1429 words 4 minute read – Let’s do this!

Football season is here (Go Bills!) – Drop us your 2024/2025 season Football predictions and to sign up for this weekly Market Update Newsletter and for updates on this new and future industry related news Marketing@portxlogistics.com. And don’t forget to subscribe to the Port X Logistics LLC LinkedIn page for up to date news and solutions for your supply chain.

Just a few short weeks until Q4 and the expiration of the International Longshoremen’s Association (ILA) Contract and not much has been resolved and seems to only be heating up. ILA President Harold Daggett and his son Dennis EVP dismissed last week’s United States Maritime Alliance (USMX) Press release as “nothing more than propaganda”. The Daggett’s claimed that inflation had cut sharply into wages, while USMX’s “corporate greed has made them delusional”. The Daggett’s have made it quite clear that “We don’t want any form of semi-automation or full automation. They added that the USMX members should have agreed with unions before investing in new equipment; that existing healthcare provisions are inadequate; that putting cameras in workstations is not a question of safety, but one of control; and decried the “constant battle over pensions”. According to the Head of Ocean Freight for the Americas, Stephanie Loomis: “It’s rumored that USMX has an offer on the table similar to the 32% wage increase and a $2 billion bonus shared by union members approved by the ILWU on the west coast”. USMX has pledged to retain the existing contract language on automation, which states that “there will be no fully automated terminals and no implementation of semi-automated equipment or technology/automation without agreement by both parties”. If the ILA goes through with a strike, it will be the first historic strike at the East Coast and Gulf ports since 1977.

Politics – both in the ILA and the White House – will be key to all issues. Meanwhile, shippers have started to look to the White House for action to prevent a strike but acknowledge that proximity to the November U.S. Presidential election has complicated matters. The only tool at the president’s disposal is the Taft-Hartley Act, under which, if it is determined that a port strike could endanger national health or safety, the U.S. president can request a court order for an 80-day cooling off period. However, Any decision to invoke Taft-Hartley would likely weigh the potential political ramifications, and could heavily influence the union voters’ decisions this election.

A work stoppage can take ports up to a month or more to return to normal performance. Planning ahead is crucial and choosing Port X Logistics to help formulate a plan is you choose to divert your cargo to the West Coast and non-Union Ports and move it via Drayage, transloading and trucking. Port X Logistics is the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com

National Oceanic and Atmospheric Administration (NOAA)’s outlook for the remainder of the 2024 Atlantic hurricane season, which lasts until November 30th predicts an 85% chance of an above-normal season, leading to the high likelihood of frequent supply chain disruptions. Hurricane Ian in 2022 caused a 200% increase in export dwell time. In 2023, Hurricane Idalia increased import dwell time by 43%. Service levels in the full truckload market fell by 20% when Hurricane Ida hit. With 2024 projected to experience 17-25 named storms and 4-7 Category 3 or above, companies need to prepare for weather-related disruptions. As Hurricane Beryl became the earliest Category 4 and Category 5 hurricane on record, we’ve already experienced the impact of this year’s season and it is earlier than normal.

The annual cost of weather-related disruptions for U.S. transportation is around $9 billion and 32.5 billion vehicle hours are lost each year to weather related congestion. To help mitigate any major impact on your supply chain, follow the updates on impact from your supply chain visibility provider or supply chain news outlets to determine next steps. This will equip your team with the data-driven insights needed to allocate resources, pivot strategies and make informed decisions on how to implement contingency plan – automation and visibility are crucial to your hurricane preparedness strategy. Technology can also help to better predict the impact of storms and ultimately soften the blow to transportation networks. Shippers can turn container tracking and geolocation data into actionable visibility insights to make informed decisions about inventory and optimize transportation routes.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

Seattle/Tacoma: Rail container dwell times at marine terminals in the Northwest Seaport Alliance (NWSA) of Seattle and Tacoma have doubled in recent weeks as intermodal container moves spiked amid peak season imports. Retailers shifted some discretionary import volumes to the Pacific Northwest gateway because of concerns over the threat of the Canada Teamsters Rail strike and by the potential ILA strike. Rail container dwell times at SSA Marine’s three terminals in Seattle are now six days, up from the normal three to four days. Dwells for BNSF Railway containers at the Husky Terminal in Tacoma this week are averaging five to six days, while Union Pacific (UP) containers are averaging four-day dwells. If your capacity is affected by the rail dwells and if you are looking for an all-star drayage and transload warehouse team, our Seattle operations has plenty of drayage capacity with the addition of 11 new drivers and a huge warehouse with plenty of open space for transloading and storage. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse rates.

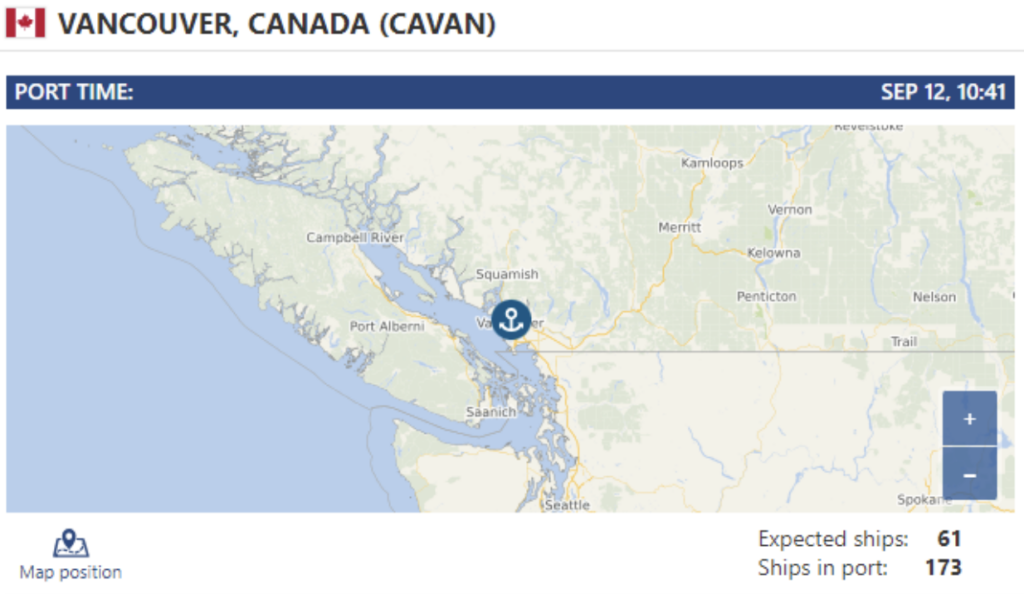

Vancouver/PRR: Rail container dwell times at Vanterm CN and Terminal are still exceeding seven days. Total on dock between all CN and Terminals are between 5-7 days.

If you need help covering your intra-Canada and crossborder containers Rachel, Erin, and the team have a wealth of experience and knowledge of Canadian deliveries and are ready to help answer your questions and support your needs and provide you the best coverage. Contact

Canada@portxlogistics.com

Memphis: Tropical Rainstorm Racine will arrive this evening in Memphis and could bring flooding that could also impact rail operations over the next couple days. Inclement weather can back up the rail for days, so contact us quickly for Memphis drayage capacity – we are currently accepting new orders. Our Memphis operations are elite with 50 drivers and a huge container yard. If you have any up and coming Memphis drayage contact Letsgetrolling@portxlogistics.com

Did you know? VMA24 is less than a month away? Did you also know our CEO and Founder Brian Kempisty will also be a guest speaker?

Hosted by Virginia Maritime Association, VMA24 is the East Coast’s premier conference on shipping, ports, logistics, and trade. Gain insights into current issues and trends in today’s maritime industry, hear industry experts, government officials, and business leaders discuss a wide range of topics related to international trade, transportation, and logistics, and network with other professionals in the industry.

This year’s theme, “Harnessing the New Normal,” directs attention to the paradigm shift occurring in the global shipping market. Change has become the norm, propelled by uncertainties in trade lanes, environmental regulations, and geopolitical dynamics. To prosper in this evolving landscape, companies must prioritize supply chain flexibility and preparedness. Emphasizing resilience and adaptability is crucial to navigating these challenges and ensuring not just survival, but success in the new normal. In addition to the symposium, VMA24 will include the highly anticipated maritime mixer, the prestigious maritime banquet, and attendee favorite, golf. Join us for VMA24 on October 8th-10th, 2024 in Norfolk, VA. For more information and to register, visit VMAsymposium.com

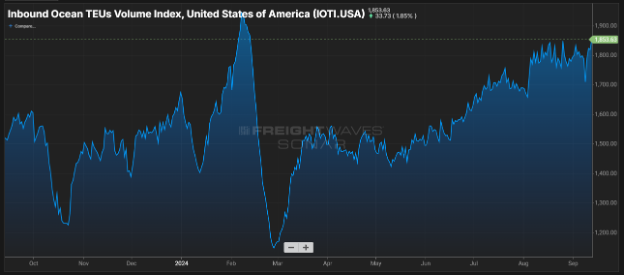

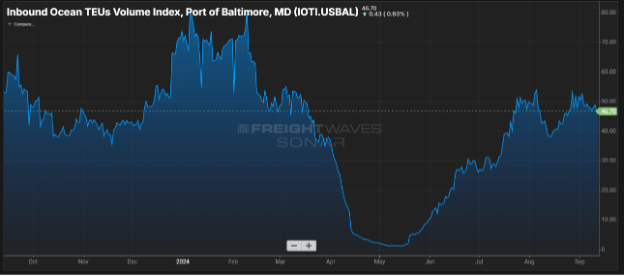

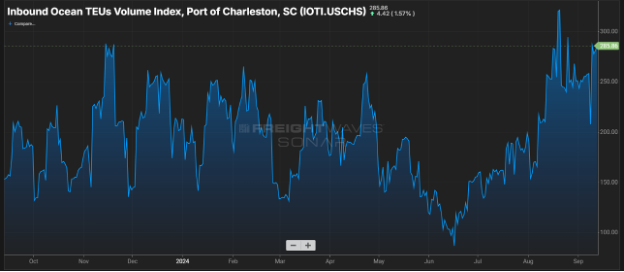

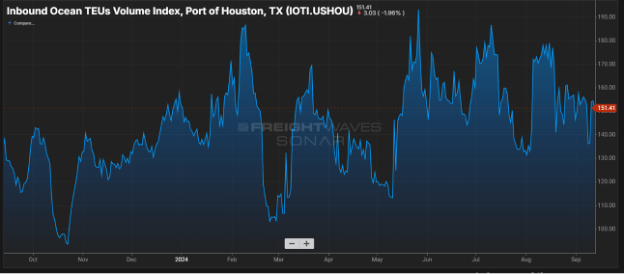

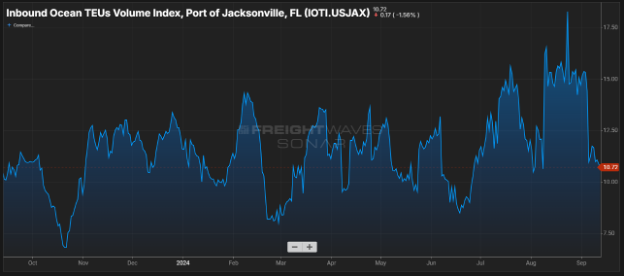

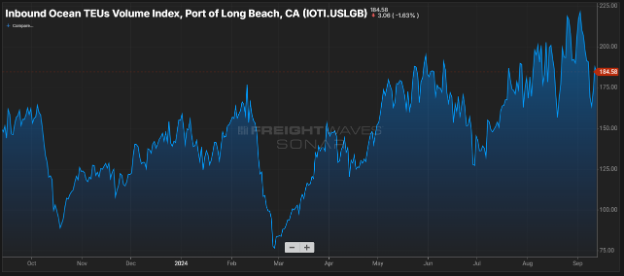

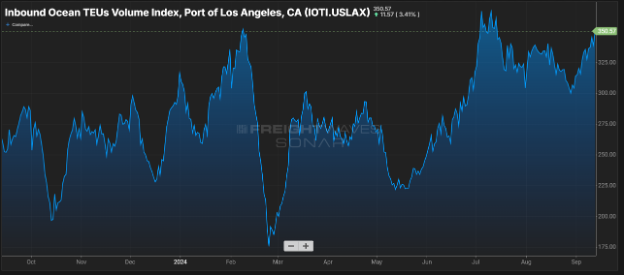

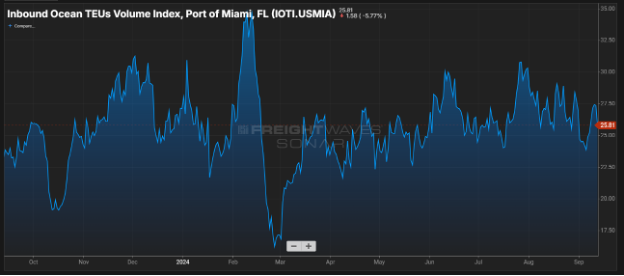

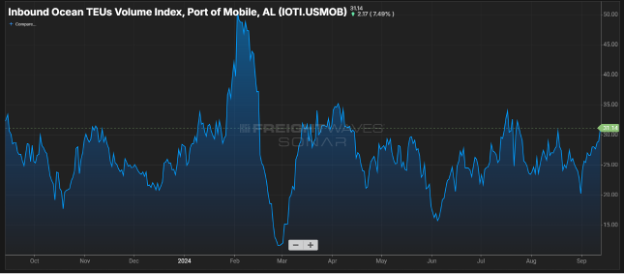

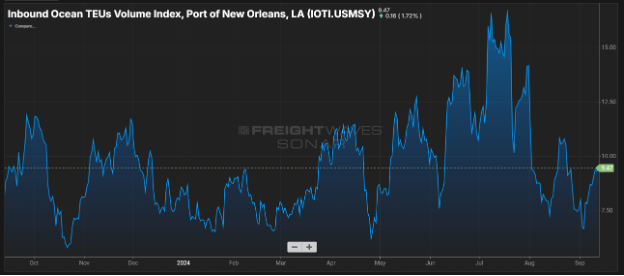

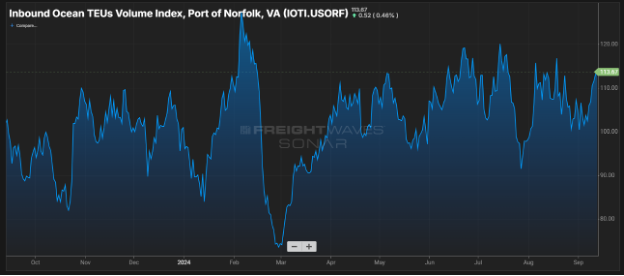

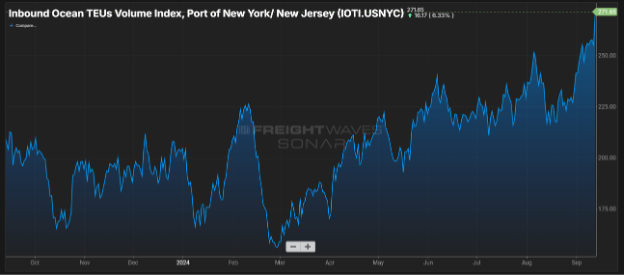

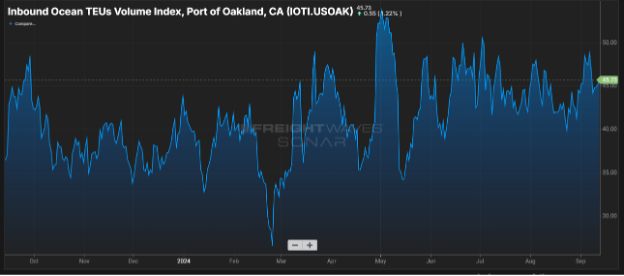

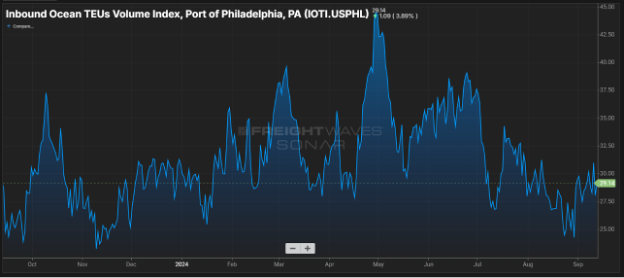

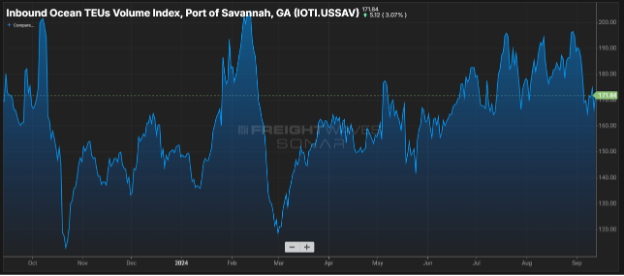

SONAR Data Images