Port of Savannah

1408 words 7 minute read – Let’s do this!

Early this week the United States and China have agreed to a 90-day pause in their escalating tariff war. Effective May 12, 2025, this agreement reduces U.S. tariffs on Chinese imports from a peak of 145% to 30%, while China lowers its tariffs on U.S. goods from 125% to 10%. It is likely to be a busy summer for shippers and Port X Logistics wants to help make your summer easier. For more information on what Port X has to offer and to get on the list for this weekly Market Update Newsletter and future industry related news sent directly to your inbox email marketing@portxlogistics.com. Don’t forget to follow our LinkedIn page to see other company news and industry related topics.

With the pause, there has been a significant surge in import bookings to the U.S. Container bookings from China to the U.S. have increased dramatically and prompted businesses to expedite shipments before the truce expires. Companies are front-loading inventory to mitigate potential future tariff increases, leading to heightened demand for shipping space. Retailers are particularly focused on stocking up ahead of key sales periods like back-to-school and the holiday season. Analysts anticipate that this front-loading will lead to an earlier-than-usual peak in shipping demand, potentially stressing port capacities and causing equipment shortages. According to data from Vizion, the average daily bookings rose from 5,709 twenty-foot equivalent units (TEUs) on May 5th to 21,530 TEUs by May 13th, marking a 277% increase. Similarly, Hapag-Lloyd reported a 50% week-on-week rise in bookings for U.S.-China routes, with volumes surpassing pre-tariff levels.

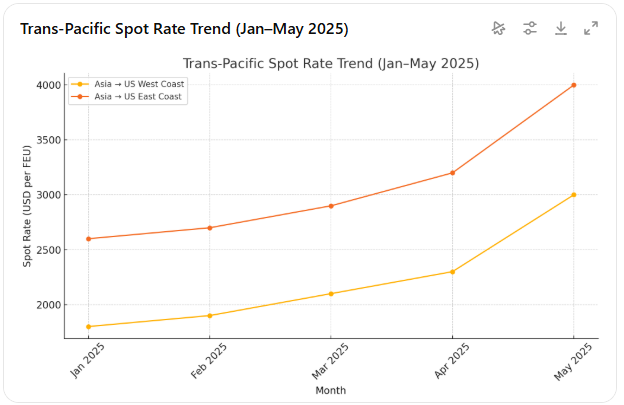

With Chinese suppliers already edging back in even before the deal was announced, freight rates on the trans-Pacific route jumped this week. In a research note Wednesday, analysts at Jefferies said Asia-West Coast spot rates are now being quoted at $3,000 per FEU, with East Coast rates at $4,000/FEU. Just how far rates could rise depends in large part on volumes, as not all observers are ready to categorize the coming flush of imports as a sustained surge. The analysts at Jefferies also advise to watch July closely — if rates remain elevated into mid-July, a stronger seasonal peak may be forming.

Here’s a visual of the trans-Pacific spot rate trends from Asia to the U.S. West and East Coasts from January through May 2025. This upward curve illustrates the growing pressure on eastbound lanes due to front-loading and space constraints. As shown:

West Coast rates have risen from around $1,800 to $3,000/FEU.

East Coast rates have jumped even more steeply, reaching $4,000/FEU.

The U.S.–China trade relationship has been unstable since the initial tariff war began in 2018. The current 90-day pause offers a breather, businesses know this is not a resolution — it’s a temporary truce, not a peace treaty. While the uptick in bookings also offers short-term relief, uncertainties remain regarding the long-term trade relationship between the U.S. and China. Many importers are planning for supply chain diversification and continuing to shift sourcing to Vietnam, India, Mexico, and nearshore partners to buffer against geopolitical disruptions. Even with cost advantages from China, the risks have prompted a long-term strategy shift.

Potential supply chain disruptions are on the horizon and shippers are actively deploying a mix of risk mitigation strategies to stabilize operations and protect margins. Along with supply chain diversification, shippers also use effective tactics like nearshoring and reshoring, inventory buffering (Safety Stock Strategy), tariff engineering, Free Trade Agreement (FTA) optimization, using Foreign-Trade Zones (FTZs), flexible logistics contracts, digital supply chain visibility and sourcing from Duty-Free programs (e.g., GSP, AGOA).

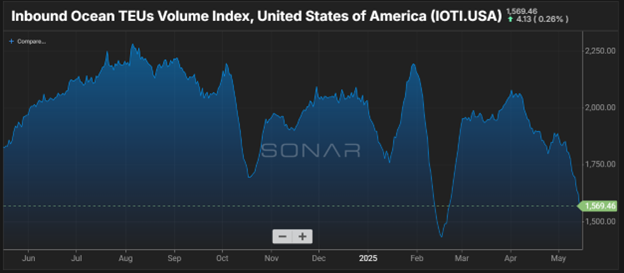

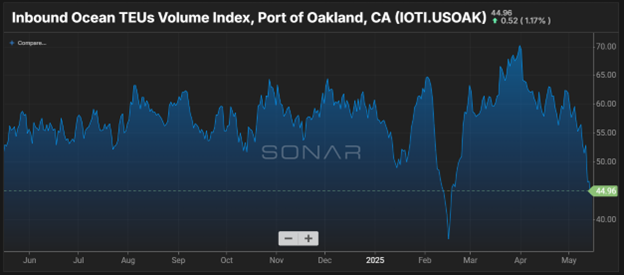

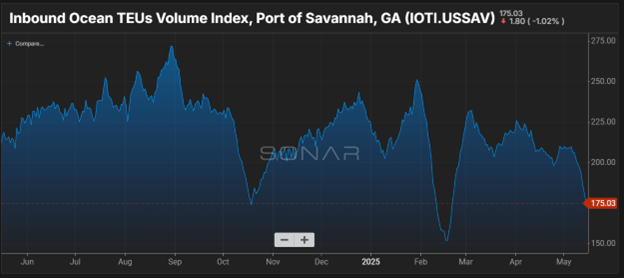

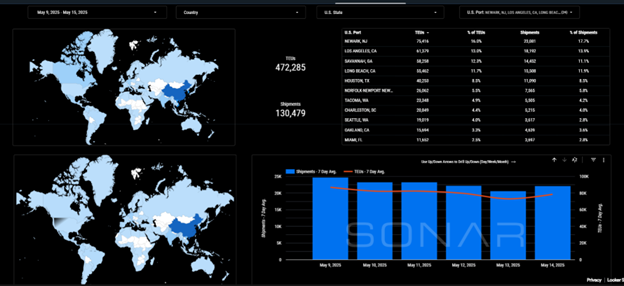

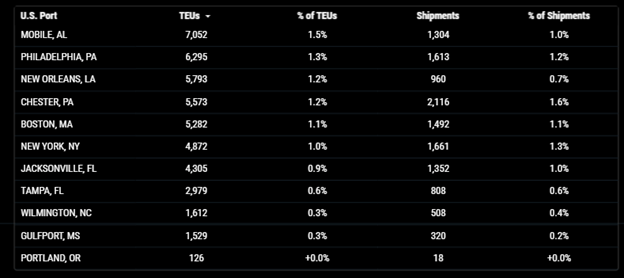

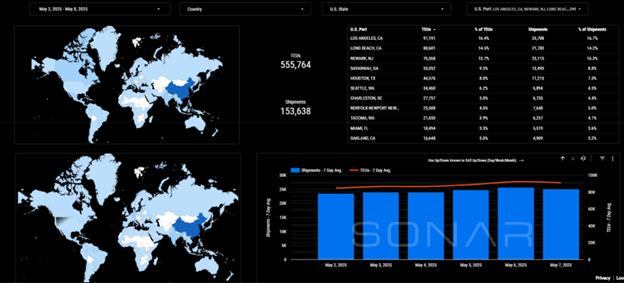

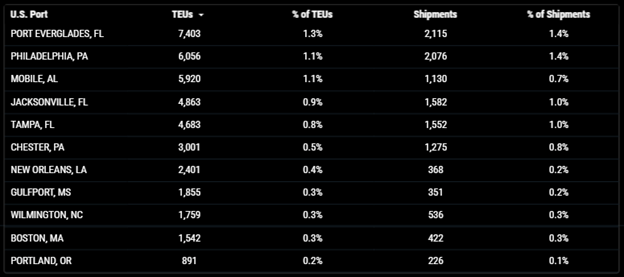

Import TEUs are down 15.02% this week from last week – with the highest volumes coming into Newark 16%, Los Angeles 13% and Savannah 12.3%. Industry professionals beware! The U.S.– China tariff pause import surge will hit ports in a few weeks, and the ports can experience a range of difficulties and congestion risks that ripple across the supply chain. For those that are new to the industry (or a reminder for those that chose to block out past events of the early 2020’s) Here’s a breakdown of what to watch for:

Vessel Bunching

- What happens: Multiple ships arrive at the same time due to front-loaded bookings.

- Impact: Longer wait times at anchor, vessel berthing delays, and idle capacity.

- Example: During pandemic surges, ships were stuck offshore for days at LA/Long Beach.

Terminal Congestion

- What happens: Ports run out of space to unload or store containers.

- Impact: Slower turnarounds, container pile-ups, increased demurrage charges.

Most at risk: LA, Long Beach, New York/New Jersey, Savannah—ports already running near capacity.

Chassis Shortages

- What happens: Not enough chassis to move containers off-dock.

- Impact: Containers sit at terminals waiting for equipment, further clogging yard space.

Truck & Drayage Bottlenecks

- What happens: Lack of available truck drivers or long lines to enter/exit port terminals.

- Impact: Missed appointments, extended dwell times, and terminal gate delays.

Rail Delays & Container Dwell Times

- What happens: Inland rail ramps (Chicago, Memphis, Kansas City) can’t absorb sudden container volume.

- Impact: Container dwell times spike, especially for intermodal cargo from West Coast ports

Labor Constraints & Work Slowdowns

- What happens: Surge conditions strain longshore labor or reignite union disputes.

- Impact: Reduced productivity, partial walkouts, or strikes that cripple port throughout.

Customs Processing Delays

- What happens: Increased import volumes overwhelm U.S. Customs inspection capacity.

- Impact: Longer clearance times, especially for flagged or exam-targeted shipments

Warehouse Backlogs & Overflow

- What happens: Downstream warehouses hit max capacity due to early inventory loading.

Impact: Delays in container unloading, extended container use charges (per diem), storage overflow at ports.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Here’s a regional breakdown of U.S. ports most vulnerable to congestion during the current import surge prompted by the U.S.– China tariff pause:

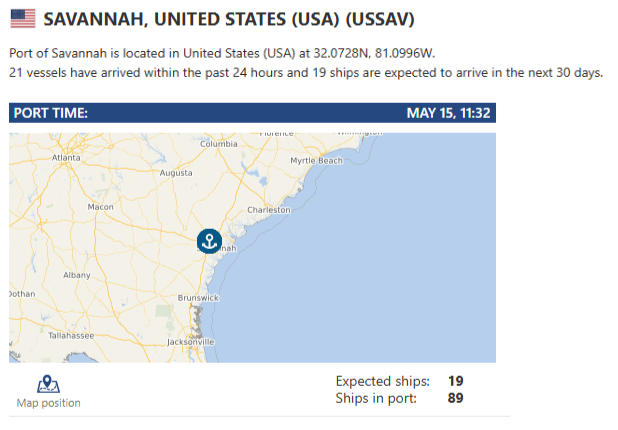

Port of Savannah: Risk Factors: Rising container traffic and operational inefficiencies.

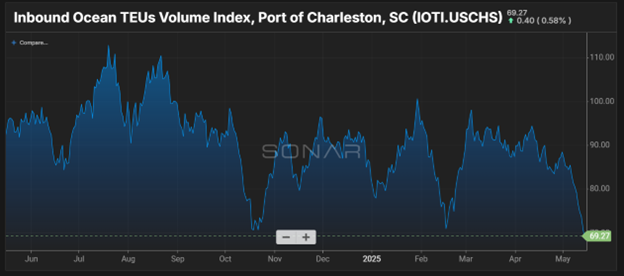

Key Challenges: Average wait times have increased to approximately 2.4 days, up by 16%. Monitoring for potential future congestion; maintaining infrastructure efficiency. Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space and we have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks Contact the team sav@portxlogistics.com for great rates and supreme customer service.

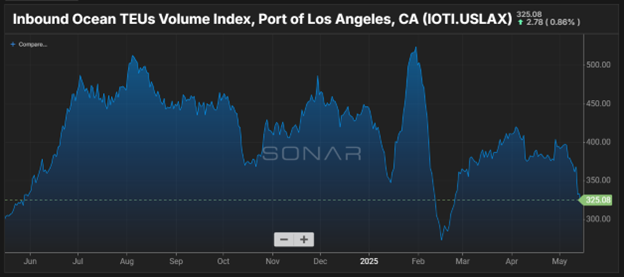

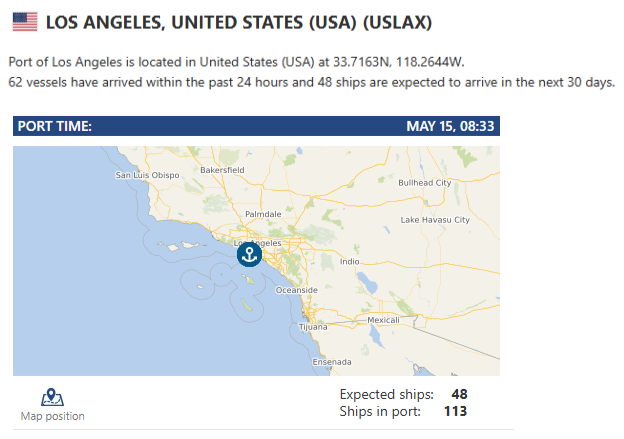

Port of Los Angeles: Risk Factors: High concentration of Chinese imports (approximately 45% of volume), potential labor disputes, and infrastructure limitations.

Key Challenges: Reduced labor hours; economic impact on local workforce. Increase in rail dwell times and potential bottlenecks.

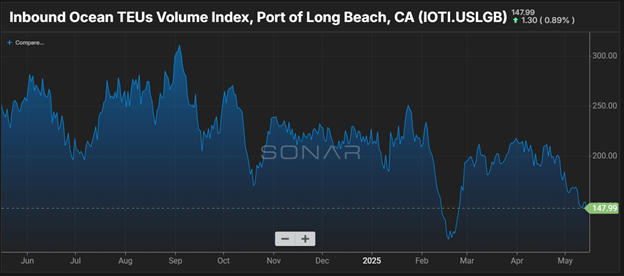

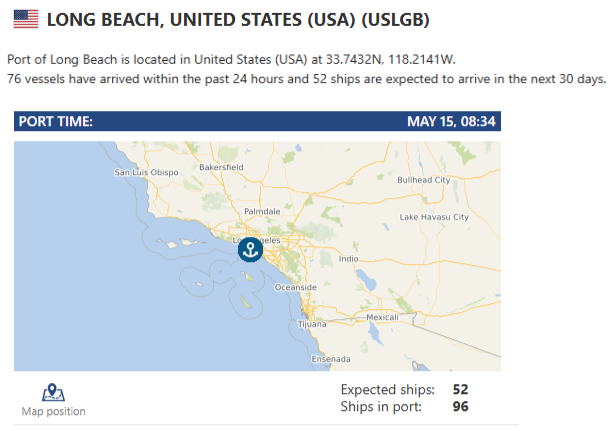

Port of Long Beach: Risk Factors: Adjacent to Los Angeles, shares similar vulnerabilities, including labor constraints and equipment shortages.

Key Challenges: Managing empty container surplus; concerns over trade policy impacts.

Did you know? We dropped our transload rates for LA/LGB! Our Los Angeles drayage yard and transload warehouse location boasts a large drayage fleet, a large, secured yard with plenty of yard storage space and a transload warehouse with immediate capacity to pull your containers for palletized and floor to pallet transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a NO DEMURRAGE GUARANATEE on all orders that have been dispatched to us 72 hours prior vessel arrival and are cleared for pickup by the last free day. Don’t let all our capacity slip through your fingers, front loading volumes, vessel backups and rail dwells will make LA transloads the hot commodity, contact the team to get on the capacity list, for rates and any questions letsgetrolling@portxlogistics.com

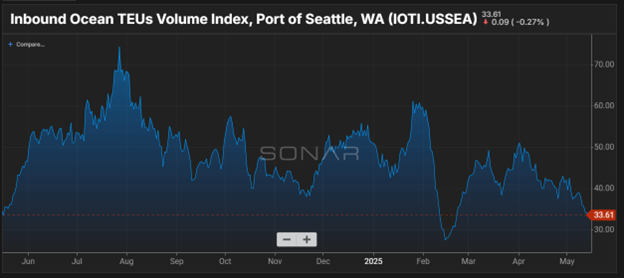

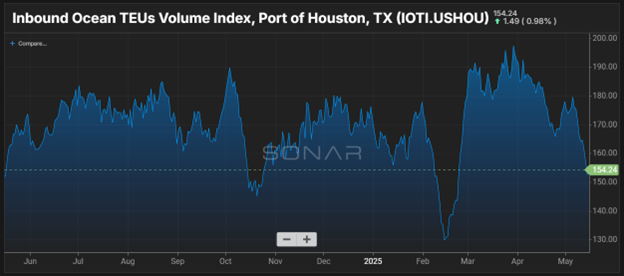

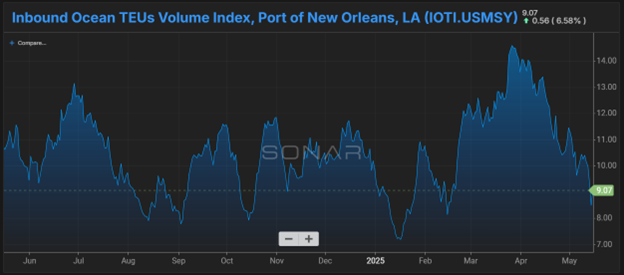

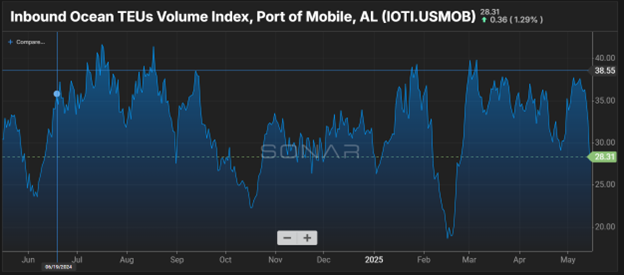

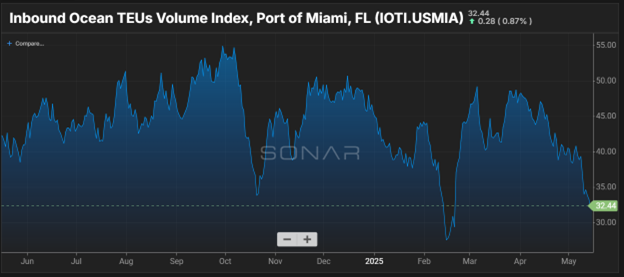

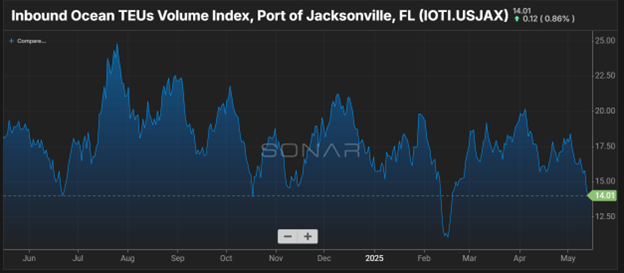

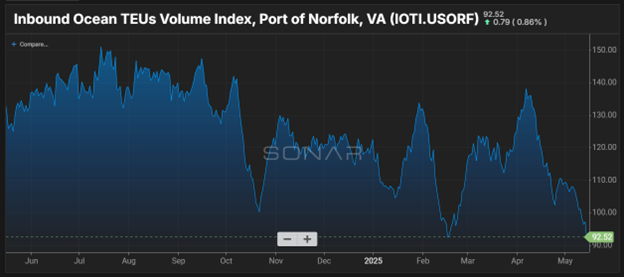

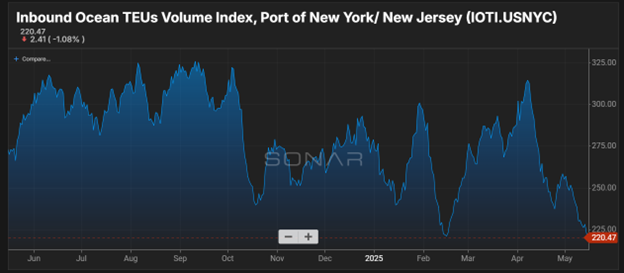

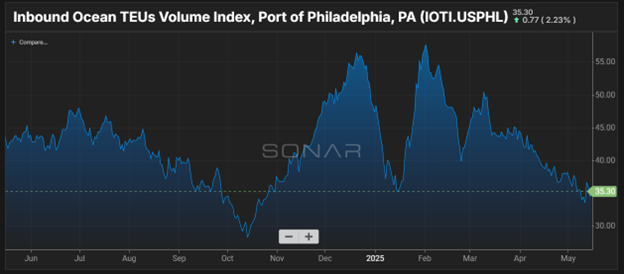

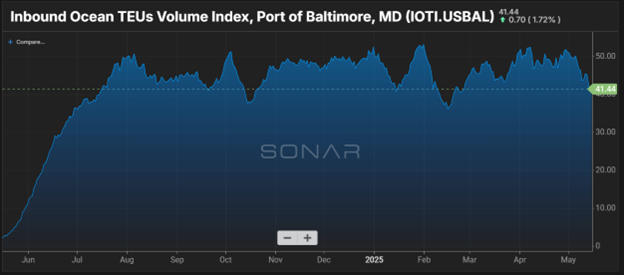

SONAR Import Data Images