Port of Savannah

1548 words 6 minute read – Let’s do this!

Two flashpoints are jolting global logistics this week: a U.S. government shutdown rippling through customs, ports, trucks, rail, and air, and a fresh strike in Montreal tightening the screws on Canadian flows. Buckle up—this week’s market run-down starts now.

Before we dive in, follow Port X Logistics on LinkedIn for real-time insights—or get these Market Updates every Thursday by emailing Marketing@portxlogistics.com.

The federal government has entered a shutdown after lawmakers failed to reach agreement on a funding bill. Hundreds of thousands of federal workers have been furloughed, while many deemed essential must continue working without pay. For the logistics and supply chain sector, the strain is already visible across ports, trucking, rail, air cargo, and warehousing.

At ports of entry, U.S. Customs and Border Protection officers remain on duty, processing cargo and collecting nearly $100 million per day in duties and tariffs. Their presence ensures trade continues, but the furlough of thousands of support staff is slowing documentation, duty assessments, and compliance checks. Imports requiring additional scrutiny—such as perishables, pharmaceuticals, and other regulated goods—are especially vulnerable to clearance delays. While ports remain operational, reduced back-office capacity is creating bottlenecks. Many importers are turning to the nation’s 1,700 bonded warehouses to store shipments until cleared, putting added pressure on facilities that are already near capacity. Shippers are adjusting by rerouting cargo through less congested gateways and prioritizing pre-clearance to avoid backlogs. Exporters face separate hurdles, as licensing approvals for controlled goods like aerospace parts or defense technology often stall during shutdowns, delaying outbound shipments. Oversight across other agencies is uneven: the USDA continues mandatory inspections of meat, poultry, and eggs, but parts of the FDA’s work slow significantly, affecting certain FDA-regulated imports.

Beyond ports, other modes are feeling the effects. Trucking continues, but federal pauses on permitting, compliance reviews, and driver background checks complicate fleet expansion and hiring. Railroads remain in operation, though cross-border trade with Mexico and Canada could face slowdowns from customs delays. In the air cargo sector, the FAA has kept air traffic controllers in place, but certifications for aircraft and pilots are frozen. TSA officers continue screening freight at major hubs such as Memphis and Louisville, but they are doing so without pay, raising concerns about staffing if the shutdown persists.

Warehousing and distribution centers face indirect challenges. Slower inflows from ports can leave facilities underutilized, followed by sudden surges once bottlenecks clear, which strain labor scheduling and raise costs. Retailers’ strict delivery standards add further pressure on providers navigating these fluctuations. For trucking and last-mile networks, delays at ports mean longer wait times, reduced chassis availability, and higher costs, compounding scheduling challenges across distributed networks.

The broader economic consequences are also in focus. During the 35-day shutdown in 2018–2019, the Congressional Budget Office estimated an $8 billion hit to U.S. GDP in the first quarter, with retail, automotive, and manufacturing among the hardest-hit sectors. Container dwell times at Los Angeles and Long Beach rose 15–20 percent during that period, and similar risks now loom as inventories for seasonal peaks hang in the balance. Markets are already reacting to the current impasse, with stock futures dipping, the dollar weakening, and gold prices climbing as investors look for stability. While trade continues to move, each day without a funding resolution increases delays, costs, and uncertainty across the supply chain. Prolonged disruption risks eroding confidence in U.S. logistics, prompting some global shippers to explore alternative sourcing and routing strategies. For now, the system remains in motion—but under growing friction. The longer the shutdown endures, the more strain it places on every link in the supply chain.

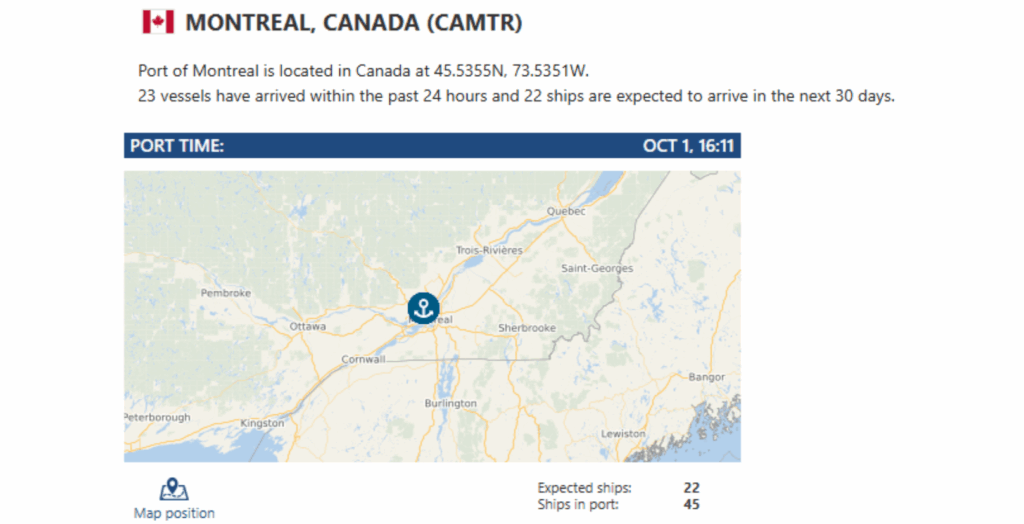

Last week 32 employees at Montreal Gateway Terminals (MGT) represented by CUPE launched an indefinite strike after voting overwhelmingly to walk off the job. According to the Port Authority, the action is confined to administrative and support staff, allowing core port operations to continue. Even so, partial strikes are already causing disruption. Documentation slowdowns, processing delays, and reduced administrative capacity are being reported, adding friction to daily operations. Recent port-tracking data shows yard utilization in Montreal at around 63%, with import dwell times improving slightly to an average of 3.1 days.

Past experience highlights how quickly the situation can escalate. During a strike in October 2024, the Viau and Maisonneuve terminals—together responsible for about 40% of container traffic—were shut down, leading to significant backlogs. Perishables and pharmaceuticals were among the hardest hit as goods piled up at forwarding agents and ships faced extended docking delays. The longer the current strike continues, the greater the risk of ripple effects. Shippers may begin rerouting cargo, neighboring terminals could experience added congestion, and supply chains dependent on tightly scheduled deliveries may face rising pressure on inventories and costs.

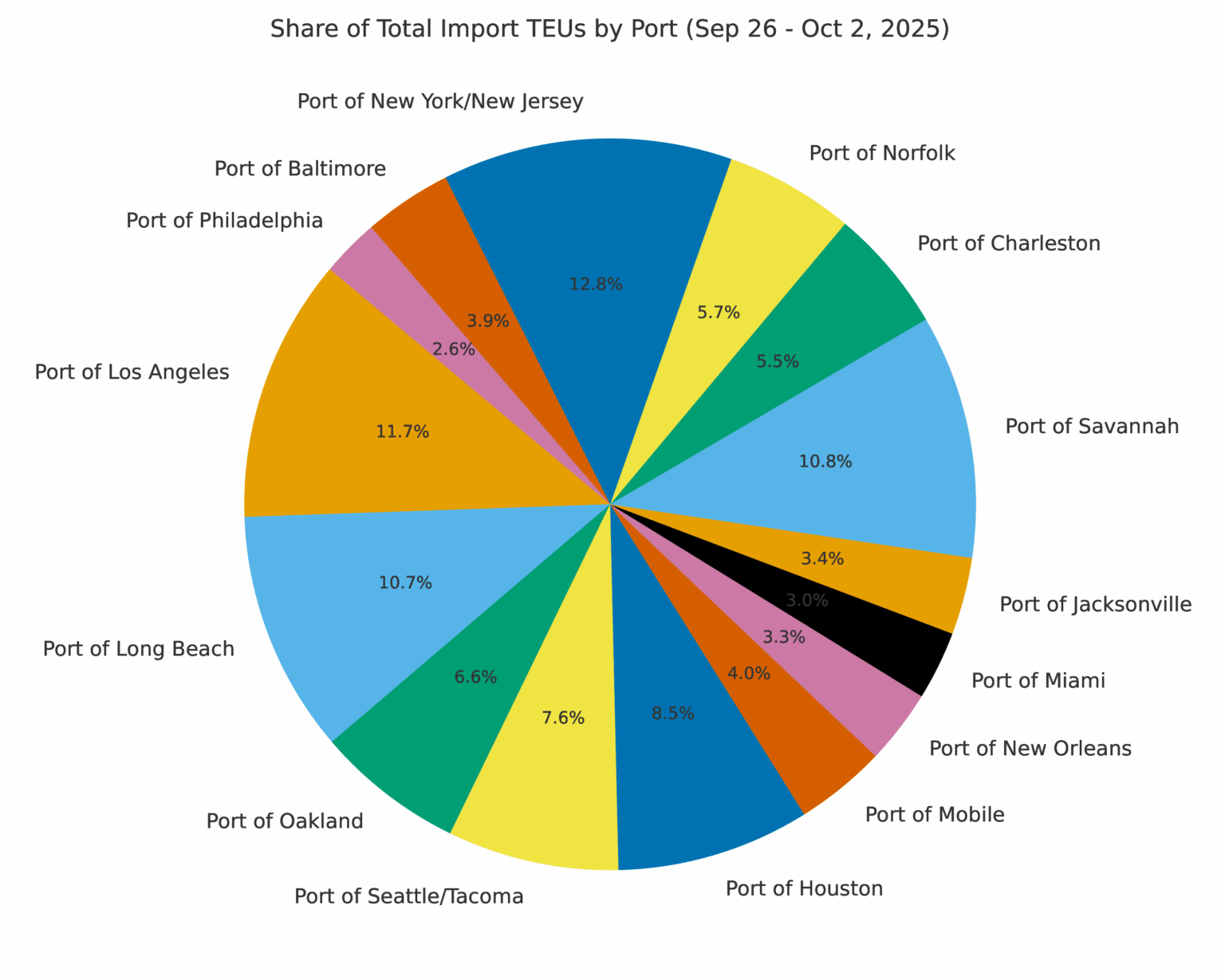

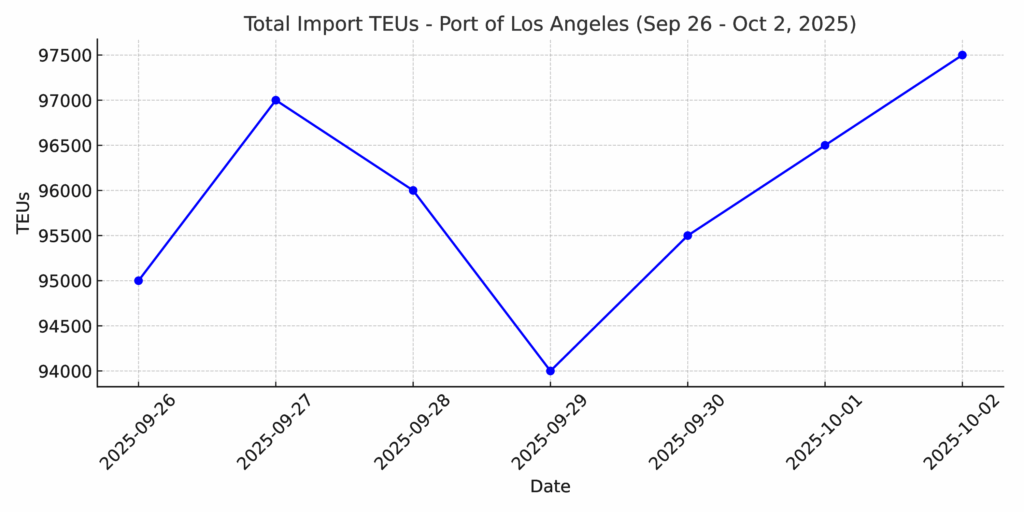

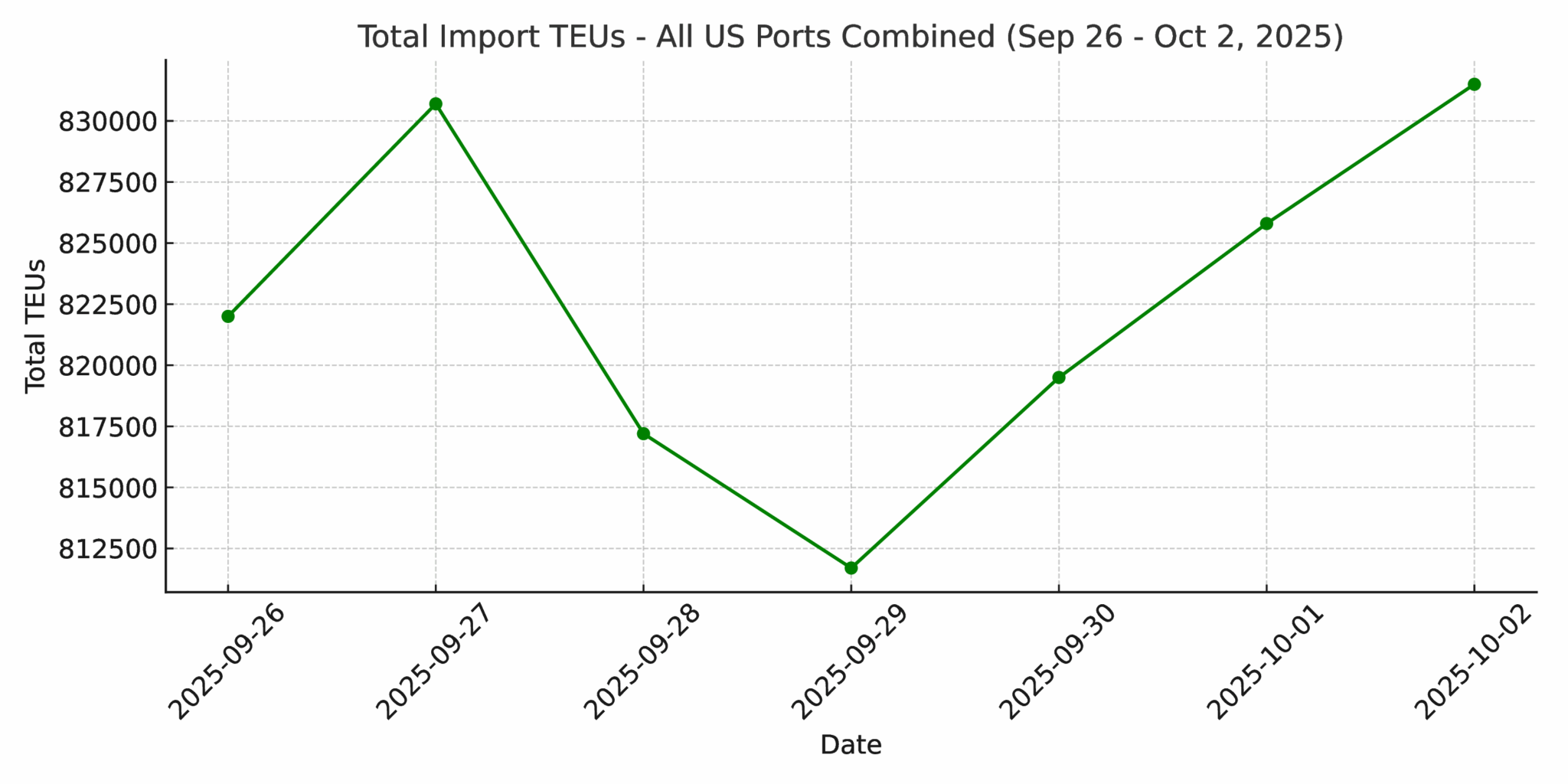

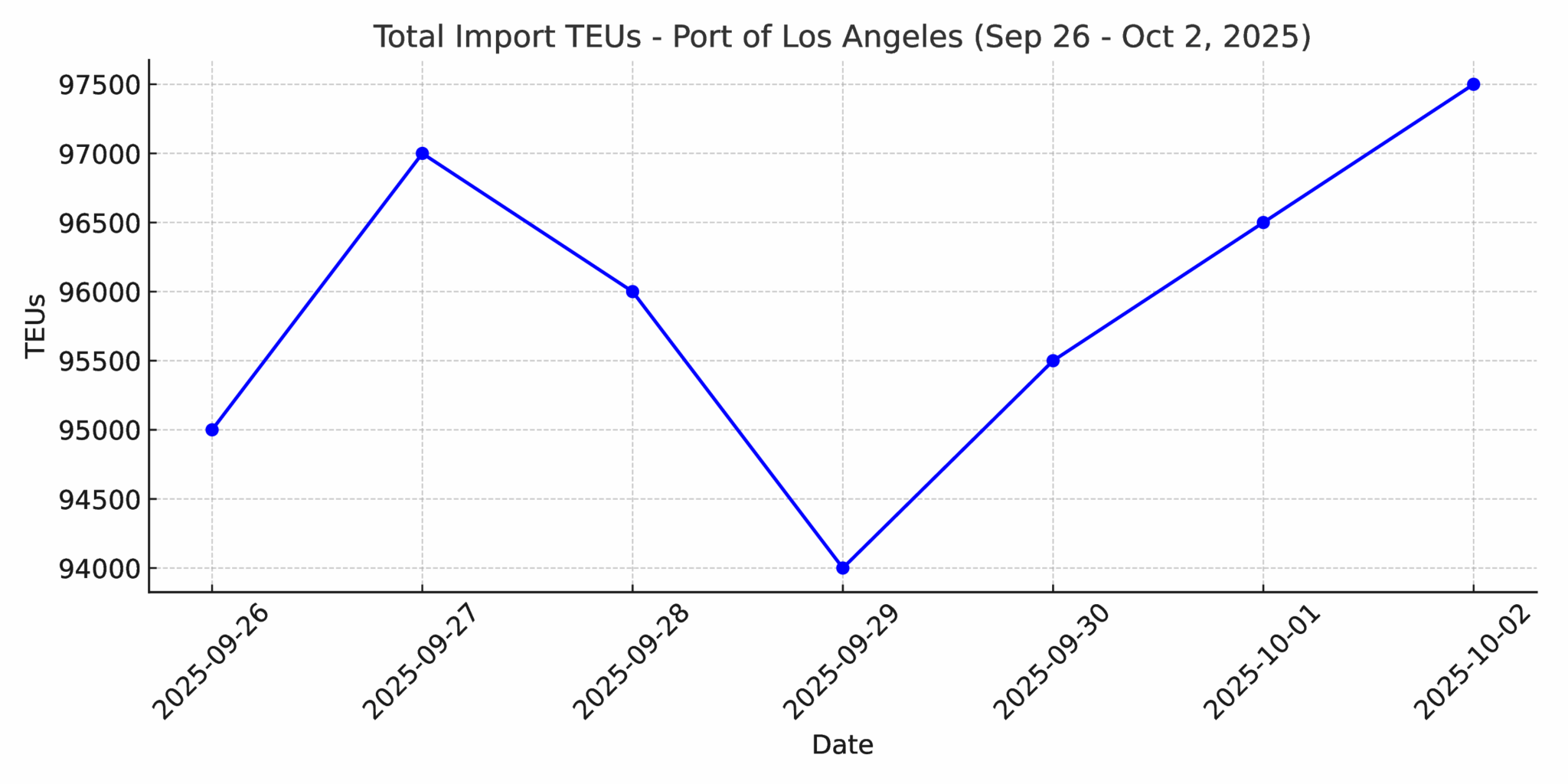

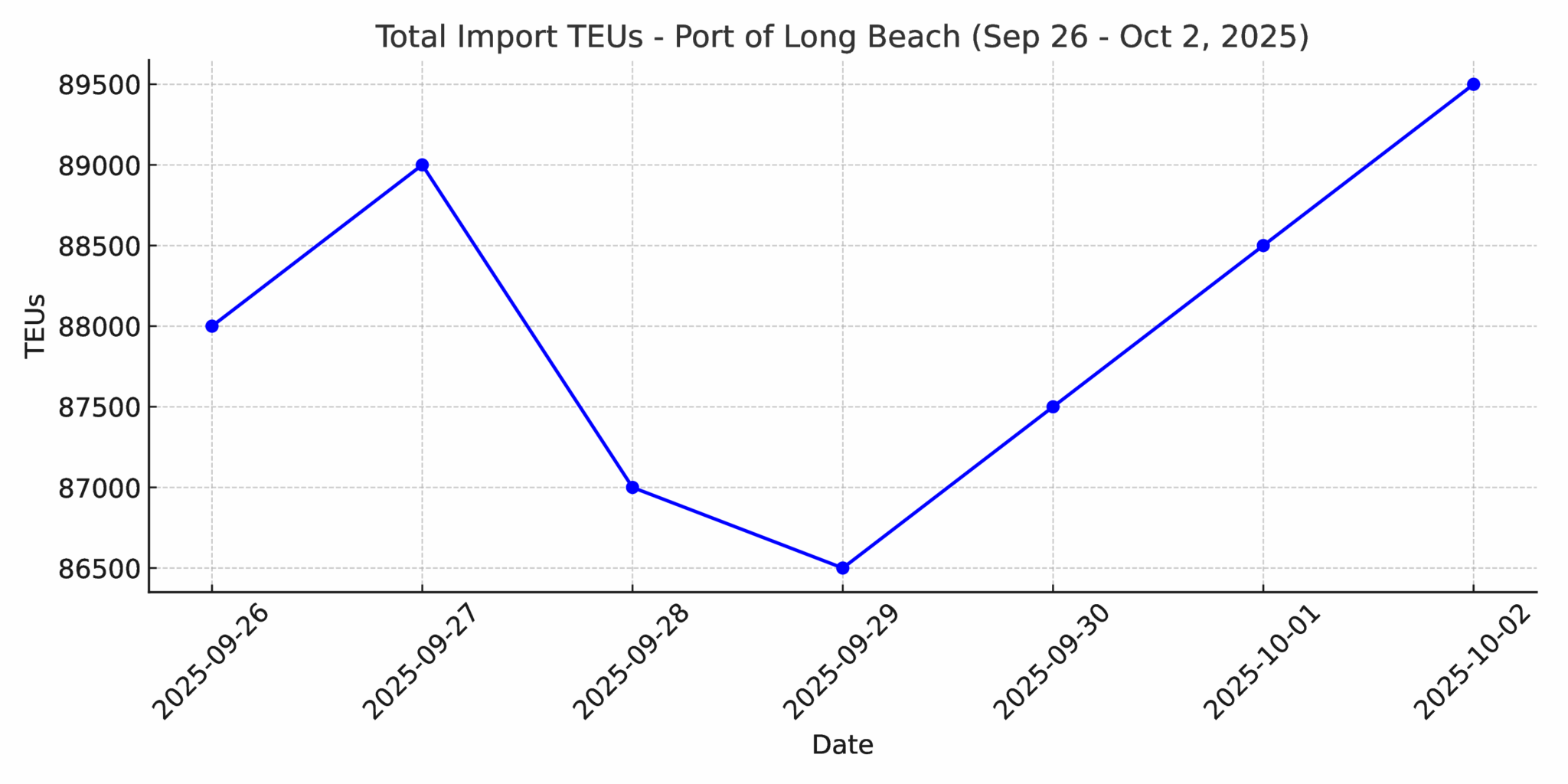

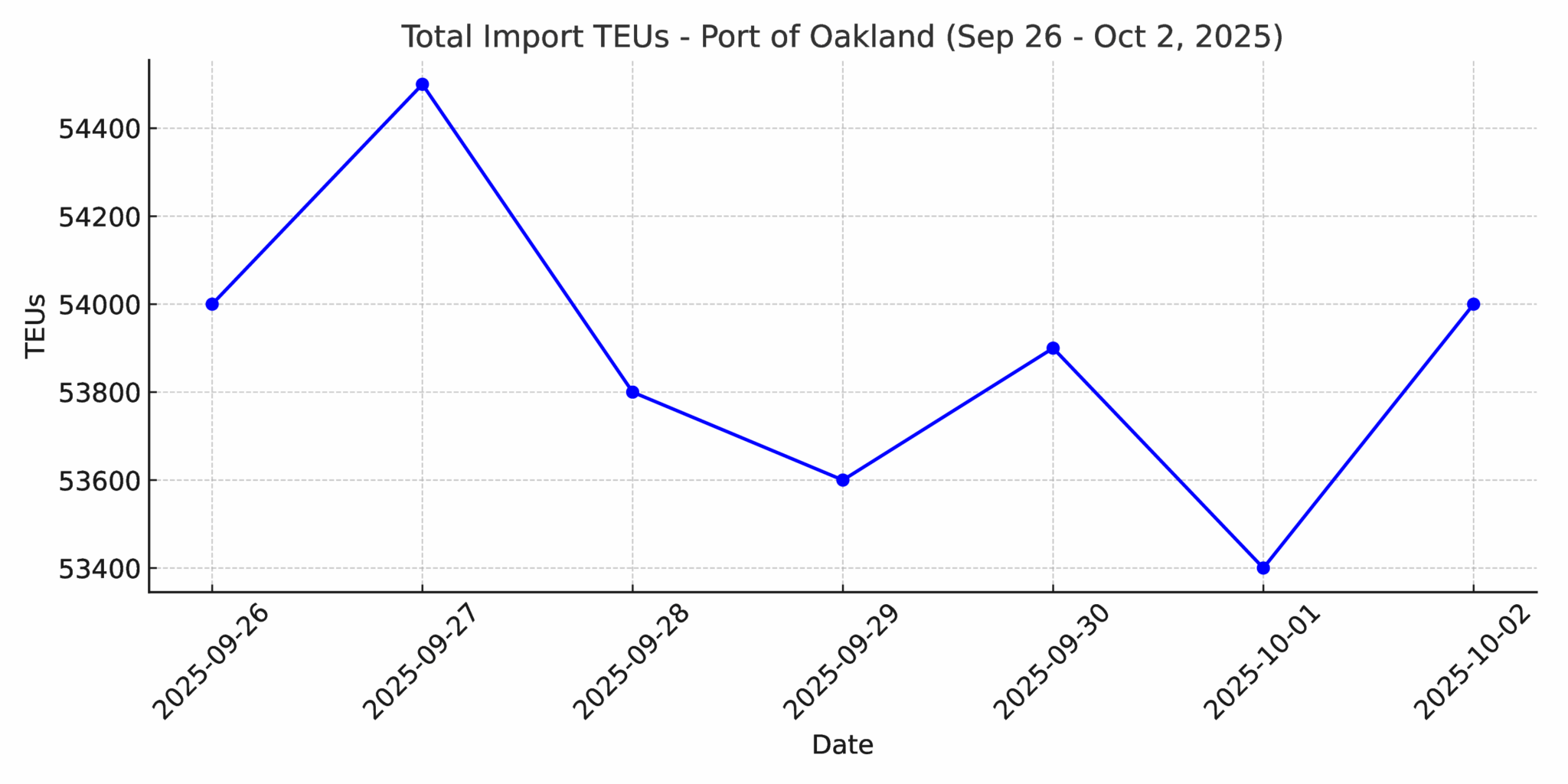

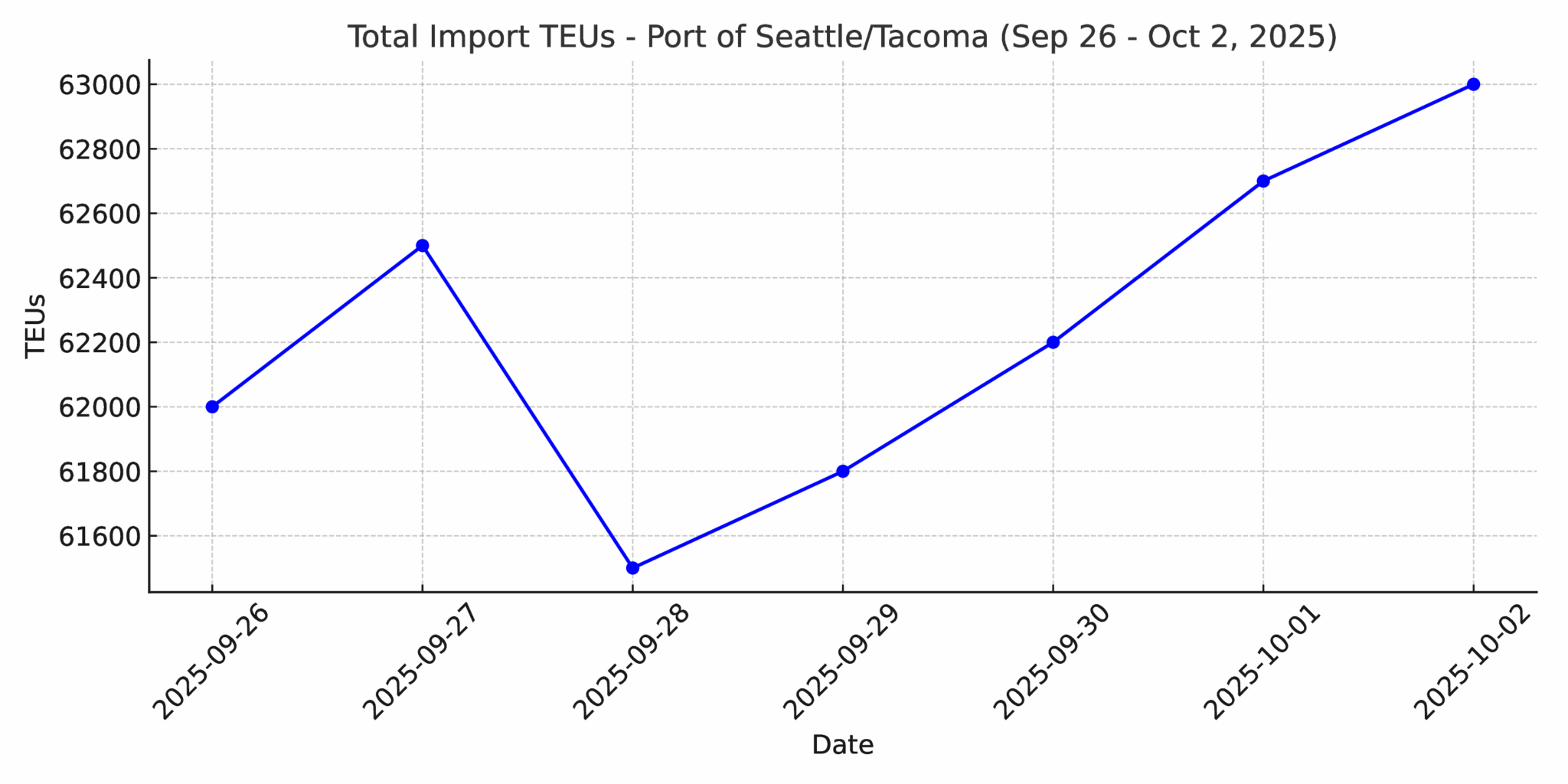

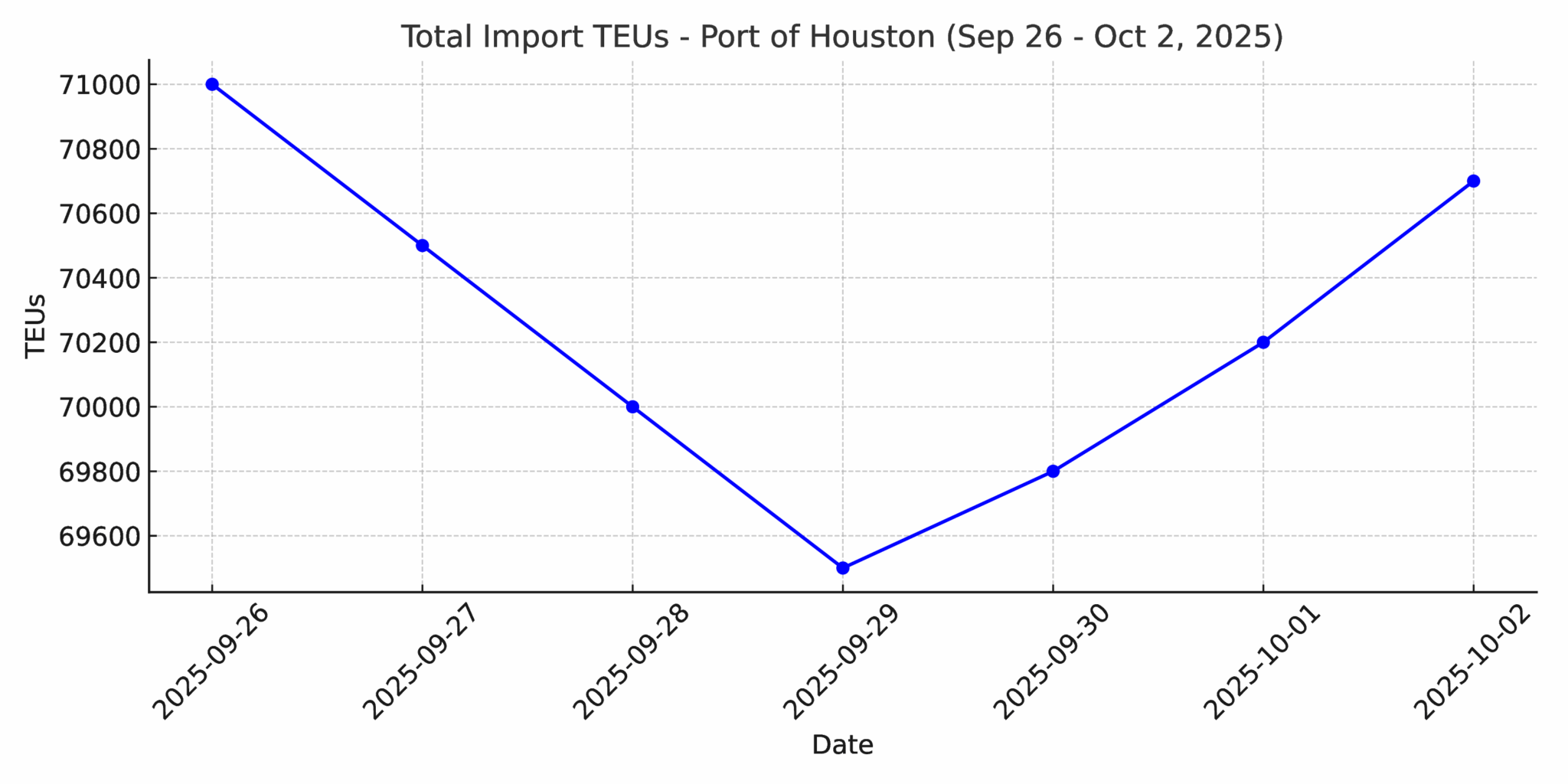

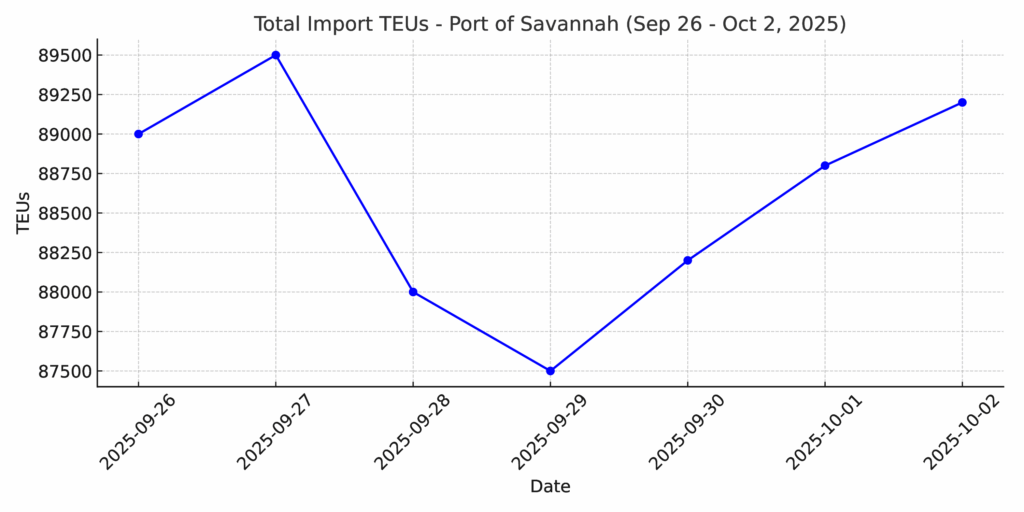

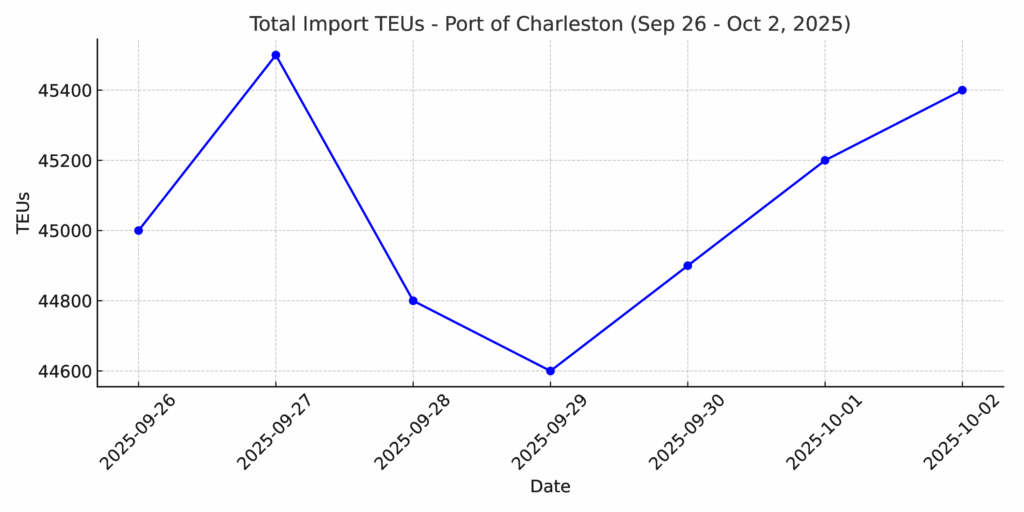

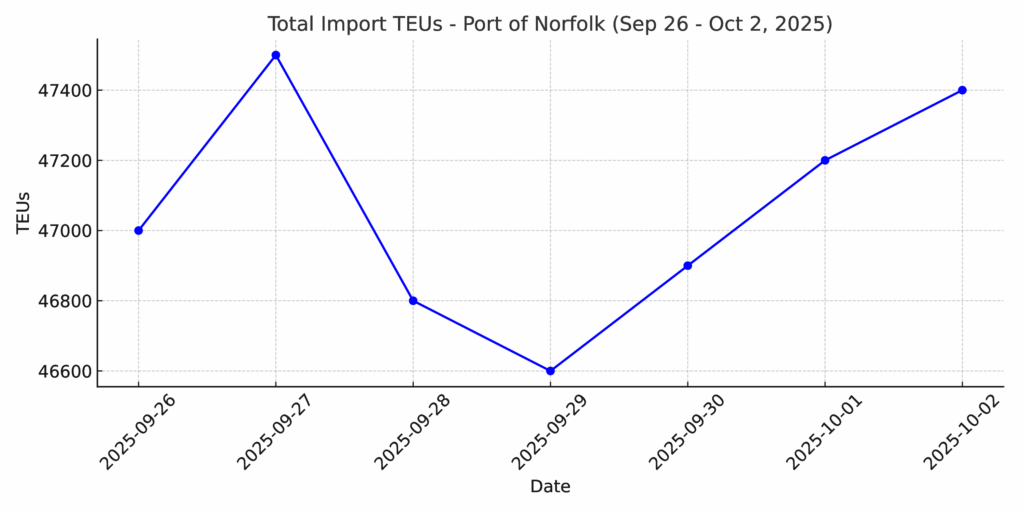

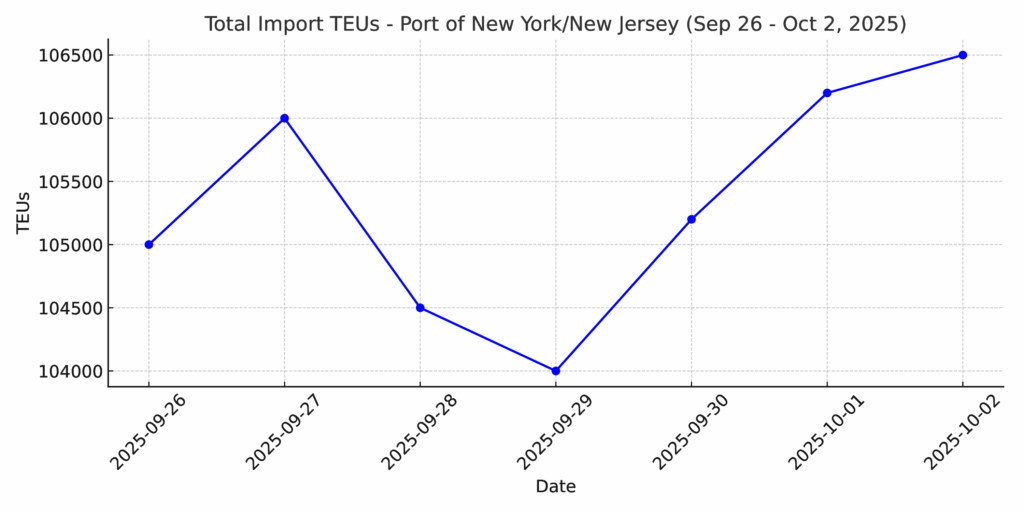

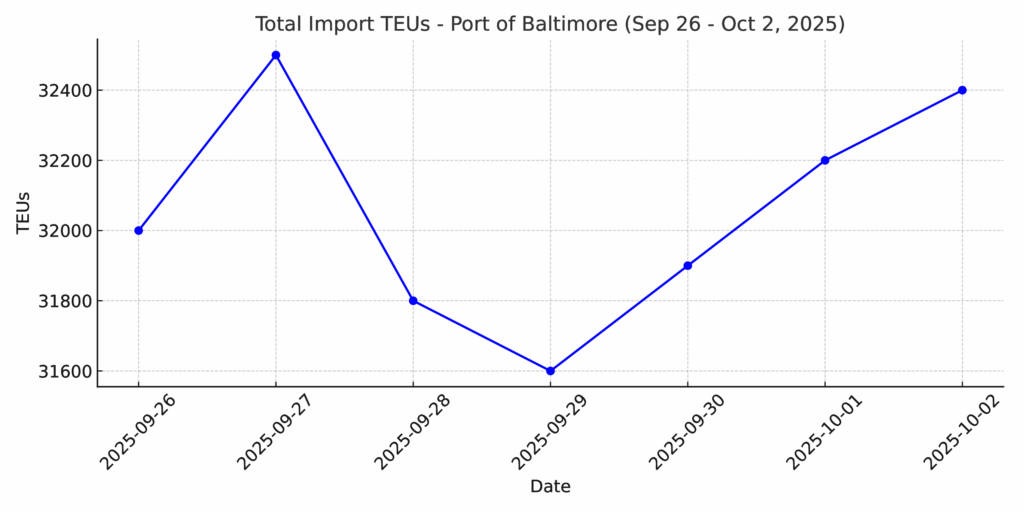

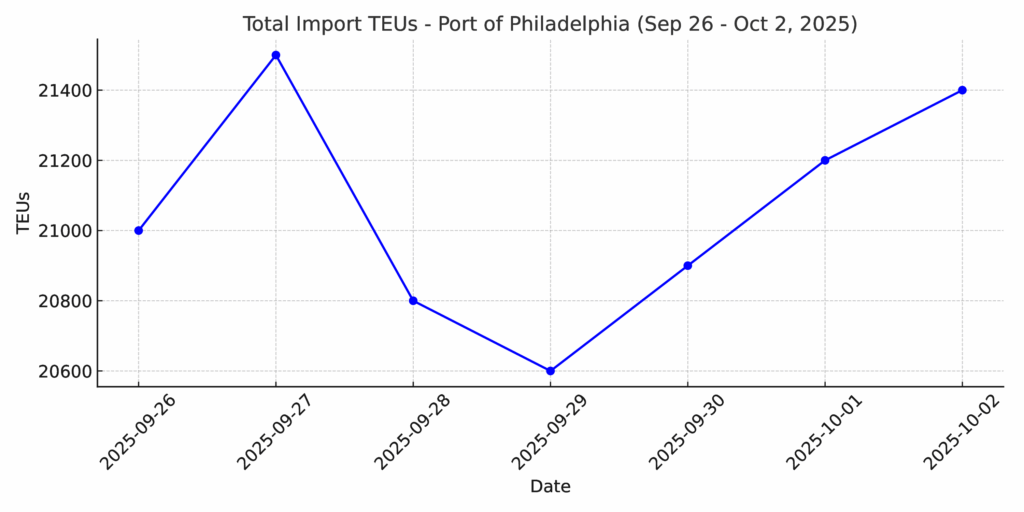

Import TEUs are up 7.49% this week from last week – with the highest volumes coming into NY/NJ 12.8%, Los Angeles 11.7% and Long Beach 10.7%. Global carriers continue to place big orders with Chinese shipyards, even as the U.S. prepares to levy steep port fees on China-linked vessels. A report from the Center for Strategic and International Studies shows Chinese yards captured 53 percent of global ship orders by tonnage in the first eight months of 2025, roughly the same as before the U.S. investigation that set the stage for the new fees. Beginning October 14th, ships built in China—or owned or operated by Chinese entities—will face U.S. port charges that could exceed $1 million per call for large vessels, with rates rising annually through 2028. The policy is aimed at reviving U.S. shipbuilding, but the scale of the challenge is clear: China produced more than 1,000 commercial ships last year, compared with fewer than 10 in the U.S. Despite the looming costs, operators like MSC, Maersk, and CMA CGM have continued ordering ships from China, often deploying them outside U.S. routes to sidestep fees. Analysts warn that COSCO is most exposed, with projected U.S. port fees of $1.5 billion by 2026. For now, China’s dominance in shipbuilding remains largely unshaken.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

📢 The Federal Maritime Commission (FMC) has closed as of October 1st, 2025, due to the federal government shutdown. Nearly all staff have been furloughed, and all Commission functions are paused until appropriations are passed and operations can restart. During this period, filings, applications, and dispute resolution services are on hold. Systems such as SERVCON and the FMC’s online databases will remain accessible, but they will not be updated or processed. Email and phone inquiries are suspended, and filing deadlines in pending proceedings are temporarily tolled. Normal operations will resume once the government reopens. The U.S. ports and rails are fully operational at this time.

Savannah: The Georgia Ports Authority has approved $614 million in upgrades for Ocean Terminal, including yard renovations, terminal improvements, and a new operations facility. Phase one is set for 2027 completion, with phase two in 2028. A separate $29 million overpass will route trucks directly to U.S. 17/I-16, reducing neighborhood traffic. GPA says the investments will expand big-ship capacity and position Savannah ahead of other U.S. ports in meeting Southeast market demand. At the same time, we’ve lowered transload rates in Savannah. Our South Atlantic fleet covers Savannah, Charleston, and Jacksonville with hazmat capabilities, yard space, and a full-service transload warehouse ready for urgent cross-docks. Reach out at letsgetrolling@portxlogistics.com for immediate capacity and competitive rates.

Montreal: Montreal continues to grapple with terminal congestion, draft restrictions on the St. Lawrence, labor disruptions at select terminals, and limited railcar supply. Ongoing road construction around Turcot, Ville-Marie, and the La Fontaine Tunnel is adding further variability to appointments. The Canadian inland market is under strain, with the West Coast seeing railcar shortages and rising volumes that leave some containers waiting up to two weeks for rail loading. Our Canadian team brings years of expertise across every major port, offering drayage, transloading, and cross-border delivery solutions. For support with your Canadian moves, reach out at Canada@portxlogistics.com

Did you know?

Port X Logistics’ own Blake Cooper will be speaking next week at CSCMP Edge? Blake will be speaking on how we’re tackling visibility challenges in drayage, transloading, and trucking, combining the strength of people with the flexibility of technology – and most notably, without Blake’s help these weekly Market Updates would not be possible!

📅 Monday, October 6

⏰ 11:30 AM Eastern/Standard

We’ll be showing how supply chains gain clarity at every step: real-time planning that prevents demurrage, full visibility from port of origin through final delivery, instant photo confirmation at transload, and live OTR tracking with milestones and PODs.

No blind spots. No guesswork. Just clear answers.

🎤 Catch Blake’s session at CSCMP Edge—or explore the solution here: https://portxlogistics.com/tech-demo/

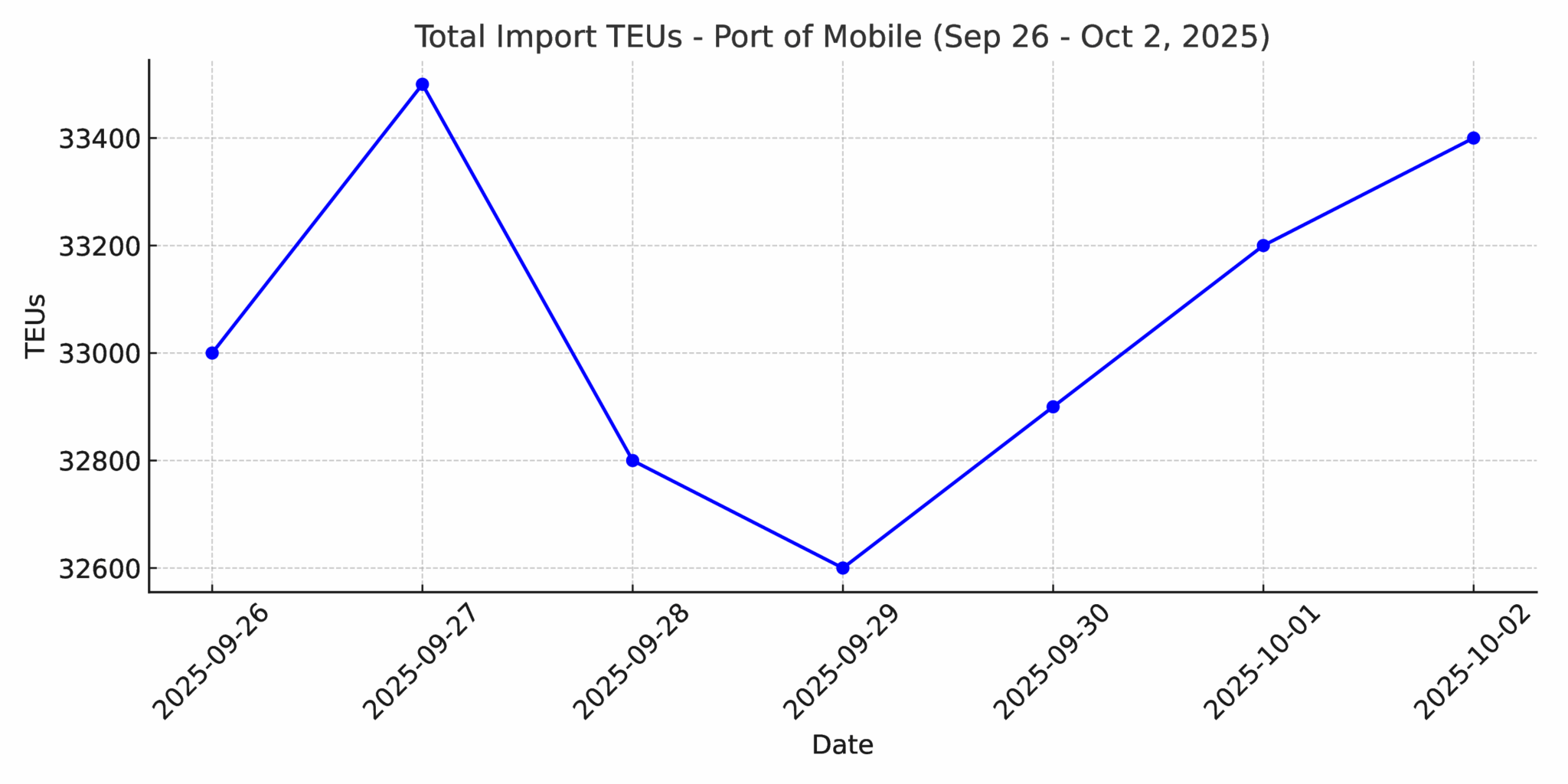

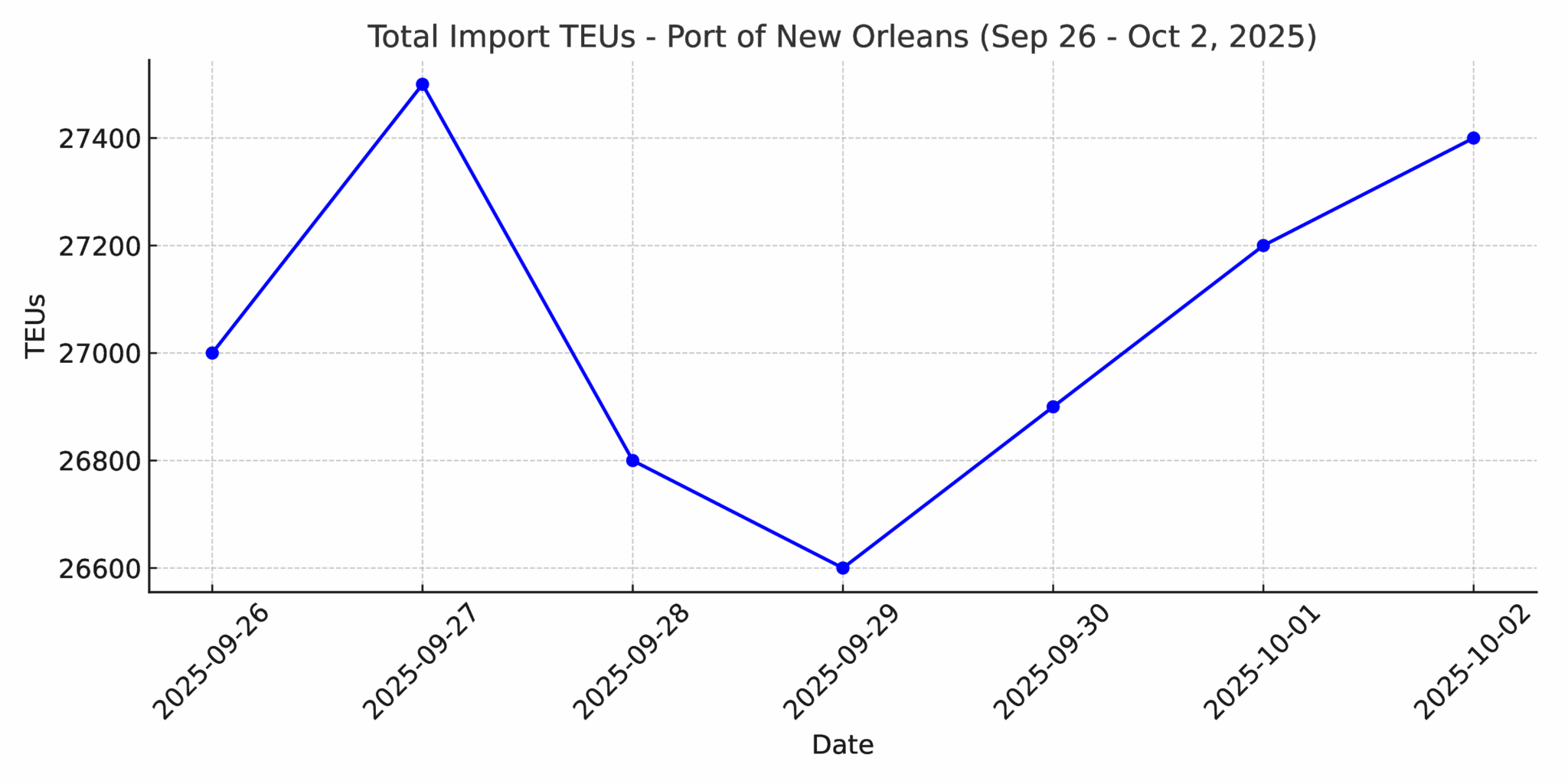

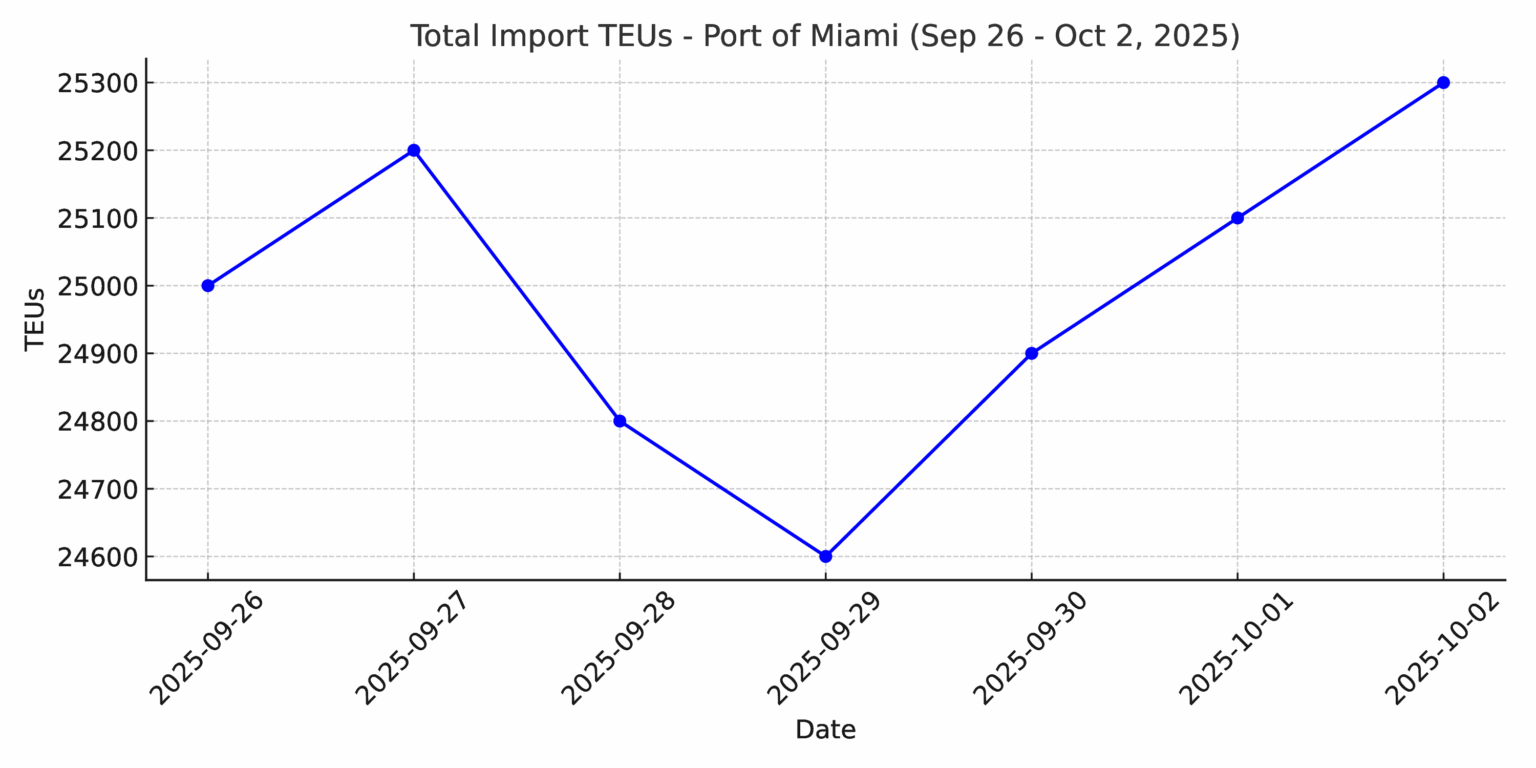

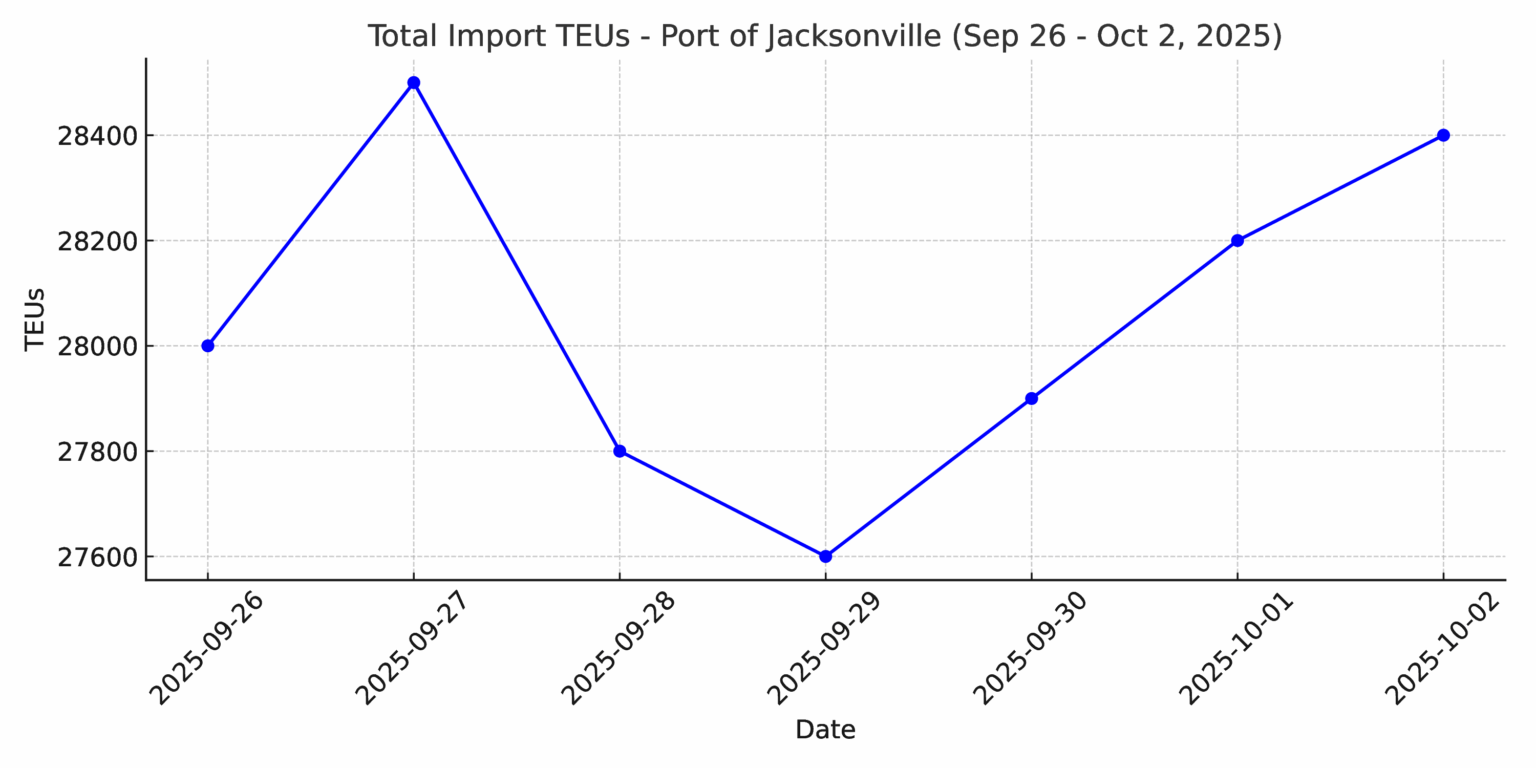

Import Data Images