Port of Seattle

Port of Seattle

1984 words 7 minute read – Let’s do this!

The spookiest day of the year is here folks! Although many in the industry have determined that 2025 has been a scary year, (Like what is scarier than your customer’s cargo not being able to clear customs in time?) finally Asia’s trade scene is entering a new phase of realignment. In just a few weeks, tariff deals, retaliatory measures, and cost pressures have begun redrawing the global freight map and forcing importers, retailers, and carriers to rethink how they operate. From Seoul to Shanghai to Singapore, the U.S. is renegotiating its trade footing — cutting deals with key partners, easing some long-running frictions, and laying new guardrails for how goods move through the region. But the story doesn’t end at the docks. Retailers like Amazon and Target are slimming down, freight rates have fallen to near break-even levels, and a wave of automation and efficiency initiatives is reshaping how global trade actually works on the ground. Amid these shifts, one theme runs through every lane and every mode: agility isn’t optional anymore — it’s the only way forward. Let’s get into it

Don’t forget to stay ahead of the curve: follow Port X Logistics on LinkedIn for weekly intel straight from the field, or get the full Market Update delivered to your inbox every Thursday at Marketing@Portxlogistics.com.

The tariff headlines out of Asia are heating up this week — and this time, there’s real movement. A flurry of new trade deals is reshaping global supply lines, testing retailer resilience, and setting the stage for how freight will flow into 2026. The biggest news came out of South Korea, where the U.S. and Seoul finalized a sweeping trade deal that’s set to reshape the flow of autos, auto parts, and industrial goods between the two countries. The U.S. agreed to cut its tariff on South Korean vehicle imports from 25% down to 15%, while South Korea pledged roughly $350 billion in new U.S. investments — including major commitments in shipbuilding, manufacturing, and clean-energy production. The deal also opens the door for tariff relief on wood products, pharmaceuticals, and aircraft parts, and is being billed as a “mutual growth pact” aimed at boosting American industry while strengthening one of the U.S.’s closest allies in Asia.

At the same time, Washington and Beijing took a rare pause from their trade sparring. The Trump–Xi meeting produced a one-year truce that will temporarily lower tariffs on select Chinese imports — including those tied to fentanyl-related chemicals and certain consumer goods — while China agreed to resume large-scale U.S. soybean purchases and delay its new export restrictions on rare earth minerals. It’s far from a permanent peace, but it’s enough to calm some of the uncertainty that’s been weighing on importers over the last few months.

In Southeast Asia, progress continues as the U.S. builds out its network of trade partners. Freshly signed agreements with Cambodia and Malaysia promise more cooperation on export controls, investment screening, and tariff transparency, while framework deals with Thailand and Vietnam are laying the groundwork for supply-chain resilience and non-tariff barrier reforms. The theme is clear: the U.S. is diversifying away from overreliance on China and tightening the rules around how goods flow through Asia.

These new trade deals could quietly shift the freight map for 2026. Lower tariffs on South Korean autos and industrial components will likely drive more inbound volume through West Coast and Gulf gateways — especially Long Beach, Houston, and Savannah — where automotive and heavy-equipment traffic is already building. The China tariff pause may take some pricing pressure off importers, but most of that freight is still moving under a cloud of caution — with routing diversification and risk mitigation becoming standard practice. As Southeast Asia strengthens ties with the U.S., expect to see growing TEU flow from Vietnam, Malaysia, and Thailand — countries now positioned as “China Plus One” sourcing hubs.

For importers, forwarders, and logistics providers, this shift signals a more balanced but still complex trade landscape. Lower tariffs on South Korean autos and eased restrictions on Chinese consumer goods could create short-term rate relief, but the broader picture still points to a reshuffling of sourcing strategies across Asia. Expect 2026 to bring more targeted agreements, closer enforcement of origin rules, and a growing focus on transparency across multi-country supply chains.

Even with the recent tariff movements, importers are still faced with nonstop cost shocks — from new tariffs to uneven demand. The United States Trade Representative (USTR)’s 100% tariff on China-linked ship-to-shore cranes will still take effect November 9th, while China’s retaliatory port fees on U.S.-linked vessels will stay in place through 2028 (culminating in a rate of RMB 1,120 per net ton for calls from April 17, 2028). These swings are driving up landed costs and tightening margins. According to KPMG, half of U.S. retailers report a 1–5% drop in gross margins tied directly to tariffs, and over a third have delayed capital investments amid ongoing uncertainty. At the same time, the trans-Pacific market has lost much of its pricing power. Container rates from Asia to the U.S. West Coast are down more than 50% year-over-year, slipping below many carriers’ break-even levels. While lower rates offer short-term relief, softer demand and slower volumes are offsetting most of the benefit. Carriers and ports are adjusting — cutting sailings, resizing vessels, and realigning capacity as sourcing expands across Southeast Asia and nearshoring grows in the Americas. Analysts expect a 7–12% dip in U.S. port throughput this year — not a collapse, but a structural reset in global trade. Both Amazon and Target are trimming corporate ranks this month in a push to become “leaner” and “more agile.” Target is cutting about 1,800 HQ positions — roughly 8% of its workforce — while Amazon plans to eliminate up to 14,000 corporate roles as it restructures around AI and automation. The polished messaging centers on efficiency, but the reality is clear: retailers are adjusting to sustained margin pressure from rising tariffs, freight volatility, and shifting sourcing strategies.

For companies like Amazon and Target, restructuring is about survival as much as speed. Traditional planning models no longer fit a market defined by volatility. Streamlined operations and automation are now tools for margin protection — strategies built for resilience in a high-cost, high-complexity world. For importers navigating these shifts, Port X Logistics is the partner built to keep you moving. Our nationwide network, technology-driven visibility, and unified drayage, transload, and over-the-road solutions ensure your freight stays on track — from port to final mile. Trade isn’t slowing; it’s transforming — and Port X Logistics is built to stay ahead of that change.

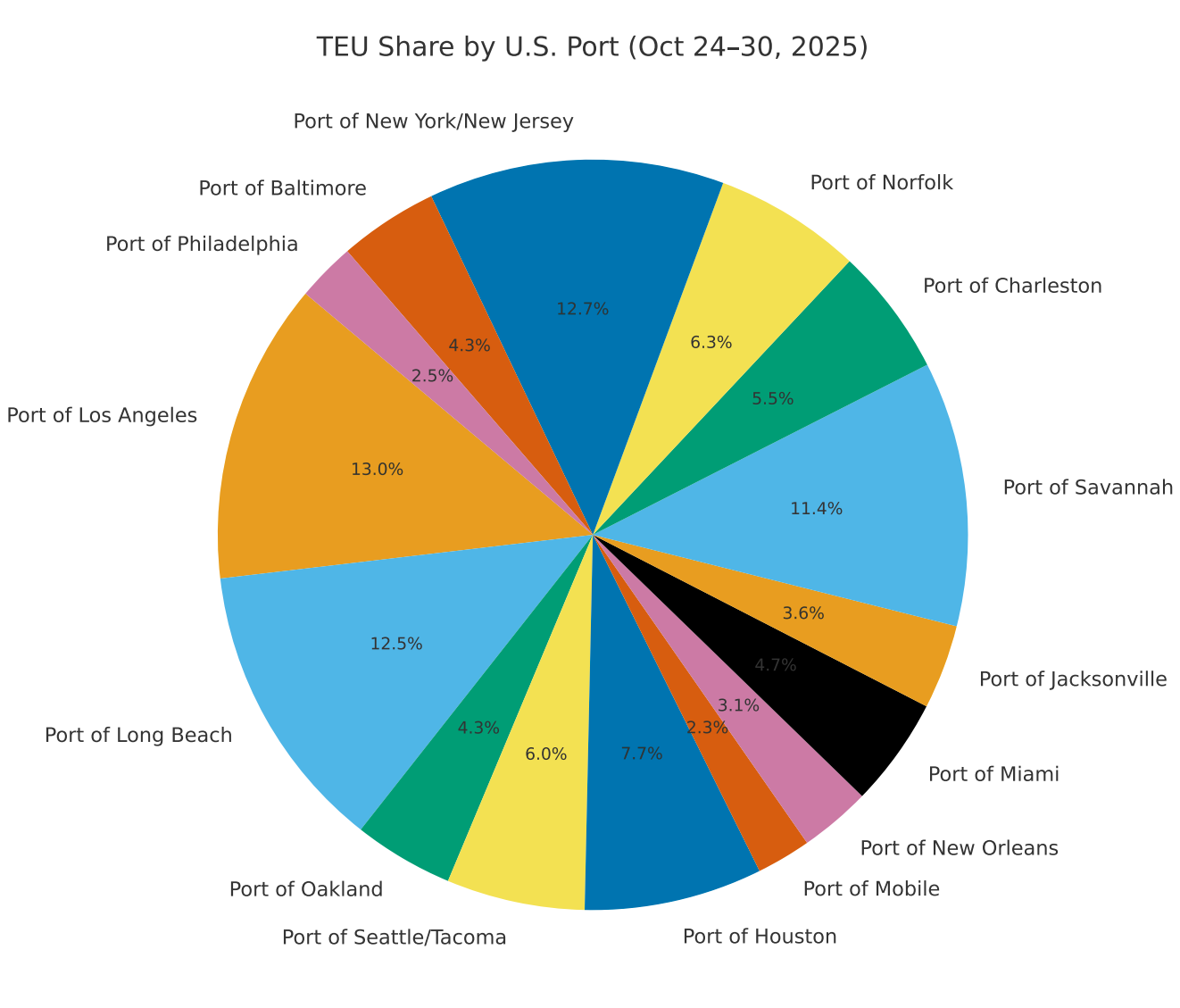

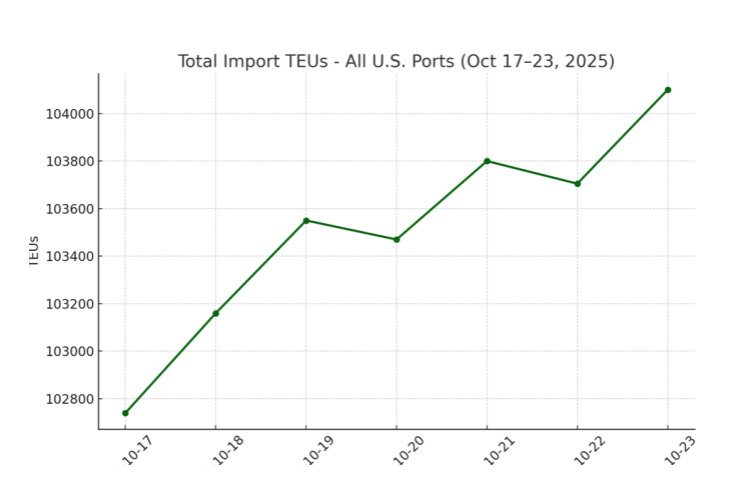

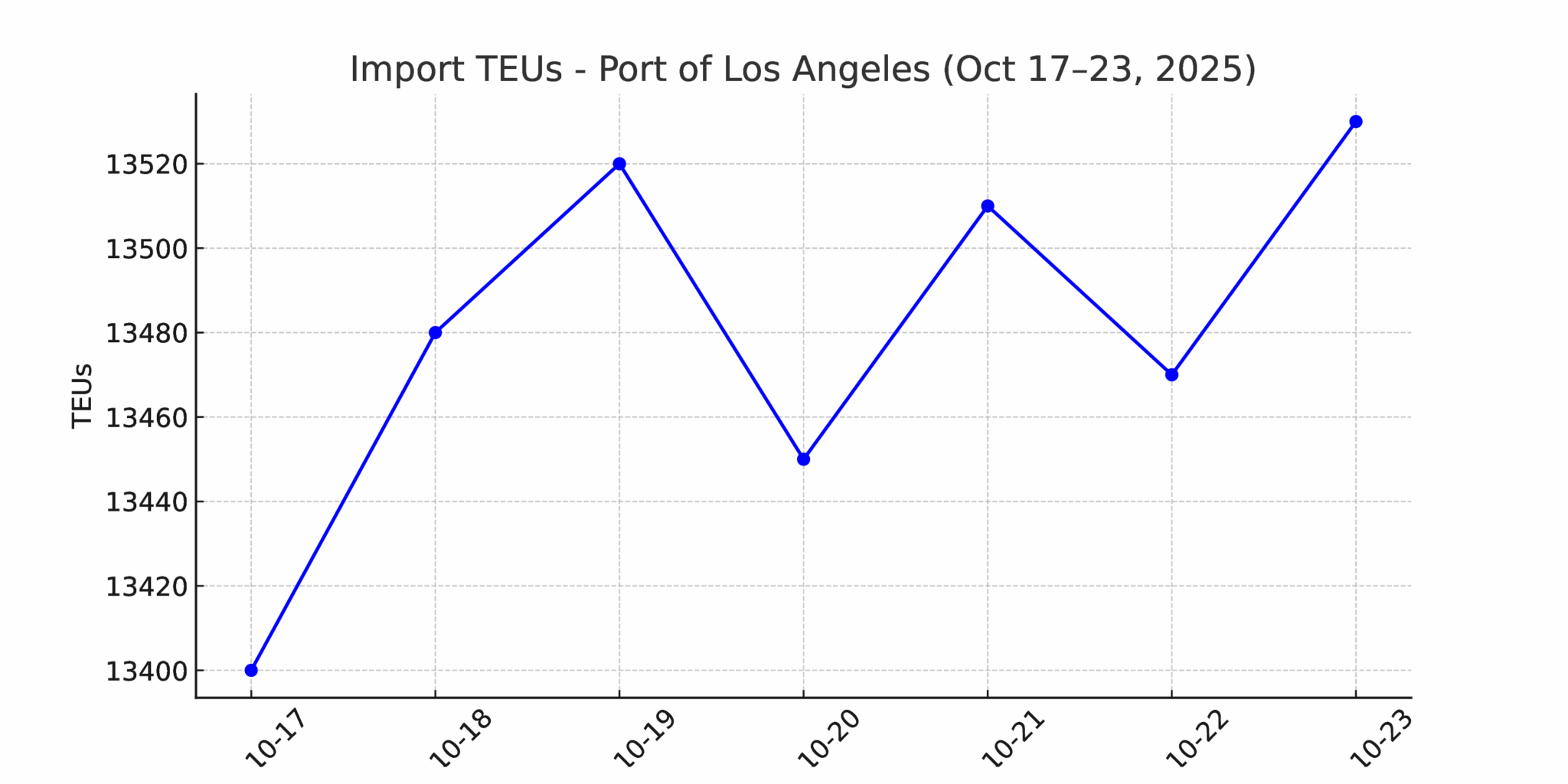

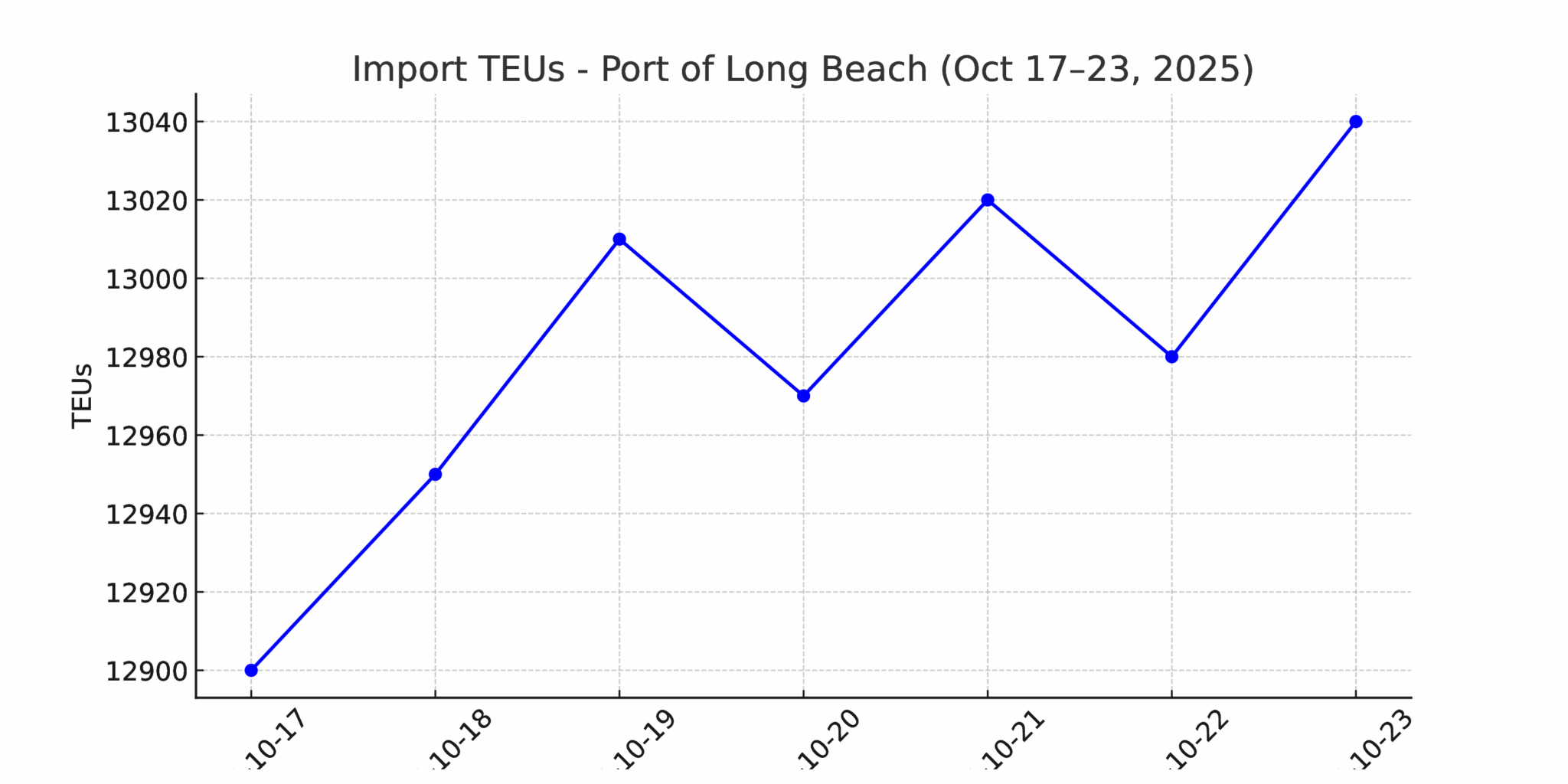

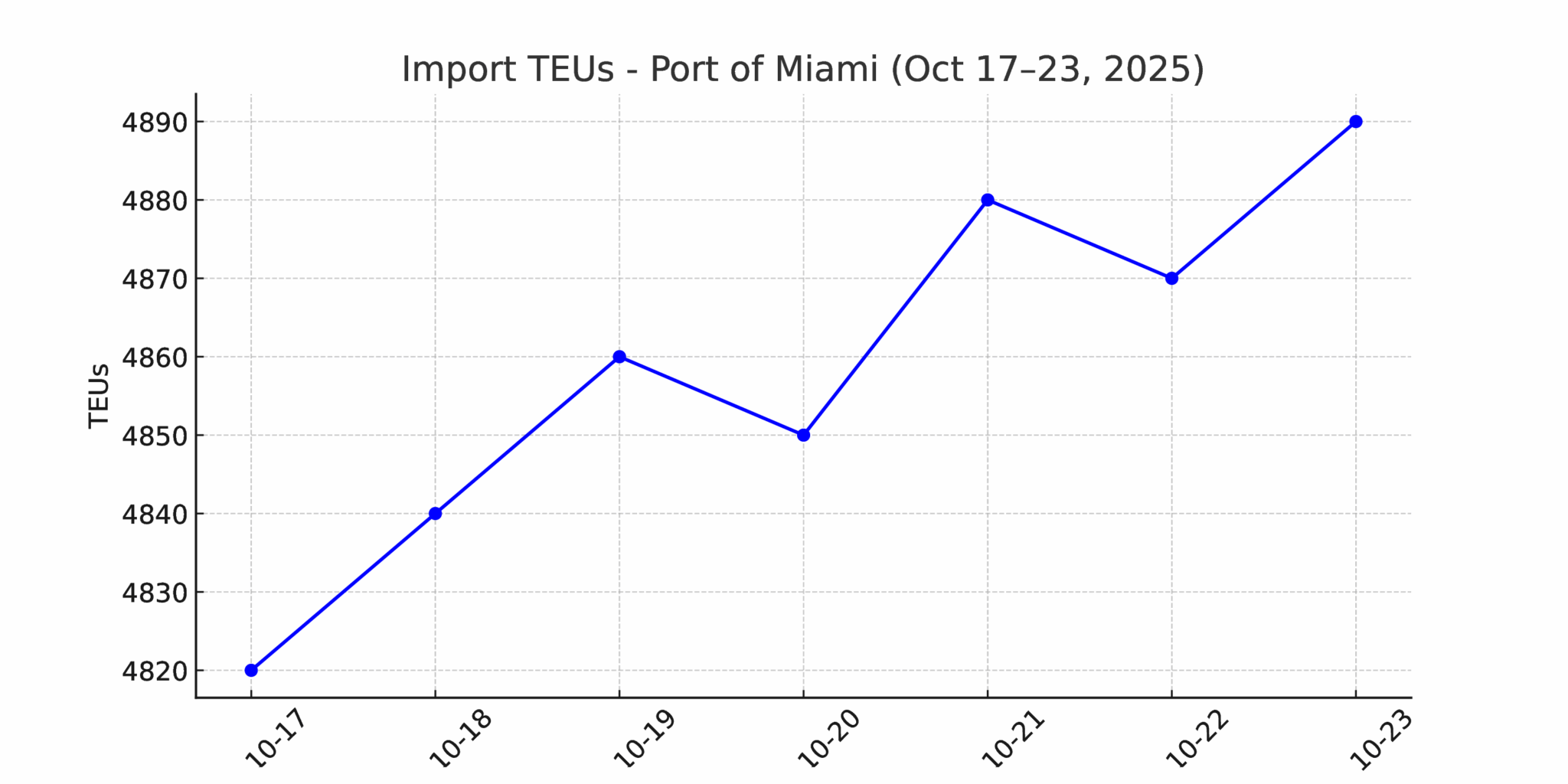

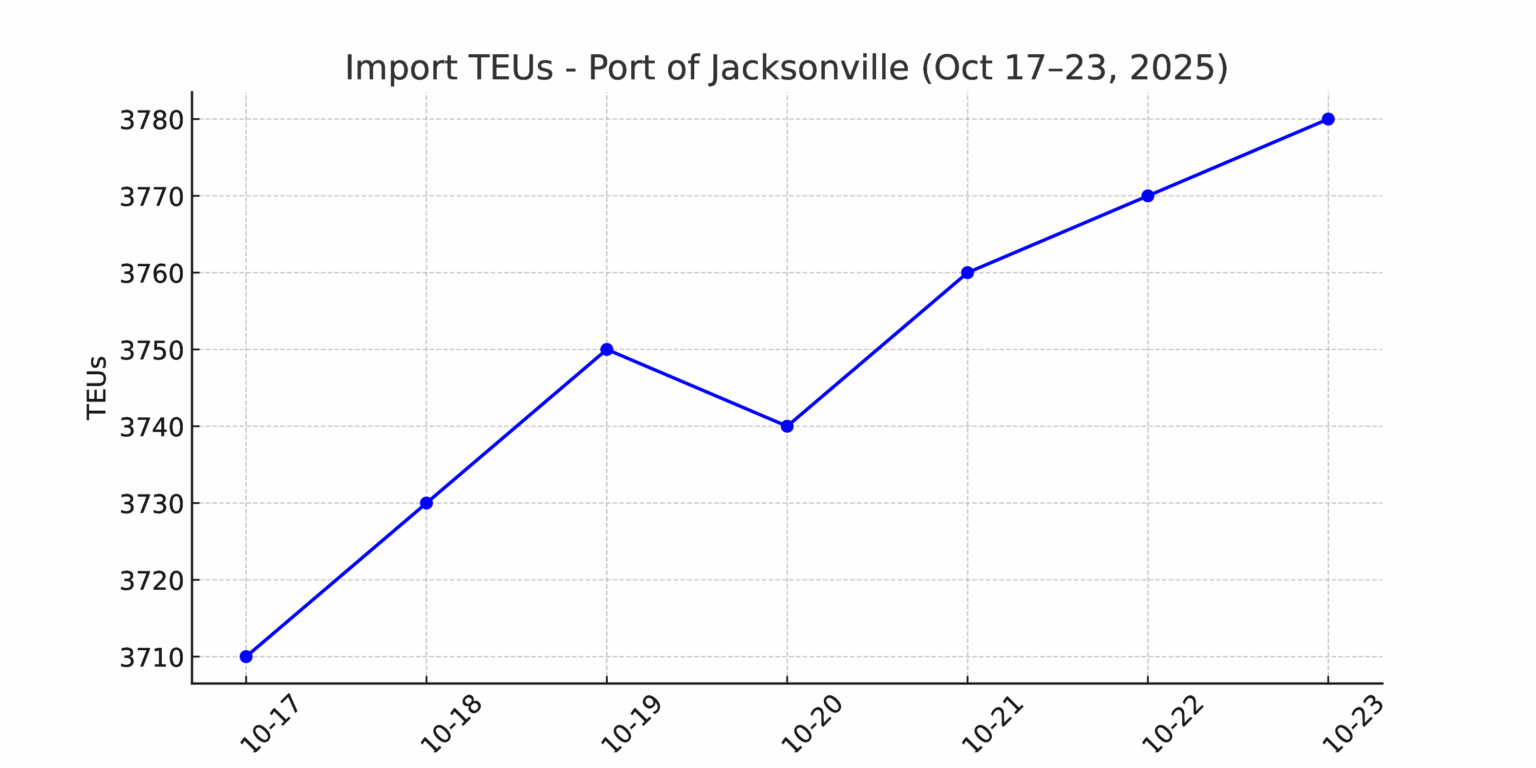

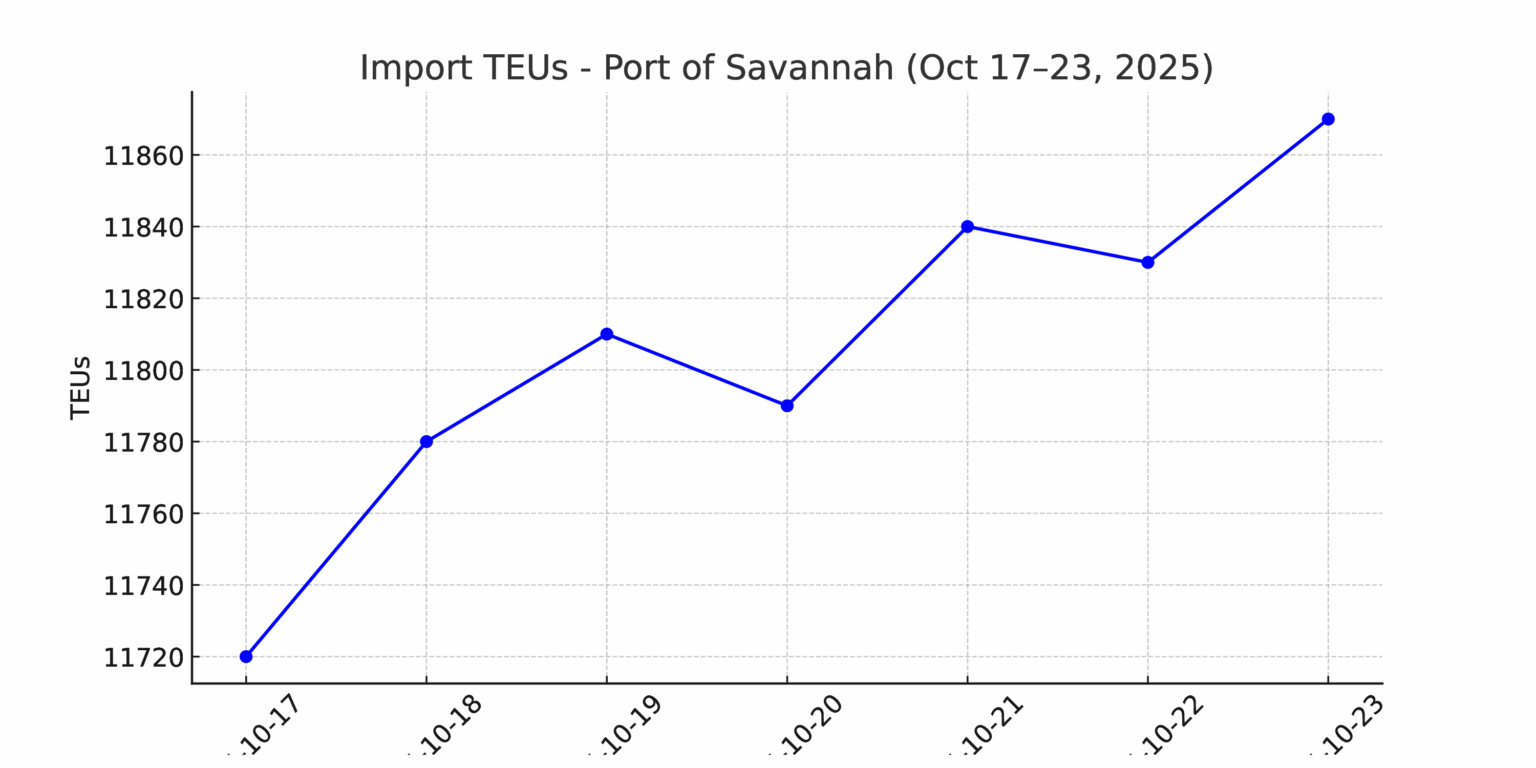

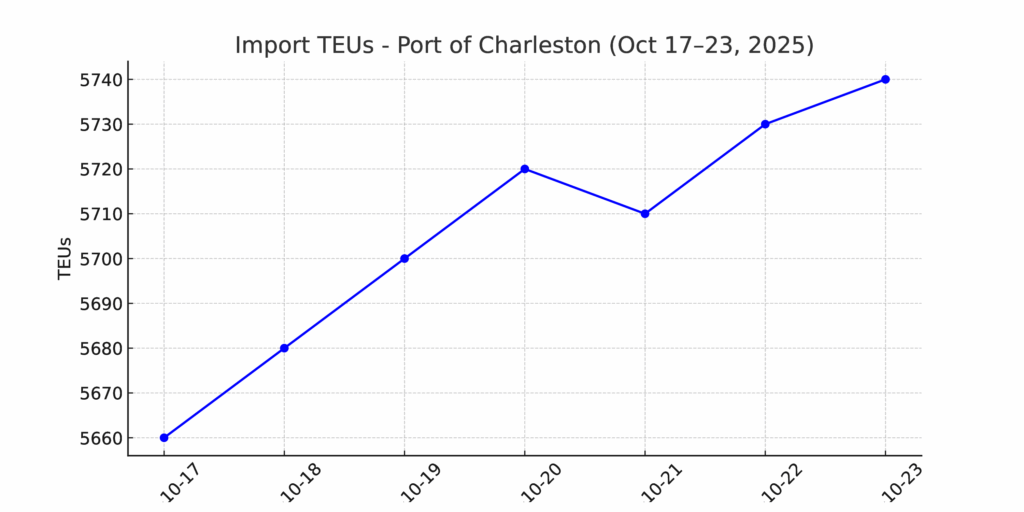

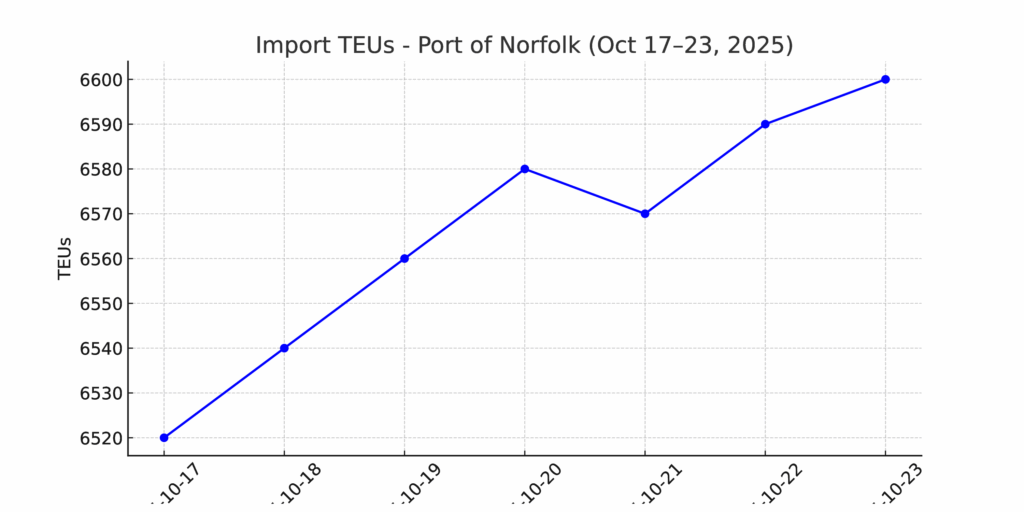

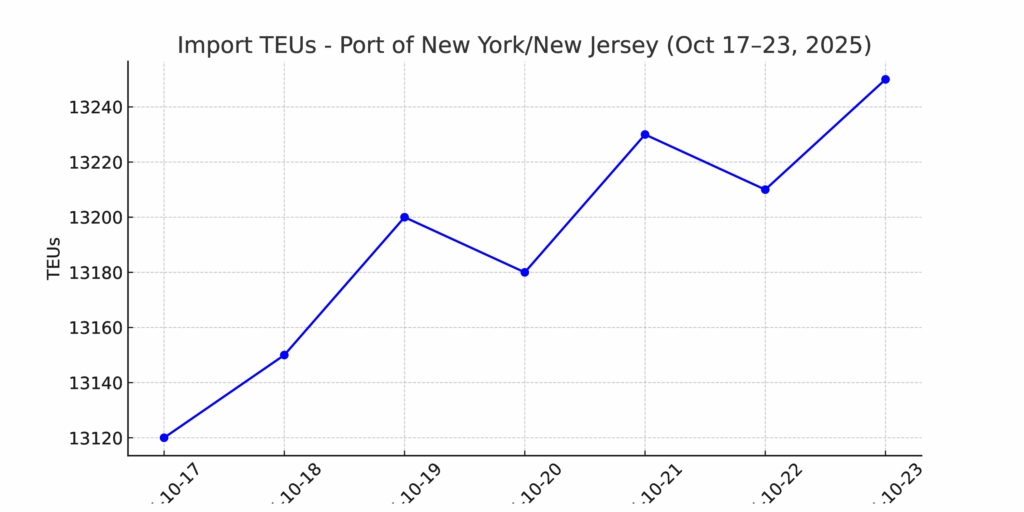

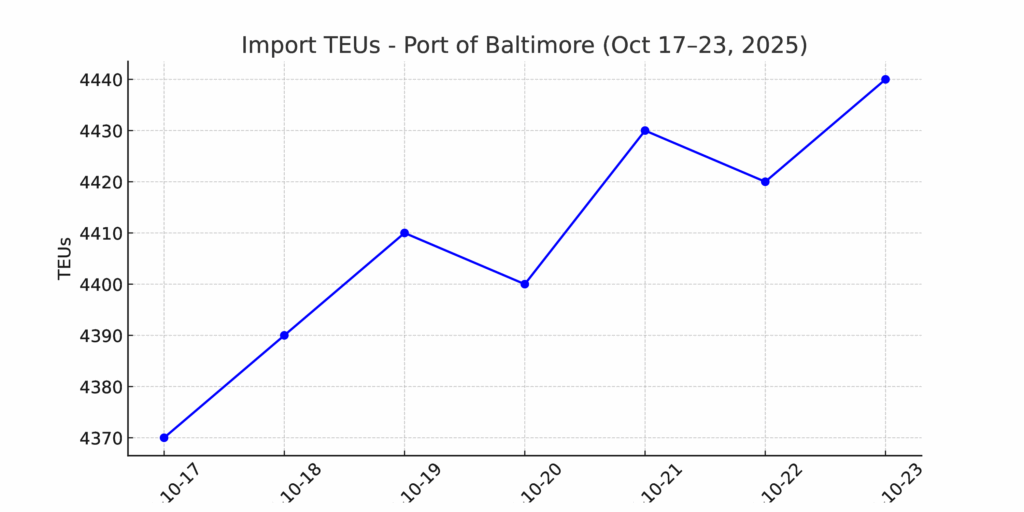

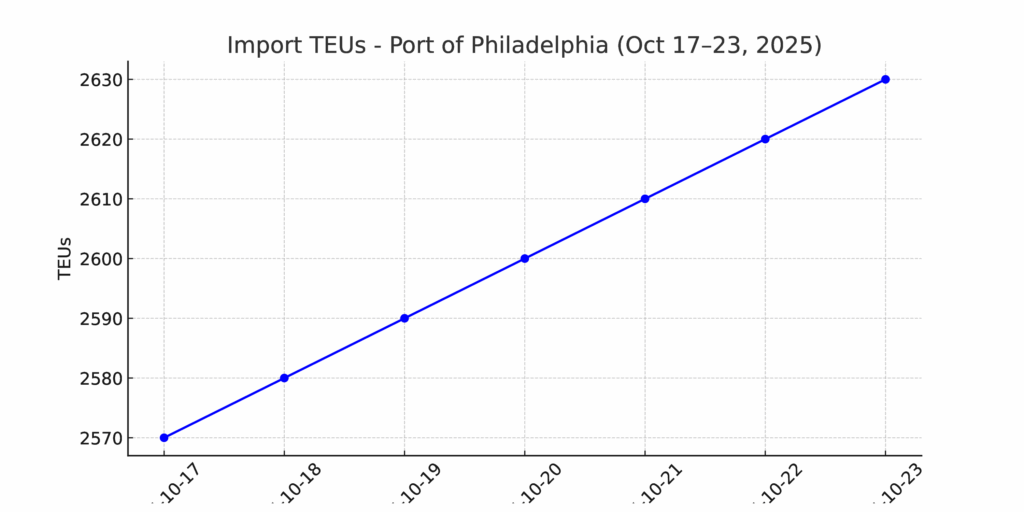

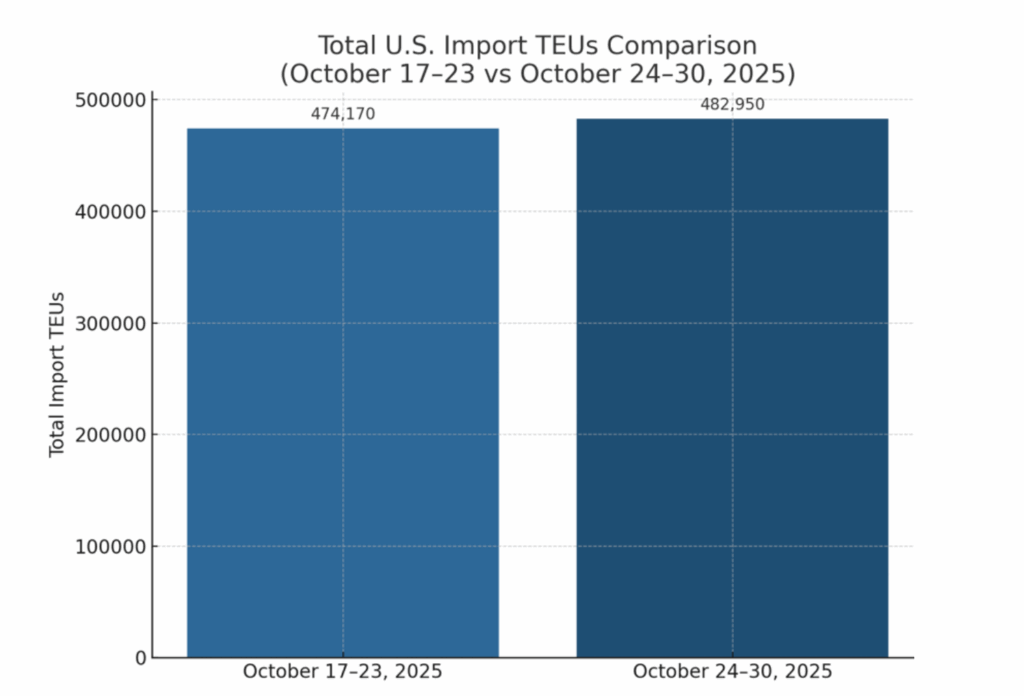

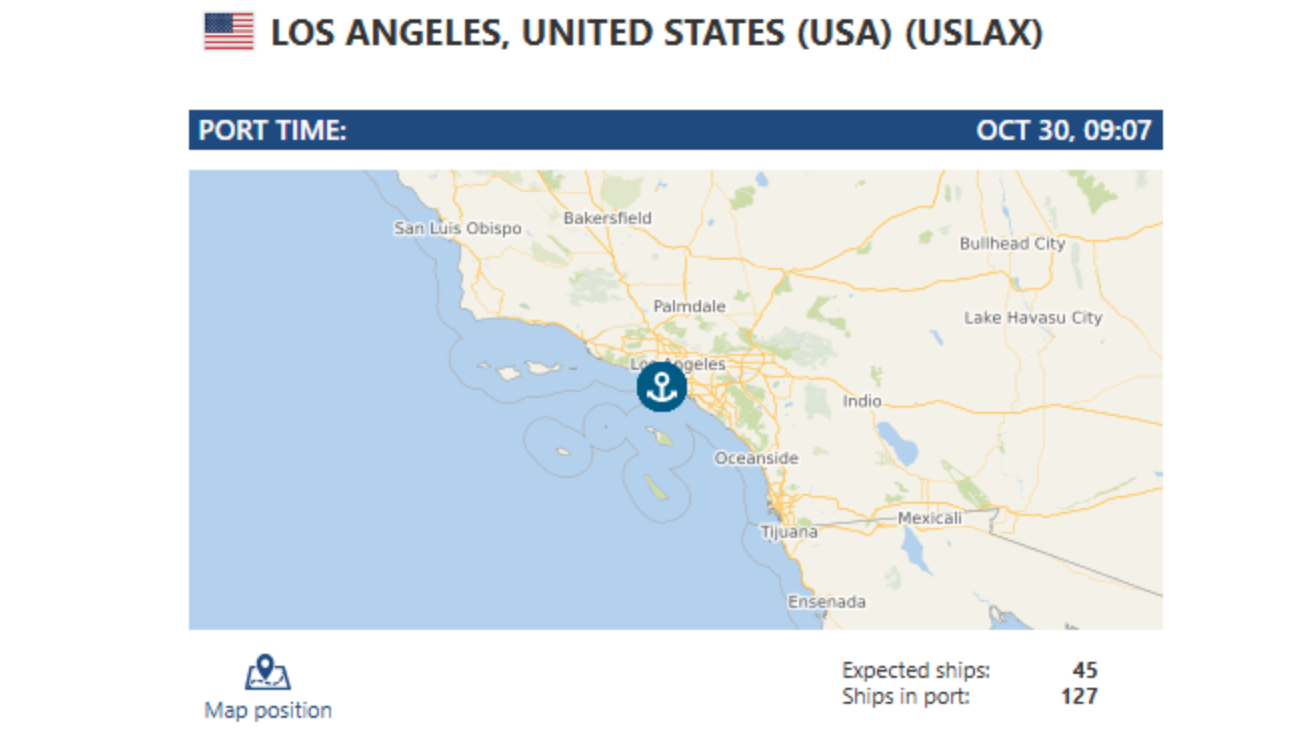

TEU’s are up 1.85% over last week, with the majority coming into Los Angeles 13%, New York/New Jersey 12.7% and Long Beach 12.5%. Container rates on the major Asia trade lanes climbed sharply in late October as progress on regional trade agreements lifted market confidence and carriers tightened capacity. Freightos data showed trans-Pacific and Asia–Europe lanes rising 15–20%, with spot rates averaging around $2,000 per FEU to the U.S. West Coast, $3,500 to the East Coast, and $2,270 to Northern Europe. Analysts noted that the gains largely held through the end of the month as carriers continued blank sailings to stabilize pricing during the seasonal slowdown. Current rate levels now sit well above pre–Red Sea crisis benchmarks, and additional general rate increases could follow in November if capacity discipline holds, although geopolitical uncertainty in the Middle East continues to temper expectations for smoother global routing through the Red Sea and Suez.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

LA/LGB: The Vincent Thomas Bridge in Los Angeles Harbor is set for a major redecking project beginning in early 2026, with state and federal funding already secured. The California State Transportation Agency has prioritized structural and safety repairs on the 63-year-old bridge before considering a separate proposal to raise its clearance to accommodate larger, 23,000-TEU container ships. For now, that height-increase plan is on hold due to its $2.2 billion price tag and the longer 28-month closure it would require. Redecking work will include partial lane closures for nine months and a full shutdown from November 2026 through March 2028, during which Caltrans will reroute truck and vehicle traffic through upgraded surface streets. Port of Los Angeles Executive Director Gene Seroka said dialogue with state officials will continue on the long-term plan to eventually lift the bridge’s clearance once the current safety work is complete. Big news from the West Coast — we’ve dropped our transload rates at Los Angeles and Long Beach! Our secure yard, flexible storage, and fully equipped transload warehouse are ready for everything from palletized freight to floor-to-pallet conversions. With a powerful drayage fleet and full OpenTrack visibility, we keep eyes on your container from vessel load overseas to arrival at the terminal. And don’t forget — our No Demurrage Guarantee still stands when freight is dispatched to Port X Logistics at least 72 hours before vessel arrival and cleared by the last free day. Ready to roll? Reach out to letsgetrolling@portxlogistics.com and make Port X your trusted West Coast transload partner.

Houston: Port Houston has officially completed its Project 11 expansion, a $1.2 billion effort to deepen and widen the Houston Ship Channel for the first time in decades. The newly expanded section—from Bolivar Roads to Morgan Point—now measures 700 feet wide, up from 530 feet, allowing two-way traffic for larger post-Panamax vessels and improving overall safety and efficiency. Once fully finished in 2026, Project 11 will enhance capacity across the entire 52-mile channel, positioning Houston as one of the most capable and future-ready ports on the U.S. Gulf Coast. Our Houston operation is running strong with 32 drayage trucks, including long-haul capability, keeping containers moving efficiently across the Gulf region. At our LaPorte transload warehouse, we handle everything from palletized freight to heavy industrial materials like lumber and coils—built for fast turns, safe handling, and flexible solutions. Beyond the port, our Dallas team adds another 19 trucks and secured yard space, ready to support overflow, reposition freight, or create regional routing options that keep your supply chain running smoothly. Whether you need local drayage, transload, or cross-market support, Port X Logistics has the capacity and coordination to deliver. Want to see how our Houston and Dallas network can strengthen your Gulf operations? Reach out at letsgetrolling@portxlogistics.com — our team is ready to roll.

Did you know? We operate at Seattle and Tacoma ports? Seattle and Tacoma remain vital gateways for U.S. imports — and our teams are keeping freight moving seamlessly through both ports. With 11 new drivers on the ground, expanded yard space, and a transload crew built for speed and precision, our SEA/TAC operation has the muscle to handle whatever your supply chain throws its way. Whether it’s high-volume import transloads, port-to-rail coordination, or time-critical recovery, we’ve got the capacity, visibility, and experience to deliver.

When the market shifts, resilience and reliability are what matter most — and that’s exactly what our Seattle and Tacoma network provides. Backed by strong local infrastructure, modern equipment, and a service team that knows how to execute under pressure, we’re ready to help you keep your cargo flowing and your customers satisfied.

Want to see how routing through SEA/TAC can give your network a true West Coast advantage? Connect with us at letsgetrolling@portxlogistics.com — our team is ready to roll.

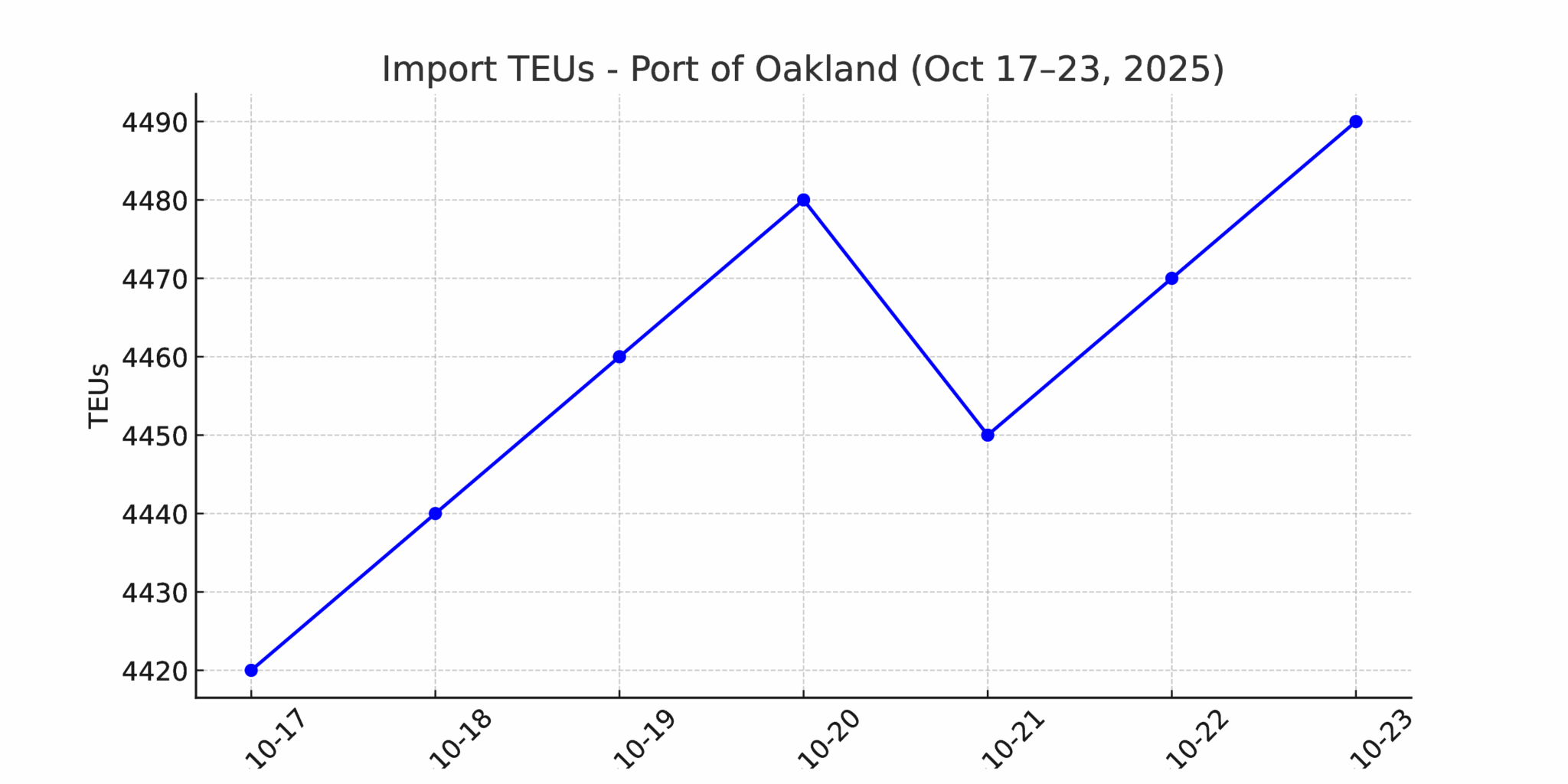

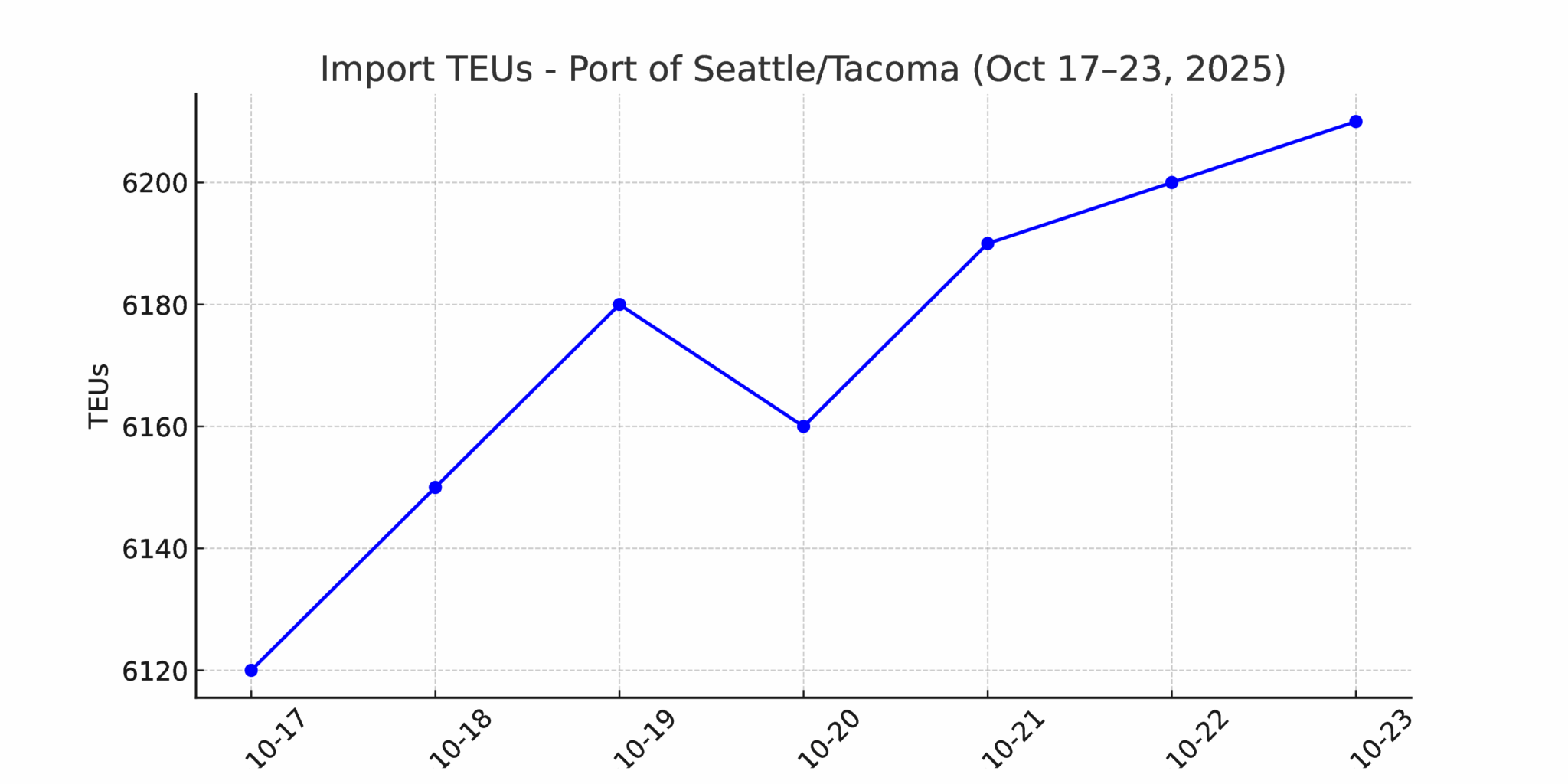

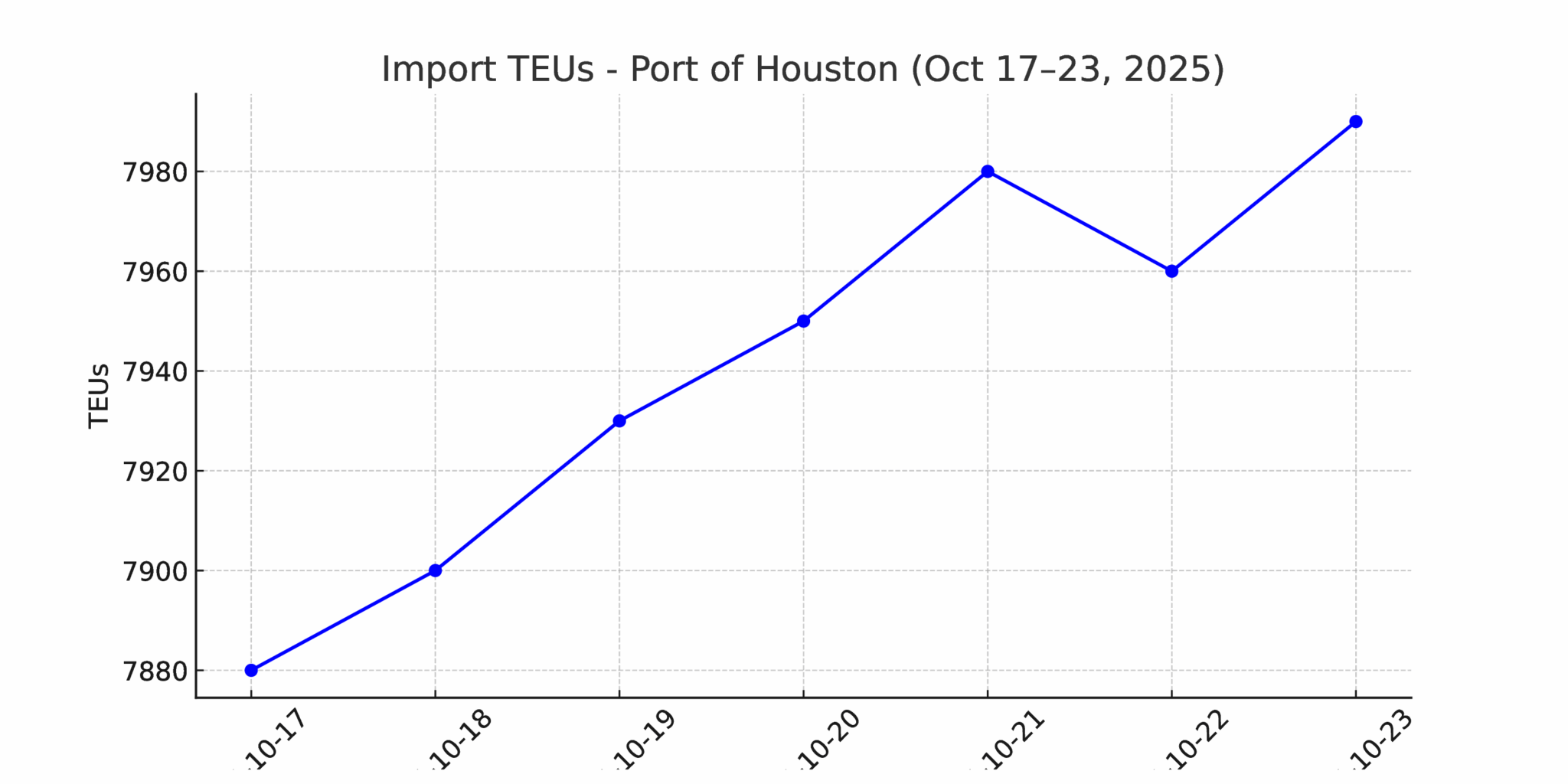

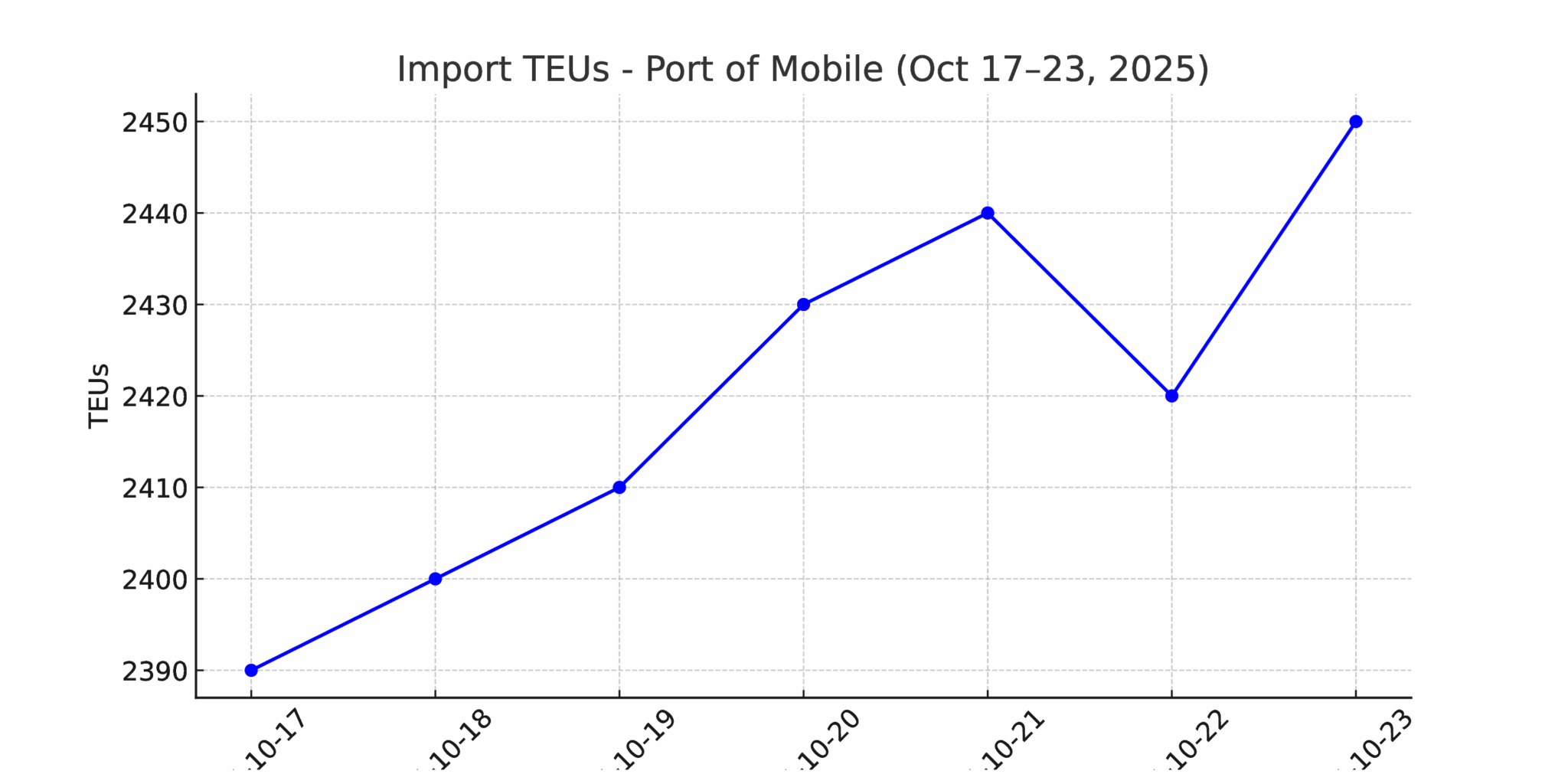

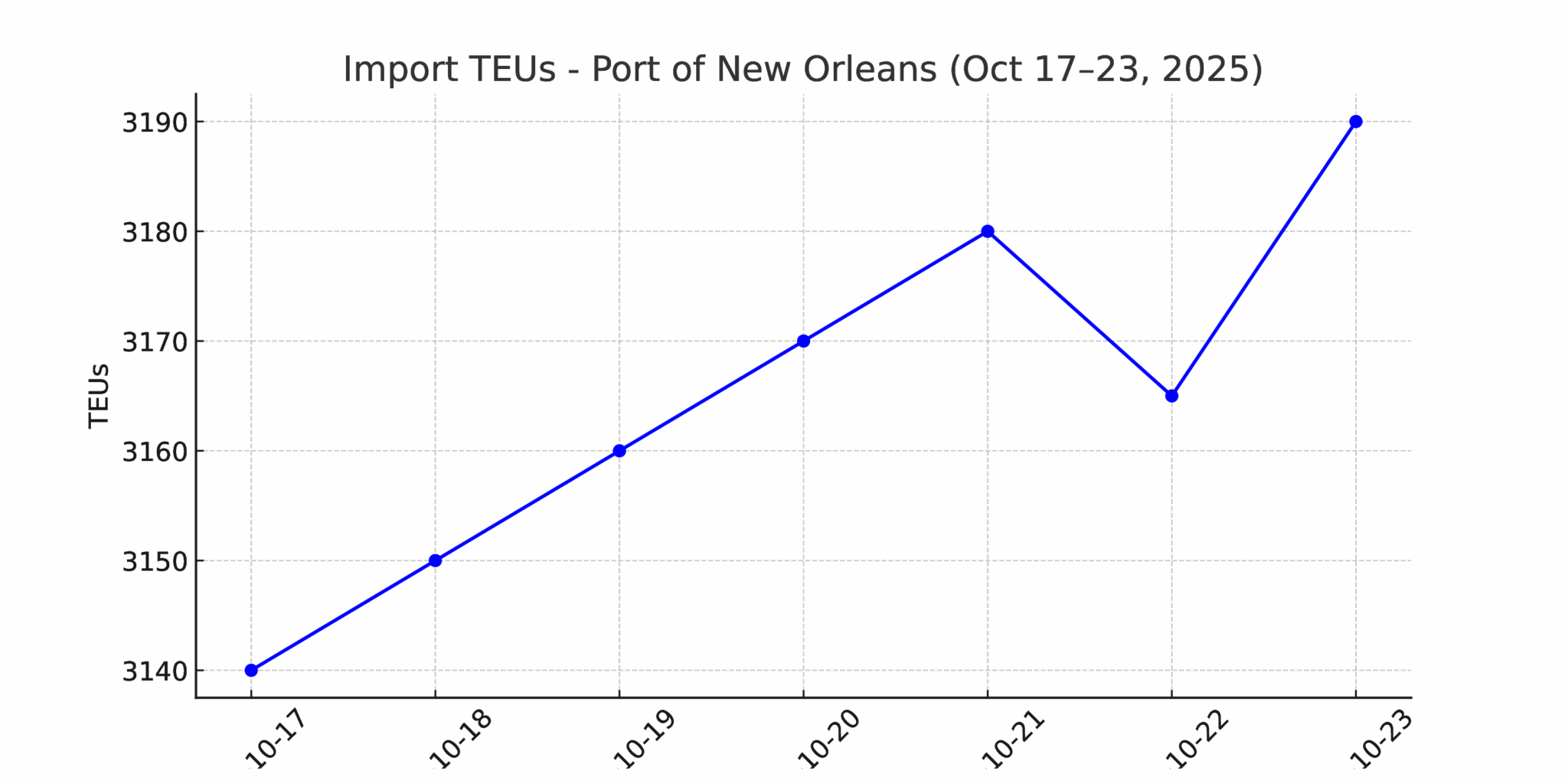

Import Data Images