Port of Charleston

1727 words 7 minute read – Let’s do this!

The last week of August is upon us, and peak season isn’t done just yet. We’re seeing a short-term spike in imports thanks to frontloaded freight and tariff pressure, so if you need capacity—now’s the time to grab it. We’ve got trucks and space available at all major ports and rails, but it’s moving fast and booked on a first come, first serve basis. Want to stay ahead of the curve? Follow Port X Logistics on LinkedIn for real-time freight insights and updates. Prefer this newsletter straight to your inbox? Just email Marketing@portxlogistics.com and we’ll hook you up.

On August 19th, the U.S. Trade Administration implemented the second phase of the new reciprocal tariff framework. This followed the August 7th rollout, which focused on raw materials (like copper and aluminum). The August 19th wave shifted attention to consumer-facing finished goods — a move designed to target import-heavy sectors. As a result, importers across industries—from furniture and appliances to lighting and electronics—rushed to get ahead of the new cost pressures. The weeks leading up to the rollout saw a sharp increase in container volumes as shippers frontloaded inventory to beat the deadline. Now, with the second wave in effect, many are reassessing sourcing strategies, evaluating tariff exposure, and preparing for tighter margins in Q4. While the long-term impact on consumer prices remains to be seen, the short-term logistics pressure has already rippled through ports, warehouses, and inland networks nationwide.

Area | August 19th Tariff Impact |

Ocean Freight Demand | Increased early August, especially for consumer goods. Volumes expected to normalize by September. |

Port Congestion | Temporary delays at East/Gulf Coast terminals due to importer frontloading |

Rates & Capacity | Rates softened post-rush; carriers saw an August 12th – 18th spike in demand on Asia–US lanes |

Q4 Inventory Strategy | Retailers accelerated back-to-school and early holiday inventory to avoid tariff fallout |

Frontloading Frenzy (Early August)

- U.S. importers pulled forward 2–4 weeks’ worth of orders to arrive by August 18th

- Spot container bookings rose sharply at ports like Savannah, LA/LGB, and NY/NJ

- Surge in customs clearance requests, particularly for HTS codes under Chapters 84, 85, and 94

- Vietnam’s Ministry of Trade issued a formal protest, citing disruption to long-term supply contracts.

- Mexico’s manufacturing sector reported record August exports of home goods to the U.S.

- EU exporters to the U.S. also flagged concern, especially for white goods and luxury lighting.

What to Expect This Week and Next (Late August)

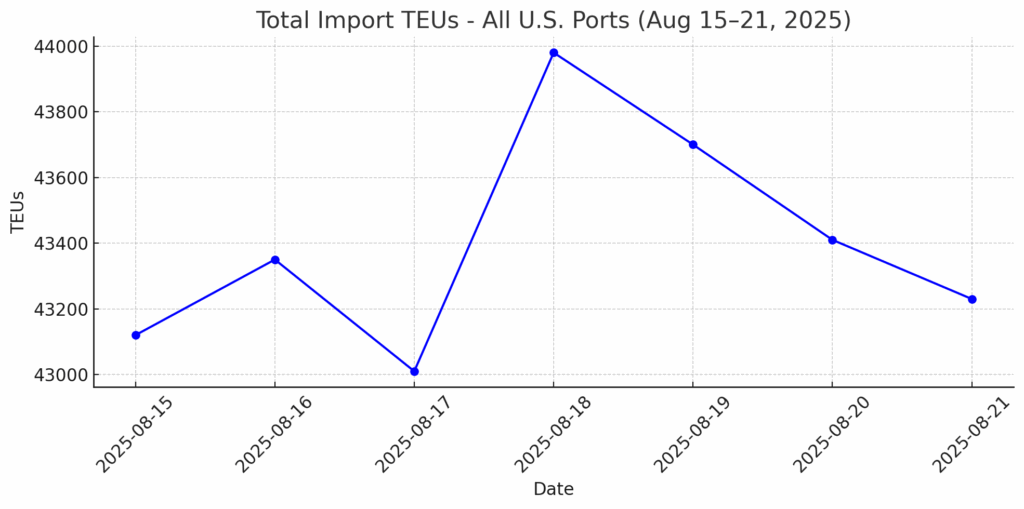

- Increased container arrivals: Many of those expedited shipments were timed to hit U.S. ports between August 15th – 25th, so we’re seeing (and will continue to see) a bump in vessel discharges and terminal activity through the end of this week and next.

- Elevated volumes at key ports:

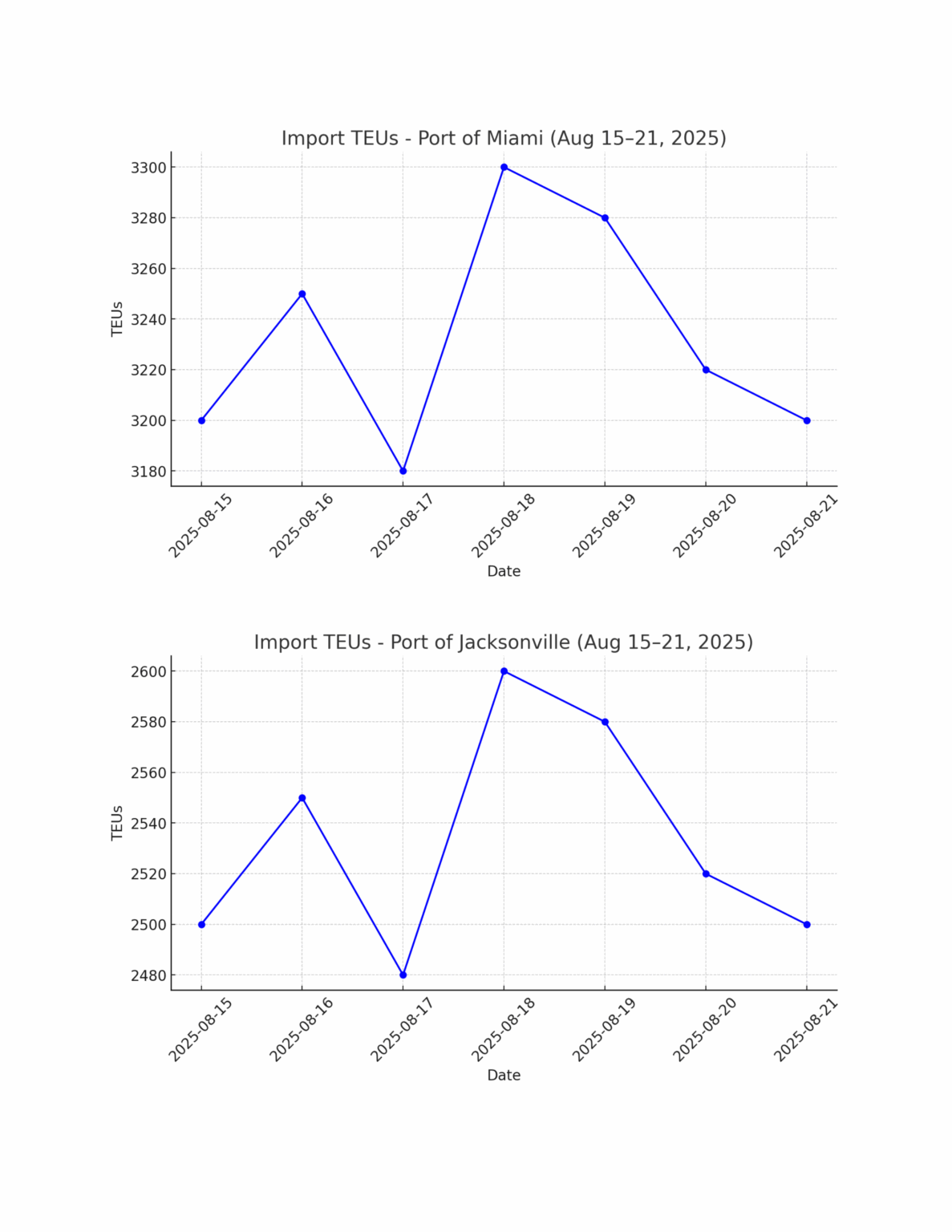

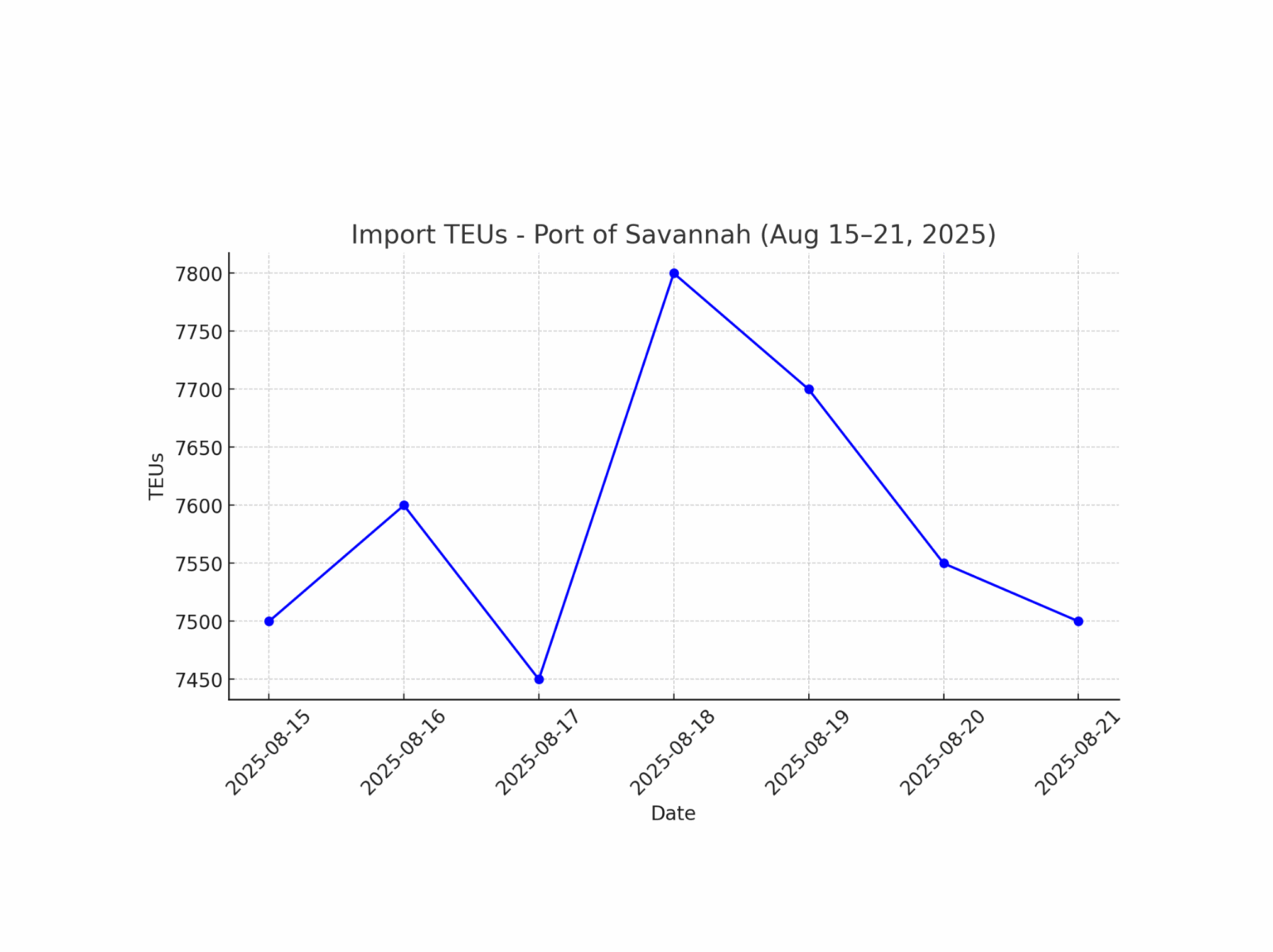

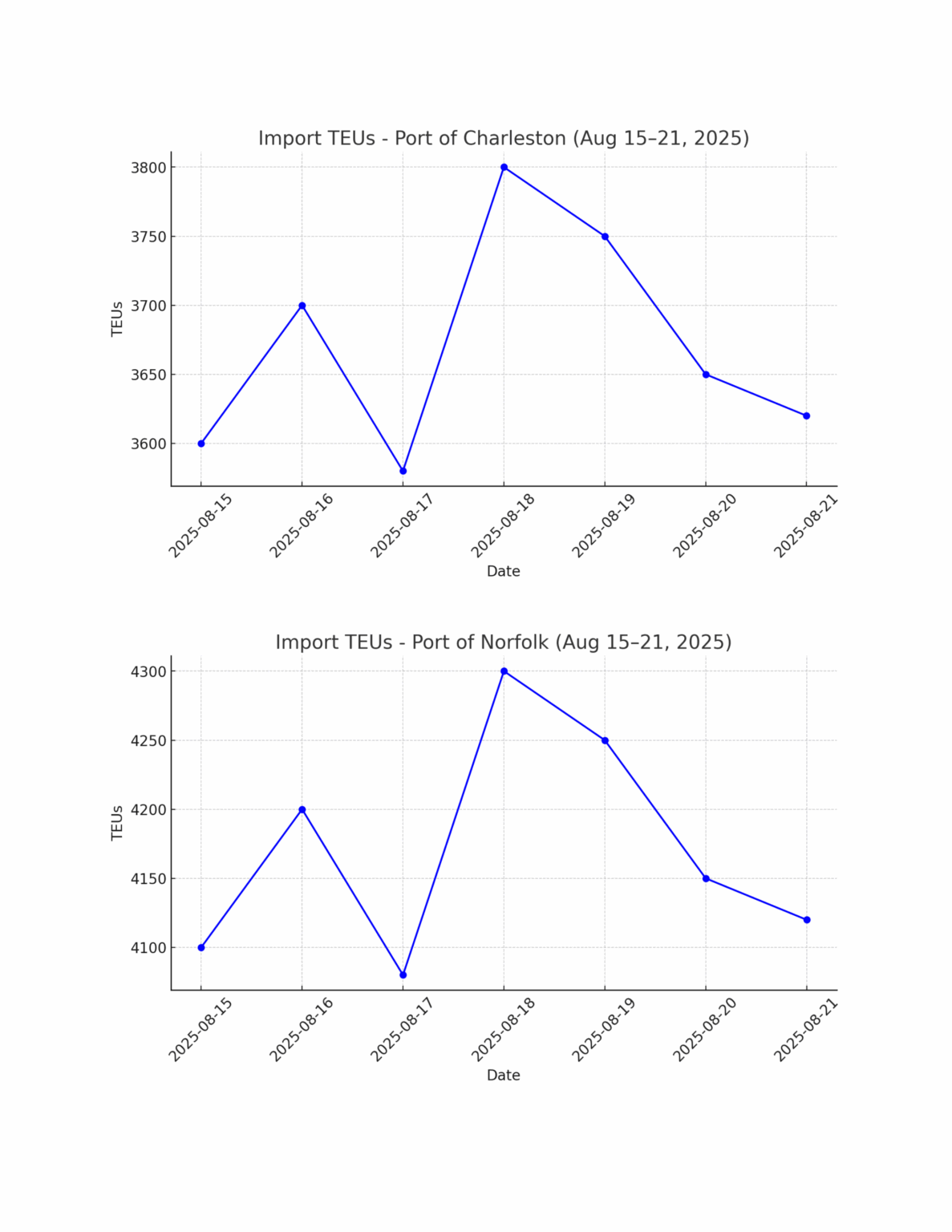

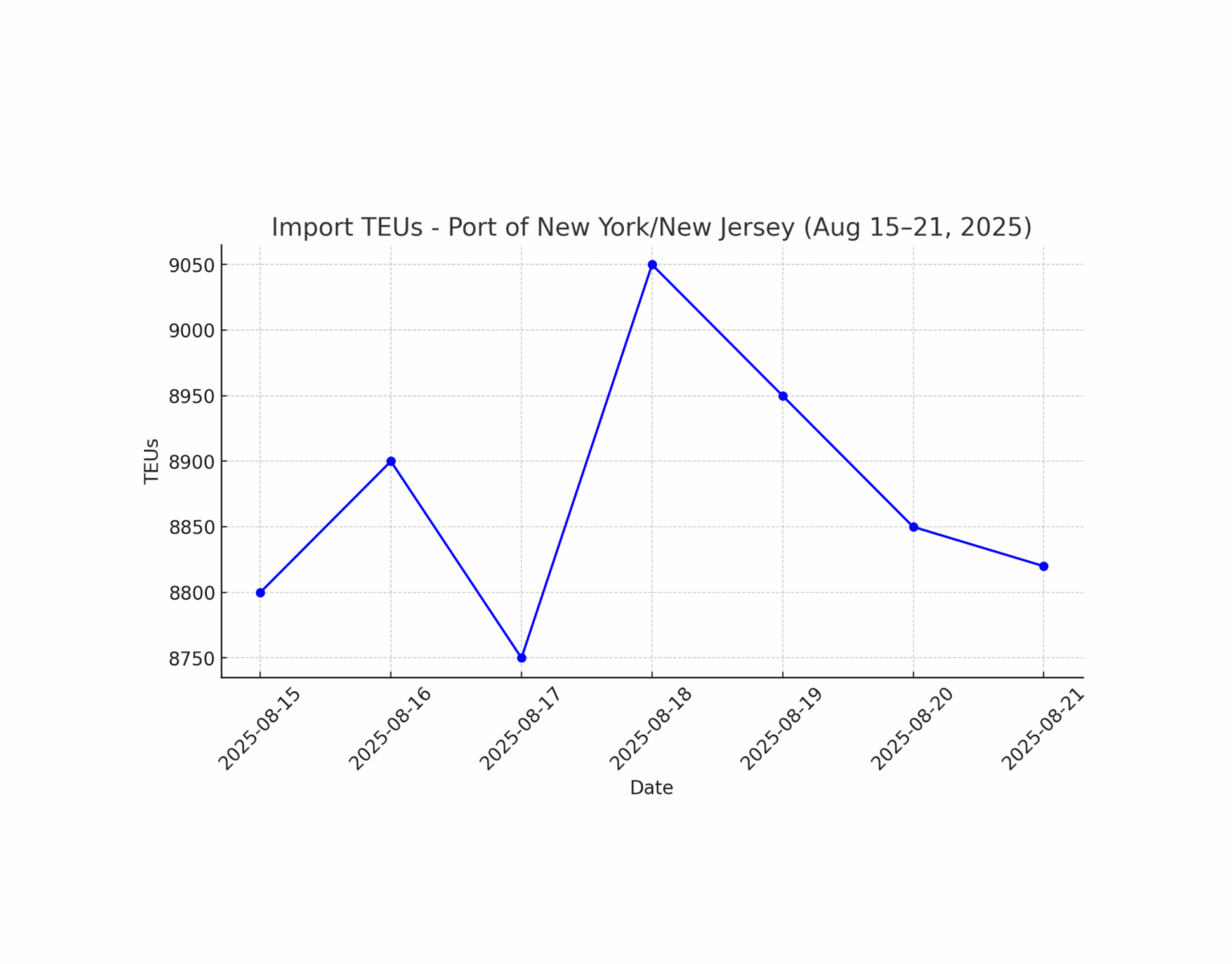

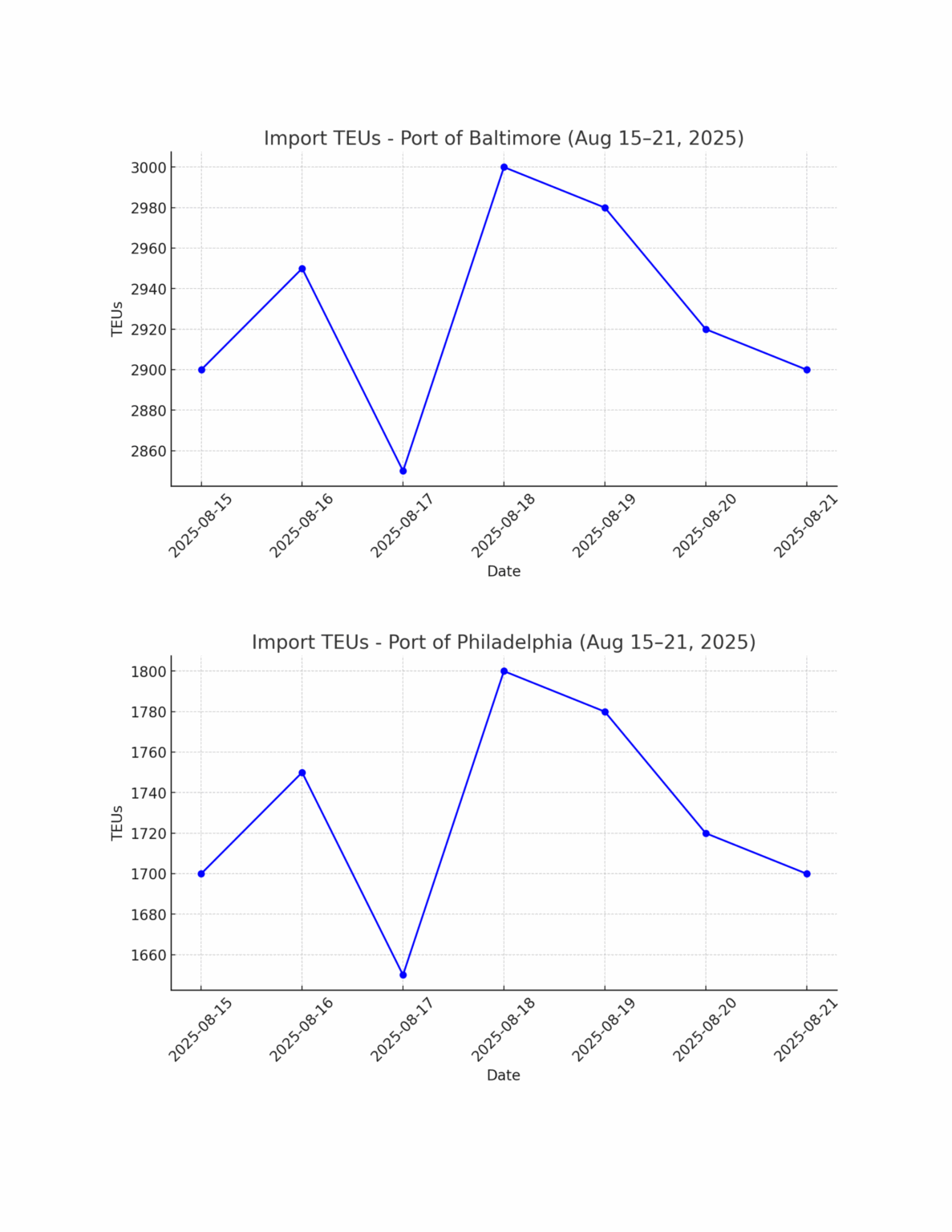

- East Coast: NY/NJ, Savannah, and Charleston are reporting more TEU activity from Southeast Asia and China.

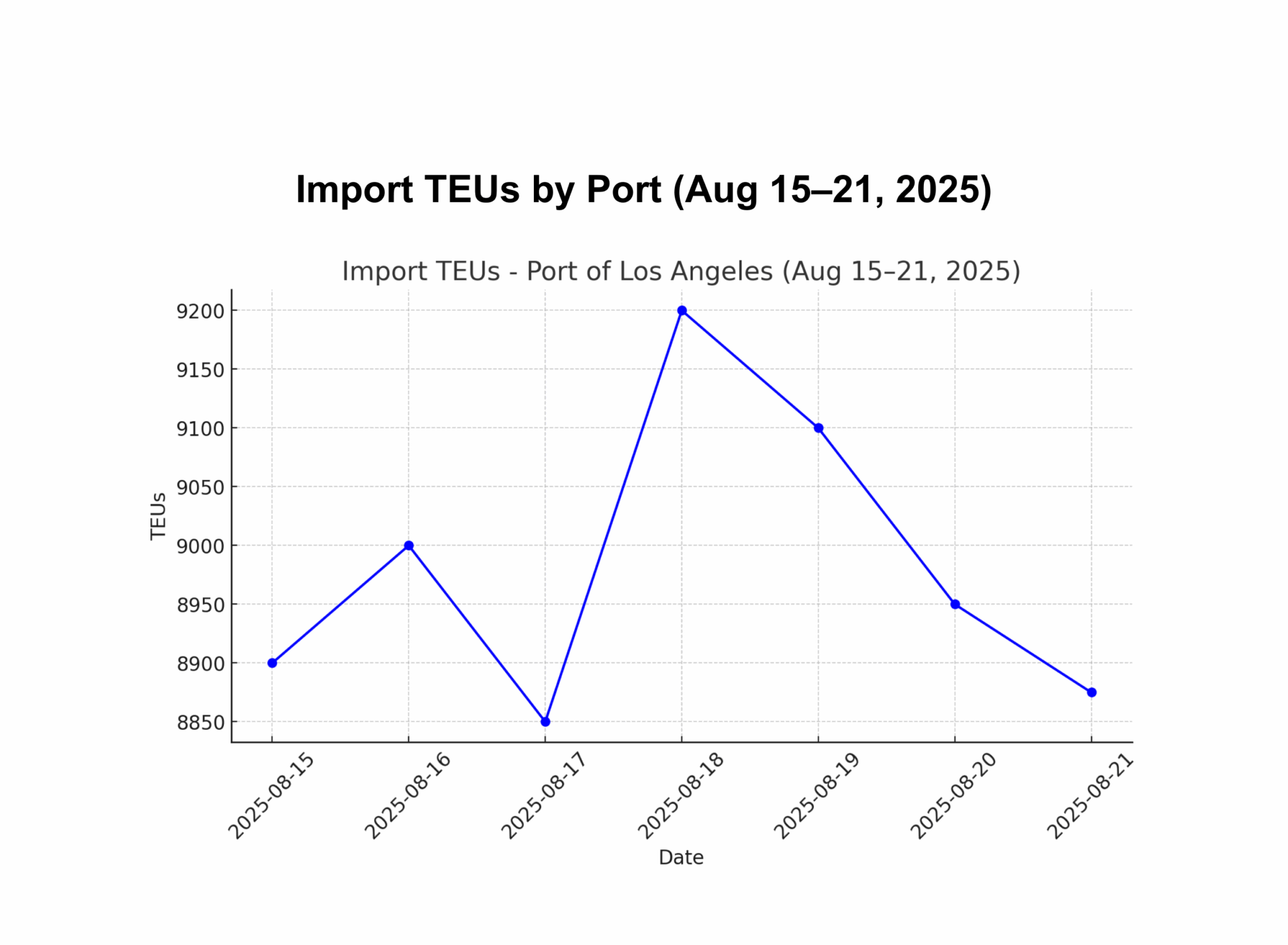

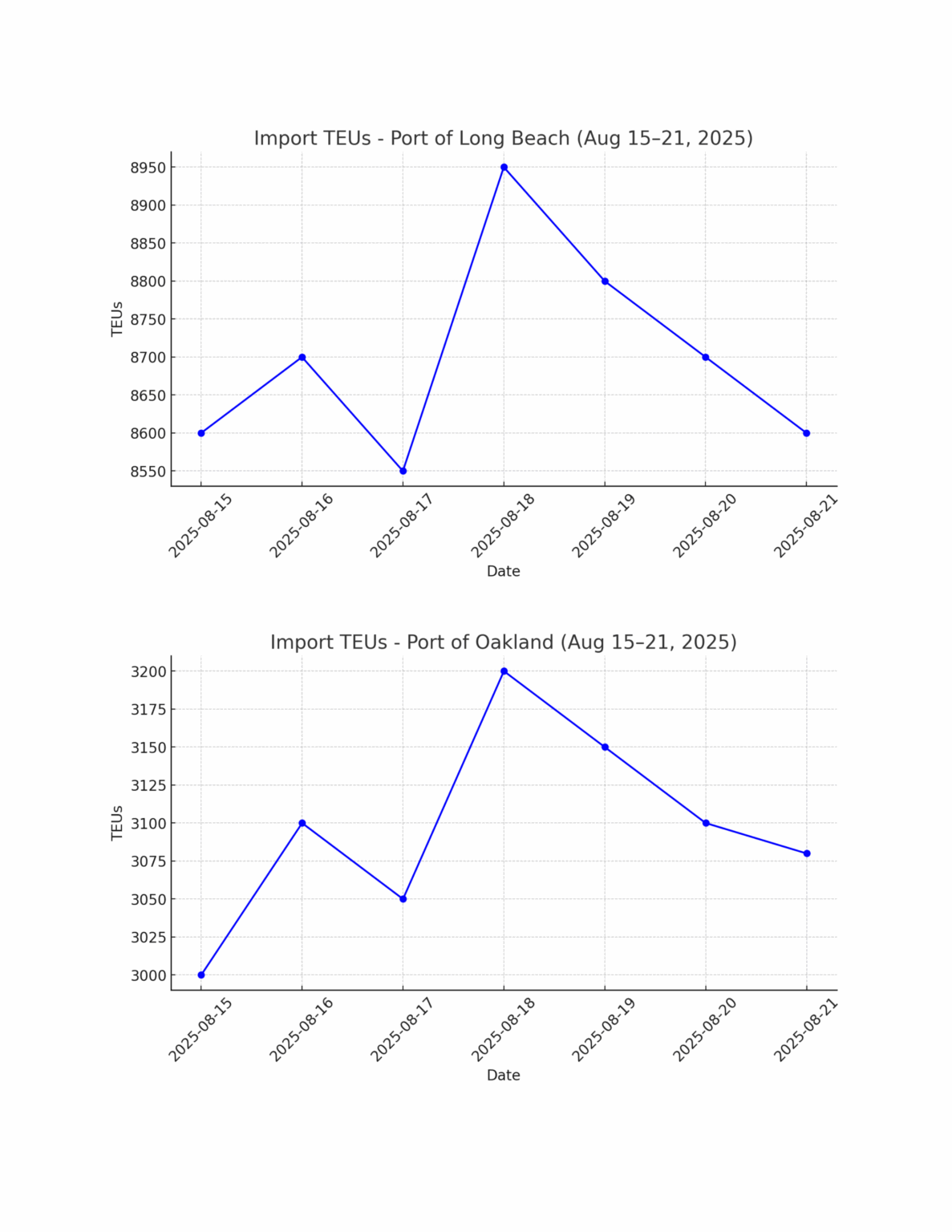

- West Coast: LA/LGB are seeing steady arrivals from China and Vietnam, though not surging like July.

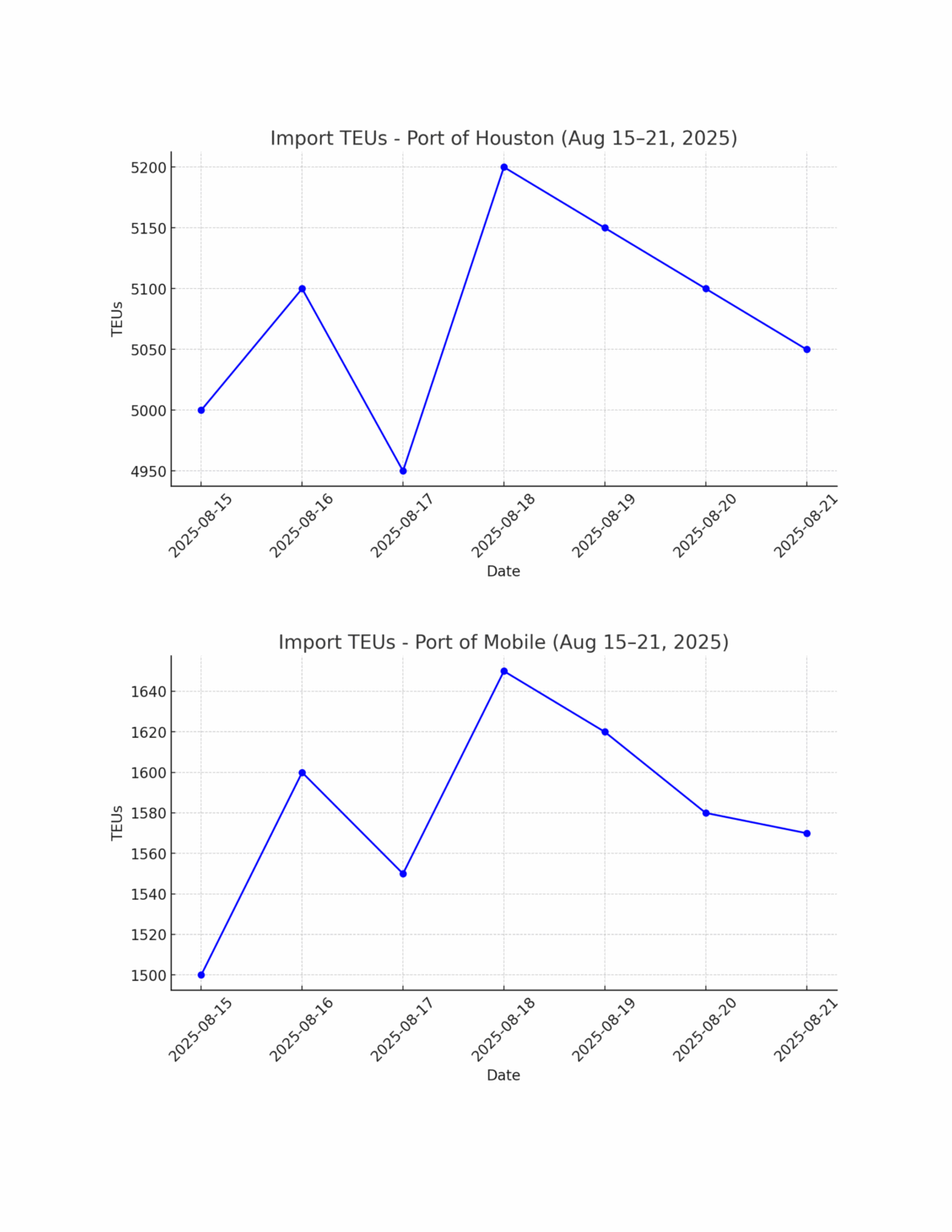

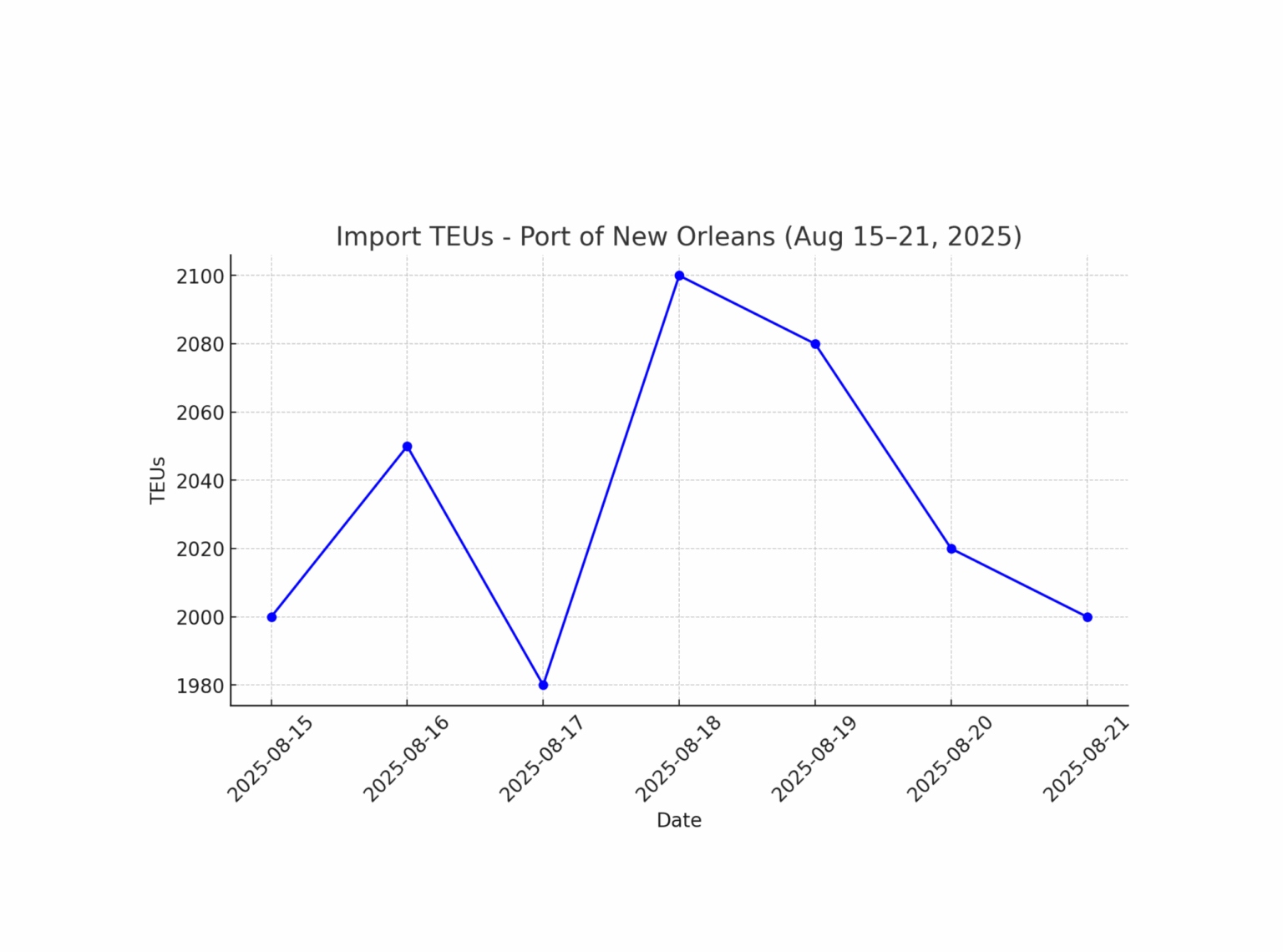

- Gulf: Houston and New Orleans are also receiving increased volumes, especially for tariff-targeted goods like furniture, copper, and building materials.

- Rail & drayage impact: Inland rail ramps (e.g., Chicago, Memphis, Dallas) are feeling the knock-on effects of port spikes. Expect increased demand for chassis and longer rail dwell times in the short term.

Bottom Line – The next 7–10 days should reflect the tail end of the tariff-driven import wave, with container volumes at elevated (though not record-breaking) levels. After this short spike, imports are forecast to cool considerably in September and October, especially for tariff-sensitive goods.

Q4 Outlook: Container Imports into the U.S.

Projected Declines Across the Board

- The National Retail Federation (NRF), citing the Global Port Tracker, projects substantial year-over-year drops in U.S. container imports throughout the final quarter:

- September: down ~19.5% YoY

- October: down ~18.9% YoY

- November: down ~21.1% YoY (lowest monthly volume since April 2023)

- December: down ~19.3% YoY

Overall, 2025 is expected to close with approximately 24.1 million TEUs, a decline of about 5.6% from the 2024 total of 25.5 million TEUs

Demand Cool-off After Early Peak –

The steep declines reflect a combination of frontloading ahead of tariff changes in early 2025 and historically elevated late-2024 volumes due to port strike concerns – skewing Q4 comparisons and softening seasonal demand.

Looking ahead, why a softer peak season could be good for your supply chain: While Q4 2025 won’t bring the traditional four-week import surge we’ve seen in past years, that’s not necessarily bad news. With much of the holiday inventory already landed early—thanks to the tariff-driven frontloading – what’s ahead is a more stable, more manageable freight environment. This “flattened peak” means fewer bottlenecks at ports, more reliable access to capacity, and greater flexibility in scheduling. For our customers, it’s an opportunity to move freight smarter, reduce avoidable costs, and take control of your final-mile timelines. Fewer surprises. More consistency. And better outcomes. Peak season pressure? We’ve already weathered the storm. Now it’s about sharp moves, smart timing, and leveraging space in the lanes. The noise is fading. The opportunity? Still shining.

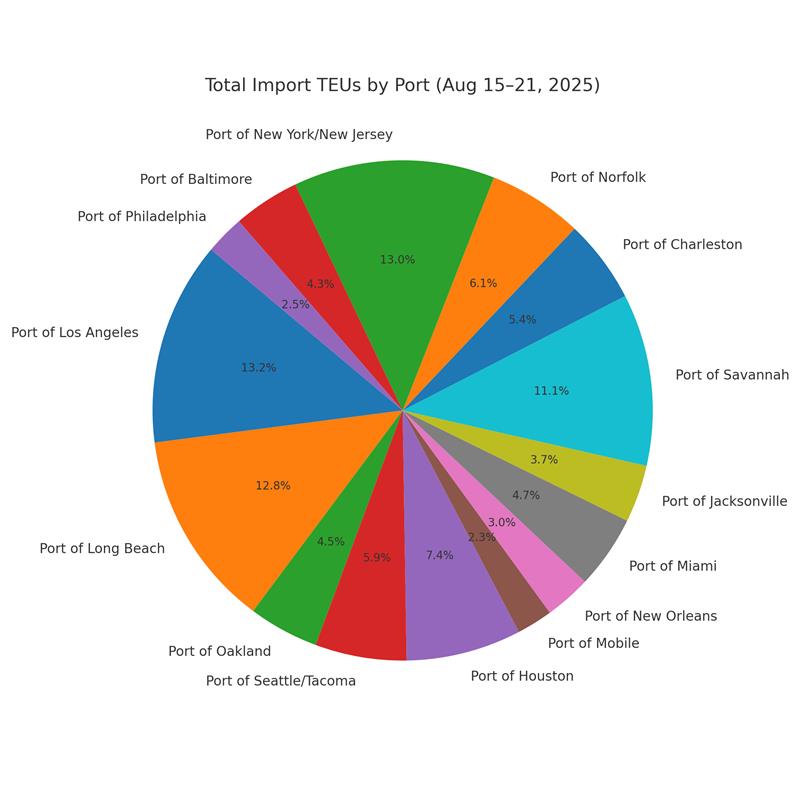

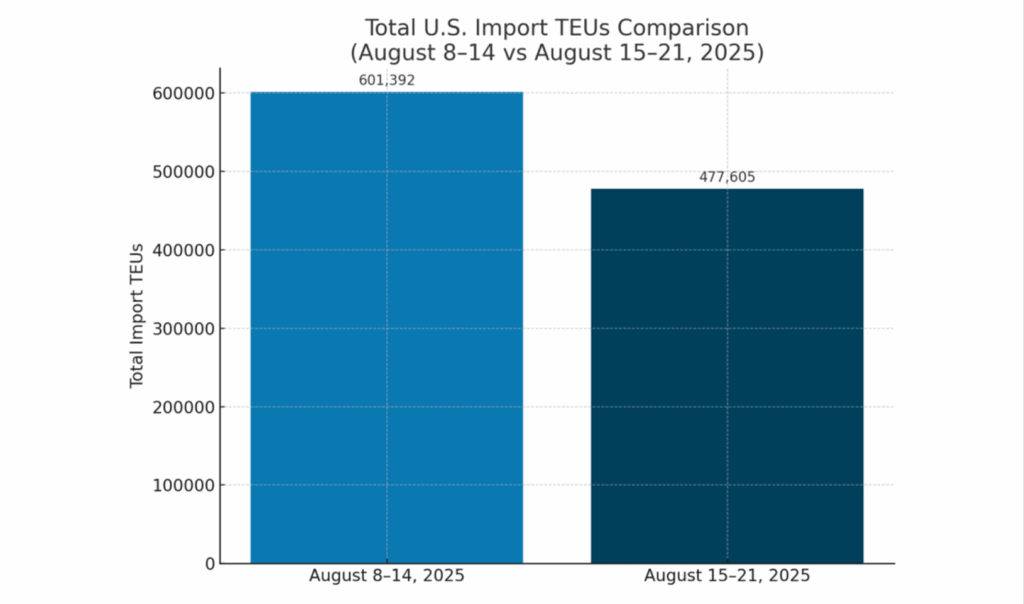

Import TEUs are down 20.55% this week from last week – with the highest volumes coming into Los Angeles 18%, Long Beach 17.1% and NY/NJ 11.9%. As August draws to a close, weather-related disruptions are becoming a significant operational constraint across multiple legs of the supply chain. Hurricane Erin’s offshore presence continues to generate hazardous marine conditions along the Eastern Seaboard and Gulf Coast, impacting vessel rotation schedules due to high swell events, restricted pilot boardings, and berth availability fluctuations. Simultaneously, inland terminals—particularly Savannah and Charleston—are experiencing heat-induced slowdowns, with late-afternoon storm activity further compressing gate hours and drayage availability. On the intermodal front, New York and Newark rail hubs are reporting multi-day dwell increases linked to a combination of terminal congestion, chassis imbalances, and weather-triggered throughput delays. With forecasts indicating continued precipitation and elevated humidity, shippers should anticipate operational drag on both port and inland rail corridors. Proactive scheduling, chassis pre-positioning, and flexible routing strategies are critical to mitigating further service degradation.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Montreal : Operations at the Port of Montreal are feeling the strain as seasonally low water levels on the St. Lawrence River limit vessel draft and reduce overall tonnage—prompting carriers to apply low-water surcharges. Meanwhile, import containers are dwelling 5–7 days on averagedue to a mixofrailcar shortagesand arrival bunching, with slower rail loading impacting movement into both Canada and the U.S. Rail and truck services remain active but are moving slower than usual, so delays should be expected. While the temporary closure of the port’s administrative tower (Aug 17th – 19th ) didn’t affect cargo handling, it’s another reminder that proactive planning and container visibility are key to navigating this stretch smoothly. Our Canadian team knows this market inside and out. With years of hands-on experience at every major port and rail across the country, we’re built to handle it all—drayage, transloading, and seamless cross-border deliveries to and from any location in Canada. If your U.S.-bound containers are getting stuck at the rail due to current congestion, now’s the time to bring in the experts. We know how to get freight moving—and fast. Reach out to canada@portxlogistics.com and let the best in the business take it from here.

Charleston: Big things are happening at the Port of Charleston. The new Leatherman Rail Facility is on track to open in early 2026, with all six electric gantry cranes installed and testing underway – designed to handle up to 1 million rail lifts per year. A dedicated drayage road is also being built to separate truck traffic from I-26. Meanwhile, phase two of the Leatherman Terminal expansion is extending the wharf by 1,600 feet to support five more ship-to-shore cranes. On the service side, MSC is adding two massive weekly loops—Albatros and Dragon—starting in September, bringing 15,000 TEU vessels and new direct connections to Europe, the Med, and Asia. Charleston is clearly leveling up. When speed and flexibility matter, our Savannah transload warehouse delivers. Whether it’s a last-minute transload, urgent cross-dock, or hazmat container that needs immediate attention, we’ve got you covered. Backed by our own 12-truck drayage fleet and service coverage across Savannah, Charleston, and Jacksonville, we’re built to move fast—no excuses. Need container yard space? Done. Need it handled today? Even better. For sharp rates and service that doesn’t miss a beat, reach out to our South Atlantic team at sav@portxlogistics.com. Let’s get it moving.

Did you know? We do drayage, transloading, and trucking without the freight freakouts, just reliable, tech-driven service that keeps your cargo (and your team) calm. At Port X Logistics, we deliver drayage and transloading services that are built for urgency, transparency, and complete peace of mind. Our asset-based network covers every major U.S. and Canadian port and rail hub, and our tech-driven operations give you full control without the headache.

Here’s how we keep things smooth:

🚢 We track your vessel

📦 Monitor container availability

🚫 Notify you of any holds

💸 Pay terminal fees when needed

📸 Upload transload photos with every shipment

📄 Provide real-time PODs at delivery

All backed by OpenTrack, our end-to-end visibility platform that connects origin to final mile.

We don’t wait until the last free day to pull a container—we move with urgency. That’s why we offer a No Demurrage Guarantee on shipments dispatched to us at least 72 hours before vessel arrival and cleared by the last free day.

And when things change? We flex fast. Our wide footprint and deep experience across transport modes mean we can scale with you, adapt on the fly, and keep freight flowing even when the unexpected hits. Our streamlined processes help us reduce costs without ever cutting corners—and we pass those savings directly to you.

If you’re ready for a drayage partner who brings speed, communication, and clarity to every move, Port X Logistics is your team.

📩 Let’s get rolling: letsgetrolling@portxlogistics.com

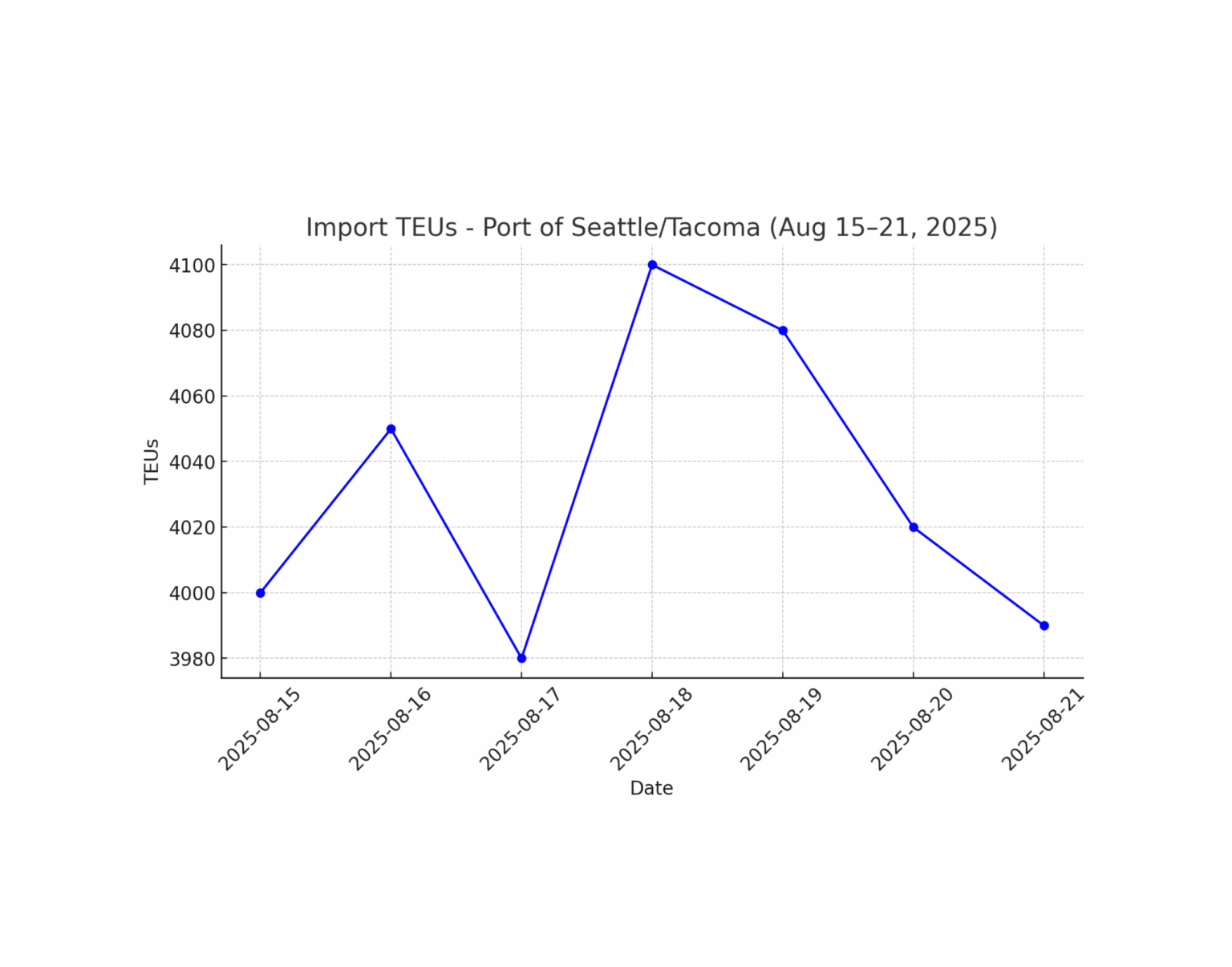

Import Data Images