1267 words 5 minute read – Let’s do this!

We are most definitely starting to see a bit of panic in the shipping world this month, everyone is brainstorming to figure out solutions and even hacks to mitigate tariff drama. Port X Logistics prides itself on being the industry experts that can curate solutions for your supply chain – and our sales and operations teams are ready to talk about it! Contact letsgetrolling@portxlogistics.com to hear about our services. Don’t forget to follow our LinkedIn page to get a weekly dose of the latest and greatest Market Updates and to get on the list for this weekly Market Update Newsletter and future industry related news sent directly to your inbox email marketing@portxlogistics.com.

China will pay no attention if the United States continues to play the “tariff numbers game”, China’s foreign ministry said on Thursday, after the White House outlined how China faces tariffs of up to 245% due to its retaliatory actions. In a fact sheet released on Tuesday, the White House said China’s total duties include the latest reciprocal tariff of 125%, a 20% tariff to address the fentanyl crisis, and tariffs of between 7.5% and 100% on specific goods to address unfair trade practices.

President Trump announced additional tariffs on all countries two weeks ago, before suddenly rolling back higher “reciprocal tariffs” for dozens of countries while keeping punishing duties on China. Beijing raised its own levies on U.S. goods in response and has not sought talks, which it says can only be conducted on the basis of mutual respect and equality. Meanwhile, many other nations have begun looking at bilateral deals with Washington. Last week, China also filed a new complaint with the World Trade Organization expressing “grave concern” over U.S. tariffs, accusing Washington of violating the global trade body’s rules. China accounts for approximately 30% of all U.S. containerized imports (down from 37% in 2018), but accounts for approximately 54% of all U.S. containerized imports from Asia (down from 67% in 2018).

This week, China unexpectedly appointed a new trade negotiator who would be key in any talks to resolve the escalating tariff war, replacing trade tsar Wang Shouwen with Li Chenggang.

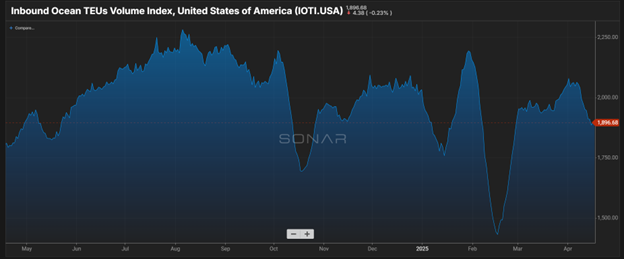

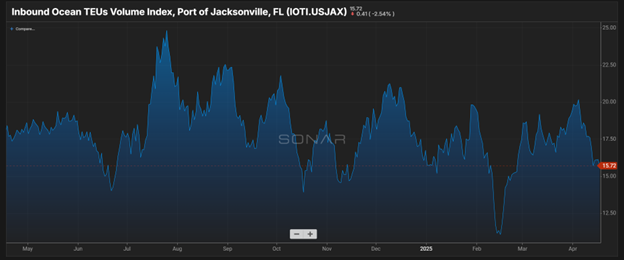

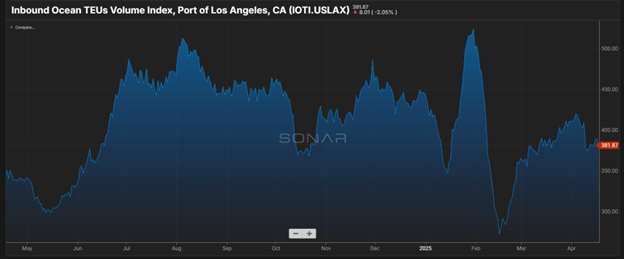

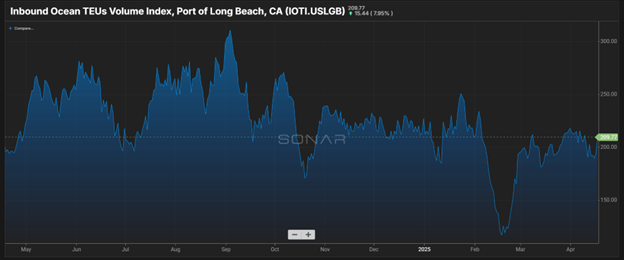

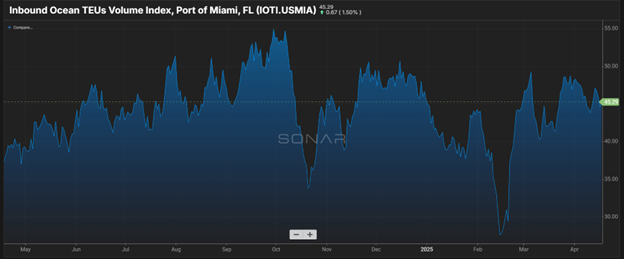

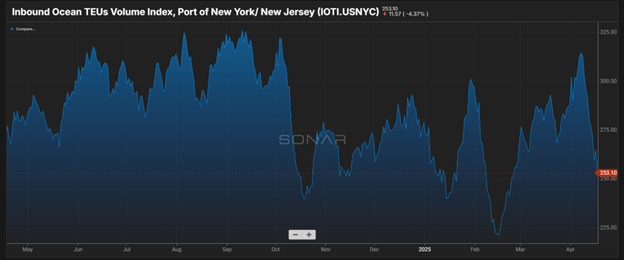

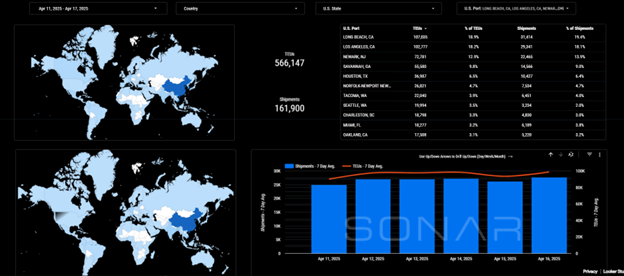

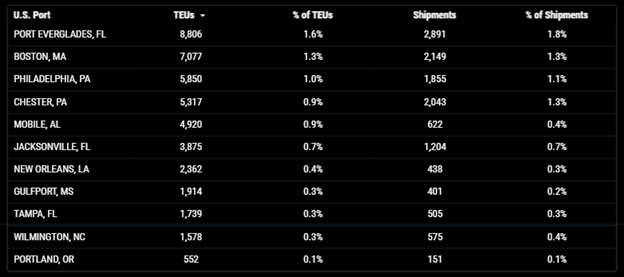

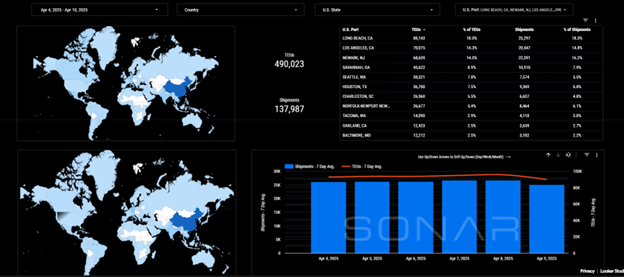

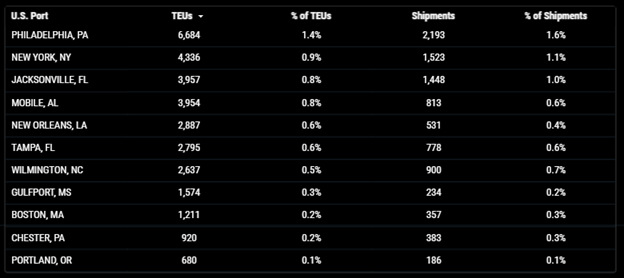

Import TEUs are up 18.9% this week from last week – with the highest volumes coming into Long Beach 18.9%, Los Angeles 18.2%, and Newark 12.9%. Despite this week’s increase, U.S. importers are being notified of an increase in canceled sailings by freight ships out of China as ocean carriers try to balance the pullback in orders resulting from President Trumps tariffs. The impact of the diminished freight container traffic to North America will be significant for many links in the economy and supply chain, including the ports and logistics companies moving the freight. If each sailing was carrying 8,000 to 10,000 TEUs (twenty-foot equivalent units), that would equal a decline in freight traffic of between 640,000-800,000 containers, and lead to decreased crane operations at the ports, lower fees that could be collected, and declines in container pick-ups and transports by trucks, rails, and to warehouses for storage.

Booking volumes from the last week of March to first week of April across global and U.S. trade lanes plummeted. There were sharp decreases in bookings across several categories, including apparel & accessories; and wool, fabrics & textiles, both down over 50%. Major product categories from China that are moved in containers include apparel, toys, furniture, and sports equipment, all of which are subject to steep tariffs.

In an executive order last week, Trump called for increasing the number of U.S.-flagged vessels in international trade, and promised incentives for shipbuilders from American allies to invest in the United States. Washington has also proposed to charge million-dollar U.S. port docking fees on Chinese-built or Chinese-flagged vessels and use the proceeds to invest in American shipbuilding. If these steps discourage shipping lines from buying more vessels from China, they could help South Korean shipbuilders. Trump has also said that the United States may buy ships from allies.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

LA/LGB: Record Cargo Volumes Amid Tariff Concerns: The Port of Long Beach reported its busiest first quarter ever, handling 2,535,575 twenty-foot equivalent units (TEUs), marking a 26.6% increase compared to the same period in 2024. This surge is largely attributed to importers accelerating shipments ahead of anticipated U.S. tariffs on Chinese goods. Coming off its best first quarter on record, the Port of Long Beach is the nation’s busiest port through the first three months of the year as imports surged ahead of anticipated tariffs. Dockworkers and terminal operators moved 817,457 twenty-foot equivalent units last month, up 25% from March 2024. Imports grew 25.8% to 380,562 TEUs and exports decreased 1% to 104,063 TEUs. Empty containers moving through the Port rose 35% to 332,832 TEUs. March also marked the Port’s 10th consecutive monthly year-over-year cargo increase. The Port also saw its busiest first half of any fiscal year on record, with 5,267,926 TEUs moved since October 1st, making it the nation’s busiest port for the last six months. For complete cargo numbers, visit polb.com/statistics.

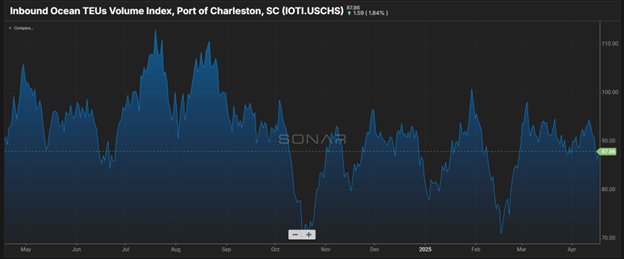

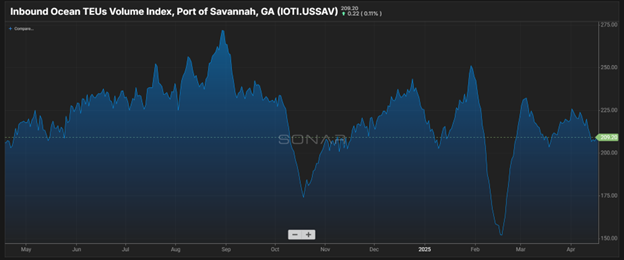

Savannah: The Port of Savannah added three new start times to vessel operations. The start times to work vessels – 6 a.m., 3p.m. and 9 p.m. – bringing the Savannah port to a total of eight start times per day. Vessel operations in Savannah are performed 24 hours a day, seven days a week. With eight start times a day the new lay berth in Ocean Terminal opening in May, the Savannah port offers a more flexible schedule to ocean carriers to make their SAV port calls faster and easier and both importers and exporters will benefit from the improved supply chain speed. Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space and we have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks Contact the team sav@portxlogistics.com for great rates and supreme customer service.

Did you know? We dropped our transload rates for LA/LGB! Our Los Angeles drayage yard and transload warehouse locations boast a large drayage fleet, a secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your containers for palletized and floor to pallet transloads. Our capacity is tendered to on a first come first serve basis. We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a “NO DEMURRAGE GUARANTEE” on all orders that have been dispatched to us 72 hours prior to vessel arrival and are cleared for pickup by the last free day. Contact the team at letsgetrolling@portxlogistics.com for rates and any questions. Let’s talk about being your #1 West Coast transload team!

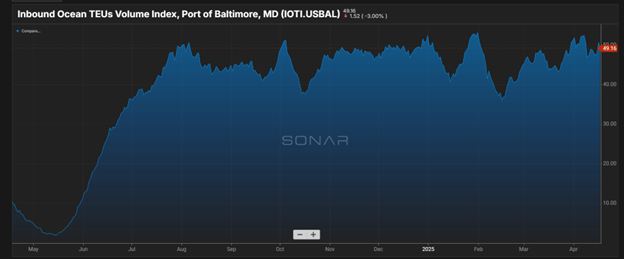

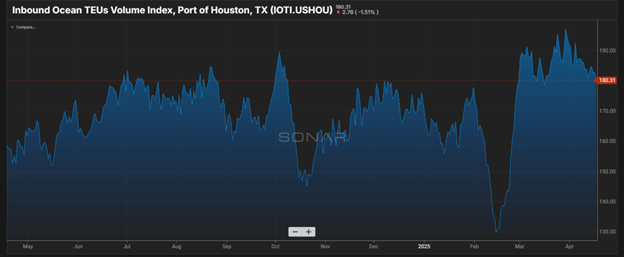

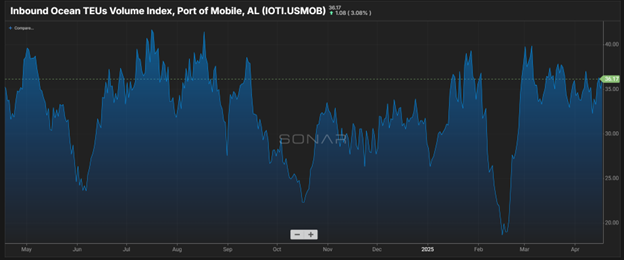

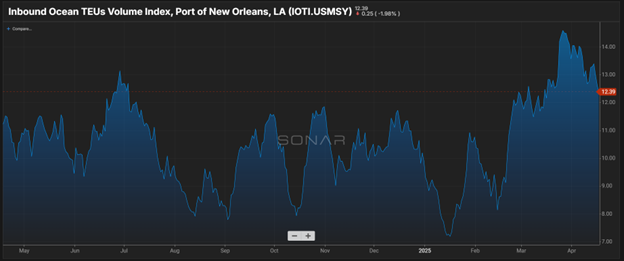

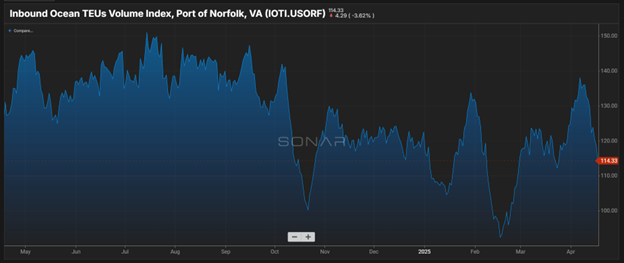

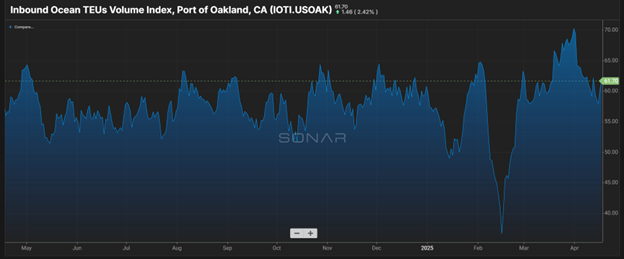

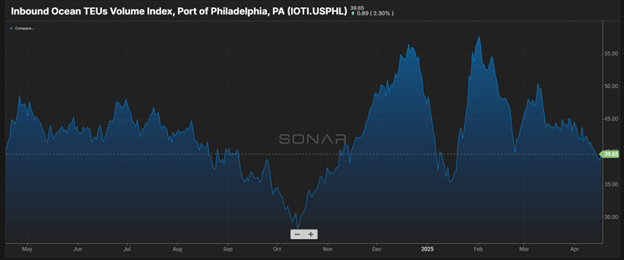

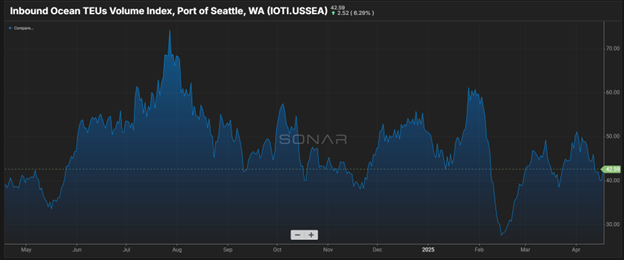

SONAR Import Data Images