Port of Tacoma

2457 words 9 minute read – Let’s do this!

Welcome to this week’s Market Update — where the biggest story isn’t a single disruption, but the steady build of pressure points that are reshaping how freight moves in early 2026. Tariffs remain the headline risk that refuses to fade, and not because the rules are brand new, but because the direction keeps shifting. With U.S. container imports softening to close out 2025 and January forecasts still pointing lower year over year, importers are navigating a market where timing decisions are being driven as much by policy expectations as by true demand. At the same time, elevated duty levels and fresh tariff threats are creating ripple effects that show up everywhere from ordering behavior and sourcing strategy to port flows and inland execution. This week we break down what tariff uncertainty really means for shippers — including why frontloading cycles can create a “container hangover,” how volatility can quietly distort capacity planning, and why flexibility across gateways, routing, and inland networks is becoming a competitive advantage. We’ll also take a look at the air freight side of the equation, where early January volumes are rebounding faster than expected and the industry is moving toward a major visibility upgrade with IATA’s ONE Record data standard. And for shippers managing urgent moves, we’re spotlighting how Carrier 911 helps keep critical freight on schedule when the clock is loud and there’s no room for missed delivery windows. Don’t forget to follow Port X Logistics on LinkedIn for real-time perspective and market commentary — or get our Thursday Market Updates delivered straight to your inbox by reaching out to Marketing@portxlogistics.com.

As 2026 unfolds, tariff policy remains one of the most influential forces shaping U.S. supply chain behavior and container import volumes — not because the rules are new, but because the direction continues to evolve. U.S. container imports softened at the end of 2025, with December volumes down nearly 6% year over year, a decline widely tied to tariff-driven frontloading earlier in the cycle and continued sourcing adjustments across key retail and industrial categories. Forecasts for January point to ongoing year-over-year weakness, reinforcing that importers are still operating cautiously as they balance inventory levels, demand uncertainty, and the risk of sudden policy shifts. In today’s environment, cargo timing is increasingly influenced by tariff expectations, not just seasonality or traditional ordering patterns. The tariff landscape itself remains broad, active, and difficult to plan around. The average U.S. tariff rate climbed sharply over the course of 2025 — rising from roughly 2.5% at the start of the year to more than 15% by year-end — marking one of the most aggressive tariff environments in decades. New levies continue to emerge across industrial inputs and consumer goods, and recent developments suggest the scope is widening rather than narrowing. In mid-January, additional 25% tariffs were introduced on select high-performance AI chips as part of a broader push to encourage domestic manufacturing, while fresh tariff threats tied to geopolitical tensions in Europe have also entered the equation. A recently announced 10% tariff on imports from several European nations could potentially rise to 25% by mid-year if conditions are not met, increasing the risk of retaliation and escalation that could ripple into procurement strategies, landed costs, and trade lane behavior.

For supply chains, this combination of elevated duties, new levies, and persistent headline risk is more than a compliance issue — it’s changing how freight moves. Tariff uncertainty has repeatedly triggered preemptive ordering and frontloading, pulling cargo forward into late 2024 and early 2025, and leaving behind a “container hangover” that is now showing up as weaker year-over-year volumes into early 2026. That pattern complicates forecasting and capacity planning for carriers, ports, and inland providers alike, because demand signals become distorted: volume surges and slowdowns are increasingly driven by policy timing rather than true consumption. The result is a market that can look calm on the surface, but remains highly reactive underneath, with sudden shifts in volume and capacity needs that challenge service reliability.

Financial markets are reflecting that same uncertainty. Recent tariff headlines have contributed to renewed investor concern around trade conflict risk, with typical risk-off signals showing up through a softer dollar, higher gold prices, and rising yields as markets attempt to price in escalation scenarios. For shippers, however, volatility doesn’t automatically translate into disruption — and in many cases, it creates opportunity for those who plan early. Even with talk of new levies and potential retaliation, economists continue to suggest the inflation impact of a baseline 10% tariff scenario may be limited, which supports a more cautious — rather than chaotic — outlook for demand. That matters because in a softer freight environment, execution and consistency often outperform pure rate moves, and shippers who stay ahead of the curve can protect service levels while keeping costs under control. At the same time, the policy direction from Washington is becoming clearer: investment and incentives are increasingly being steered toward “strategic industries” such as industrials, materials, energy, and technology. As corporate commitments and domestic buildouts accelerate, these sectors are positioned to support steadier freight demand tied to components, industrial inputs, and time-sensitive replenishment — even if discretionary retail import demand remains uneven. In other words, while trade policy headlines may stay noisy, the underlying freight picture can still generate meaningful volume in the sectors moving critical cargo, supporting more consistent flows in certain lanes and equipment types.

What this means for shippers: 2026 is shaping up to reward proactive planning and flexibility. Tariff conditions can shift quickly, and the biggest risk isn’t always the tariff itself — it’s the ripple effect on timing, capacity, and execution. Importers should expect more uneven volume patterns as cargo is pulled forward or delayed based on policy expectations, which can create short-term congestion pockets, equipment imbalances, and sudden rate pressure even in a softer market. The shippers who win in this environment will be the ones building optionality: diversifying routing and gateway strategies, keeping alternative sourcing plans ready, and maintaining the ability to pivot between port pairs or inland modes when conditions change.

This also puts a premium on visibility and inland readiness. When tariff uncertainty drives last-minute ordering shifts, the pressure often shows up after the vessel discharge — at terminals, rail ramps, and warehouse doors. Shippers should tighten coordination of drayage and transloading, confirm storage and chassis access ahead of peak weeks, and treat appointment windows and last free day management as core parts of cost control. In practical terms, the best defense against tariff-driven volatility is a supply chain that can move freight quickly off-dock, reposition inventory efficiently, and adjust distribution plans without creating service failures downstream. In a year where policy risk may influence trade flows as much as the broader economy, execution speed and flexibility will be the competitive edge.

Global air cargo markets typically slow down in late December and early January as holiday retail demand fades and networks reset, but early January 2026 data is showing a faster-than-usual recovery. Volumes increased roughly 5% versus the prior two weeks, signaling that airfreight demand is stabilizing sooner and that time-sensitive shipping activity is re-engaging after the year-end lull. That matters because air cargo often reflects the health of urgent, high-value supply chains first—technology components, healthcare and life sciences, perishables, and expedited replenishment moves that can’t wait for ocean transit. A rebound at this stage suggests shippers are already back in motion, and it also supports stronger network utilization, which can improve schedule reliability and reduce the need for last-minute premium capacity buys as January progresses. Don’t let urgent freight be the burden to your 2026. Carrier 911 is built for the moments when everything goes sideways — and this year, we’re bringing the speed, precision, and calm execution your supply chain needs when the clock is loud. While others are still “circling back,” our team is already moving, solving, and recovering the shipments that absolutely cannot miss.

At the same time, the air freight industry is preparing for a major visibility upgrade through adoption of the IATA ONE Record data-sharing standard. The shift is significant because it moves air cargo away from fragmented status updates and disconnected systems toward a more unified “single record” for each shipment that can be shared securely across carriers, forwarders, ground handlers, and other stakeholders. By centralizing shipment data and standardizing how it is exchanged, ONE Record has the potential to reduce reporting gaps, improve real-time transparency, and speed up exception management when disruptions occur. With more than 70% of industry stakeholders already familiar with the framework and pilots underway across the market, 2026 is shaping up to be a year where airfreight becomes not only more active after the seasonal dip, but also more digitally coordinated—giving shippers better control, faster decision-making, and fewer surprises in a mode where minutes and visibility often matter as much as cost. Our Carrier 911 crisis-response specialists are airfreight veterans available 24/7/365, ready to jump on AOG recoveries, hotshots, expedited ground, aerospace, industrial, and automotive moves, plus front- and back-end charters and first/last-mile OBC. If it’s urgent, complex, or mission-critical, that’s our lane. Need wheels right now? Our exclusive-use Sprinters, straight trucks, and dry vans are staged and ready at a moment’s notice — with real-time tracking, zero-guesswork visibility, and instant PODs delivered straight to your inbox. No chasing updates. No surprises. For a free demo, email info@carrier911.com or schedule here: www.portxlogistics.com/tech-demo/

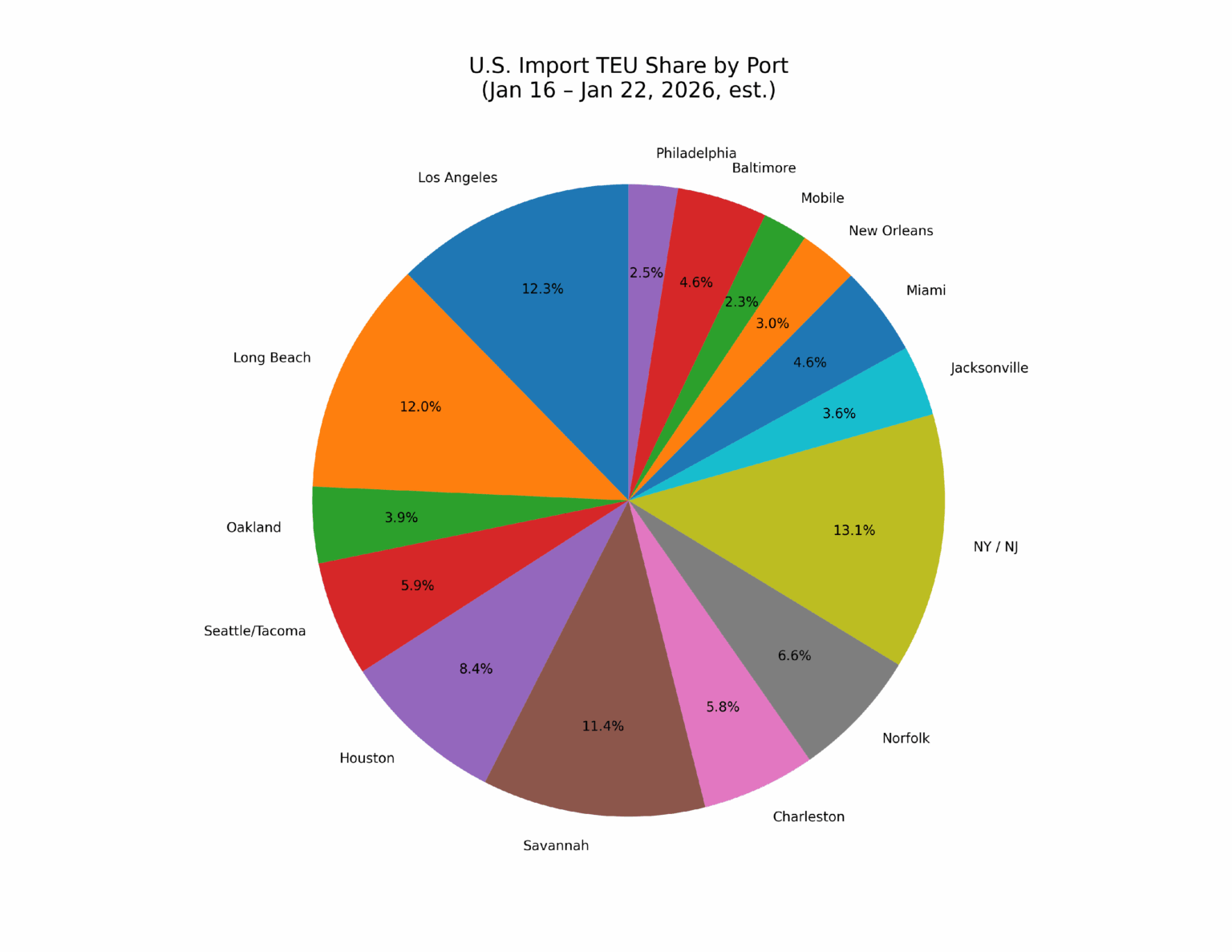

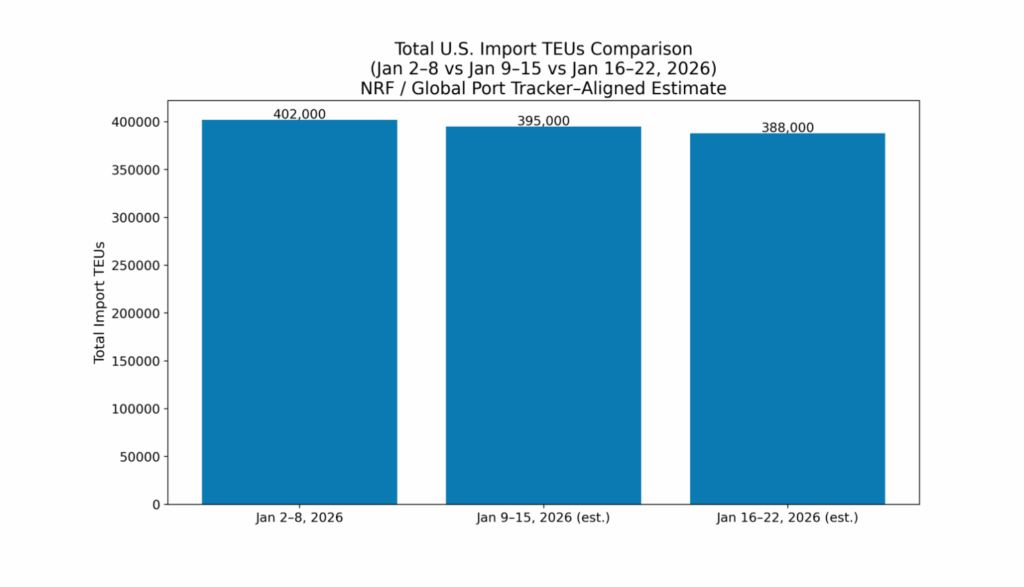

TEU’s are down 1.77% over last week, with majority coming into New York/New Jersey 13.1%, Los Angeles 12.3% and Long Beach 12%. Tariff Watch: Why Imports Are Still Uneven in Early 2026 – Tariff uncertainty continues to be one of the biggest “hidden hands” shaping U.S. container imports as 2026 begins. After a frontloading cycle pulled freight forward in late 2024 and early 2025, the market is now digesting higher landed costs and more cautious ordering behavior—especially for China-origin cargo. December U.S. container imports fell nearly 6% year over year, signaling that demand is softening even as the supply chain remains highly reactive to policy headlines. The result for shippers is a more unpredictable planning environment: cargo timing shifts based on tariff expectations, not just seasonal demand, and that volatility can ripple into ocean capacity, port flows, and inland transportation pricing.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

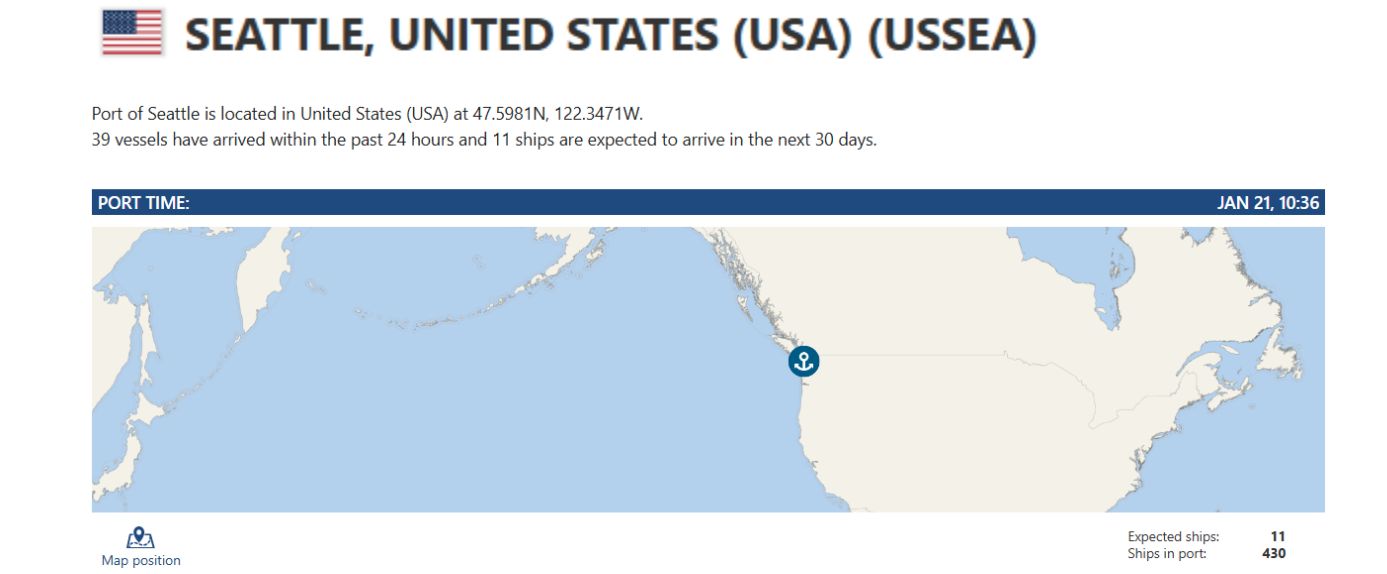

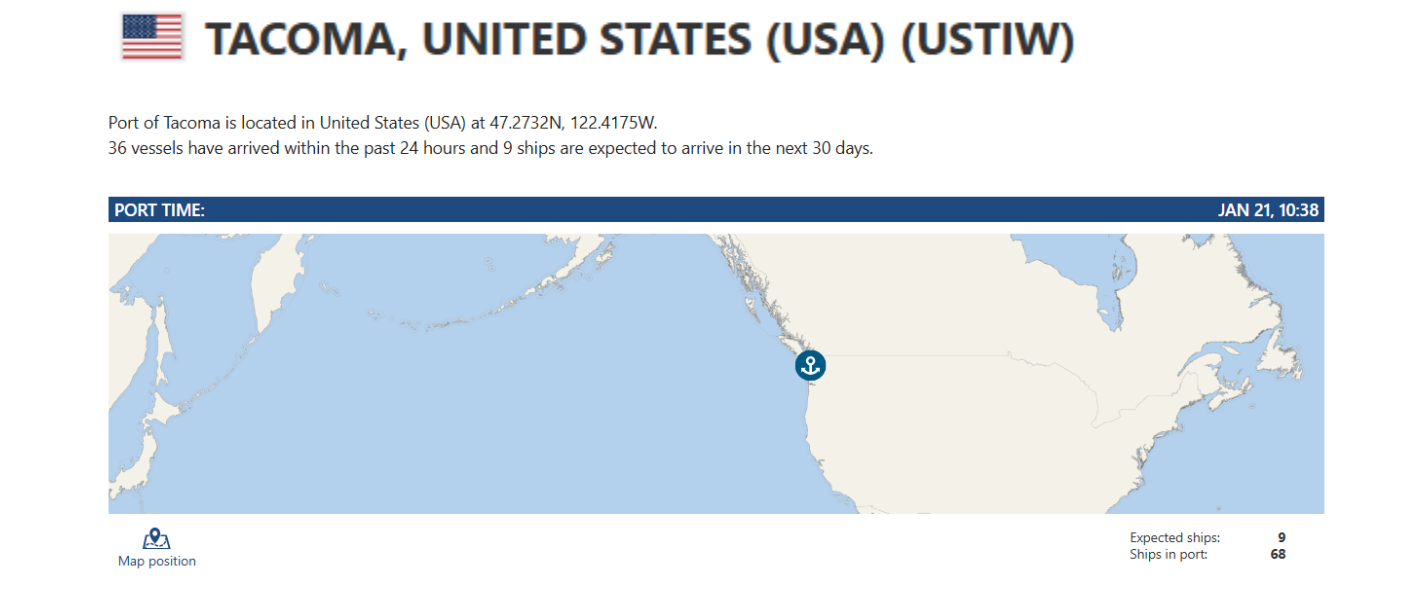

Seattle/Tacoma: Seattle is starting 2026 with noticeably softer volumes, but the slowdown is creating a rare advantage for shippers: breathing room. With fewer import surges hitting the terminals at once, the Northwest Seaport Alliance is positioned for smoother vessel operations, faster truck turns, and more predictable inland flow compared with the stop-and-go congestion cycles that can show up during peak demand periods. A quieter January can translate into better appointment availability, less terminal crowding, and improved reliability for cargo owners moving freight through the Puget Sound gateway — giving shippers a chance to tighten execution, recover schedule consistency, and reduce costly surprises early in the year. At the same time, the Port of Seattle is using this period to push forward on long-term competitiveness through strategic leadership and sustainability initiatives. With Ryan Calkins installed as Commission President on January 13, the Port’s 2026 agenda is centered on innovation, workforce development, and continued progress on projects like shore power expansion and decarbonization — investments designed to strengthen the regional economy, support future trade growth, and prepare the gateway for major global visibility events like the 2026 FIFA World Cup. Port X is leveling up in Seattle–Tacoma with 11 new drivers added to the team and the drayage and warehouse capacity to match. Whether you need quick-turn transloads, consistent port pickups, or a reliable flow plan when volumes and schedules start shifting, our SEA/TAC operation is built for speed, accuracy, and clean execution. With the right equipment, local know-how, and dependable capacity on the ground, we help keep Northwest freight moving without the usual friction. Want to put Seattle and Tacoma to work for your network? Reach out at letsgetrolling@portxlogistics.com — we’re ready to roll.

Chicago: At the Chicago rail crossroads, recent weeks have brought a mix of strategic capacity gains and broader traffic signals that bode well for rail users in 2026. Norfolk Southern’s launch of the East Edge double-stack intermodal route between Chicago and New England promises faster, higher-capacity moves for containers heading out of the Midwest into Northeast markets, while early January rail traffic data show intermodal and carload volumes moving ahead of last year’s pace. The Midwest Association of Rail Shippers winter meeting in Chicago also put the spotlight back on the proposed Union Pacific–Norfolk Southern merger, signaling that network design and service innovation will remain key themes through the year ahead. Together, these developments suggest momentum around service expansions, infrastructure optimization, and capacity alignment at a gateway that still ties much of North America’s freight system together. Chicago is staying busy — and Port X is built for exactly that pace. Our asset-based drayage operation in the Windy City is running strong with 88 trucks, 150 chassis, and the specialty equipment to handle the hard freight, including tri-axles and spread axles. With secure yard space and the permitting muscle for overweight moves, we keep containers moving cleanly across Chicagoland, rail ramps, and regional lanes without the usual bottlenecks. If you need capacity that actually shows up and a team that stays proactive from dispatch to delivery, hit us up at letsgetrolling@portxlogistics.com — we’re ready to roll.

Did you know? Port X Logistics is turning up the heat for 2026 — and our next stop is Las Vegas 🎲🚛

We’re lining up a major inland expansion with a new Port X facility in Las Vegas tentatively planned for Summer 2026, designed to give shippers more control over the lanes that matter most. This move will support drayage service to and from the Las Vegas and Salt Lake City rail ramps, along with secure yard storage built for fast turns, flexible overflow, and smoother inland execution. The goal is simple: unlock smarter routing options across the Southwest and Mountain West, while adding speed, capacity, and reliability to your network when the market shifts.

Keep an eye on LinkedIn for launch updates, timelines, and a few extra surprises we’re cooking up for 2026. And if you want to get ahead of it now, email marketing@portxlogistics.com — we’d love to connect early.

Import Data Images