2133 words 7 minute read – Let’s do this!

A big week is ahead with the International Longshoremen’s Association (ILA) Union contract, as we get closer to the September 30th deadline, we will keep you up to date as any contract news declines or progresses so we urge you to subscribe to the Port X Logistics LLC LinkedIn page . And for up to date news and solutions for your supply chain, and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox email Marketing@portxlogistics.com

An East and Gulf coast port strike is looking increasingly likely after the Biden Administration says it does not intend to invoke the Taft-Hartley Act to prevent a strike. “We’ve never invoked Taft-Hartley to break a strike and are not considering doing so now,” an unnamed Biden administration official stated. However, Publicly, the administration hasn’t been clear on its potential decision. The Taft-Hartley Act is a federal law enacted in 1947 that restricts the activities and power of labor unions. Under the legislation, if it is determined that a port strike would endanger national public health and safety, the president can request a court order for an 80-day cooling-off period.

The United States Maritime Alliance (USMX) welcomed the letter sent earlier this week to the government, ILA and USMX, urging the White House to “immediately work with both parties to resume contract negotiations and ensure there is no disruption to port operations and cargo fluidity” Pointing out that the White House had stepped in before to avert strike action, the trade associations, representing a wide array of businesses, noted: “A strike at this point in time would have a devastating impact on the economy, especially as inflation is on the downward trend.” It urged both parties to return to the “bargaining table”, with administration support, adding: “The administration needs to be ready to step in if a strike or other action occurs that leads to a coastwide shutdown or disruption.” Unsurprisingly, the USMX issued a statement “in strong agreement” with the letter. And noting the group’s “tremendous respect for the ILA”, it said it was disappointed that the ILA was “unwilling to reopen dialogue unless all of its demands are met”. The stakes are high, however, with both trade and politics at risk, with the Democrats currently supportive of the unions in an election year. Politically, this must be set against the potential impact of a strike on the US economy. In addition, some observers believe ILA leader Harold Daggett is looking for a record deal that would cement his legacy. In a statement yesterday, the ILA boss said: “A sleeping giant is ready to roar on Tuesday October 1st if a new master contract agreement is not in place. My members have been preparing for over a year for that possibility of a strike.” The ILA is demanding significantly higher wages and a total ban on the automation of cranes, gates and container movements that are used in the loading or loading of freight at 36 U.S. ports. Whenever and however the dispute is resolved, it’s likely to affect how freight moves in and out of the United States for years to come.

Some ports along the US East and Gulf coasts are going public with their contingency plans ahead of a planned strike by dockworkers on October 1st, including staying open for business on weekends.

The Georgia Ports Authority (GPA) said in a customer advisory Wednesday that shippers should take delivery of cargo before October 1st, noting its Garden City Terminal in Savannah will be closed after that in the event of a strike. In addition to opening for the two Saturdays remaining in September, Garden City will open for a full day on Sunday, September 29th for cargo retrieval. The GPA said it will take export containers until September 30th, including refrigerated containers. But it said that if a reefer box does not make it onto a ship by that day, “they will not be monitored and maintained if the port is closed due to a work stoppage.” The GPA added that it will not charge terminal demurrage to shippers during a work stoppage.

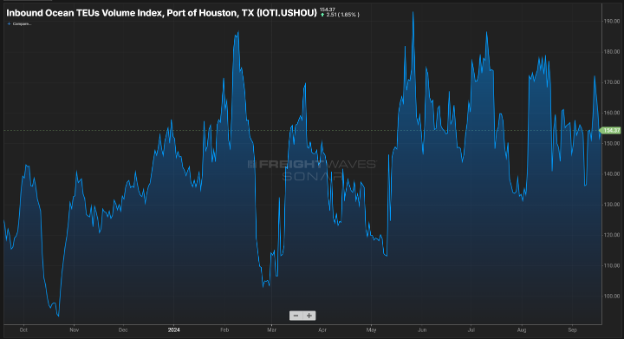

A notice Wednesday from the Port of Houston said its two container terminals plan to open truck gates and work on vessels up until 7 pm on September 30th, with the cutoff for export drop-offs an hour earlier. The port said it is evaluating the need for extending regular work hours for the terminals next week, with plans to open Saturday, September 28th. “We encourage imports to be picked up as soon as possible, anything in the yard after 7 pm on September 30th, 2024, will be unavailable until the work stoppage ends,” the notice said. Houston said it would waive an import dwell fee for containers.

The Port of Virginia said in an operations alert that it will open its two main container terminals and the Pinner’s Point Container Yard, which handles empties and chassis, for the next two Saturdays and the Sunday immediately before a strike. Ocean carriers have not been as public about what they plan to do in the event of a strike. The ILA has warned USMX carriers that it will monitor any ships diverted from East and Gulf coast ports.

Along with stopping some cargo bookings, some ocean carriers are levying new charges for handling any cargo that is currently en route to East and Gulf coast ports but may be affected by a port strike

Hapag-Lloyd announced Wednesday a “work disruption surcharge” of $1,000 per TEU that would apply to non-Asia exports headed to the US East and Gulf coasts. The surcharge goes into effect October 18th.

CMA CGM announced last week that it would implement beginning October 11th a “local port charge” of $1,500 per TEU for cargo destined to East and Gulf coast ports.

A strike that persists for more than a month would likely cause a shortage of some consumer products, although most holiday retail goods have already arrived from overseas. A prolonged strike would almost certainly hurt the U.S. economy. Even a brief strike would cause disruptions. Heavier vehicular traffic would be likely at key points around the country as cargo was diverted to West Coast ports, and once the longshoremen’s union eventually returned to work, a ship backlog would likely result. Experts say it takes four to six days to clear up every day of a port strike. Planning ahead is crucial and choosing Port X Logistics to help formulate a plan is you choose to divert your cargo to the West Coast and non-Union Ports and move it via Drayage, transloading and trucking. Port X Logistics is the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com

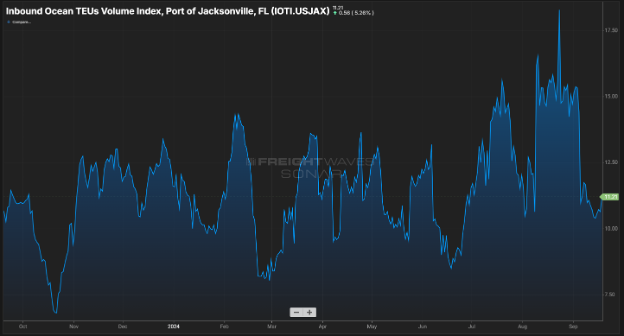

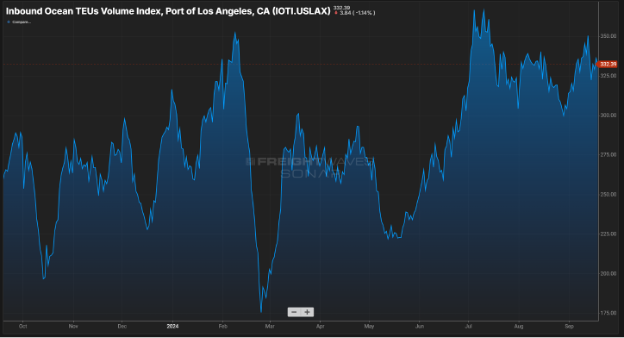

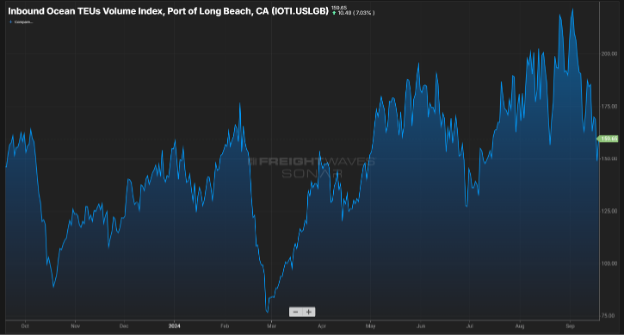

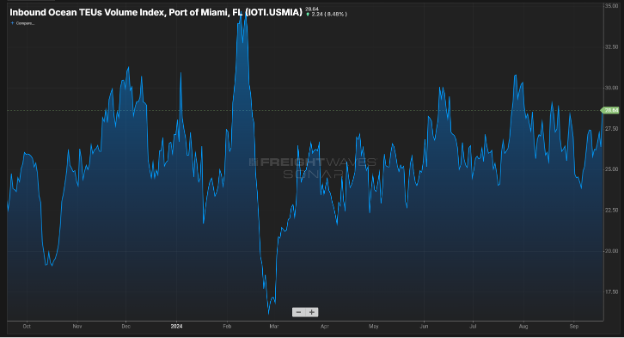

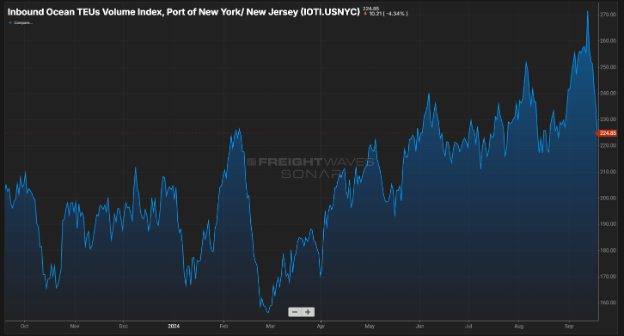

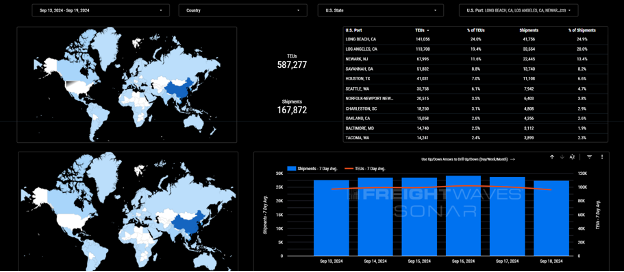

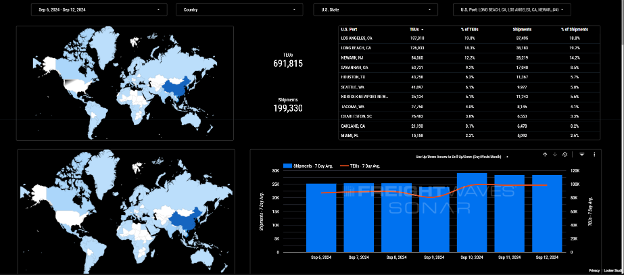

Import TEUs are down 15.11% this week from last week – with the volume coming into Long beach at 24%, Los Angeles at 19.4% and Newark NJ 11.6%. HSBC Global Research’s latest Global Freight Monitor report noted that U.S. Gulf and East Coast ports accounted for 57% of U.S. imports and 8% of global container trade in 2023. A surge in volumes diverted to U.S. West Coast ports in recent months has seen this share reduce slightly in 2024 to 55.5% of total import volume year-to-date. Currently West Coast yard capacity utilization stands at 65-71% with minimal delays to berthing, however rail dwell time runs at 5-12 days. “If volumes diverted rapidly to the WC during a strike on the EC and GC ports, we could see these metrics deteriorate and also lead to equipment shortages (trailers and chassis). Separately, any go-slow actions by port workers at WC ports in solidarity with the ILA could worsen the situation,” HSBC said.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

LA/LGB: Shippers, transportation interests and the International Longshore and Warehouse Union (ILWU) are urging the mayors of Los Angeles and Long Beach to lead the effort against the implementation of new regional air emissions rules they say will cap cargo growth at the largest US port complex. Stakeholders sent a letter to Mayor Karen Bass and Long Beach Mayor Rex Richardson stated that Port Independent Source Rule (ISR) would fail to achieve the goal of a zero-emission port environment without first building the electric and hydrogen fuel infrastructure needed to fuel trucks, cargo-handling equipment and vessel operations “There is broad agreement among stakeholders that it would be more effective and productive to forego a Port ISR and instead focus on an infrastructure and streamlined permitting program to support current and future needs related to zero-emission infrastructure and equipment,” the letter said. The AQMD board last month approved the Rail ISR and the regulatory agency has said it will focus on the Port ISR in the first quarter of 2025, according to Michele Grubbs, another PMSA vice president. Transload orders have been piling up as many shippers have been taking the early initiative to avoid a potential strike at the East and Gulf Coast ports, but we have all the transload capacity in the world for you! We also have 66 trucks and a huge amount of yard space to take on your LA and Long Beach drayage moves. Contact CA@portxlogistics.com for all your West Coast drayage, transloading and trucking needs.

Seattle/Tacoma: Rail container dwell times at the UP in Tacoma are still increasing and some containers are taking 2+ weeks to be loaded on the rail. Dwells for BNSF Railway containers at the Husky Terminal in Tacoma this week are averaging five to six days, while Union Pacific (UP) containers are still averaging four-day dwells. If your capacity is affected by rail dwells and if you are looking for an all-star drayage and transload warehouse team, our Seattle operations has plenty of drayage capacity with the addition of 11 new drivers and a huge warehouse with plenty of open space for transloading and storage. Contact Letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse rates.

Denver: Container grounding delays at BNSF Hudson are increasing and taking on average 3-5 days to ground. No congestion or major chassis shortages reported at BNSF Hudson, however driver wait times are on the rise. We have open drayage capacity to service all Denver ramps as well as a transload warehouse and dry vans for local deliveries, contact Denver@portxlogistics.com for immediate capacity and great rates!

Did you know? The ILA strike could bring in a significant amount of airfreight over the next few months. Many shippers have already turned to airfreight due to unreliable shipping options, longer transit times and high ocean freight rates. The demand is very strong and will continue to pick up from late September through December. Are you starting to feel your airfreight piling up in the wake of the upcoming strike possibility? Let our Carrier911 team help manage your domestic urgent shipments coming into the airport – We can get your drivers assigned and on site at the airport in most cases within 1 hour. We have access to cargo vans, straight trucks, dry vans and more. All of our drivers have experience with airport and CFS pickups and have access to retrieving the proper documentation to make these pickups seamless. Don’t forget we provide shareable tracking links and PODs sent at the time of delivery, so you can relax stress free with all of your most critical shipments. Contact the Carrier911 team 24/7/365 info@carrier911.com

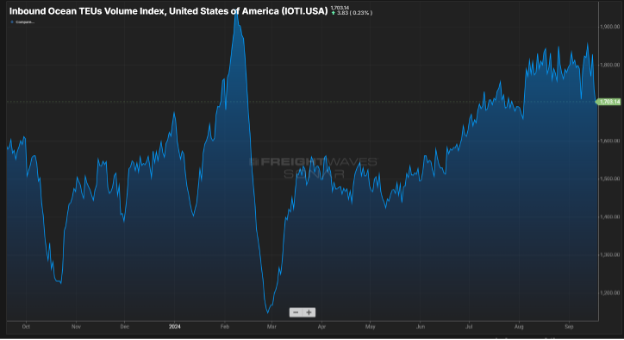

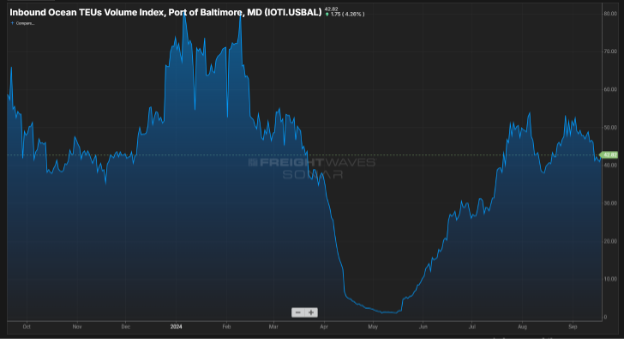

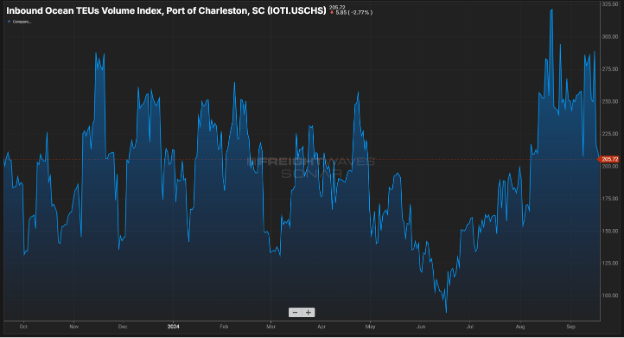

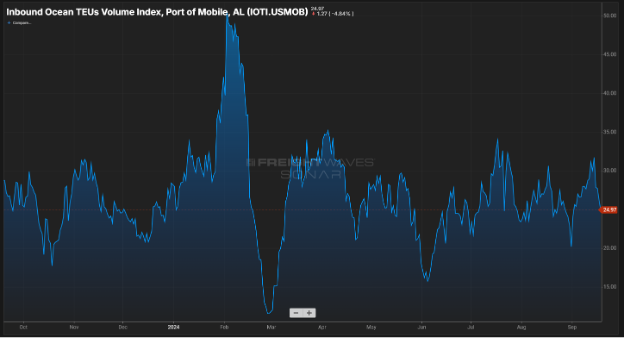

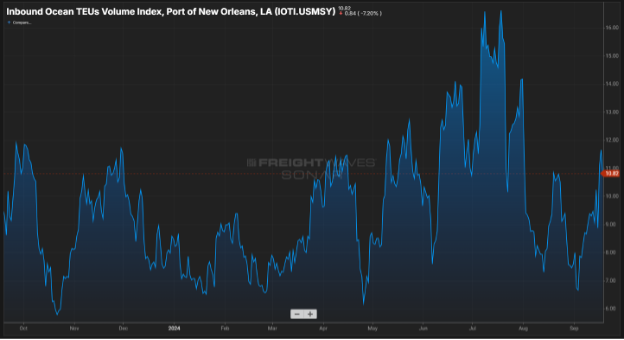

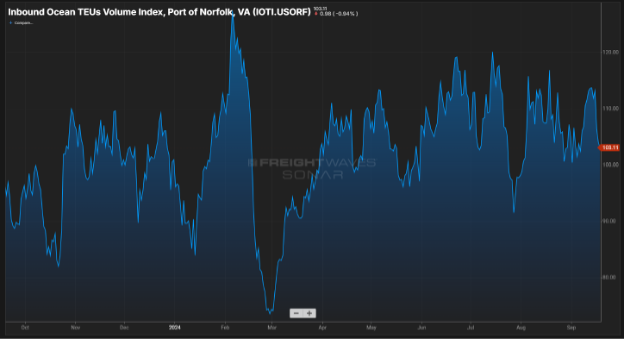

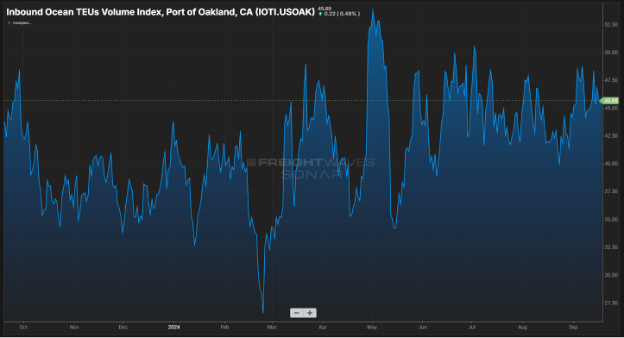

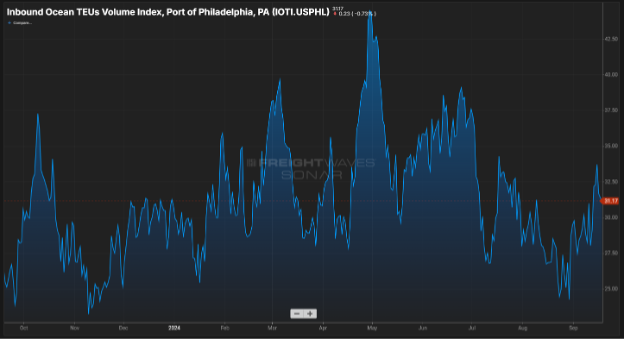

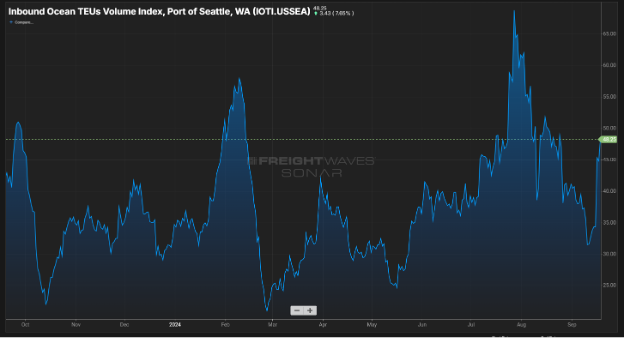

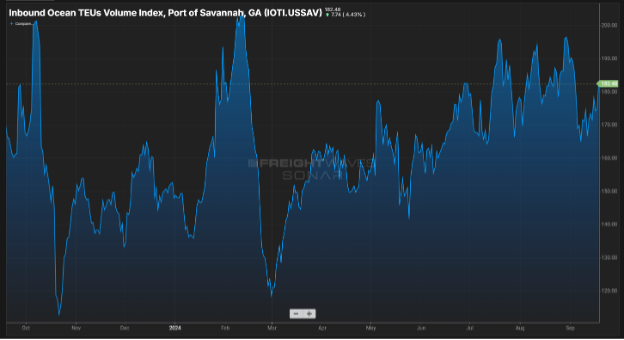

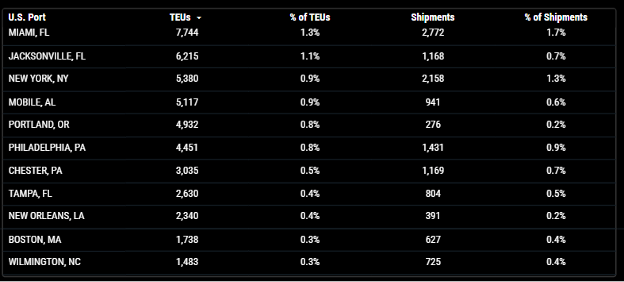

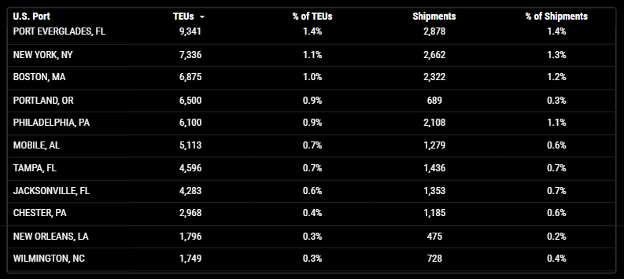

SONAR Import Data Images