Port of Memphis

Port of Memphis

1254 words 5 minute read – Let’s do this!

It’s one of those rare weeks when the logistics world feels… still.

No major tariff shocks, no dock strikes, no fresh disruption alerts. Just the hum of containers moving and a steady flow of freight through the ports. But anyone who’s been in this business long enough knows — quiet seas don’t stay calm for long. For now, we’re using this moment to do what Port X does best — plan ahead. Our teams are reviewing contracts, tightening up risk models, and making sure our port-to-door networks are ready for whatever comes next. Whether the next curveball is policy, weather, or demand-driven, we’ll be ready to move when the market wakes back up. Calm waters make the best time to tune the engine. Let’s keep rolling.

Don’t forget to stay ahead of the curve: follow Port X Logistics on LinkedIn for weekly intel straight from the field, or get the full Market Update delivered to your inbox every Thursday at Marketing@PortXLogistics.com.

Forecasts for November inbound TEUs are softening — roughly 1.75 million TEU, down about 19 percent year-over-year — and that tells its own story. Retailers pulled freight forward earlier this year to dodge tariff uncertainty, leaving less to land in the traditional holiday window. The short-term impact? Clearer ports, faster turns, and maybe a little breathing room for drayage and warehouse ops. The long-term takeaway? The market’s still shifting under our feet.

The U.S.–China one-year port-fee suspension adds to that sense of temporary calm — a tactical truce that buys everyone time to reassess exposure, renegotiate terms, and re-evaluate sourcing. But like any truce, there’s an expiration date stamped right on it. When it lifts, we could see another wave of trade and cost volatility hit the water.

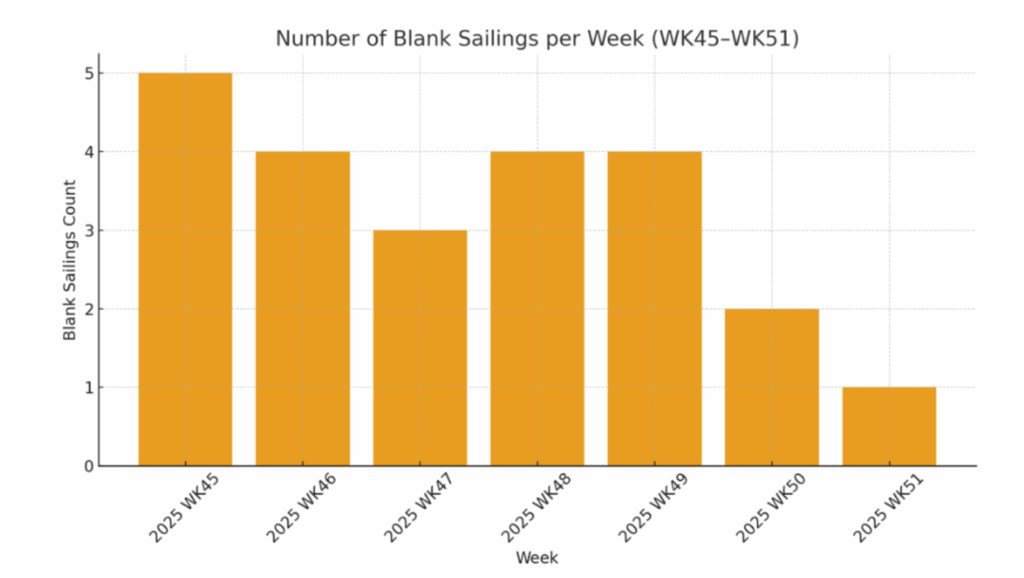

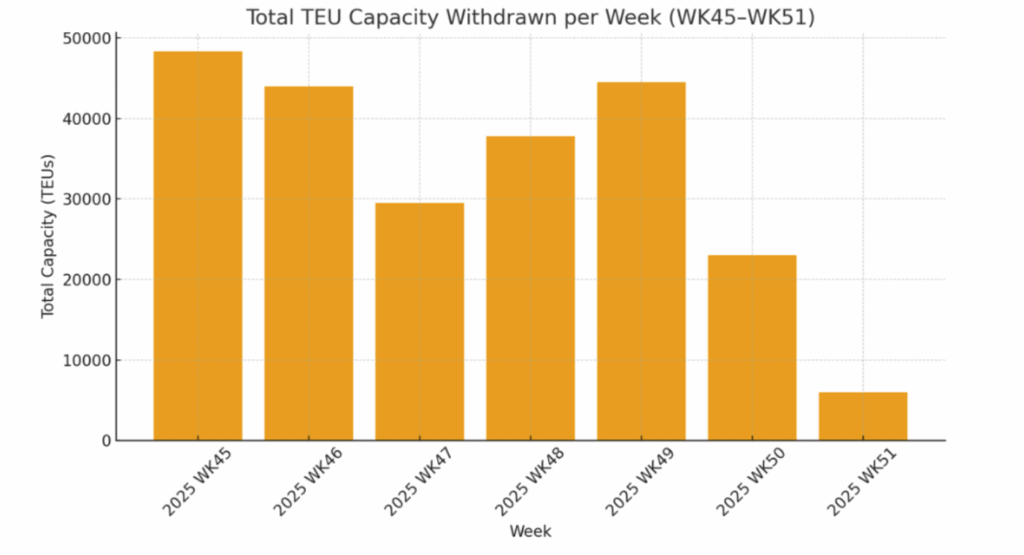

Carriers continue to trim capacity through late November as trans-Pacific demand eases. According to alliance schedules, the sharpest service cuts occur in Weeks 45–46, tapering off toward Week 47 as vessel space normalizes.

- Ocean Alliance (COSCO / CMA / EMC / OOCL)

Leading in schedule adjustments, the alliance blanked multiple US West Coast (PNW & PSW) and East Coast loops in Weeks 45–46.

Typical sailings affected include OPNW / DAH / PNW1, AWE2 / ECX2, and AWE4 / SAX, each skipping origins such as Hong Kong, Port Kelang, Laem Chabang, and Singapore.

Capacities pulled per vessel average 8,000 – 14,500 TEUs, representing a short-term 8-10 % reduction in available tonnage. - Regional Impact

Most omissions fall on PNW, PSW, USEC, and Gulf services — signaling a continued cautious stance on U.S. import flows post-Golden Week. Space tightness should ease from Week 47 onward as blank sailings decline. - Market Implication

The front-loaded wave of cancellations helped carriers stabilize rates ahead of November’s short-lived GRI but with booking forecasts softening, additional voids beyond Week 48 appear unlikely. Expect network normalization by early December.

In short:

Weeks 45–46 = heavy blankings.

Weeks 47–51 = gradual recovery and reinstated loops.

Total withdrawn capacity: roughly 100K–120K TEUs systemwide across major alliances.

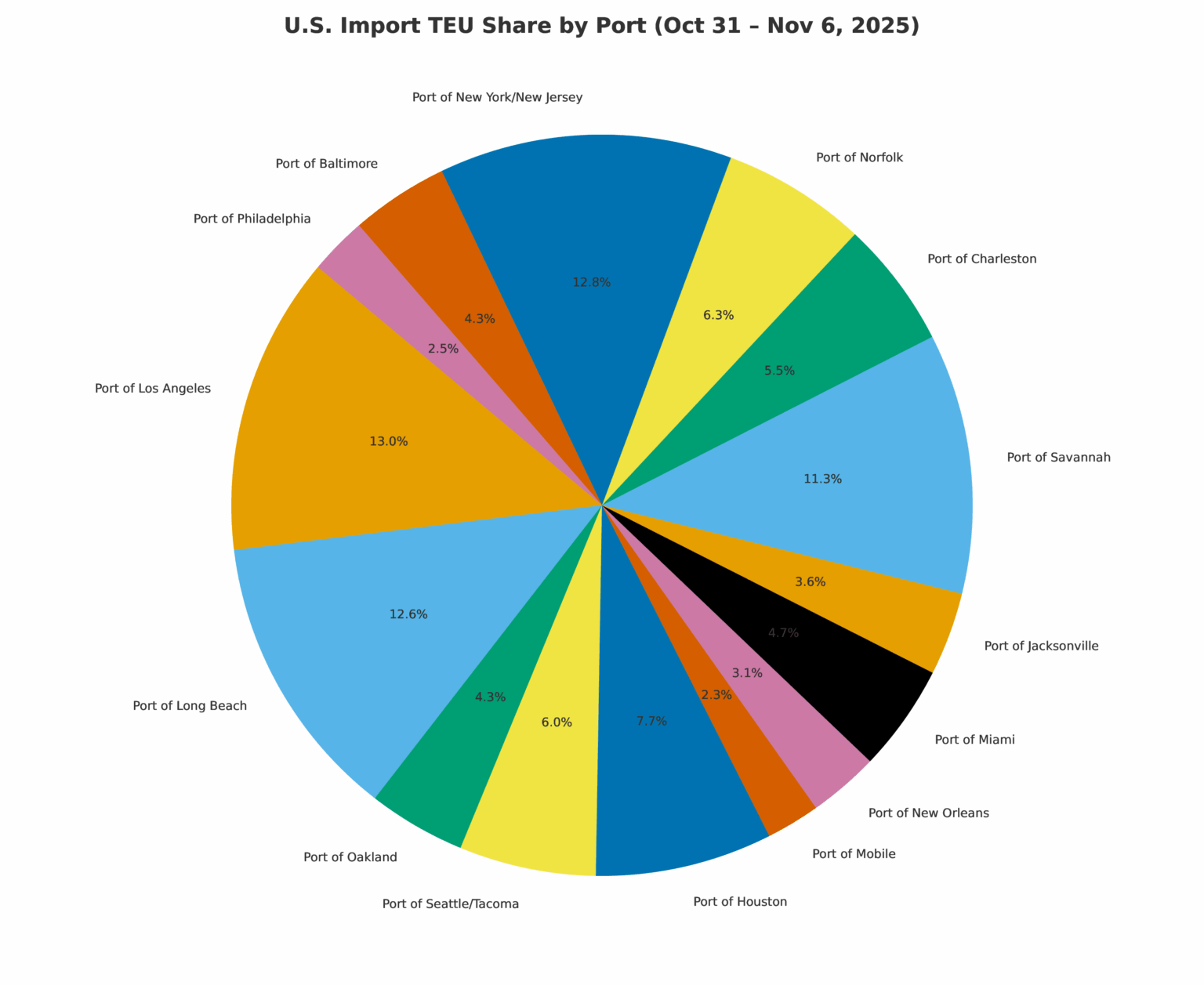

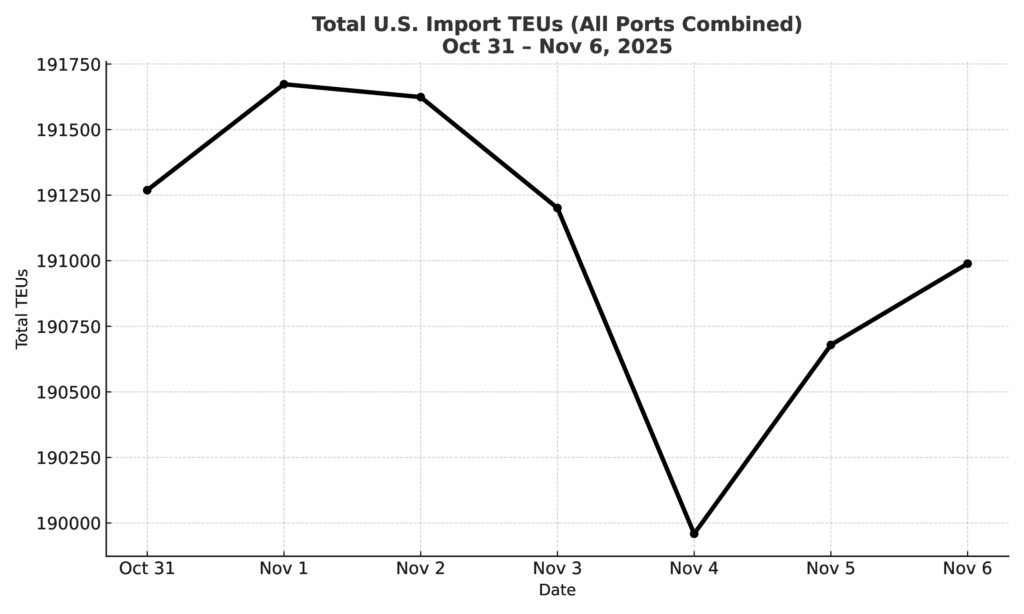

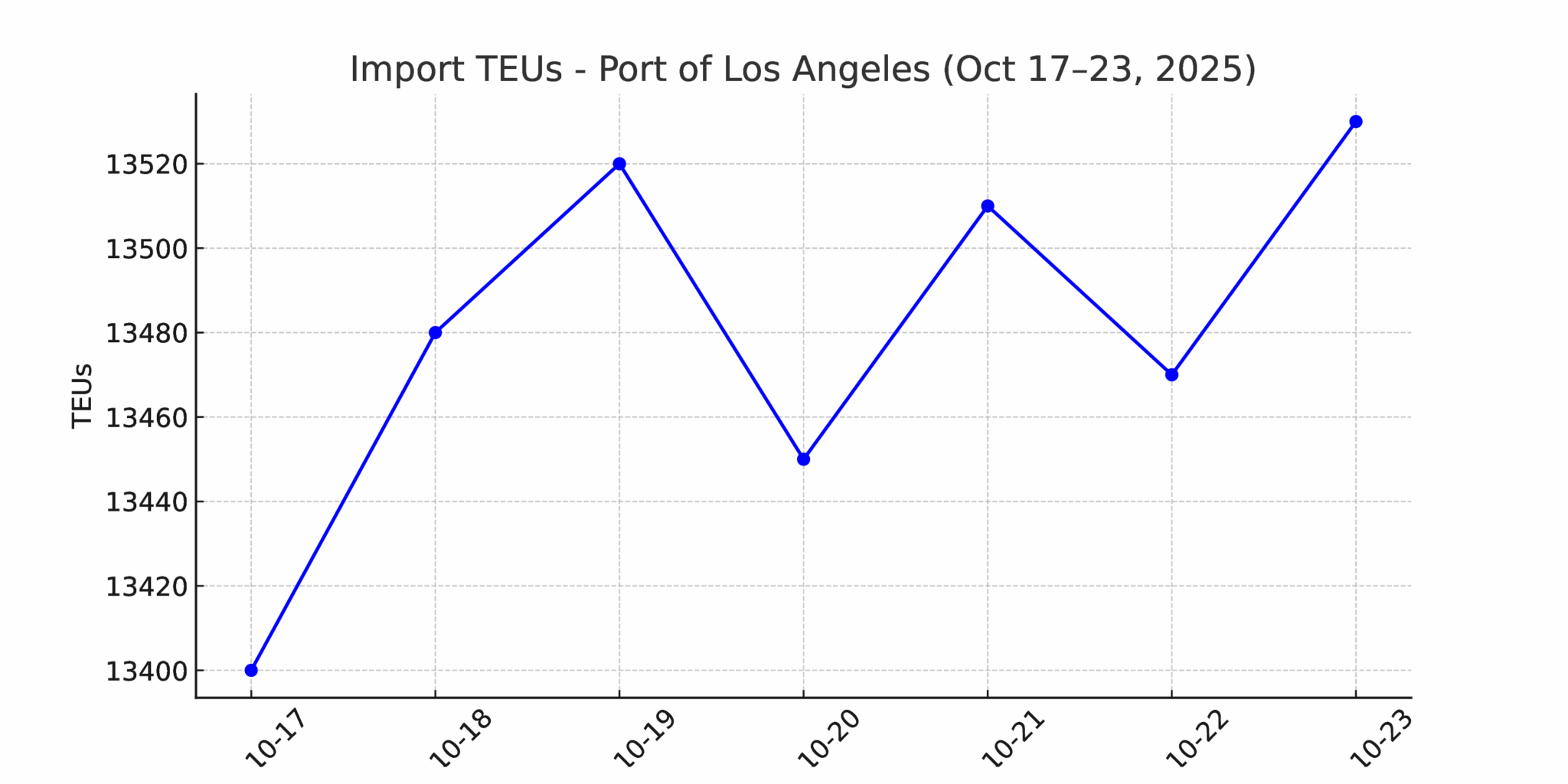

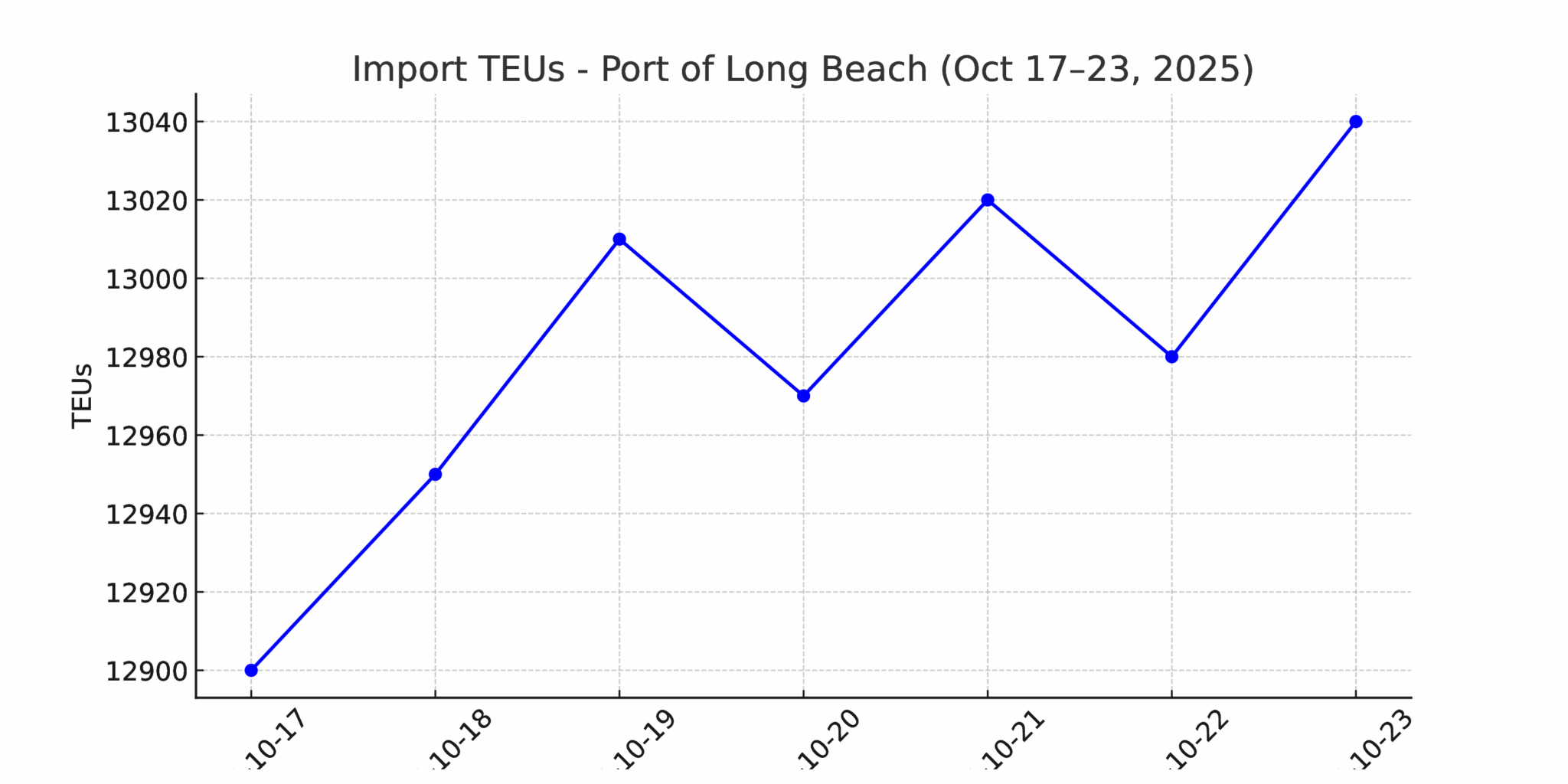

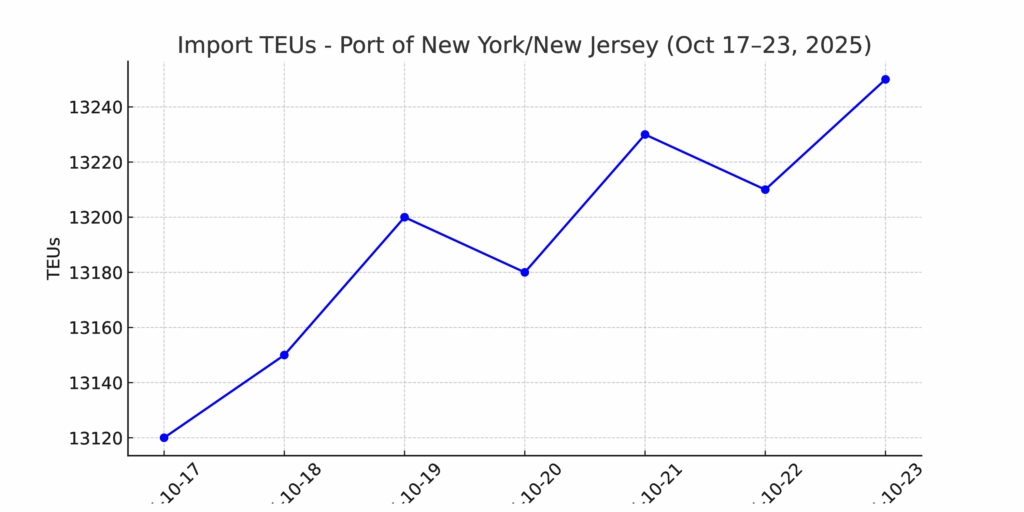

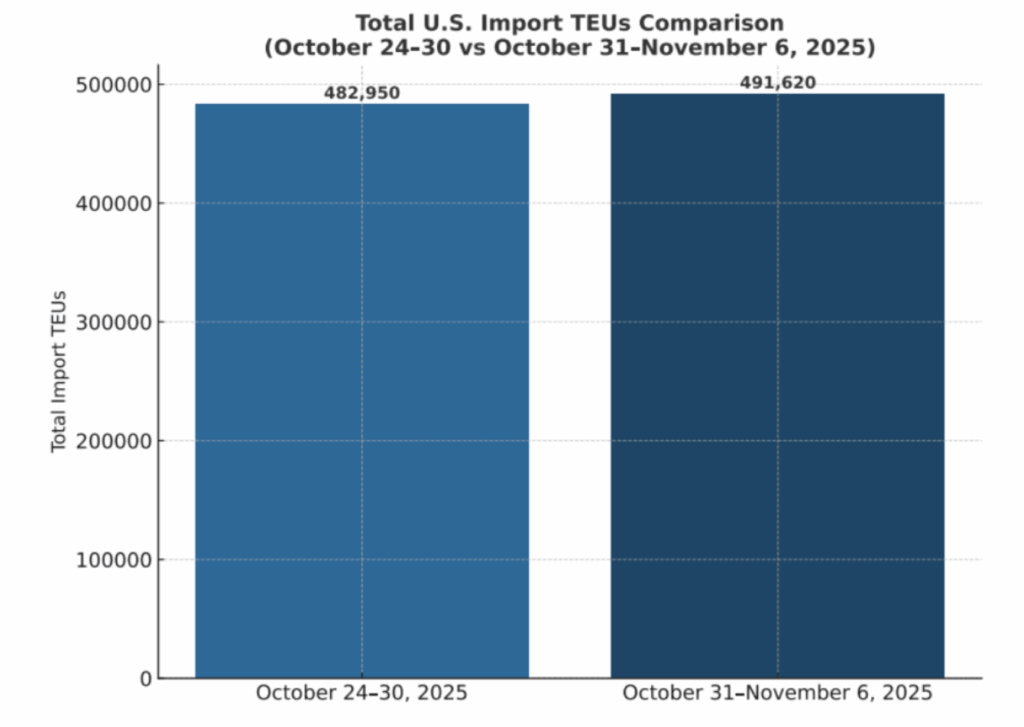

TEU’s are up 1.79% over last week, with majority coming into Los Angeles 13%, New York/New Jersey 12.8% and Long Beach 12.6%. The rate surge tied to the General Rate Increase (GRI) on November 1st was brief. On the U.S. East Coast (USEC), spot rates slipped below $3,000/40’ and are continuing to fall. While USWC rates held steady last week, the easing of U.S.–China trade tensions means demand out of China could slow further in Q4, putting downward pressure on USWC pricing as well.

Benchmark Spot Rates — First Half of November

- Far East → U.S./Canada West Coast: $2,800–$2,900 per FEU, but momentum is softening and rates may fall to $2,300/40’ by the second week of November.

- Far East → U.S./Canada East Coast: $2,700–$2,800 per FEU (Panama Canal surcharges apply)

- Far East → U.S. Gulf Coast: $2,900–$3,000 per FEU (subject to Panama Canal surcharges and Gulf wharfage)

- Far East → Chicago via USWC: $4,700–$4,800 per FEU, but downward pressure could bring it to $4,400-$4,600/40’ starting week 2 of November.

- Far East → Toronto/Montreal: $4,800–$4,900 per FEU (plus Canada-specific surcharges). Some carriers are offering spot rates as low as $3,800-$4,100/40’ on a case-by-case basis.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Houston: It’s officially fog season along the Gulf, and marine agents are already issuing low-water and visibility advisories for the Houston Ship Channel and surrounding terminals. Operations remain open and steady, but vessels should expect intermittent slowdowns if dense fog rolls in during early mornings or overnight hours. The Port of Houston and nearby Gulf terminals are monitoring conditions closely, with pilot associations ready to suspend movements if visibility drops below safety thresholds. For drayage and inland moves, that means potential short-term vessel berthing delays and shifting availability windows. It’s a seasonal rhythm for the region — brief pauses, then quick rebounds once the fog lifts — but worth watching as schedules tighten heading into peak holiday imports. At our LaPorte transload facility, we handle everything from palletized freight to heavy industrial materials like lumber and coils — built for fast turns, safe handling, and flexible solutions. Just up the road, our Dallas team adds 19 trucks and secured yard space, ready to support overflow, reposition freight, or build regional routing options that keep your supply chain moving. Whether you need local drayage, transload, or cross-market support, Port X Logistics has the capacity and coordination to deliver. Want to see how our Houston–Dallas network can strengthen your Gulf operations? Reach out at letsgetrolling@portxlogistics.com — our team’s geared up and rolling across the Gulf.

Memphis: BNSF has rolled out a new Truck Spot Check-In system at its Memphis Intermodal Facility, effective November 5th. The process is designed to reduce congestion and improve gate efficiency, giving drayage drivers a faster, more predictable experience on site. Instead of traditional manual gate queues, drivers will now check in via designated staging areas where BNSF staff verify unit information before release. The change should help shorten turn times and cut idle delays during peak hours — a welcome improvement for one of the Southeast’s busiest inland hubs. Our Memphis team is firing on all cylinders — expanding capacity, adding drivers, and setting new performance records across the board. With more trucks and tighter coordination, we’re delivering the consistency, flexibility, and speed your freight demands. And with the new BNSF Memphis Truck Spot Check-In system now live, efficiency just got another boost. Faster gate turns mean faster freight — and our local Port X team is ready to maximize it. Whether it’s local drayage, regional hauls, or connecting intermodal moves, Memphis is moving — and we’re ready to roll right alongside you. Put our expanded capacity to work today: letsgetrolling@portxlogistics.com

Did you know? Port X Logistics is an Amazon-approved carrier!

If you’ve got containers or truckloads delivering to Amazon, we’re ready to roll. Partner with a team that knows the Amazon network inside and out — fast, reliable, and visibility-driven from port to fulfillment center. Let’s get rolling: letsgetrolling@portxlogistics.com

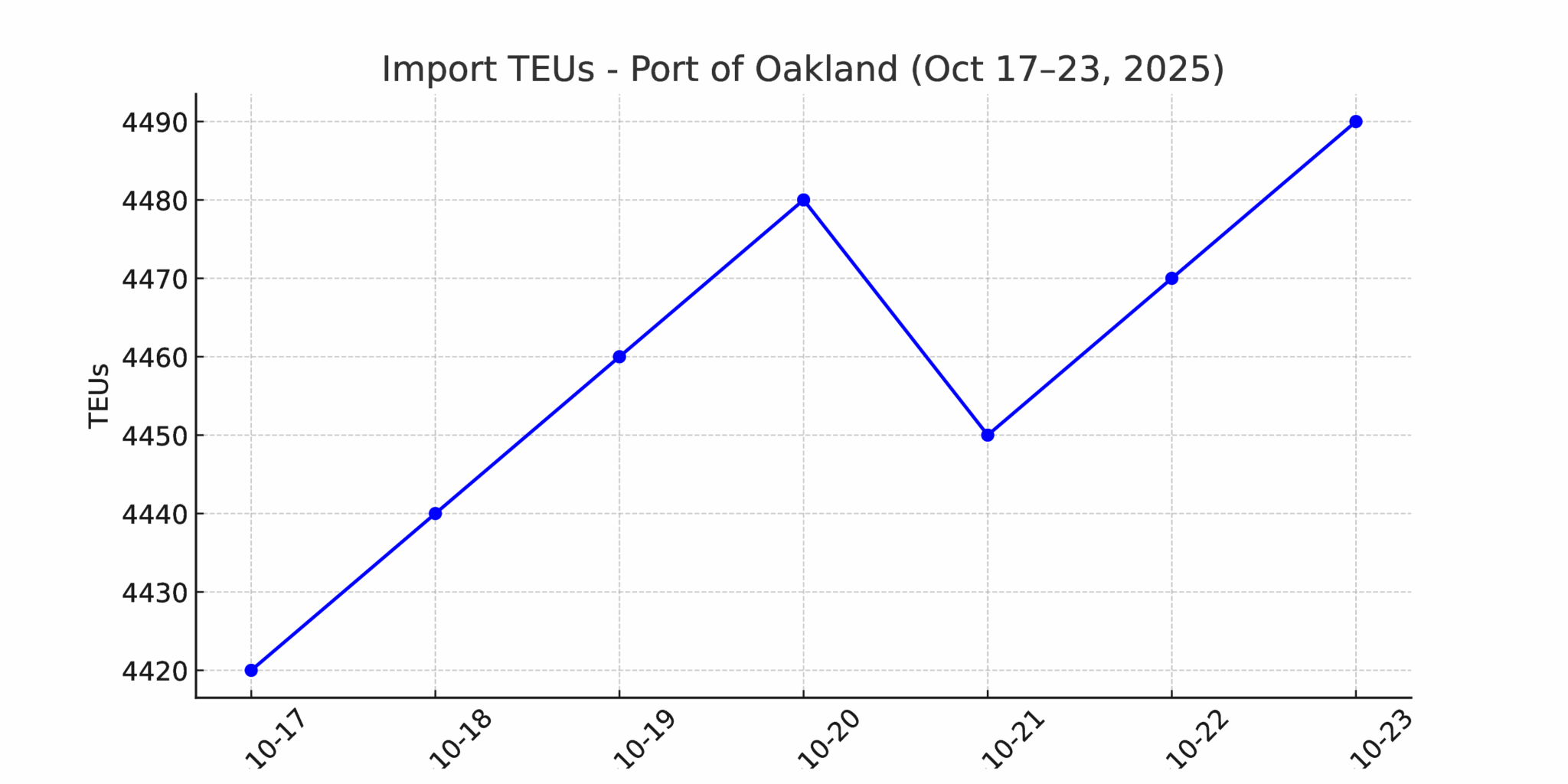

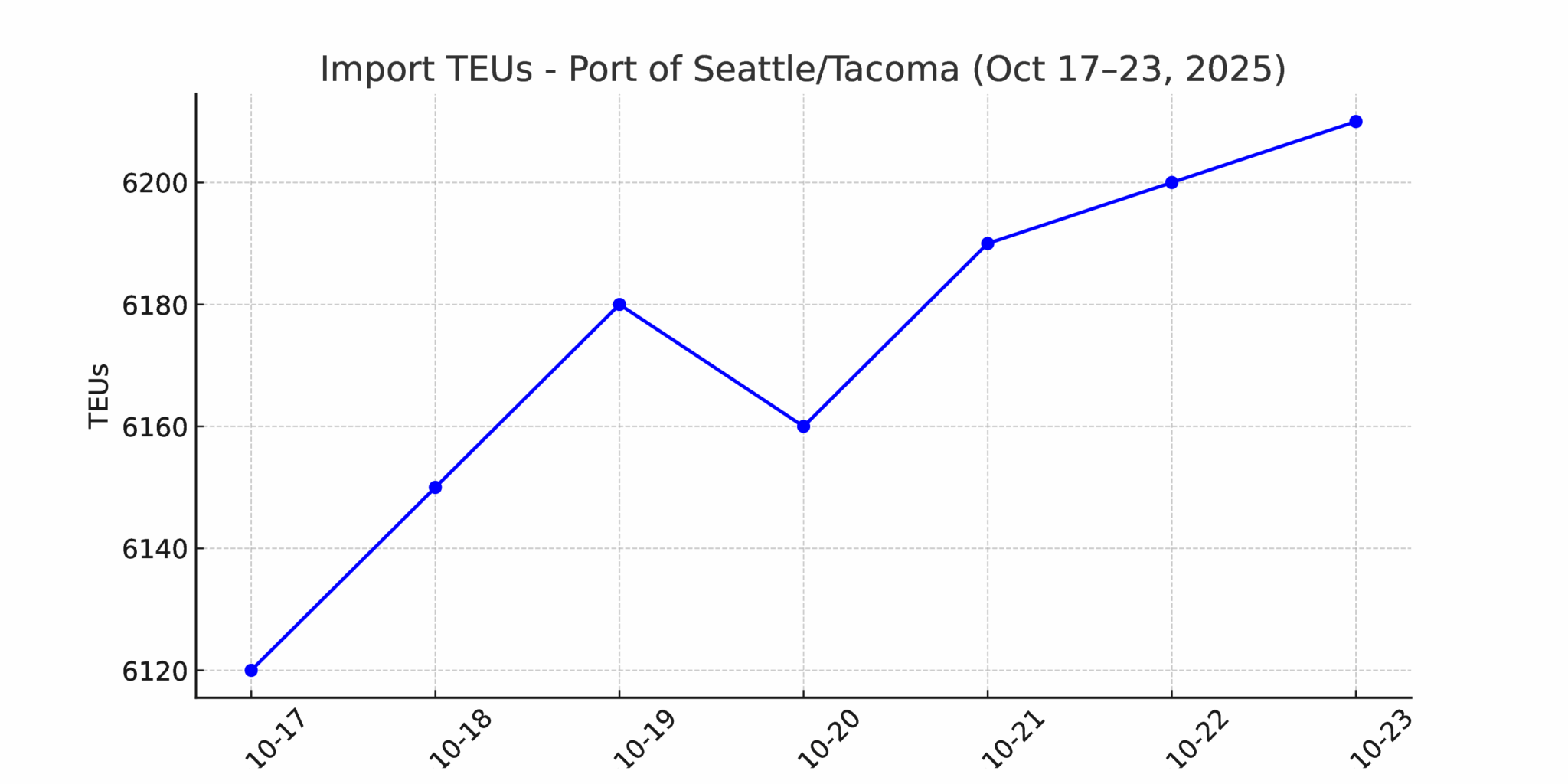

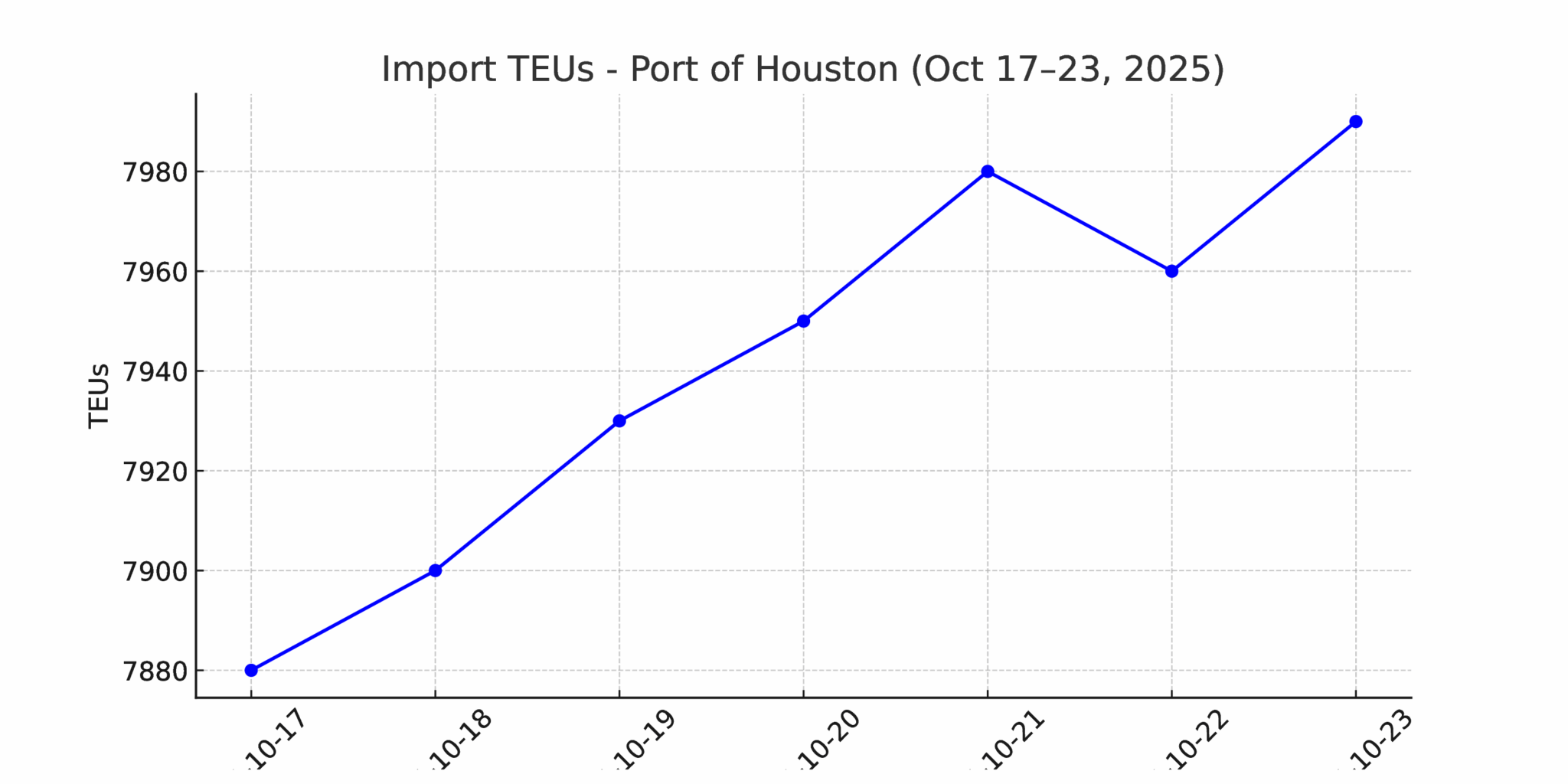

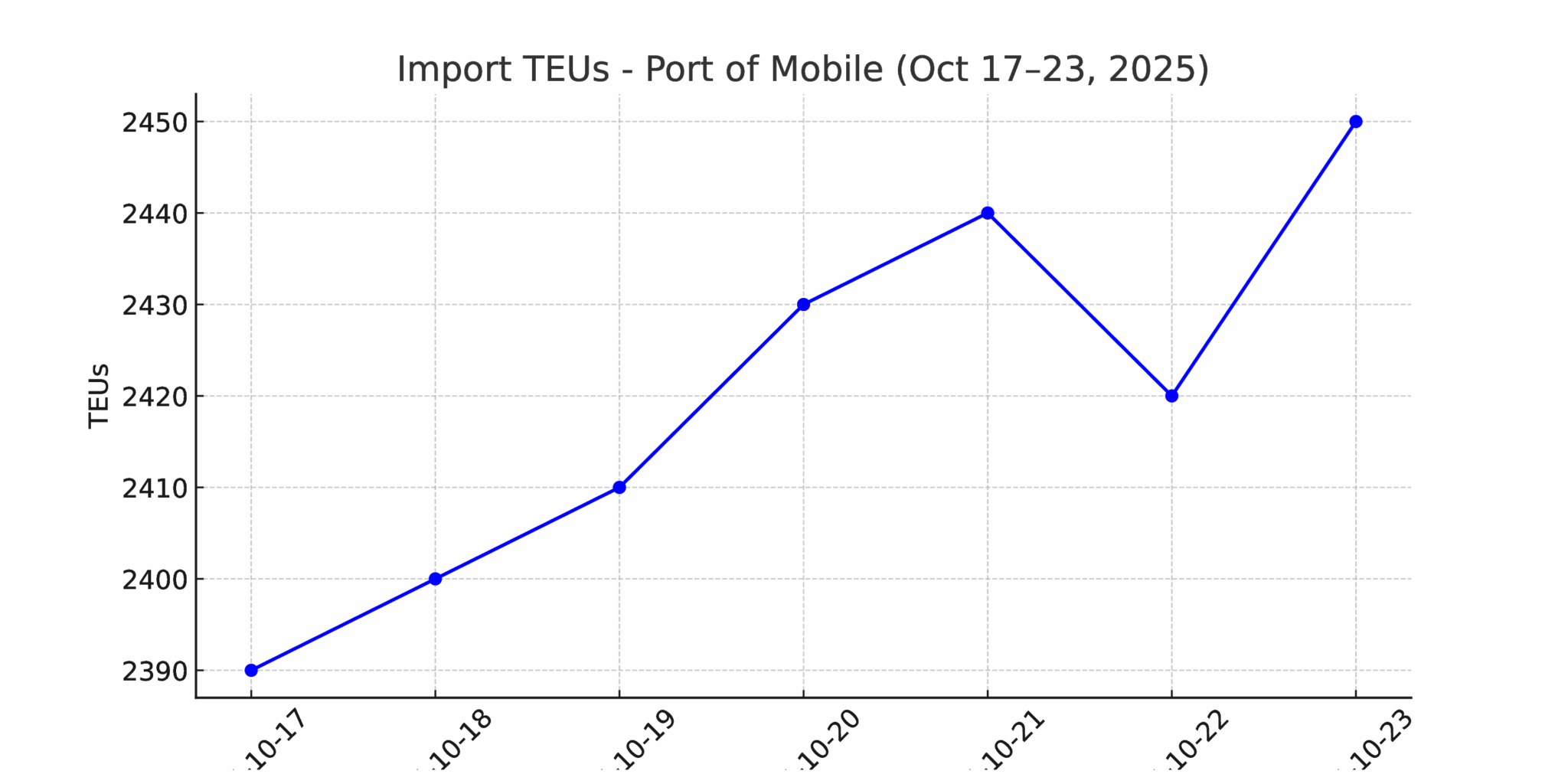

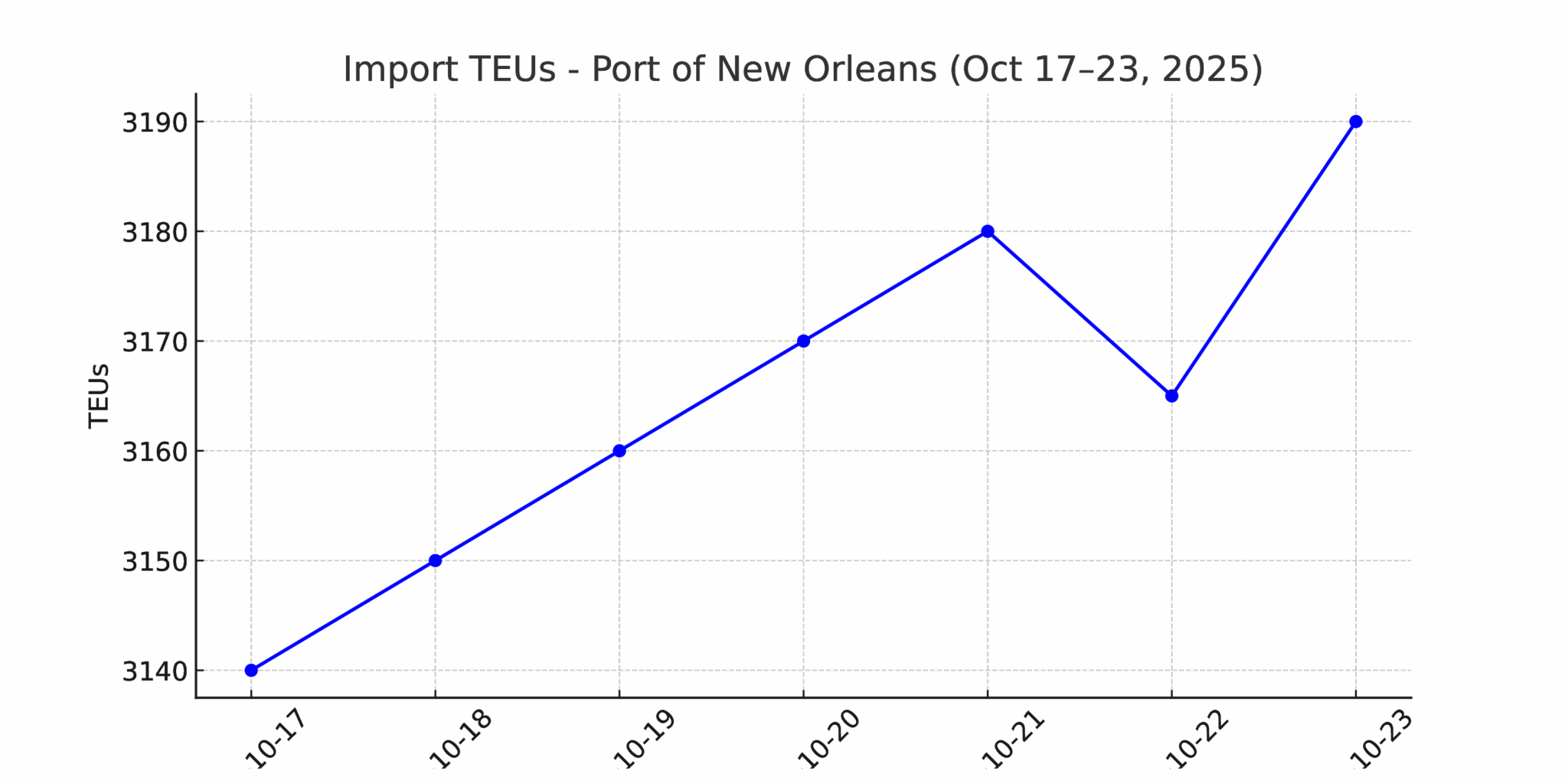

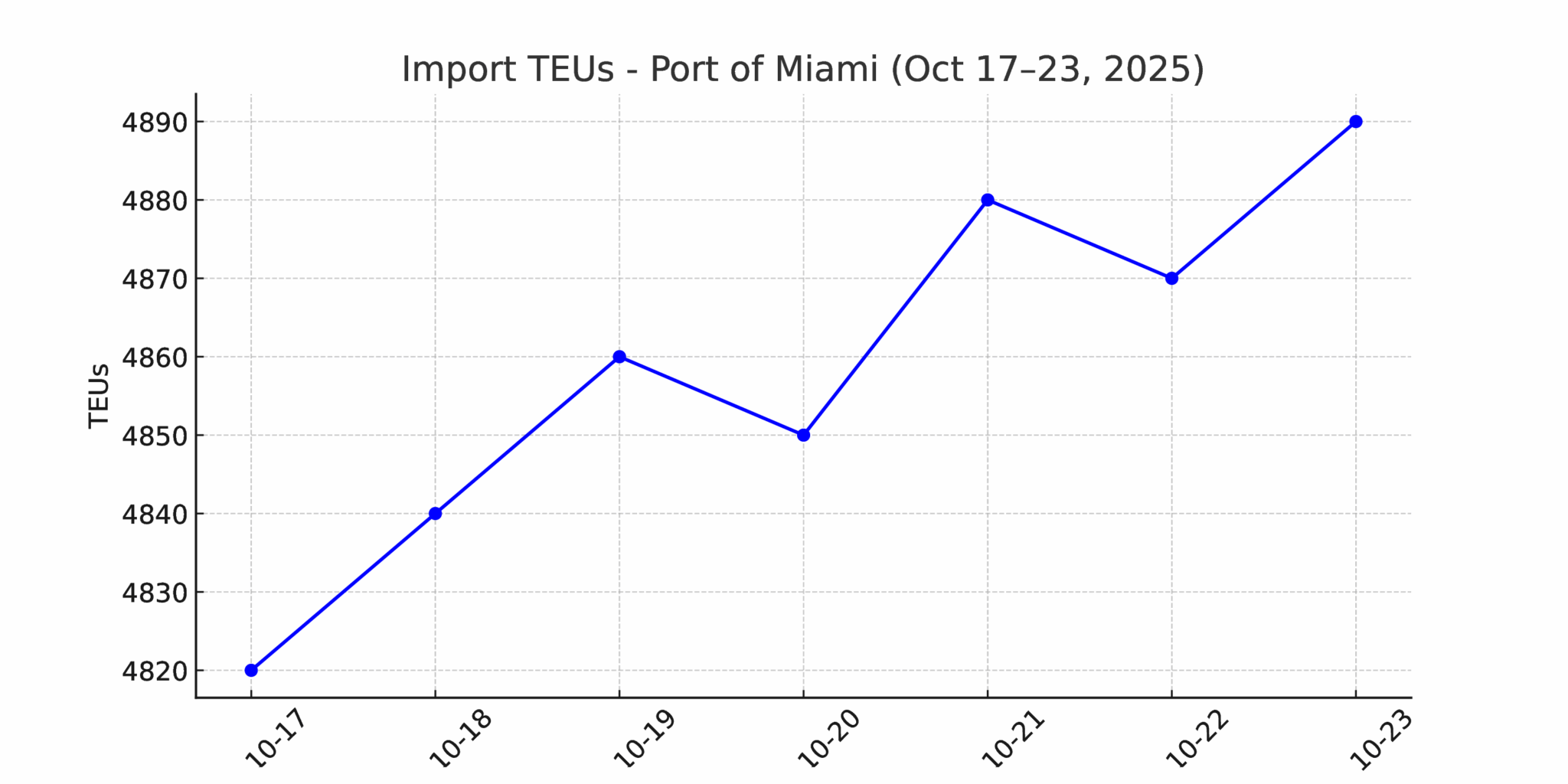

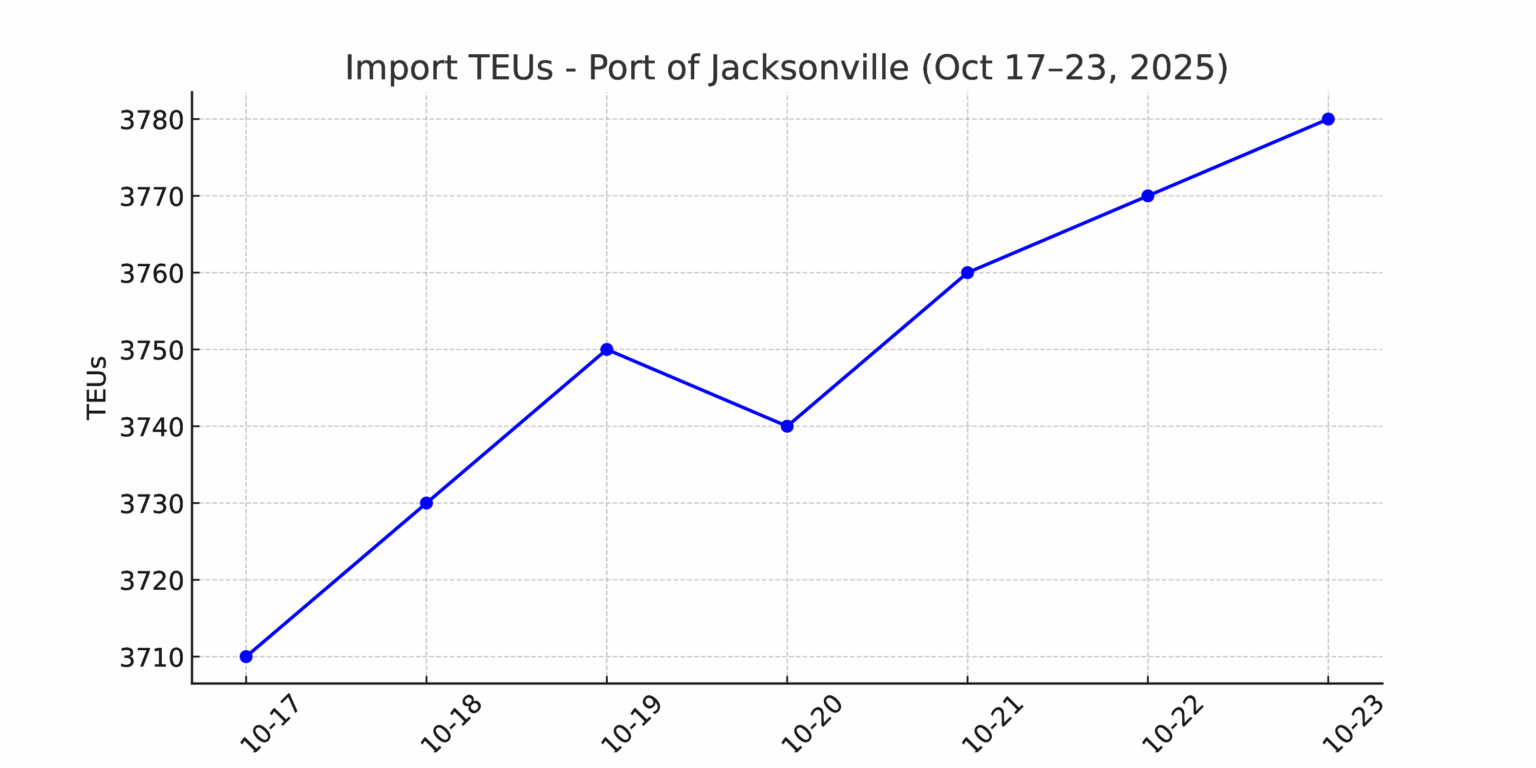

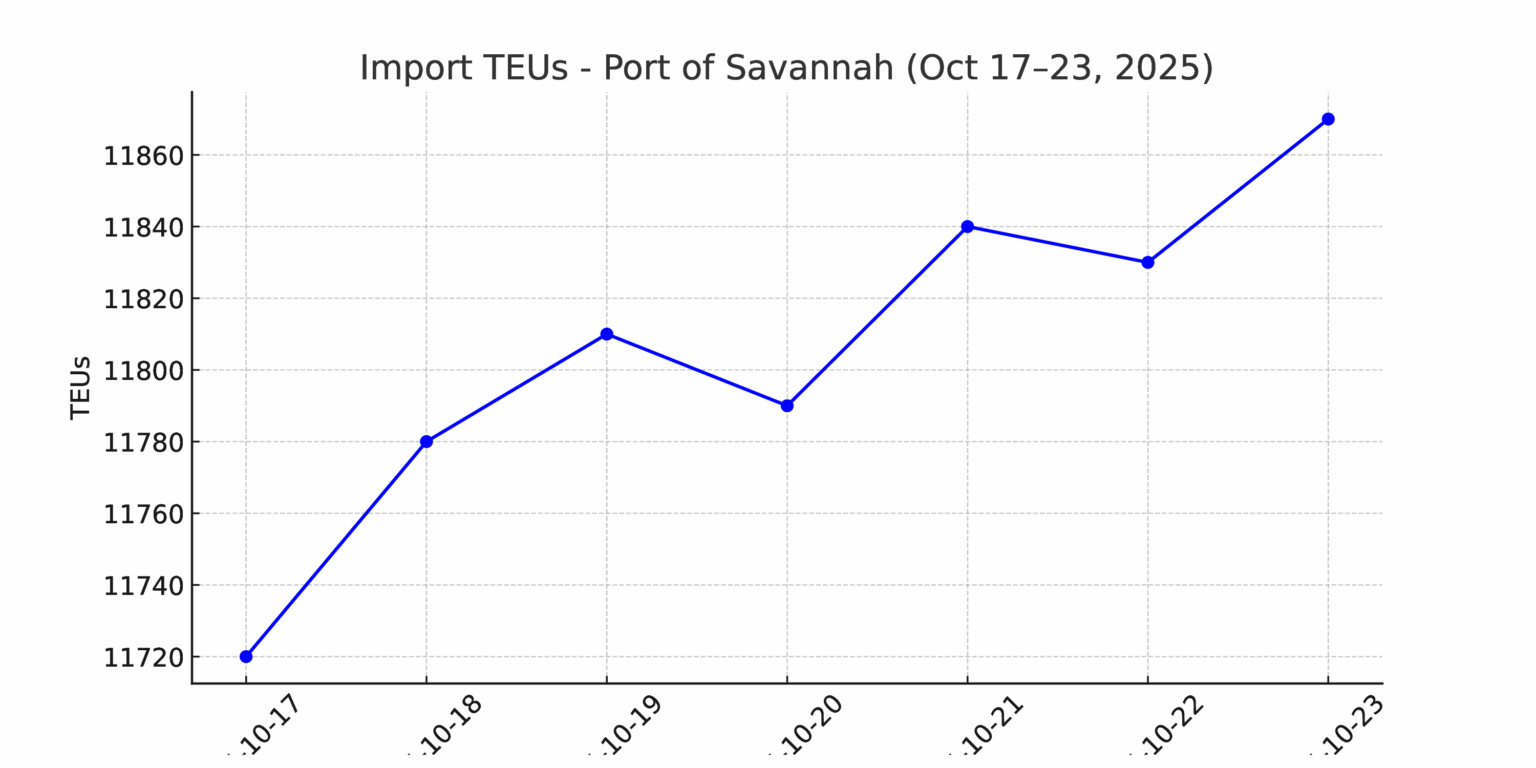

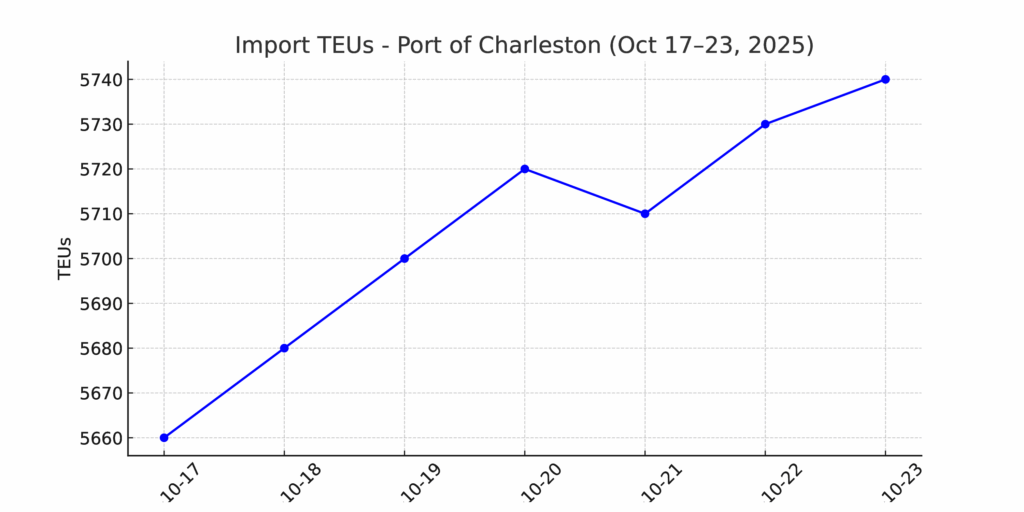

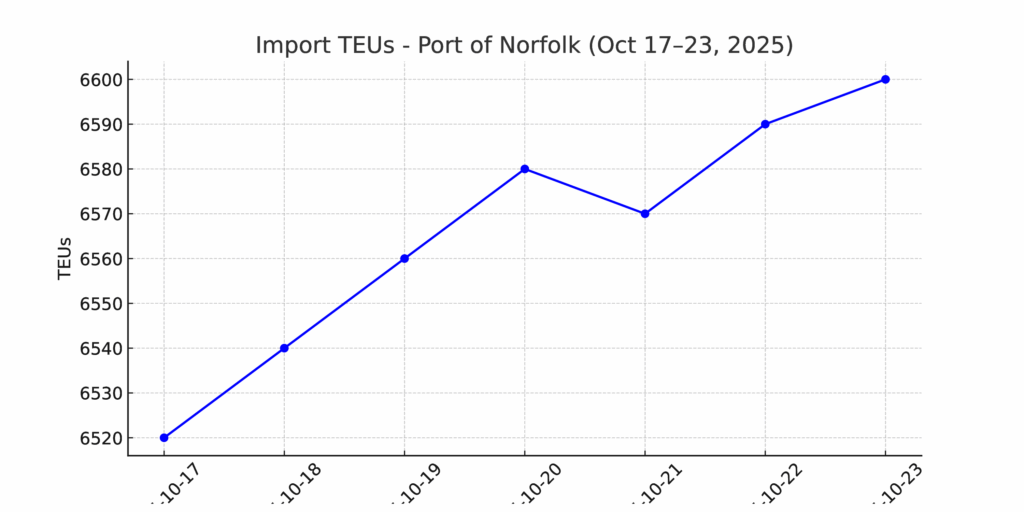

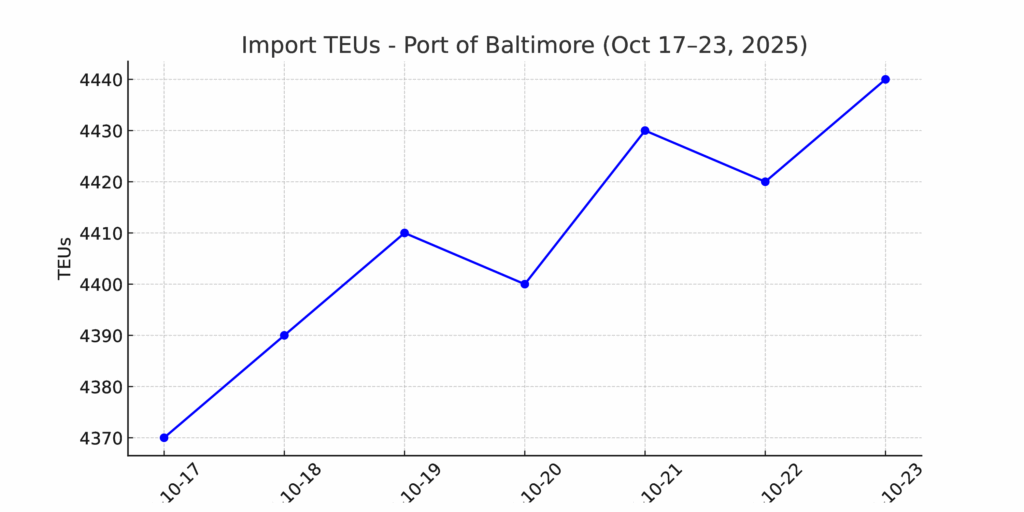

Import Data Images