1651 words 5 minute read – Let’s do this!

Congratulations to the Philadelphia Eagles in their Superbowl win last week, a mini revenge for us Bills Mafia. The football season has come to an end and we are almost half way through February. Happy Valentine’s Weekend to all the love birds out there, one of my personal favorite holidays to have an excuse to spoil myself – don’t forget to spoil your loved ones.

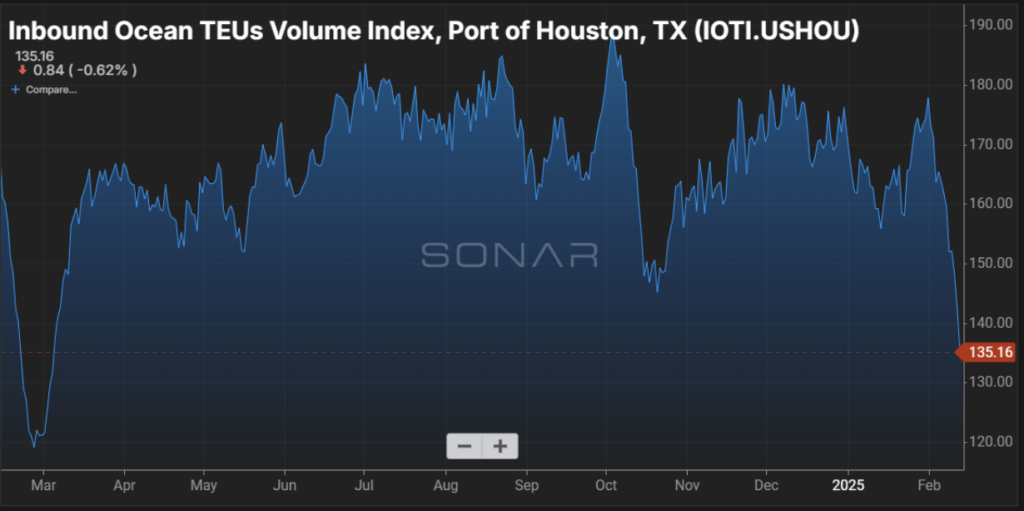

The weather is still pretty dicey, what a long winter it has been, more storms are set to hit the Midwest this week, with some impact to the Chicago and Kansas City rail areas. Severe thunderstorms with heavy rain targeting the southern U.S. with multiple tornadoes and flooding being the top concerns. These storms are expected to extend from the upper Texas coast to central and eastern Kentucky on Saturday, and include Houston, New Orleans, Atlanta, Nashville, Pensacola Florida and Birmingham Alabama. The potential of thunderstorms packing strong wind gusts and flooding downpours is likely to extend from northern Florida to the Carolinas and Virginia on Sunday. Stay safe this weekend if you will be within those areas! The weather has been a mess this year so far – weather can drastically impact your ocean and air shipments in a moment’s notice. We urge you to subscribe to the Port X Logistics LLC LinkedIn page for the most up to date news affecting your supply chain, as well as information on exciting Port X Logistics news. To get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox email Marketing@portxlogistics.com

Europe is joining the U.S. in saying “bye, bye bye” to the “de minimis” exemption for low value packages. The de minimis exemption — derived from Latin meaning “too small to be of significance” — was an amendment to the Tariff Act of 1930 and was enacted by Congress in 1938 to “avoid expense and inconvenience” to the government on imported goods valued at US$1 or less

The European Commission (EC) wants joint action from member states to address concerns from the surge of unsafe, counterfeit, non-compliant or illicit products entering the European market, with its consumer protection authority launching an unspecified “coordinated action” against Chinese e-commerce giant Shein. Last year, 4.6 billion consignments with a value below the European Union’s de minimis threshold of €150 ($155) entered the EU market duty free, mostly from China and double the number recorded in 2023, EC data shows.

In the U.S., China accounted for two-thirds of the 1.36 billion de minimis imports last year. De minimis regulations in the U.S. allow one shipment of less than $800 in value to move between a single shipper and single consignee per day duty free.

Over the years, Congress has revised the de minimis threshold several times. Starting in the 1990s, the U.S. began using the exemption — also referred to as Section 321 — to minimize transaction costs for businesses and consumers and to reduce trade barriers for U.S. exports. When Congress raised the threshold from U.S. $200 to U.S. $800 in 2015, the U.S. experienced a boom in de minimis imports. The U.S. received over 1.4 billion such packages in 2023, up from 153 million in 2015. Sellers and shippers of all stripes, from Chinese e-commerce giants such as Temu and Shein to small- and medium-sized Canadian retailers have leveraged the rule to efficiently transport low-value goods directly to U.S. consumers. Around 80 percent of all e-commerce shipments into the U.S. use de minimis, according to a 2022 U.S. congressional research report. The popularity of the exemption has also brought scrutiny: Some American lawmakers have argued that the rule allows narcotics or goods made with forced labor to flow into the country more easily.

As the U.S. navigates changes to the de minimis exemptions, some e-commerce companies are starting to switch to U.S. located fulfillment centers and sending inventories via ocean instead of air. Some air freight analysts are trying to estimate the impact removing de minimis protection would have on the air cargo industry. Niall van de Wouw, chief air freight officer at rate benchmarking platform Xeneta, said the impact on air freight capacity between China and the US would be “profound,” but he believes e-commerce demand is strong enough to withstand the clampdown. “Products may be slightly more expensive if de minimis is removed, but they will still be cheaper than buying through retailers in the U.S.,” he added. “But delays in receiving the goods due to operational disruptions could have a bigger impact than price because it takes away the attractiveness for consumers.”

Since we are on the topic of airfreight – are you looking to find a more streamlined way to reduce your stress and your need to babysit your urgent airfreight shipments on the domestic trucking side? Let our Carrier911 team be your best solution. We can get your drivers assigned and on site at the airport in most cases within 1 hour. We have access to cargo vans, straight trucks, dry vans and more. Each of our drivers have experience with airport and CFS pickups and have access to retrieving the proper documentation to make these pickups seamless. Don’t forget we provide shareable tracking links and PODs sent at the time of delivery, so you can relax stress free with all of your most critical shipments. Contact the Carrier911 team 24/7/365 info@carrier911.com

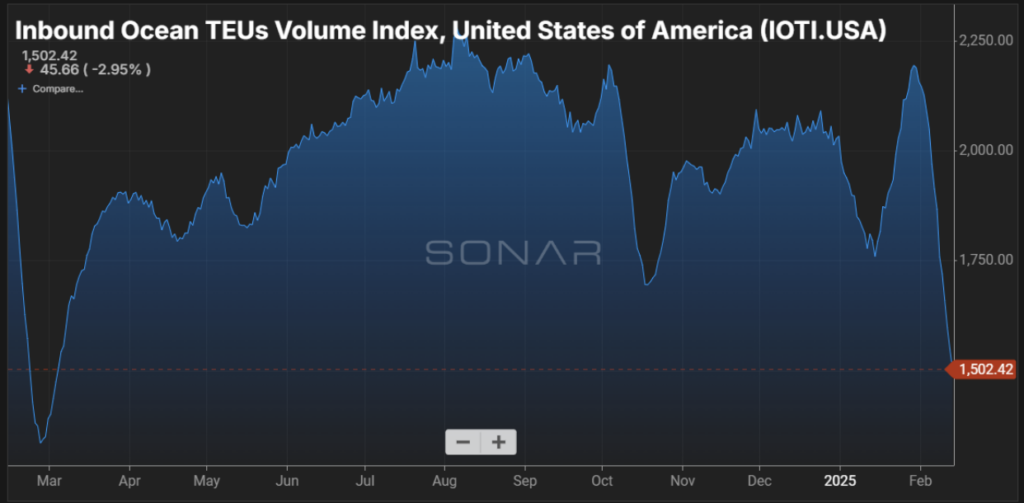

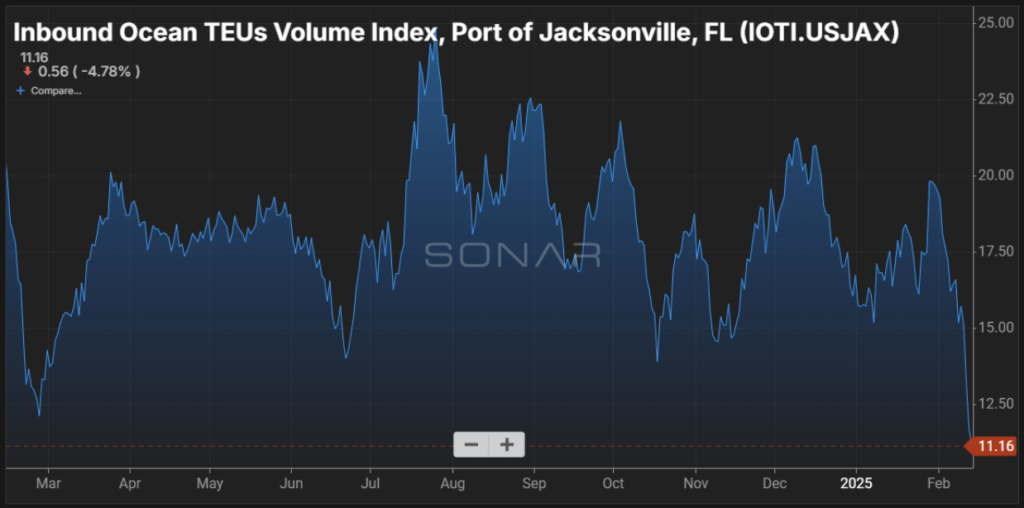

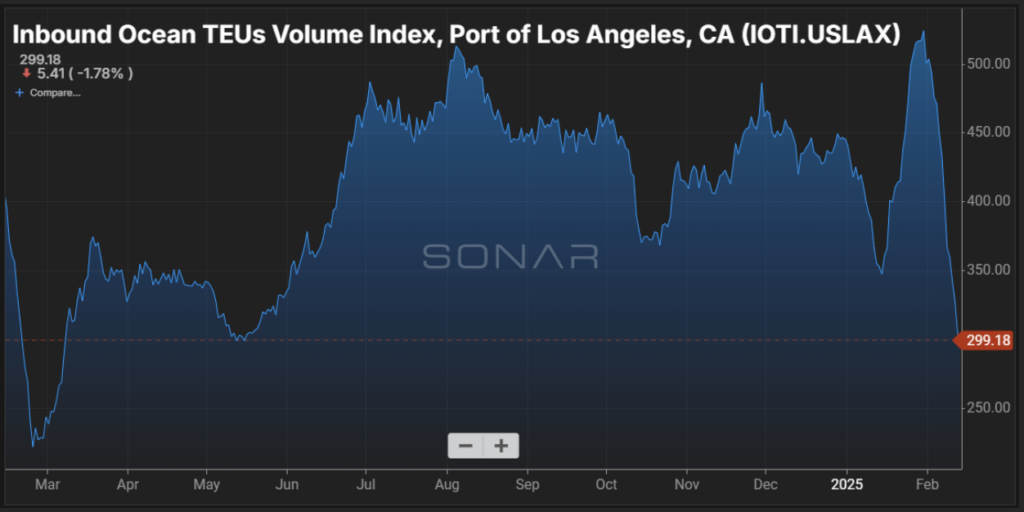

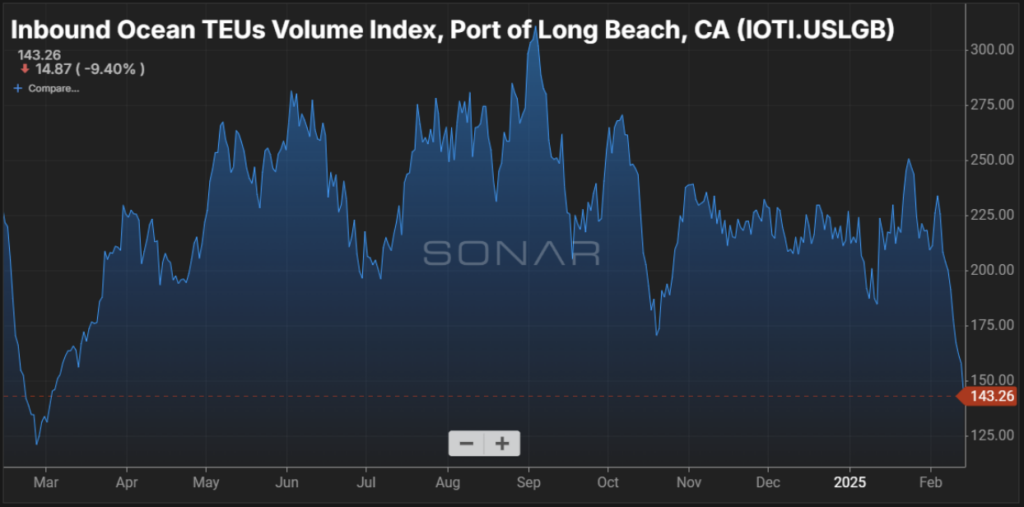

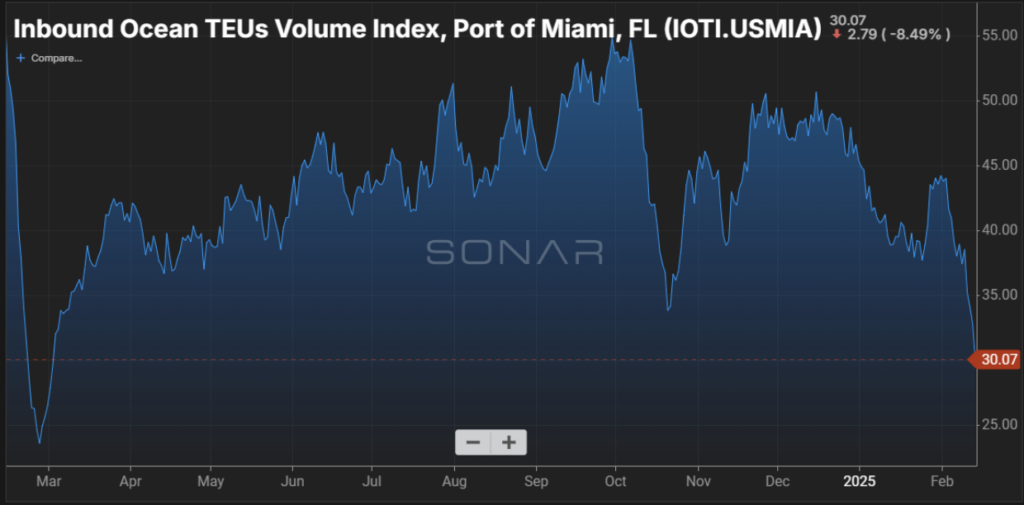

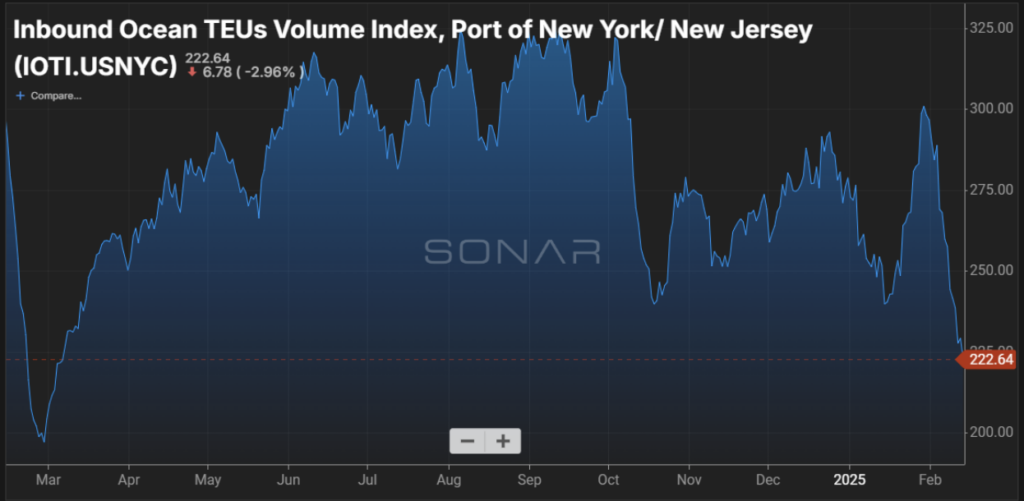

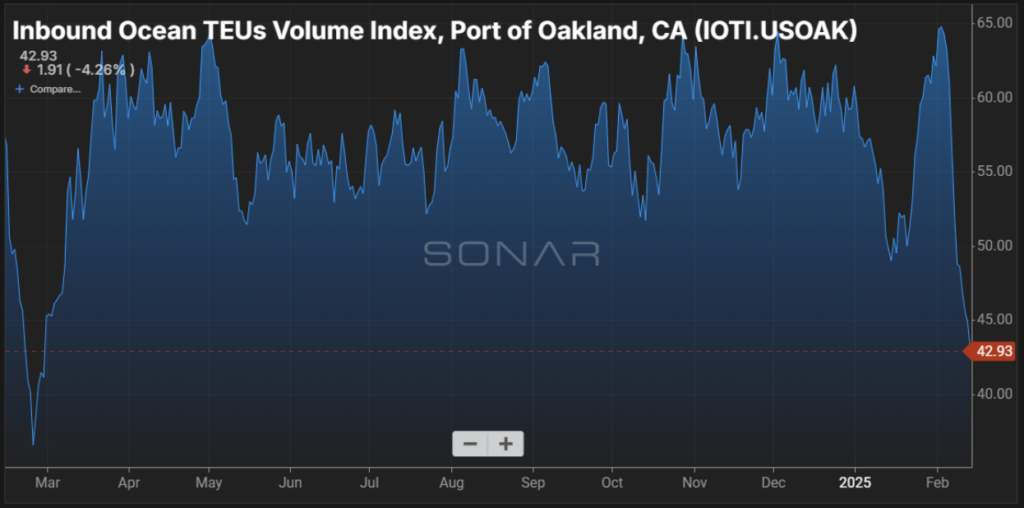

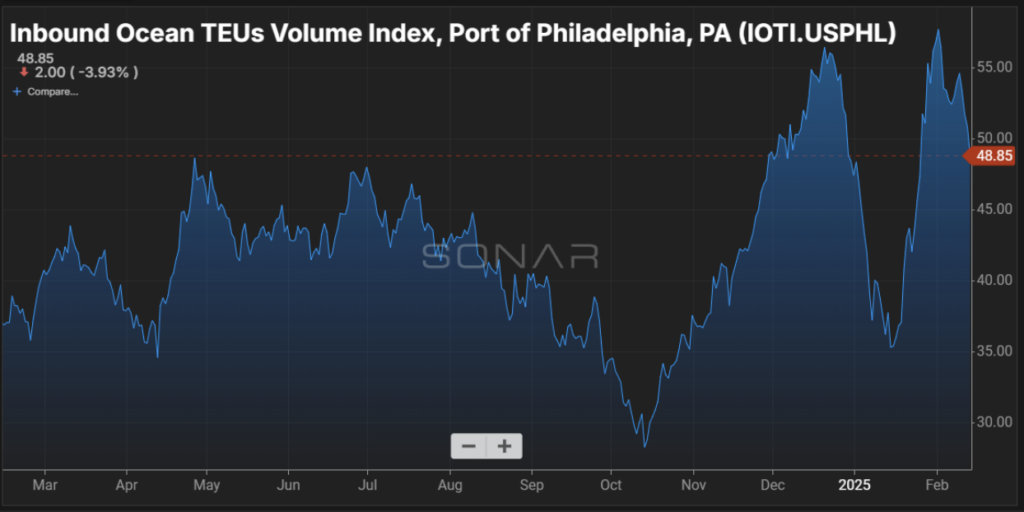

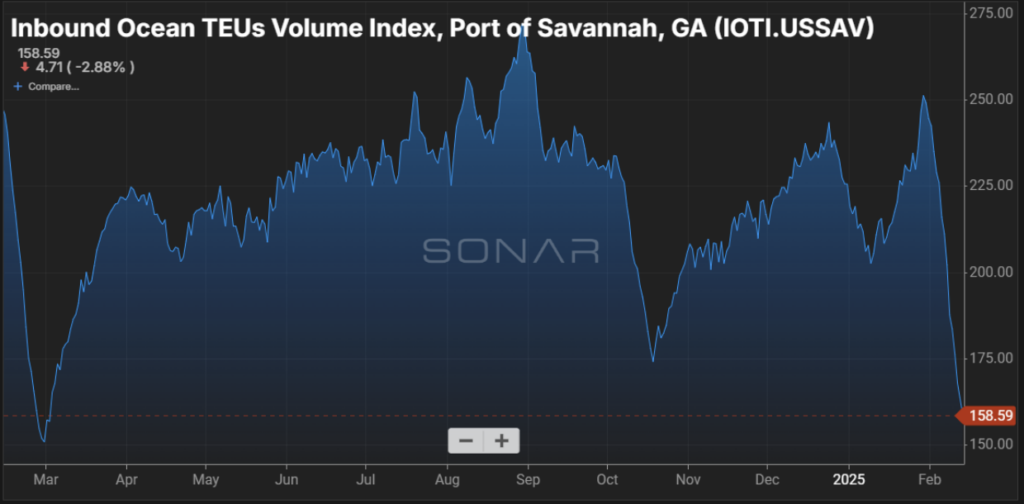

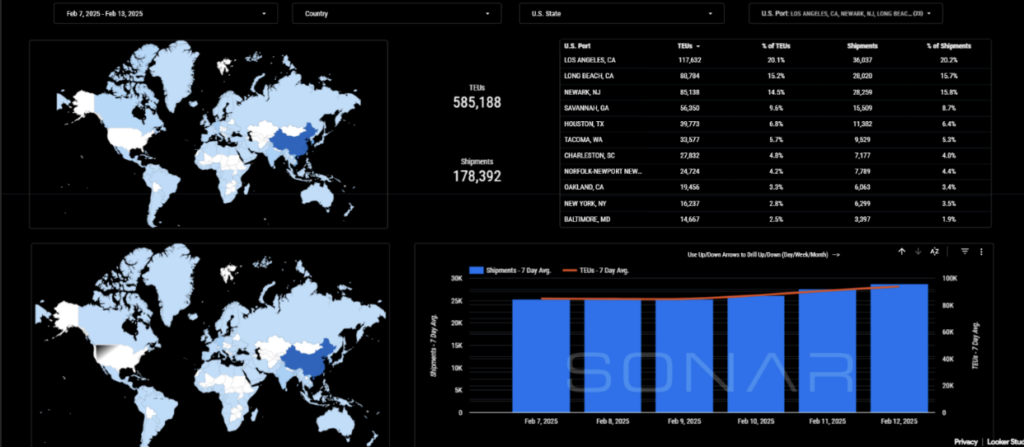

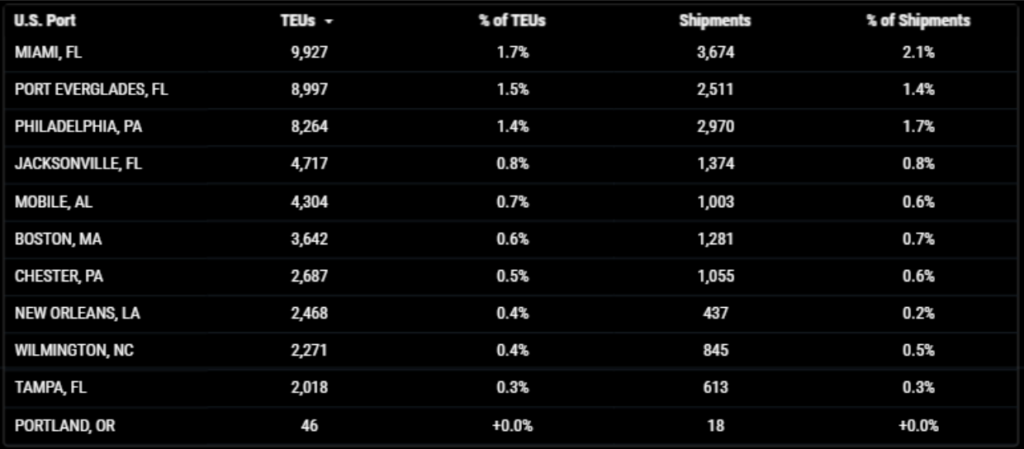

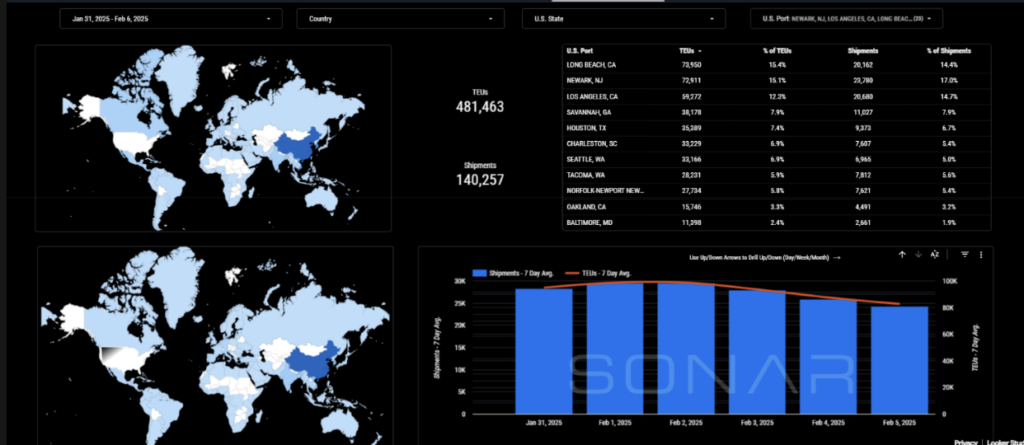

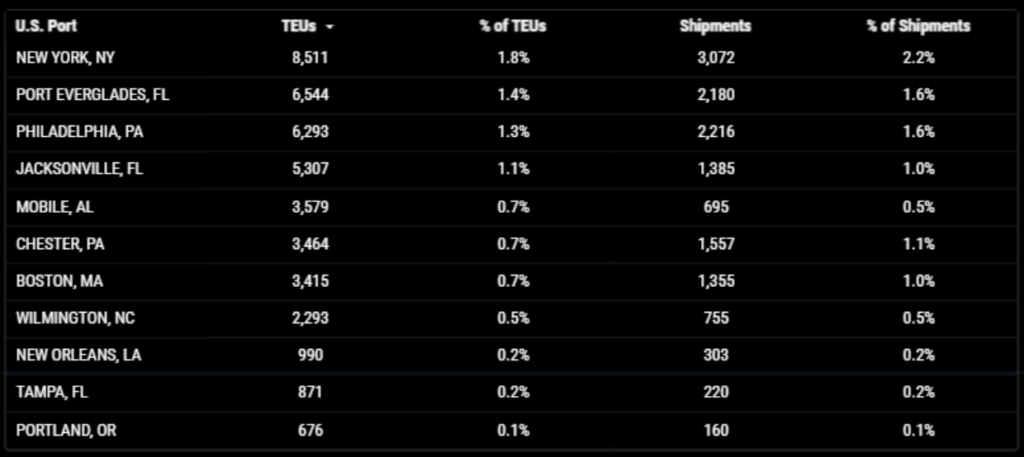

Import TEUs are up 15.93% this week from last week – with the highest volumes coming into Los Angeles 20.1%, Long Beach 15.2% and Newark 14.5%. The Global Port Tracker’s latest data shows impressive growth in inbound container volumes. U.S. ports processed 2.14 million Twenty-Foot Equivalent Units (TEUs) in December, marking the busiest December on record despite a slight 0.9% decrease from November. The year-over-year increase was a substantial 14.4%. Total container volume for 2024 reached 25.5 million TEUs, showing a 14.8% increase from 2023, approaching the pandemic-era record of 25.8 million TEUs set in 2021. Looking ahead, the NRF projects continued growth through most of the first half of 2025. January is expected to handle 2.11 million TEUs, while February, typically slower due to Lunar New Year celebrations in China, is forecast at 1.96 million TEUs. Projections show steady increases through May, with volumes expected to reach 2.19 million TEUs before a slight decline in June. Meanwhile, a new report from Descartes showed U.S. container imports surged to a record 2.487 million TEUs in January, marking a 9.4% increase over the previous year and surpassing the previous January high set in 2022.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE for Port & Rail Updates

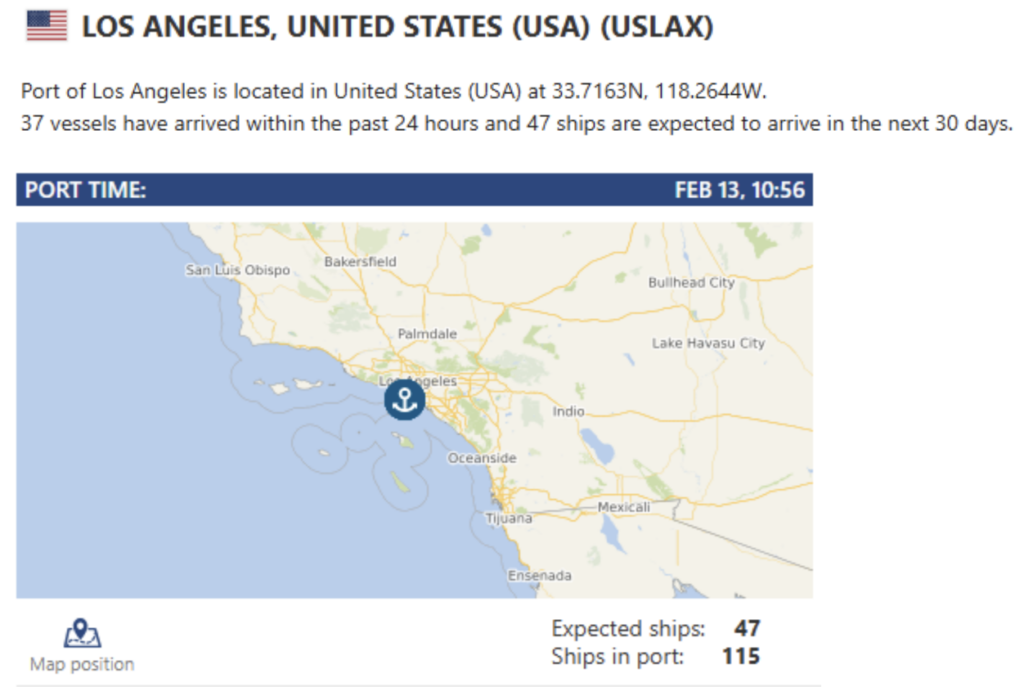

Los Angeles/Long Beach: The Port of Long Beach started the new year with its strongest January on record and its second-busiest month ever. Dockworkers and terminal operators moved 952,733 twenty-foot equivalent units in January, up 41.4% from the same month last year and surpassing the previous record, set in January 2022, by 18.9%. Imports jumped 45% to 471,649 TEUs and exports rose 14% to 98,655 TEUs. Empty containers moving through the Port climbed 45.9% to 382,430 TEUs. Our Los Angeles location boasts, a large drayage fleet, a huge secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your diverted containers for transload to avoid and navigate the current longer than average rail dwell times. Our capacity is tendered to on a first come first serve basis. Container the team at letsgetrolling@portxlogistics.com with your new orders today.

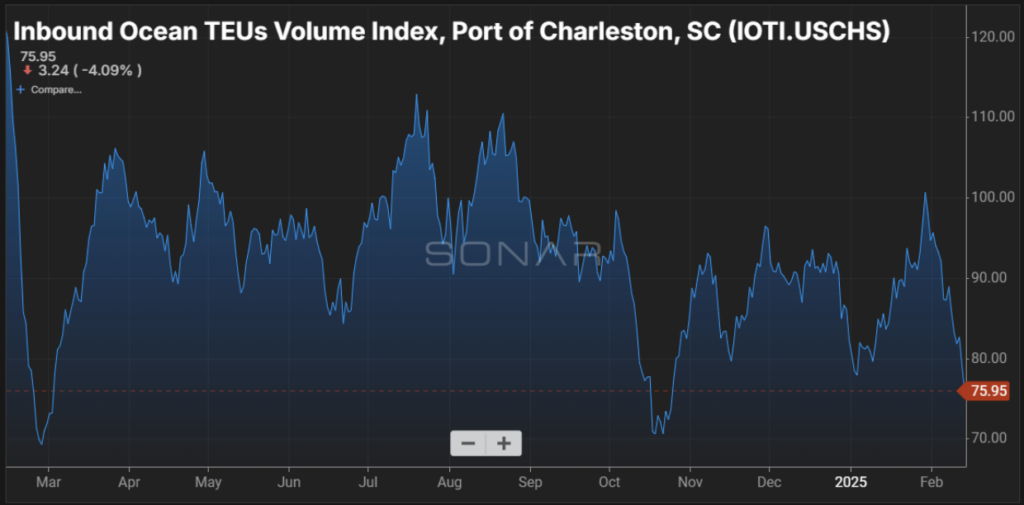

Savannah: The Georgia Ports Authority is poised for more growth in the coming years – and perhaps could become the nation’s No. 2 port, a GPA official said. The GPA is spending $4.2 billion over the next 10 years in port infrastructure. The GPA owns about 450 acres across the river, where it hopes to build the Savannah Container terminal. Ocean terminal is being converted to a 100% container facility, and the ports also expect to open the Savannah Container terminal, across the river from Ocean terminal. Dubbed the Savannah Container terminal, the facility is in the permitting phase and if approved, it will have capacity for more than 3 million containers. Savannah is the fastest-growing container gateway and the GPA budgets for about 4.5-5% growth on an annual basis. What’s even cooler? We have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks. Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space. Contact the team sav@portxlogistics.com for great rates and supreme customer service.

Did you know? Our dedicated project cargo team is skilled in navigating the complexities of large-scale logistics. From coordinating with multiple on-site parties to managing regulatory compliance, Port X Logistics ensures that every aspect of your project freight is meticulously planned and executed. We have the resources and expertise to manage your most demanding shipments, and our team is continuously growing with talent. To learn more about how the Port X Logistics team can help to lead you to industry expertise contact letsgetrolling@portxlogistics.com

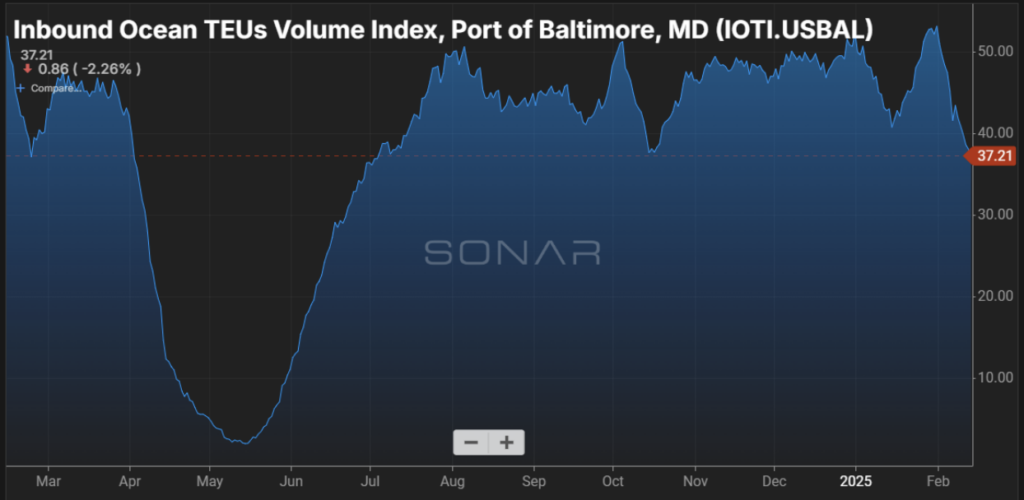

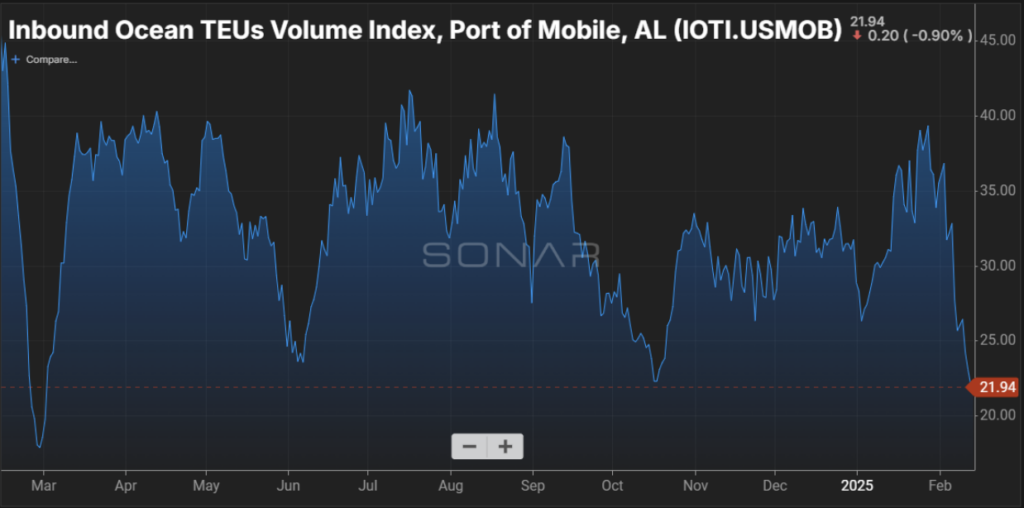

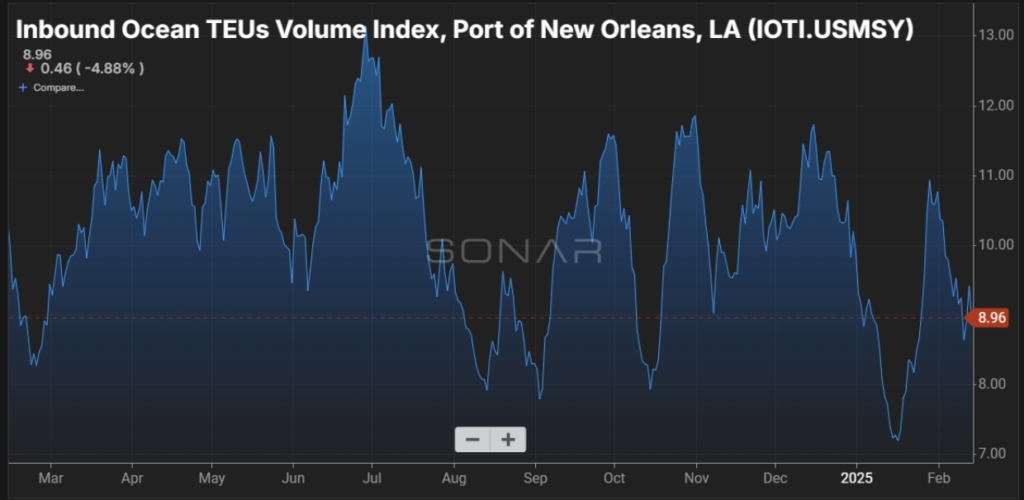

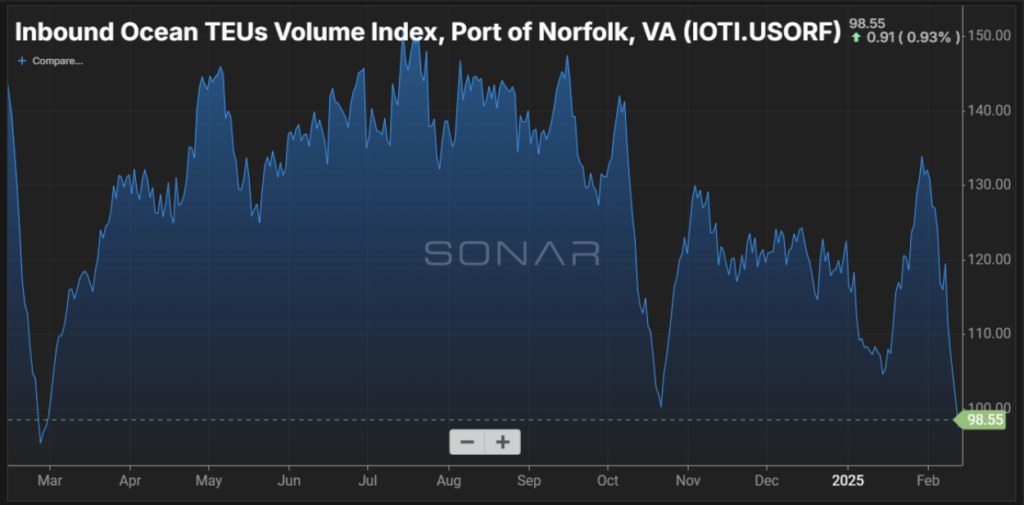

SONAR Import Data Images