Port of Savannah

1893 words 7 ½ minute read – Let’s do this!

Welcome to the final Market Update of November — the one where the freight market slows down, the news cycle takes a nap, and all of us collectively shift our focus to what really matters: eating like we trained for it and shopping like it’s an Olympic sport. With ports and rail ramps running smooth and steady, the timing couldn’t be better for a mini-break before we all dive headfirst into turkey, stuffing, pies, leftovers, and the glorious madness of Black Friday sales. But don’t worry — before we slip into our food comas and battle for discounted air fryers, we’ve got one last rundown of everything happening beneath the surface: trucking capacity shakeups, the ripple effects of paused China vessel fees, and Los Angeles creeping toward a historic TEU milestone. Keep your logistics game strong — follow Port X Logistics on LinkedIn or subscribe at Marketing@PortXLogistics.com for Thursday Market Updates that keep you one step ahead of the chaos.

Lower import and export volumes have kept U.S. ports and rail ramps running smoothly this fall. November’s activity mirrors October: terminals across the West, East, and Gulf coasts — along with major inland rail hubs — continue to operate at normal, fluid levels with minimal congestion. But stability on the surface doesn’t mean the landscape is standing still. Several developing factors could reshape capacity and service as we head toward 2026. The prolonged freight recession continues to thin the trucking sector. Elevated operating costs, weak rates, and tighter margins have pushed many small and mid-sized carriers out of the market. At the same time, federal actions targeting non-domiciled CDL holders and stricter English-proficiency enforcement could sideline a significant portion of the current driver pool. Some analysts estimate up to 600,000 drivers may ultimately be affected. If these trends continue, shippers could face meaningful capacity pressure — even in a low-volume environment. November also brought a noticeable jump in West Coast trucking activity. Many shippers appear to be securing capacity early or shifting freight patterns to get ahead of potential shortages. It’s too early to call it a trend, but it’s a movement worth watching as network planning for 2026 ramps up. For now, port and rail operations remain steady. But underlying structural changes — especially in trucking — could introduce volatility next year. Keeping a close eye on driver availability and shifting freight patterns will be critical as the industry enters 2026.

The short-lived China vessel fees may have been paused, but the conversation they sparked is far from over. For carriers servicing U.S. exporters — including those bringing agricultural commodities into our transload and inland networks — any unexpected spike in operating cost eventually finds its way into the total landed cost. And in a low-rate, low-volume environment, even small policy changes can reverberate quickly across the supply chain. Cosco and OOCL reportedly paid tens of millions in the first week alone. If these fees had continued, analysts projected potential exposure into the billions by 2026. That kind of overhead inevitably translates into higher freight rates, tighter capacity allocations, or both.

From a Port X standpoint, we’re watching two layers closely:

Export behavior:

China’s soybean buys are still lagging, with Brazil maintaining a heavy lead. Softer export flows can shift chassis balance, backhaul opportunities, and equipment availability at key hubs — especially LA/LB, Houston, and Norfolk.

Carrier cost structures:

If carriers face unpredictable expenses, we often see schedule shifts, blank sailings, and equipment repositioning ripple into our port drayage, transloads, and inland trucking timelines. The larger takeaway mirrors what Friedmann emphasized: if the U.S. wants its own maritime strength, investment in domestic shipyard capacity — like Hanwha’s Philadelphia expansion — is a more productive route than fees that ultimately land on U.S. shippers.

In a month where TEU forecasts are already soft — with U.S. ports trending lower sequentially into December — the pause on China vessel fees removes a major wild card from the cost stack. Had the fees stayed active, China carriers like Cosco and OOCL were on track to absorb hundreds of millions in new charges, which would have ultimately raised export rates right as volumes are thinning.

Exporters are already navigating a shifting demand picture. China has imported roughly 42M tons of soybeans from Brazil this year versus about 16M tons from the U.S. during January–July. Even with last month’s trade commitments, actual forward bookings remain far lighter than promised.

Higher carrier costs + weaker export pull-through = potential equipment imbalances and more volatility in port operations — especially at West Coast gateways.

Long-term, maritime competitiveness is pointing toward reinvestment rather than penalties. The SHIPS Act, Hanwha’s $5B Philadelphia shipyard expansion, MSC’s U.S.-flag move, and CMA CGM’s proposed $20B U.S. maritime investment all suggest a pivot toward rebuilding domestic capability instead of taxing foreign tonnage. For now, the fee pause reduces immediate rate pressure — but the underlying dynamics of tariffs, TEU softness, and export uncertainty remain very much in play.

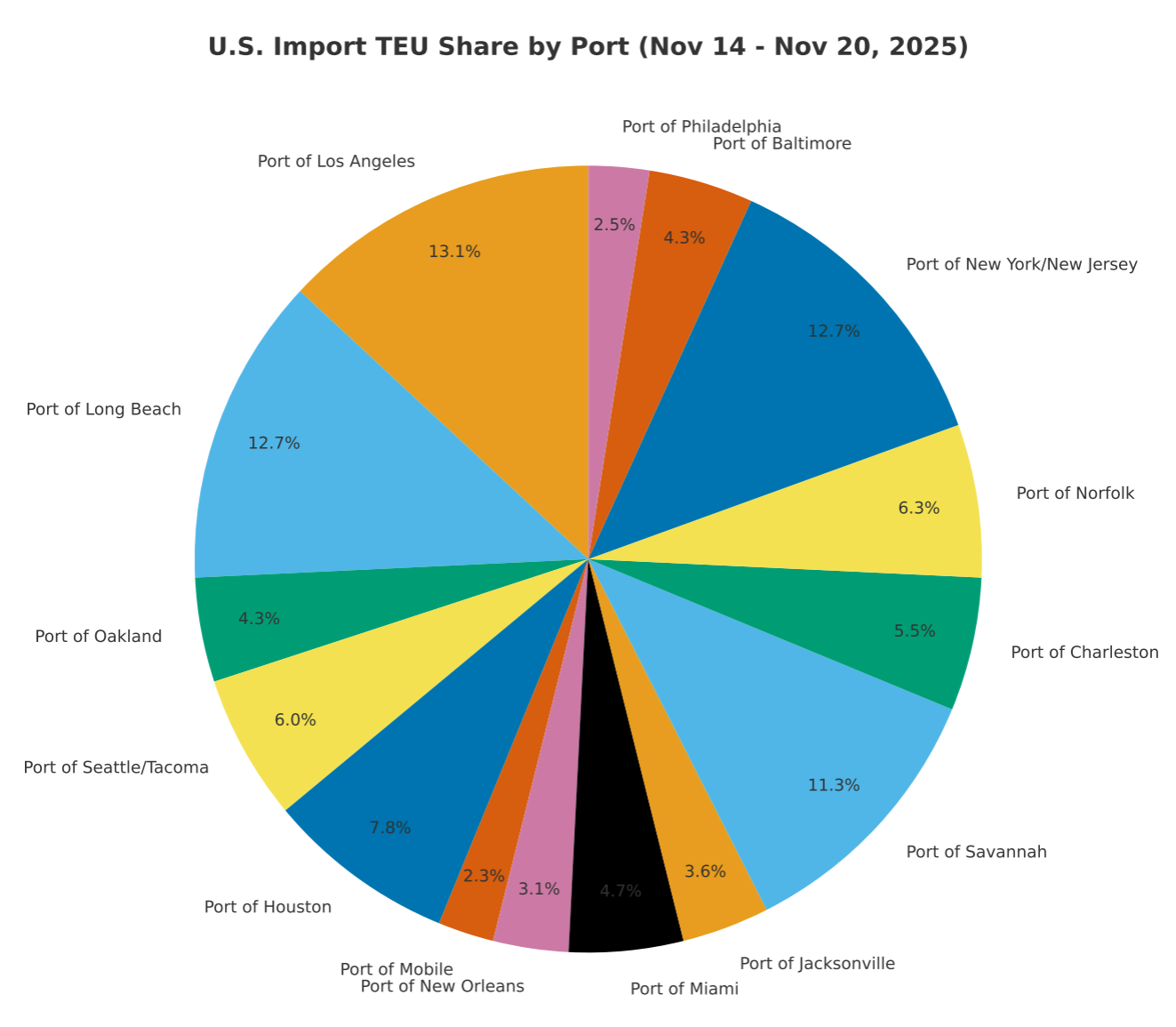

TEU’s are up 1.03% over last week, with majority coming into Los Angeles 13.1%, Long Beach 12.7% and New York/New Jersey 12.7%. The Port of Los Angeles delivered another solid month in October, moving 848,431 TEUs and keeping pace with what could become a record-setting year. According to Executive Director Gene Seroka, the nation’s busiest gateway is now within striking distance of the 10-million-TEU mark — a threshold reached only twice in its history and unmatched anywhere else in the Western Hemisphere. Through the first ten months of 2025, total throughput reached 8.66 million TEUs, running about 2% ahead of last year. Seroka credited the port’s steady performance to the reliability of its longshore workforce and terminal partners, whose consistency has kept operations fluid in a season defined by shifting demand and political uncertainty.

But the strong October numbers don’t necessarily signal a full Q4 surge. Importers pulled significant cargo forward earlier this year to stay ahead of potential tariff actions, which means November and December are likely to track softer against 2024. This aligns with what we’re seeing across retail and manufacturing sectors, where inventories remain well above seasonal norms.

October Snapshot

- Loaded imports: 429,283 TEUs (down 7% year-over-year)

- Loaded exports: 123,768 TEUs (up 1% year-over-year)

- Empty containers: 295,380 TEUs (down 8% year-over-year)

The decline in empty outbound units — often a signal for future import strength — partially reflects carriers redistributing equipment and adjusting vessel rotations in response to ongoing tariff policy shifts. Some of that traffic has diverted north, where Canadian ports saw meaningful increases tied to China’s evolving trade strategy.

At the Port of Vancouver, first-half container volumes rose 6% year-over-year as China shippers shifted flows away from U.S. gateways earlier in the year. Prince Rupert saw an even more dramatic jump — a 56% spike in total volume this October — as carriers repositioned vessels and reworked schedules ahead of the now-paused U.S. fees targeting China-built and China-operated ships.

With six weeks left in the year, all eyes are on Los Angeles to see whether it can cross the 10-million-TEU mark once again — and how shifting tariff policies, inventory levels, and carrier routing decisions will shape the close of peak season.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Savannah: Construction of the $127 million Blue Ridge Connector, a new inland rail terminal in Northeast Georgia, is on track for a Spring 2026 opening. The facility, located 50 miles from Atlanta, will link directly to Savannah by rail — easing highway congestion and reducing reliance on the current five-hour trucking route. Once fully operational, the Connector is expected to remove up to 52,000 truck trips from Atlanta roads in its first year, with the long-term potential to reach 400,000 trips annually. GPA estimates the shift will cut CO₂ emissions by 90%, equal to more than 22,000 metric tons saved in year one. Recent upgrades in Hall County — including rerouted roads, resurfacing projects, and rail-crossing improvements — were completed in preparation for the launch. Norfolk Southern will operate daily double stack rail service Monday through Friday once the facility opens. Port X Logistics isn’t just operating in Savannah—we’re fueling the entire South Atlantic corridor. Our 12-truck drayage fleet powers Savannah, Charleston, and Jacksonville with hazmat-certified drivers, secure yard space, and a full-service transload warehouse ready for anything. Need a last-minute cross-dock? A rapid-fire transload? A same-day solution when everyone else says “tomorrow”? We’re on it—fast, precise, and competitively priced. When you move freight with Port X, you’re not just moving containers… you’re getting the inside lane. Let’s make it happen: letsgetrolling@portxlogistics.com.

Houston: With winter weather on the way, the Houston Pilots are reminding ship and terminal operators that current maximum draft limits in the channel depend on maintaining at least a zero MLLW tide. As cold fronts move through and water levels dip below zero, allowable drafts will be reduced. Operators may want to build in a 1–2 foot buffer to prevent delays caused by low water. For tracking how incoming fronts may affect tides, the NWS PETSS model is a helpful resource. https://slosh.nws.noaa.gov/petss/index.php?stid=8770613&datum=MLLW&show=1-1-0-

1-1-1-1-1 . At our LaPorte transload warehouse, we’re built for speed and built for muscle — moving everything from palletized freight to heavy industrial commodities like lumber and coils with fast turns, safe handling, and the flexibility your operation demands. And we don’t stop at the port. Our Dallas team brings another 19 trucks, secured yard space, and smart routing options that keep freight flowing, whether you’re managing overflow, repositioning equipment, or tightening up your regional network. From local drayage to transloads to cross-market coordination, Port X Logistics has the horsepower and precision to keep your Gulf operations running at full throttle. Want to see what our Houston + Dallas network can do for you? Reach out at letsgetrolling@portxlogistics.com — our team is ready to roll.

Did you know?

Carrier 911 doesn’t take holidays off — we thrive in them.

While everyone else is carving turkeys and hunting Black Friday deals, our team is on duty making sure your holiday airfreight moves without a hiccup. Thanksgiving weekend is one of the toughest times of the year for urgent shipments, but that’s exactly where we shine.

Our Carrier911 crisis-response specialists are veterans in airfreight logistics and ready 24/7/365 to jump on anything you throw our way — AOG recovery, hotshots, expedited ground, aerospace, industrial and automotive moves, front- and back-end charters, and first/last-mile OBC. If it’s urgent, complex, or absolutely-cannot-fail… it’s our wheelhouse.

Need wheels fast? Our exclusive-use Sprinters, straight trucks, and dry vans are locked, loaded, and ready at a moment’s notice. You’ll get real-time tracking, no-guesswork visibility, and immediate PODs straight to your inbox — even at 2 a.m. on a holiday.

Make sure your Thanksgiving weekend freight is the least stressful thing on your plate.

For a free demo, email info@carrier911.com or schedule here: portxlogistics.com/tech-demo/

Import Data Images