Port of Los Angeles

1448 words 6 minute read – Let’s do this!

Capacity is overflowing, rates are crashing, and importers are stuck in neutral. On the trans-Pacific, the post-tariff surge is yesterday’s news—spot rates are falling fast as carriers scramble to cut back. Over on the trans-Atlantic, ocean lines are loading up on space ahead of the July 9th tariff deadline, but importers aren’t biting. The result? Dirt-cheap rates, ships with room to spare, and a “maybe later” vibe heading into peak season. As you enjoy a well-deserved Independence Day weekend full of sunshine, grilling, and fireworks—rest easy knowing the ocean market is anything but explosive right now.

As the July 9th expiration of the Trump administration’s 90-day pause on “reciprocal” tariffs approaches, ocean carriers are keeping trans-Atlantic capacity high—but shippers are taking a more cautious approach. Despite the uncertainty, carriers are standing by to handle a potential spike in bookings depending on how trade negotiations between the U.S. and European Union (EU) unfold. A 10% blanket tariff on EU imports, along with potential new tariffs on autos, steel, and aluminum, is on the table—though a pause extension is still possible.

Carriers appear to be hedging their bets. According to eeSea, scheduled westbound trans-Atlantic capacity will reach 344,811 TEUs in July—the highest monthly volume in the past 12 months. August capacity will dip slightly to 327,226 TEUs, and blank sailings remain minimal, with just 24,840 TEUs removed in July and none announced for August.

While the first quarter saw a steep 21.6% drop in trans-Atlantic spot rates, the decline moderated in May and June. Still, according to freight rate benchmarking and market analytics platform Xeneta, North Europe–to–U.S. spot rates are now down 37% year-to-date, sitting at $1,206 USD per FEU. “Falling demand from January through April—combined with rising capacity—has kept rates under pressure,” said Peter Sand, Xeneta’s chief analyst. Capacity on the trade jumped from 75,000 TEUs/week in February to 89,000/week now, with expectations to hit up to 97,000 TEUs/week in July and August. There’s a bit of early shipping activity on some trans-Atlantic lanes, but most shippers are holding off for now.

According to PIERS:

- Imports from North Europe reached 196,580 TEUs in May, down from March’s peak of 212,730 TEUs

- U.S. imports from the Mediterranean fell 19% in May, after hitting a high of 170,360 TEUs in April

The Bottom Line: Carriers are keeping capacity open, but importers are hitting pause. With tariffs still up in the air, July is shaping up to be more about positioning than peaking. Barring a sudden shift in policy or demand, we may see continued softening in volume and rates—despite all the space out there waiting to be filled.

After a brief run-up in demand tied to tariff concerns earlier this spring, spot rates are now falling fast—driven largely by excess vessel capacity across the trans-Pacific.

As of July 1st, S&P Global Commodity Insights (formerly Platts) reports spot rates from North Asia to the U.S. West Coast at $2,200 USD per FEU, down 15% from the previous week. Rates to the East Coast fell 12%, landing at $4,300 USD per FEU. Xeneta’s data, though slightly lagging, shows a June 26th rate of $2,800 USD to the West Coast and $5,473 USD to the East Coast—a reminder that published indexes don’t always reflect what’s actually being paid in the market.

Most Asia import shipments this week are clearing at:

- $2,400–$2,500 USD per FEU to the West Coast

- $4,400–$4,500 USD per FEU to the East Coast

Some retailers and forwarders shopping around are securing even better deals. Spot/FAK quotes as low as sub-$2,000 USD to the West Coast and under $4,000 USD to the East Coast are on the table, according to industry adviser Jon Monroe.

With carriers now ending peak season surcharges on fixed-rate accounts to the West Coast and only holding in place on East Coast shipments through July 14th, it’s clear the tariff-driven booking rush has faded. “Tariffs are quickly becoming a non-issue,” said one forwarder.

Shipper anxiety around summer space is easing—thanks to a major injection of vessel capacity. According to eeSea, July eastbound trans-Pacific capacity has swelled to 1.57 million TEUs, the highest since 2021. Even with 8.6% blanked sailings, that’s 20% more capacity than July 2024. August is projected to dip slightly to 1.48 million TEUs, with 7.7% blanked—but still 10.6% higher year over year.

This oversupply is a hangover from the spring booking surge. Carriers scrambled to add vessels after the Trump administration paused tariff hikes, but as volumes tapered off, excess capacity dragged rates into a free fall. Expect more blank sailings in the months ahead if volumes don’t rebound. “Rates are falling because a lot of capacity was brought on,” a carrier source noted. “If the drop continues, lines may pull capacity to stabilize pricing.”

Peak Season outlook is uncertain at best – Forecasting August–October import volumes remain a challenge. Forwarders and retailers alike are in wait-and-see mode. One large retailer said July is expected to be their peak, but even then, volume is softer than last year. While they’re still paying a $500 USD peak season surcharge into the West Coast, that’s down from $2,000 USD per FEU earlier this year. Despite frontloading by many retailers earlier this spring, there’s still fall and holiday cargo in the pipeline. Seasonal goods and inventory restocking will keep some momentum moving eastbound, even if overall volumes are lower year over year.

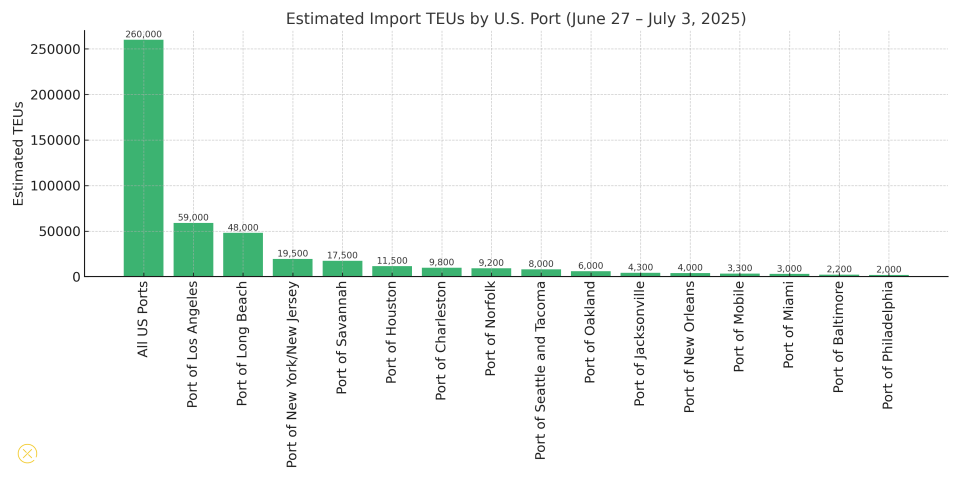

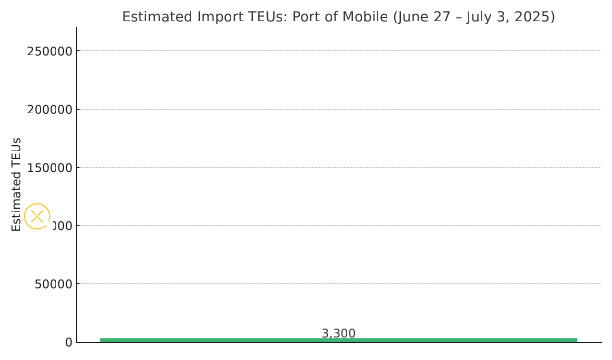

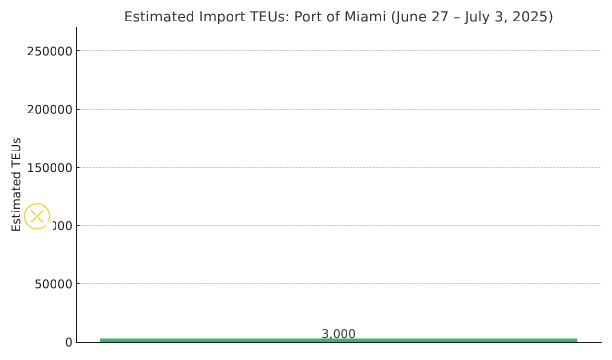

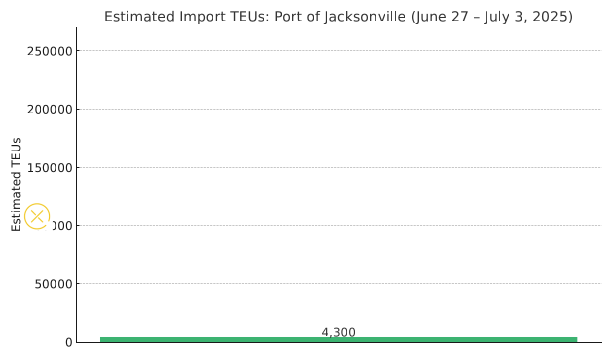

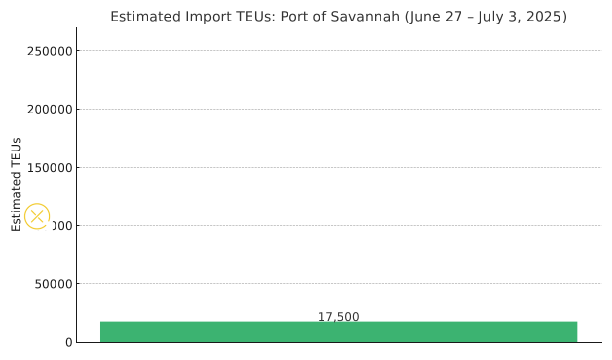

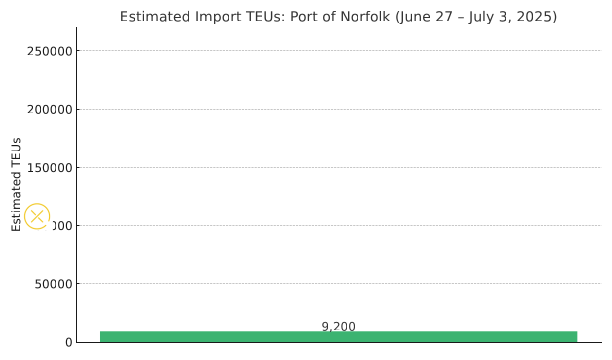

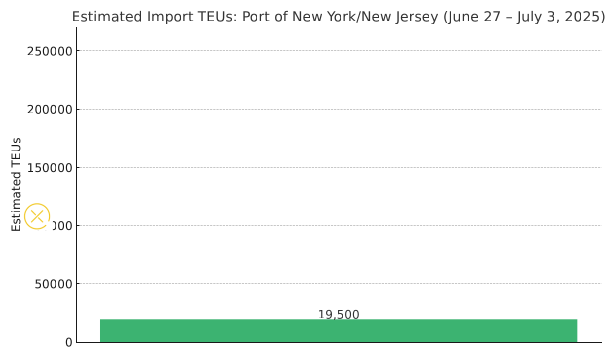

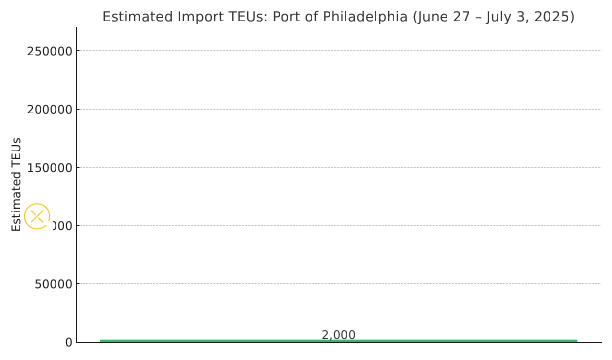

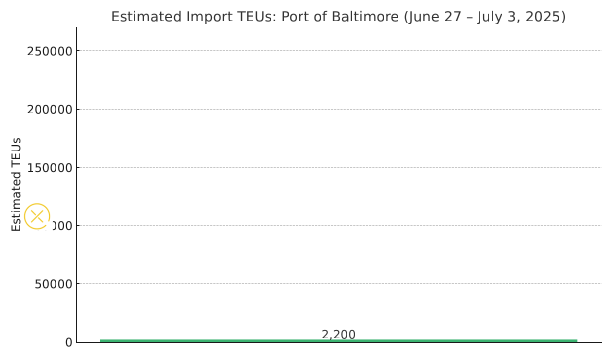

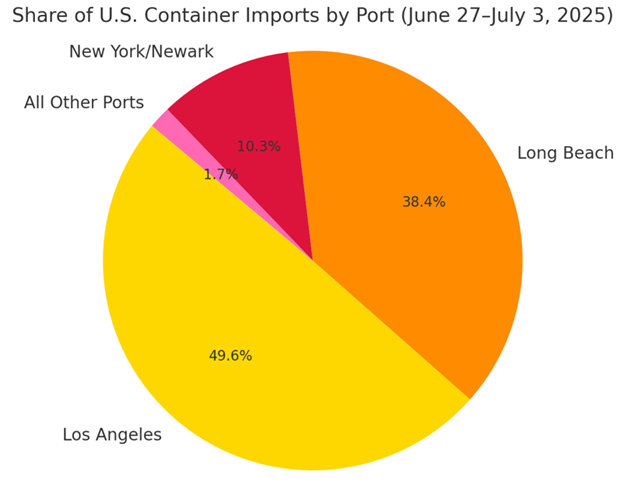

Import TEUs are down 2.53% this week from last week – with the highest volumes shown in the chart below:

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

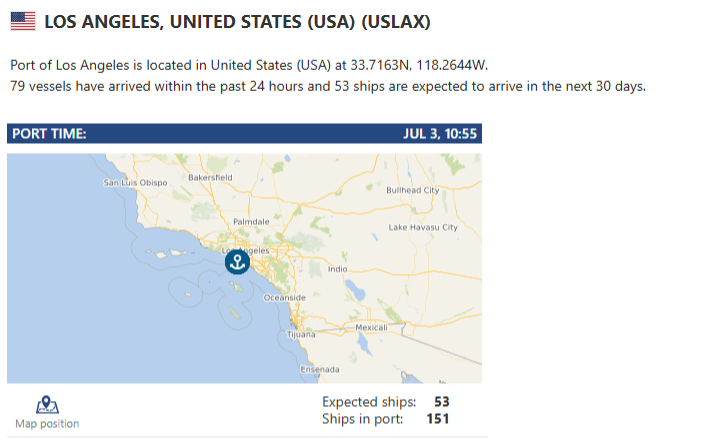

LA/LGB: Beginning August 1, 2025, the TMF will be $38.78 per TEU (twenty-foot equivalent unit) and $77.56 for all other size containers. The TMF is charged on non-exempt containers. Containers exempt from the TMF include empty containers; import cargo or export cargo that transits the Alameda Corridor in a container and is subject to a fee imposed by the Alameda Corridor Transportation Authority; and transshipment cargo. Empty chassis and bobtail trucks are also exempt. We dropped our transload rates for LA/LGB! Our Los Angeles drayage yard and transload warehouse location boasts a large drayage fleet, a large, secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your containers for palletized and floor to pallet transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a NO DEMURRAGE GUARANTEE on all orders that have been dispatched to us 72 hours prior to vessel arrival and are cleared for pickup by the last free day. Contact the team at letsgetrolling@portxlogistics.com for rates and any questions. Let’s talk about being your #1 West Coast transload team.

Did you know? Carrier 911 works through holiday weekends?! We are equipped to make your holiday airfreight shipments run smoothly with minimal monitoring on your end. Our Carrier911 team consists of crisis management experts who have extensive experience in airfreight logistics. We stand ready 24/7/365 to handle your needs for Aircraft on Ground (AOG) Recovery, Hotshot Trucking, Expedited Transportation, Aerospace, Industrial & Automotive Logistics, Front & Back-End Charter Services, and First and Last Mile On-Board carrier (OBC) – Perfect for your upcoming urgent holiday weekend shipments. Our exclusive-use Sprinters, Straight Trucks, and Dry Vans are ready to meet your needs at a moment’s notice, 24/7, 365 days a year. We recognize that freight emergencies can happen at any time, and our dedicated fleet ensures we can respond swiftly. With Carrier 911, you can relax knowing you have real-time visibility of the driver’s location, day or night. The Proof of Delivery (POD) will also appear in your inbox immediately, guaranteeing timely receipt of your essential documents. For a free demo email info@carrier911.com or click the link below to schedule: portxlogistics.com/tech-demo/

Import Data Images