Port of Los Angeles

Port of Los Angeles

1746 words 6minute read – Let’s do this!

As we are already 2 weeks away from Turkey Day and as 2025 is winding down, the global freight picture is shifting from reaction to recalibration. After two volatile years of frontloading, tariff battles, and geopolitical tension, the market is finally catching its breath. Retailers are heading into the holidays with somewhat full shelves and stable prices, the driver pool has avoided a major regulatory shock, and shipping lanes through the Red Sea are showing a possibility of reopening. Together, these trends point toward a more predictable environment for shippers and forwarders — one where strategy once again takes the wheel. Stay informed and stay ready: follow Port X Logistics on LinkedIn for real-time industry updates or subscribe to our Thursday Market Update at Marketing@Portxlogistics.com for a front-row view of the supply chain in motion.

After a year defined by tariff anxiety and early inventory builds, U.S. retailers are entering the holidays well-stocked and well-prepared. According to the National Retail Federation (NRF) and Hackett Associates, container imports totaled 2.1 million TEUs in September, down 9.3% from August and 7.4% year-over-year. October volumes are projected at 1.99 million TEUs (down 11.5% year-over-year), November at 1.85 million (down 14.4%), and December at 1.75 million (down 17.9%) — marking the softest close to the year since early 2023. On the surface, that sounds like a slowdown. But for shippers and freight forwarders, it’s also a return to balance after two years of frontloading and uncertainty. Retailers moved aggressively earlier in 2025 to get ahead of potential tariffs and keep inflation in check — a strategy that paid off. Shelves are full, prices have stayed in line, and the NRF still expects holiday sales to grow between 3.7% and 4.2%, topping $1 trillion. With less congestion at ports and inland terminals, the flow of goods is steadier, allowing importers and logistics partners to focus on efficiency instead of crisis management.

The ongoing reset in containerized trade is giving logistics planners the breathing room they’ve needed since the pandemic era. Hackett Associates notes that while 2026 will likely begin with a mild decline in volumes — January forecast at 1.98M TEUs (down 11.1%), February at 1.85M (down 9%), and March at 1.79M (down 16.7%) – the industry is now operating on firmer ground. Ocean carriers are investing in next-generation ships and expanding service networks, while global route discussions — such as Maersk’s potential full return to the Red Sea corridor — signal renewed stability and capacity growth. For freight forwarders, softer demand translates into more competitive rates, improved reliability, and faster transit times — all of which help shippers rebuild predictability into their supply chains. After years of paying premiums to secure space, customers are now seeing the return of choice and leverage.

As the trade landscape recalibrates, the coming year could offer shippers the kind of environment they’ve been waiting for — one built on planning instead of panic. The early import surge of 2025 minimized disruption and kept U.S. inventories strong heading into peak season. Now, with volumes easing, transportation networks have room to catch up and reset service levels. In short, the data may show a decline in TEUs, but beneath the surface lies a positive story: supply chains that are functioning more smoothly, cost pressures that are easing, and a freight market that’s finally returning to equilibrium. For retailers, forwarders, and importers alike – stability is back on the menu. But 2026 could always bring surprises!

The FMCSA’s CDL rule is on hold — What it means for shippers: A new regulatory twist out of Washington could have major implications for supply chains heading into 2026. The U.S. Court of Appeals for the D.C. Circuit has issued a stay halting the Federal Motor Carrier Safety Administration’s recent rule on non-domiciled commercial driver’s licenses. The rule — now on hold — would have barred asylum seekers, refugees, DACA recipients, and other lawfully authorized non-citizens from holding or renewing CDLs. The court’s temporary pause buys time for nearly 200,000 drivers who could have been sidelined overnight, while judges review whether FMCSA’s “national emergency” justification holds up under scrutiny.

Why it matters to shippers: Even though this may sound like a regulatory footnote, the implications for freight flow are real. Had the rule taken effect, thousands of qualified drivers could have been pulled off the road, tightening capacity and driving up transportation costs — especially for shippers reliant on flexible spot market capacity or time-sensitive freight. The stay keeps the current system intact for now, but it highlights just how quickly government action can impact the balance between truck supply and demand.

With imports softening and linehaul rates showing early signs of stabilization, the market doesn’t have much margin for capacity disruption. A sudden driver shortage, even temporary, could push rates back up in key lanes and create bottlenecks for distribution centers that rely on consistent turn times. For shippers managing seasonal peaks or replenishment cycles, maintaining close communication with carriers and brokers remains critical to avoid getting caught in the middle of regulatory shifts. The court will now review FMCSA’s internal records — including crash data, state audits, and safety memos — to determine whether the “emergency” rule was justified. Depending on the outcome, the rule could be upheld, rewritten, or struck down entirely. For shippers, it’s another reminder that capacity risk isn’t just market-driven — it’s policy-driven. The teams that plan ahead, diversify carrier networks, and stay close to market intelligence will be best positioned to navigate whatever the next regulatory wave brings.

The Red Sea is stirring again — but not without caution. After nearly two years of detours, there are early signs of life returning to the Red Sea shipping corridor. Yemen’s Houthi forces have paused attacks on commercial vessels, prompting a few carriers — including CMA CGM — to cautiously test transits through the Bab el-Mandeb Strait. Egypt’s Suez Canal Authority has called these moves a positive indicator, even encouraging Maersk to consider a gradual return once conditions allow. For shippers and freight forwarders, this pause could mark the beginning of a long-awaited reset. A full reopening of the Red Sea route would shorten Asia-to-Europe and East Coast U.S. sailings by thousands of miles and release roughly 2 million TEUs of capacity currently tied up on longer detours around Africa. That could bring faster transit times — but also renewed rate swings as global tonnage floods back into circulation. The message for the market: optimism with guardrails. Security remains fragile, insurance premiums high, and schedules unpredictable. But every vessel testing the route is a step toward stability — and a reminder that even small geopolitical shifts can ripple through the world’s supply chains.

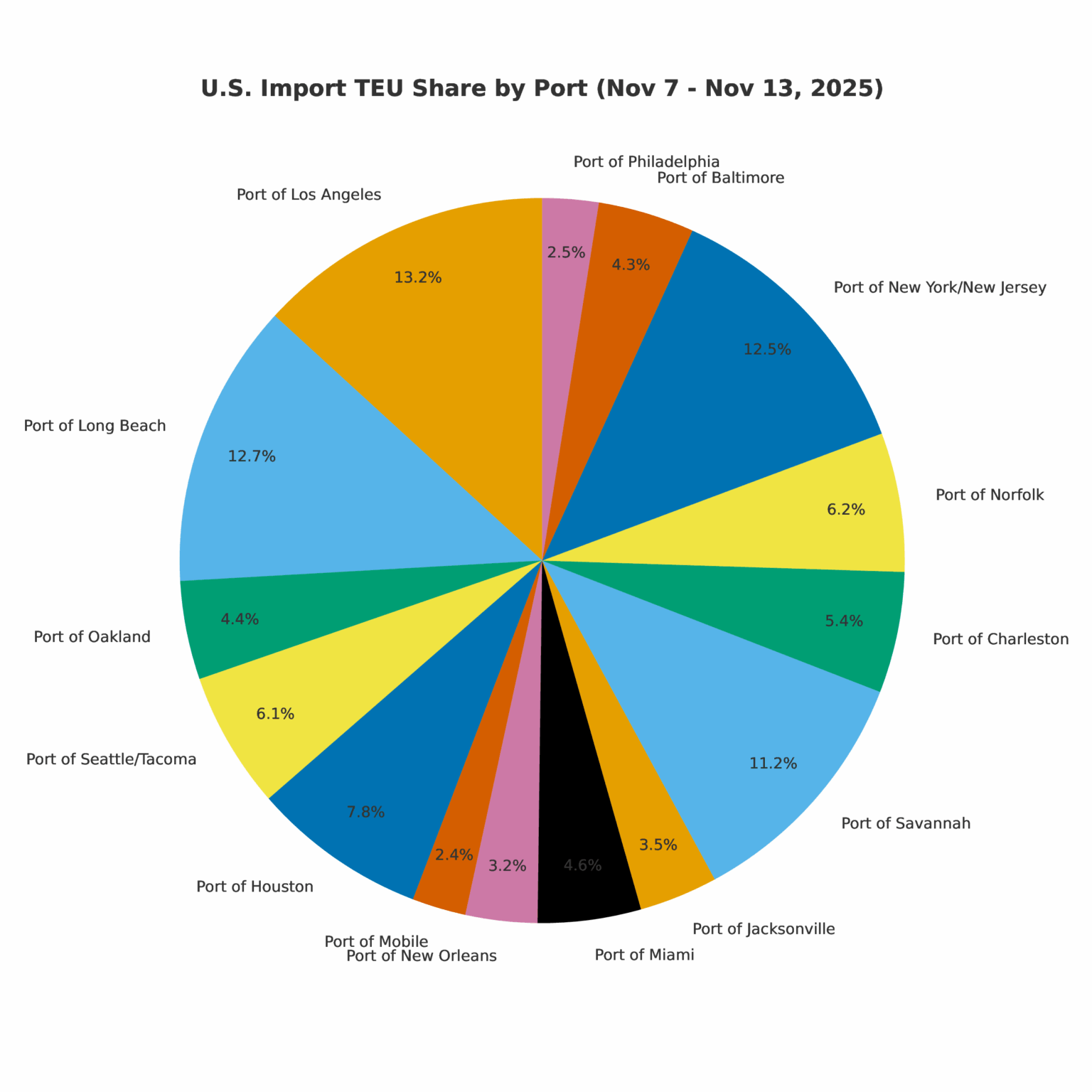

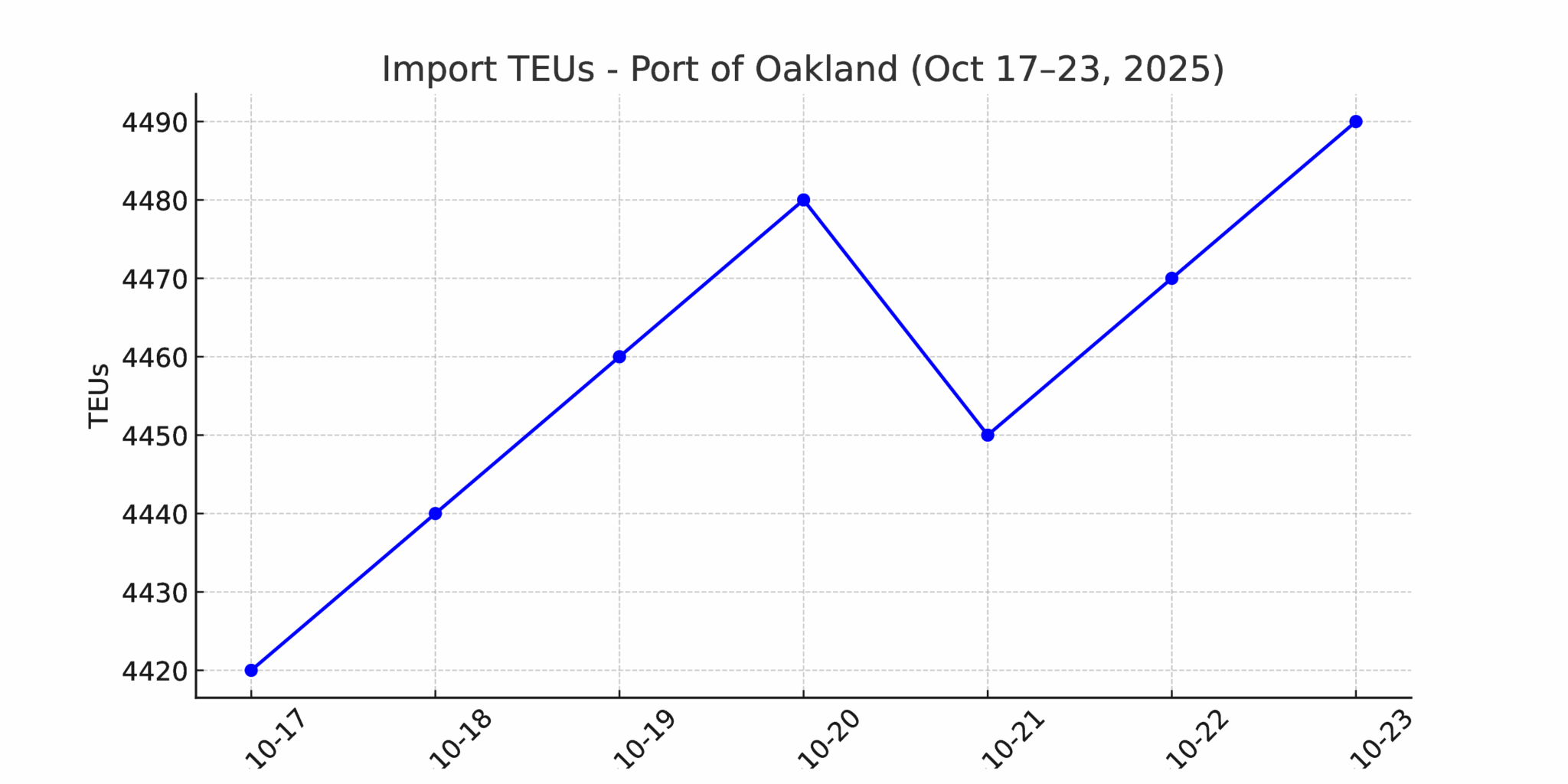

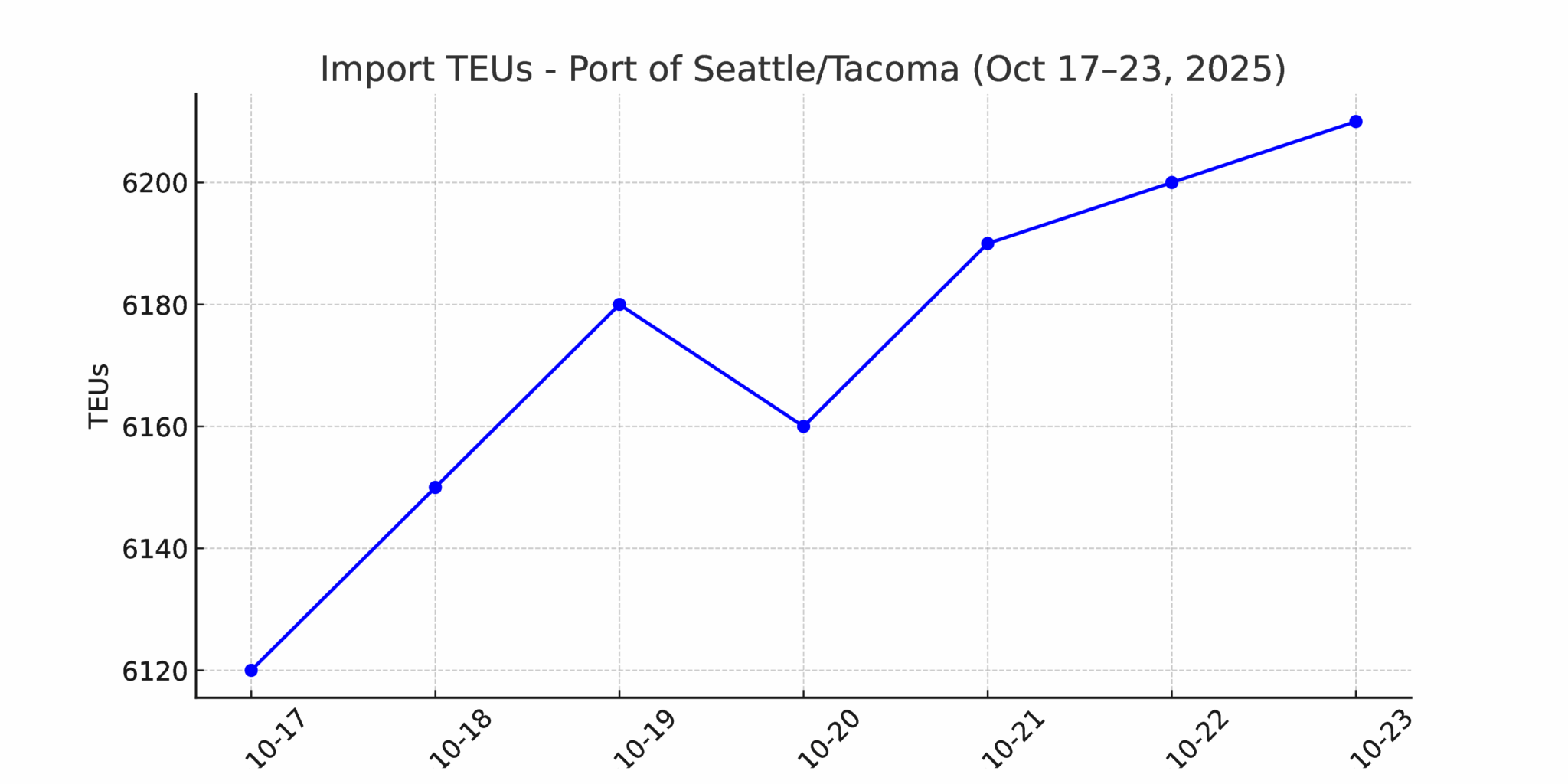

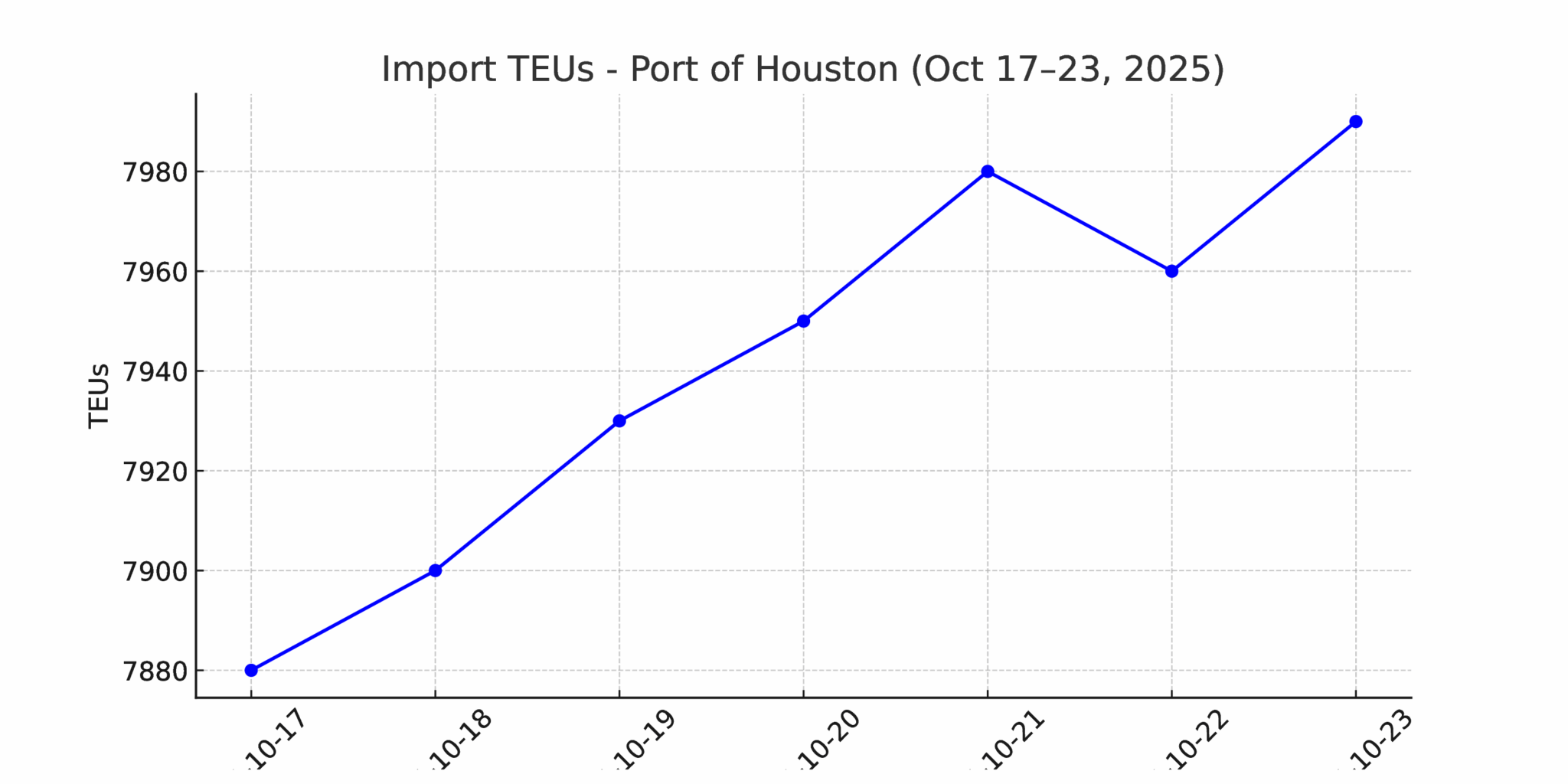

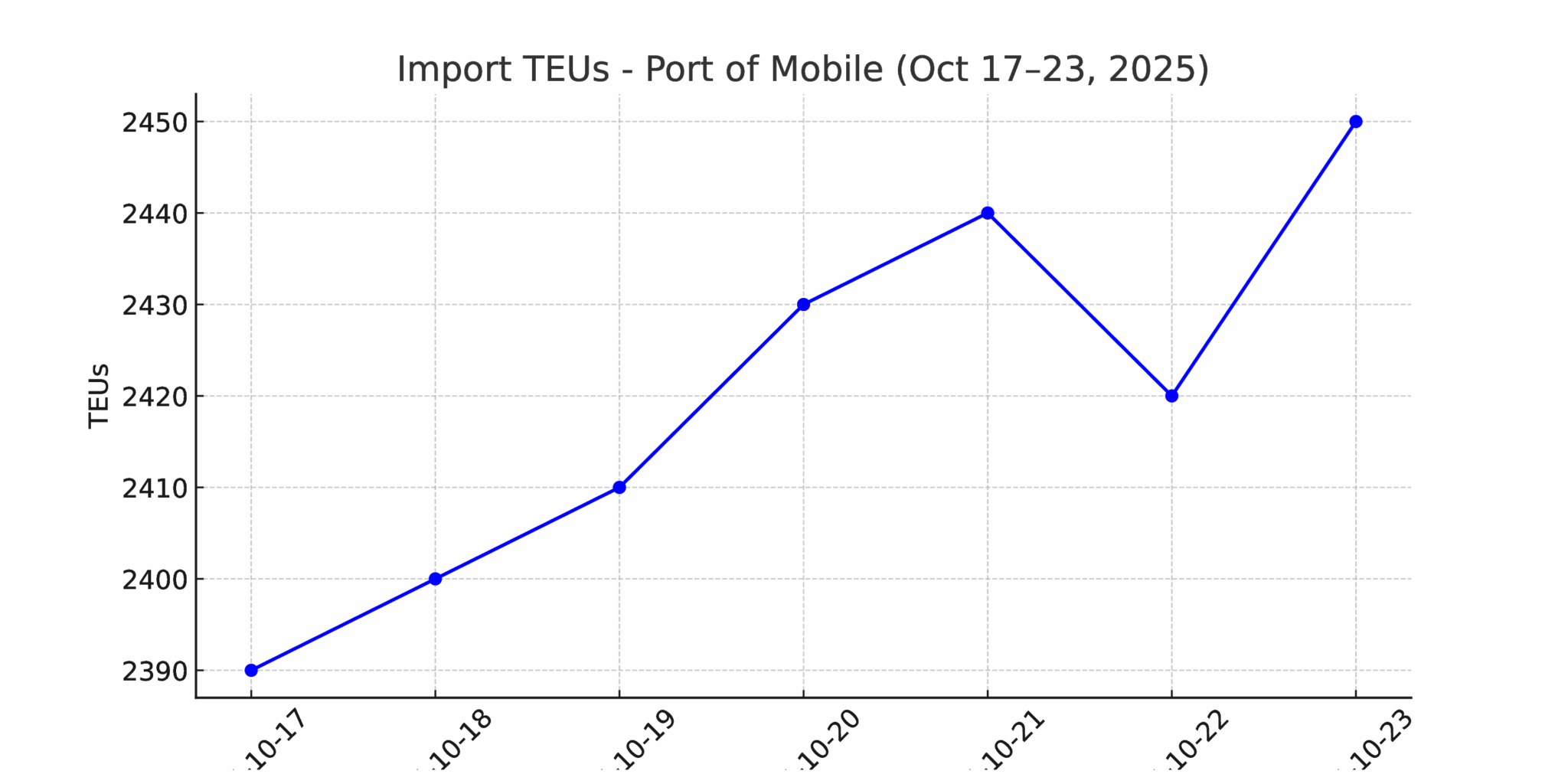

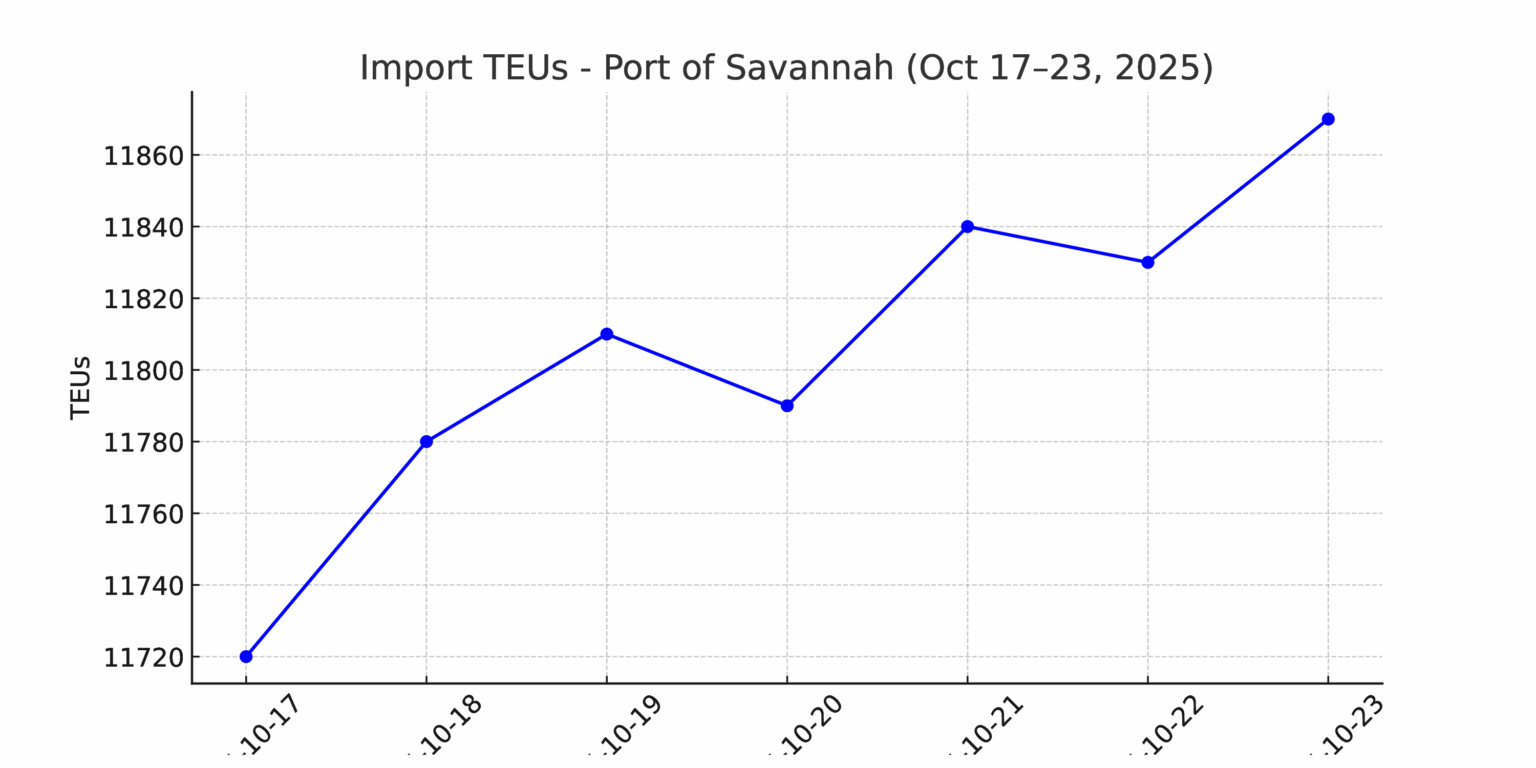

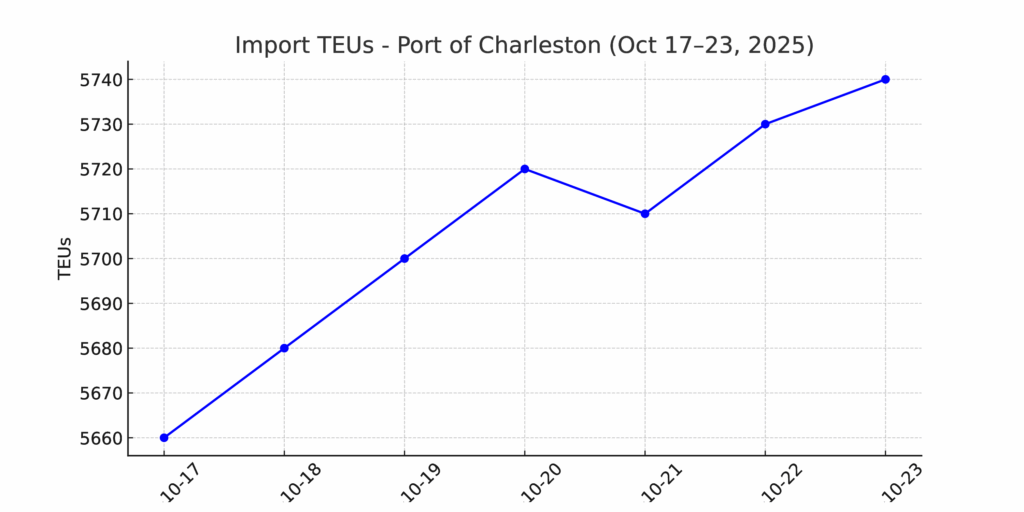

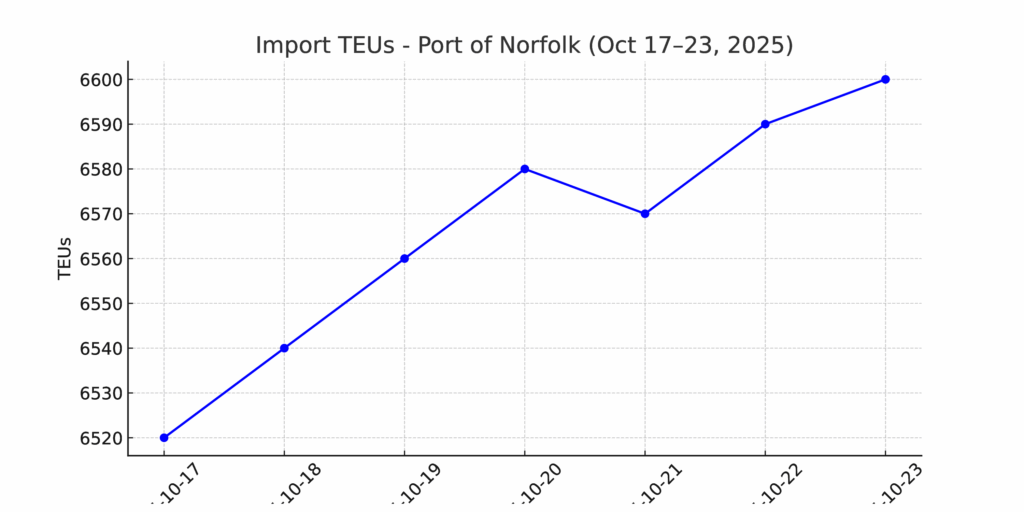

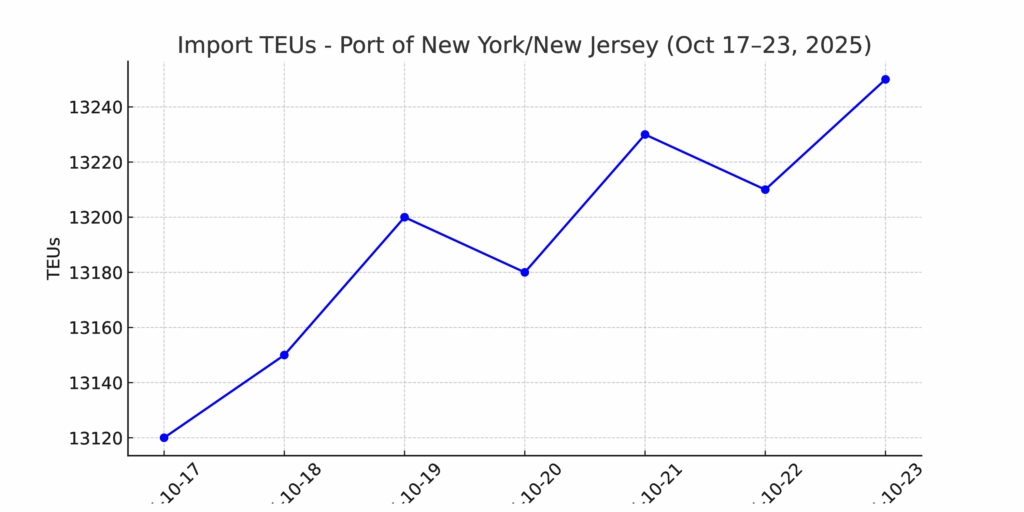

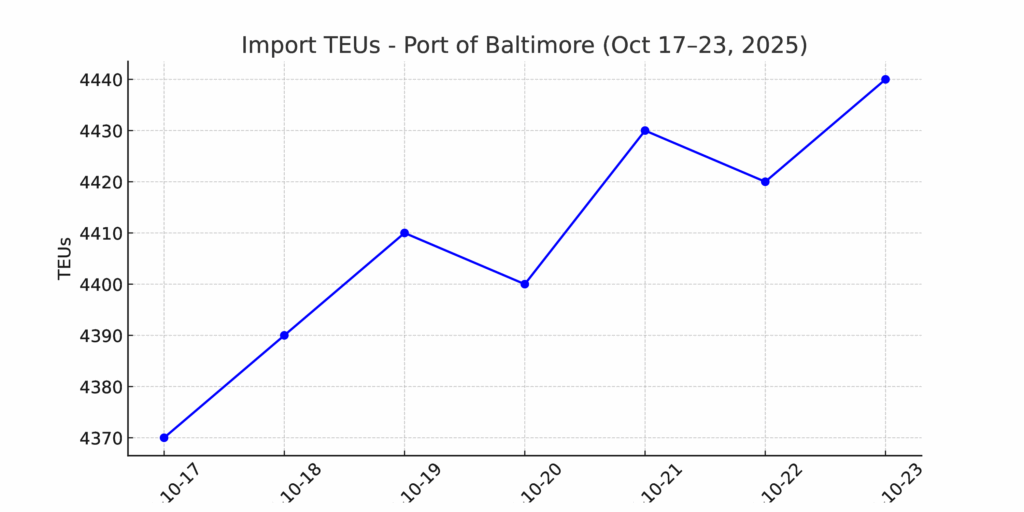

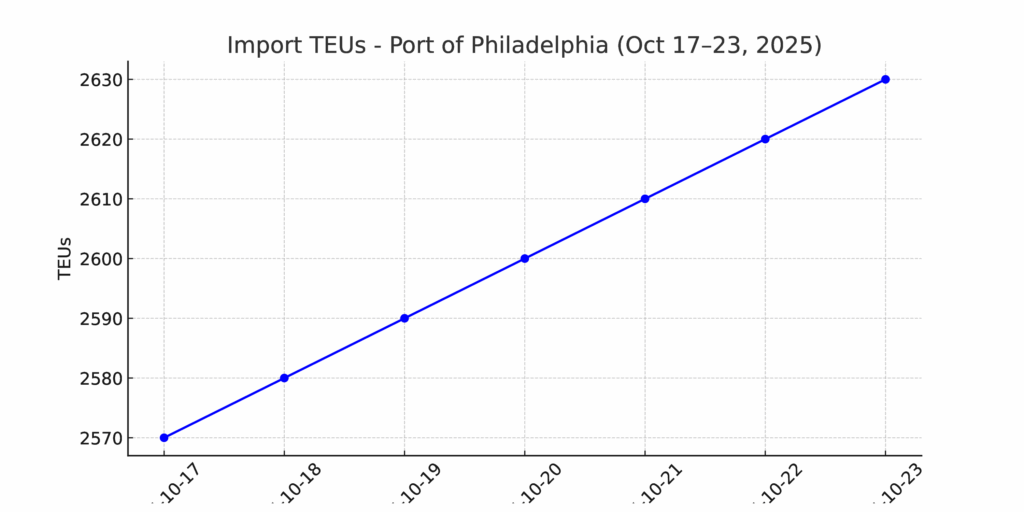

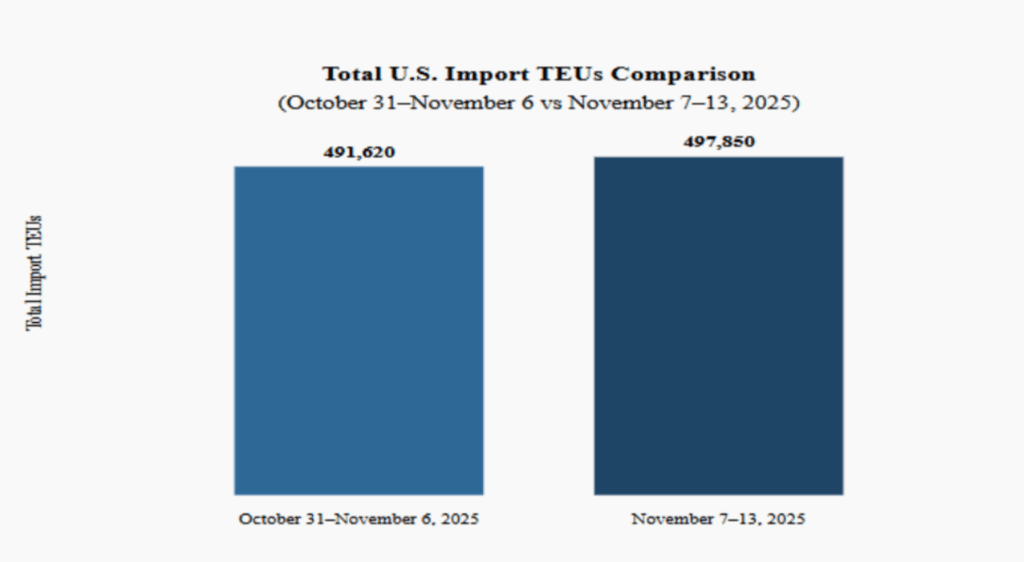

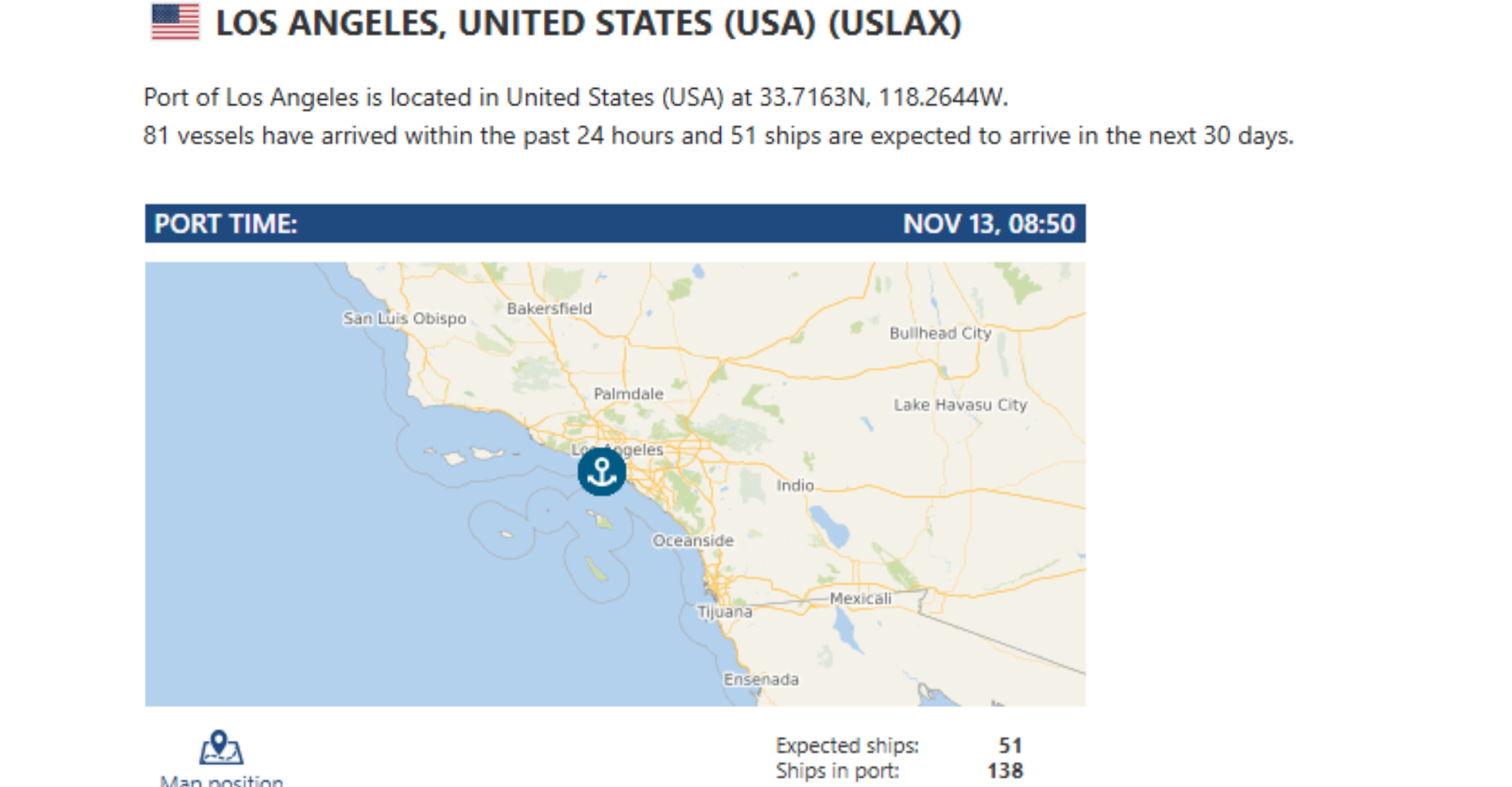

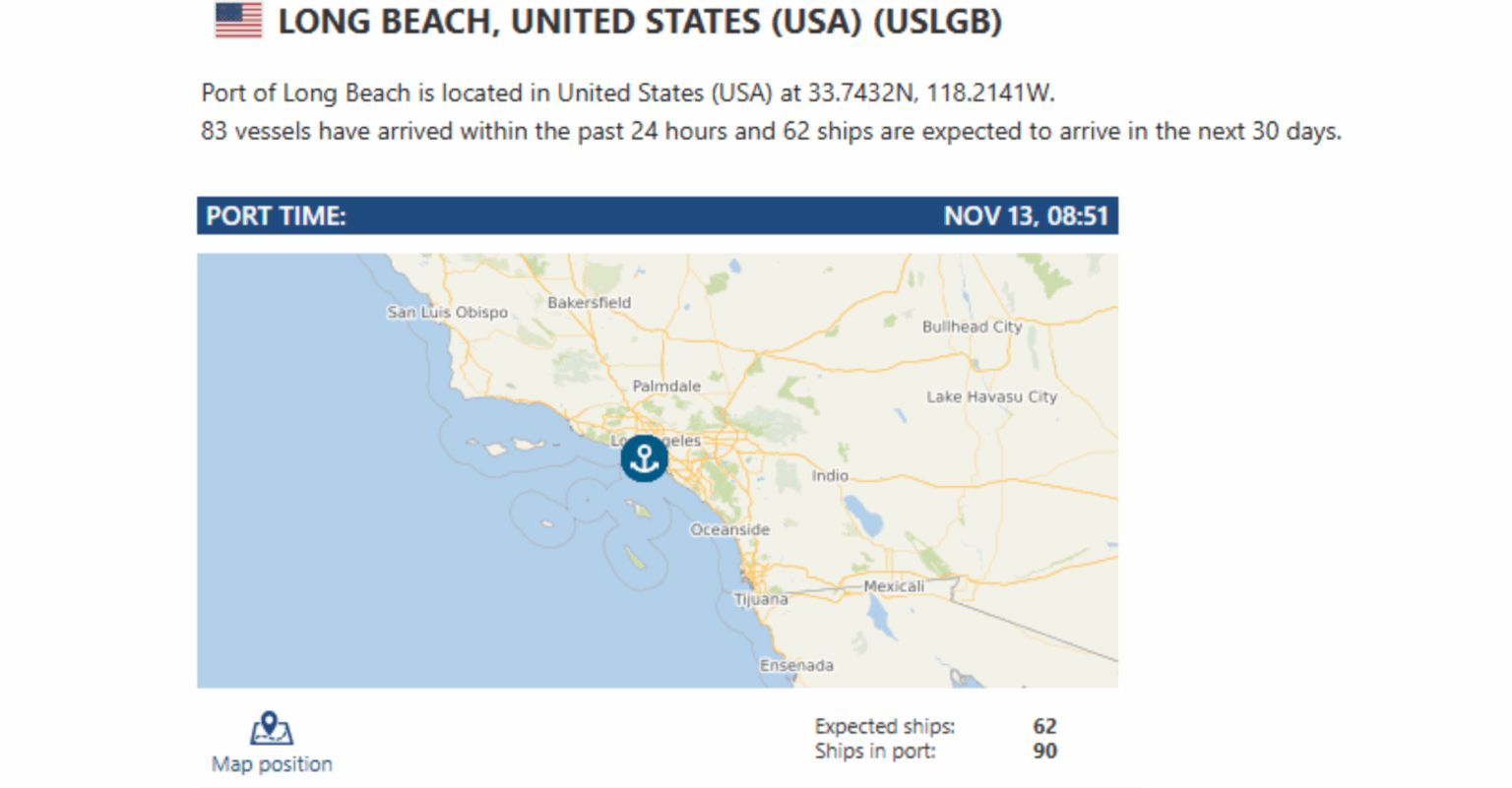

TEU’s are up 1.26% over last week, with majority coming into Los Angeles 13.2%, Long Beach 12.7% and New York/New Jersey 12.5%.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

LA/Long Beach: Los Angeles and Long Beach are pushing ahead with a bold zero-emission plan, joining the South Coast Air Quality Management District to lock in firm deadlines for cleaner equipment, expanded charging infrastructure, and new incentives aimed at cutting vessel and drayage emissions. With roadmap milestones landing in 2027 and full plans across all cargo-handling equipment due by 2029—and more than $3B committed to long-term upgrades—the nation’s busiest port complex is gearing up for a cleaner, more efficient future. And as the ports evolve, so are we: Port X Logistics has lowered transload rates in LA and Long Beach, backed by a secure yard, flexible storage, full OpenTrack visibility, and our No Demurrage Guarantee when freight is dispatched 72 hours before arrival. Want a smoother West Coast solution? Reach out to letsgetrolling@portxlogistics.com — our team is ready.

Seattle/Tacoma: The recent downturn in volumes at the Northwest Seaport Alliance is a signal that the Seattle–Tacoma gateway may be entering a softer cycle, creating a different set of considerations for shippers that rely on these terminals. Lower throughput often leads to excess capacity on the ground and at berth, which can influence carrier behavior, service frequency, and rate structures. While this can offer short-term advantages—such as more flexible scheduling or opportunities for cost negotiation – it also raises the risk of blank sailings, shifting service rotations, or reduced inland connectivity as carriers rebalance networks. For importers and forwarders moving freight through the PNW, it’s a moment to stay close to the Port X team, monitor service reliability, and evaluate whether diversification across gateways could strengthen routing resilience heading into 2026. Despite a recent dip in volumes across the Northwest Seaport Alliance – which could bring shifts in carrier schedules, service patterns, and inland connections – the moment also highlights why having a strong local partner matters. Our Seattle–Tacoma operation is scaling fast – 11 new drivers, solid drayage capacity, and a warehouse team built for rapid, precise turns. When port volumes soften, flexibility becomes a competitive edge, and our SEA/TAC network is designed to pivot with the market. With reliable infrastructure, the right equipment in place, and a crew that knows how to keep freight moving through the PNW, we deliver consistency no matter the conditions. Want to strengthen your routing through Seattle and Tacoma? Reach out at letsgetrolling@portxlogistics.com – our team is ready to roll.

Did you know?

Looking for drayage capacity in Kansas City or Chicago? We’ve got you covered — and we’re hungry for more freight.

In Kansas City, we’re on the hunt for exports: 71 company drivers, 89 trucks, and 100+ standard, triaxle, and spread-axle chassis ready for your heaviest, most demanding moves. With two yards for empty storage and a flexible transload warehouse, we’ve got the space, gear, and agility to keep your export street turns moving.

In Chicago, we’re building imports: 88 trucks, 150+ chassis (yes, including 20s), and over 100 triaxle and spread-axle units. Heavy haul? We’ve got the permits, secured yard space, and experience to handle it. We’re ready to take on more import street turns every single day.

Let’s get rolling. Lock in capacity in these high-demand markets at letsgetrolling@portxlogistics.com.

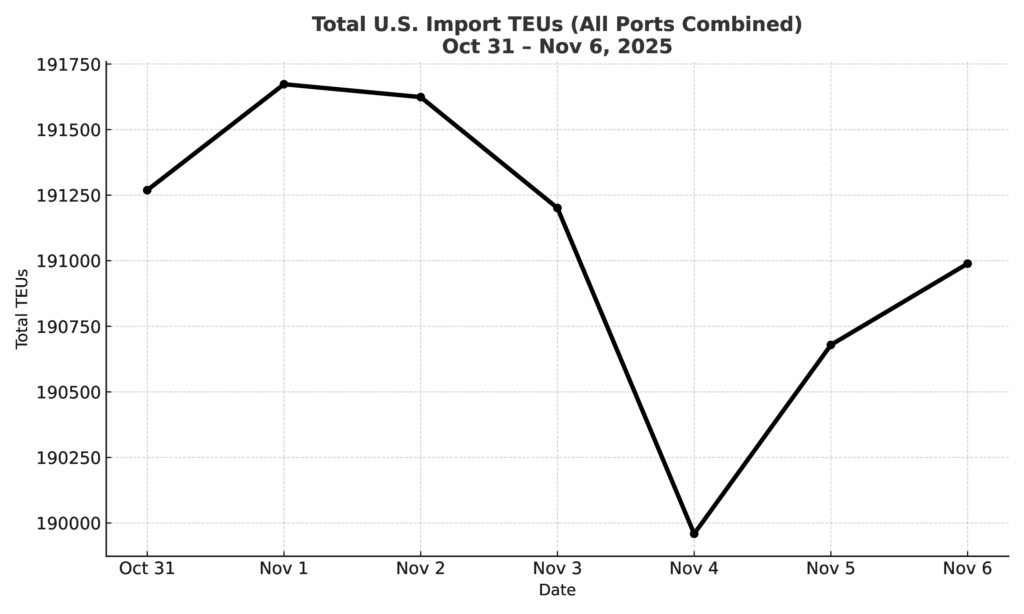

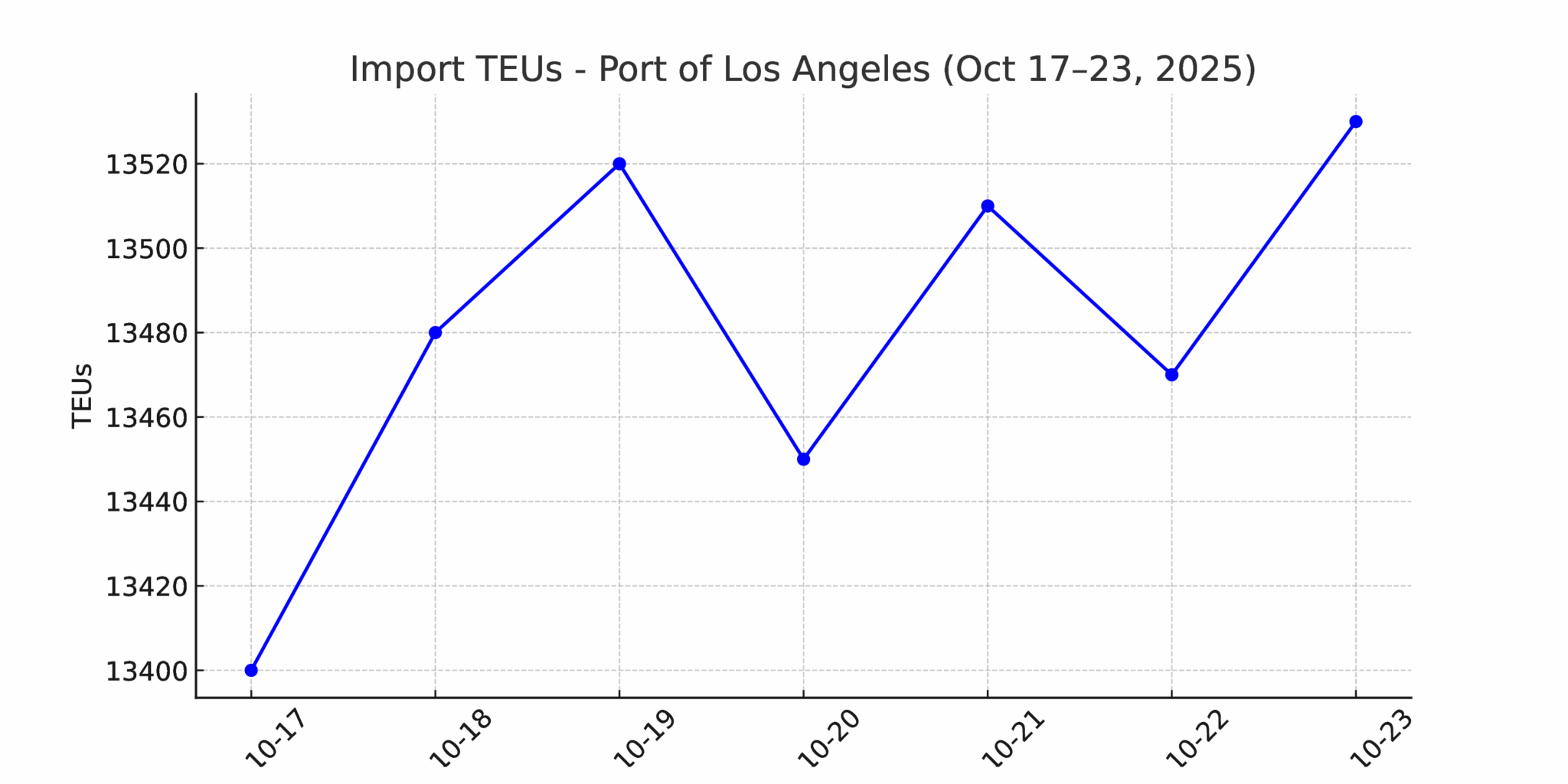

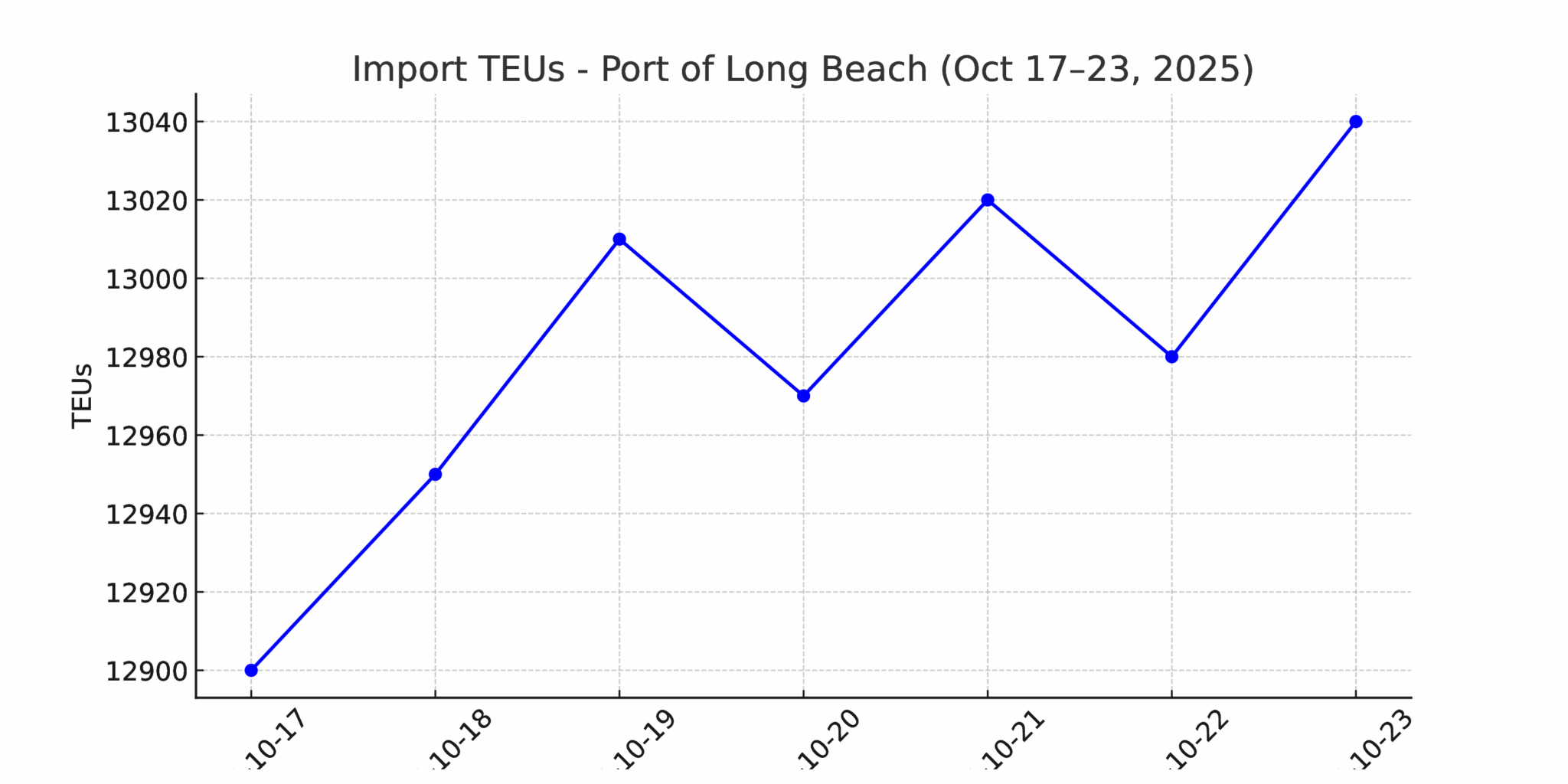

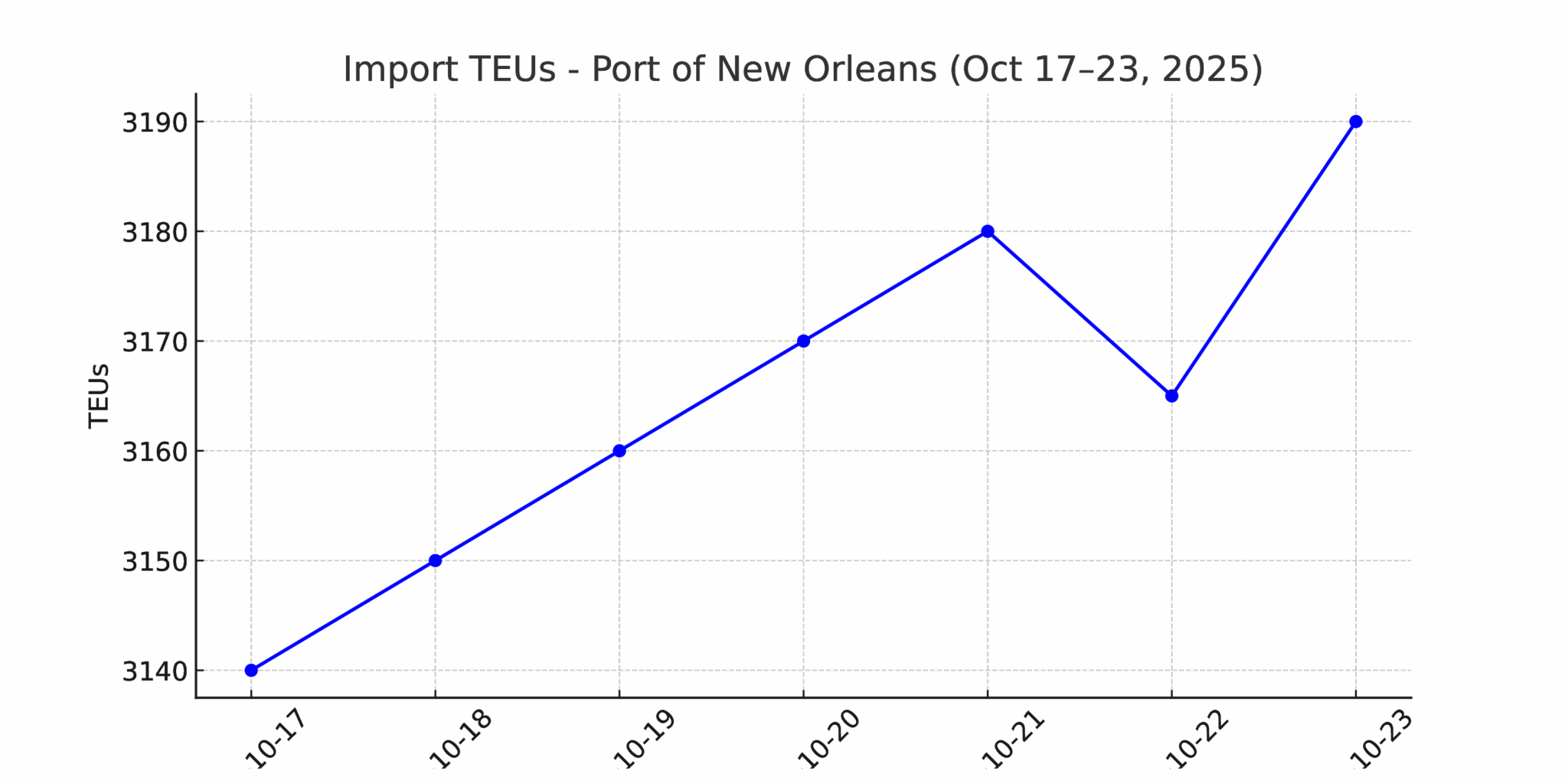

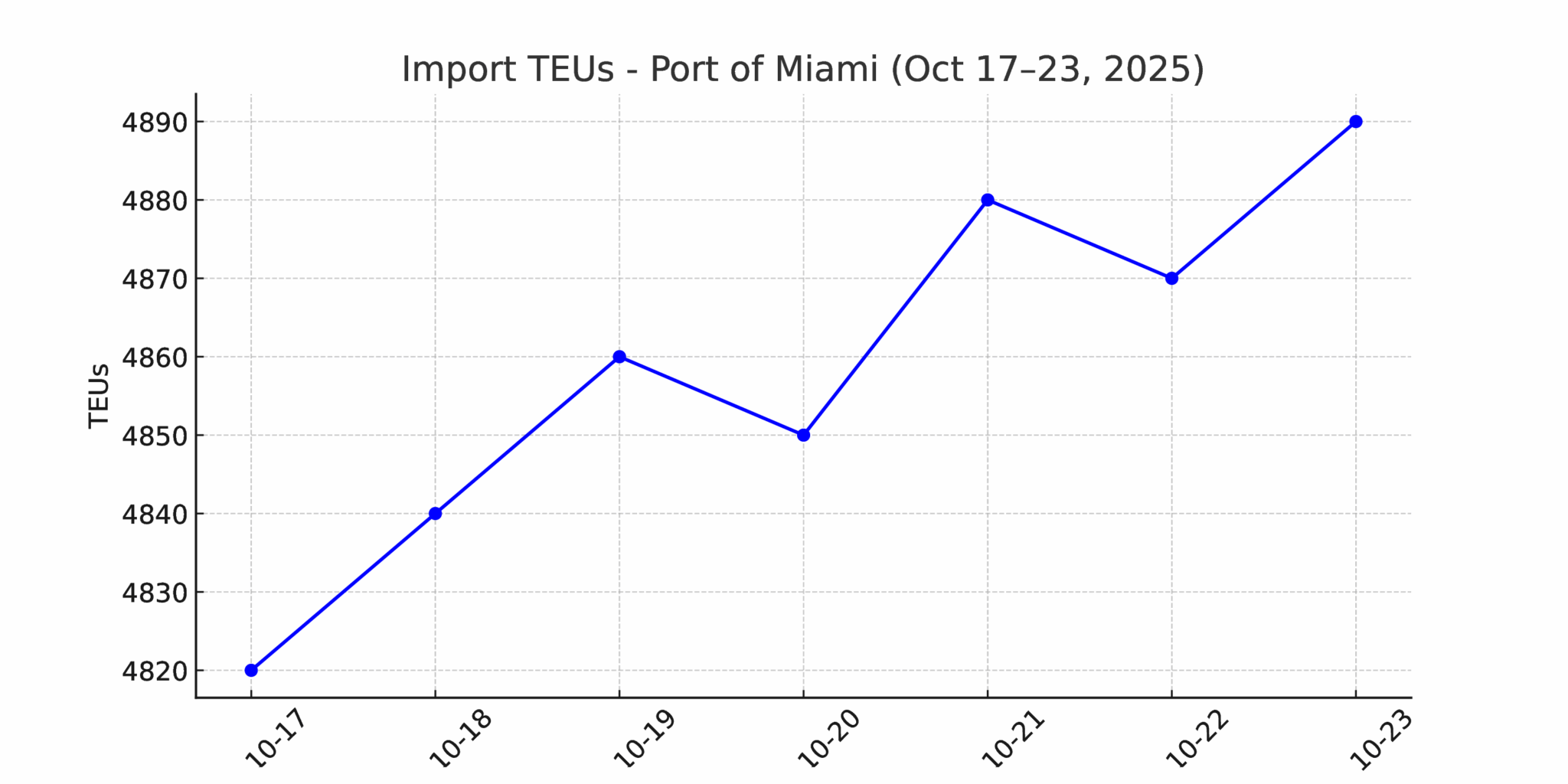

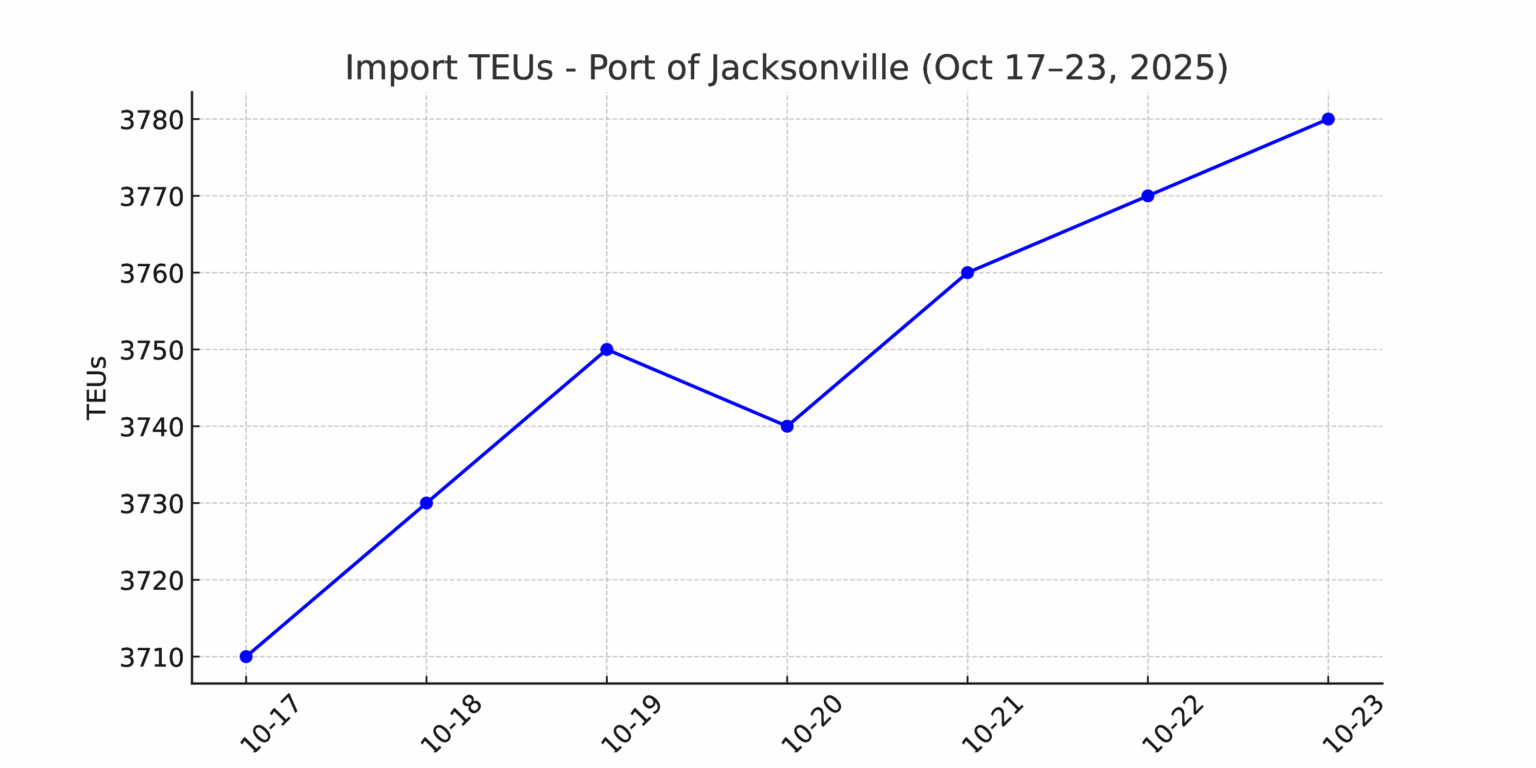

Import Data Images