Port of Charleston

1431 words 6 minute read – Let’s do this!

Change is rolling in across the world’s ports — and labor is leading the charge. Next month’s “People Over Profit: Anti-Automation Conference” in Lisbon will unite dockworker unions from the U.S. and Europe to confront automation head-on. On the East and Gulf coasts, the ILA is drawing a hard line with new contract language banning full automation. Out West, California’s veto of SB 34 cleared the way for modernization at major terminals like APM Pier 400 and Fenix Marine Services — exposing a growing divide between ports resisting change and those racing toward it. At the same time, U.S.–China trade tensions are reshaping freight flows. Trans-Pacific rates fell 8% week-over-week as new U.S. port fees on Chinese-built vessels and China’s retaliatory taxes stirred market volatility. Carriers are adapting with network adjustments and tighter capacity, keeping global freight moving as Q4 gains momentum. Don’t forget to Follow Port X Logistics on LinkedIn for the inside scoop, or get our Market Updates every Thursday straight to your inbox at Marketing@PortXLogistics.com

Maritime labor is stepping into the global spotlight this fall as dockworker unions from the U.S. and Europe unite to confront one of the industry’s most divisive issues — automation. The “People Over Profit: Anti-Automation Conference,” scheduled for November 5-6 in Lisbon, Portugal, will bring together the International Longshoremen’s Association (ILA), the International Dockworkers Council (IDC), and union leaders from around the world to rally against what they call “job-killing automation.”

The ILA, representing more than 85,000 longshore workers across the East and Gulf coasts, has taken a hard-line stance — embedding strict language in its 2024-2030 master contract that bans fully automated terminals and mandates job protections for any semi-automated equipment. The Lisbon summit will amplify that message globally, strengthening the ILA’s push for a unified labor front to slow or reshape automation projects at major from New York/New Jersey to Houston.

On the opposite coast, the International Longshore and Warehouse Union (ILWU) faces a more complex reality. West Coast contracts, renewed through 2028, already permit controlled automation under the PMA-ILWU framework, allowing terminals to deploy robotic or remote-operated systems in exchange for guaranteed jobs, retraining, and maintenance jurisdiction. For years, the ILWU relied on California Senate Bill 34 (SB 34) to add a political layer of protection — a bill that would have blocked public funding for automated port equipment at Los Angeles and Long Beach. But Governor Gavin Newsom vetoed SB 34 in October 2025, effectively removing that shield and signaling state support for modernization and “green-port” efficiency over labor restrictions.

That veto leaves automation fully legal under existing PMA-ILWU agreements and opens the door for new proposals at major West Coast terminals like APM Pier 400 and Fenix Marine Services. The ILWU still holds significant contractual power — especially through required staffing, jurisdiction, and wage protections — but it now faces a long-term strategic challenge. Without state-level backing, the union must rely solely on collective bargaining to shape the next phase of automation after 2028.

Taken together, the Lisbon summit, the ILA’s aggressive stance, and California’s veto of SB 34 highlight a growing divide in the U.S. maritime labor landscape. The East and Gulf coasts are closing ranks to resist automation outright, while the West Coast is cautiously adapting to it. As the industry races toward cleaner, more efficient port operations, the question remains: Can technology and labor find common ground — or are we heading toward the next great standoff on the docks?

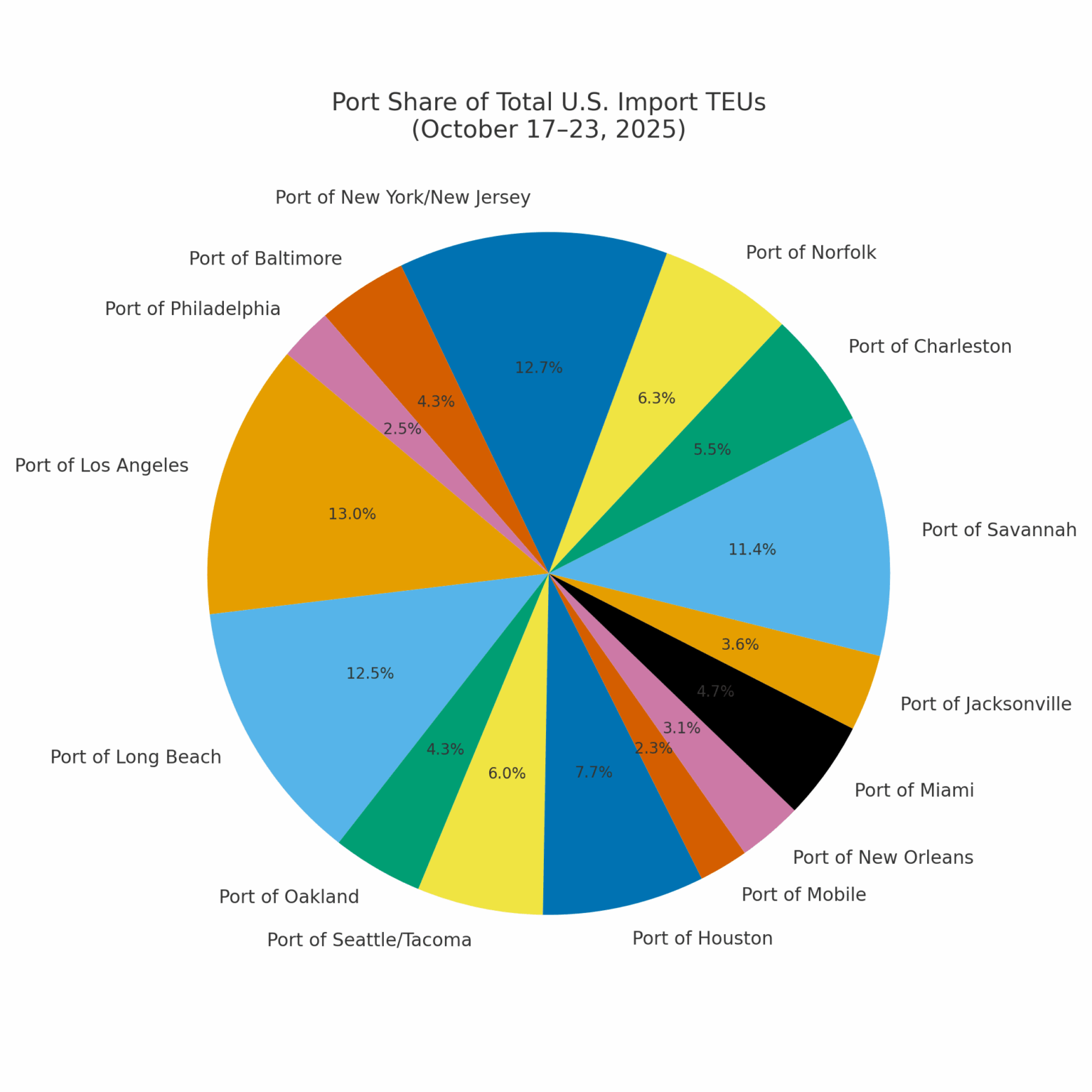

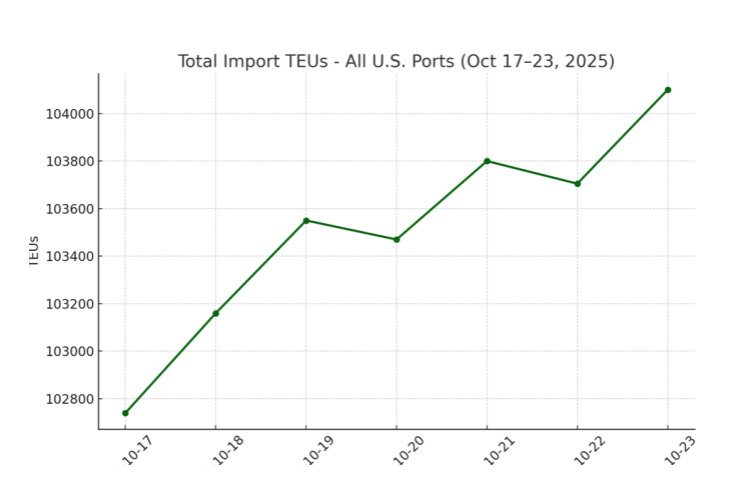

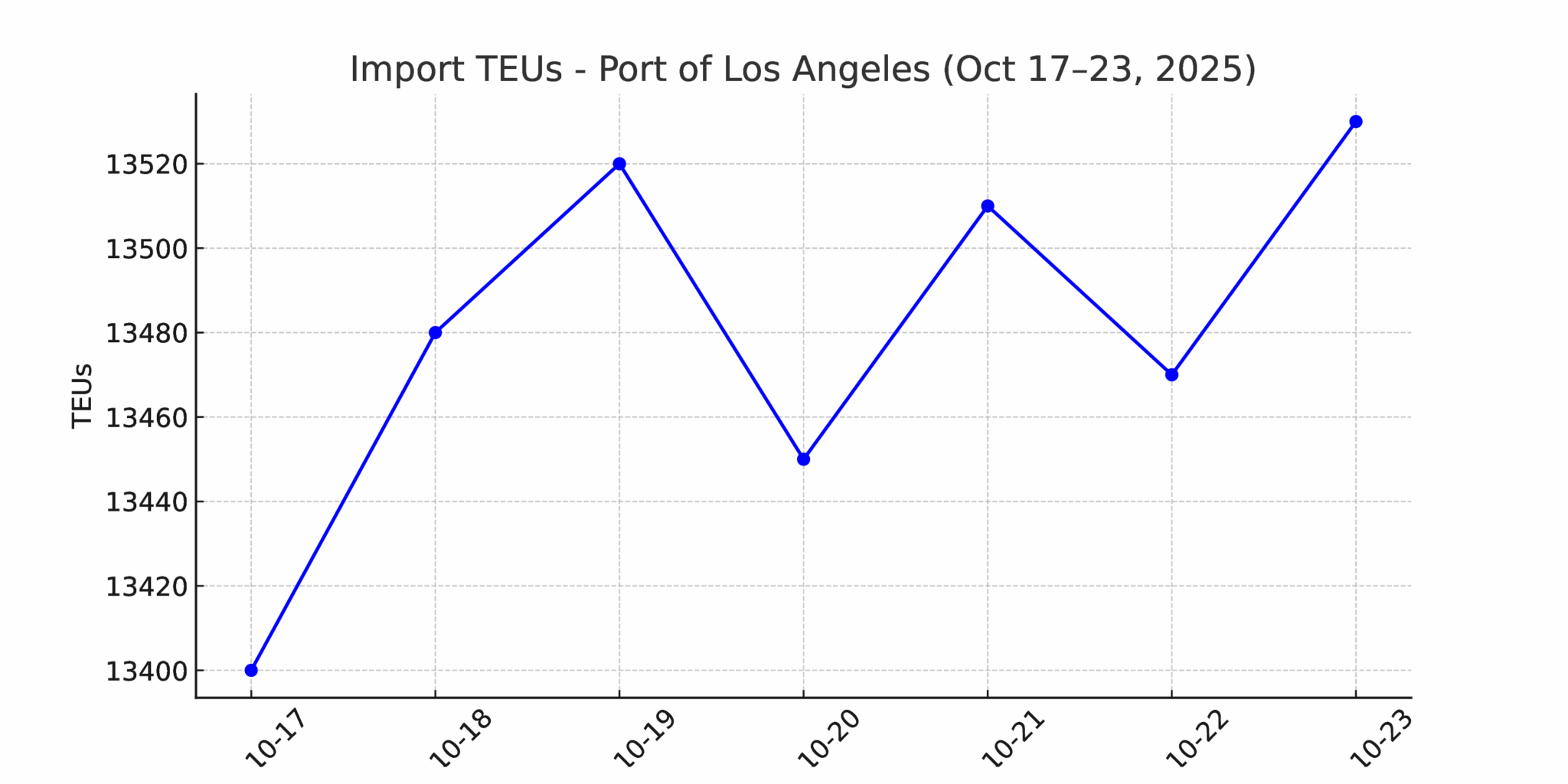

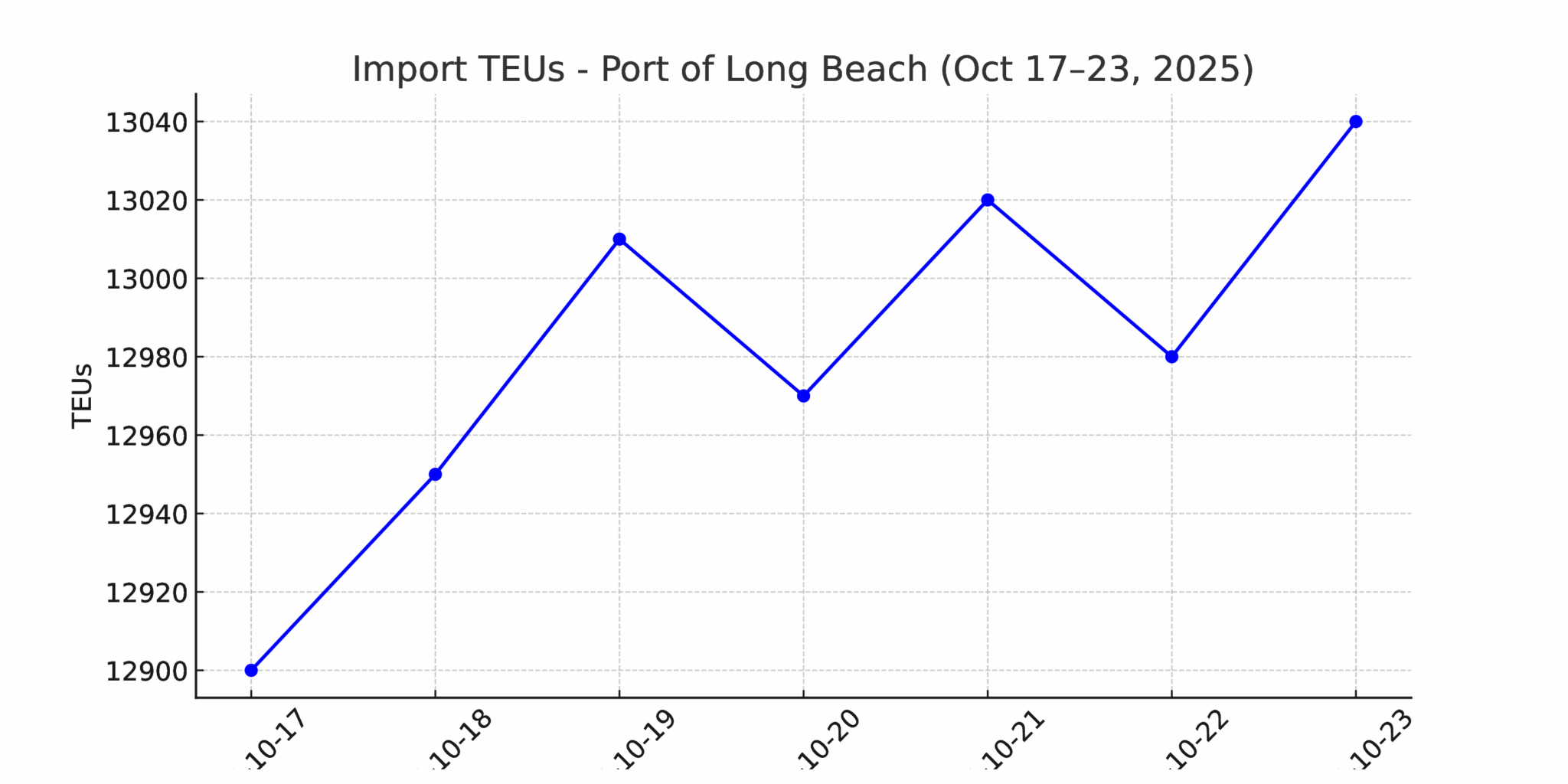

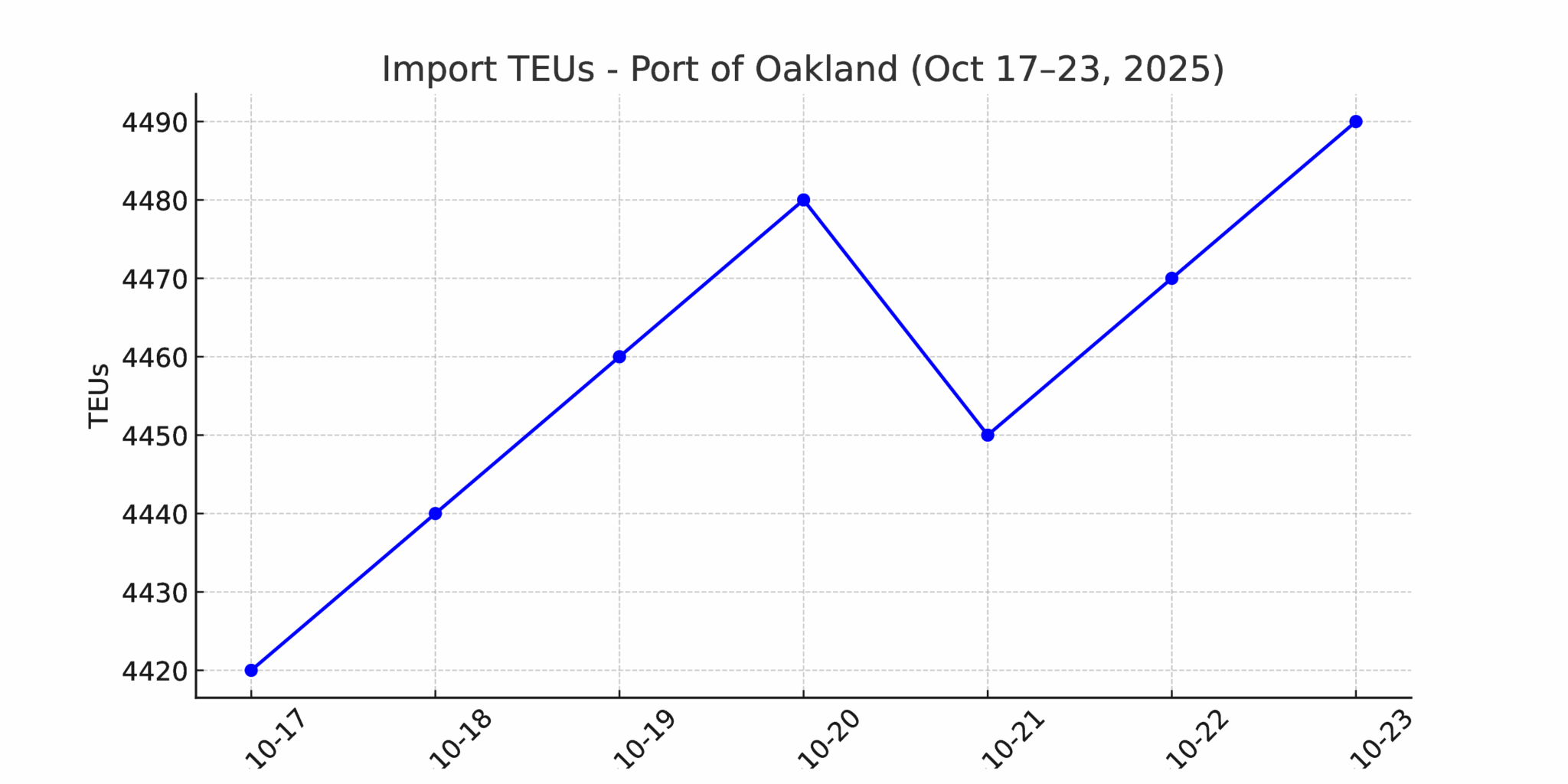

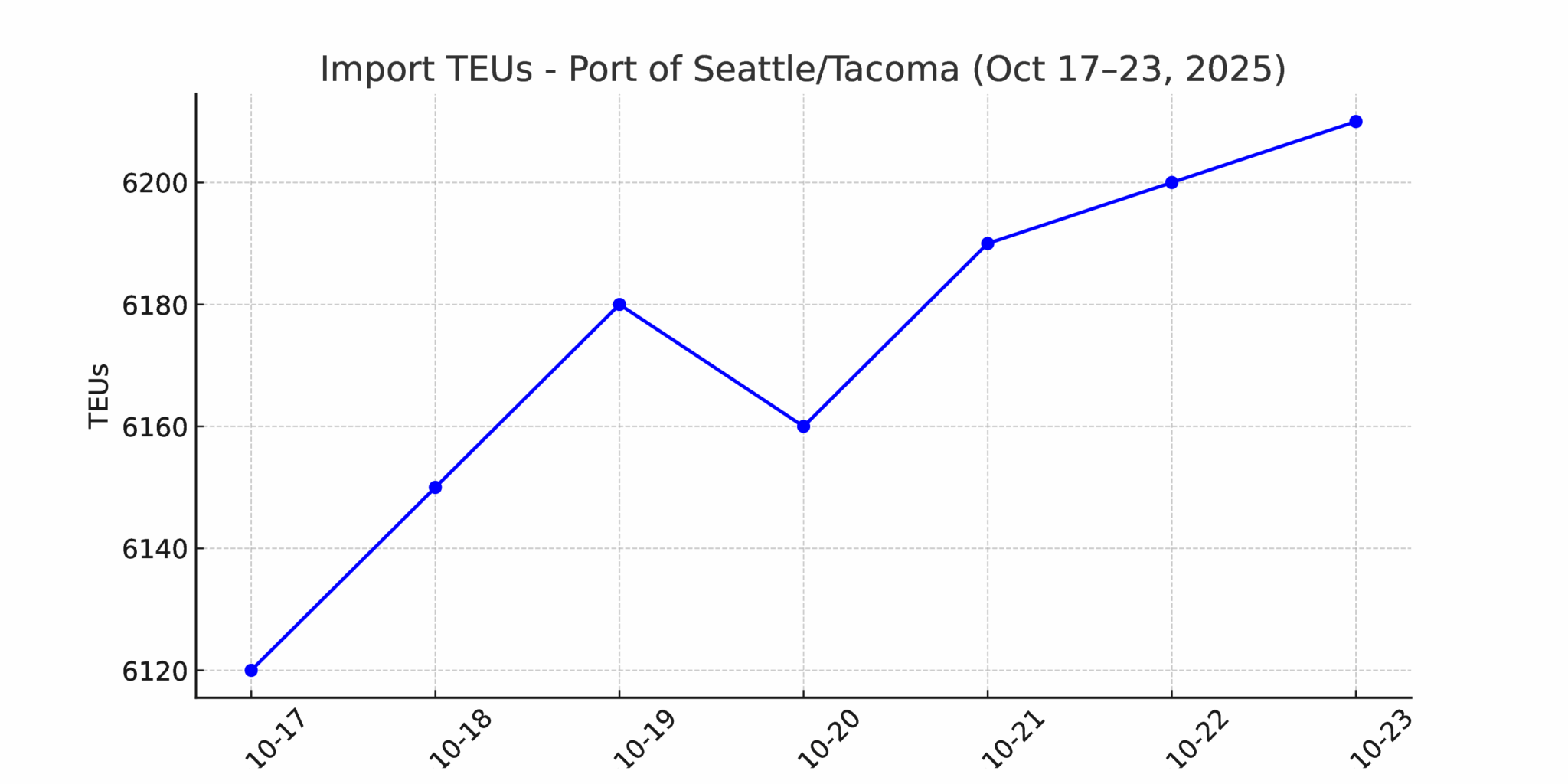

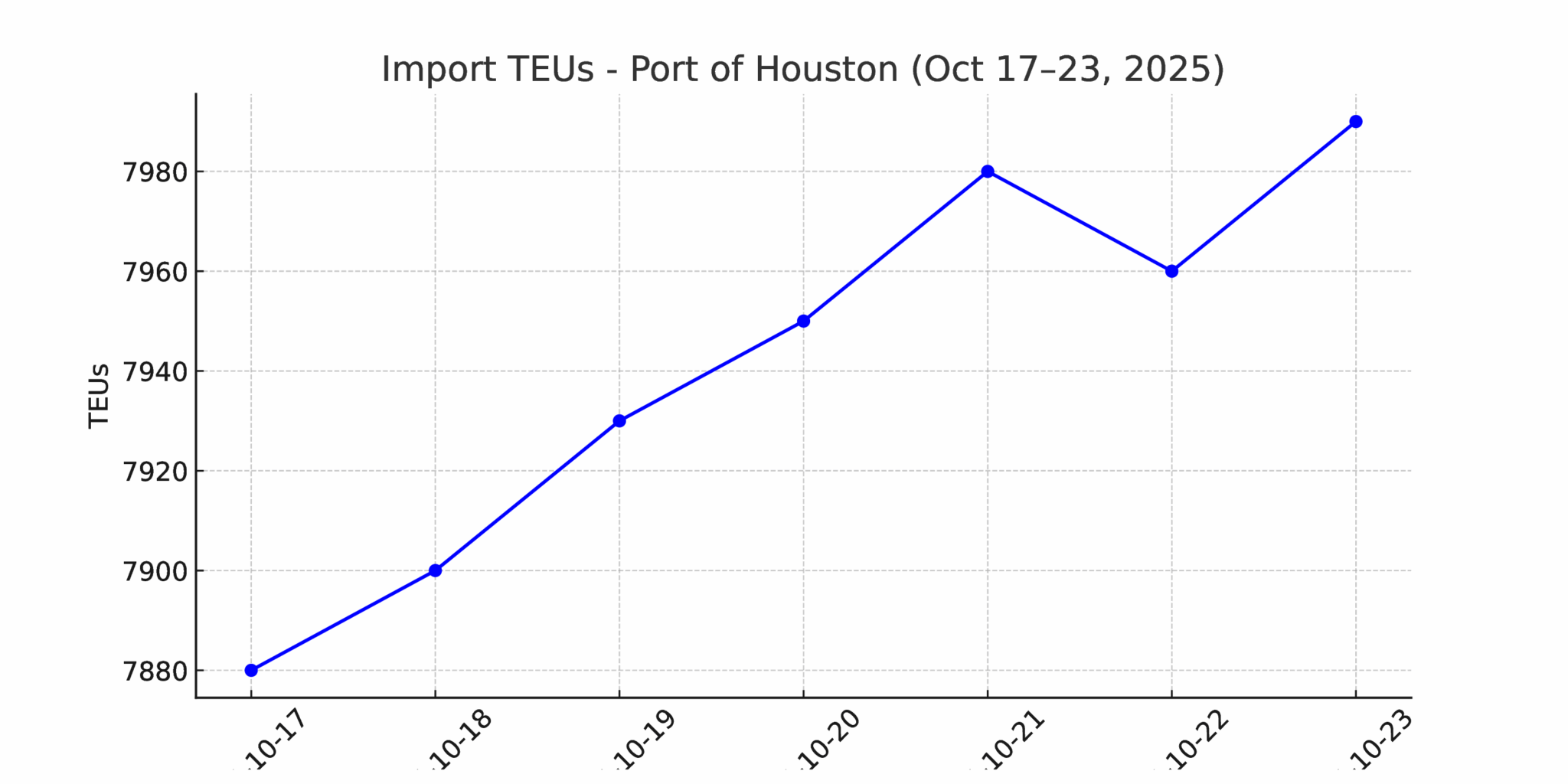

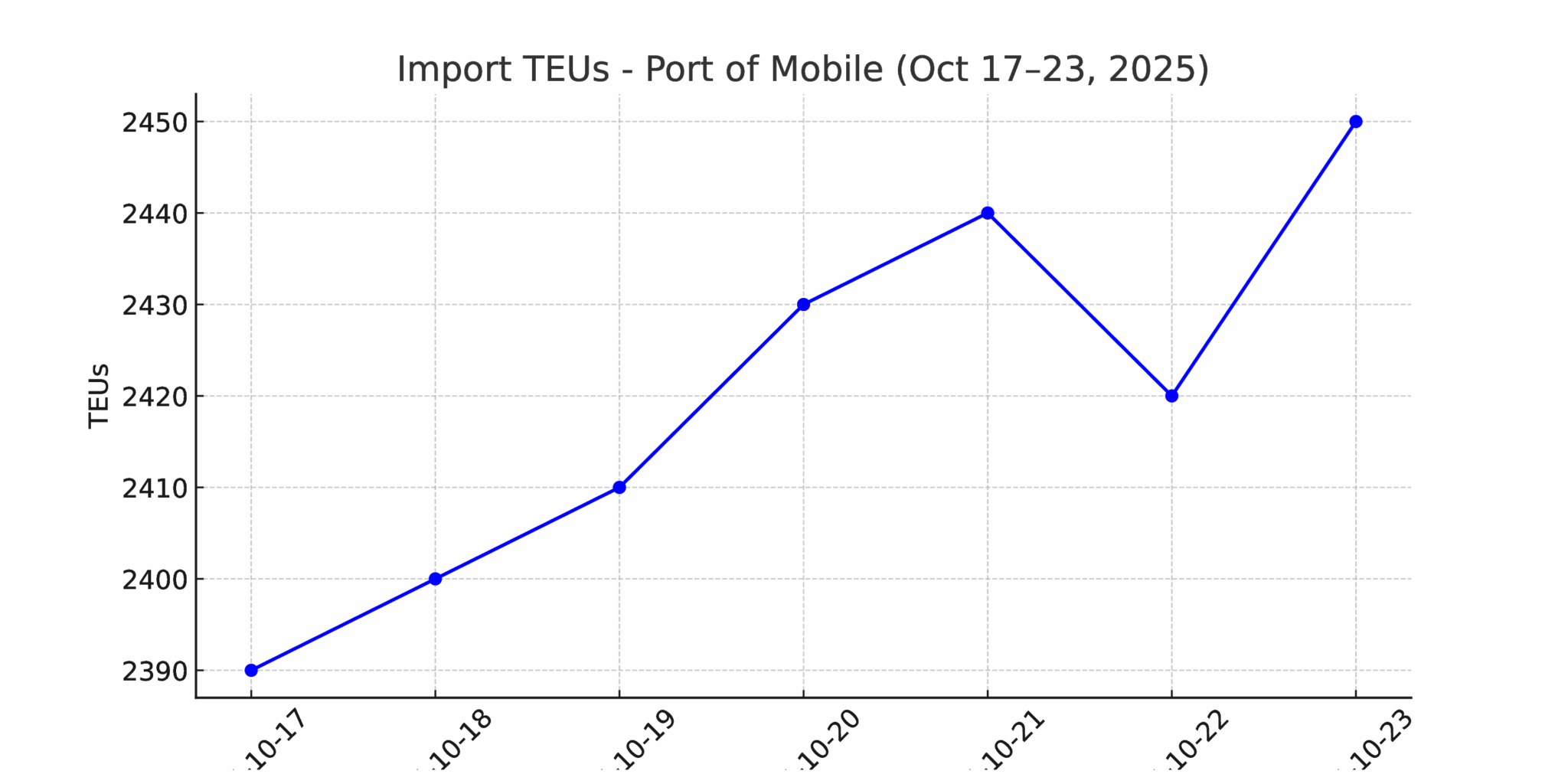

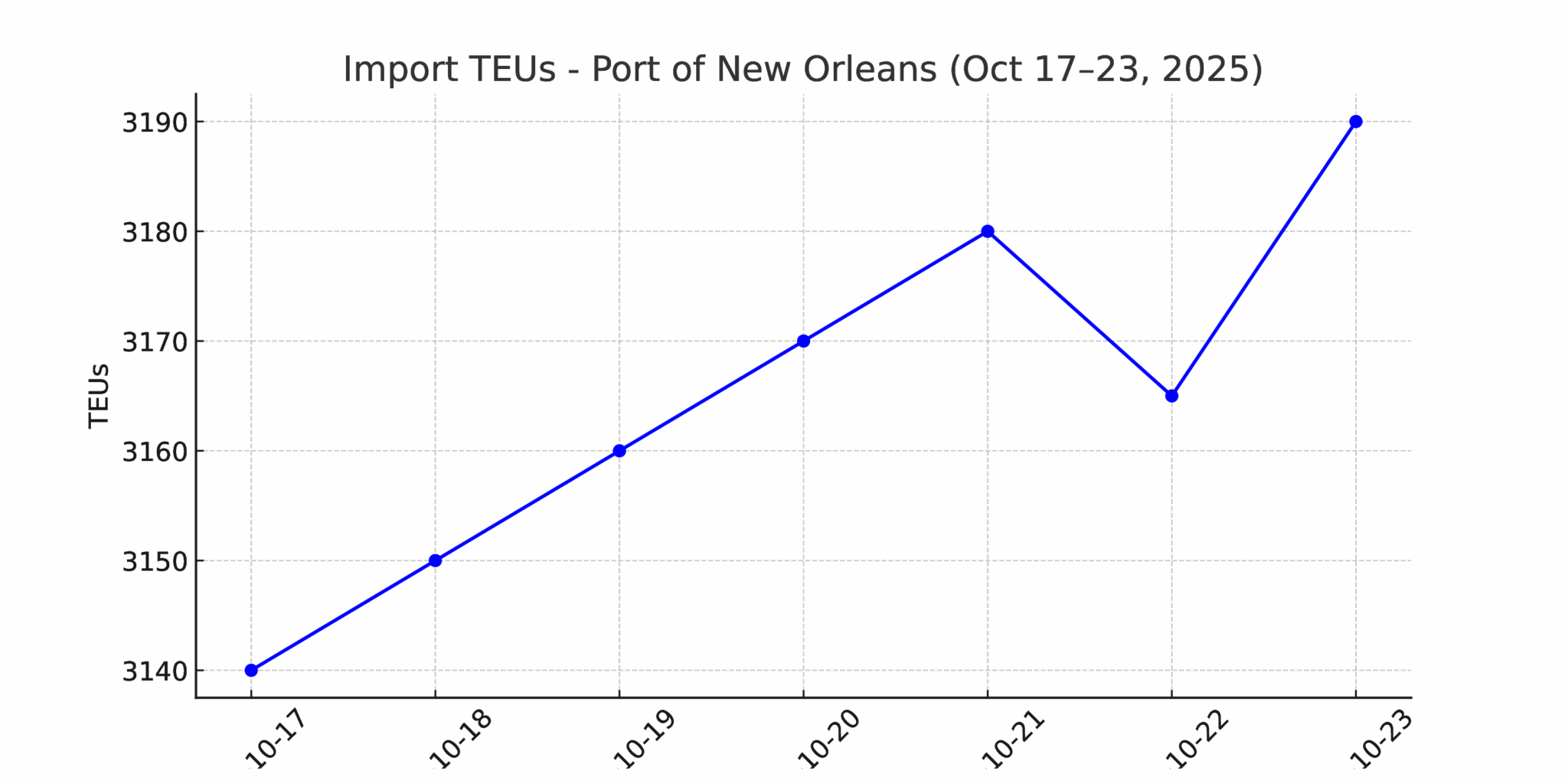

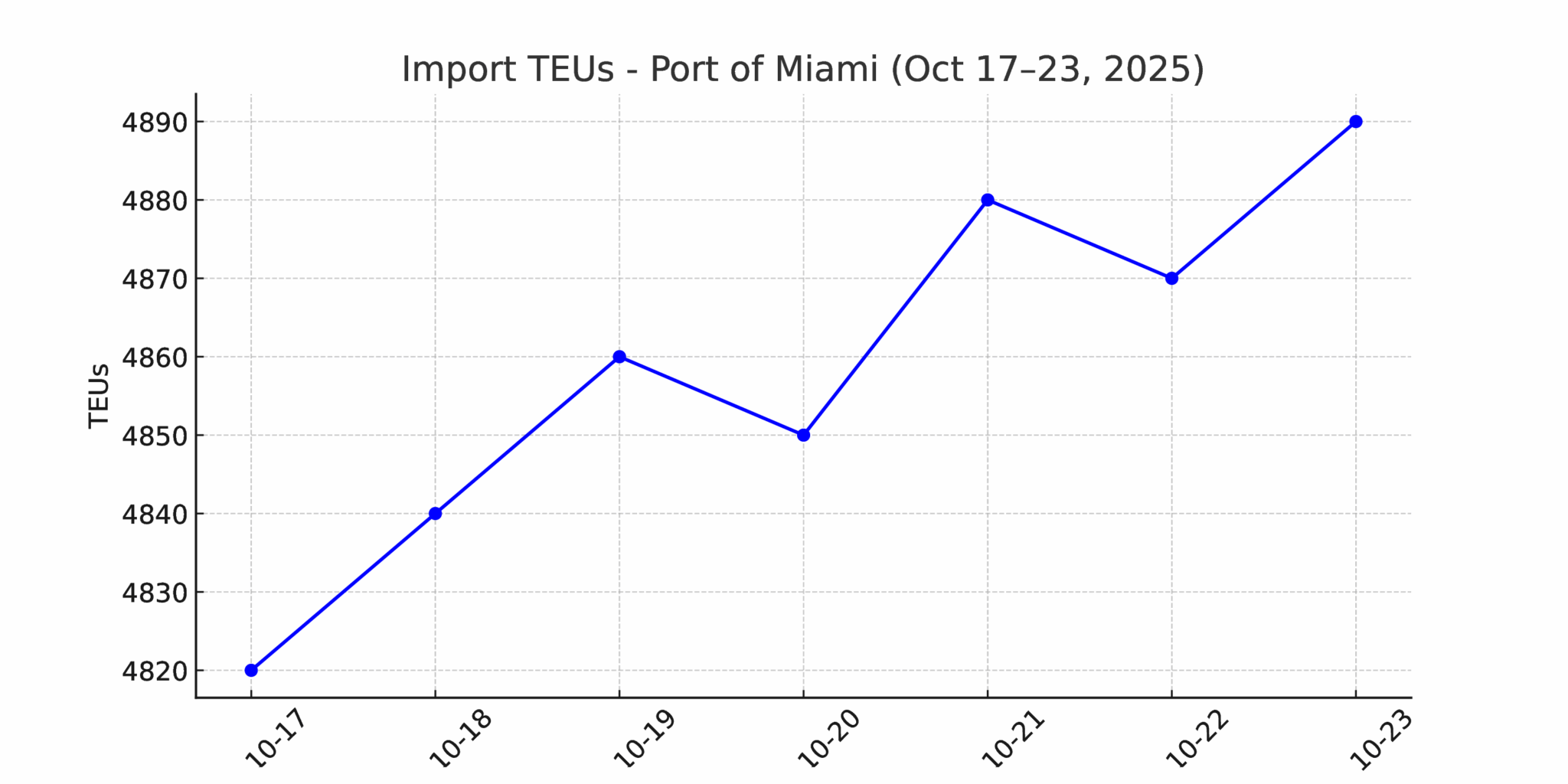

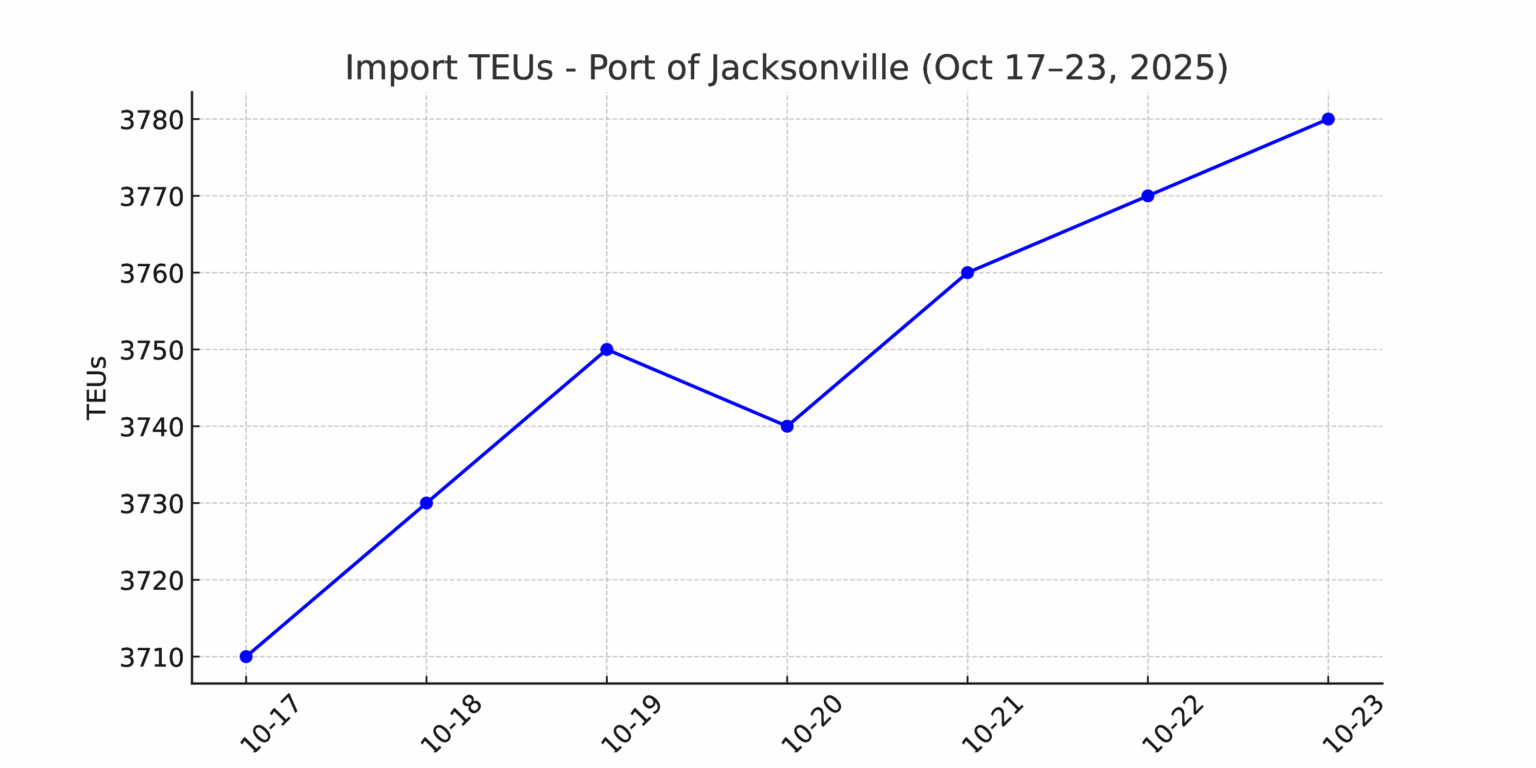

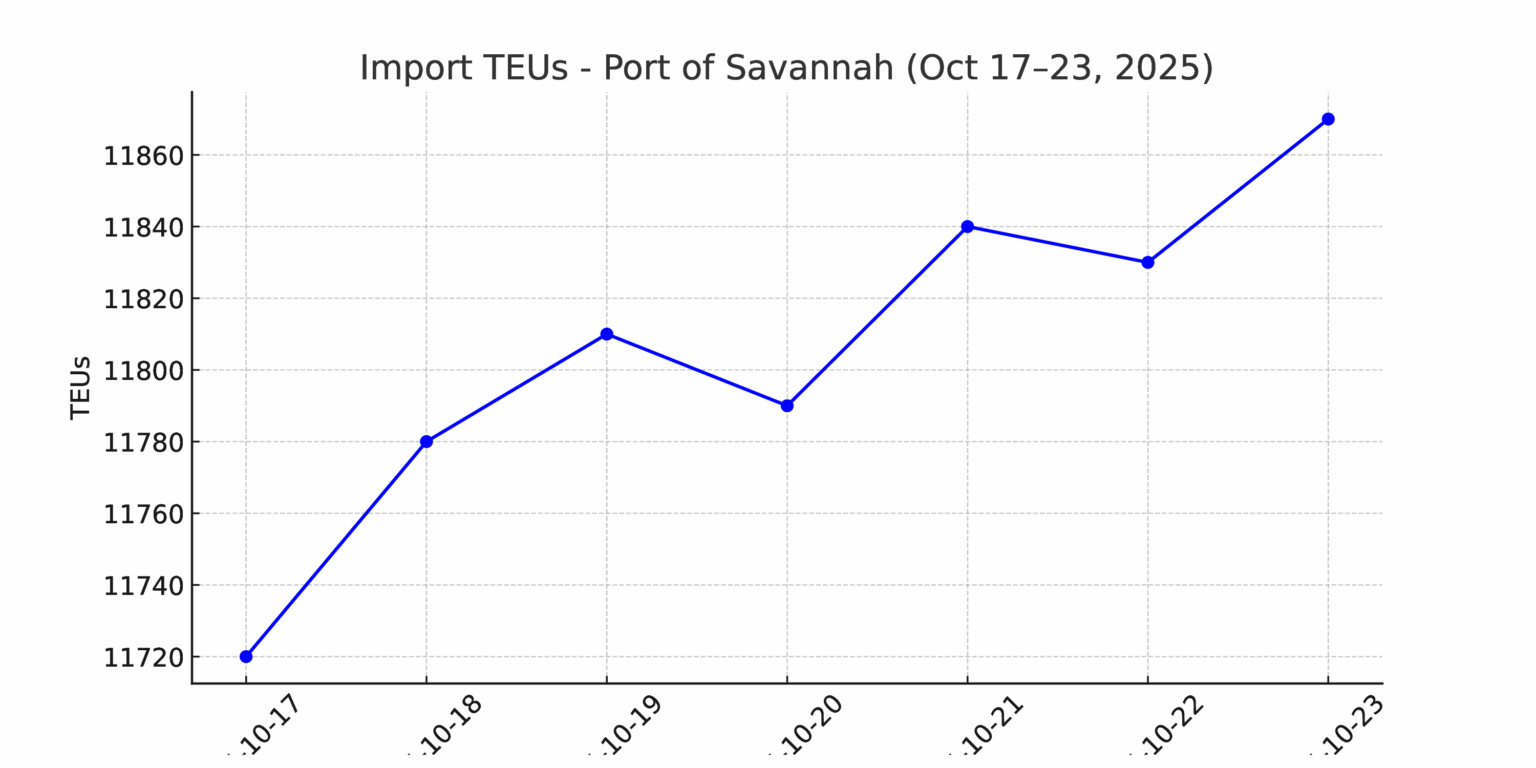

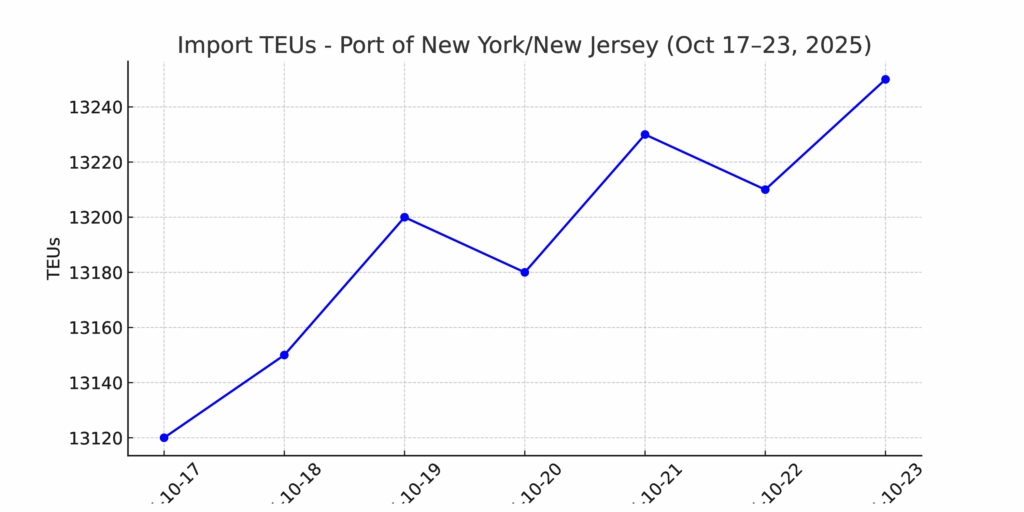

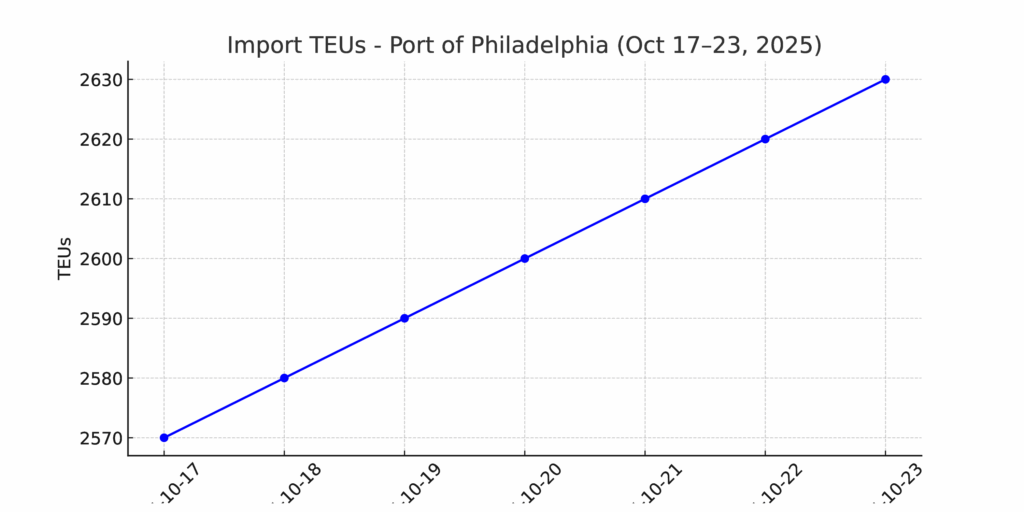

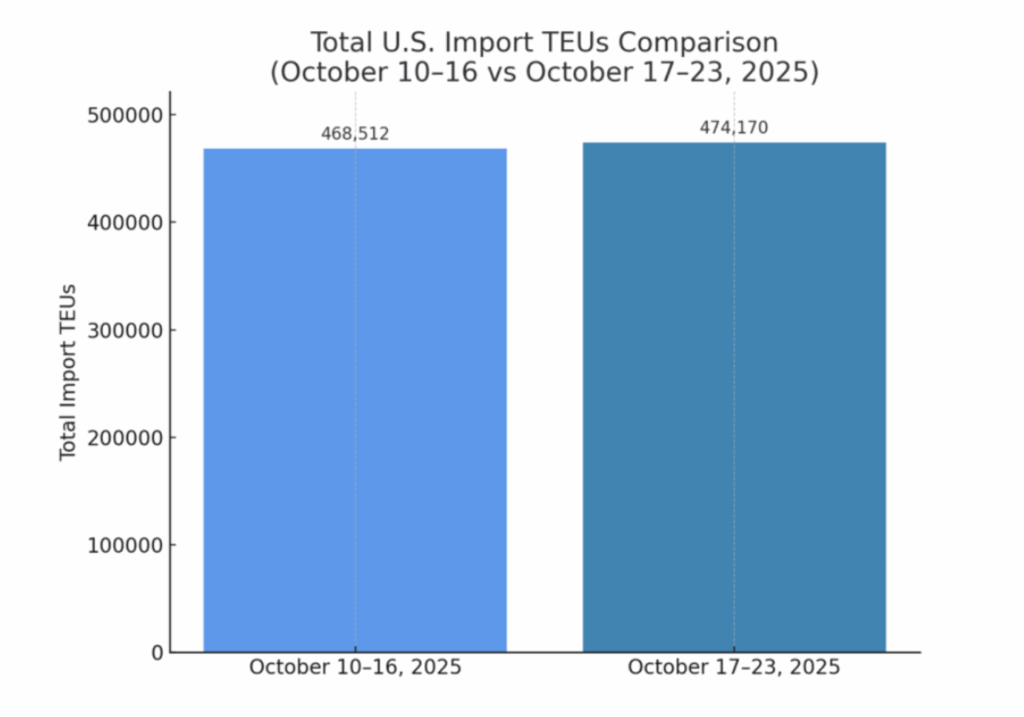

TEU’s are up 1.20% over last week, with the majority of volumes coming into Los Angeles 13%, New York/New Jersey 12.7% and Long Beach 12.5%. Container freight rates on the trans-Pacific trade lane eased this week as trade tensions between China and the United States escalated into a wider tariff and port fee dispute. The benchmark cost to ship a 40-foot container from Asia to the U.S. West Coast slipped 8% to $1,431 for the week ending October 10th, according to the Freightos Baltic Index, while East Coast rates dipped to $3,015. The adjustment comes ahead of new U.S. port fees on Chinese-built or Chinese-linked ships, effective October 14th, and Beijing’s reciprocal tonnage tax on U.S.-flagged and U.S.-operated vessels. China’s measure also applies to companies with at least 25% American ownership, creating added complexity for global operators. Several U.S.-based directors have stepped down from boards of major shipowners including Pacific Basin Shipping, Okeanis, and Danaos Corp., which charter vessels to Maersk, CMA CGM, and Hapag-Lloyd.

Despite the policy turbulence, many carriers are proactively adapting their networks to manage exposure and keep freight moving. Industry executives note that a small portion of the global fleet—roughly 3% of large dry bulk vessels—is directly impacted, which may even tighten capacity and stabilize earnings on some trade lanes. Analysts suggest that the long-term fundamentals remain intact, with global trade flows likely to rebalance as carriers diversify routing and equipment deployment. Freightos data shows that U.S. import volumes have moderated since mid-2023 following earlier frontloading, but steady demand on Asia–Europe lanes and renewed activity in alternative markets are helping absorb capacity. While short-term volatility persists, carriers continue to manage supply with targeted blank sailings and service adjustments, positioning the industry for a more balanced rate environment heading into the fourth quarter.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

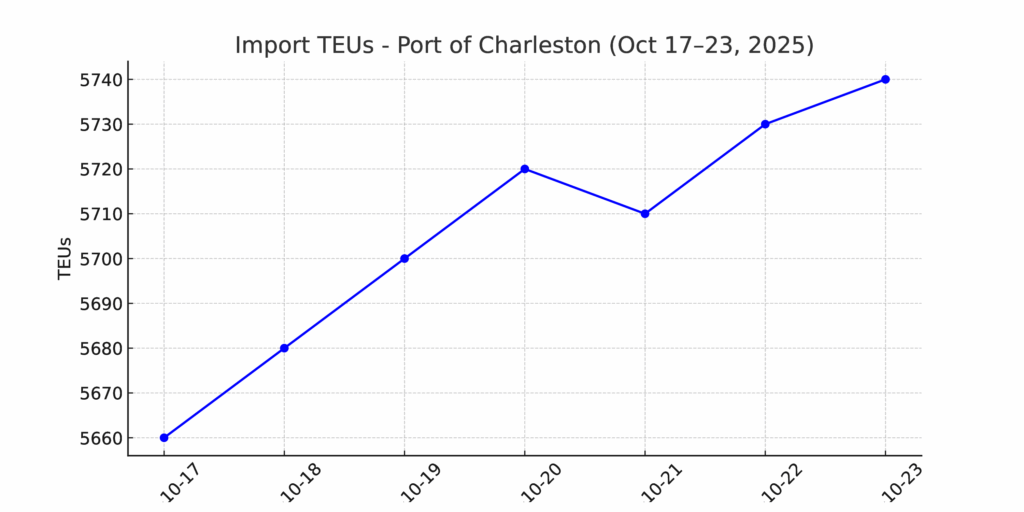

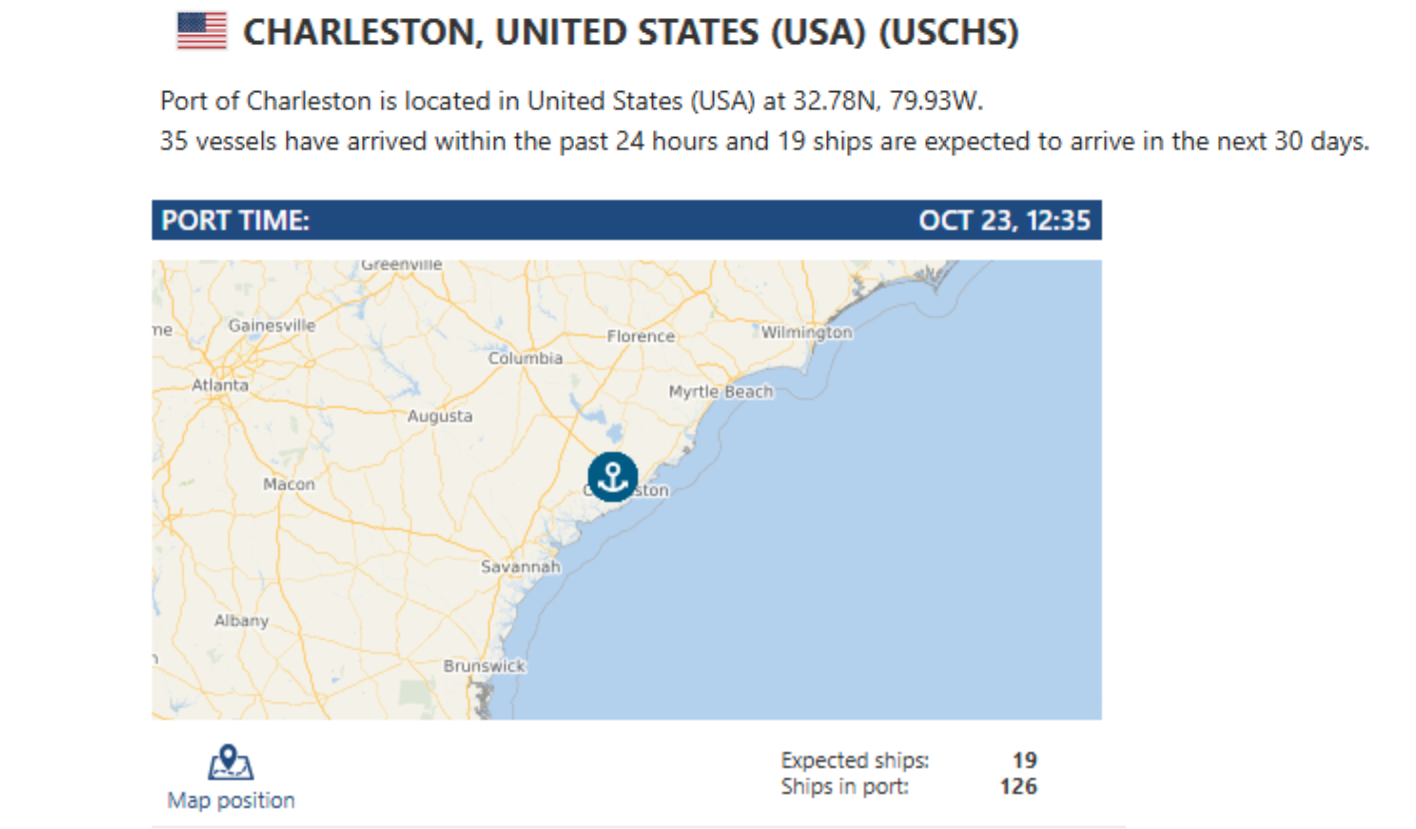

Charleston: Big shifts are underway at the Port of Charleston. Newly appointed CEO Micah Mallace (as of October 13th, 2025) has hit pause on more than $1 billion in planned expansion and terminal upgrade projects, citing rising construction costs and broader market uncertainty. The South Carolina Ports Authority is taking a closer look at its capital roadmap before moving forward — a move that signals fiscal discipline amid shifting trade volumes and infrastructure inflation. While Charleston continues to post steady container and inland rail growth, Mallace’s decision reflects a growing trend across U.S. ports: balancing long-term capacity goals with near-term economic realities. From Savannah to Charleston to Jacksonville, we’re not just covering ground — we’re owning it. Our 12-truck drayage fleet runs tight, fast, and smart, supported by hazmat credentials, secured yard space, and a fully equipped transload hub ready for anything your supply chain throws our way. Need a same-day cross-dock or a late-night transload rescue? We’ve got the horsepower and hustle to make it happen — no delays, no drama. At Port X Logistics, we turn port chaos into smooth sailing. letsgetrolling@portxlogistics.com — when you roll with us, you move like a pro.

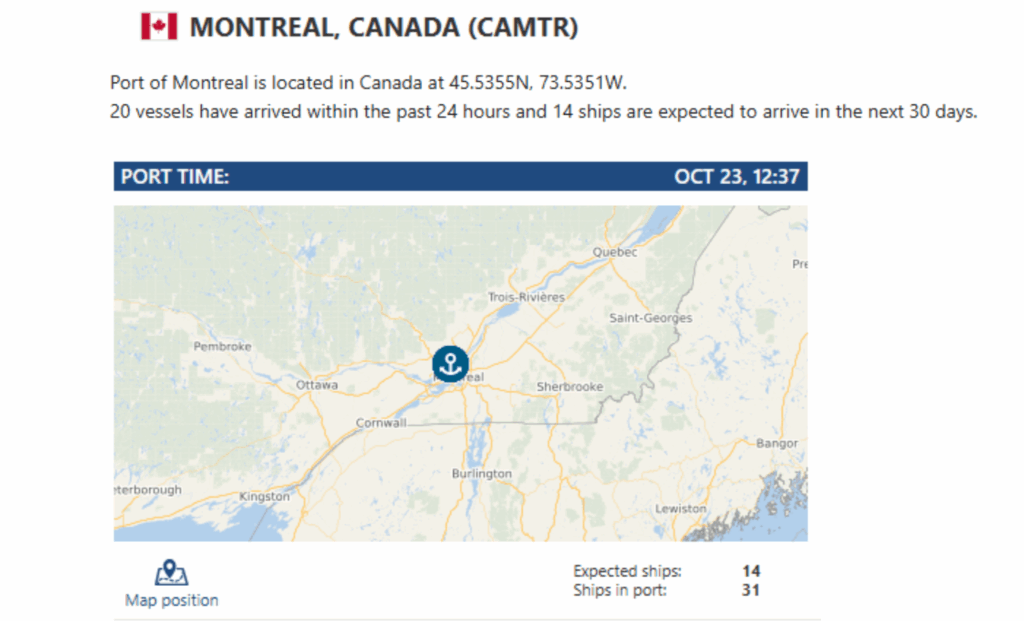

Montreal: The strike at the Canadian Union of Public Employees Local 4317 (CUPE 4317) affecting 27 administrative staff at the Montreal Gateway Terminals Inc. (MGT) commenced September 22nd and while operations are reported “as normal”, it is still a potential stress point. Our Canadian team keeps freight rolling across every major port — from coast to coast and across the border. With deep local expertise, we deliver drayage, transloading, and cross-border solutions built for speed, compliance, and consistency. For support with your Canadian freight, reach out at Canada@PortXLogistics.com — and move with the team that knows the route best.

Did you know? Carrier 911 is heading to Miami! Join us November 11th –14th at Transport Logistic Americas — Booth #1030 — where Tom Zeis, Jason Conrad, and Ty McCullouch will be ready to talk all things expedited logistics. Stop by, meet the team, and see firsthand how Carrier911 keeps freight moving when every second counts. 👉 https://www.tl-americas.org/trade-show/

But that’s not all… Did you also know Carrier911 never slows down for the holidays? When time-sensitive freight can’t wait, our 24/7 crisis-response team is already in motion — recovering AOG, handling hotshot trucking, and managing aerospace, industrial, and automotive freight with precision and speed. From exclusive-use Sprinters, straight trucks, and dry vans to charter coordination and on-board courier services, we deliver when others can’t.

✅ Real-time tracking.

✅ Instant PODs.

✅ Capacity that doesn’t quit — day or night.

This holiday season, skip the stress and let Carrier911 keep your freight moving — fast, visible, and reliable.

📧 info@carrier911.com | 💻 portxlogistics.com/tech-demo

We’ve got your back — 24/7/365.

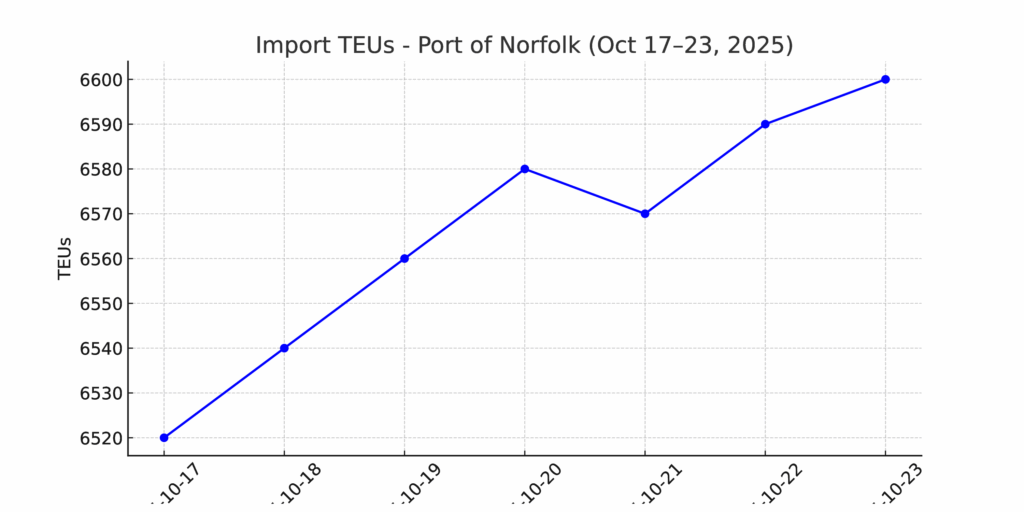

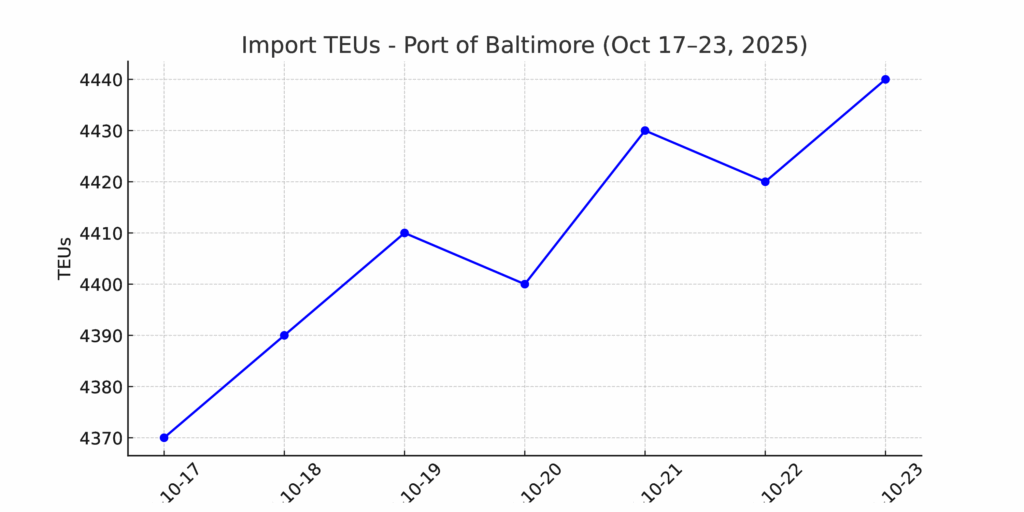

Import Data Images