1548 words 5 minute read – Let’s do this!

As we roll into the holiday season and hopefully roll out of the dinner tables next week – we should really start thinking about the state of the industry as we approach 2025. We will also be taking a break from the Market Update next week and would like to wish you and your families a very happy, healthy and relaxing Thanksgiving Holiday 2024.

Wrapping up 2024: Canada’s Union labor situation is still a mess and is making the rail disruption even messier, little to no change for an ILA agreement by January 15th, and rail dwell in the LA/LGB ports that will continue to increase if shippers send more freight to the west coast in anticipation of an East and Gulf Coast port strike. Q1 has potential to be full of uncertainties, so we encourage you to subscribe to the Port X Logistics LLC LinkedIn page for up to date news and solutions for your supply chain, and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox email Marketing@portxlogistics.com

Another topic going into January is the possibility of a harsher tariff hike on imports from China. For now, attempts to get ahead of tariffs might be a meaningful, albeit temporary boost to growth. Companies are scrambling to shift production out of China bolster inventory and weigh price increases as they brace for tariff hikes from a second Trump administration. President elect Trump has threatened to ramp up duties on China, Mexico and possibly elsewhere, increasing the cost of importing products from those countries for U.S. businesses.

Why it matters? Some companies are pushing through orders sooner to try to beat the clock on the expected harsher trade regime — the type of activity that, if widespread enough, could temporarily jolt GDP.

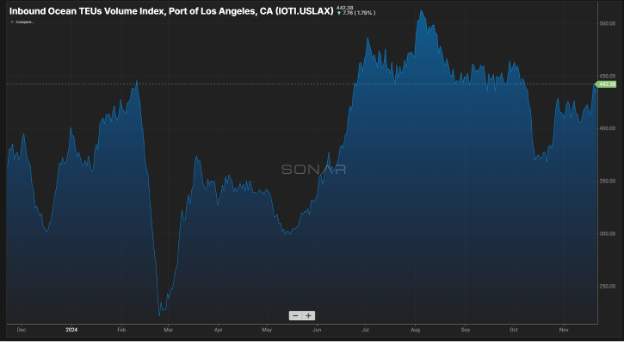

The Big Picture: Trump wants businesses to rely less on imports. But the opposite is happening now: Companies are importing goods at a historic pace because of his election win. West Coast ports are handling more cargo than usual for the season. The consumer is strong, and shippers might divert containers to head off delays from possible East Coast dock worker strikes. But port leaders say the Trump hoarding effect can’t be counted out: “Most of the factories we talk to are running full tilt,” Gene Seroka, head of the Port of Los Angeles, told reporters this week. According to Seroka, People have been preparing for some time, “How much cargo can I bring in before warehouses start busting at the seams?” Seroka said a similar hoarding phenomenon happened in 2018: The port saw a run-up in cargo before tariff implementation, followed by a drop-off so sharp that the port’s business fell by double digits. It is likely any impact from these effects is, almost by definition, temporary. Companies are likely not going to tie up capital and pay for warehouse space for years’ worth of supplies just to front-run a tariff.

The longer-term question is how much a new tariff system triggers fundamental rethinking of international supply chains. In what situations do companies reshore manufacturing activity, as the Trump administration will desire, versus paying tariffs and either passing higher costs on to customers or taking a hit to margins? Companies have already been rethinking the complex global supply chains with heavy dependence on China. Rather than make goods in one place and ship them worldwide, they are shifting toward locating production closer to the markets being served – a pattern a new wave of tariffs could accelerate. We would love to hear your thoughts on the future of the market as it pertains to a new tariff regime, email marketing@portxlogistics.com with your insight and you will be in the running for a fun prize put together by the Port X Buffalo team!

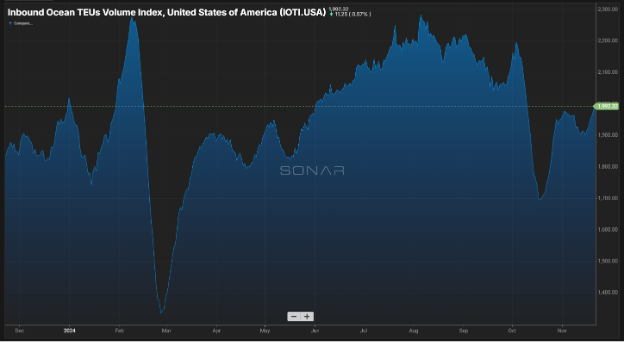

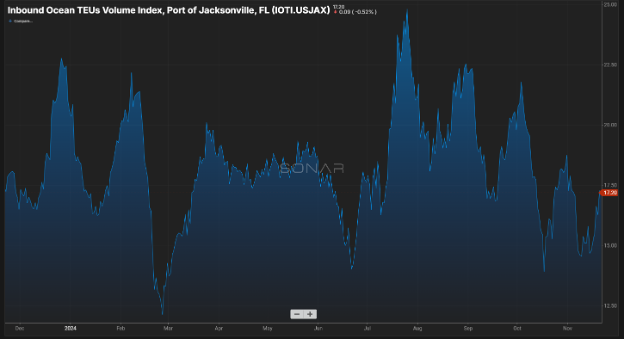

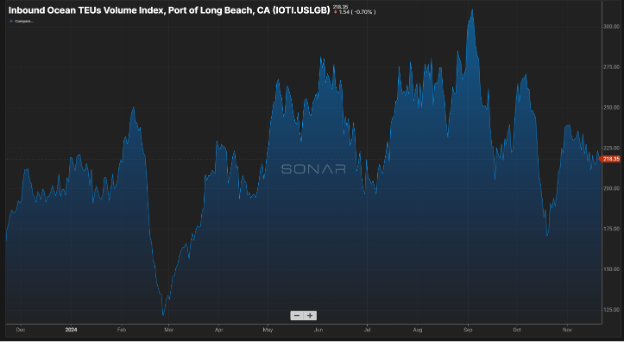

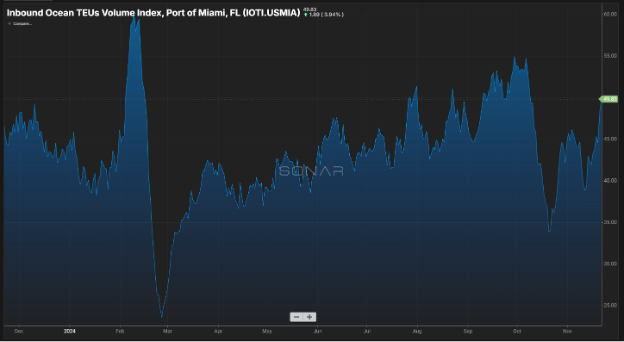

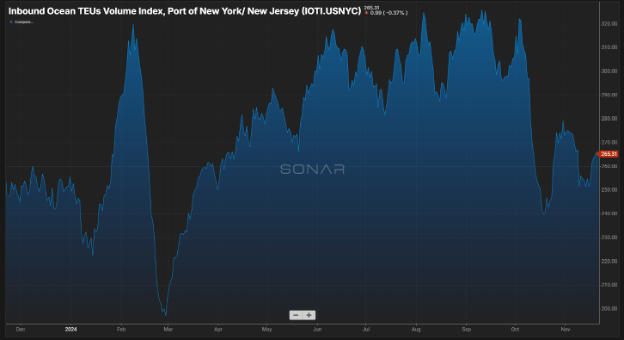

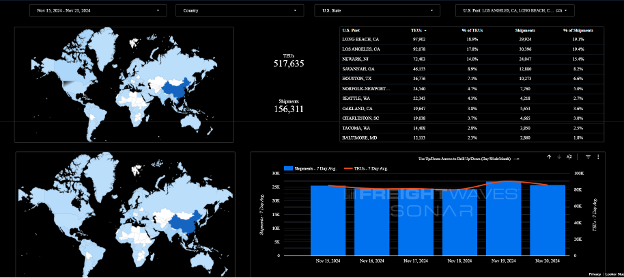

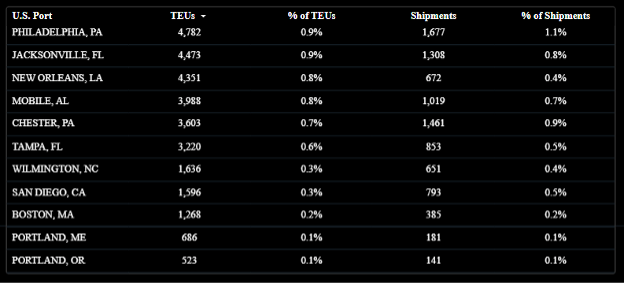

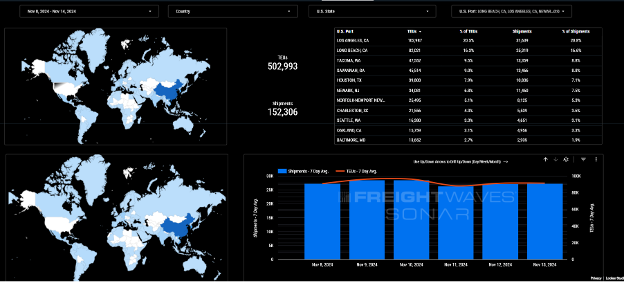

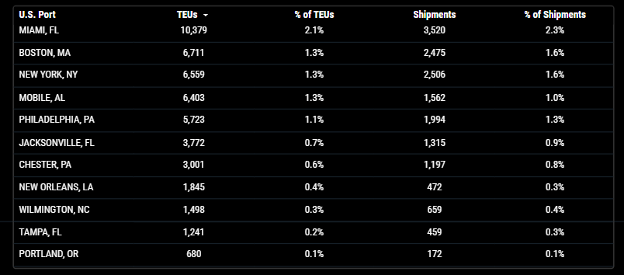

Import TEUs are up 2.19% from this week from last week – with the highest volumes coming into Long Beach at 18.9%, Los Angeles at 17.8% and Newark at 14%. According to the founder of global equity firm Blue Alpha Capital John McCown, Q3 2024 had the highest quarterly volume on record, beating the previous highest record in 2021 at the height of the pandemic by just over 2% – coming in at 47 million TEUs.

John McCown wrote in his quarterly market report this week that volume data from Container Trades Statistics (CTS) also showed that for the first nine months of 2024, the 136.7-million-TEU volume moved worldwide was up 6.3% year over year and 1.5% above the first nine months of 2021.

The increased volume was accompanied by higher rate levels that saw the average revenue per load assessed by CTS up 52.5% in the third quarter year over year and 23.4% higher compared with the second quarter. “Driven by the capacity tightening resulting from the Red Sea situation and augmented by robust volume, the sector moved to a $5.4 billion Q1 profit that was doubled in the second quarter and more than doubled in the third quarter,” McCown said. Average global spot rate levels in the third quarter recorded by the Shanghai Containerized Freight Index (SCFI) of $3,074 per TEU were more than double the year-ago period and up 19% from the second quarter.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

LA/LGB: Rail container dwell times at the ports of Los Angeles and Long Beach rose to their highest level in two years last month and will likely remain elevated through January amid higher-than-normal import volumes driven in part by cargo diversions from the U.S. East and Gulf coasts. U.S. imports from Asia moving through Los Angeles-Long Beach have been exceptionally strong since the earlier-than-usual peak season began in early summer. Asian imports in the gateway were up 30% in July through September compared with the same period last year, according to PIERS.

Whenever supply chain disturbances directly affect the market like long rail dwell delays, and union uncertainty, remember Port X Logistics can play a role in helping to improve the flow of your supply chain – We are the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com. We have immediate capacity in LA to pull your diverted containers for transload to avoid the rail, capacity is tendered to on a first come first serve basis. We also have 66 trucks and a huge amount of yard space to take on your LA and Long Beach drayage moves.

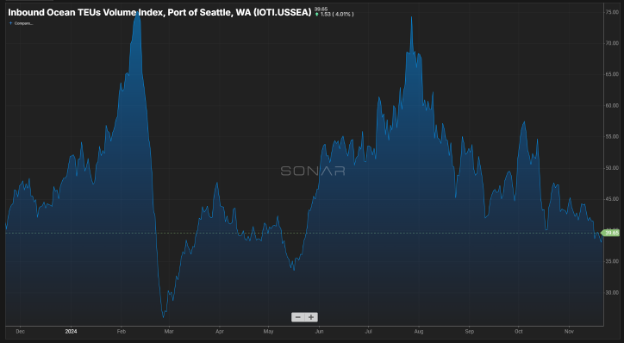

Seattle/Tacoma: With all the lingering drama at the Canadian ports and Canadian rail dwell, Seattle and Tacoma port diversions are on the rise – Port X Logistics’ Seattle location offers a full suite of services, including drayage, transloading, warehousing, and a team of experts who go above and beyond to ensure smooth operations. With our advanced technology, you’ll get the transparency and real-time updates you need to stay informed at every step of the process. From the Pacific Northwest ports to your final destination, we’ve got you covered! Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse rates.

Rail announcement: The Union Pacific has implemented Effective December 1st, 2024, Union Pacific will be simplifying destination storage charges contained in Intermodal Terms and Conditions (ITC) Section C.12. This change applies to both international and domestic containers.

Changes effective December 1, 2024:

- Intermodal terminals will no longer be separated into Group 1 and Group 2. All terminals will be subject to the same charges.

- Charges will be assessed at $150 for Days 1-2 and $250 for Days 3+.

Did you know? We’re proud to announce that we will be gold sponsors yet again for TPM 25! 🎉

We truly value TPM and the opportunity it gives us to connect with so many industry friends, both new and old.

Our team will be at our usual spot – right outside the conference center on the promenade across from the Hyatt Regency. Make sure to come by and say hello!If you’d like to set up a meeting with our team in anticipation of the event, reach out to marketing@portxlogistics.com✉️

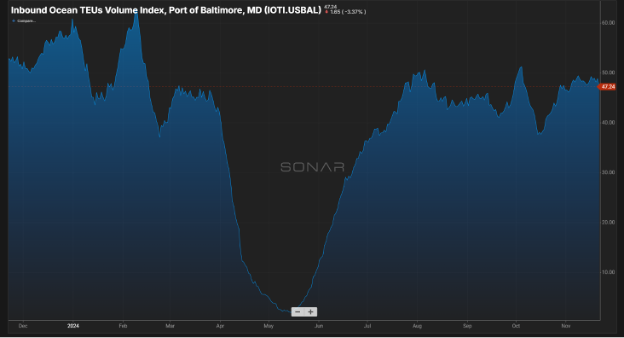

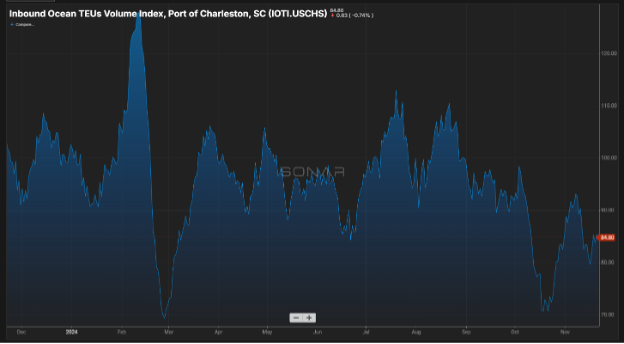

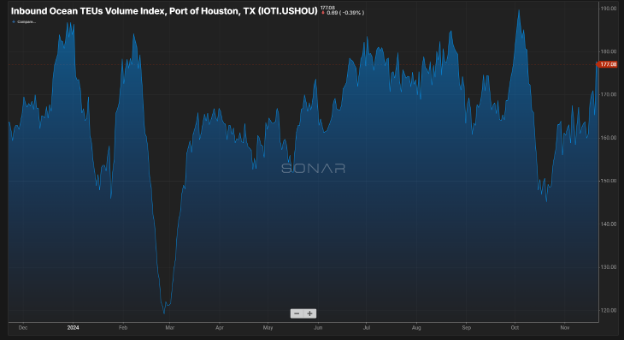

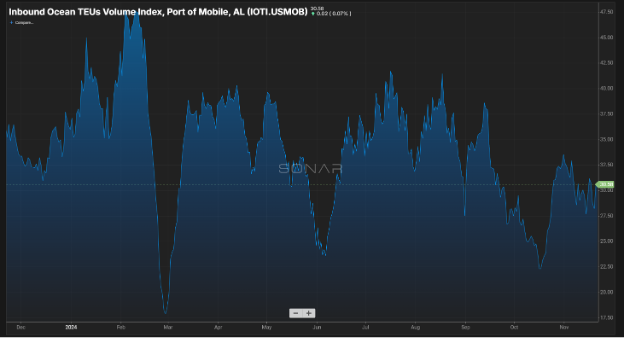

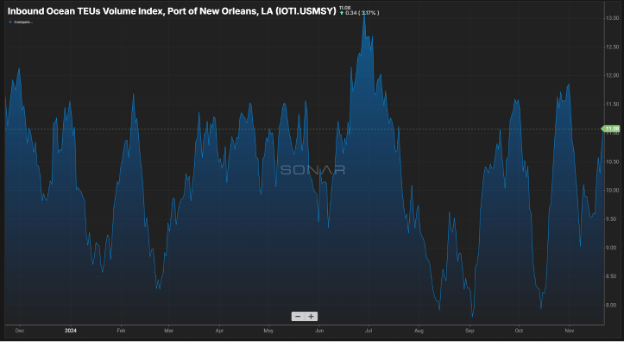

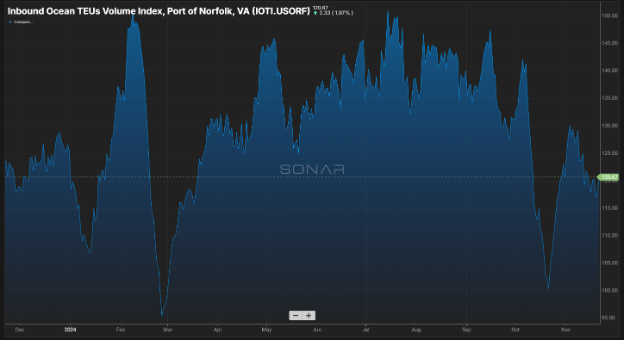

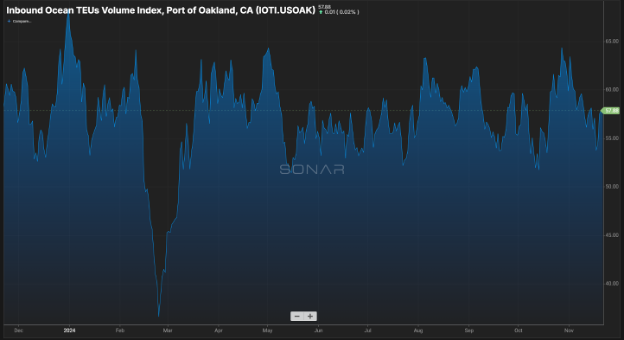

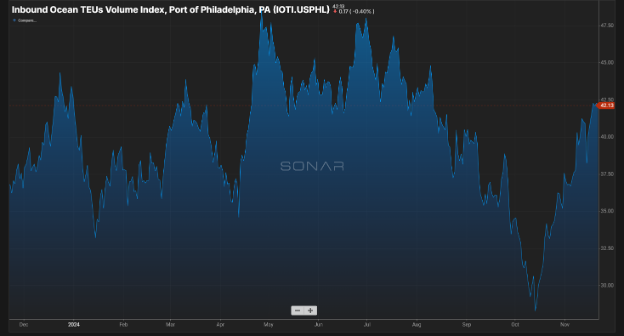

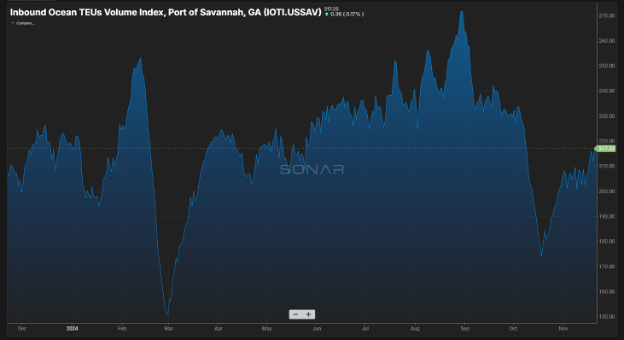

SONAR Import Data Images