Port of Chicago

2039 words 8 minute read – Let’s do this!

It’s the season of sparkly lights, holiday playlists, and pretending we’re not refreshing container tracking apps at family gatherings. U.S. imports may have hit the brakes in November — down 7.8% year-over-year after earlier inventory front-loading — but it still shaped up to be one of the strongest Novembers we’ve ever seen. Ports are flowing, ocean rates are softening, and there’s actually room to breathe… for now. The numbers hint that this could be the quiet pause before a Q1 restock rush and a very eventful 2026. With new leadership stepping in at the Port of Long Beach and major infrastructure upgrades looming in Southern California, change is definitely in the air. Add in favorable rate dynamics for early movers, and there’s a lot of opportunity wrapped up like a bow for those already planning their next supply-chain play. The market might be cooling, but smart shippers are heating up their 2026 strategy — locking in capacity, optimizing routings, and setting themselves up to win when demand thaws. Stay ahead of the next shift: Follow Port X Logistics on LinkedIn or subscribe at Marketing@PortXLogistics.com for Thursday Market Updates that keep your operation festive, fluid, and future-proof.

U.S. container imports dropped by 7.8 percent in November compared with a year earlier, as softer demand for goods from China and a shorter Thanksgiving holiday month combined to reduce volumes, according to a recent report by Descartes Systems Group. That said, November still ranked as the fourth-strongest November on record — handling about 2.18 million TEUs — a point of resilience against a backdrop of trade-policy uncertainty and economic headwinds. The decline was especially steep for imports from China, which dropped nearly 20 percent year-over-year, and this slump had an outsized impact on national totals. Over the first 11 months of 2025, container volumes overall came in almost flat compared with 2024 — up by just 0.1 percent — after a strong start to the year, reflecting a broader pullback in ordering behavior and import activity. Much of this softness stems from retailers building inventory earlier in the year — anticipating tariffs and supply-chain disruptions — which has left many with full warehouses heading into the holiday season. As a result, Global Port Tracker (compiled by National Retail Federation (NRF) and Hackett Associates) projects several months of lower-than-normal import volumes, with November and December expected to mark the slowest period of 2025.

Looking ahead into 2026, the outlook remains mixed — but not without opportunity. While the first quarter may continue to feel the effects of front-loaded inventory and cautious consumer demand, the underlying strength in overall trade patterns suggests that the market could rebound when restocking cycles kick in. The low-volume period offers a window for logistics providers and importers to recalibrate capacity, streamline routing, and prepare for what may become a volatility-driven rebound once trade policy stabilizes and consumer demand resurges.

In short: November’s dip isn’t a collapse — it’s a reset. And for companies that plan ahead, 2026 could offer a chance to capitalize on lower congestion, better lead times, and smarter inventory positioning.

Heading into the new year, the Port of Long Beach is undergoing a major leadership transition. Longtime CEO Mario Cordero — who led the port through record-volume surges, pandemic disruptions, and ambitious environmental initiatives — is stepping down at the end of 2025. His successor, Noel Hacegaba, currently serving as the port’s COO, will assume the CEO role on January 1st, 2026. Hacegaba brings a deep institutional understanding of the port – 15 years in senior roles overseeing everything from commercial services and finance to infrastructure development and environmental compliance. During his tenure he also helped lead the port’s digital and operational modernization, including initiatives to improve cargo visibility and streamline throughput. As such, his appointment signals continuity – not upheaval – which should be reassuring for shippers, carriers, and inland partners watching capacity and flow dynamics closely.

Looking ahead to 2026, this leadership change may translate into meaningful advantages for the logistics community. Given Hacegaba’s background, the port is likely to continue focusing on infrastructure upgrades, operational efficiency, and sustainability – three themes that tend to support reliable routing and capacity stability. Given plans already underway for zero-emission transitions and modernization, we can expect POLB to stay competitive, which may help maintain throughput, minimize congestion, and potentially reduce turnaround times.

Some major infrastructure changes are scheduled for early 2026 around the Vincent Thomas Bridge – a critical connection between the Port of Los Angeles’ harbor terminals and the mainland highway network. The state has approved about $700 million for a full redecking and essential upgrades of the 60-year-old span, including replacement of the deck, railings, fences, seismic sensors, and median barriers. Because this bridge links San Pedro / Terminal Island to the broader freeway system, trucking and drayage traffic flowing in and out of the port area could be significantly impacted while work is underway. The project timeline calls for closures that could last 16 months — meaning, at some point in 2026, freight traffic may face detours, rerouted flows, longer transit times, and potential delays.

For shippers and logistics planners relying on SoCal gateways, this isn’t cause for panic — but it is a serious moment to review routing plans, timing, and inland drayage strategy. Consider building extra buffer time into schedules, exploring alternate gateway ports, or pre-booking drayage capacity to avoid last-minute congestion.

In the longer term, once the bridge work is complete, the upgrades promise improved structural integrity, safety, and reliability for years to come. For 2026 planning, think of this not just as a disruption, but as a necessary reset to keep Southern California’s gateway infrastructure strong — with ample lead time and smart planning, your freight doesn’t have to wait.

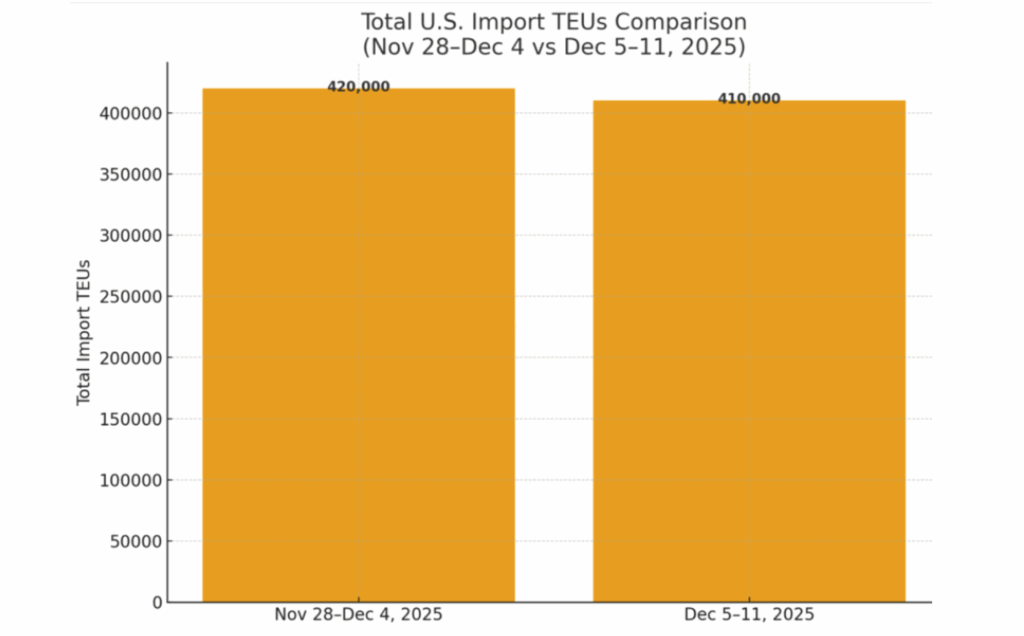

TEU’s are down 2.38% over last week, with majority coming into Los Angeles 13.2%, New York/New Jersey 12.8% and Long Beach 12.5%. Ocean freight markets are showing signs of softness heading into the new year — but that isn’t necessarily bad news for importers. Across many major trade lanes, spot container rates have fallen sharply from their recent highs, thanks to a mix of softened demand, increased vessel capacity, and importers drawing down on earlier front-loaded inventory. Routes from Asia to the U.S. West Coast, for instance, have seen spot rates decline significantly over recent months, with broad downward pressure evident across global indices. At the same time, capacity is growing: new ships are entering service, and carriers are managing deployments more conservatively — a factor that contributes to sustained rate softness and helps prevent sudden spikes. The result is a better negotiating position for shippers who move decisively.

For companies preparing freight plans for 2026, this environment can be viewed as an opportunity rather than a burden. Lower rates give buyers a window to lock in favorable contracts now — before any potential rebound in demand or policy shifts. By securing space while capacity remains ample and rates remain depressed, shippers can hedge against future volatility. That said, the softness may not last indefinitely. If consumer demand stabilizes or rises, or if unforeseen disruptions (weather, regulatory changes, or global re-routing) reintroduce capacity constraints, rate pressure could return quickly. For this reason, flexibility and early planning will be key in 2026. Freight buyers who build contingency into their sourcing — combining port and inland options, securing transport assets early, and maintaining visibility on bookings — will be better positioned to ride out swings and take advantage of favorable conditions when they arise. In short: the current lull in ocean freight rates isn’t a signal to relax indefinitely — but it is a timely moment to act. Smart planning now could lead to freight savings, smoother routing, and stronger supply-chain resilience when 2026 picks up steam.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Houston: Port Houston has issued a compliance update that shippers and carriers will want to act on quickly. As of December 9th, a new mandatory submission workbook — Version 8.0 — is required by the U.S. Coast Guard for all Notice of Arrival and Departure (NOAD / eNOAD) filings related to vessel movements. Older workbook versions are now rejected, meaning any stakeholder still using outdated documentation risks delays in vessel clearance and berthing schedules. With Houston continuing to handle strong Gulf-region import and export flows, tightening up documentation workflows is essential. This change reinforces a trend we’re seeing across major U.S. gateways: digital accuracy and real-time regulatory alignment are becoming just as critical to port fluidity as physical assets like cranes and terminals. For operators, this is a simple update — but ignoring it could create schedule disruptions that are entirely avoidable. In LaPorte, we don’t just move freight — we muscle it. Our transload warehouse is built for fast turns and heavy hitters, handling everything from standard palletized cargo to oversized industrial product like coils and lumber with confidence, safety, and speed. And the momentum doesn’t stop at the dock. Up the road in Dallas, our team brings 19 trucks, secured yard space, and smart routing strategies that keep cargo moving — whether you’re clearing port overflow, repositioning assets, or tightening up your Texas distribution game. From port-to-warehouse handoffs to cross-market coordination, Port X Logistics delivers the horsepower and precision needed to keep the Gulf region running hot. Want to see how our Houston + Dallas network can elevate your next move? Email letsgetrolling@portxlogistics.com — we’re ready when you are.

Chicago: Chicago’s intermodal infrastructure — especially in Will County and surrounding yard hubs — remains relevant and active, even when national freight volumes soften. For shippers routing to or through the Midwest, that means Chicago continues to offer a viable inland gateway: containers can transfer from rail to truck efficiently, and inland distribution is still structurally supported. However, the UP-NS merger introduces uncertainty. Depending on how regulators rule and how the new combined rail entity configures its network, smaller terminals or less-served corridors might see reduced service. That makes it a good moment for shippers to evaluate: if your freight depends on intermodal flexibility, it’s time to stress-test alternate routes, compare service guarantees, and consider contingencies — rather than assume current patterns last forever. Yet there is potential upside. If consolidation leads to smoother rail-transit lanes, reduced handoffs, and more consistent scheduling — especially through rail-heavy hubs like Chicago — intermodal could emerge more competitive vs. pure drayage, particularly for long-haul inland runs. In short: Chicago remains a freight-flow backbone for now — but 2026 could bring structural changes that make planning, flexibility, and partner selection more important than ever. Chicago is rolling — and so are we. Our asset-based drayage fleet in the Windy City is fully charged with 88 trucks, 150 chassis, and the specialty gear to handle the heavy stuff, including tri-axles and spread axles. With secure yard space and permit capabilities for overweight moves, we keep containers flowing smoothly across Chicagoland and beyond. When you need capacity that shows up and customer service that goes the extra mile, reach out at letsgetrolling@portxlogistics.com — our team is ready to move.

Did you know? TPM25 is sneaking up fast — and we’re fired up for our fourth year as a sponsor. Every year we walk away energized, reminded that TPM isn’t just another conference… it’s the place where the industry actually comes together. The conversations, the ideas, the reunions — there’s nothing else like it.

You’ll find us right where the action is: out on the promenade across from the Hyatt Regency, holding down our usual spot. Swing by, say hi, and let’s catch up on all things logistics, supply chain, and maybe a little fun too.

And if you want to get plugged into the events we’re hosting throughout the week — trust us, there’s a lot happening — shoot us a note at marketing@portxlogistics.com. We’ll make sure you’re on the invite list for all the good stuff. Let’s make TPM25 the best one yet!