Port of Long Beach

1458 words 6 minute read – Let’s do this!

Shutdowns, strikes, and shifting policies are hitting the logistics world all at once — and every move counts. From D.C.’s budget standoff to Montreal’s port slowdown and California’s high-stakes fight over automation, disruption is rewriting the playbook on how freight flows, clears, and connects. In this week’s Market Update, we’re breaking down what’s real, what’s next, and how to stay ahead of the chaos. Don’t forget to follow Port X Logistics on LinkedIn for the inside scoop — or get our Market Updates every Thursday straight to your inbox at Marketing@portxlogistics.com

The federal shutdown is entering its second week, and strain is mounting. Air traffic control and TSA staffing shortages are now translating into multi-hour flight delays at hubs like Newark, Boston, and Chicago. While essential staff continue working unpaid, absenteeism is rising and fatigue is spreading. FAA certifications, TSA approvals, and Customs compliance checks remain heavily delayed — all of which slows import flow and pilot approvals for new air cargo capacity. On the surface, trade is still moving — Customs and Border Protection continues processing cargo — but support staff furloughs are throttling the back-office. Expect more unpredictable clearance timelines for FDA-regulated and high-value goods. Rail and trucking continue operating, but paused federal reviews and permitting could pinch expansion plans or new fleet onboarding. Each additional week without a funding deal compounds the ripple effect: higher costs, slower flows, and rising operational stress. Analysts now estimate as much as $15 billion in GDP loss per week if the shutdown drags through mid-October.

At the Port of Montreal, the CUPE 4317 strike that began September 22 remains unresolved — but the Canadian government has stepped in with back-to-work legislation to force administrative and support staff to return. Operations have mostly continued, yet documentation and scheduling delays persist.

Union leaders are challenging the bill in court, raising the risk of renewed work stoppages if the injunction lands in their favor. For now, throughput has improved slightly — yard utilization hovering around 63% and average import dwell near three days — but the uncertainty is keeping shippers cautious. Some cargo has already been rerouted through Halifax or New York, adding congestion to neighboring gateways.

What to Watch & What to Do in the Upcoming Weeks

- Hidden chokepoints: Not every delay will show up in port dashboards. The real friction points this week are in certification, inspection, and documentation pipelines.

- Diversion patterns: Expect continued rerouting from Montreal into Halifax, NY/NJ, and East Coast U.S. ports — a potential short-term boost for transload and cross-border drayage volumes.

- Operational planning: Build extra clearance days into schedules, pre-file customs paperwork, and secure bonded or transload storage space early.

Don’t forget Port X Logistics’ ability to pivot quickly! – leveraging flexible drayage, transload, and truckload deliveries and Hot Shot airport recovery with Carrier911’s rapid-response services to minimize disruption as crises evolve.

California’s maritime gateways are once again at the center of a high-stakes policy fight. Governor Gavin Newsom is reviewing Senate Bill 34 (SB 34) — legislation that would prohibit automated or remotely operated cargo-handling equipment from connecting to the state power grid. Backed by the International Longshore and Warehouse Union (ILWU), supporters frame it as protection for good-paying jobs and a check on over-automation. Opponents argue it could stall zero-emission and modernization projects, jeopardizing billions in clean-energy investment. For ports already under pressure from the South Coast Air Quality Management District (SCAQMD) to cut emissions, the bill adds major uncertainty to future electrification plans.

Automation remains deeply polarizing on the West Coast. Labor groups point to community impacts and job displacement fears, while terminal operators say limited automation—like stacking cranes, digital gates, and guided yard tractors—has already boosted safety, throughput, and emissions performance. At the Ports of Los Angeles and Long Beach, these systems have helped reduce truck turn times and congestion while supporting California’s clean-air goals. A Martin Associates study found the San Pedro Bay complex generated $851 billion in economic activity in 2024—around 20% of California’s GDP—and supported 3.5 million jobs statewide. Industry leaders warn that restricting modernization could push discretionary cargo to Houston, Savannah, Vancouver, or even Mexico, where automation continues at pace.

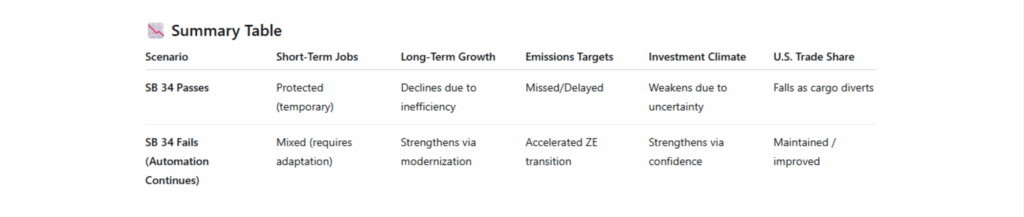

If SB 34 passes, it could slow capital investment and delay the rollout of advanced zero-emission systems that depend on grid power—reducing yard efficiency and extending equipment life cycles. If vetoed, automation and electrification will likely accelerate, supported by public and private funding but paired with renewed scrutiny over how modernization benefits the workforce. Either way, California’s ports face the same long-term challenge: balancing technology, labor, and climate mandates while keeping America’s busiest gateways competitive.

For logistics partners, the takeaway is clear: watch California closely. The policy outcome will shape everything from terminal throughout and chassis availability to cross-dock velocity and regional emissions compliance in 2026 and beyond.

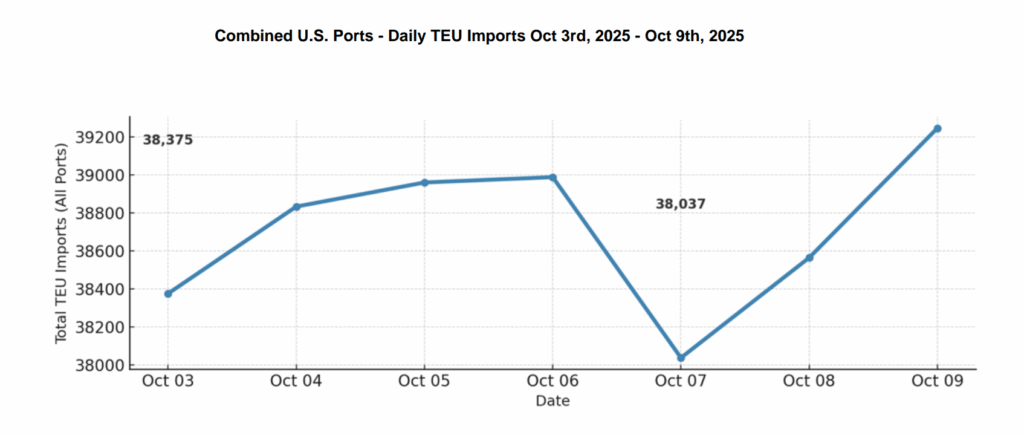

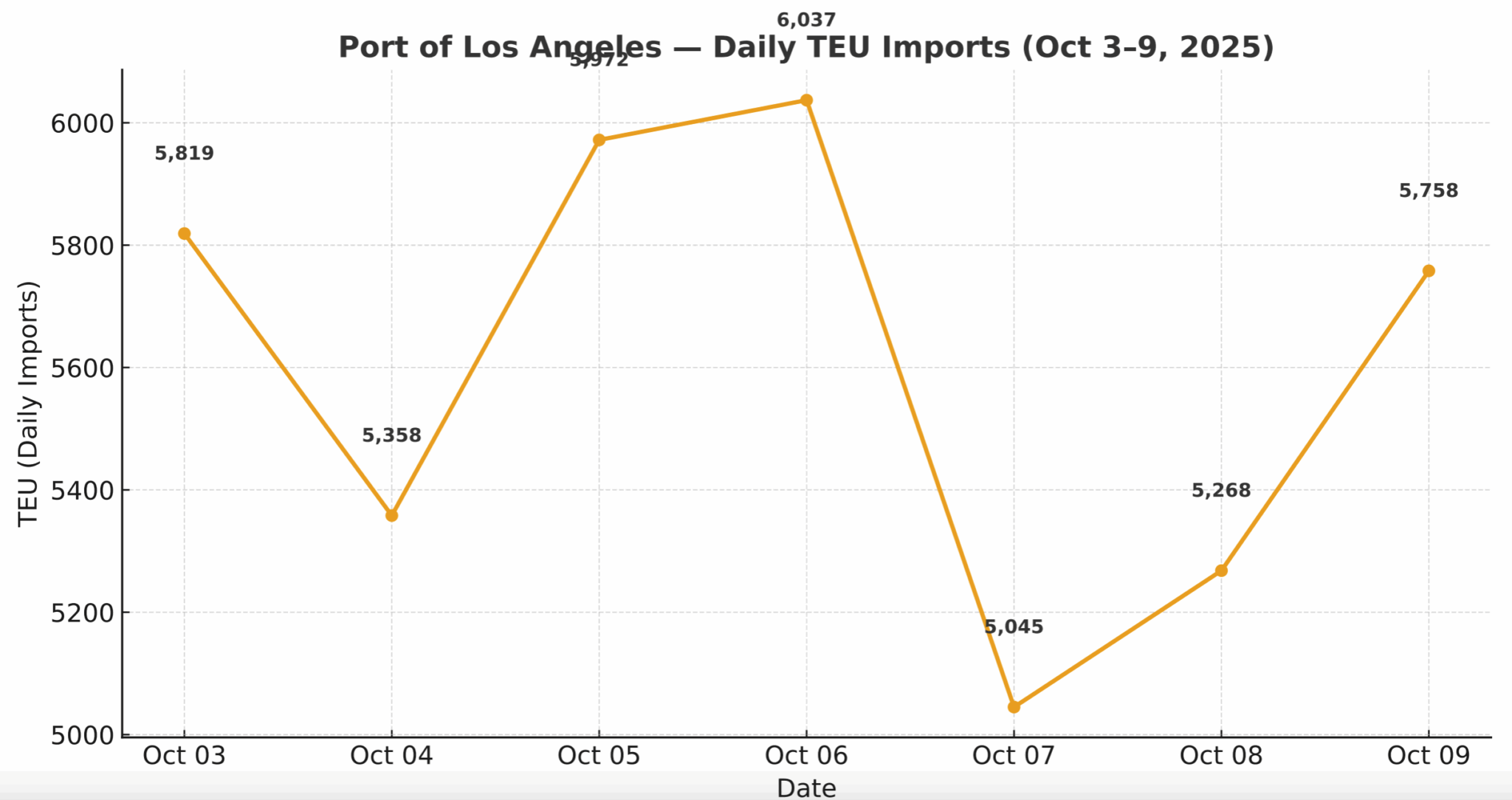

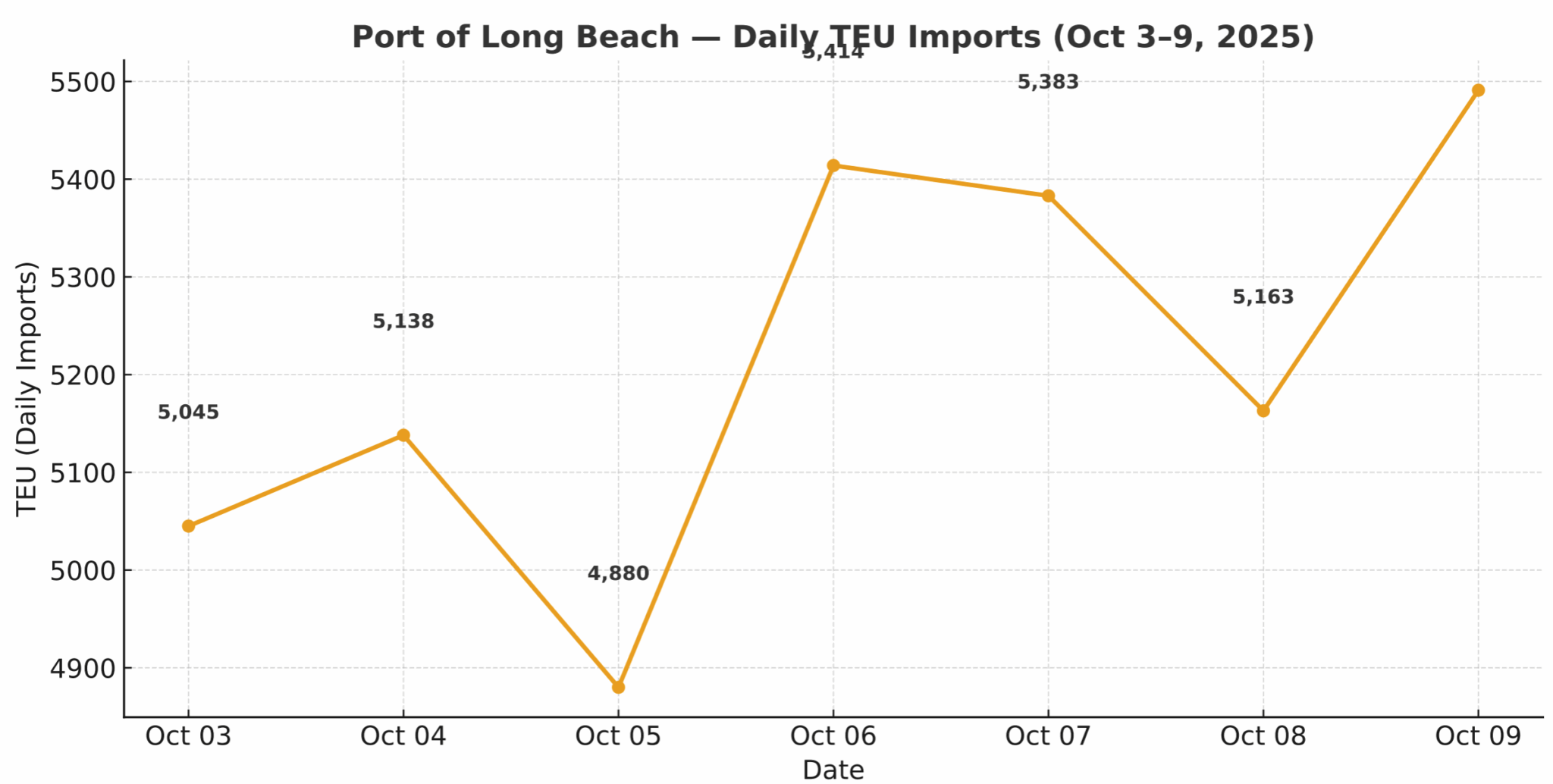

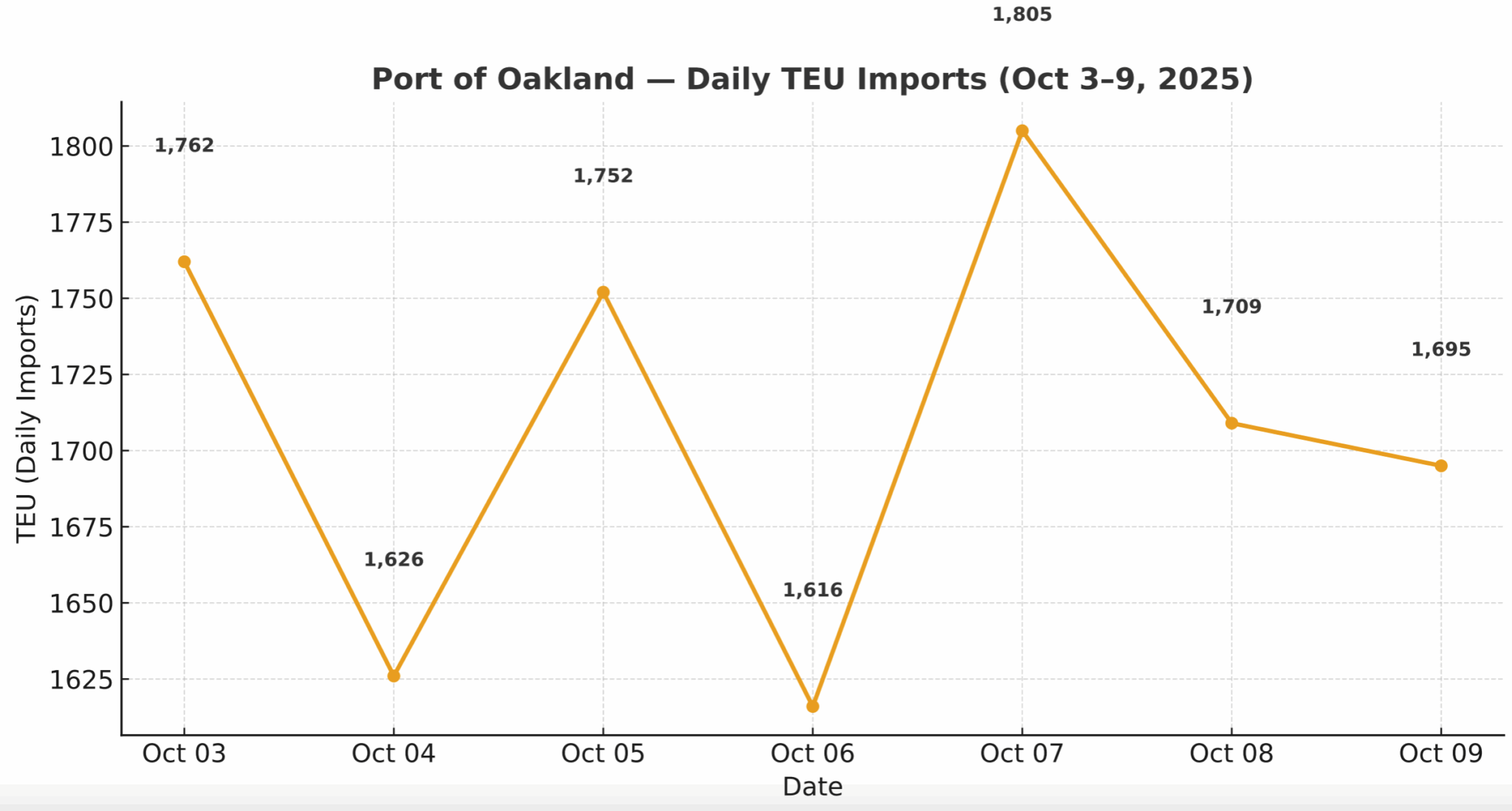

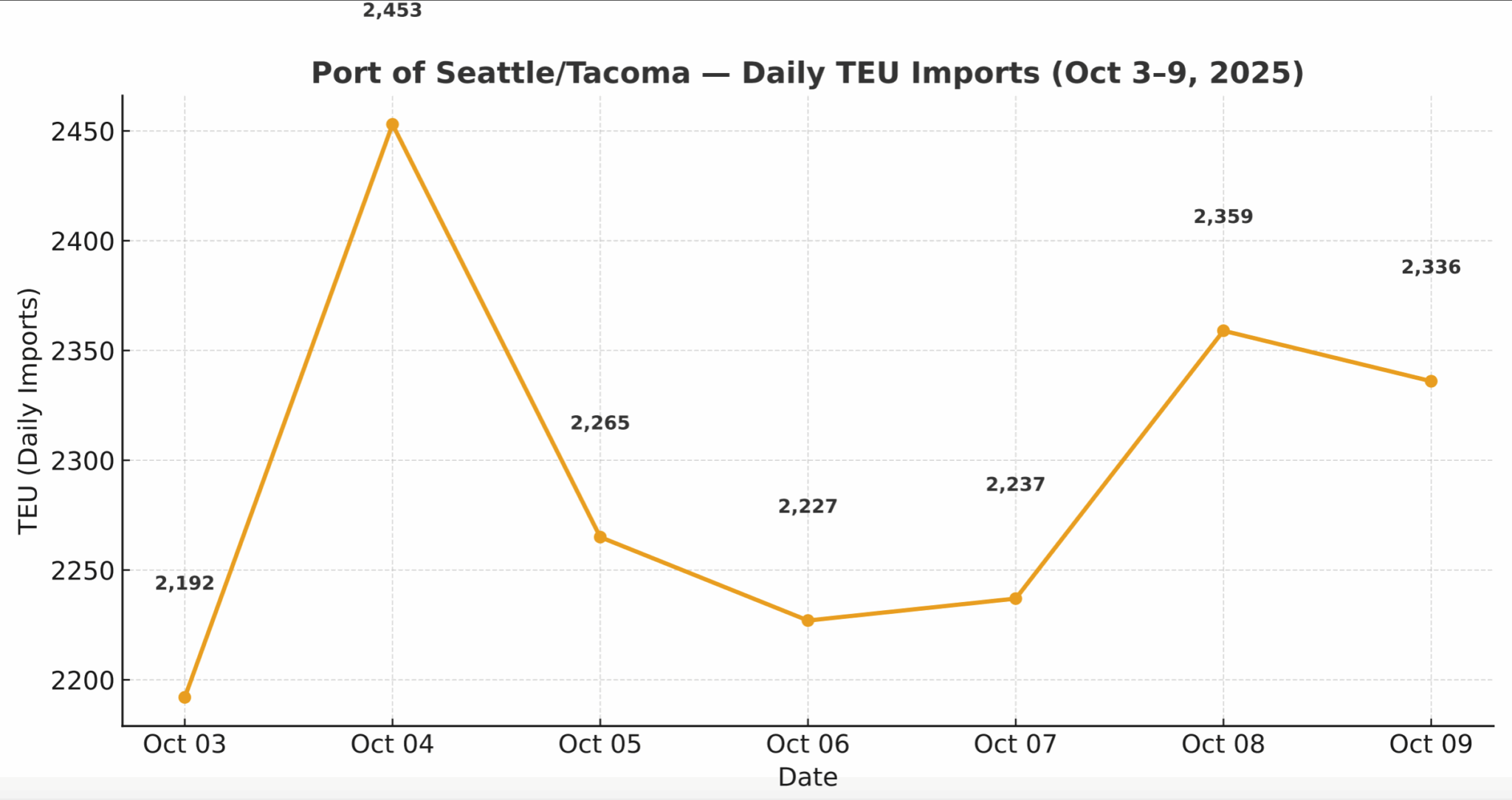

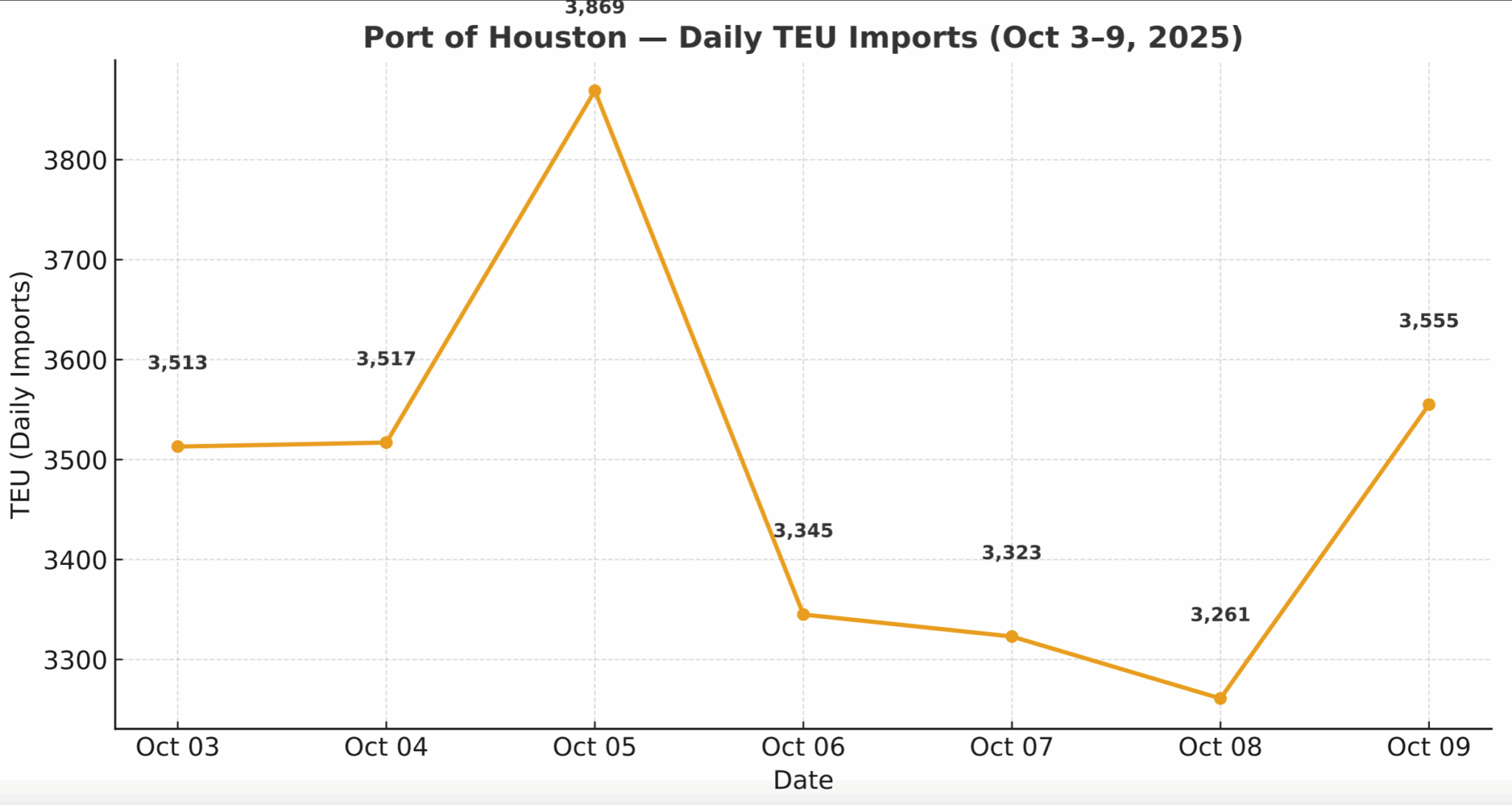

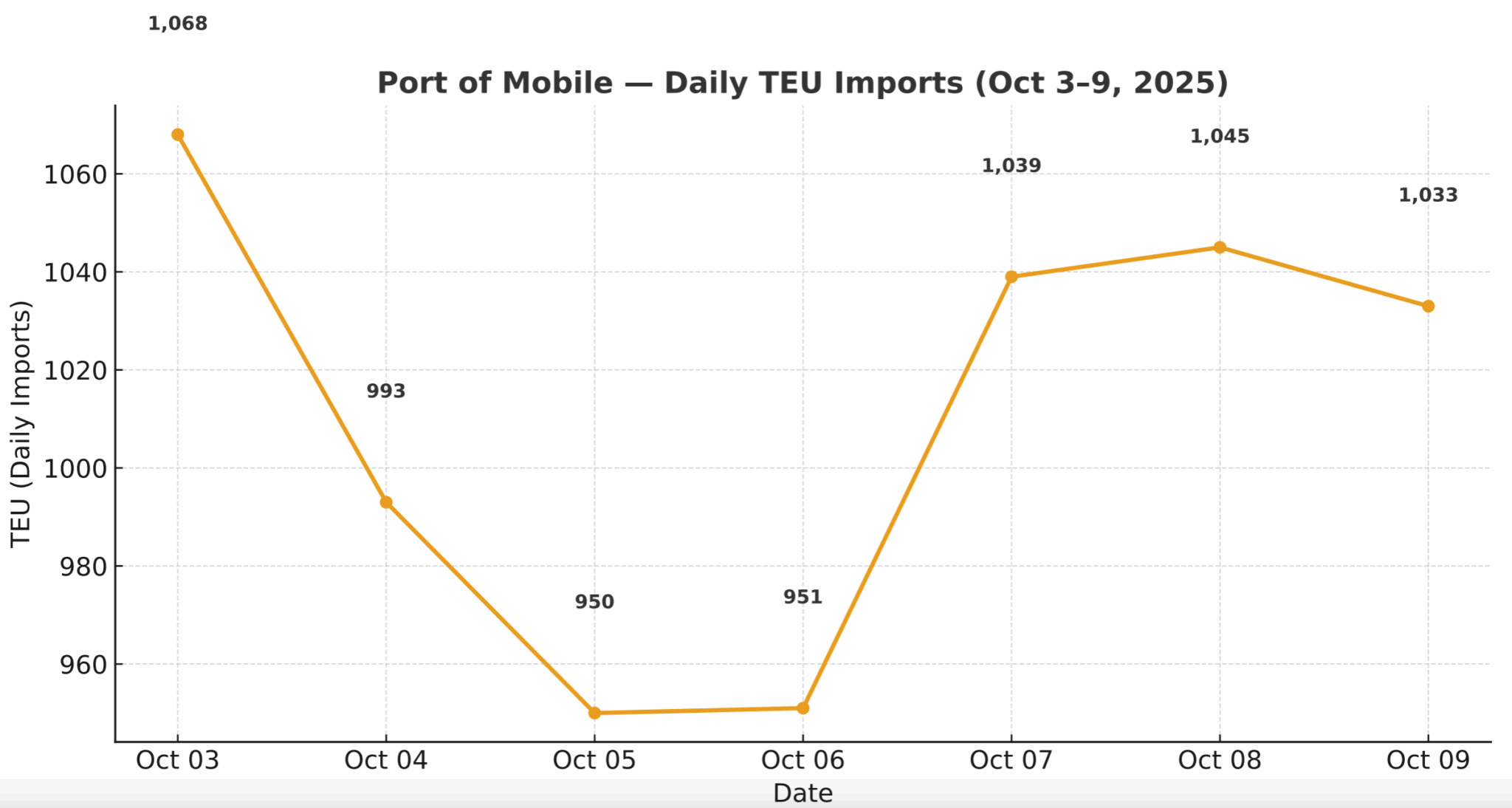

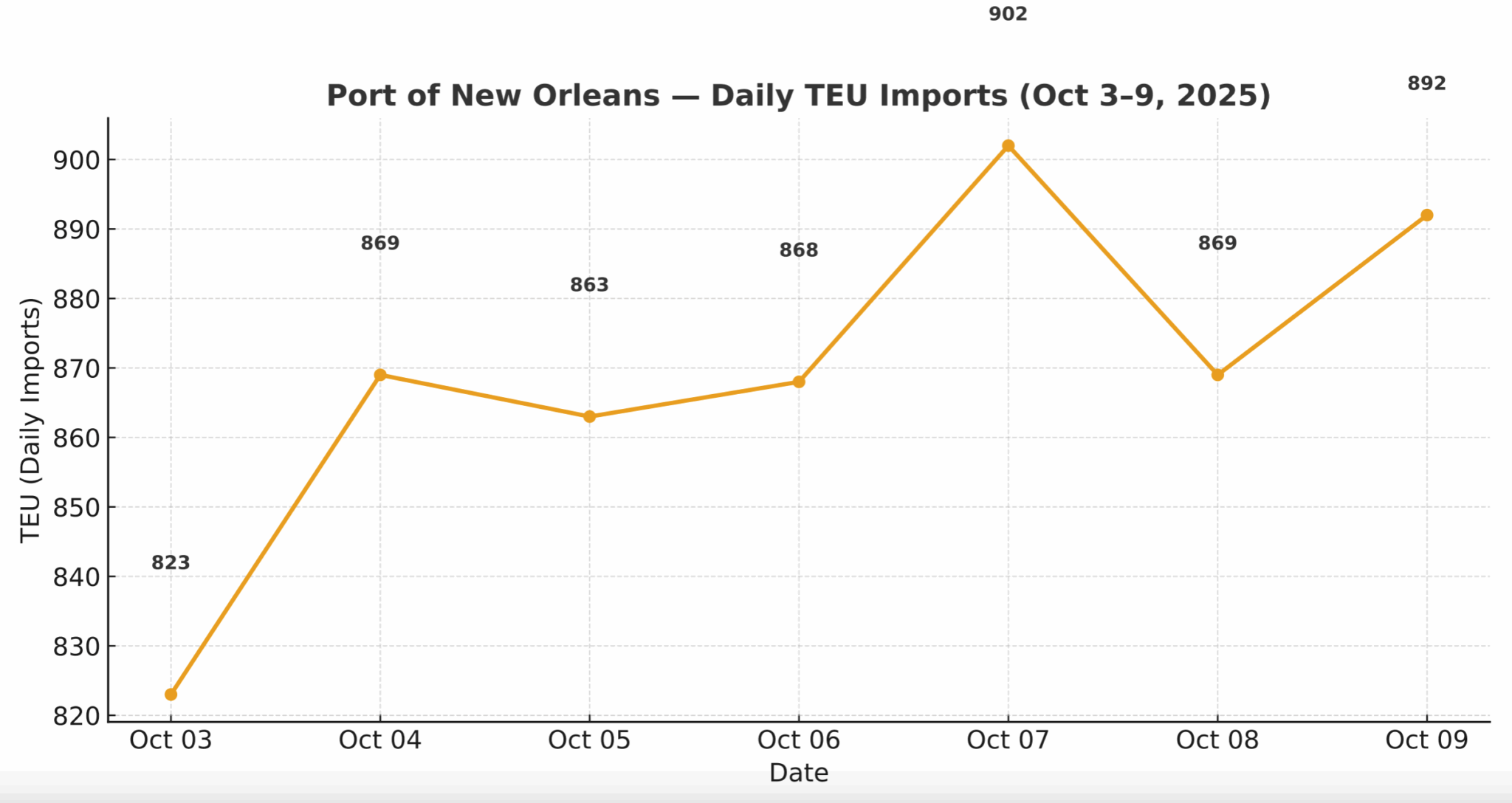

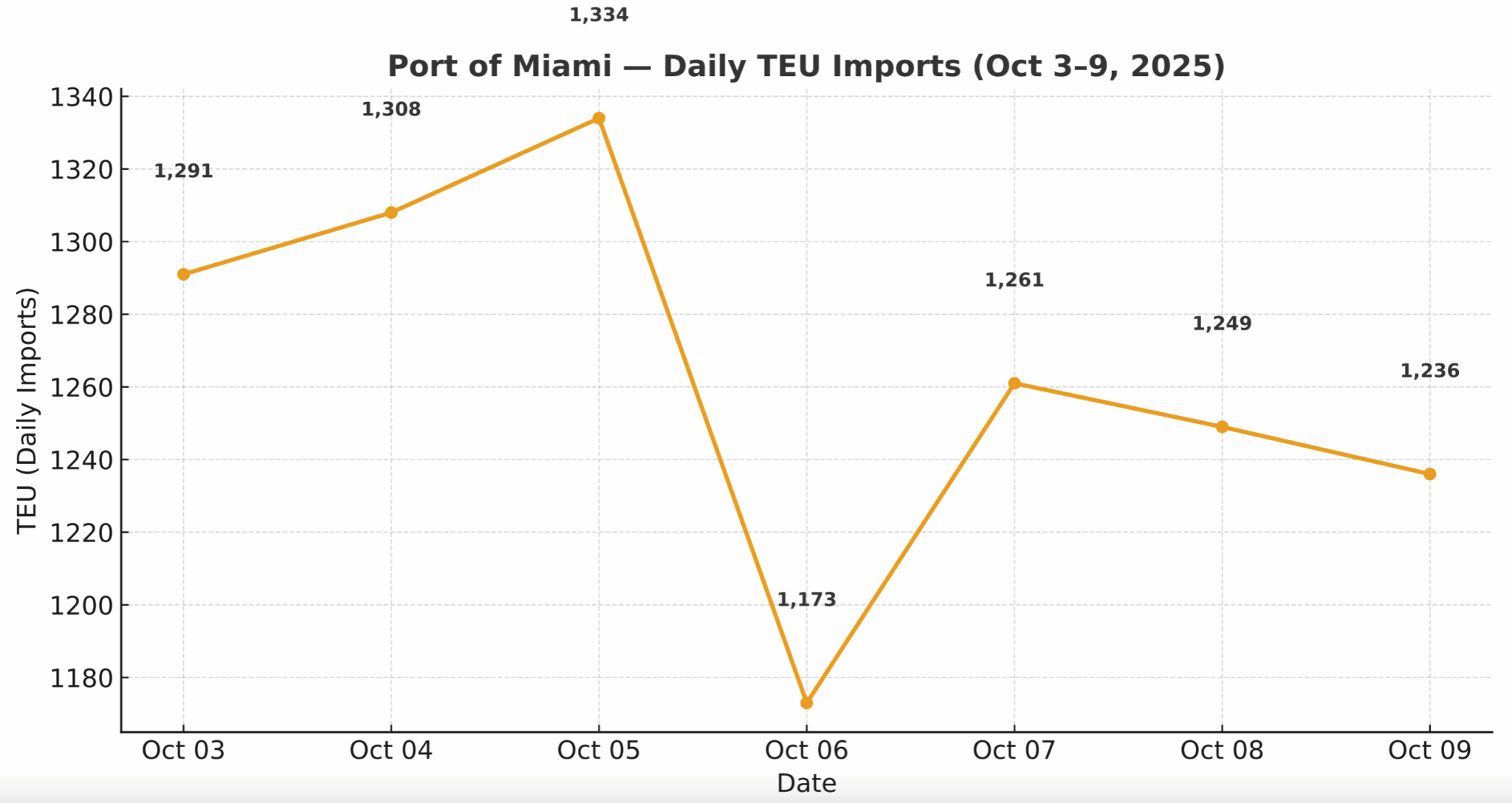

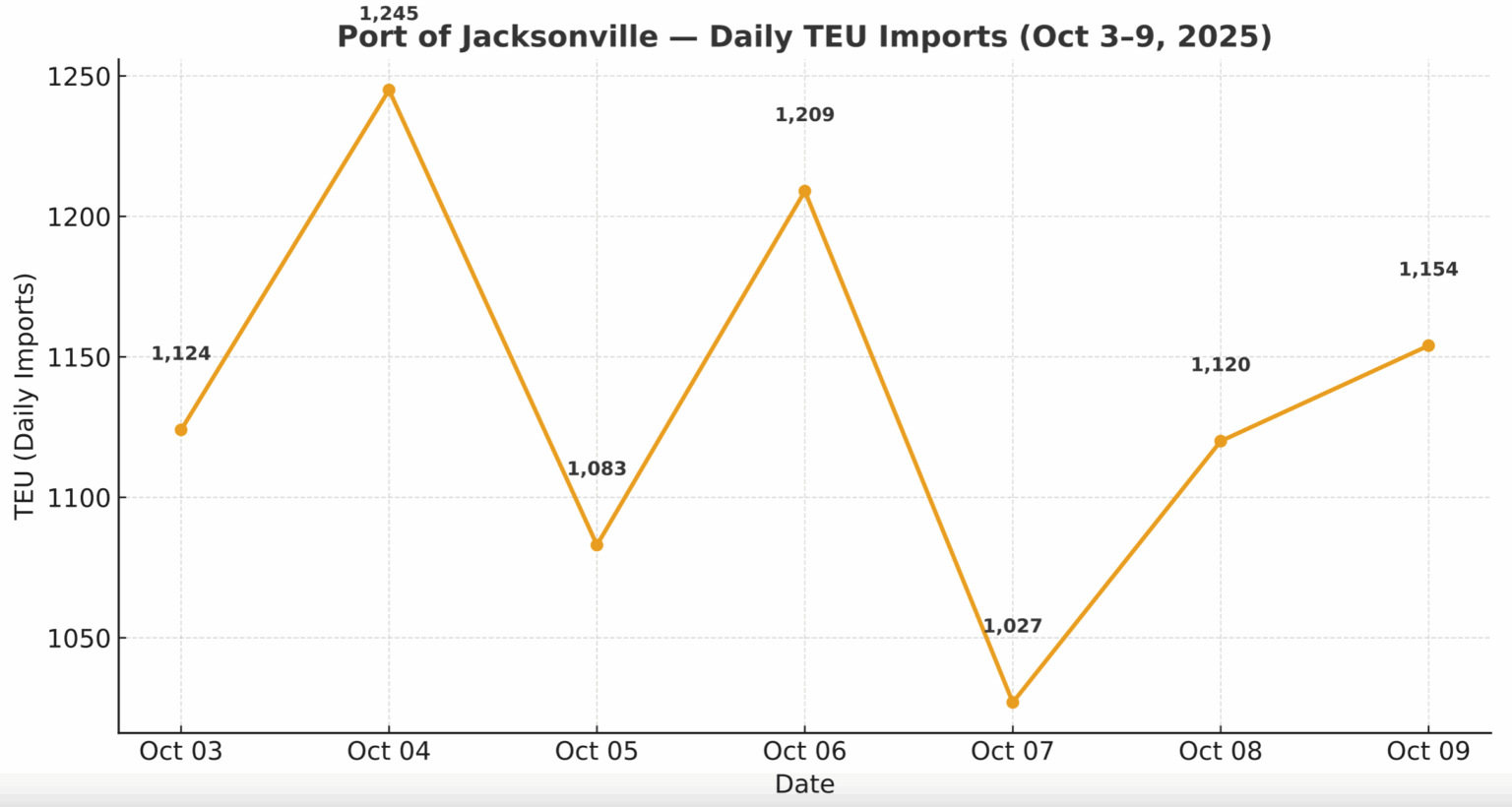

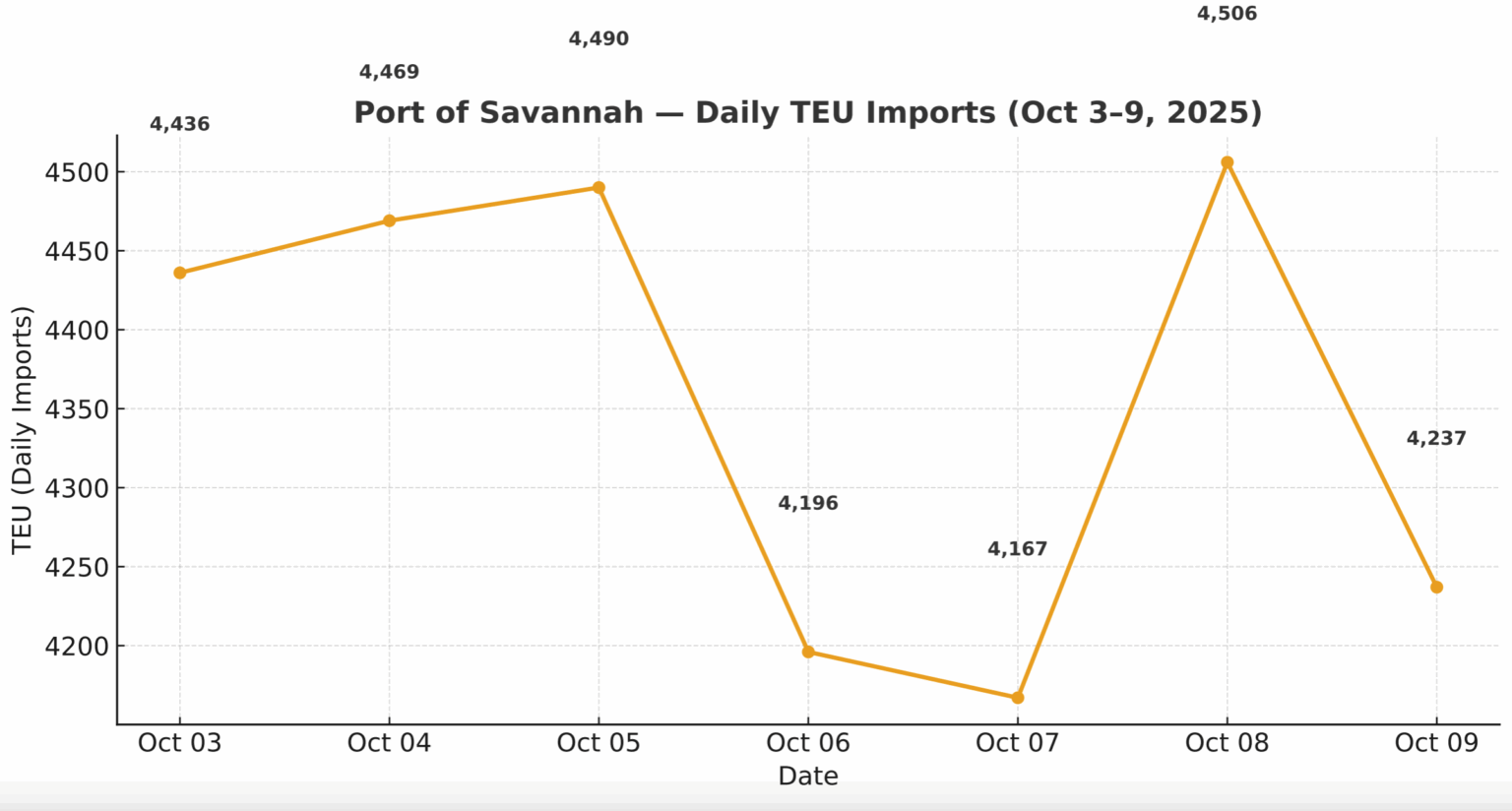

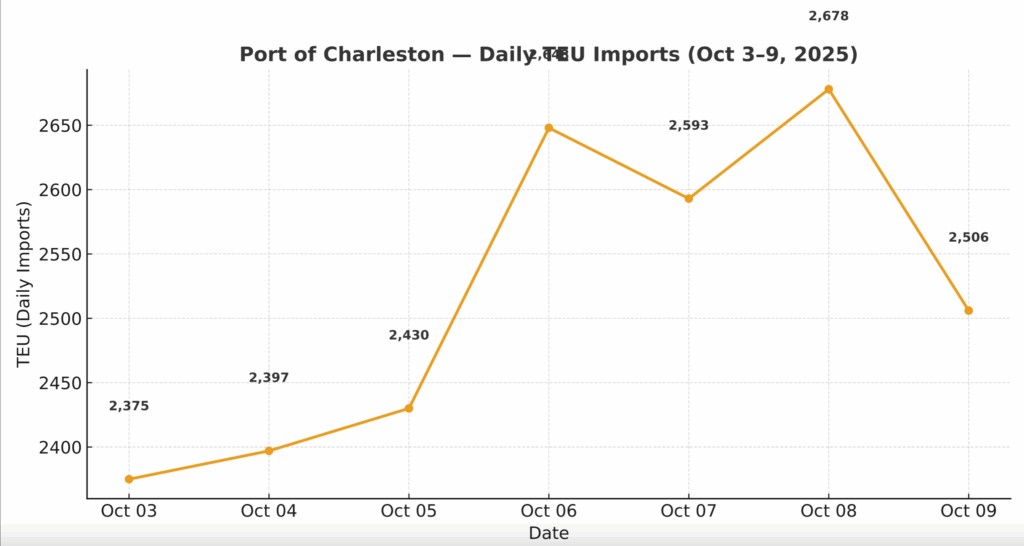

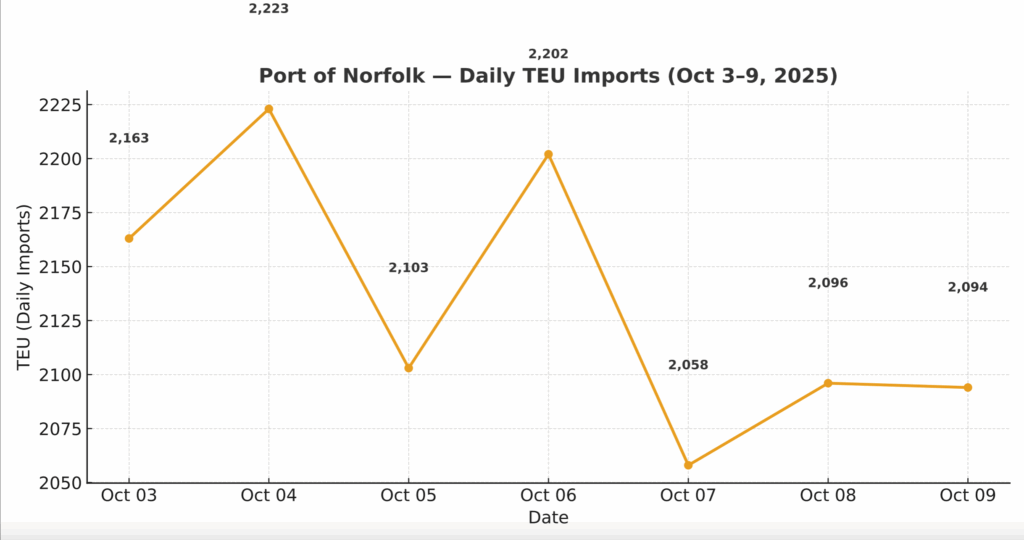

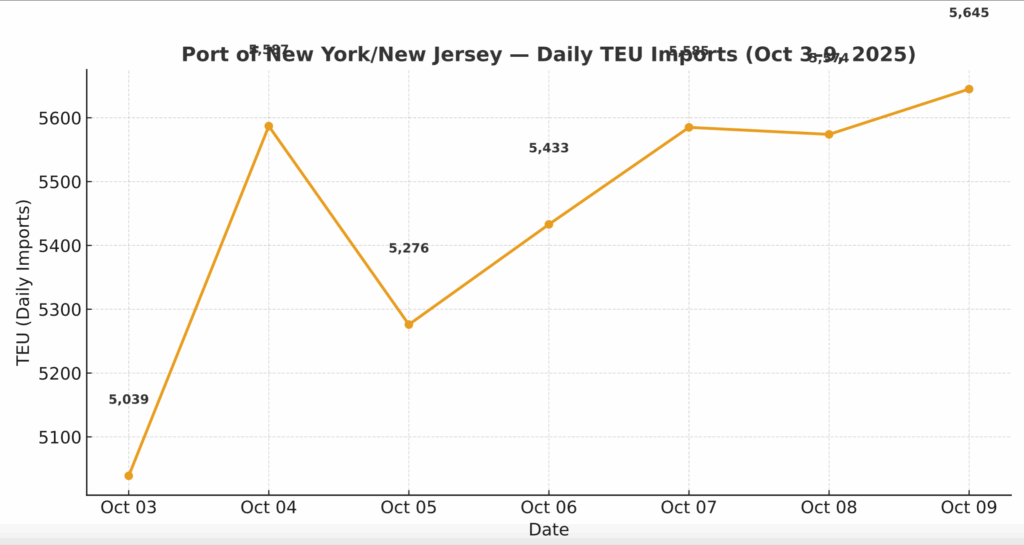

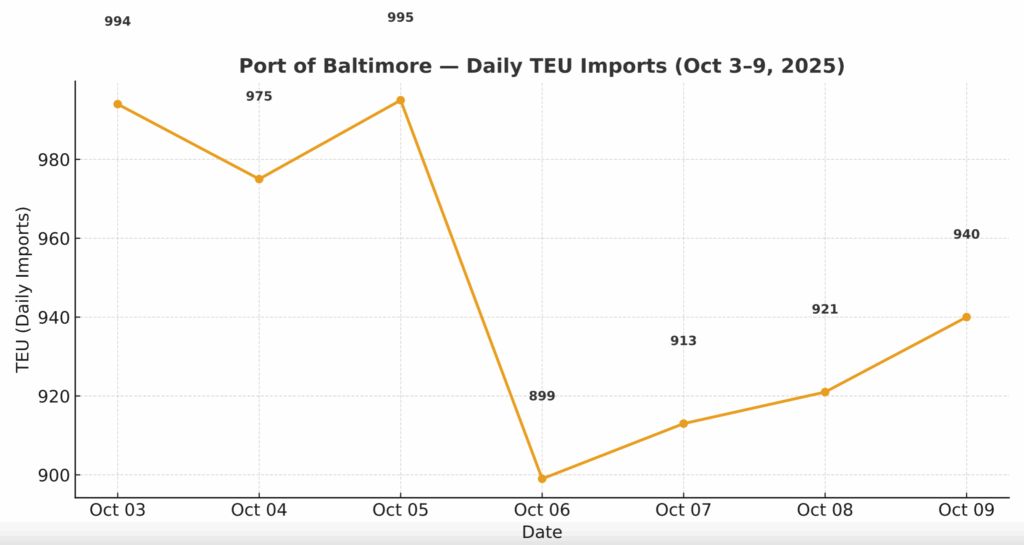

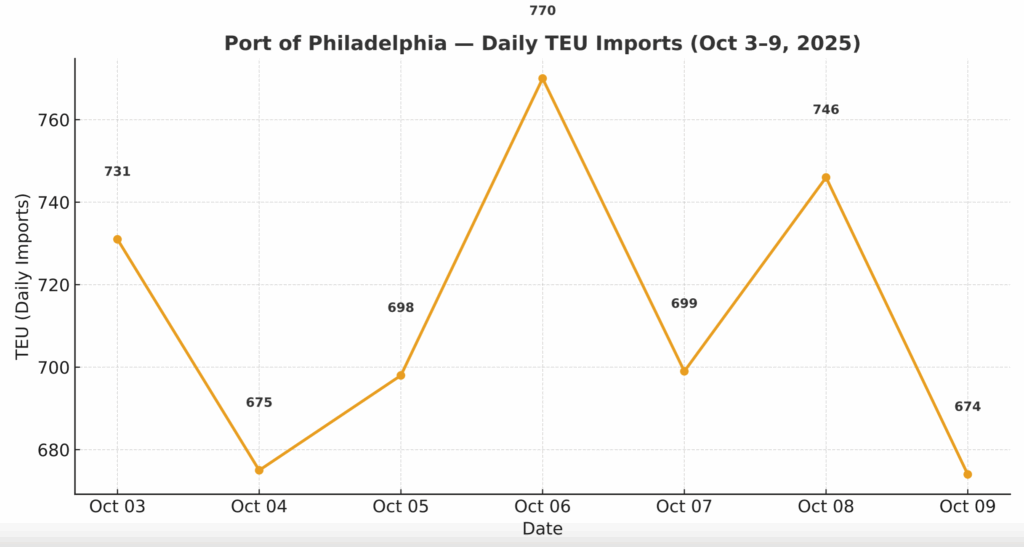

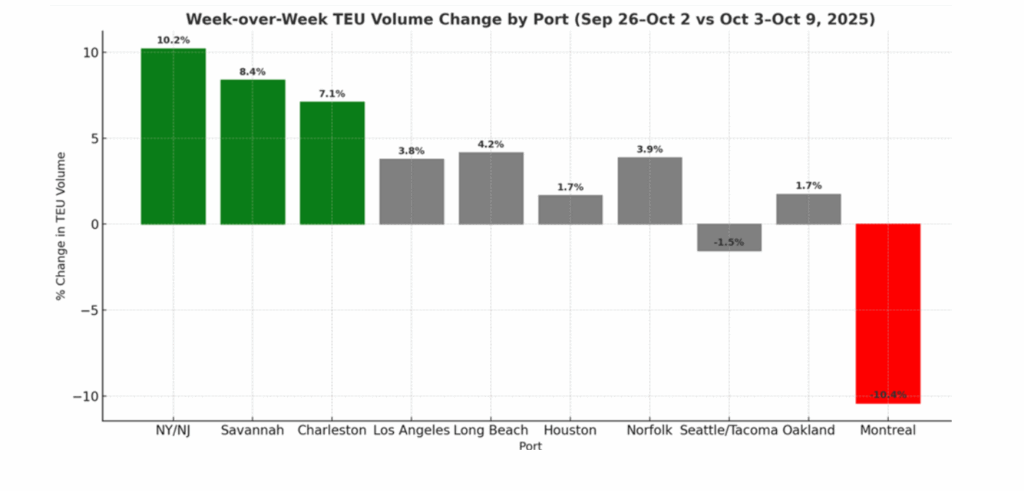

While the headlines center on strikes and shutdowns, container flows keep moving — just not always where you’d expect. U.S. import TEUs climbed another 6.9% week-over-week, continuing a late-season surge driven by restocking and pre-holiday bookings ahead of tariff uncertainty. The biggest jumps came through NY/NJ (+10.2%), Savannah (+8.4%), and Charleston (+7.1%), as shippers diverted cargo from Montreal and West Coast gateways toward East Coast reliability. Los Angeles and Long Beach volumes were modestly higher (+3.8% and +4.1%, respectively), reflecting steady Transpacific flows — but analysts expect a potential softening if the shutdown continues to slow customs and FDA clearances. Some inland rail hubs are also reporting longer dwell times and inconsistent chassis availability, a byproduct of both East Coast rerouting and delayed returns. Carriers continue adjusting network capacity to match these shifts, with some short-term reallocation of sailings from Canadian and Northern routes toward the U.S. South Atlantic. The result is a rare late-Q4 imbalance: higher TEU throughput on the East Coast even as West Coast rates flatten.

Below, this week’s TEU charts highlight those directional changes — showing where volumes are climbing, where slowdowns are emerging, and how regional share is evolving week-over-week.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

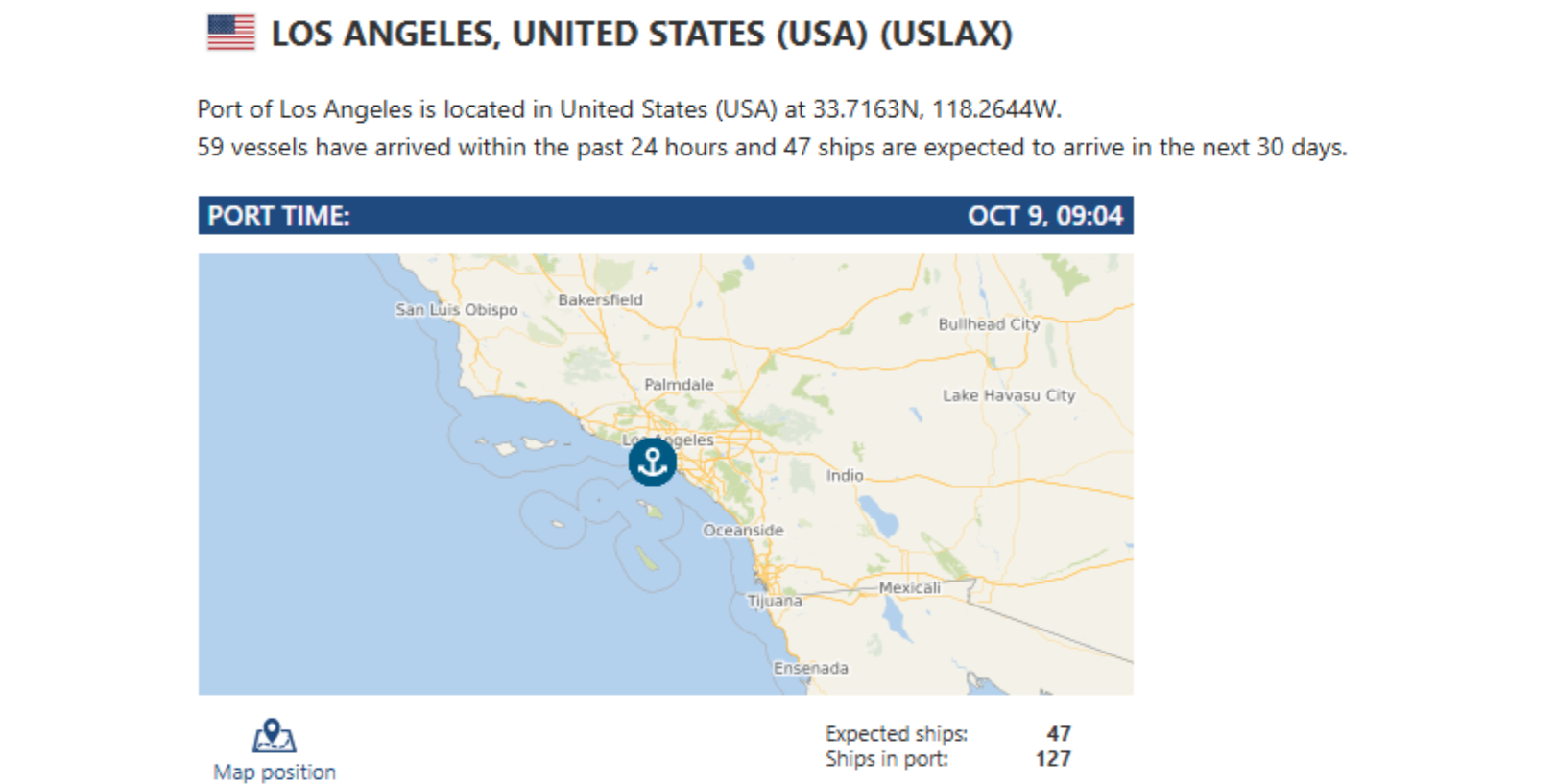

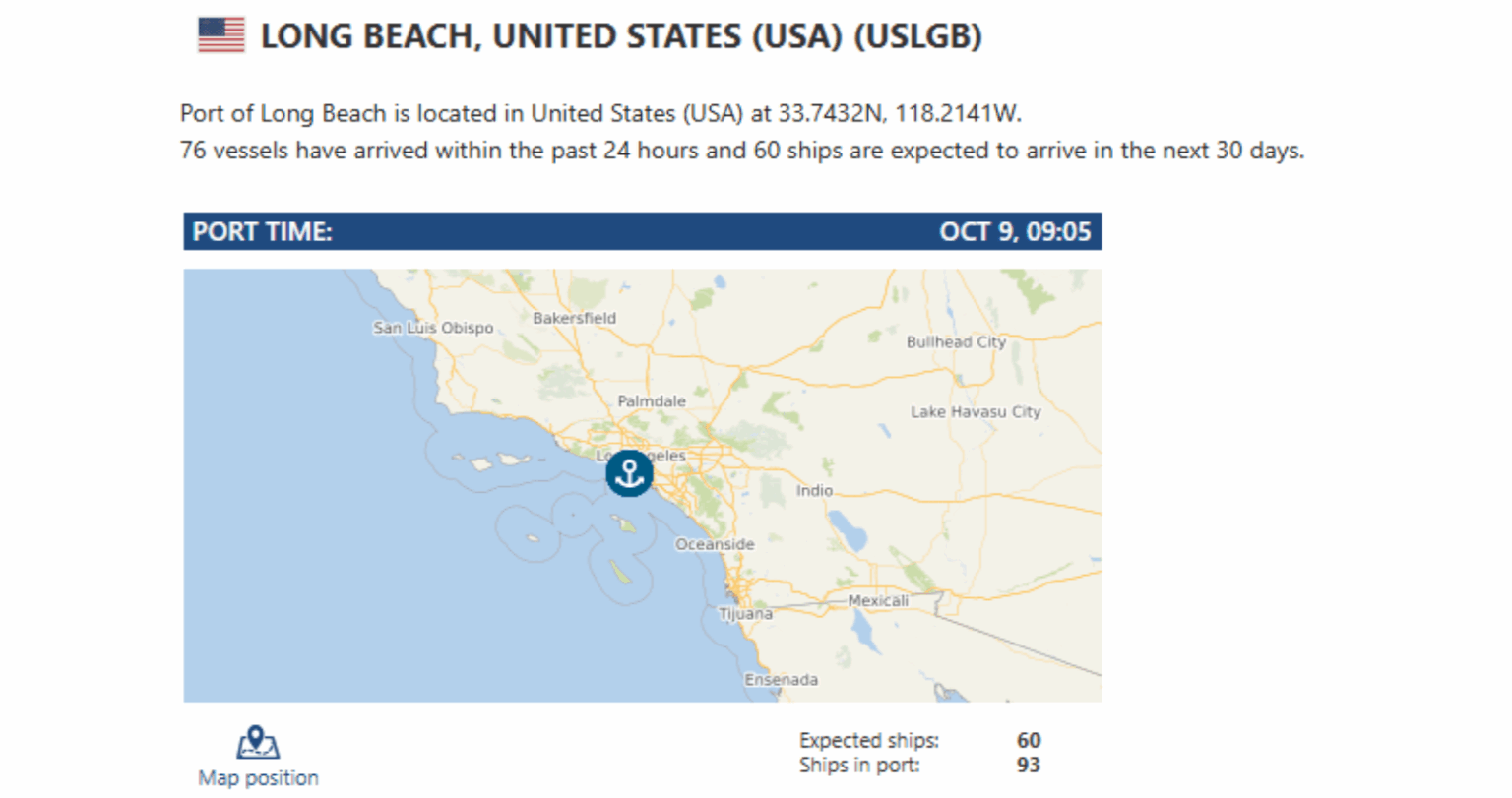

LA/LGB: West Coast import dwell times and rail bottlenecks remain a soft spot – Long Beach and Los Angeles are still under strain evacuating import containers, largely because rail and intermodal connections are stretched. Congested drayage lanes, limited chassis availability, and rail backlog are delaying inland dispatch. For cargo that must still move via those gateways, the delays inside the terminal or on the rail ramps are creeping—and could get worse if staff or regulatory delays intensify under the government shutdown. Port X Logistics has trucks, yard space, and transload capacity ready right now for your LA and Long Beach freight. With 66 trucks in play and limited first-come, first-serve slots, don’t wait — secure your lift today. Contact letsgetrolling@portxlogistics.com for all West Coast drayage and transload moves.

Chicago: According to the Association of American Railroads (AAR), U.S. intermodal volumes jumped 6.7% year-over-year for the week ending October 4th — a clear sign that rail demand remains strong despite port slowdowns and the federal shutdown. With roughly one-third of all intermodal freight moving through the Chicago gateway, that surge is being felt across the city’s rail ramps, drayage yards, and chassis pools. Chicago continues to serve as the country’s inland pressure valve — keeping containers flowing from coastal ports even as the system runs hotter heading into mid-October. 88 trucks. 150+ chassis. 100+ heavy haulers. That’s how Chicago rolls. From overweight imports to quick-turn drays, our team’s got the gear, permits, and grit to move what others can’t. We’re built for the grind—and we’ve got room to roll more. Need a lift? Hit us up: letsgetrolling@portxlogistics.com

Did you know? Port X Logistics is hitting the road for the VMA 2025 International Trade Symposium October 14th – 16th! Catch Tom Zeis and Kristen Kimmick on site, ready to talk all things drayage, transload, and trucking logistics. From port to final mile, we’re built to move freight without friction — and we’d love to show you how.

📍 Find us at Booth 21 to see how Port X Logistics helps shippers move faster, smarter, and more efficiently.

https://vamaritime.com/VMASymposium/VMASymposium/About/VMA25/VMA25_Registered_Attendees.aspx?hkey=210ac17b-eacc-44c2-96a7-f8395a80a7c4

Global trade and logistics face constant pressure from economic swings, evolving regulations, and tech disruption. Adaptability isn’t enough anymore — it’s time to move forward with confidence and lead with innovation. The 2025 International Trade Symposium unites shippers, carriers, and supply chain leaders exploring AI in logistics, tariff management, sustainability, safety, and 2026 market outlooks. Together, we’re charting a path toward more agile, tech-driven, and sustainable supply chains built to thrive in any market.

Import Data Images