1681 words 6 minute read – Let’s do this!

BIG NEWS is north of the border – On Tuesday, Canadian National Railway Co. (CN) said it would halt the movement of hazardous materials this week and has set up a similar embargo on domestic refrigerated containers. Canadian Pacific Kansas City (CPKC) imposed a ban on the movement of dangerous goods that are toxic or poisonous by inhalation, starting on Monday. We have officially run into the time when we all should be a lot more than just mildly concerned, and even though it is still the “cooling off period”, we have entered disruption mode. We are making it our mission to help keep you informed with what is happening with the rail union and how the potential of work stoppage could heavily affect your supply chain and how Port X Logistics can help. Please follow our LinkedIn page and email Marketing@portxlogistics.com to sign up for this weekly Market Update Newsletter for updates on this new and future industry related news.

In a pair of decisions on Friday, the Canada Industrial Relations Board (CIRB) advised that a work stoppage between the two sides would not pose an immediate threat to public health and safety, meaning a rail strike could occur as soon as August 22nd . The CIRB has imposed a 13-day cooling-off period before a strike can occur. “Serious concerns were raised about potential impacts to the health and safety of Canadians,” Labor Minister Steven MacKinnon said in a statement. “The parties in this dispute have a responsibility to Canadians. I call upon the parties to stay at the bargaining table and continue holding productive and substantive discussions that meet the needs of this moment.”

The Teamsters Canada Rail Conference (TCRC), claimed that CPKC wants to “gut the collective agreement of all safety-critical fatigue provisions.”

CPKC said the sticking points for its “status quo” proposal revolve around wages as well as “held-away” pay — income that kicks in after a certain number of hours off-shift in a spot that is not the worker’s home terminal. The railway wants to push back the start time on that pay, an adjustment made in response to the longer rest-period times mandated by tighter federal regulations. CPKC said it would have no choice but to institute a lockout if no resolution is reached during the cooling-off period and union officials continue to refuse binding interest arbitration. The company also noted that it’s trying to protect the supply chain from a more widespread disruption. CN formally requested intervention by the minister of labor.

CN has targeted fewer points linked to fatigue, but has also proposed what the union called a “forced relocation scheme” that would see some employees move to more remote locations for several months at a time to fill labor gaps. One CN proposal would see employees on a scheduled 40-hour work week, with at least 10 or 12 hours of rest between shifts — depending on whether they’re at home or away — and either two or three consecutive days off each week, in compliance with the law. CN said it also extended an offer that aligns more with the framework of the current contract and includes pay bumps.

If accepted, the new arrangement would make for more predictability for workers and managers, the railways say. But if an employee reached their destination hours ahead of time, it would also mean they could be assigned to other tasks rather than clocking out on arrival.

“From the very beginning, rail workers have only ever sought a fair and equitable agreement. Unfortunately, both rail companies are demanding concessions that could tear families apart or jeopardize rail safety,” said Teamsters president Paul Boucher in a statement Friday.

A work stoppage can take ports up to a month or more to return to normal performance. Planning ahead is crucial and choosing Port X Logistics to help formulate a plan is you choose to divert your rail cargo to the Ports and move it via Drayage, transloading and trucking. Port X Logistics is the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. Transload orders have been piling up as many shippers have been taking the early initiative to speed up deliveries whether it was an ocean delay or to avoid the rails, but we have all the capacity in the world for you! If you want more information on how you can get your cargo diverted at the port and on the road for a speedy delivery with full visibility contact Letsgetrolling@portxlogistics.com

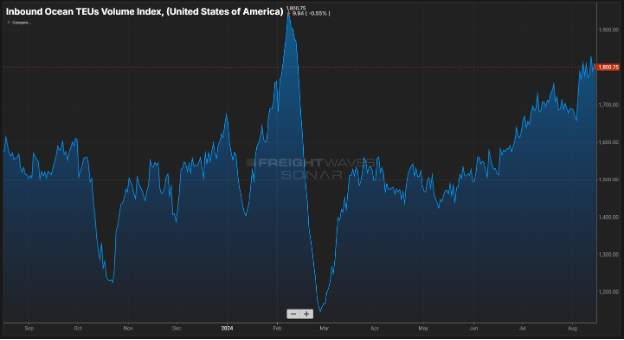

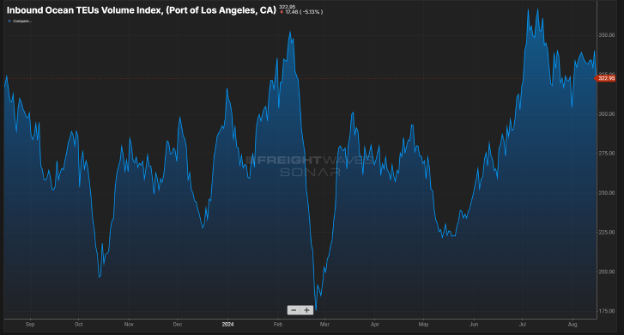

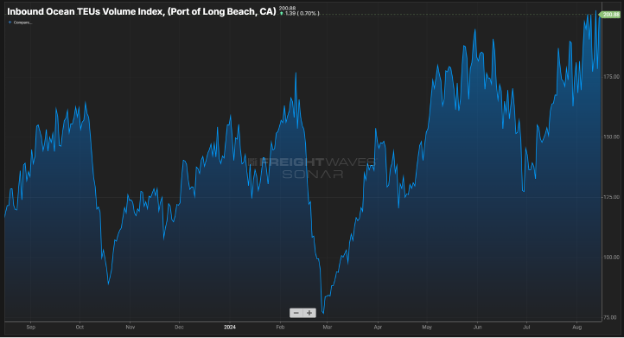

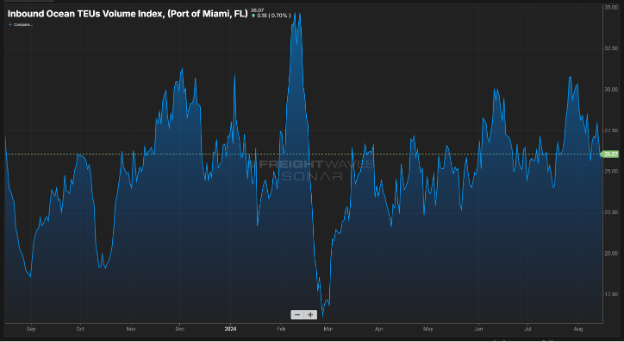

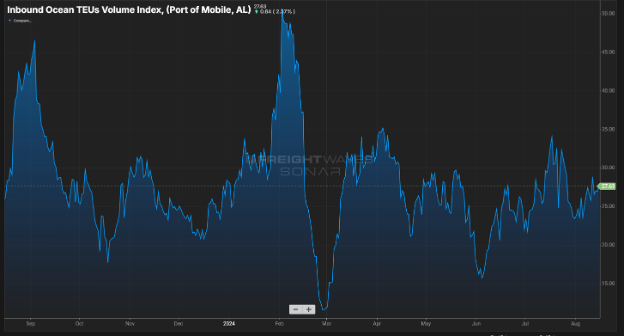

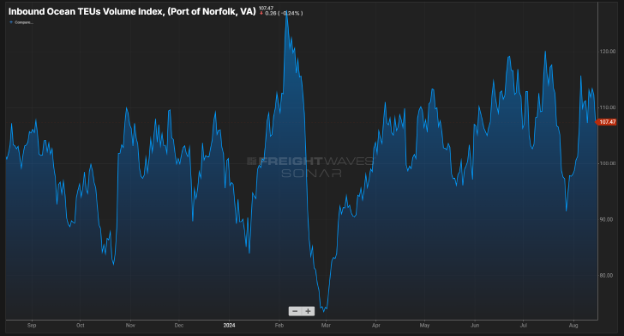

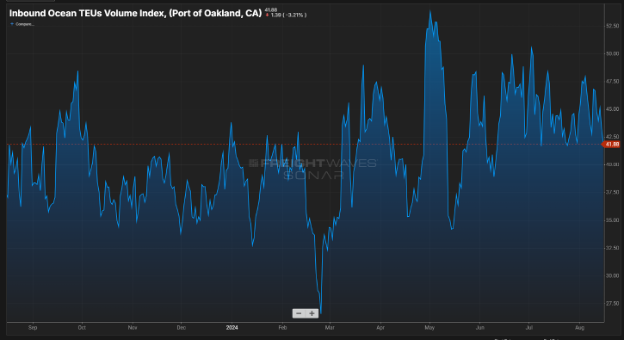

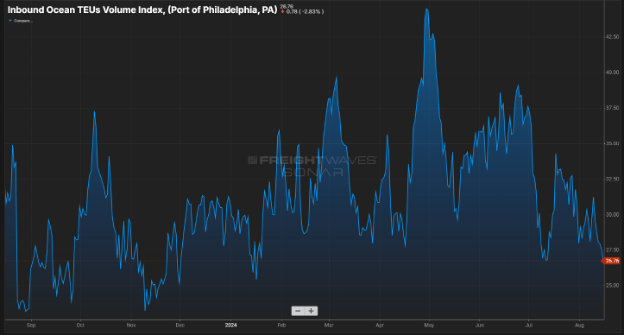

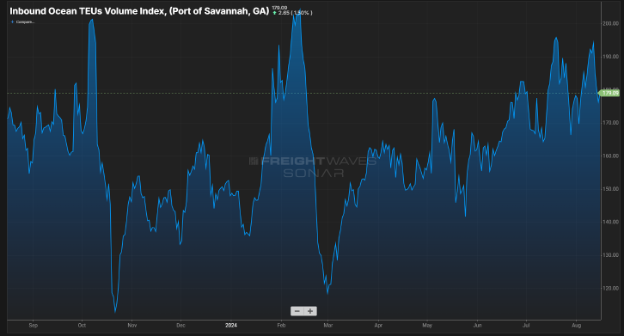

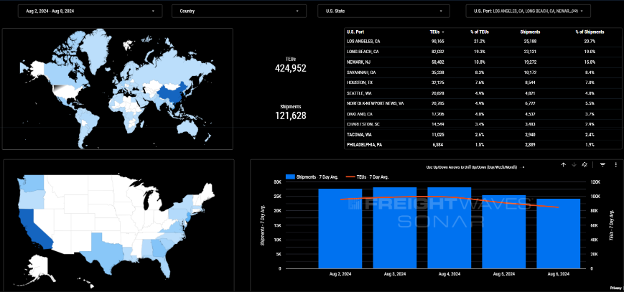

Import volume took a slight dip at the beginning of August, but has since surpassed the incoming volumes in July.

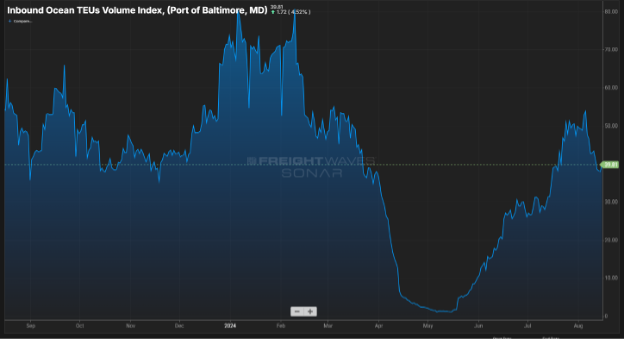

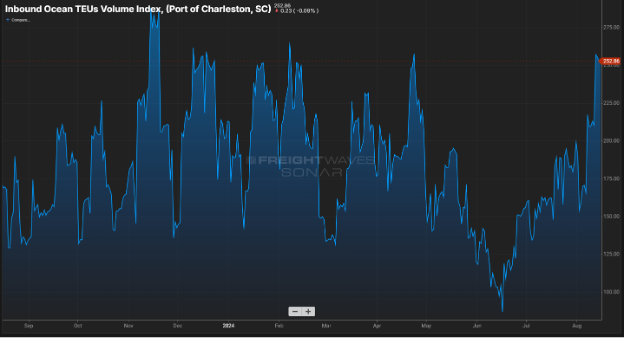

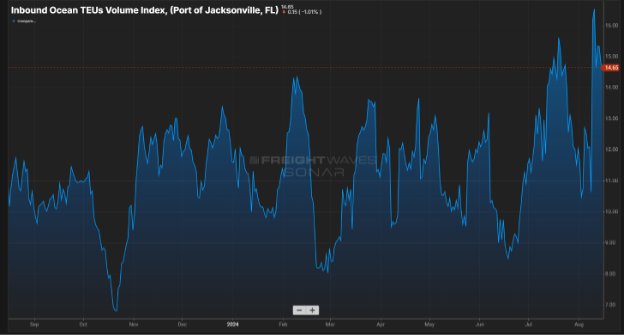

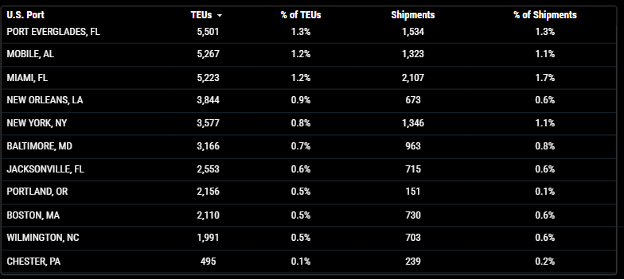

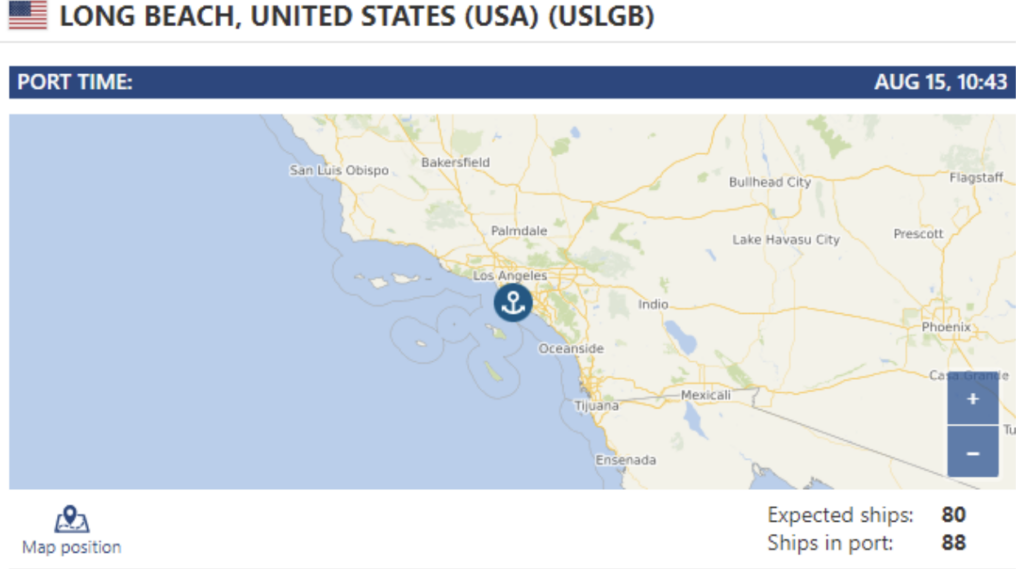

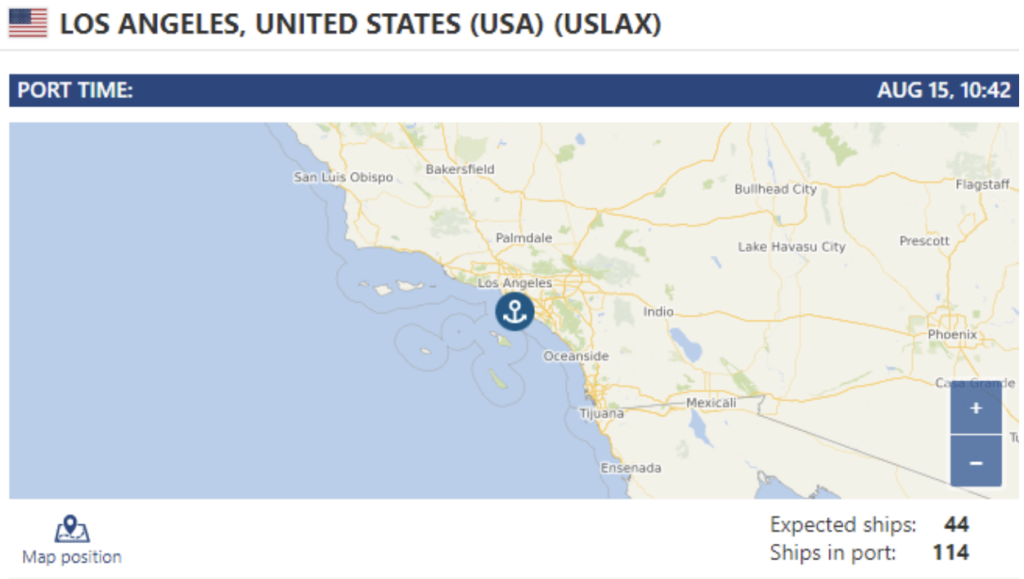

The United States is continuing to shift volume back to ports along the West Coast with 44% of imports during peak season arriving at Los Angeles, Long Beach, Tacoma, and Oakland. The biggest change in 2024 compared to 2023 is the jump in volume to the Port of Long Beach, this has increased by 5% from 2023 and now makes up 22% of peak season volume so far in 2024. While some of this volume may have shifted from the Port of Los Angeles, it appears that the U.S. is continuing to move volumes away from the East Coast and back to the West Coast. In June and July, 44% of shipments were delivered to Los Angeles, Long Beach, Tacoma, or Oakland, while ports like New York, Savannah, and Baltimore saw decreases in volume. Retailers are bringing in merchandise ahead of a potential job action at East Coast and Gulf Coast ports this fall, according to the report by the National Retail Federation and Hackett Associates. The contract between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) expires on September 30th of this year. Negotiations have stalled, and the ILA has threatened a walkout if a new contract is not agreed to by then. The ILA is currently planning a 2 day “marathon session” September 4th-5th, where it will prepare its members for a strike that could arrive as early as October 1st .

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

Vancouver/Prince Rupert: Prince Rupert continues to lag due to limited rail cars because of the wildfires in Northern BC. Our operations team has had to navigate around the fires adding extra mileage and transit times. We expect that the rail dwell will continue to increase as the Canadian Railways endure contract negotiations with an August 22nd strike possibility. If you have containers arriving to the Canadian ports – even if they are destined for U.S. railheads, we urge you to start exploring the options of drayage, transloading via port diversions. Rachel, Erin, and the team have a wealth of experience and knowledge of cross border deliveries and are ready to help answer your questions and support your needs. Contact Canada@portxlogistics.com

Los Angeles: The Port of Los Angeles handled nearly 940,000 twenty-foot-equivalent units (TEUs) of cargo in July, marking the highest total in that month for the port in its 116-year history. According to an August 13 briefing, the port also saw a 37% year-over-year increase in TEUs, and in the first seven months of the year is 18% ahead of its cargo volume pace for 2023. A surge in imports could indicate a need for more transloading and our West Coast team has you covered. We can transload any container from in gauge containers to out of gauge and project cargo and we have 66 trucks for local and long haul drayage and plenty of yard space for short and long term container storage. Contact CA@portxlogistics.com for all your West Coast drayage, transloading and trucking needs.

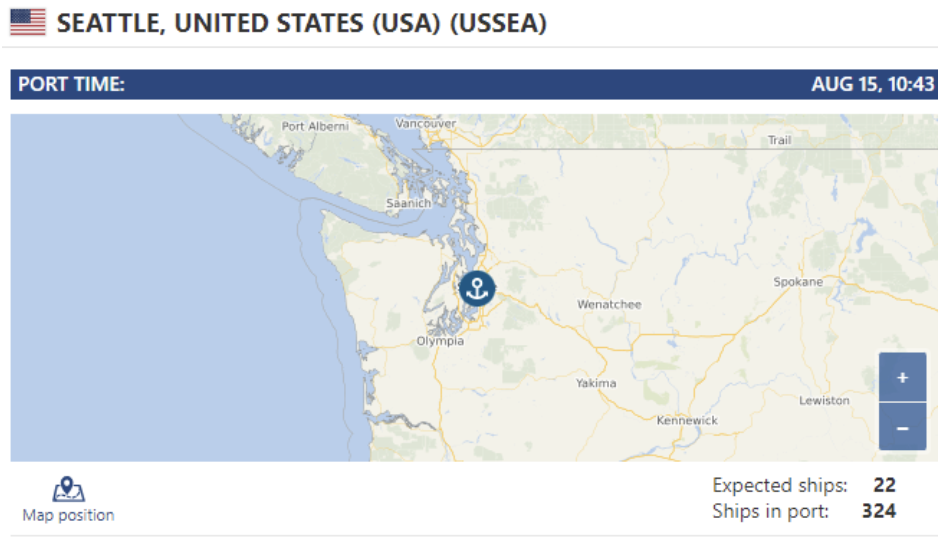

Seattle/Tacoma: On August 13th, The U.S. Department of Transportation (DOT) announced the Northwest Seaport Alliance, which includes the Port of Seattle and Port of Tacoma, are now members of the Freight Logistics Optimization Works (FLOW). FLOW is a private-public partnership created and led by DOT that helps create a shared picture of the U.S. supply chain for members, which include the nation’s busiest container ports, major ocean carriers, and some of the largest retail importers. Through the FLOW initiative, DOT collects, aggregates, and anonymizes key information shared by participants on inbound containerized freight, starting with importer purchase orders, and aligns future demand volumes against current regional capacity to move ocean containers. With all major U.S. West Coast ports now FLOW members, ocean carriers, shippers, truckers, and railroads will be able to better plan for and predict capacity needs to keep cargo moving and avoid bottlenecks. The Port X Seattle operation also works hard to keep the cargo “flow” with plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse space for transloading and storage. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse rates.

Did you know? Our Savannah Warehouse offers hazmat transloading? We have a full service transload warehouse in Savannah and can handle your dangerous goods cargo and any last-minute urgent transloads and cross docks. Our South Atlantic operation also has a drayage fleet that is growing by the day with service to and from Savannah, Charleston and Jacksonville ports as well as container yard space and we are currently operating with plenty of open capacity and warehouse space and labor. Contact Kyle and the team sav@portxlogistics.com

SONAR Import Data Images