Port of Seattle

2200 words 8 minute read – Let’s do this!

As the year winds down and holiday playlists replace port alerts (at least temporarily), we’re closing out 2025 with a supply chain that looks very different than it did twelve months ago. Instead of reacting to crisis, the market is recalibrating — catching its breath after a year of front-loaded inventory, cautious ordering, and constant risk management. This final Market Update of the year is all about what comes next: how U.S. container and air import dynamics are setting up Q1 2026, why today’s calm is more of a transition than a landing, and where smart shippers can find opportunity as we turn the page into the new year. Consider this your send-off into 2026 — equal parts reflection, outlook, and strategy for what lies ahead. As the market evolves, insight matters. Follow Port X Logistics on LinkedIn or subscribe at Marketing@PortXLogistics.com for Thursday Market Updates that deliver timely intelligence to help your operation stay agile and prepared for 2026.

U.S. container import volumes entering the first quarter of 2026 are expected to reflect the aftereffects of aggressive front-loading earlier in 2025. Many importers moved inventory forward to hedge against policy changes and supply-chain disruptions, leaving warehouses fuller than usual as the year winds down. That dynamic is likely to suppress ordering activity in January and February, resulting in softer-than-average volumes and uneven weekly flows rather than a clean, seasonal rebound. This is not a collapse in demand, but a digestion phase as inventories normalize.

Ocean freight rates are likely to remain under pressure early in Q1, supported by ample vessel availability and cautious purchasing behavior. However, the current softness is being influenced by temporary capacity absorbers — including ongoing Red Sea diversions, intermittent congestion in Europe and Asia, and conservative carrier deployment strategies. If those conditions ease, or if carriers respond to margin pressure by idling or scrapping tonnage more aggressively, capacity could tighten faster than many shippers expect. The early months of 2026 therefore represent a narrow window where negotiating leverage, routing flexibility, and operational planning are all working in favor of importers.

Gateway strategy will play a more prominent role than simple rate comparison in this environment. While Southern California remains a dominant entry point for U.S. imports, upcoming infrastructure projects and network strain reinforce the importance of optionality. East Coast and Gulf gateways may offer steadier flows for certain cargo profiles, but the real differentiator will be inland execution — drayage availability, rail performance, and transload flexibility. Q1 is when these networks can be evaluated, adjusted, and optimized without the pressure of peak-season congestion, allowing shippers to pressure-test strategies before demand returns.

Taken together, the container market in early 2026 appears less defined by volume growth and more by discipline. Shippers that treat this period as a planning opportunity — rather than a pause — will be better positioned when ordering cycles resume and carrier capacity management tightens the market later in the year.

U.S. air import demand entering Q1 2026 is expected to follow a more traditional post-holiday pattern, with softer volumes in January and gradually stabilizing conditions as the quarter progresses. After the year-end surge tied to e-commerce and retail replenishment, capacity availability typically improves and pricing pressure eases. This creates a more predictable airfreight environment — but one that is increasingly defined by control and reliability rather than pure speed. Air imports will continue to play a critical role for sectors that cannot afford disruption, including pharmaceuticals, aerospace, automotive components, and high-value manufacturing inputs. In addition, many importers are using air strategically to rebalance inventory positions, recover from ocean delays, or protect service levels when production or transit timelines shift. Rather than serving as an emergency solution, airfreight in early 2026 becomes a precision instrument — deployed intentionally to maintain continuity across broader supply chains.

One of the more notable shifts heading into 2026 is the growing adoption of blended air-and-ocean strategies. Importers are increasingly segmenting SKUs, moving baseline inventory via ocean while reserving air capacity for higher-value, time-sensitive, or delayed goods. The first quarter provides an ideal testing ground for these hybrid models, allowing companies to refine decision frameworks, improve visibility, and align internal teams before volumes and complexity increase later in the year.

In this environment, success in air imports will depend less on chasing the fastest transit and more on securing dependable execution, flexible capacity, and strong communication. Shippers that align early with partners capable of managing expedited moves, forecasting demand shifts, and integrating air decisions into broader logistics strategies will gain a measurable advantage as conditions evolve.

As the industry turns the page on 2025, the message for early 2026 is consistent across both ocean and air: this is not the time to wait for certainty. The quieter months ahead offer a rare opportunity to refine networks, lock in partnerships, and build resilience before volatility re-enters the market. Forecasts will always change, but preparation compounds. The companies that act now will be the ones best positioned to move quickly — and profitably — when demand begins to thaw.

Looking ahead to 2026, Carrier911 is your dependable support layer as networks grow more complex and timelines tighter. We help you stay agile, protect service levels, and respond quickly when plans shift — so your operation stays ahead instead of catching up. Carrier911 is built to keep freight moving — anytime, anywhere, without the stress. Our team of airfreight and expedited-logistics experts operates 24/7/365, supporting time-sensitive moves across air, ground, and first/last mile. From aerospace, industrial, and automotive shipments to high-priority expedited freight, we specialize in precision, speed, and reliability.

Need capacity on demand? Our exclusive-use Sprinters, straight trucks, and dry vans are ready when you need them. With real-time tracking, full shipment visibility, and immediate PODs, you’re always informed — even after hours, on weekends, or during peak season. Make sure your high-priority freight is the easiest part of your day.

For a free demo, email info@carrier911.com or schedule here: portxlogistics.com/tech-demo/

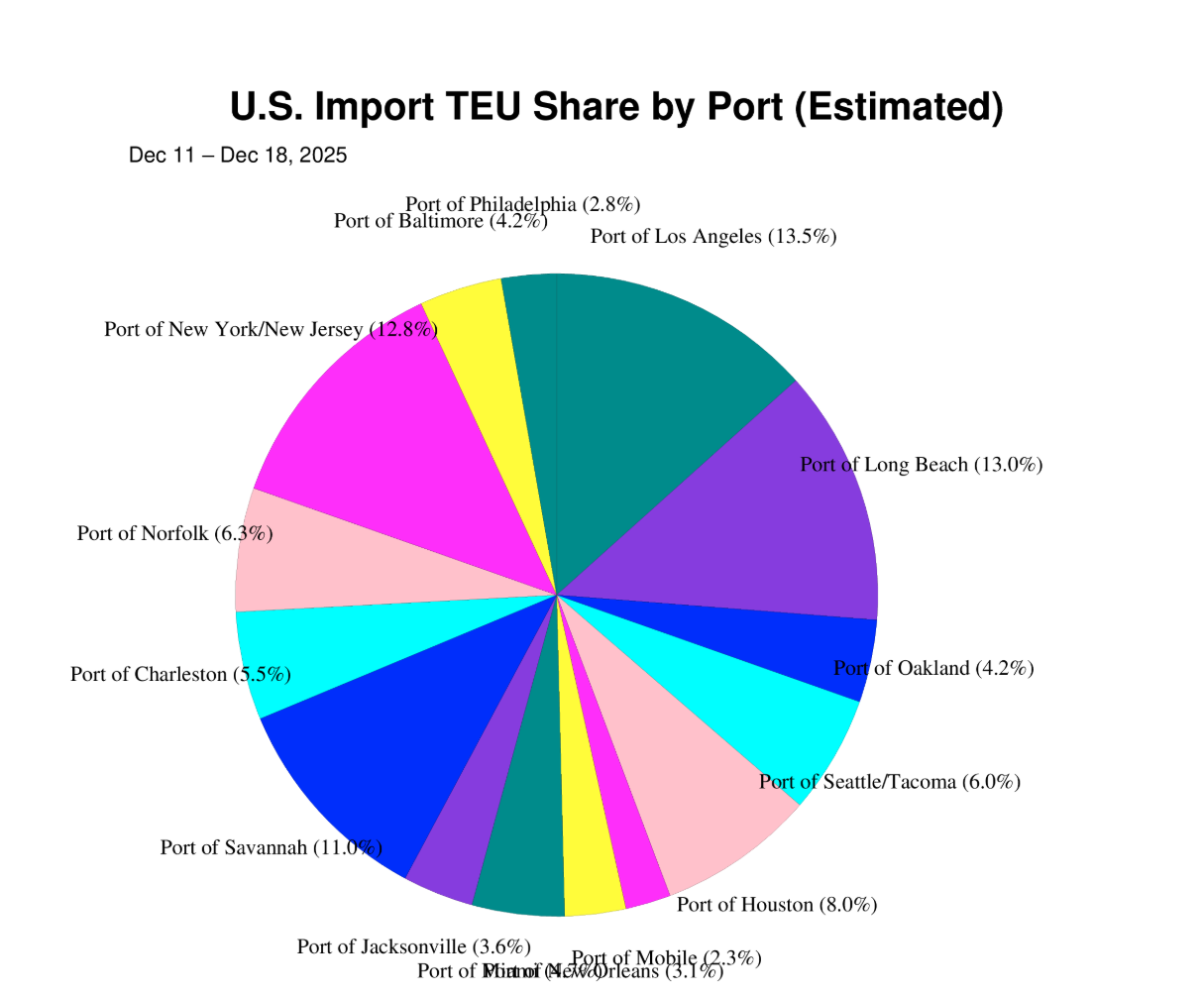

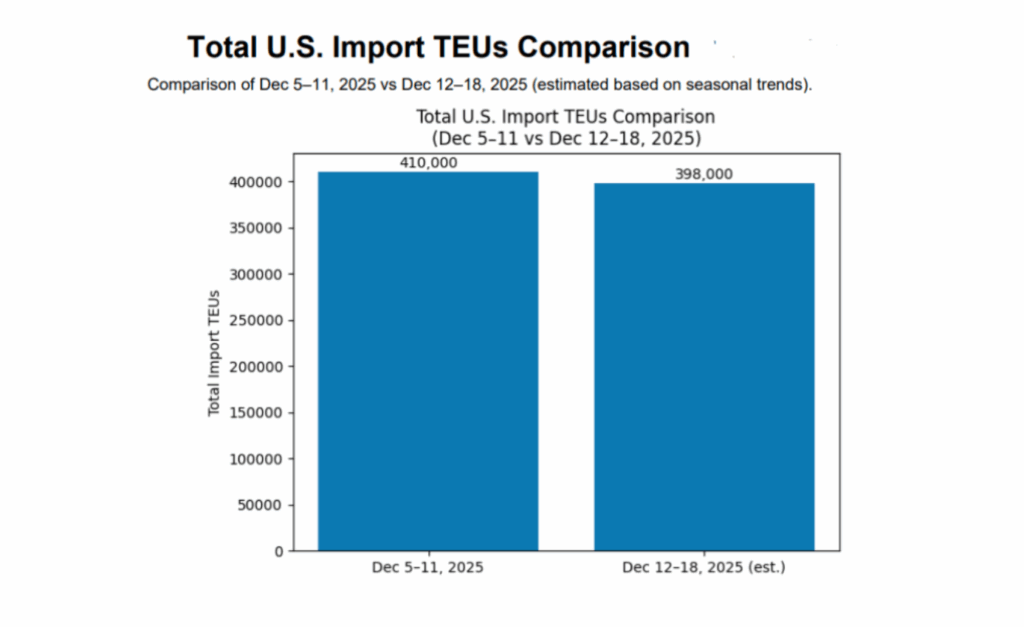

TEU’s are down 2.92% over last week, with majority coming into Los Angeles 13.5%, New York/New Jersey 12.8% and Long Beach 13%. A growing number of independent analysts are converging on the same conclusion: the real capacity story isn’t about how many ships arrive in 2026 — it’s about how little demand is left to absorb what’s already here. While new container tonnage deliveries are set to slow next year compared with 2025, the market impact may actually intensify as growth cools and the industry inches closer to a structural imbalance.

According to forecasts from BIMCO and Drewry, global container demand growth is expected to decelerate to the low single digits in 2026 — roughly 2.5% to 3.5% — well below the pace seen during the post-pandemic rebound. That slowdown follows a period of aggressive inventory front-loading, which pulled demand forward and left many importers entering 2026 with fuller warehouses and more cautious ordering behavior. In short, volumes aren’t collapsing — but they’re no longer growing fast enough to mask excess capacity. At the same time, industry analysts warn that today’s rate stability is being propped up by temporary capacity absorbers, not structural fixes. Ongoing congestion in parts of Europe, intermittent bottlenecks in Asia, and continued Red Sea diversions have all tied up functional capacity that would otherwise be available to the market. Clarksons data shows these disruptions have absorbed a meaningful share of the global fleet — but that buffer could unwind quickly if conditions normalize.

Alphaliner and Drewry have also pointed out that carrier discipline remains historically light. Vessel idling levels are still low relative to market conditions, and scrapping activity is well below pre-pandemic norms — despite rising fuel costs, emissions regulations, and aging fleets. While carriers are clearly aware of the imbalance risk, many are delaying decisive action in hopes that demand rebounds or disruptions persist long enough to justify keeping ships active.

The implication for shippers is clear: today’s soft rates and improving reliability are not permanent signals of balance — they’re symptoms of a market in pause mode. Sea-Intelligence data shows schedule reliability improving as excess capacity gives carriers more flexibility, but history suggests these calm periods often precede sharper capacity pullbacks once pricing pressure intensifies.

For importers and logistics planners, this reinforces why 2026 strategy needs to be built now — not once volatility returns. The current window offers lower congestion, better negotiating leverage, and time to pressure-test routings and inland execution before the next shift hits. When carriers eventually idle tonnage or accelerate scrapping, the market could tighten faster than many expect.

In other words, 2026 may not start loud — but it’s unlikely to stay quiet. The companies that treat this period as a reset, rather than a slowdown, will be best positioned to capitalize when demand cycles turn and capacity discipline finally catches up to reality. Ocean freight markets are showing signs of softness heading into the new year — but that isn’t necessarily bad news for importers. Across many major trade lanes, spot container rates have fallen sharply from their recent highs, thanks to a mix of softened demand, increased vessel capacity, and importers drawing down on earlier front-loaded inventory. Routes from Asia to the U.S. West Coast, for instance, have seen spot rates decline significantly over recent months, with broad downward pressure evident across global indices. At the same time, capacity is growing: new ships are entering service, and carriers are managing deployments more conservatively — a factor that contributes to sustained rate softness and helps prevent sudden spikes. The result is a better negotiating position for shippers who move decisively.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Savannah: Looking ahead to 2026, one inland development worth watching closely is the Blue Ridge Connector, Georgia Ports Authority’s new inland rail terminal in Gainesville, Georgia, scheduled to open in spring 2026. Designed to extend the Port of Savannah’s reach deeper into Northeast Georgia, the facility will offer direct double-stack rail service via Norfolk Southern, giving importers and exporters a faster, more cost-effective alternative to long-haul trucking. With capacity for roughly 200,000 container lifts annually, the Blue Ridge Connector is expected to reduce truck miles through the Atlanta corridor while improving inland reliability for shippers serving the Southeast. For cargo owners, this shift means more routing optionality and earlier inland decision-making. Containers moving through Savannah will have a new rail-served off-dock release point, making transload planning, drayage coordination, and inventory positioning even more critical. we’ve lowered transload rates in Savannah. Our South Atlantic fleet covers Savannah, Charleston, and Jacksonville with hazmat capabilities, yard space, and a full-service transload warehouse ready for urgent cross-docks. Reach out at letsgetrolling@portxlogistics.com for immediate capacity and competitive rates.

Seattle/Tacoma: At the Northwest Seaport Alliance, which oversees the Ports of Seattle and Tacoma, November container volumes reflected the broader market reset underway across U.S. gateways. Throughput totaled about 253,500 TEUs, down 12.6% year over year but improved from October, signaling early stabilization after earlier inventory front-loading. International imports were down nearly 19% year over year, with exports also softer. Despite these headwinds, the Alliance is prioritizing reliability heading into 2026, recently awarding over $330,000 to carriers delivering strong schedule consistency and on-time arrivals. At the same time, the Port of Tacoma continues advancing modernization and clean-air initiatives, including electric cargo-handling equipment, reinforcing long-term efficiency and resilience at the gateway. Momentum is building in the Pacific Northwest. Our Seattle–Tacoma operation has expanded with 11 new drivers, strong drayage capacity, and a warehouse team built to move fast and stay precise. From rapid-turn transloads to steady, high-volume port flows, we’re set up to keep freight moving when conditions shift. In a market that rewards execution, our SEA/TAC team brings dependable capacity, the right equipment, and local expertise that keeps cargo flowing smoothly through the Northwest. Curious how Seattle and Tacoma can work harder for your network? Connect with us at letsgetrolling@portxlogistics.com — we’re ready when you are.

Did you know?🎰 Port X Logistics is going ALL IN for 2026 — and we’re headed to Vegas! 🎰

Big moves are on the board, and the next chip we’re placing is Las Vegas.

🚛 Tentatively planning for Summer 2026:

- A new Port X facility in Las Vegas

- Drayage service to and from the Las Vegas & Salt Lake City rail ramps

- Secure yard storage designed to support fast, flexible inland moves

This expansion strengthens our inland strategy and opens new routing options across the Southwest and Mountain West — giving shippers more speed, control, and capacity where it matters most.

🔔 Stay tuned: Follow us on LinkedIn for launch updates, timelines, and a few more surprises we have planned for 2026.

📩 Want in early?

If you’d like to learn more about our Las Vegas + SLC plans, email marketing@portxlogistics.com — we’d love to connect.

Import Data Images