1472 words 5 minute read – Let’s do this!

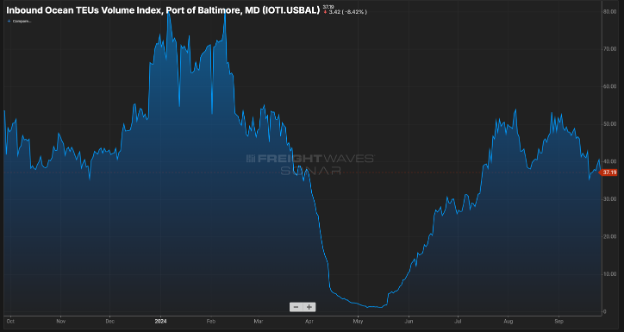

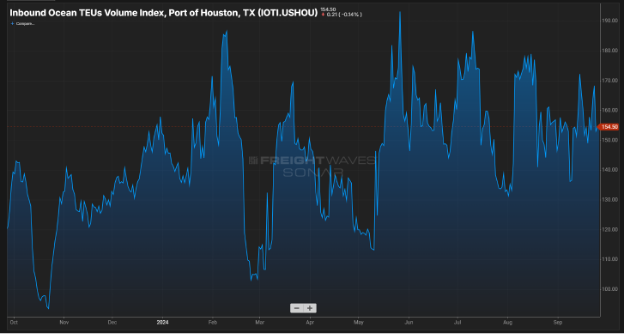

As we have talked about for weeks, the International Longshoremen’s Association (ILA) at ports from Maine to Texas are set to walk off the job early October 1st, and it could become the most disruptive strike to the U.S. Ports in decades. Shippers that rely on East and Gulf Coast seaports have been importing early, shifting goods to the West Coast, and even putting cargo on pricey flights to hedge against the strike that could jam supply chains and reignite inflation 5 weeks ahead of the U.S Presidential Election. To stay informed of what is to come of all the disruption, subscribe to the Port X Logistics LLC LinkedIn page for up to date news and solutions for your supply chain, and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox email Marketing@portxlogistics.com

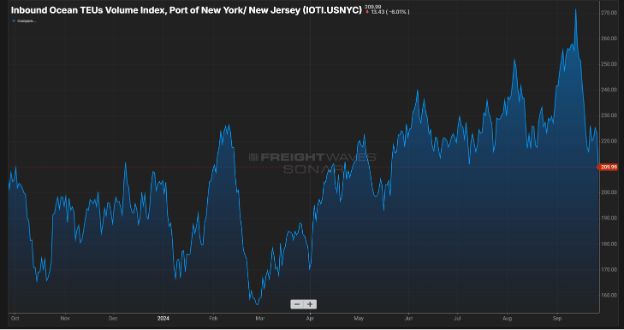

As of Saturday, there were 42 container ships scheduled to arrive at the Port of New York and New Jersey, one of the biggest ports involved in the labor dispute, according to S&P Global’s maritime tracking service Sea-web. Thirteen of the ships are scheduled to arrive after September 30th. As of today, the United States Maritime Alliance (USMX) has filed an unfair labor practice with the National Labor Relations Board requesting “immediate injunctive relief — requiring the union to resume bargaining — so we can negotiate a deal.”

Union workers at ports in the East Coast and Gulf Coast earn a base wage of $39 an hour after six years on the job. That is significantly less than their unionized West Coast peers, who make $54.85 an hour — a rate that will increase to $60.85 in 2027, excluding overtime and benefits. Assuming a 40-hour workweek, West Coast port workers are making more than $116,000 a year, versus $81,000 for their counterparts in the East. The ILA’s initial demands included a 77% wage hike over six-year contract, with the labor group arguing that the increased pay would make up for the surge in U.S. inflation in recent years. The differences are not only over pay – to protect job security, the ILA is demanding a complete ban on the automation of cranes, gates and container movements used in the loading or unloading of cargo at the 36 ports.

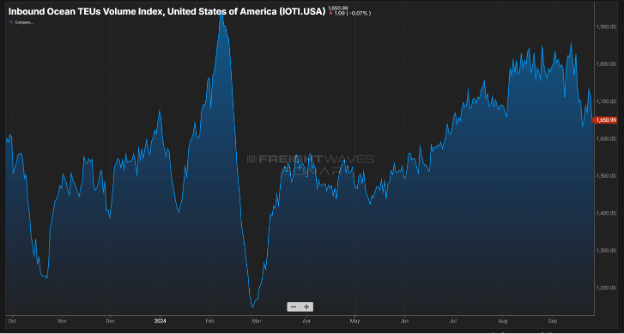

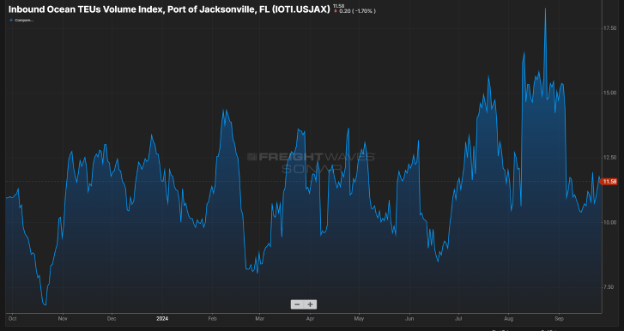

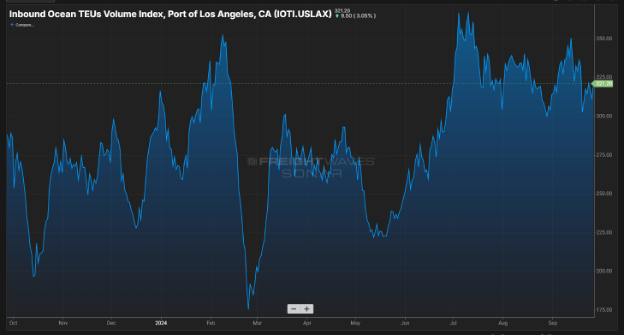

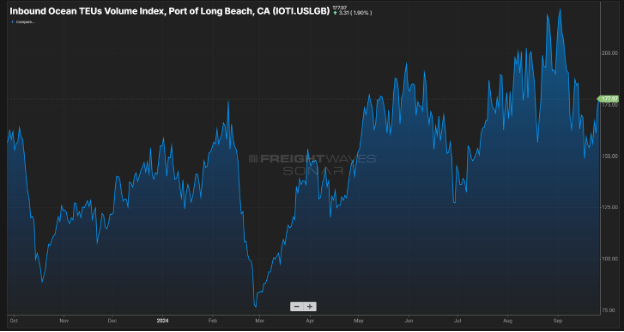

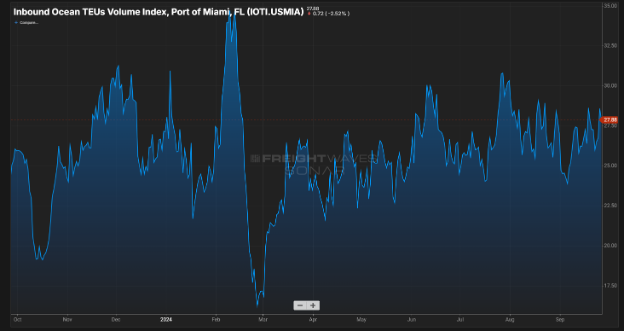

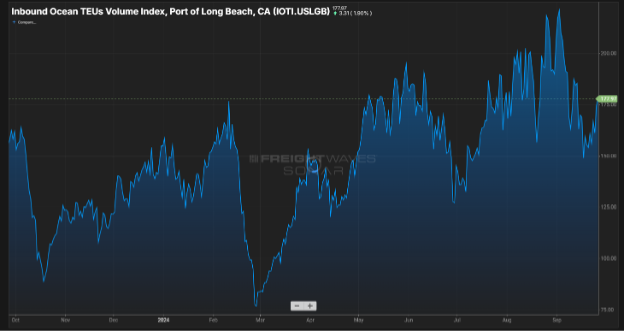

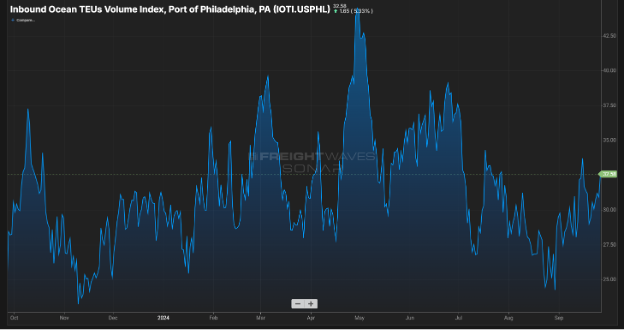

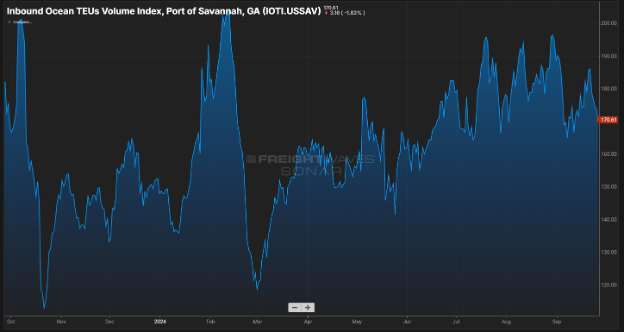

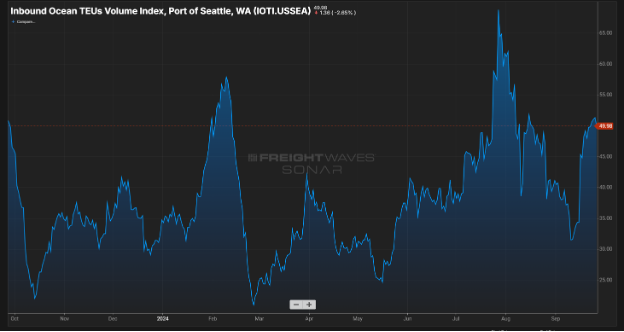

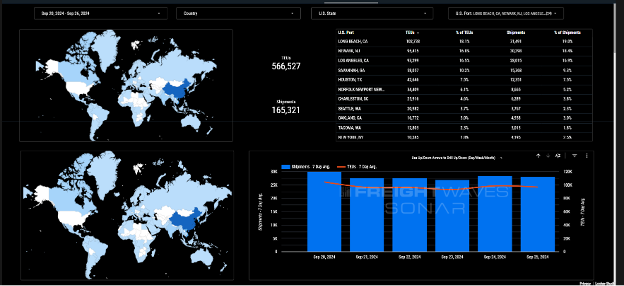

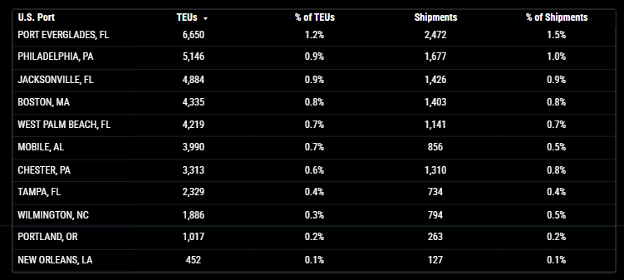

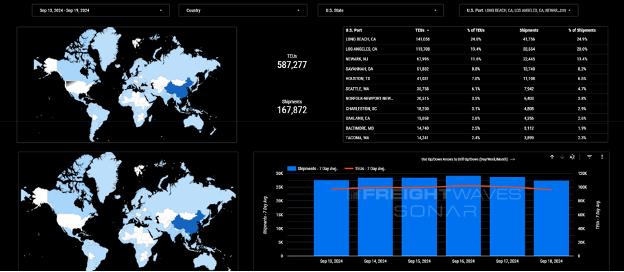

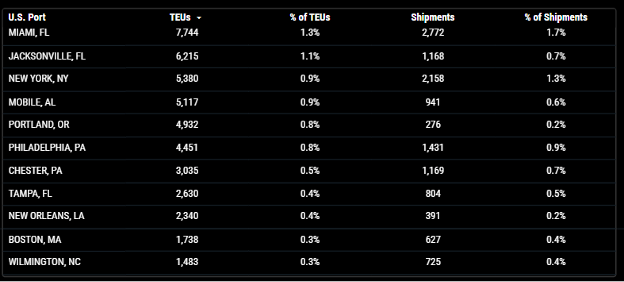

Import TEUs are down 3.53% from this week from last week – with the heaviest volume coming into Long Beach at 18.1%, Newark NJ 16.8% and Los Angeles at 16.5%. Import volumes through the Pacific Northwest has increased by double-digit percentages this summer due primarily to front-loading of shipments by retailers who sought to get ahead of the ILA strike on the East and Gulf coasts and the brief work stoppage by the Teamsters union against the Canadian National and CPKC railroads in August. US imports from Asia in August increased 34.6% in Seattle-Tacoma year over year, according to PIERS. Imports in Vancouver last month rose 17.4% while jumping 35% in Prince Rupert, according to data from the ports.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

Montreal: Dockworkers at the Port of Montreal have approved a strike mandate after more than a year of contract negotiations. Longshore workers voted 97.9% in favor of granting their union executive the authority to call a strike if it chooses. The union local, affiliated with the Canadian Union of Public Employees, would need to issue a 72-hour notice before it’s nearly 1,200 members could walk off the job and the parties remain in mediation, and the Maritime Employers Association says it hopes to hash out a deal at the table in the coming days. Shippers have also been relying on the Canadian Ports as a rerouting option to avoid the ILA labored ports. If you have or are planning to have diverted containers arriving at the Canadian ports, our Canadian team has a wealth of experience and knowledge of drayage, transloading and cross border deliveries and are ready to help answer your questions and support your needs. Contact Canada@portxlogistics.com

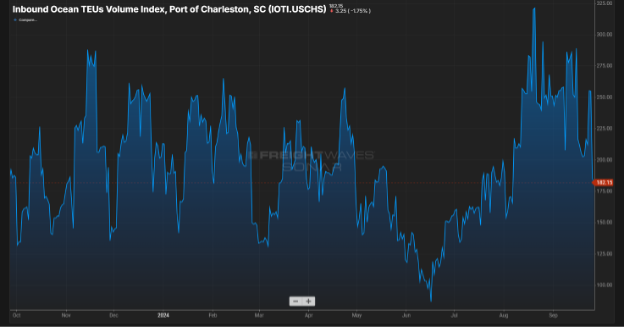

Savannah: Savannah Port main gate is closed today due to a train accident. Both Savannah and Charleston ports are monitoring the possible effects of Hurricane Helene and any port closures are still to be determined. Both ports are planning to work the weekend as well, weather permitting. Between the weather and ILA shutdown, urgent containers are going to become a huge deal in the Southeast and we have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks. Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space. Contact the team sav@portxlogistics.com for great rates and supreme customer service.

Chicago: The Chicago Railroads have set deadlines for accepting exports before the potential ILA strike. NS exports in Chicago were to be dropped off by Wednesday (yesterday) for Virginia International Gateway and by Thursday (today) for Norfolk International Terminals, the two terminals at the Port of Virginia. The deadline for the Port of New York and New Jersey is Friday September 27th. If a strike does occur, railroads face the challenge of positioning enough railcars to keep freight moving. CSX and NS plan to stage railcars in Chicago to ramp up operations once a resolution is reached, but space is limited. Our Chicago asset drayage team has full capacity to get your Chicago containers moving. We have 80 trucks and secured yard space and we are able to secure permits to haul heavy containers. For great rates, capacity and supreme customer service contact Danny and the team at letsgetrolling@portxlogistics.com

Did you know? What impact could the strike have? The ports that would close in an East and Gulf Coast strike handle more than 68% of all containerized exports in the U.S. and roughly 56% of containerized imports, according to industry data. So even a short strike would cause significant disruptions in regional trade flows. One analysis estimated that could cost the U.S. economy as much $5 billion a day. For example, heavier vehicle traffic is likely at key points around the nation as freight is diverted to West Coast ports. For every day of a port strike, it would take four to six days to catch up with the backlog in ships, analysts say. Although West Coast terminals could absorb some cargo diverted from eastern ports, they couldn’t handle it all, nor could the U.S. rail system, experts say. Should a strike persist longer than a month or so, some companies could face shortages of parts and other inputs. The auto and pharmaceutical industries, which maintain lean inventories, could be particularly affected. Exports of cars and other products that are moved through the East Coast could be impacted. In addition, a strike could hamper shipments of products such as bananas, manufacturing components and plywood, interrupting the flow of both consumer goods and industrial parts for factories. Fresh meat and other refrigerated food could spoil, resulting in shortages and increased prices. So yes, this is a bigger deal than for just those of us in the industry. But for those of us in the industry that are getting hit with the supply chain planning woes, planning ahead is crucial! Choosing Port X Logistics to help formulate a plan is you choose to divert your cargo to the West Coast and non-Union Ports and move it via Drayage, transloading and trucking. Port X Logistics is the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com.

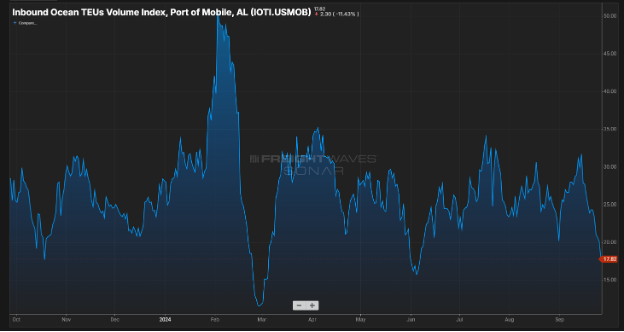

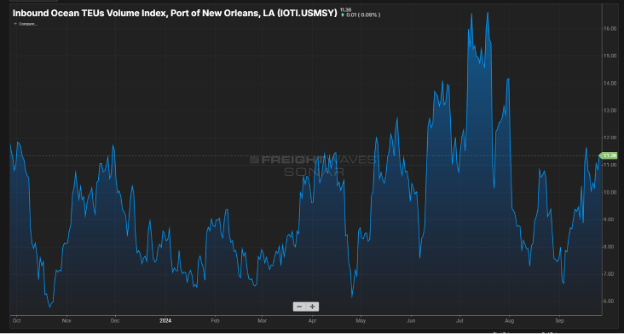

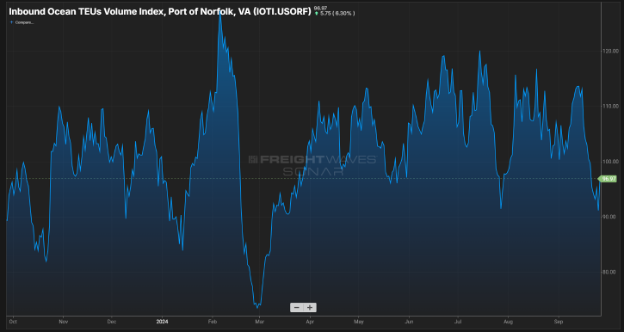

SONAR Import Data