The News

Even with the supply chain being slow, there is still a lot of drama going on everywhere! Potential strike threats are getting hot during this year’s midterm election time and talks of diesel fuel shortages in the US (it has been said that currently the US only has 25 days of diesel supply in reserve) are increasing rates and hitting some nerves. I will keep a close watch on both, it will be my pleasure to digest the stressful news first, I have been in the supply chain/logistics industry for over 20 years. I am a seasoned vet, well trained in managing my ulcers and praying to the freight gods. I got this!

A majority of The Brotherhood of Railroad Signalmen (BRS) has also voted against ratifying the union’s tentative labor agreement that members of the Brotherhood of Maintenance of Way Employees Division rejected earlier this month. A Freightwaves article from October 26th states the BRS announced Wednesday that 60.57% of voting members opposed ratification, largely due to President Biden thoroughly rejecting a union proposal to add paid sick time for short-term absences to the existing system https://bit.ly/3U2oJmN.

The possibility of a rail strike still lurks around the corner like your creepy neighbor, however early December would be the probable timeframe if a strike is going to take place. If you notice how fast the time has been going, early December will seem like next week! Midterm elections, in my opinion, could likely play a part in the contract decisions, so I guess we are in the middle of a waiting game. Rail dwells still exist and will only get slower, which reminds me of a group discussion that I was a part of yesterday about the hardships of port and rail congestion. Dwell time has a lot to do with congestion, as does chassis shortages and empty return issues and the list goes on. If these are pre-strike matters that already exist, just imagine a post-strike fallout. It will be even scarier than your creepy neighbor.

The jurisdictional dispute over the Port of Seattle terminal has put contract negotiation talks on hold for what could possibly be a few more months. The inability to get past the jurisdictional issue in Seattle has now led some observers to conclude that the contract negotiations between the International Longshore and Warehouse Union (ILWU) and Pacific Maritime Association (PMA) are unlikely to be resolved this year. “I don’t see it getting resolved in the next couple of weeks,” Gene Seroka, executive director of the Port of Los Angeles, told JOC.com this week. “We’re probably months away.”

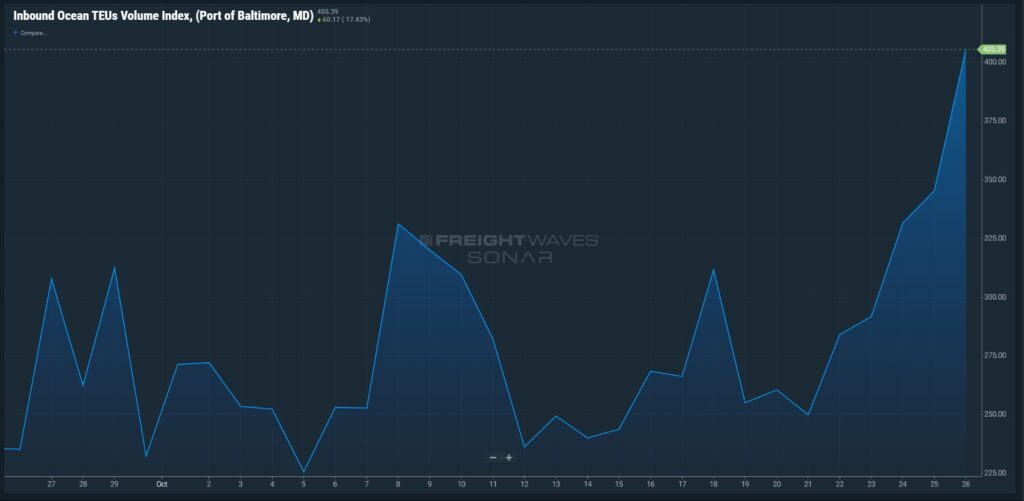

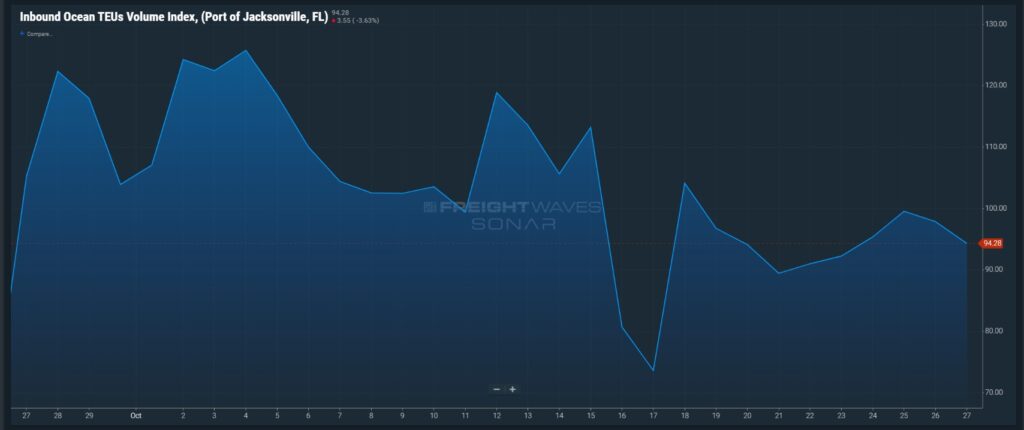

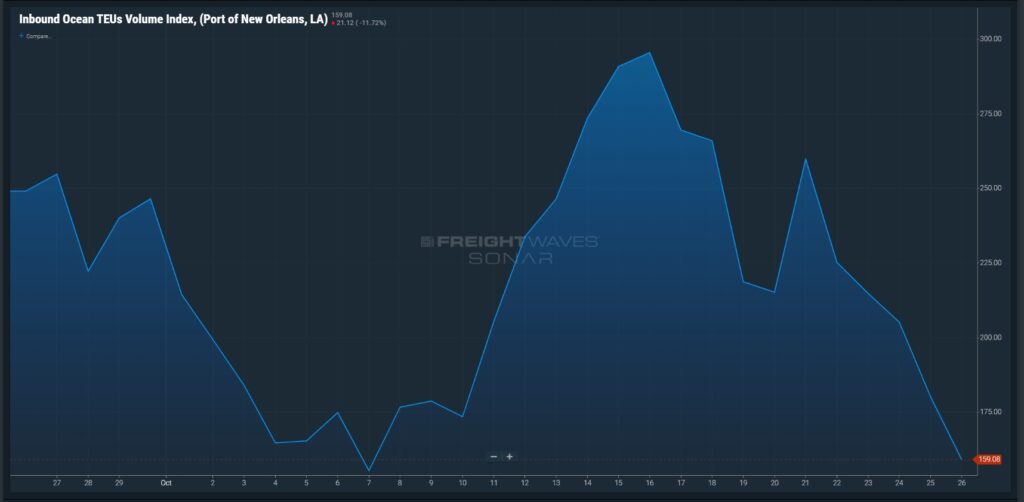

The longer it takes to get resolved, the more cargo will be diverted to East and Gulf coast ports and to Canada, some of it permanently, and the greater the risk that port disruption tied to the negotiations will grow. https://bit.ly/3Na4mC1.

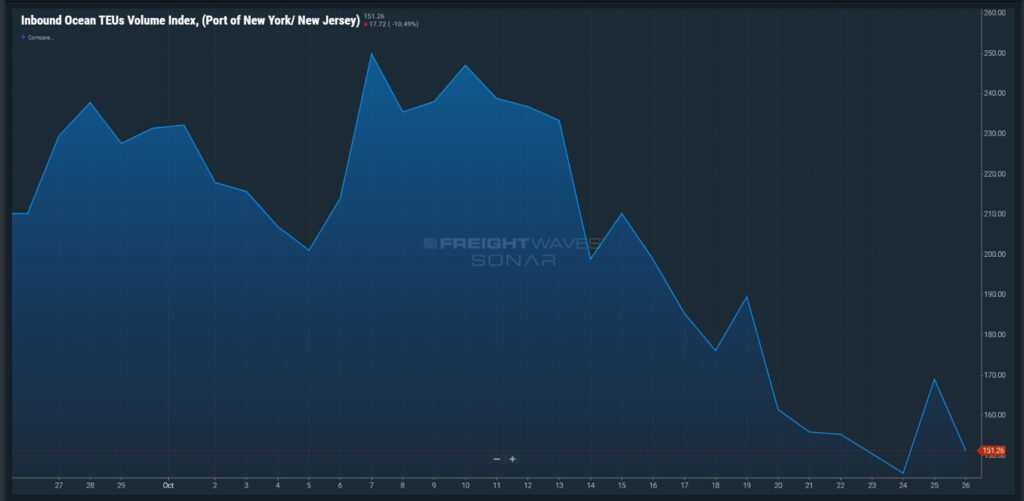

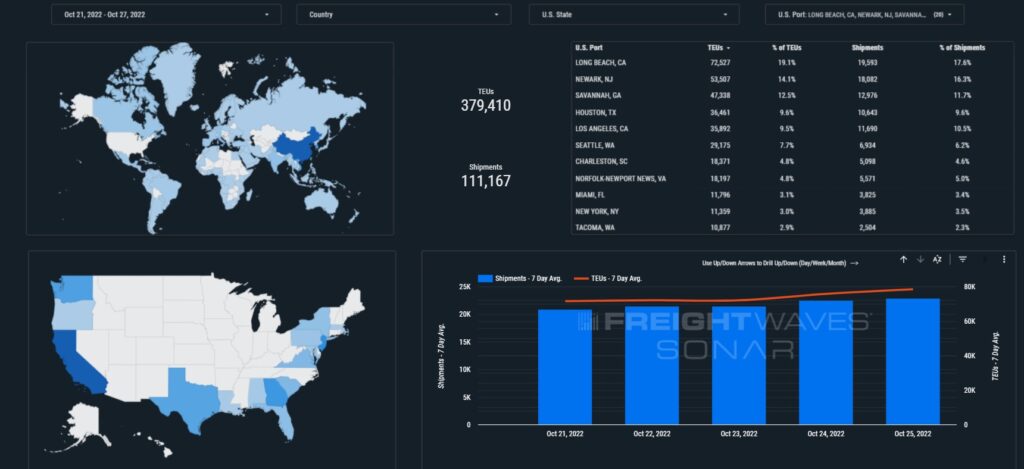

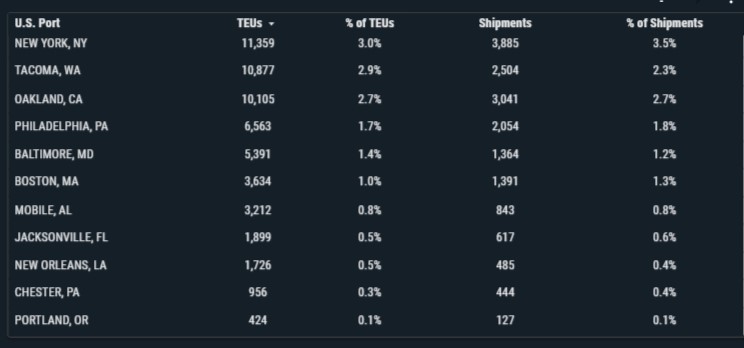

TEU volumes increased this week a little bit, up 3.48% from last week, not causing much impact to current port congestion. Want to hear some crazy data? TEU volumes are down 74% this week from the same week last year in 2021. What has caused such a change? If last year mostly reflects the need for inventory fulfillment due to pandemic shutdowns, why are we still having inventory shortages on auto parts and electronic parts? These are the kinds of topics that fill my brain, keeping me up at night.

What are the port hardships this week?

- Oakland Empty return appointments for some major steamship lines are backed up well over a couple weeks causing additional yard storage and chassis days. It is unclear if these lines will charge per diem for these idle empty containers, but anything is possible.

- NY/NJ Same thing, some steamship lines are currently not entertaining empty returns, truckers yards are getting overflowed causing them to refuse work containers from these particular steamship lines.

What looks positive this week?

· LA/LGB Softer cargo volumes were a major contributor to improved fluidity at the ports. Container vessels at anchor are down 93% from January. The average street dwell for a 40-foot chassis this week is down to 9.7 days from almost 11 days in early September, according to the Pool of Pools that is managed by the three largest intermodal equipment operators in Southern California. Laden import containers sitting on chassis at warehouses have been the major cause of the chassis shortages at LA/LGB Ports.

· Savannah North Atlantic right whale vessel speed restrictions reduce the likelihood of lethal collisions between vessels and these endangered whales. NOAA Fisheries announced proposed changes to the North Atlantic right whale (Eubalaena glacialis) vessel speed rule to further reduce the likelihood of mortalities and serious injuries to endangered right whales from vessel collisions. Listen, this may not directly impact your port planning for the week, but in a post-recent pandemic world where more people value animals over humans, this is a beautiful newsworthy law!

Did you know? November is the month of gratitude, and we are grateful for our Leadership team this month. Did you also know? They are crazy, but full of heart. Every summer since 2019, our Leadership team embarks on an annual hike led by Founder Brian Kempisty and Chief Heart Officer, Dionne Kress in the mountains of Montana. Far from “glamping” the team prepares to take on steep altitudes, erratic weather conditions and many many tears. All for the experience of getting uncomfortable to build better leaders. They have life changing stories because they want to inspire people to change their own lives. Port X Logistics is all about stories and we love to share them!

Contact the leadership team via letsgetrolling@portxlogistics.com .

~Jill Rice

Sonar Images