886 words 4 minute read – Let’s do this!

It’s now or never! Or maybe just a continued stall for the ILWU/PMA contracts.

Talks remain at a standstill – what are the future dangers created by the lack of an ILWU-PMA contract?:

Terminals are reducing hours because they lack sufficient volume of import containers to justify hiring the longshore labor to keep them open. Both the terminal operators and the longshore labor will be losing out.

The uncertainties that come with West Coast marine terminal operations without a labor contract, creates a disincentive to invest in additional facilities through which cargo will transit West Coast gateway ports. For example, transload facilities that might have been built to serve a West Coast gateway are being built to serve cargo through East Coast gateways. The same for warehouses, cold storage facilities, etc. Once those are built, the millions of dollars spent will not be abandoned – the cargo will continue to move through those facilities for years, even decades, to come. This makes it even more challenging for the West Coast gateways to gain back lost import container market share.

West Coast marine terminals are operating on reduced schedules, some are open only four days a week, creating massive disruption and additional trucking and storage expenses for agriculture exporters. Most agriculture cannot afford to ship in these lengthy alternative routes. For example, the sale price of that hay does not generate sufficient revenue to pay for long haul drayage trucking from Houston port to the west coast.

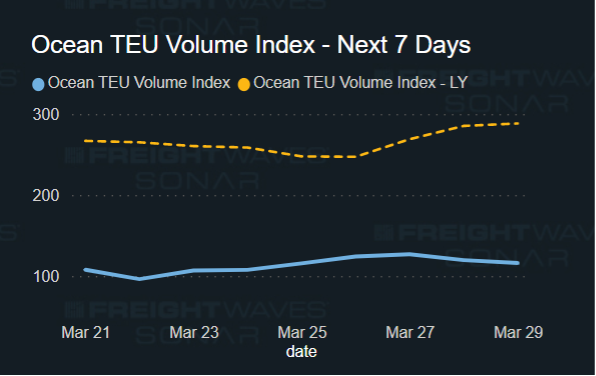

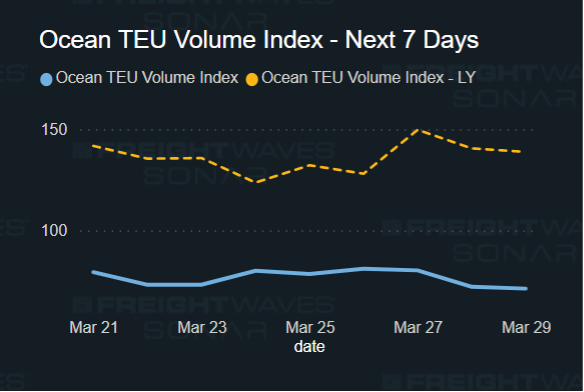

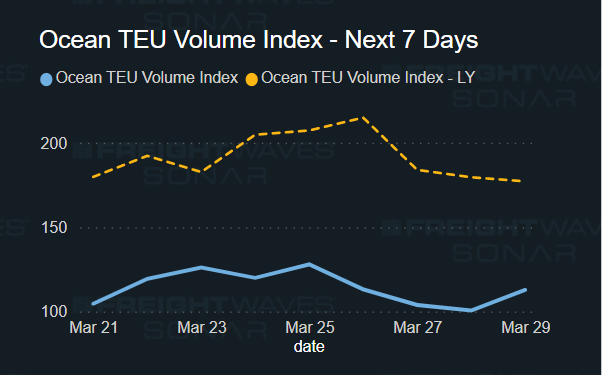

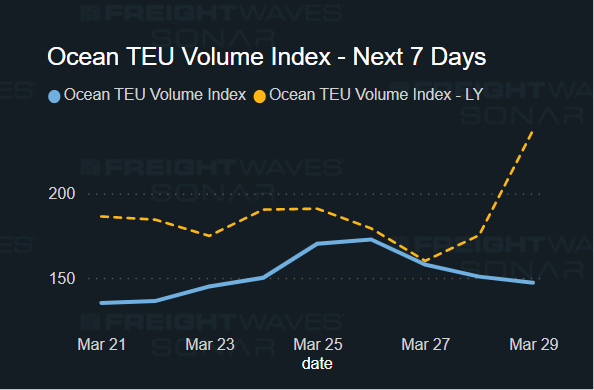

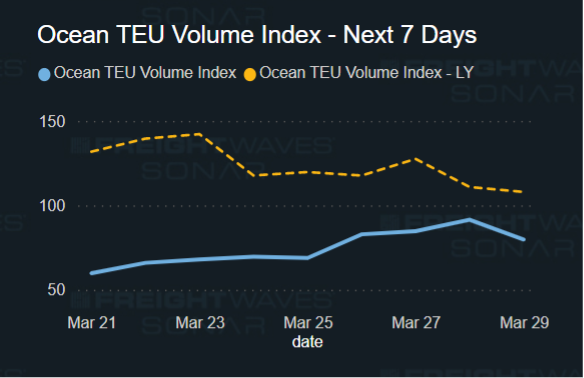

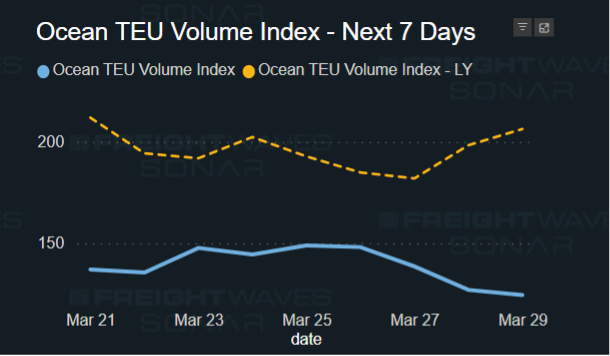

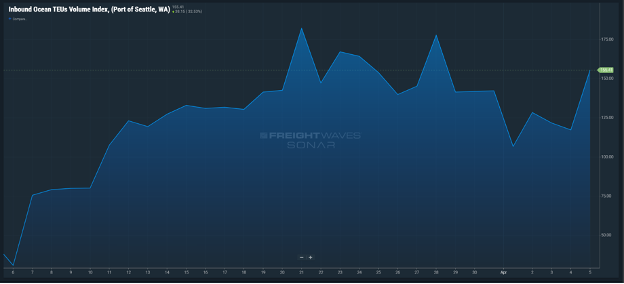

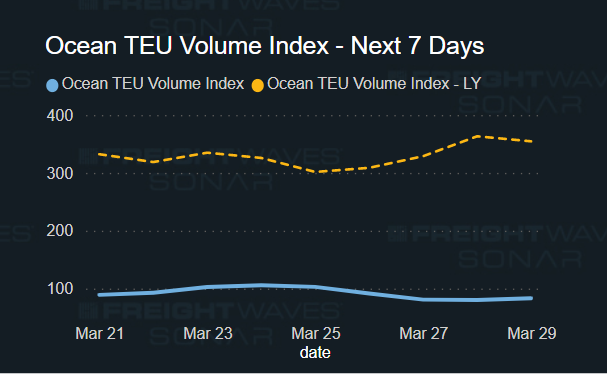

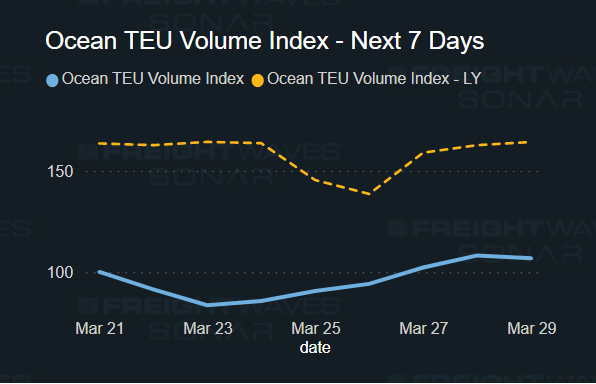

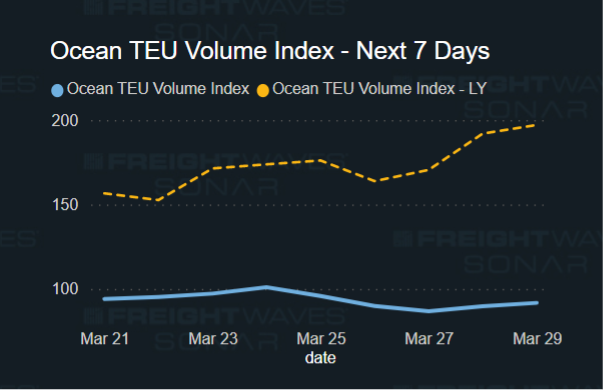

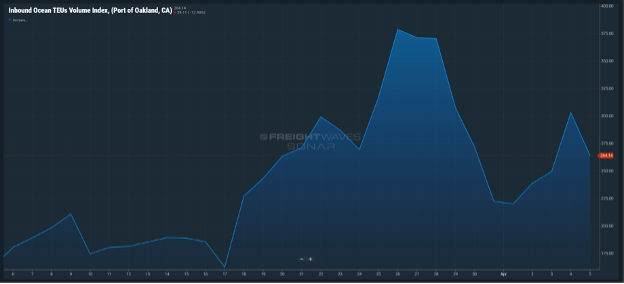

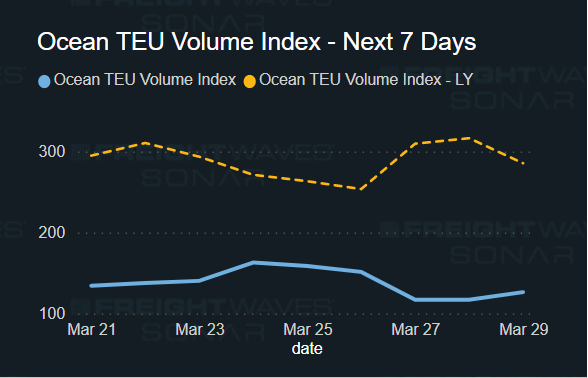

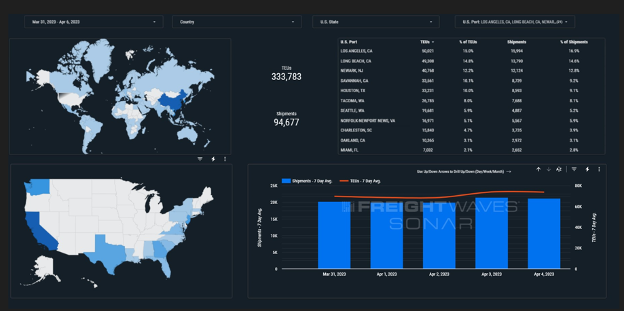

We have a 6.1% increase in imports this week compared to last week, a small percentage although helpful for the start of the quarter, is not quite leaps and bounds to celebrate over Q1. It makes you wonder what the months ahead look like for 2023? Last week at the American Association of Port Authorities’ annual legislative summit John Wolfe, CEO of the Northwest Seaport Alliance, which includes container terminals at the ports of Seattle and Tacoma, Washington, is seeing similar downward volume trends. “Optimistically I believe we’re going to see a stronger second half. It’s a matter of how much stronger,” he told attendees. “Are we going to have a peak season later this year? In talking to our customers, most are pretty optimistic. They’re watching their inventories go down, and I think they recognize that in the second half of the year, in preparation for the holiday season, they’re going to need to replenish. “My one concern is, what is the Federal Reserve going to do — are they going to continue to ratchet up interest rates, and if so, how will that affect consumer demand? That’s something everyone’s watching. But from our perspective, we’re investing in our infrastructure as though we’re going into recovery in the second half and into 2024.”

Taking a look back over the past 2 years: Ocean container net income has been on a consistent downturn trend since Q4 of 2022 – Total industry net income of 2022 Q4 was down 41.1% at $34.7 billion compared to 2021 Q4 that was $52.5 million earned.

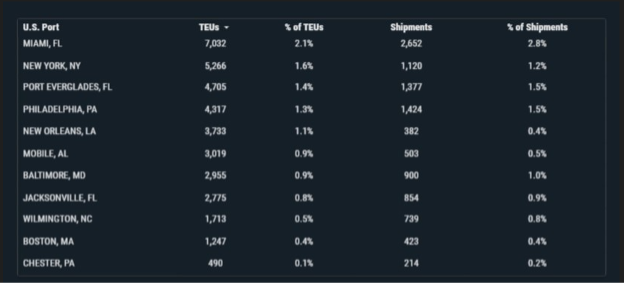

What’s happening at the ports and rails?:

You can find all the information on the page below where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads

A couple highlights:

Many Ports will be closed and rails will have minimal operation hours Friday April 7th in observance of the holiday – click on the link above for the complete list

Jacksonville: Slight congestion in the afternoon due to reduced terminal hours and empty equipment shortages

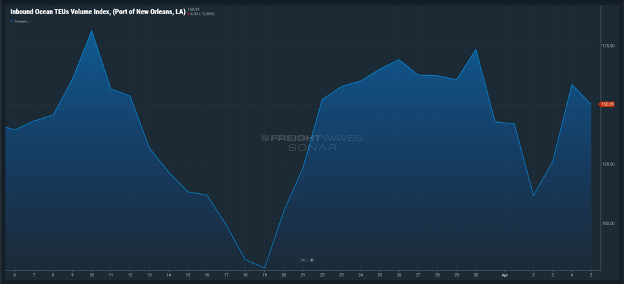

New Orleans: 40’ Chassis shortages causing excessive wait times

Montreal: The port is experience heavy volume causing dwell time of 4-7 days for containers hitting the rail

Cleveland Rail: There is a slight chassis shortage in Cleveland, nothing major at the moment but we will keep an eye on the situation over the next few weeks

We are passionate about keeping you connected with up to date information about the ports and rails as well as keeping you informed on critical industry news and Port X Logistics asset, location and team updates and you can see it all here https://www.linkedin.com/company/port-x-logistics-llc/ .Please follow our LinkedIn page as we strive for 10k followers!

Did you know? With potential rail dwells and chassis situations impacting the flow of rail drayage on the horizon, we offer a killer solution. How does getting ahead of your competition by pulling off same day drayage, transload and over the road trucking sound to you? Port X Logistics is confident that we can fulfill that promise with the help of your paperwork prior to the container’s arrival. If the steamship line approves your request to diverge the container to stay at the port before it prepares to hit the rail, in most cases, we can get your container out of the port, transloaded into a dry van and on to the delivery location within the same day. Oh! and we even offer a no demurrage guarantee to boot. Contact us today for more information and how we successfully get it done every day. Letsgetrolling@portxlogistics.com

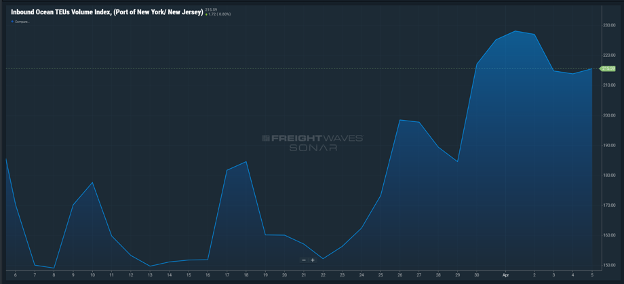

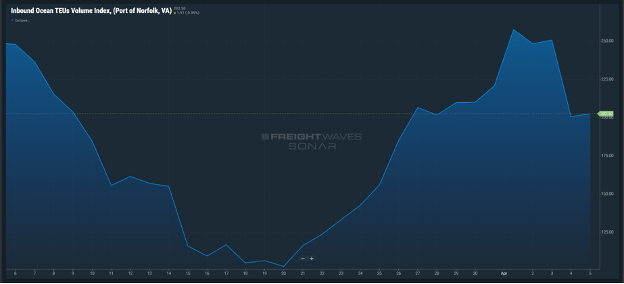

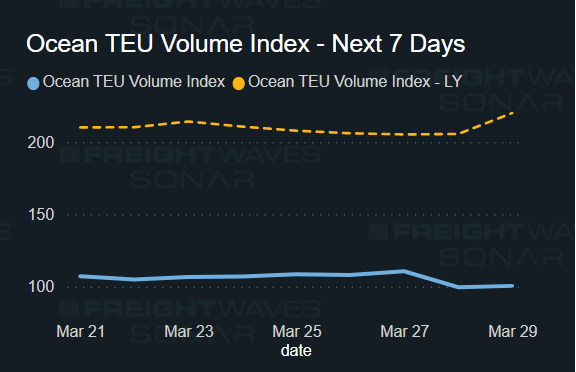

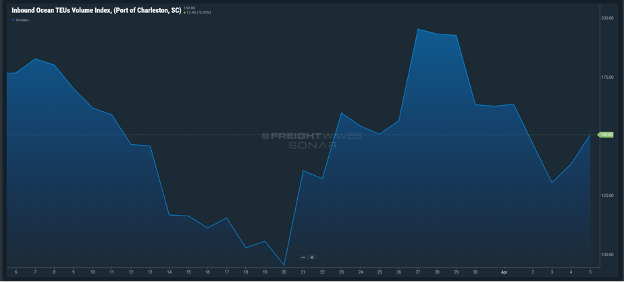

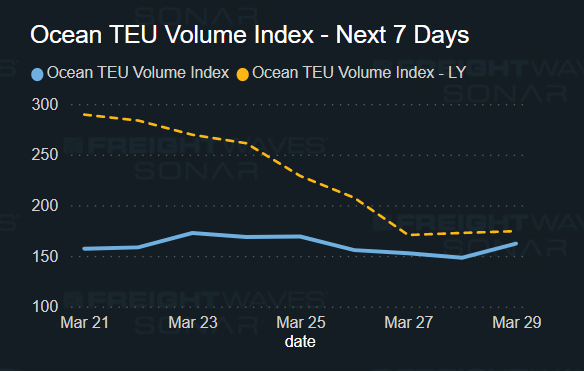

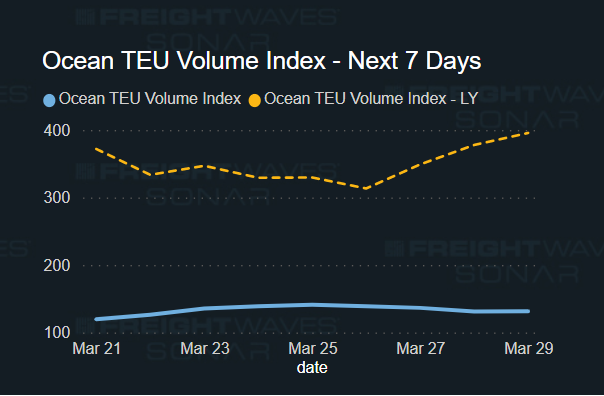

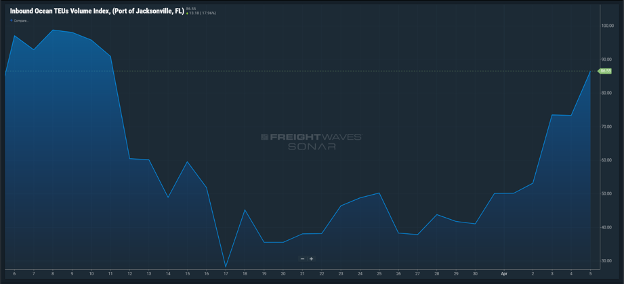

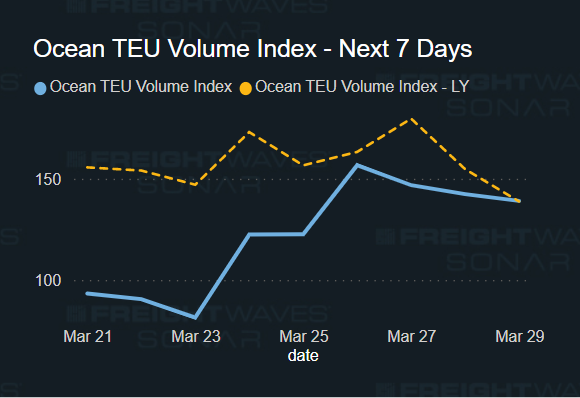

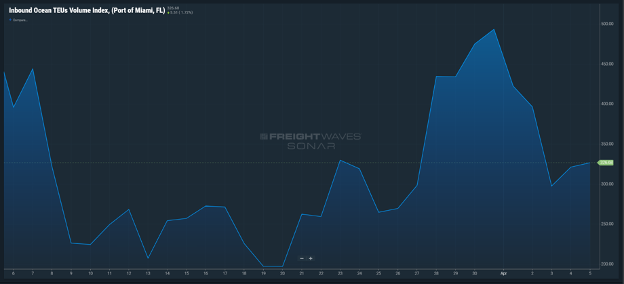

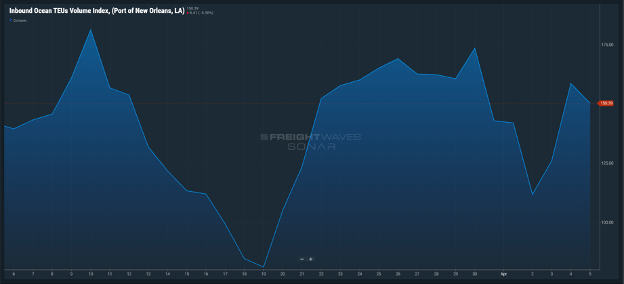

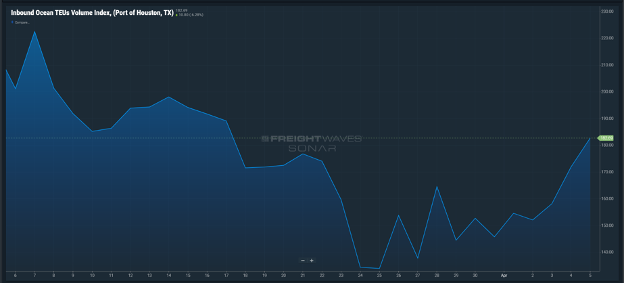

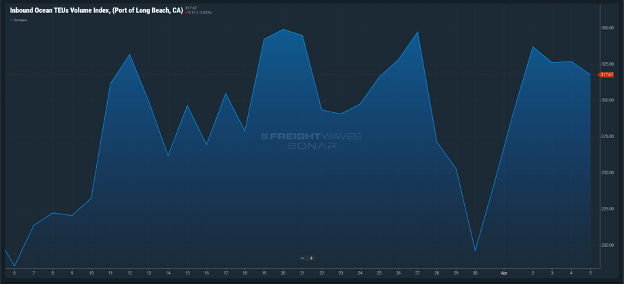

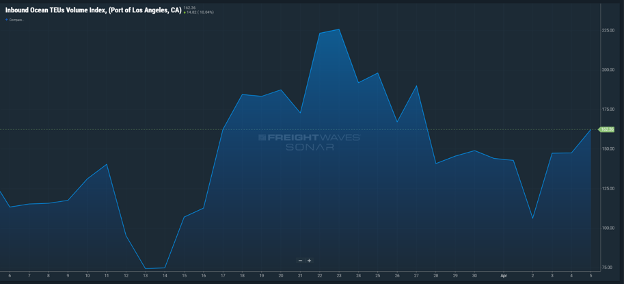

SONAR Images