1584 words 5 minute read – Let’s do this!

As we start to approach November and the U.S. Presidential election, anything goes for the next couple weeks. We are within prime holiday shipping time but 2025 may not exactly have a slow start. Unresolved issues remain with labor unions in both the U.S. and Canada and winter weather scares will soon be here. I personally have been uneasy during this election year, but other than that to me November and December is the most wonderful time of the year!

The International Longshoremen’s Association (ILA) wants to remove language allowing any degree of automation, while the United States Maritime Alliance (USMX) wants to not only retain the automation allowed in past contracts, but also create a mechanism to consider more in consultation with the union. This could make or break a contract resolution for January 15th – We encourage you to subscribe to the Port X Logistics LLC LinkedIn page for up to date news and solutions for your supply chain, and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox email Marketing@portxlogistics.com

The recently resolved International Longshoremen’s Association’s (ILA) strike, that shut down ports on the East and Gulf Coasts, wasn’t just about wages and benefits, but also focused on opposing automation at container terminals where the union says jobs are threatened.

But is the ILA right about the threat of automation?

The ILA’s assertion that automation eliminates jobs is not brought out by the experiences at two automated container terminals on the West Coast where dockworkers are represented by the International Longshore and Warehouse Union (ILWU). There, jobs lost to automation have been replaced by new jobs. A 2022 study, commissioned by the Pacific Maritime Association (PMA), noted: “in 2008, the ILWU explicitly accepted automation by agreeing to allow ‘fully mechanized and robotic-operated marine terminals.’” The report also noted: “Two terminals in Norfolk, Virginia, and one in New York are semi-automated; the International Longshoremen’s Association opposes fully automated terminals at East and Gulf Coast ports.”

The report was authored by Dr. Michael Nacht, Professor of Public Policy at the University of California, Berkeley and former Assistant Secretary of Defense, and Larry Henry, Founder of ContainerTrac, Inc.

Key findings were:

- With physical growth limited at the twin ports of Los Angeles and Long Beach, automation is enabling terminals to expand cargo throughput and capacity on their existing footprints through densification:

- Since 2019, automated terminals have processed containers faster – at times more than twice as fast – as conventional terminals.

- Throughput of Twenty-Foot Equivalent Units (TEUs) per acre is 44% higher than in nonautomated terminals, thanks to autonomous vehicles and cranes that stack containers higher, closer together, and more efficiently for transferring to trains and trucks.

- Contrary to fears of job losses, the higher output due to automation at the San Pedro Bay ports has increased, not reduced, ILWU jobs and work opportunities, including training and upskilling. Between 2015, the last year before the transition to automated operations, and 2021.

- Paid ILWU hours at the two automated terminals rose 31.5%, more than twice the 13.9% growth in paid hours at the non-automated terminals.

- The registered ILWU workforce in Los Angeles and Long Beach grew 11.2%, compared to 8.4% for the other 27 West Coast ports.

The report, “Terminal Automation in Southern California: Implications for Growth, Jobs, and the Future Competitiveness of West Coast Ports” found automation enabled terminals at West Coast ports to remain competitive, facilitating growth in both cargo and jobs, and reducing greenhouse gas-emissions.

According to the U.S. Government Accountability Office (GAO) report released this year, U.S. ports lag when it comes to digital twin technologies. The creation of a “digital twin” to its physical container counterpart allows for not just monitoring, but predicting snags and autonomously adjusting for them. In terms of adoption of automated port handling equipment, the U.S is trailing its foreign counterparts. That includes automated guided vehicles, remotely operated ship-to-shore cranes and automated gantry cranes.

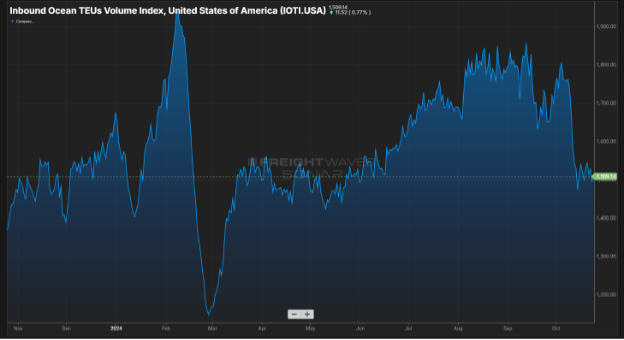

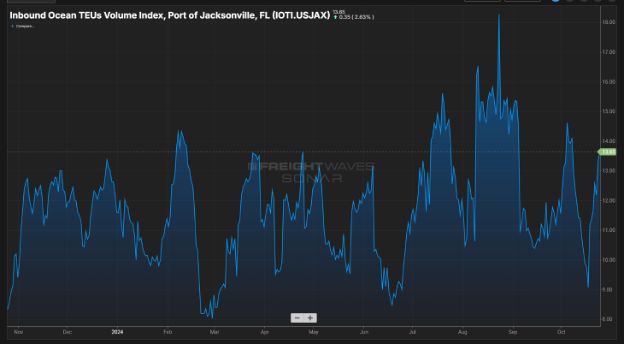

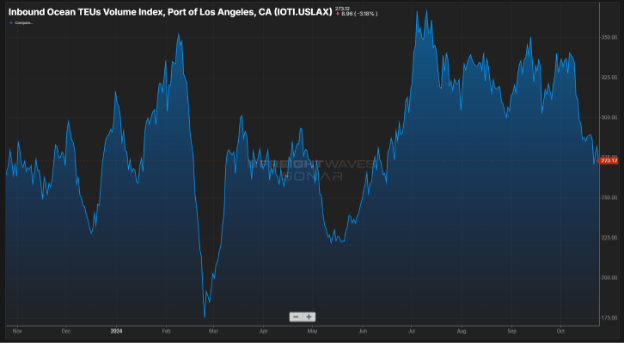

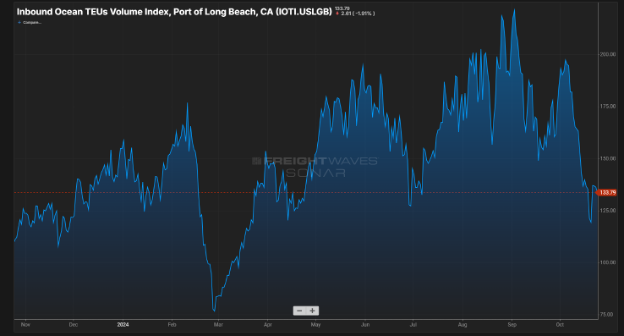

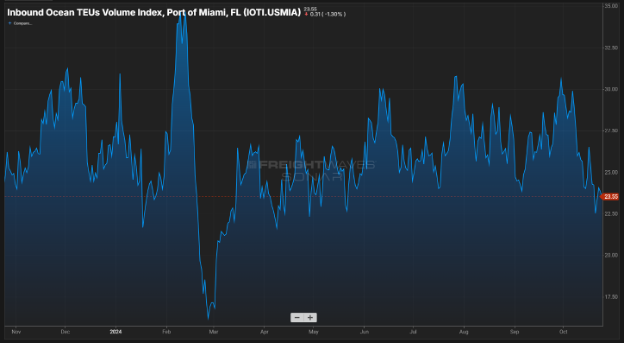

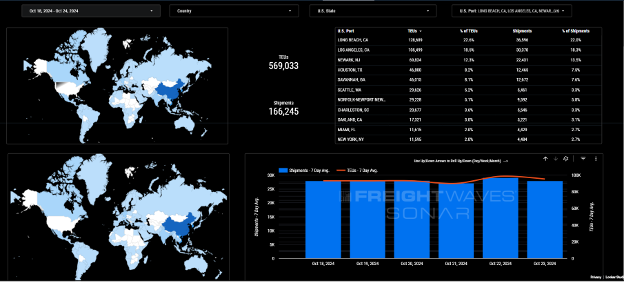

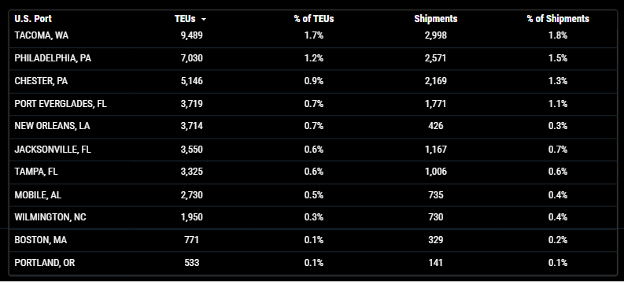

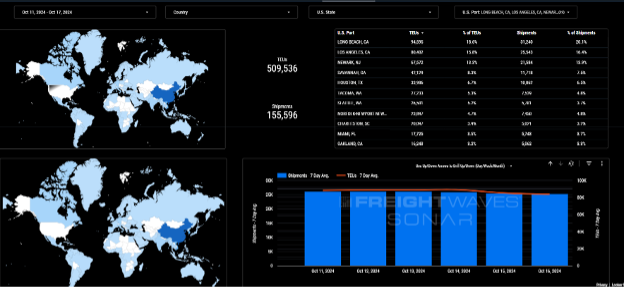

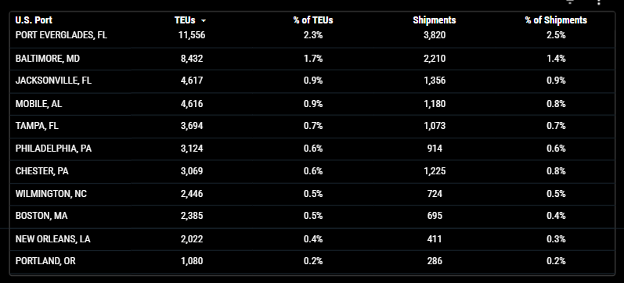

Import TEUs are up 11.6% from this week from last week – with the volume coming into Long Beach at 22.6%, Los Angeles 18.5% and Newark NJ 12.3%. Los Angeles and Long Beach Ports Just smashed Pandemic-Era cargo volumes – The ports of Los Angeles and Long Beach have closed their busiest quarters on record, surpassing even the volumes achieved during the pandemic-driven surge, as shippers moved cargo ahead of traditional peak season and in response to disruptions in the global supply chain. In September, the Port of Los Angeles handled a record-breaking 954,706 Twenty-Foot Equivalent Units (TEUs), marking a 27% increase from the previous year. This achievement capped the busiest quarter ever for the port, with 2,854,904 TEUs processed between July and September. Los Angeles’ September imports surged to 497,803 TEUs, a 26% increase compared to last year, while exports dipped 5% to 114,702 TEUs. Empty container movement jumped by 45% to 342,201 TEUs. Over the first nine months of 2024, the port moved 7,586,395 TEUs—an 18% increase over 2023. Imports at Long Beach increased by 2% to 416,999 TEUs in September, while exports fell by 12.8% to 88,289 TEUs. The port also saw a 1.5% rise in empty containers, reaching 324,211 TEUs. Notably, September was the fourth consecutive month where loaded imports exceeded 400,000 TEUs. Imports are projected to peak in Los Angeles at 125,882 TEUs this week before dropping to 111,713 TEUs the next week, while Long Beach’s imports are expected to fall from 102,756 TEUs this week to 87,780 TEUs next week, according to data from the ports.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

Montreal: The Port of Montreal will be the site of a one-day strike by longshore workers on Sunday as contract talks continue to lag. But unlike previous work stoppages, Sunday’s walkout is expected to be felt at all four of the installation’s terminals. The FTQ-affiliated Syndicat des débardeurs du port de Montréal filed a 72-hour strike notice on Thursday advising management that its members will be starting their strike at 7 a.m. Sunday and ending it at 6:59 a.m. Monday. The union will hold a special meeting for the membership on Sunday, the agenda and content of which will not be shared with news media. Since the October 10th announcement that the longshoremen’s union would stop all overtime work due to the prolonged negotiations, there has been a slow down handling around 50 percent of goods transiting through the Port of Montreal, both imports and exports. These goods include food, medical and pharmaceutical products, raw materials for industry, consumer goods for retail, as well as a variety of other goods crucial to the operations of thousands of businesses. We hope to see the union and port employers come to agreement, as currently there is quite a backup on Montreal containers and transload orders, much beyond anyone’s control until the two sides come together. Our team in Canada has years of knowledge and experience with all Canadian ports and we can dray, transload and provide crossborder deliveries to and from all Canadian ports. Contact the team at Canada@portxlogistics.com for all your Canadian needs.

LA/LGB: With all the volume backlog and incoming rail dwell times out of the LA and Long Beach terminals continue to climb and we are now seeing 8.3 average days inbound container shipments waiting for rail transport at the LA/LGB terminals, as of yesterday. We recommend diverting your hot rail containers to the port for transloading – We have immediate capacity to pull your diverted containers for transload to avoid the rail, capacity is tendered to on a first come first serve basis. We also have 66 trucks and a huge amount of yard space to take on your LA and Long Beach drayage moves. If you are interested in learning how to expedite diverted containers or looking for LA/LGB dray capacity contact Letsgetrolling@portxlogistics.com

Did you know? Whenever supply chain disturbances directly affect the market remember Port X Logistics can play a role in helping to improve the flow of your supply chain – We are the Gold Standard in drayage, transloading and trucking? We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com.

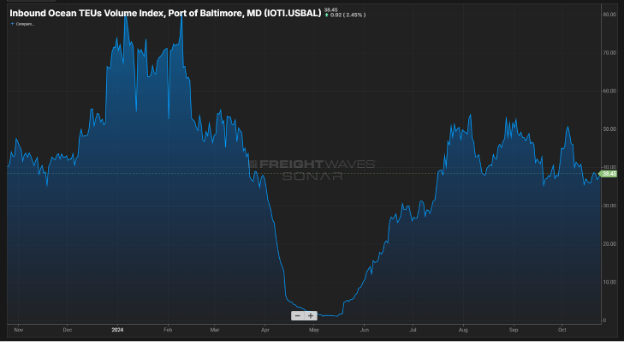

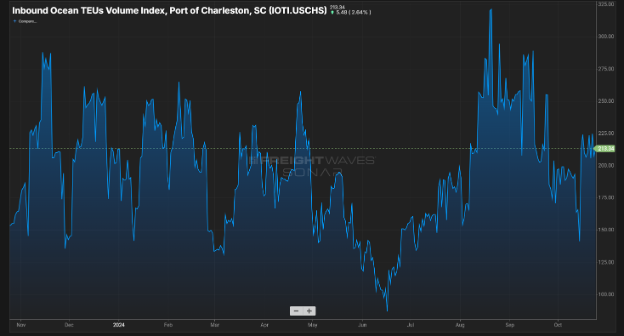

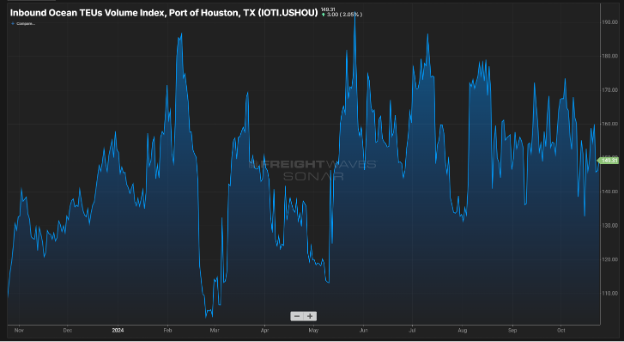

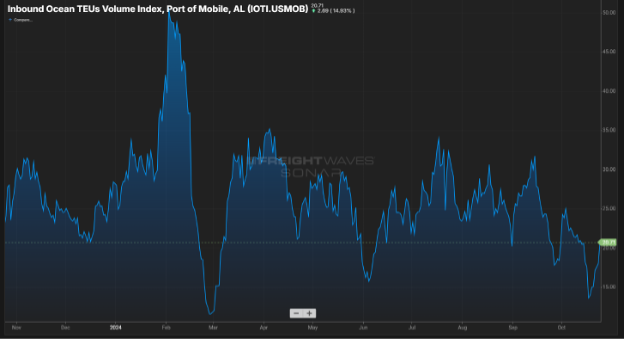

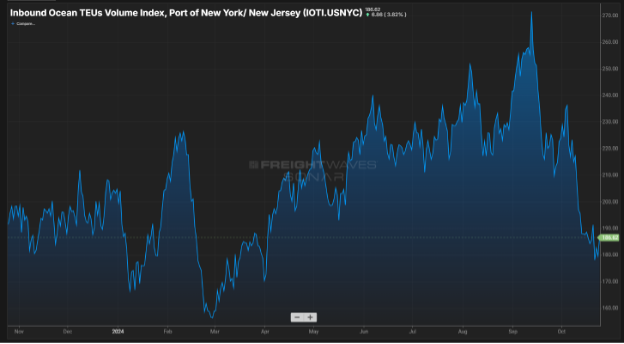

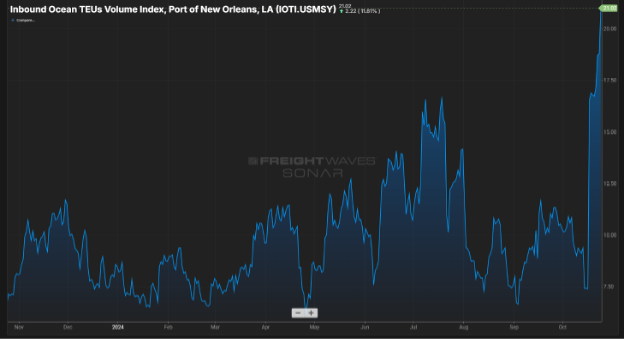

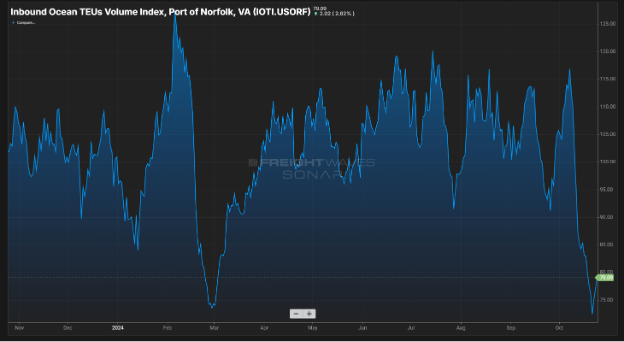

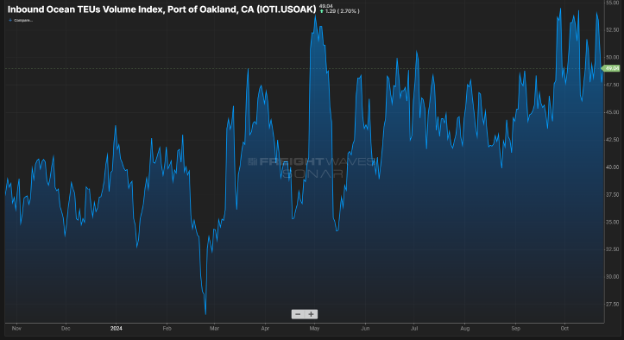

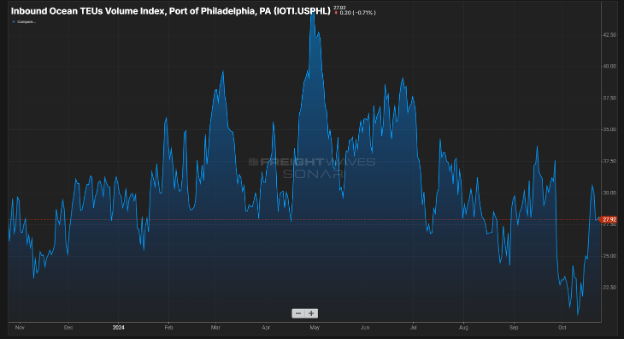

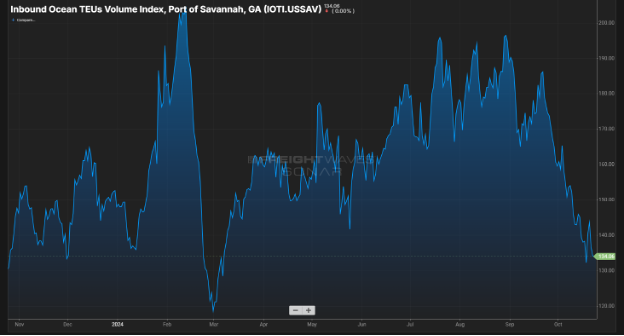

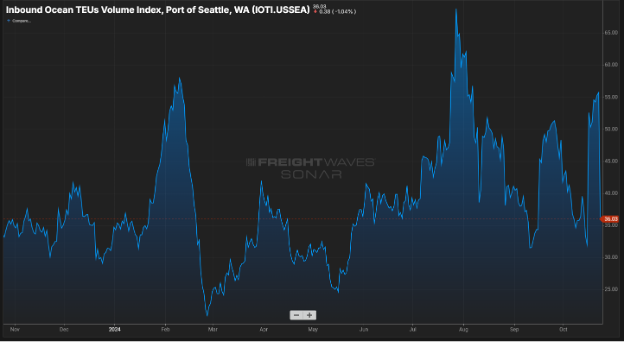

SONAR Data Import Images