Port of Chicago

2061 words 8 minute read – Let’s do this!

Welcome to a new year and the first Market Update of 2026! As we turn the page on another chapter in global logistics, the industry isn’t stepping into a blank slate so much as a reset. After years defined by disruption and rapid swings, this new season begins with a quieter market on the surface, but one that remains complex and highly reactive underneath. Geopolitical risk, uneven capacity deployment, regulatory enforcement, and shifting trade patterns are all setting the tone for a year that will reward discipline, flexibility, and strong execution over volume alone. This Market Update kicks off a new season of insight as we track how 2026 unfolds across ocean, rail, trucking, and inland networks. TEU volumes are already ticking higher week over week, West Coast ports are operating with rare stability, and regulatory changes are quietly reshaping truckload capacity — reminders that even in calmer conditions, the system can pivot quickly. As always, our goal is to cut through the noise and focus on what actually matters for shippers navigating the year ahead. Don’t forget to follow Port X Logistics on LinkedIn for real-time perspective and market commentary — or get our Market Updates every Thursday delivered straight to your inbox by reaching out to Marketing@portxlogistics.com. Here’s to a smart, strategic start to 2026 — let’s get rolling.

As 2026 begins, the global ocean freight market remains on unstable footing. Uncertainty surrounding the Red Sea continues to influence carrier behavior and inject risk into an already fragile supply-demand balance. While some operators are monitoring a potential return to Red Sea transits, an early reopening could release excess capacity back into the market at a time when trade volumes remain muted, increasing volatility rather than easing it. This caution is echoed across global trade. Despite the U.S.– China tariff truce extending through November 2026, shippers and carriers remain reluctant to commit to aggressive volume growth. Clear signals of long-term trade normalization have yet to emerge, and expectations for a meaningful rebound remain low through at least the first half of the year. As a result, some alliances continue routing vessels around South Africa, highlighting how geopolitical and operational risk — not just cost — is shaping network decisions. Global container capacity continues to grow, but unevenly. New vessel additions have been concentrated on routes linking Asia with the Middle East, the Indian Subcontinent, Africa, and Europe, while transpacific capacity has declined and transatlantic capacity has increased. Intra-Asia and Asia–Latin America growth has been modest, creating pockets of congestion on certain regional trades even as long-haul demand remains soft. Weak demand is keeping pressure on freight rates across most major lanes. Post-holiday slowdowns in the U.S. and Europe, combined with ongoing inventory digestion, have weighed on Asia–Europe and Asia–U.S. pricing. Carrier attempts to push rates higher through blank sailings and general rate increases have struggled to gain traction, with short-lived spikes reinforcing the market’s sensitivity to even small capacity shifts.

Northeast Asia reflects this softness, with subdued demand in Taiwan and South Korea — particularly on U.S. West Coast routes — keeping rates under pressure. Brief increases have faded quickly as excess capacity returns, though stronger intra-Asia flows between China and Southeast Asia are tightening space in select markets and lifting local charges.

Across China, congestion and seasonal dynamics ahead of the Lunar New Year are shaping conditions. Northern port delays are supporting higher intra-Asia rates, while tight transshipment capacity through hubs such as Singapore, Port Klang, and Kaohsiung is firming pricing into January. East China carriers are preparing peak season surcharges after rates fell below sustainable levels, while South China is expected to see gradual increases as pre-holiday restocking accelerates. Southeast Asia is also tightening under the combined effects of congestion and holiday demand. Port Klang delays are pressuring Malaysian exports, while space constraints are emerging in Thailand and Vietnam on China-bound and intra-Asia lanes.

Advance bookings are increasingly important for Europe and U.S. routes, with modest rate pressure building across the region. Singapore remains relatively stable, though early planning is still advised.

India’s market remains comparatively steady, with ocean rates largely holding despite announced increases for January, though fog-related inland disruptions may complicate supply chains. In North America, demand remains weak, with Asia–U.S. volumes falling to one of their lowest monthly levels since mid-2023. Limited carrier discipline and minimal blank sailings reduce the likelihood of near-term tightening, keeping rate relief in place but making early booking around the Lunar New Year essential.

Overall, the outlook for 2026 remains cautious. Ongoing routing uncertainty, uneven capacity deployment, muted demand, and localized congestion are expected to keep the ocean freight market fragile and highly reactive as the year unfolds. In a market defined by uncertainty and rapid shifts, having the right execution partner matters more than ever. Port X Logistics is built for exactly these conditions, combining boots-on-the-ground drayage expertise with flexible transload and inland trucking solutions across key U.S. gateways. Our teams operate where congestion, routing changes, and capacity mismatches are felt first — and solved fastest — giving shippers the ability to pivot ports, reroute freight inland, and protect service levels without disruption. With real-time visibility, disciplined carrier networks, and scalable warehouse and yard capacity, Port X helps importers turn volatility into optionality, keeping freight moving efficiently even when the market refuses to cooperate.

A 2026 regulatory enforcement — not demand — is emerging as a quiet but powerful force shaping U.S. truckload capacity. A series of recent federal actions has put renewed focus on who is legally qualified to hold and maintain a commercial driver’s license, with particular emphasis on citizenship status, domicile requirements, and English-language proficiency. While these rules are not new, enforcement has intensified, and the downstream effects on capacity are becoming harder to ignore. The most visible flashpoint has been California, where the U.S. Department of Transportation withheld $160 million in federal funding after the state delayed revoking more than 17,000 CDLs issued to drivers deemed ineligible under federal standards. The move underscores a broader shift toward stricter compliance and signals that federal agencies are willing to apply financial pressure to force alignment. At the same time, large freight stakeholders are adjusting their own policies. These actions point to a meaningful tightening of the eligible driver pool, particularly in regions and fleets that have relied heavily on non-domiciled or marginally compliant labor. While the full impact may not be immediate, the risk to capacity is real. Drivers losing credentials, contractors being removed from networks, or carriers needing to re-screen and restructure fleets all reduce available truck supply — even in a market where freight demand remains relatively soft.

For trucking rates, this creates a disconnect between surface-level demand signals and underlying capacity fundamentals. Spot and contract pricing may appear stable in the near term, but regulatory-driven capacity erosion can quickly tighten lanes, especially during seasonal surges or regional disruptions. In practical terms, fewer compliant drivers mean higher utilization of remaining capacity, upward pressure on wages, and less flexibility for shippers when freight needs to move fast. As enforcement expands beyond isolated cases, trucking capacity — not cargo volume — could become the limiting factor for rate stability in key U.S. corridors in 2026.

For shippers, stricter CDL enforcement adds a new layer of risk that won’t always show up in headline freight data. Even in a softer demand environment, reduced driver eligibility can tighten capacity quickly on specific lanes, at ports, or during seasonal surges. Shippers should expect more variability in truck availability, greater sensitivity to lead times, and upward pressure on rates when compliance-driven capacity constraints collide with demand. Working with carriers and logistics partners that prioritize credentialed drivers, maintain flexible routing and transload options, and plan capacity well in advance will be critical to protecting service levels and cost stability as these enforcement trends unfold.

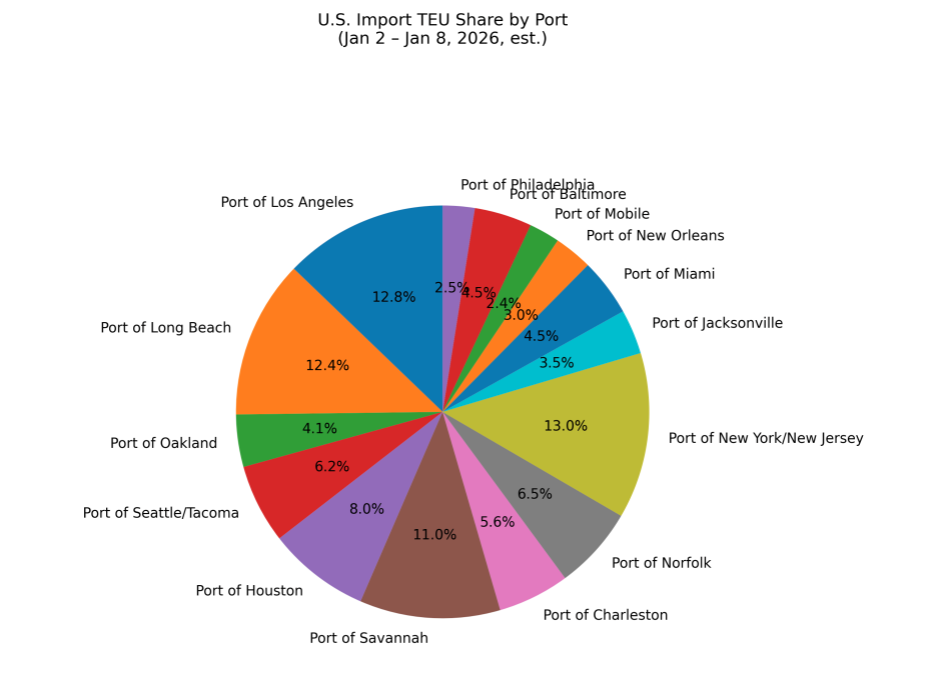

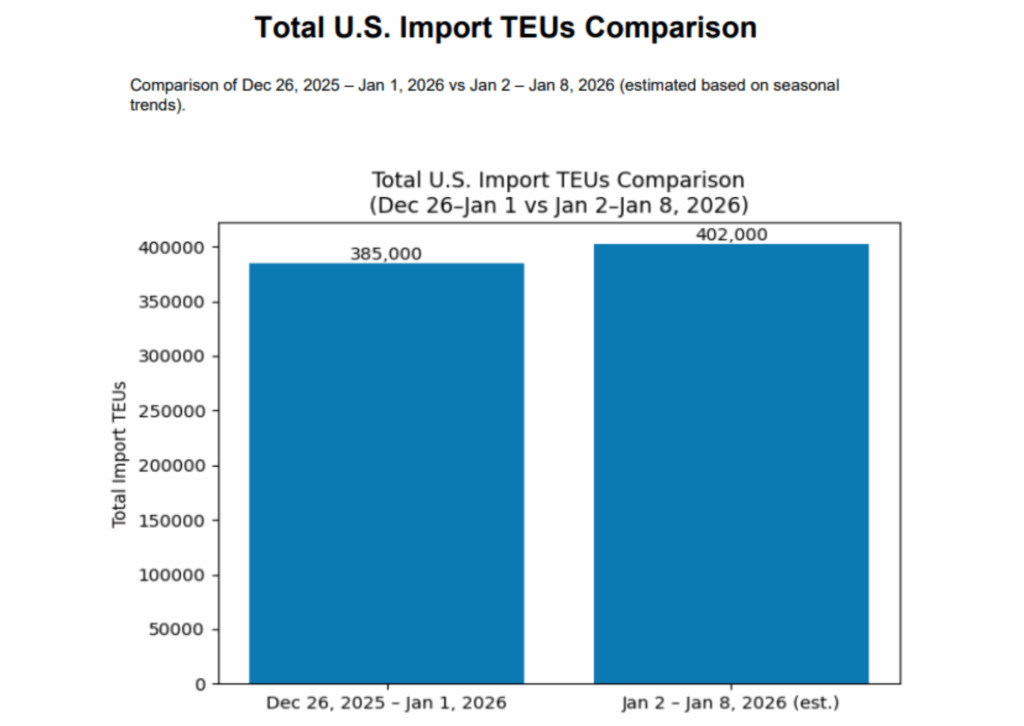

TEU’s are up 4.41% over last week, with majority coming into New York/New Jersey 13%, Los Angeles 12.8%, and Long Beach 12.4%. West Coast ports are entering early 2026 with a rare advantage: soft demand and steady operations. After holding onto the market share gains achieved during 2024’s supply chain reshuffle, Pacific gateways benefited again in 2025 from tariff-driven frontloading and faster Asia transit times. As volumes cooled in the back half of the year, congestion remained limited — a trend that is expected to continue through Q1 2026 as import demand stays muted. Even with sharp demand swings throughout 2025, West Coast gateways proved more resilient than in past cycles. Improved forecasting, tighter coordination across terminals, drayage, rail, and warehouses, and faster truck turn times helped absorb peak summer volumes without triggering prolonged bottlenecks. The result has been a more balanced, predictable operating environment despite uneven cargo flows.

Looking ahead, macroeconomic headwinds are likely to cap near-term growth. Elevated inflation, softer consumer sentiment, and cautious retail ordering are expected to limit any meaningful pre-Lunar New Year surge, extending year-over-year softness into the first half of 2026. At the local level, stakeholders are also monitoring infrastructure constraints in Southern California, where a long-term bridge redecking project near the Port of Los Angeles could introduce episodic roadway congestion. While mitigation plans are in place, access and drayage fluidity will remain an operational watchpoint as the year unfolds.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Houston: On December 31st, the U.S. Coast Guard’s Vessel Traffic Service issued a Low Water Advisory for the Houston Ship Channel and Galveston Bay due to negative tide levels in the region. Mariners were advised to account for reduced water depth when planning transits. While these conditions were temporary, they underscore the importance of real-time navigational awareness for carriers and vessel planners calling Houston’s terminals. Our LaPorte transload facility is purpose-built to move freight fast — and handle the heavy stuff without hesitation. From palletized cargo to industrial commodities like lumber and steel coils, we deliver quick turns, safe handling, and the flexibility needed in today’s unpredictable market. That capability extends beyond the port through our Dallas operation, where an additional 19 trucks, secured yard space, and smart regional routing give shippers room to adapt. Whether it’s overflow management, equipment repositioning, or tightening up Gulf-to-inland flows, Port X Logistics provides the scale, control, and execution to keep freight moving. Ready to put our Houston –Dallas network to work? Reach out at letsgetrolling@portxlogistics.com — and let’s get rolling.

Chicago: Chicago remains the backbone of the U.S. intermodal network as 2026 begins — even without a single headline event driving the story. Capacity uncertainty, tariff pressure, regulatory shifts in driver availability, and potential rail consolidation continue to shape how freight moves through the nation’s busiest inland hub. The proposed Union Pacific–Norfolk Southern merger remains a key watchpoint, with the potential to streamline interchanges and reduce crosstown drayage if approved. Because Chicago connects West Coast rail flows to Midwest and East Coast corridors, these dynamics will play an outsized role in shaping rates, availability, and service reliability through mid-year. That’s where Port X operates. With 88 trucks, a 150+ chassis pool, and more than 100 heavy haulers on the ground, our Chicago team is built to handle overweight imports, tight turns, and complex drays when execution matters most. Need a reliable drayage partner in Chicago? Reach out at letsgetrolling@portxlogistics.com and let’s make it happen.

Did you know? The countdown is officially on as we lock in plans for Port X’s return to TPM — and 2026 is shaping up to be our strongest showing yet. This marks our fourth year as a sponsor, and every time we head to Long Beach, we’re reminded why TPM stands apart. It’s not just another conference — it’s where real conversations happen, ideas get challenged, and the industry reconnects.

You’ll find the Port X team right where the action is, posted up on the promenade across from the Hyatt Regency in our usual spot. Stop by, say hello, and let’s catch up on everything from logistics and supply chain strategy to whatever else is worth talking about that week.

We’ve also got a full lineup of events planned throughout TPM week, including lunches, dinner and the most fun: helicopter tours over the port! You won’t want to miss what’s on the calendar. If you’d like to be included, send a note to letsgetrolling@portxlogistics.com and we’ll make sure you’re in the loop. Let’s make TPM 2026 one to remember.

Import Data Images