1564 words 5 minute read – Let’s do this!

Uncertainty, Disruption? The market could see a “Wild Ride” over the second quarter and it is likely that predictions won’t always be predicting. Are you ready and braced for impact? How do you stay ahead of what is going on in the world that affects this industry? – Follow our LinkedIn page to get a weekly dose of the latest and greatest Market Updates and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox Email Marketing@portxlogistics.com

President Donald Trump announced a complete three-month pause on all the “reciprocal” tariffs that went into effect at midnight, with the exception of China. Enormous tariffs will remain on China, the world’s second-largest economy. President Trump said they will be increased to 125% from 104% after China announced additional retaliatory tariffs against the United States earlier Wednesday. The higher tariffs on China came after Beijing announced new retaliatory tariffs of 84% on U.S. goods set to take effect on Thursday, the Trump administration has taken particular aim at China’s trade practices. Announcing China’s response, the State Council Tariff Commission said in a statement: “The U.S. escalation of tariffs on China is a mistake upon mistake, severely infringing upon China’s legitimate rights and interests, and seriously damaging the multilateral trading system based on rules.” The retaliation comes after China repeatedly warned that it would “fight to the end” if the U.S. moved forward with further tariffs.

All other countries that were subjected to reciprocal tariff rates Wednesday will see rates go back down to the universal 10% rate, according to the president. Mexico and Canada won’t face the 10% tariffs. Almost every good coming from the two nations will continue to be tariffed at 25%, unless they are compliant with the US-Mexico-Canada Agreement, in which case they won’t face tariffs. However, that does not apply to sector-specific tariffs that President Trump has imposed. The European Union said it will suspend its first wave of retaliatory duties against the U.S. for 90 days to focus on negotiations after the Trump administration’s pause.

Yesterday, the Dow surged nearly 3,000 points or 7.87%, the S&P 500 climbed up 9.5% and Nasdaq soared 12.2%. This marked the best day for the S&P 500 since October 2008. The Nasdaq posted its best day since January 2001 and its second-best day on record. While the Dow posted its best day in five years – very good news after markets have been getting slammed by the prospect of the significantly higher tariffs Trump laid out last week. U.S. stocks retreated today, as investors sort through a global economic outlook that has improved drastically over 24 hours but still remains slightly uncertain.

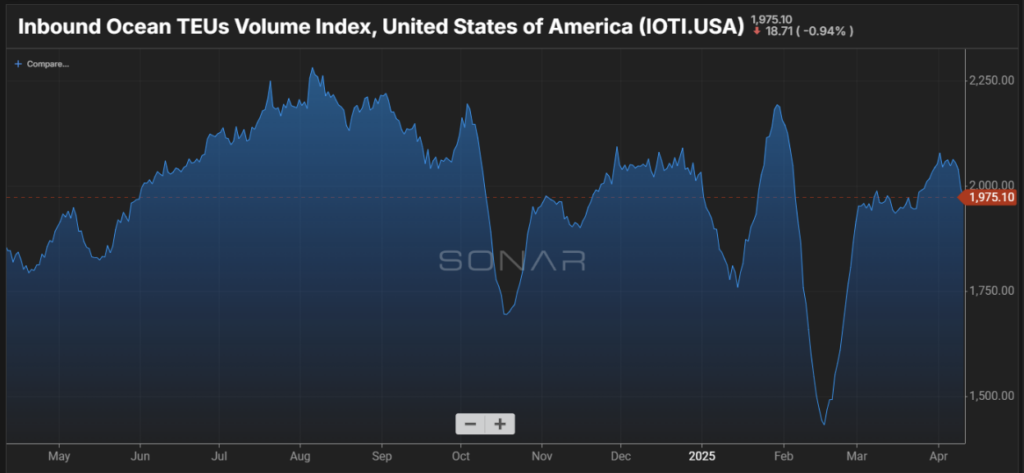

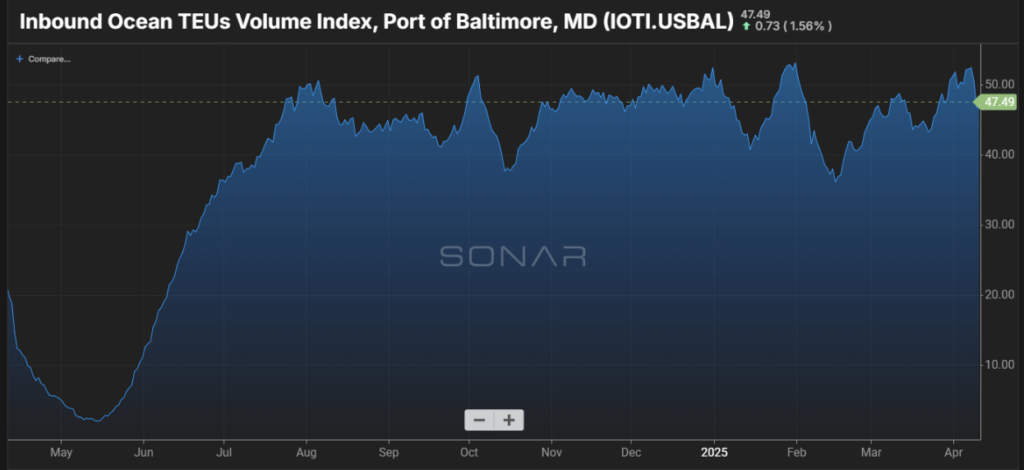

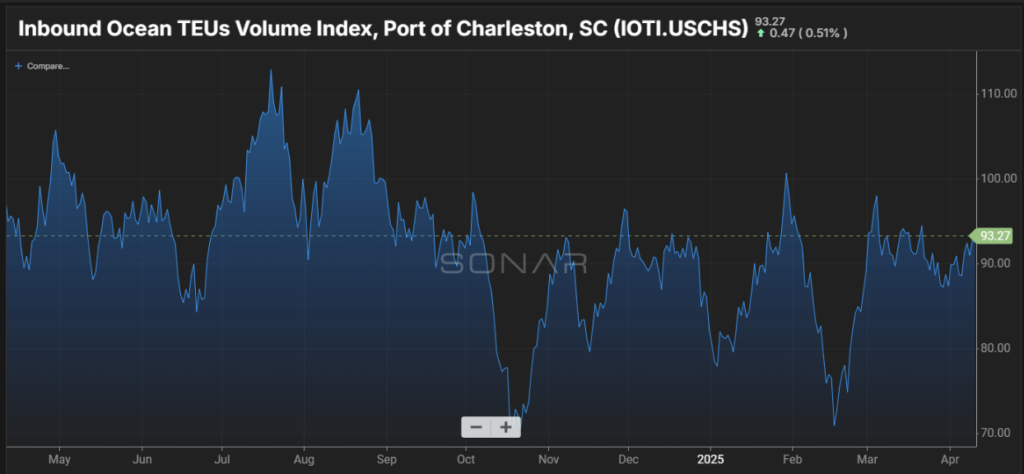

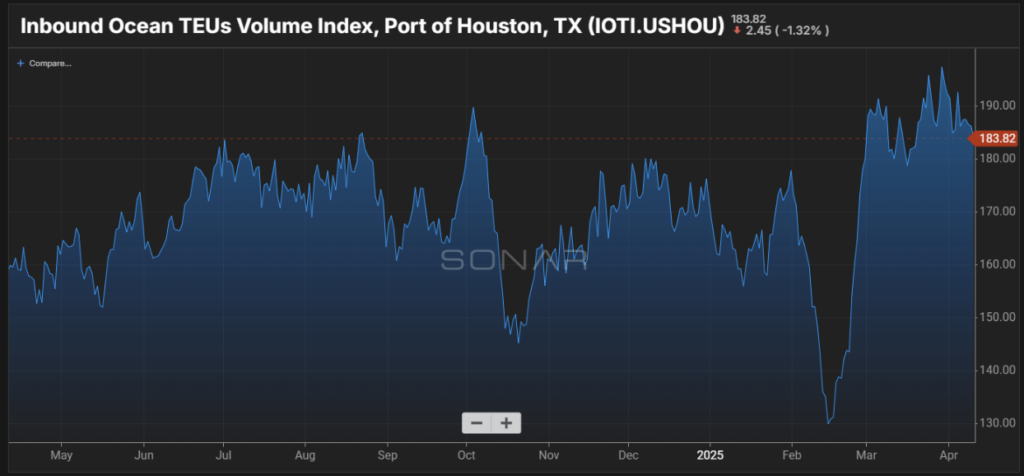

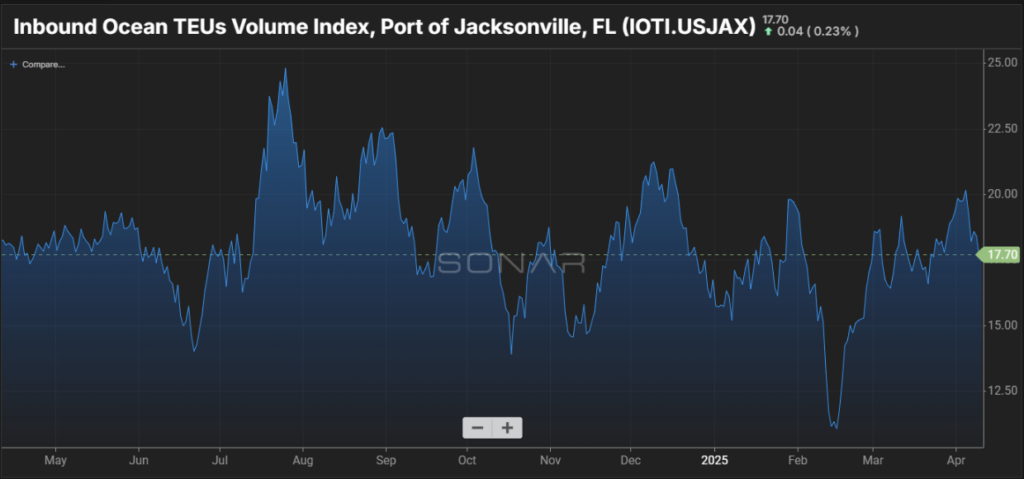

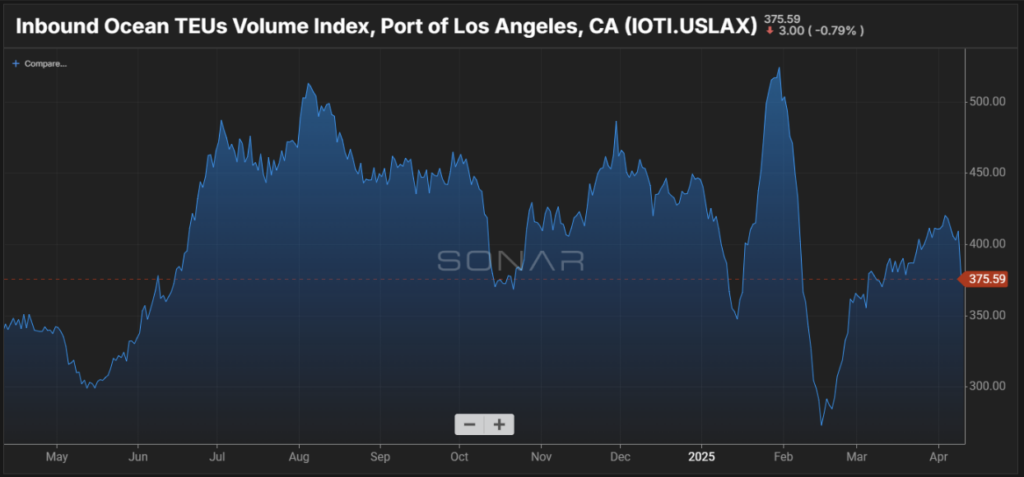

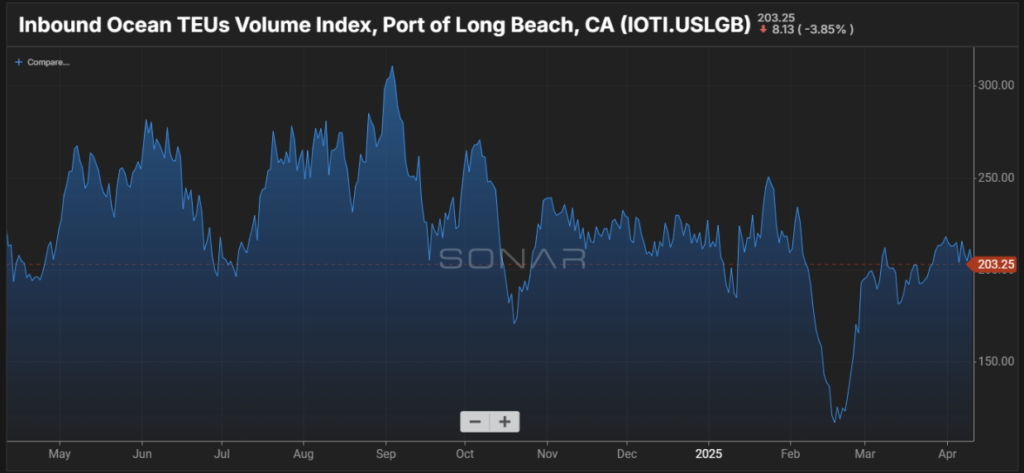

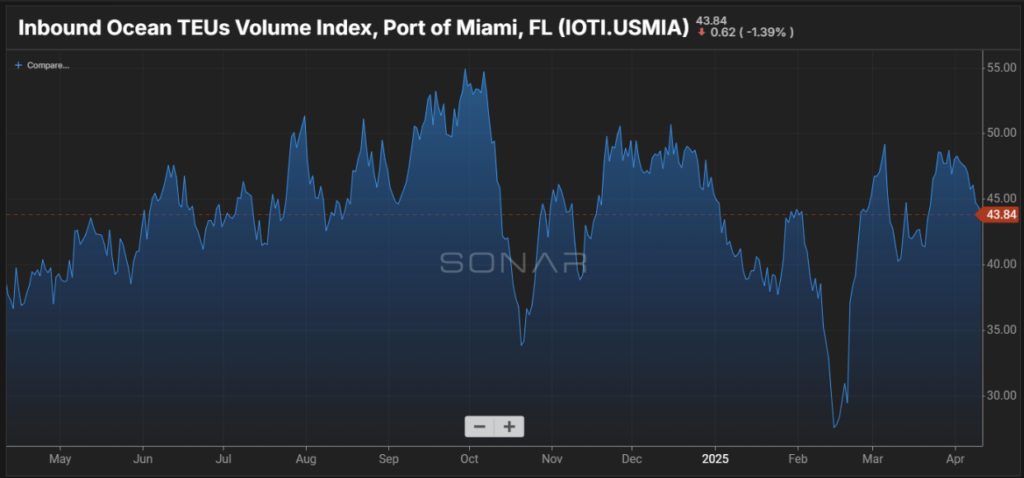

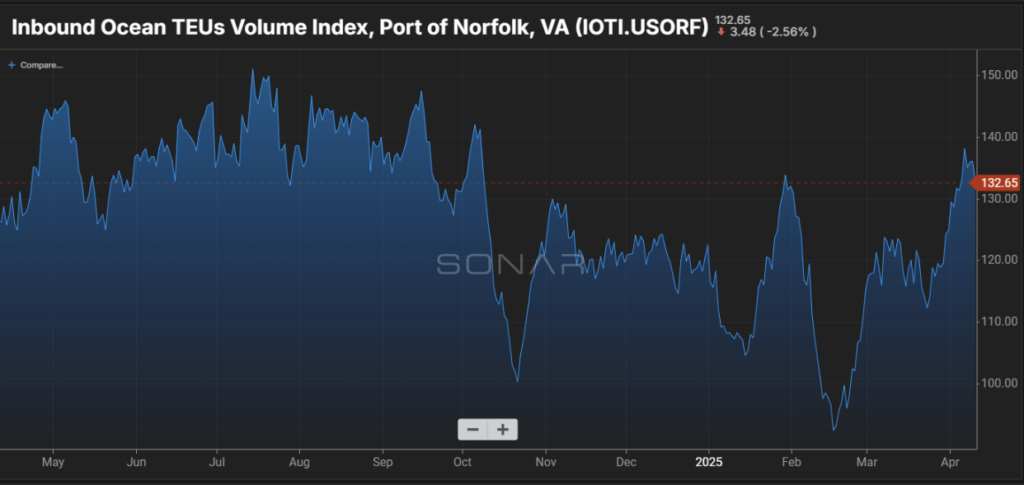

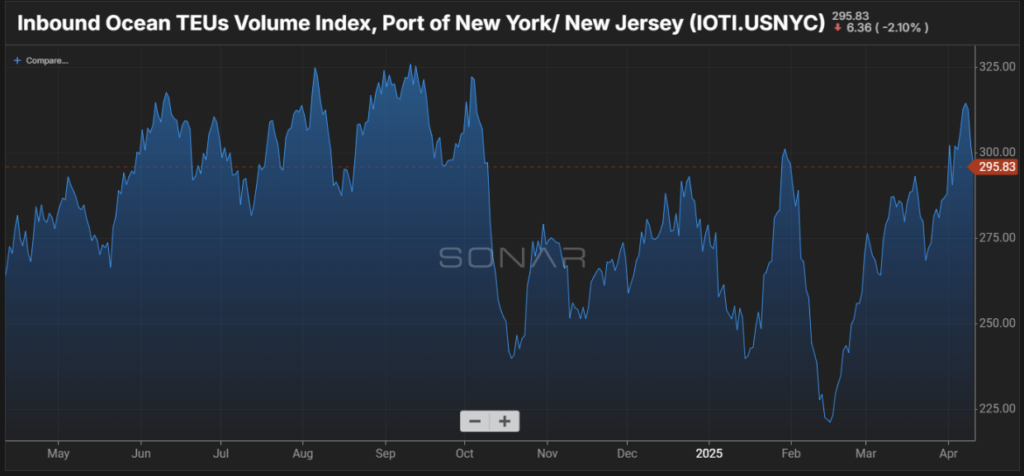

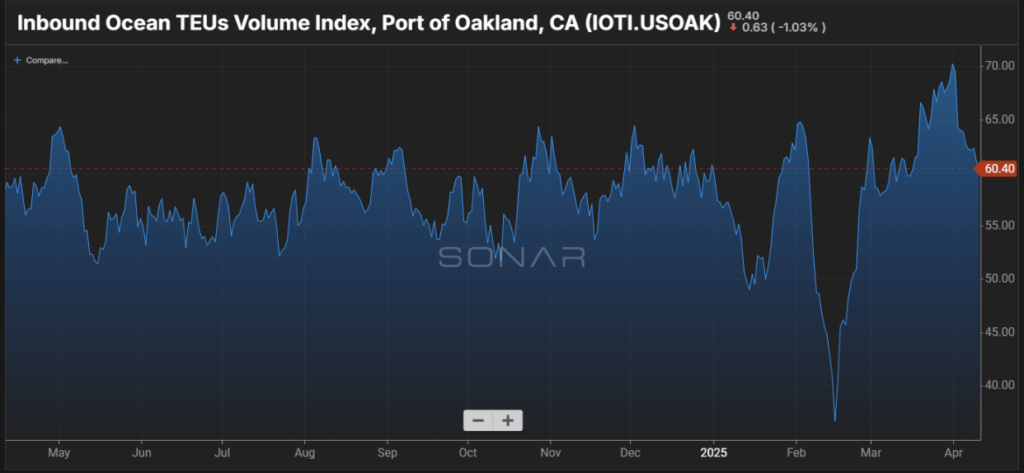

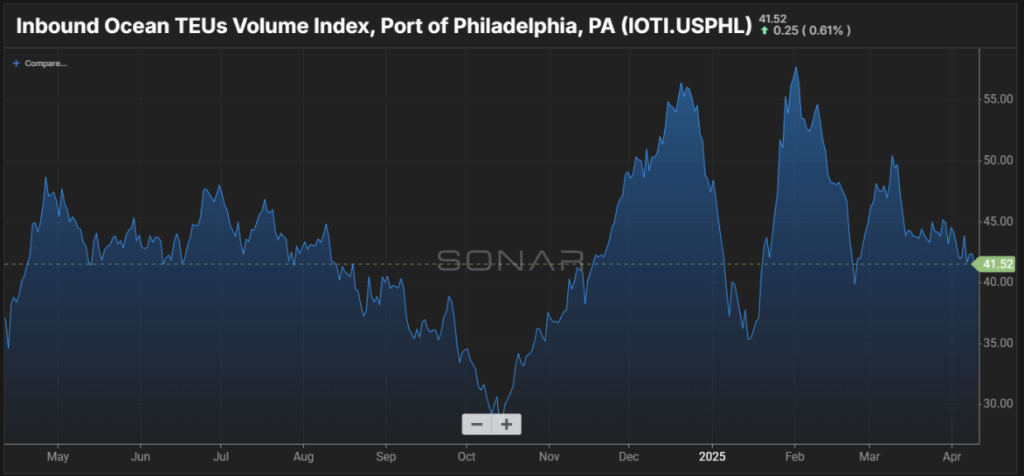

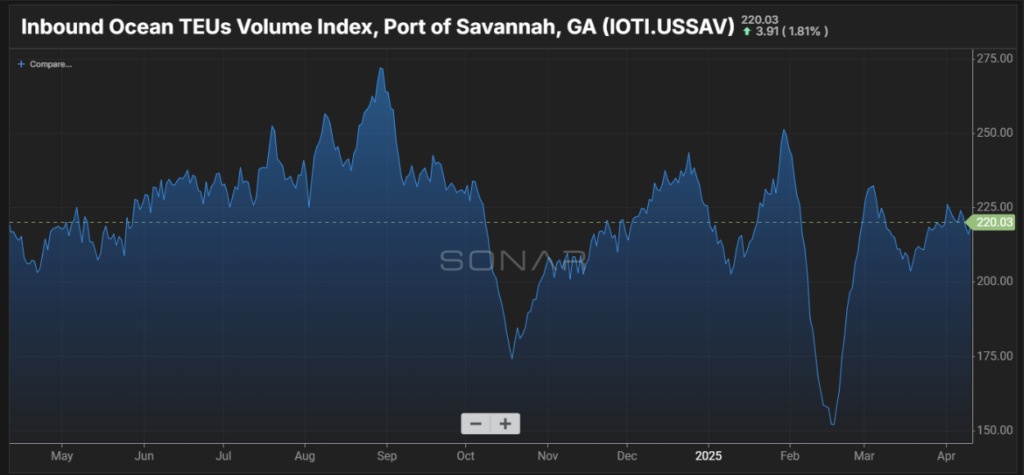

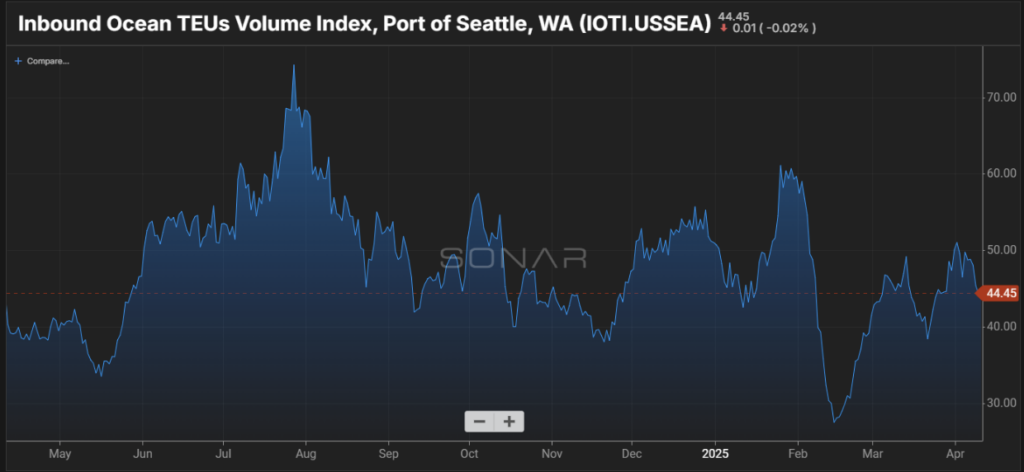

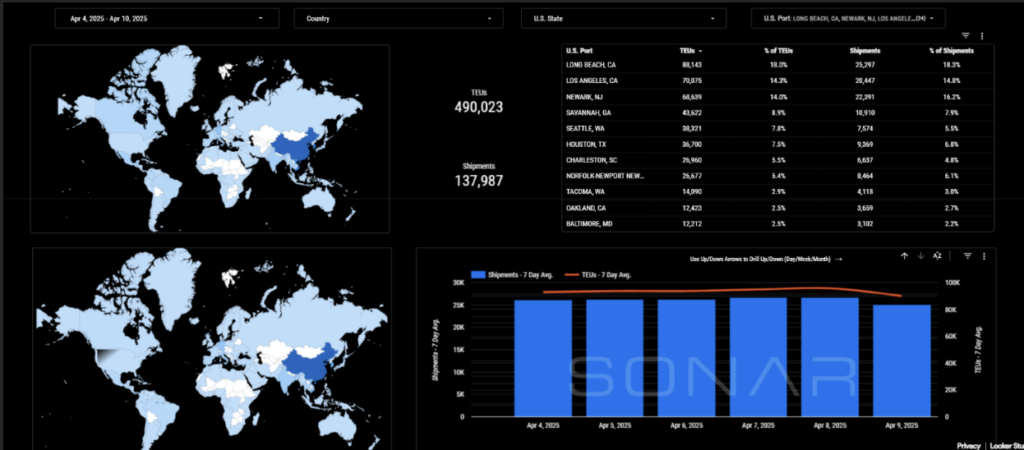

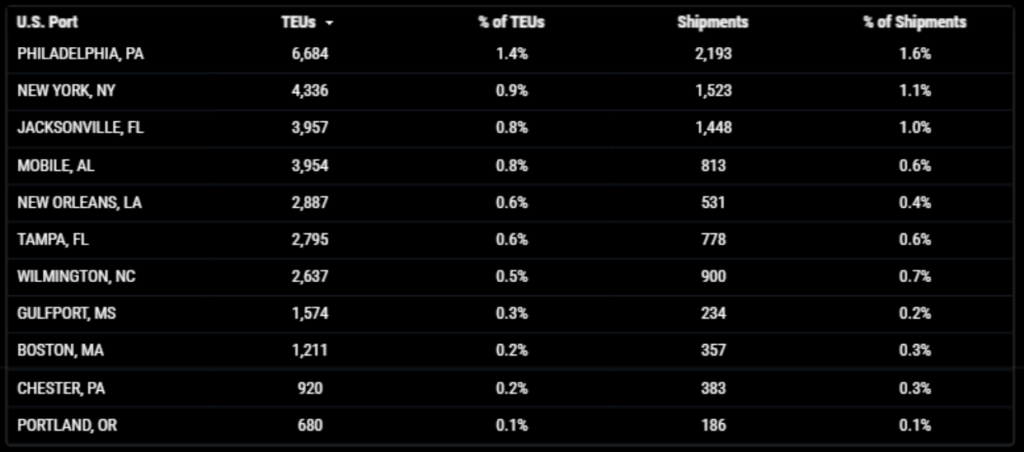

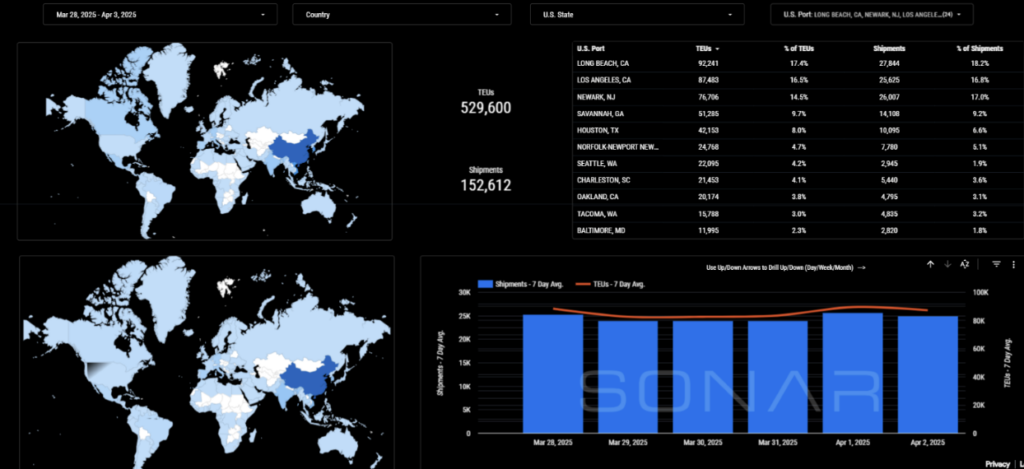

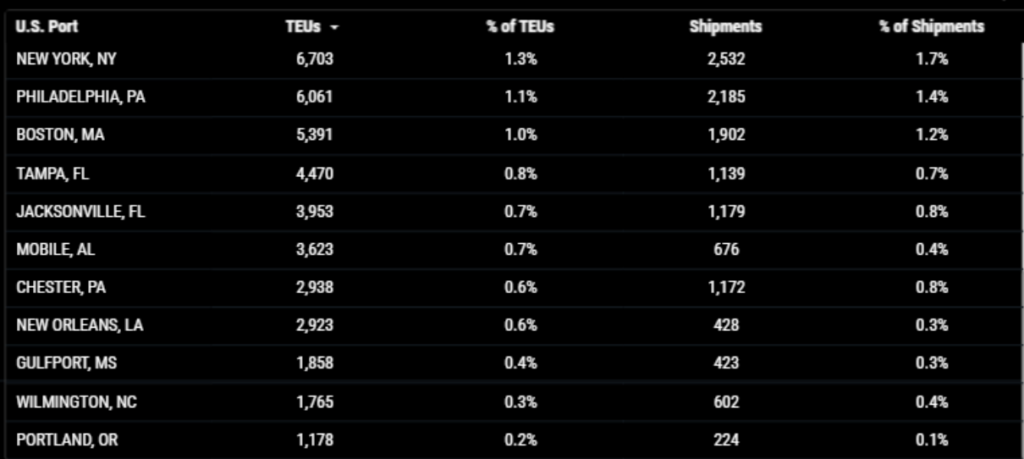

Import TEUs are down 7.47% this week from last week – with the highest volumes coming into Long Beach 18%, Los Angeles 14.3%, and Newark 14%. According to an article in the JOC, cargo bookings on vessels leaving Asia bound for the U.S. over the next few weeks have fallen 20% to 30% as retailers delay the receipt of non-critical freight in the aftermath of the widespread global tariffs implemented by the Trump administration. The decline in vessel bookings is reflected in data: according to maritime visibility provider Vizion and data and analytics company Dun & Bradstreet, some 225,900 TEUs of U.S. imports from Asia were booked in the last seven days, down from about 633,000 TEUs booked the week prior. On Wednesday, U.S. retailers significantly downgraded their projections for imports over the next several months, chalking it up to uncertainty over tariffs. But some carriers expect imports will pick up strongly during the late summer to fall peak shipping season, saying the tariff negotiations between the U.S. and most Asian nations outside of China should produce some clarity for importers by the key peak season. For the month of April, ocean carriers have plans to cancel 19 sailings to the Southern California ports, amounting to a nearly 14% capacity drop during the month. The Pacific Northwest ports will see 10 fewer sailings during April, amounting to a 20% capacity withdrawal. April’s blank sailings come against a backdrop of seasonally weaker demand ahead of shippers ramping up bookings for summer and back-to-school merchandise. However, in a sign of slowing or flat demand further ahead, Ocean Network Express said Tuesday it would not resume its previously suspended PN4 service to the Pacific Northwest in May as had been expected.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

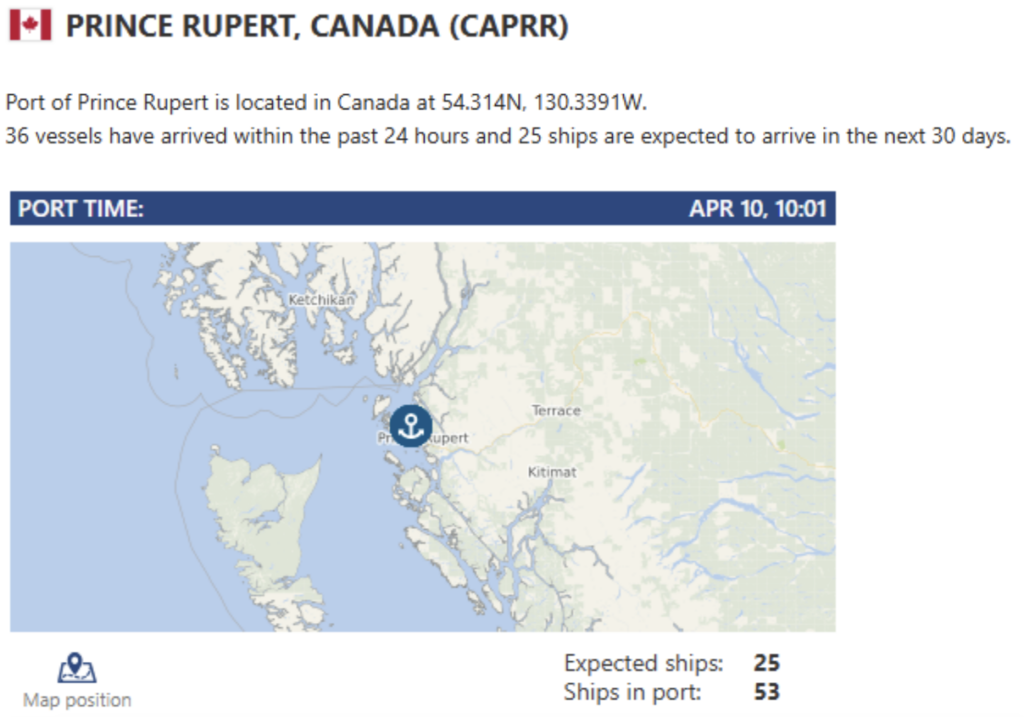

Vancouver/PRR: Marine terminal operators at the Port of Vancouver are still in the midst of extended dwell times for containers moving inland by rail, from a combination of severe winter weather in the Canadian interior and a backlog of containers from longshore labor disruption in late 2024. The average rail container dwell time in March at Vancouver’s four container terminals was 7.7 days. While that was marginally down from 8.5 days in February and 8.3 days in January, according to port statistics, it’s well above the four to five days terminal operators on North America’s West Coast say they can live with in order to keep rail dwells at their facilities manageable. A forwarder said it has taken him as long as 30 days to retrieve some of his containers from Vancouver, saying whether it’s a weather event or labor action or a peak season surge in imports, excessive rail container dwell times are a condition he’s come to expect at the port, calling it “business as usual.” – BUCKLE UP. Where there is rail dwell and delays, congestion and equipment shortages follow. Do you have containers that need to be expedited to avoid any further rail delays in Vancouver? Our team in Canada has years of knowledge and experience with all Canadian ports and we can dray, transload and provide crossborder deliveries to and from all Canadian ports. Contact the team at Canada@portxlogistics.com

Chicago: BNSF Railway, Norfolk Southern, and the Northwest Seaport Alliance have teamed up to offer faster international intermodal service to Chicago inland points from the ports in Seattle and Tacoma. The new service, they announced last week, will cut three days from existing transit times for traffic from the Pacific Northwest destined to and through Chicago. Port terminals will build trains in less than two days of on-dock dwell, with enough density to allow the trains to serve Chicago and destinations on Norfolk Southern in Ohio and Pennsylvania. BNSF and NS will deliver all interchange traffic to one Chicago location, NS-Ashland, and make a single crew swap. With reduced on-dock dwell time and faster transit time, the total time from ship to Chicago is six days, a three-day reduction that makes the service the fastest from any Pacific Northwest gateway in North America. Our Chicago asset drayage team has full capacity to get your Chicago containers moving – We have 80 trucks and secured yard space and we are able to obtain special permits to haul heavy containers. For Chicago drayage capacity and supreme customer service contact the team at letsgetrolling@portxlogistics.com

Did you know? Our Carrier 911 team will have a brand new booth at this year’s CNS Partnership conference from May 13-15th! The CNS Partnership Conference is a key component of CNS’ work. It has brought together leaders and decision-makers of the industry to explore and influence the future development of air cargo. Lasting business relationships, strategic partnerships, and life-long friendships were initiated at our annual conference.

- Create connections with potential partners and prospective new businesses.

- Learn about the latest trends and developments affecting the air cargo supply chain through a conference-type set-up in addition to a variety of panels and break-out sessions.

- Stay up-to-date with the latest government regulations and their impact on our industry.

To schedule a meeting with the Port X/Carrier911 team at this year’s CNS Partnership Conference email Marketing@portxlogistics.com

Are you seeing an increase in air freight from tariff uncertainty? Are you looking to find a more streamlined way to reduce your stress and your need to babysit your urgent airfreight shipments on the domestic trucking side? Let our Carrier911 team be your best solution. We can get your drivers assigned and on site at the airport in most cases within 1 hour. We have access to cargo vans, straight trucks, dry vans and more. Each of our drivers have experience with airport and CFS pickups and have access to retrieving the proper documentation to make these pickups seamless. Don’t forget we provide shareable tracking links and PODs sent at the time of delivery, so you can relax stress free with all of your most critical shipments. Contact the Carrier911 team 24/7/365 info@carrier911.com .

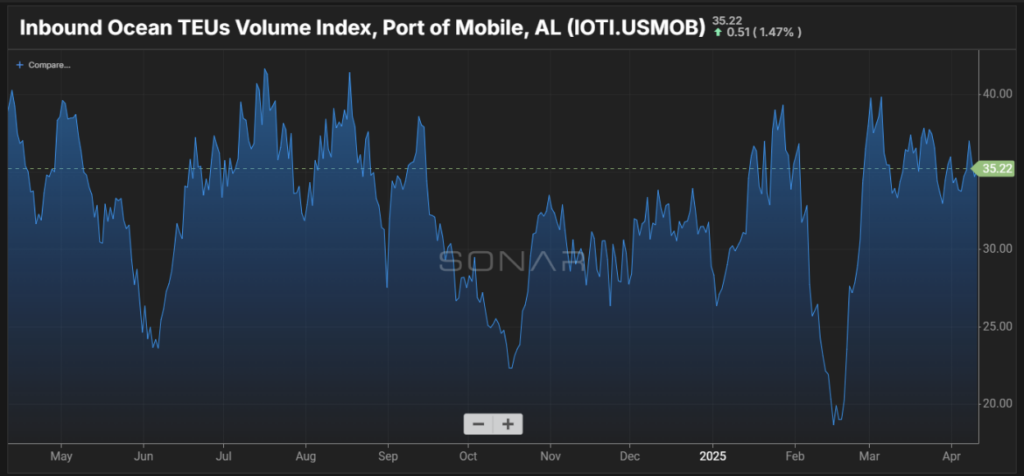

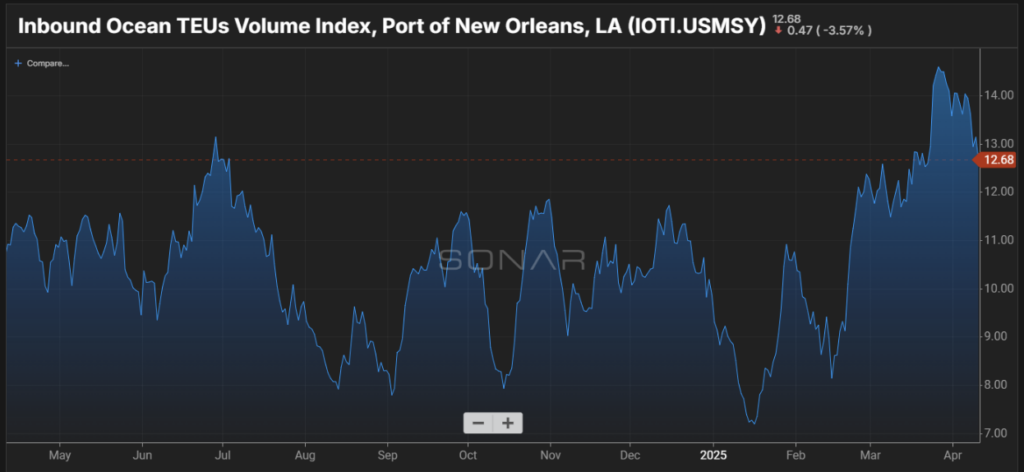

SONAR Import Data Images