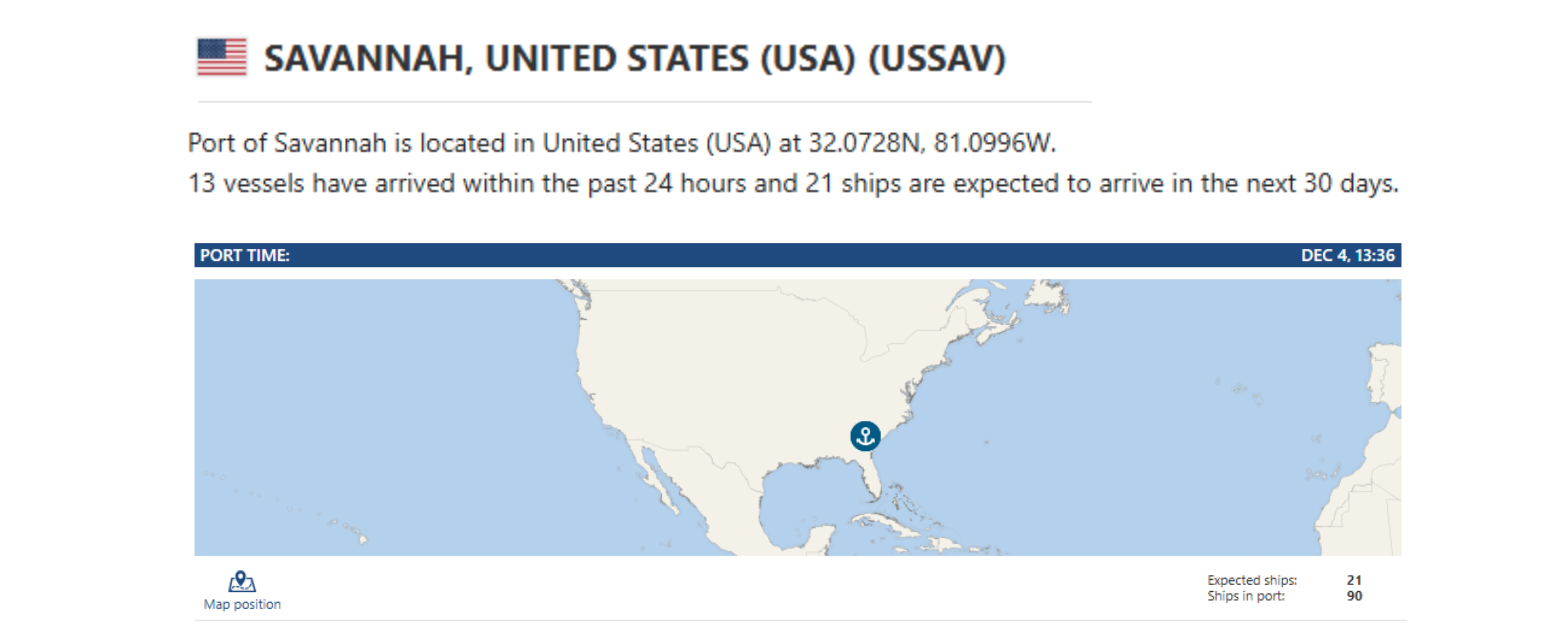

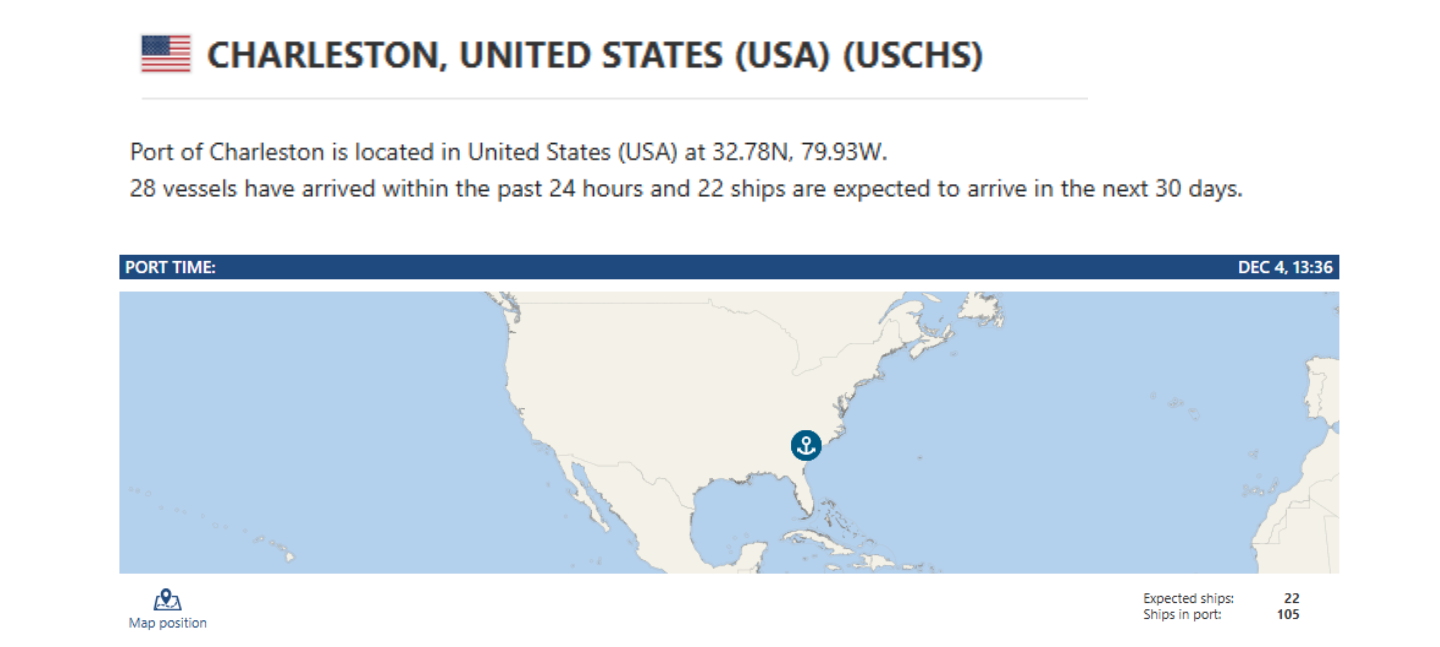

Savannah/Charleston: Savannah and Charleston have firmly established themselves as the fastest-growing gateways in the U.S. South Atlantic, and their market influence continues to rise. Manufacturers and large importers are increasingly shifting distribution networks closer to high-growth population centers like Atlanta and Charlotte, reducing inland transportation costs and improving speed-to-market. That shift is fueling major investment in port infrastructure, rail connectivity, dredging, and new warehouse development — creating a logistics ecosystem built for high velocity. The result: greater throughput capacity, shorter dwell times, and more resilient cargo flows. With discretionary freight moving away from historically congested hubs and toward diversified routing, the Southeast’s prominence in U.S. supply chains is becoming less of a trend and more of a long-term structural shift.

Port X Logistics isn’t just in Savannah — we’re running the South Atlantic like it’s our home track. Our 12-truck squad covers Savannah, Charleston, and Jacksonville with hazmat-certified pros, secure yard space, and a transload warehouse that eats chaos for breakfast. Last-minute cross-dock? Freight that needs superhero energy? We don’t slow down. We don’t say no. We just roll. Hit us up and let’s cause some good trouble: letsgetrolling@portxlogistics.com

LA/LGB: On November 20th, 2025, the governing board for Port of Los Angeles approved a cooperative agreement with the South Coast Air Quality Management District (SCAQMD) — along with Port of Long Beach — to accelerate zero-emission infrastructure deployment across cargo handling, trucks, harbor craft, rail, and vessels. And the “Clean Air Action Plan” (CAAP) — which governs emissions reductions at the twin ports — is set to get a quarterly update on December 9th, 2025. The update will include recent emissions inventories and progress on the clean-truck program. Good news from the West Coast – We’ve dropped our transload rates in LA and Long Beach — and the perks are still stacked: secure yard ✔ flexible storage ✔ full OpenTrack visibility ✔ and our No Demurrage Guarantee when you dispatch 72 hours out. If you’re tired of surprises at the terminals, let’s make your cargo’s life easier.

Email letsgetrolling@portxlogistics.com and we’ll take the wheel.

Did you know? 🚚 Why Transload Wins? At Port X Logistics, we don’t just move containers — we engineer smarter supply chains. Transloading at the port gives our customers the advantage of speed, flexibility, and cost control from the moment freight hits U.S. soil. By pulling cargo off the vessel and into our network of trucks, yards, and transload facilities, we help shippers bypass inland rail delays and take immediate control of their routing decisions.

Need priority cargo moving faster than the rail can get there? Looking to shift freight closer to demand hubs as orders change? Did the rail divert your container to a routing that is more than just a little crazy? We can make transloads happen — fast. Our teams consolidate and deconsolidate product to reduce touches and build optimized truckloads that cut time, handling, and total landed cost. The beauty of “port-to-door with Port X” is that urgency never becomes chaos — it becomes a competitive advantage.

Transload + domestic trucking = speed to market + savings

When the supply chain throws curveballs, Port X keeps you nimble, visible, and moving forward — without the demurrage, detention, or uncertainty. Want to know more about what Port X can do for your transloading needs and above and beyond? Contact letsgetrolling@portxlogistics.com to talk to one of our industry experts!

Import Data Images