Port of Montreal

1789 words 7 minute read – Let’s do this!

The first week of fall has arrived with a storm of activity across global logistics. Super Typhoon Ragasa swept through southern China, shutting down key terminals and grounding flights just as Golden Week closures are underway, leaving cargo piled up and schedules stretched thin. In Canada, Montreal’s Cast and Racine terminals are feeling the impact of an indefinite strike, slowing gate operations and raising the risk of mounting congestion. And across the Pacific, carriers are stepping in with blank sailings, canceling voyages and suspending loops in an effort to steady utilization during a volatile market. The combination of weather, labor unrest, and shifting capacity is colliding all at once, creating a dramatic start to the season and setting the tone for an unpredictable October – let’s get into it

But first, remember to follow Port X Logistics on LinkedIn for real-time insights or get these Market Updates delivered to your inbox every Thursday by emailing Marketing@portxlogistics.com.

Super Typhoon Ragasa moved across East Asia this week, bringing heavy rainfall, flooding, and widespread disruption to Taiwan, the Philippines, Hong Kong, and southern China. The storm made landfall in Guangdong province on Wednesday before weakening into a tropical storm as it continued west toward Vietnam. Local authorities are now focused on recovery efforts, from clearing debris and restoring power to reopening schools, airports, and other infrastructure. The storm also disrupted logistics networks. Container ports and airports in Hong Kong and southern China suspended operations earlier in the week, with only partial reopenings by Thursday. Carriers have warned of backlogs and potential vessel delays at key hubs such as Yantian, where congestion could extend for several days. These interruptions come at a sensitive time, as shippers work to move cargo ahead of China’s Golden Week holiday, though reduced demand expected in October may soften the longer-term impact.

On the ocean side, the transpacific continues to see rate swings. East Coast spot rates rose 2% last week to $3,426/FEU, while West Coast rates slipped 5% to $2,185/FEU and are now trending below $1,900/FEU in daily trading. Additional blank sailings announced for October could help carriers maintain some pricing stability as seasonal volumes ease.

Airfreight has been equally affected. Thousands of flight cancellations in Hong Kong and southern China temporarily cut capacity, and although some services have resumed, the backlog is expected to drive a short-term shift to air for urgent shipments. Meanwhile, trade flows are adjusting: Vietnam–U.S. volumes have doubled, and intra-Asia activity has picked up as freight is redirected around storm-affected ports. Freightos data show China–North America air rates rising 4% last week to $5.44/kg, with regional Asia routes also taking on additional demand.

For U.S. importers, the overlap of typhoon-related disruptions and Golden Week factory closures creates added pressure on supply chains. Cargo already on the water is vulnerable to delays from congestion at South China ports and the resulting bunching of vessel arrivals at U.S. gateways. Sensitive goods like electronics, perishables, and pharmaceuticals face the greatest risk of disruption, but the broader retail sector will also feel the strain as companies push to build inventory for the holiday season. With tariff policy changes still looming, October may prove more unpredictable than usual.

The Port of Montreal is once again at the center of labor tensions, this time at the Cast and Racine container terminals operated by Montreal Gateway Terminals Inc. On September 22nd, administrative staff represented by CUPE 4317 launched an indefinite strike after voting in favor of the action earlier this month. The dispute focuses on subcontracting, wages, and minimum staffing levels. While the walkout only involves administrative staff, its reach covers two of the port’s most critical terminals, raising concerns about ripple effects across supply chains. Terminal management has emphasized that mitigation measures are in place, with operations continuing “as normal” aside from some schedule adjustments. Vessels are still working cargo, including the Mombasa Express at Racine, and export receiving windows remain open, though late deliveries now require tighter approval. These signals show that vessel berthing and gate activity continue, but gaps in documentation, dispatch, and processing create the risk of slower support functions. Over time, this could translate into longer dwell times, yard congestion, and extended truck turnarounds.

For now, the strike’s impact is contained to Cast and Racine, with other Montreal terminals operating normally. However, even modest slowdowns at MGT can ripple outward, straining trucking operations, pushing carriers to adjust schedules, and forcing shippers to consider alternate routing. Yard occupancy, which averaged 62% before the strike, could quickly climb if cargo processing lags vessel discharge.

The greatest uncertainty lies in duration. With no timeline for resolution and deeper disputes over employment practices, prolonged disruption is possible. If negotiations stall, carriers may begin diverting vessels to Halifax or Saint John, while cross-border shippers could reroute through U.S. ports. The strike also comes at a sensitive time as peak-season volumes converge with already tight inland rail and trucking capacity. For now, cargo continues moving at Cast and Racine under added friction, but the longer the strike lasts, the higher the likelihood of delays, congestion, and added costs. At Port X Logistics, our Canadian team is following developments in real time and is prepared to support customers with rerouting strategies, alternate port coverage, and transparent communication to keep freight moving through what promises to be another challenging chapter at the Port of Montreal – email canada@portxlogistics.com for more insight and possible hardships the strike could bring to your supply chain.

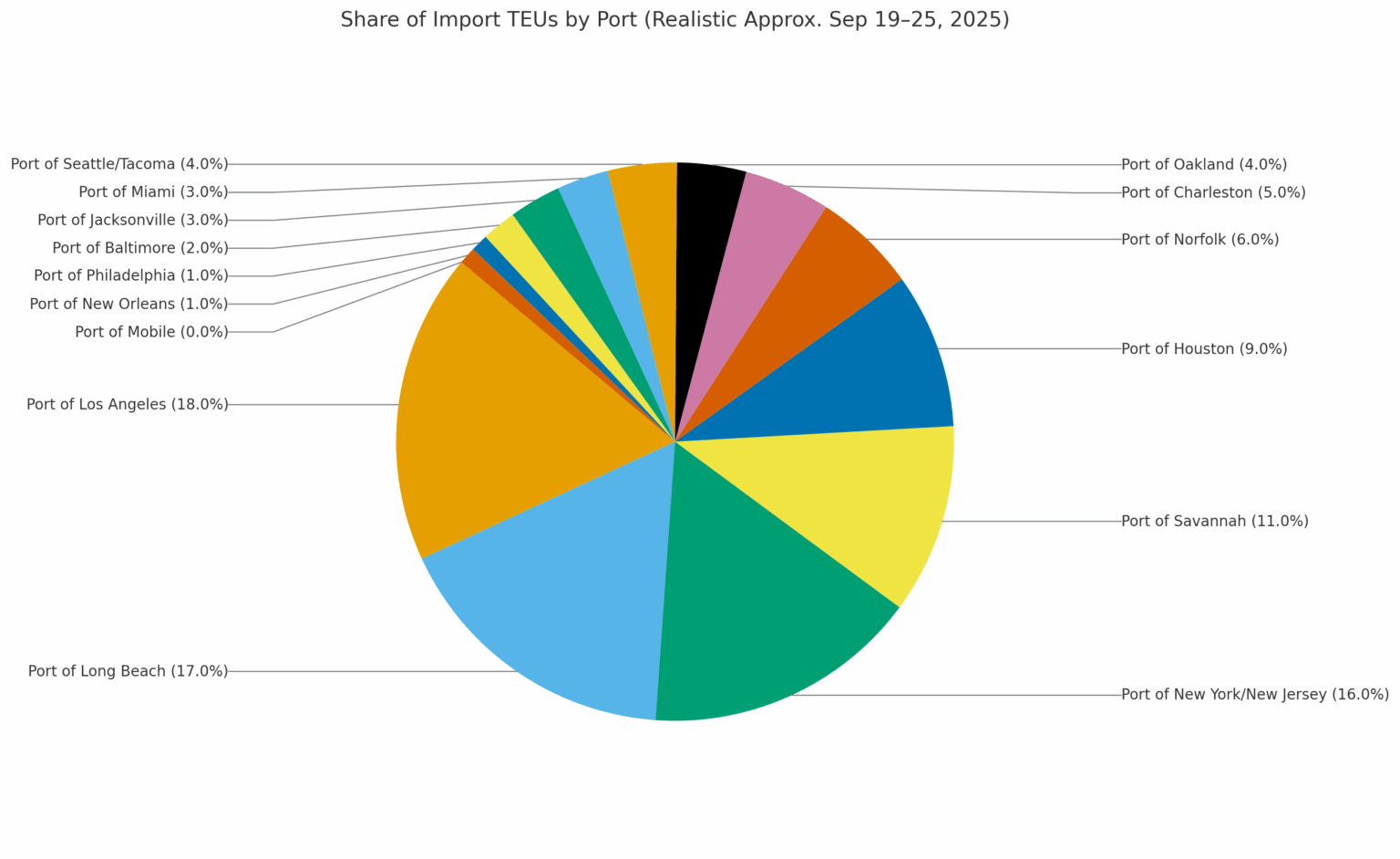

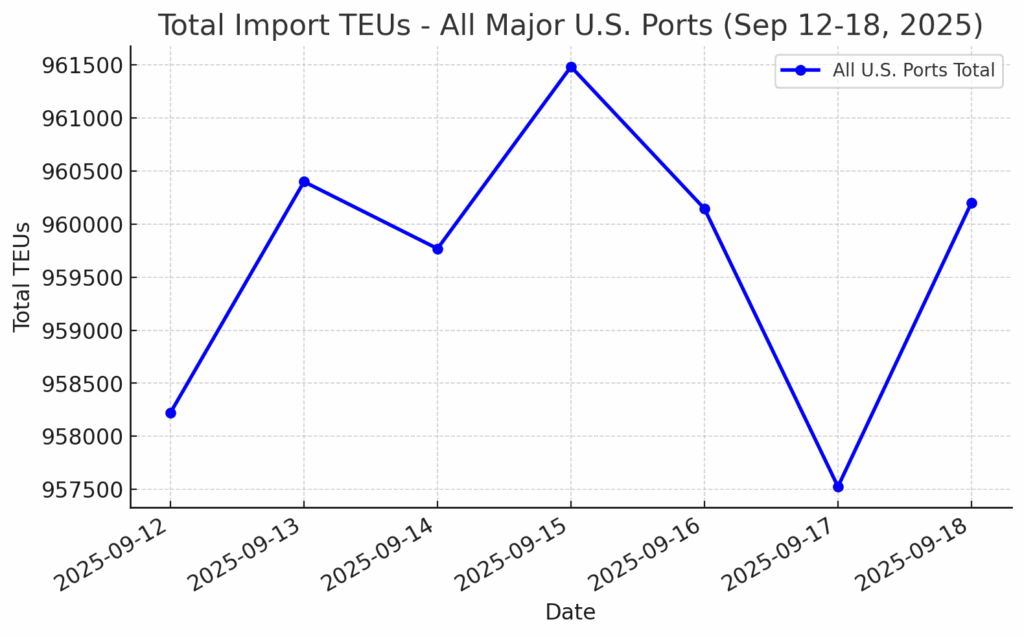

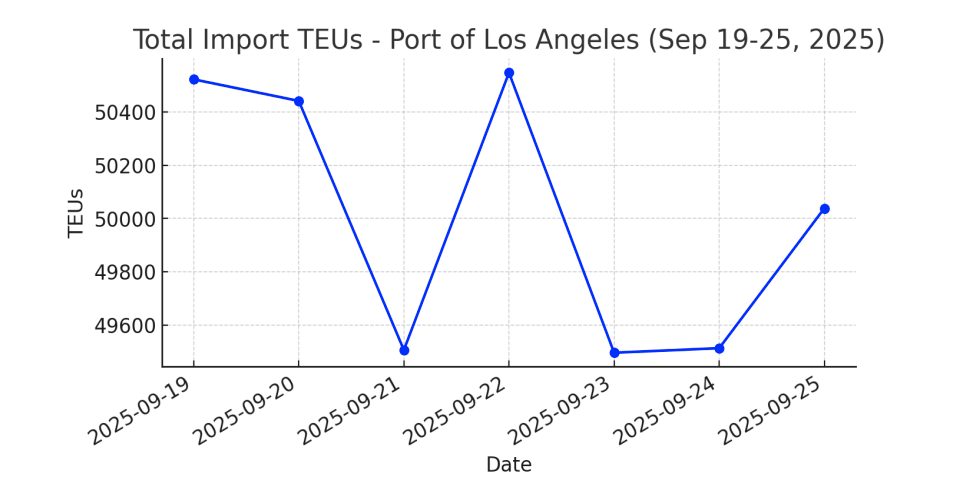

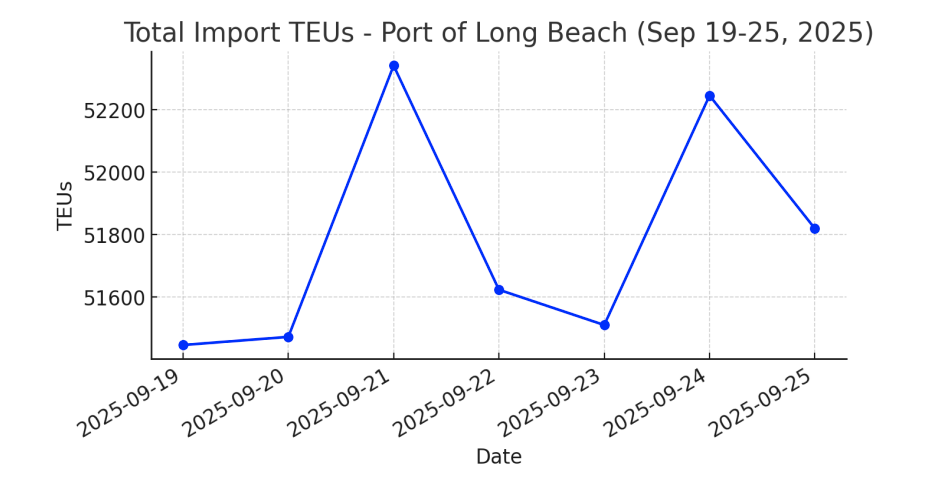

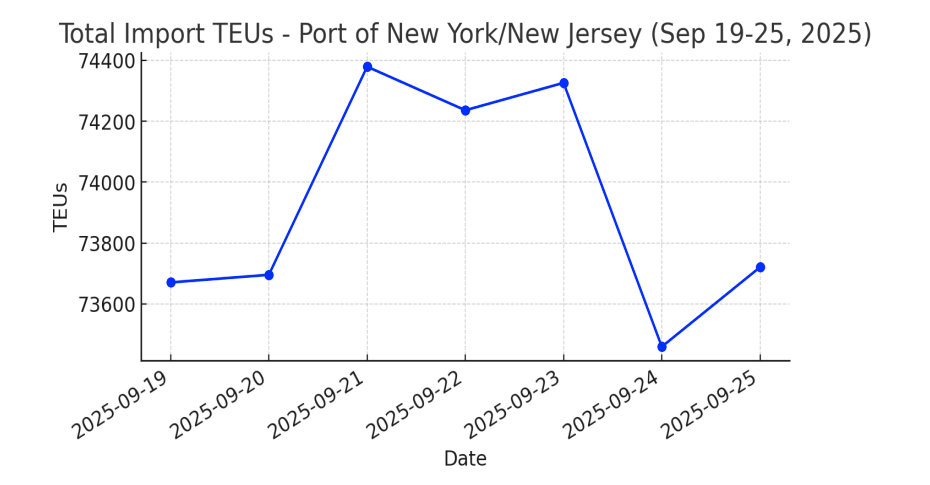

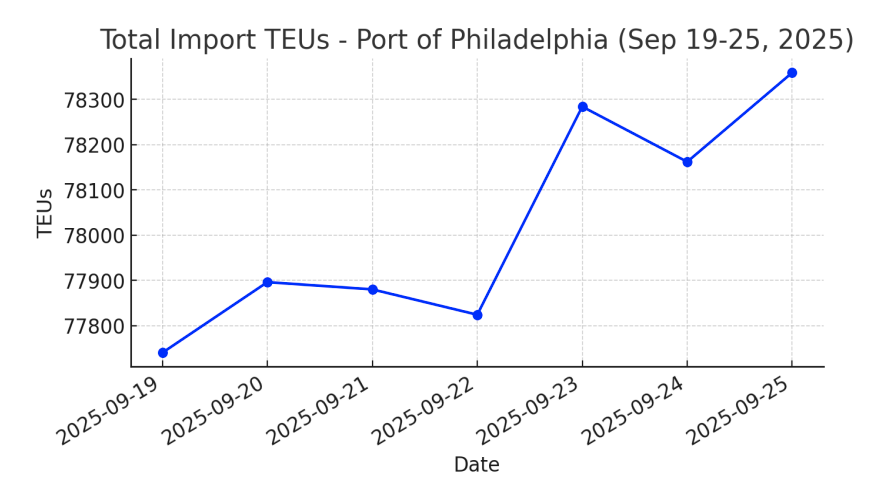

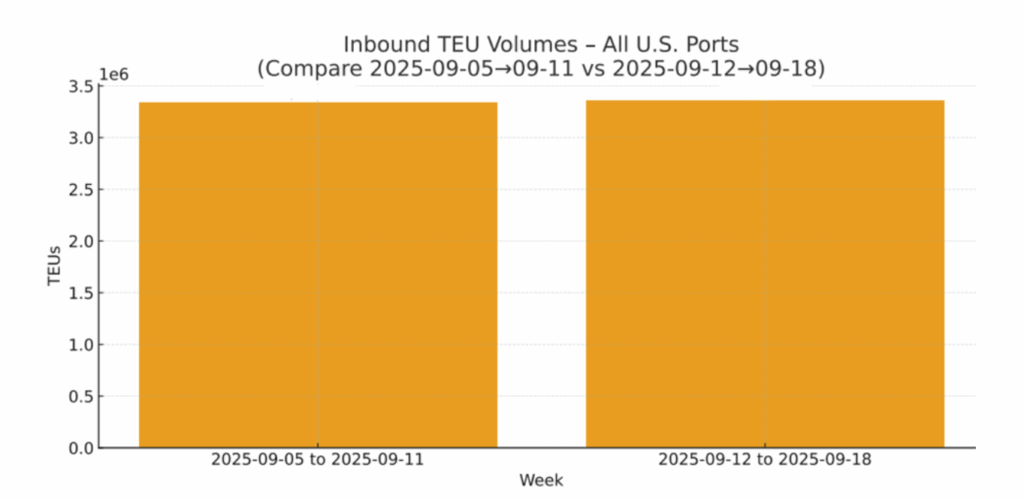

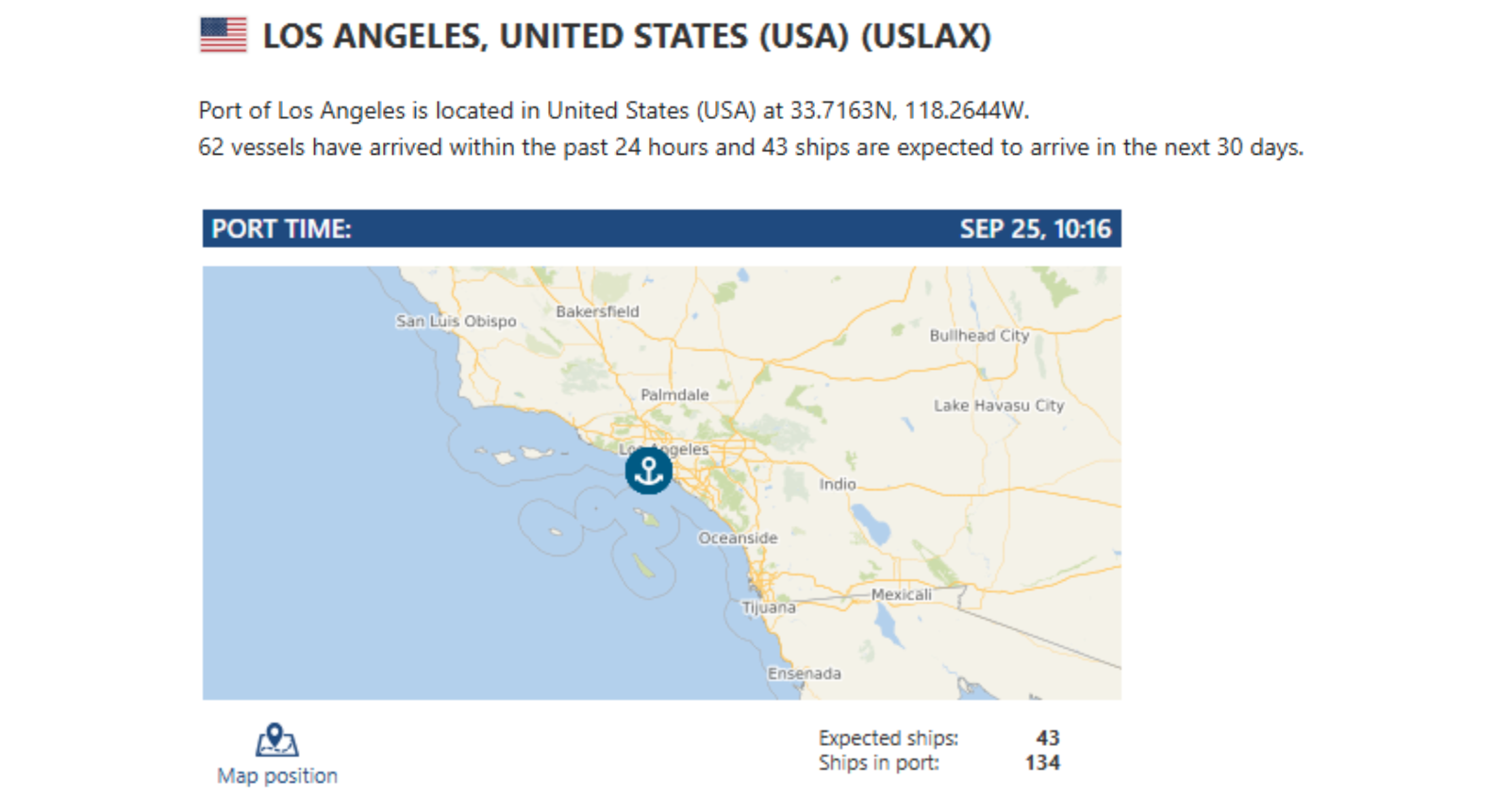

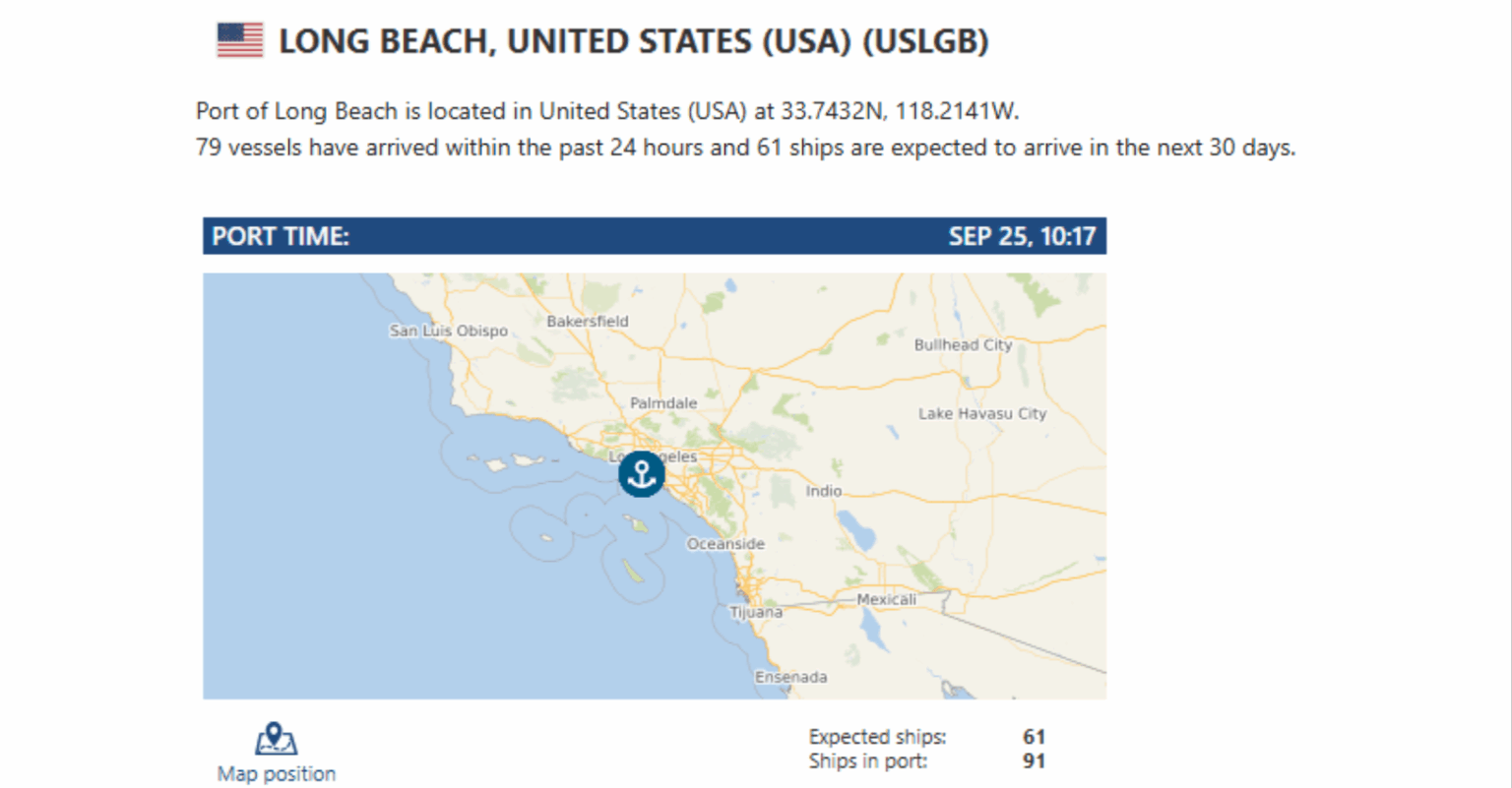

Import TEUs are up 18% this week from last week – with the highest volumes coming into Los Angeles 15.2%, Long Beach 17% and NY/NJ 16%. Carriers are reshaping schedules as the transpacific market heads into Q4 2025. Blank sailings are once again being used to manage capacity amid softer demand, tariff uncertainty, and Golden Week slowdowns. Drewry’s Cancelled Sailings Tracker shows that between late September and late October, about 11% of scheduled east–west sailings have been withdrawn, more than half on the transpacific, with most concentrated in Weeks 39–43 during China’s holiday shutdown. Some of these cuts are already tied to specific vessels and services. Ocean Network Express has suspended its PS5 loop, with the final voyage operated by the NYK Constellation in early September, while Hapag-Lloyd has blanked its AA7 service ex-Shanghai in mid-October. Forwarders also report cancellations of PS5 Week 38 from Qingdao and EC1 Week 41 from Kaohsiung. MSC has published its Golden Week program, including selective voids and skipped port calls through October.

What makes this year unusual is the smaller scale of announced capacity cuts compared with history. Sea-Intelligence notes reductions of just 3.8% on the U.S. West Coast and 4.8% on the East Coast, far below the double-digit figures typical in past years. More cancellations are likely to surface closer to departure as carriers adjust to conditions, with alliances trimming loops, doubling voids, and even suspending entire strings to keep utilization steady. For shippers, the takeaway is that Q4 will be marked by “stealth blank sailings” — not always visible in advance but disruptive when vessels skip ports or shift rotations, creating missed connections and bunching at U.S. gateways. With Golden Week closures, tariff pressures, and storm recovery in South China overlapping, the coming weeks bring heightened risk of delays, schedule volatility, and added costs.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

LA/Long Beach: PACECO Corp. and MITSUI E&S will supply two new ship-to-shore cranes to Total Terminals International (TTI) at the Port of Long Beach, with delivery expected in 2027. Built in Japan with U.S.-made components, the cranes mark a shift away from reliance on Chinese manufacturers and will be capable of handling vessels up to 24,000 TEUs. This follows PACECO’s August delivery of hybrid RTG cranes to TTI, which are designed to transition to zero-emission operation. We’ve cut our transload rates at Los Angeles/Long Beach! With a secure yard, plenty of storage, and a transload warehouse ready for both palletized and floor-to-pallet moves, we’ve got capacity waiting for you. Our strong drayage fleet, paired with OpenTrack visibility, means we can monitor your container from overseas vessel load all the way to U.S. port arrival. And remember—our NO DEMURRAGE GUARANTEE applies when freight is dispatched to us 72 hours prior to vessel arrival and cleared for pickup by last free day. Reach out to letsgetrolling@portxlogistics.com and let’s make Port X your go-to West Coast transload team.

Memphis: CSX and Canadian National plan to launch a new intermodal service moving international containers from Canada’s West Coast through Memphis directly into Nashville. The all-rail route will replace the current trucking leg with a steel-wheel interchange, offering shippers a greener and lower-cost alternative while easing highway congestion. CN says the service will primarily carry auto parts into Nashville’s growing manufacturing hub. A launch date has not yet been announced. Our Memphis team has expanded capacity, added drivers, and set new performance records—bringing you more consistency, flexibility, and options. Whether it’s local drayage or regional runs, we’re ready to keep your freight moving. Put our expanded capacity to work today: letsgetrolling@portxlogistics.com

Did you know? We are fired up to share that Brian Kempisty will be speaking next week at the JOC Inland Conference 2025 in Chicago! After a great spring conversation with William Cassidy (S&P Global) about where drayage, transloading, and trucking are headed—and how to make drayage a core part of your supply chain solution—BK’s taking the discussion to the big stage.

Catch BK on the “A View from the Top” panel on Tuesday, September 30th 2025 at 10:30 a.m. CT. He’ll break down practical ways shippers can integrate drayage end-to-end: real visibility from origin port to destination, seamless handoffs at transload or rail, and GPS-tracked final delivery. Think of it as turning the “fly and hammer” analogy into a concrete playbook for reliability, speed, and accountability.

See you in Chicago. If you can’t make it and want to see how we run the lifecycle of a shipment from door to door, reach out to BK, Patrick Morrison, or Blake Cooper for a full demo.

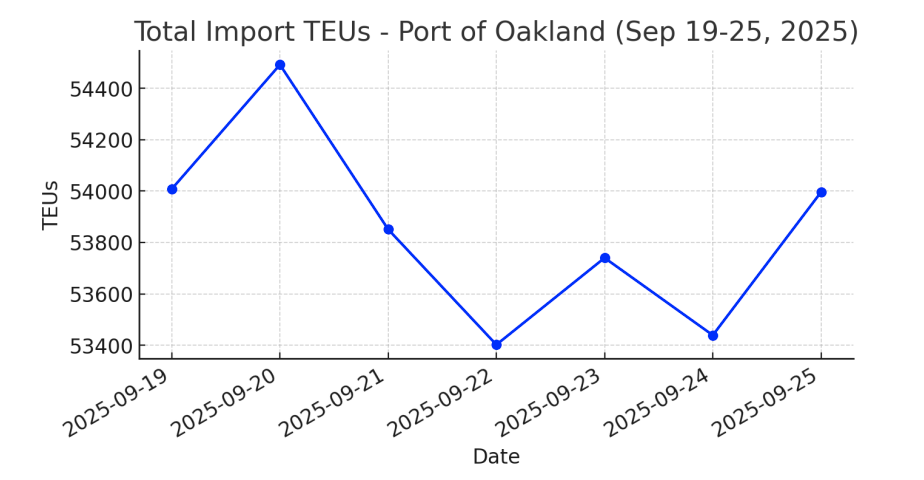

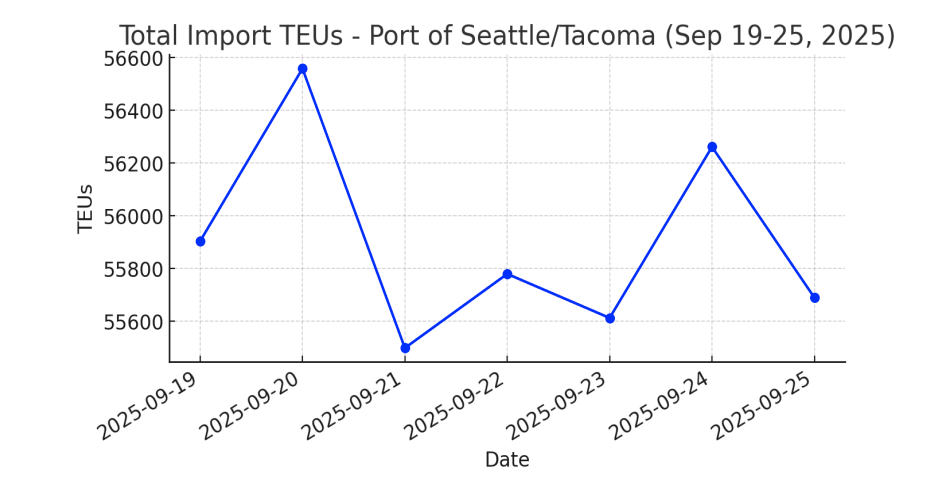

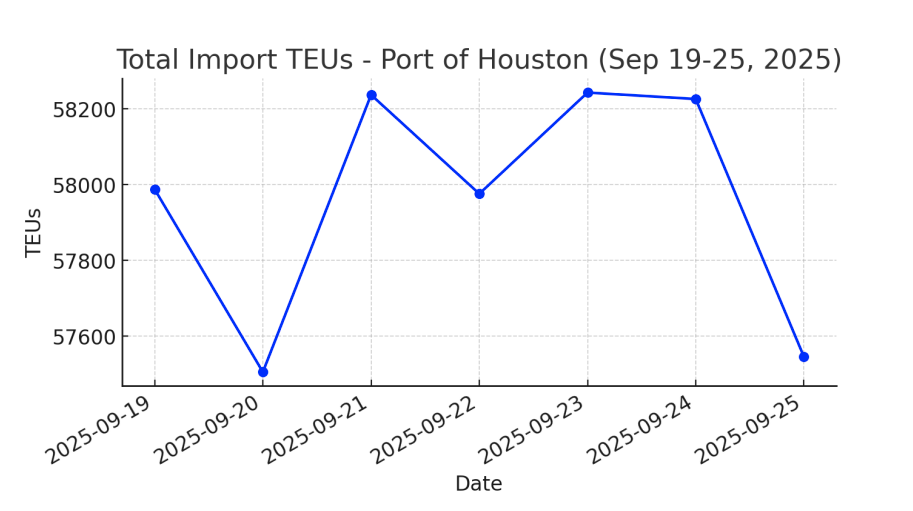

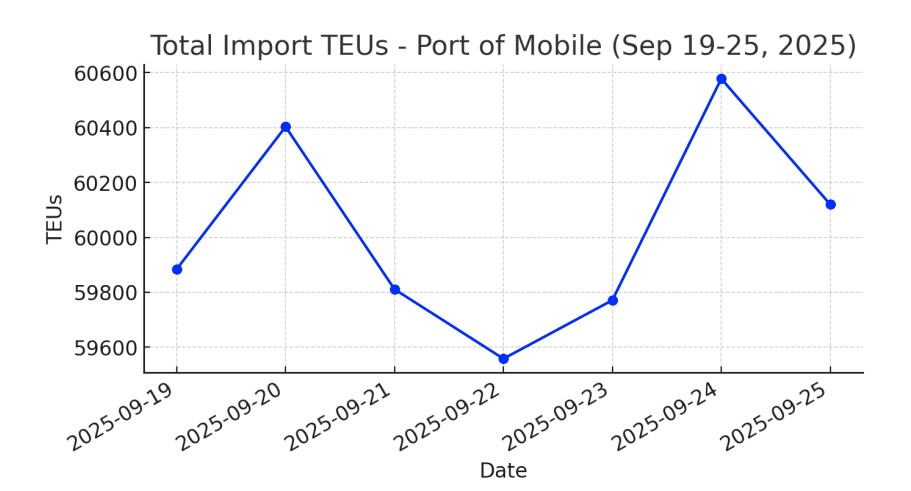

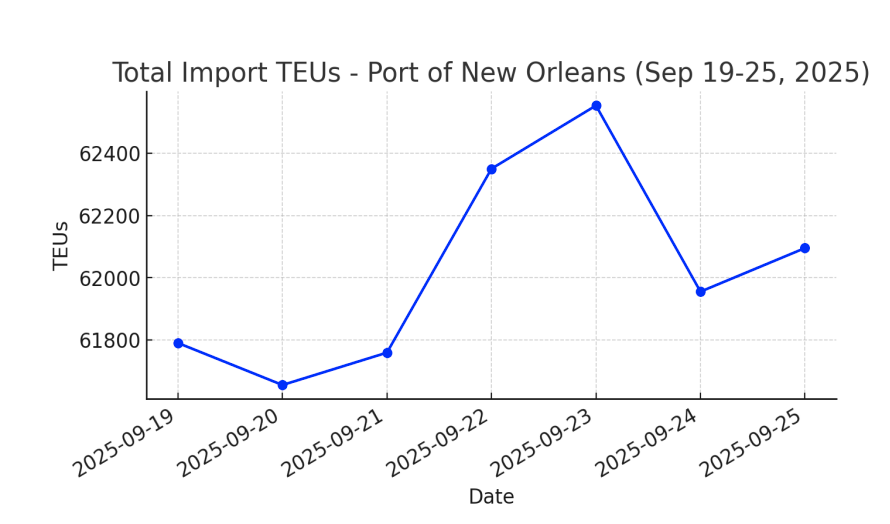

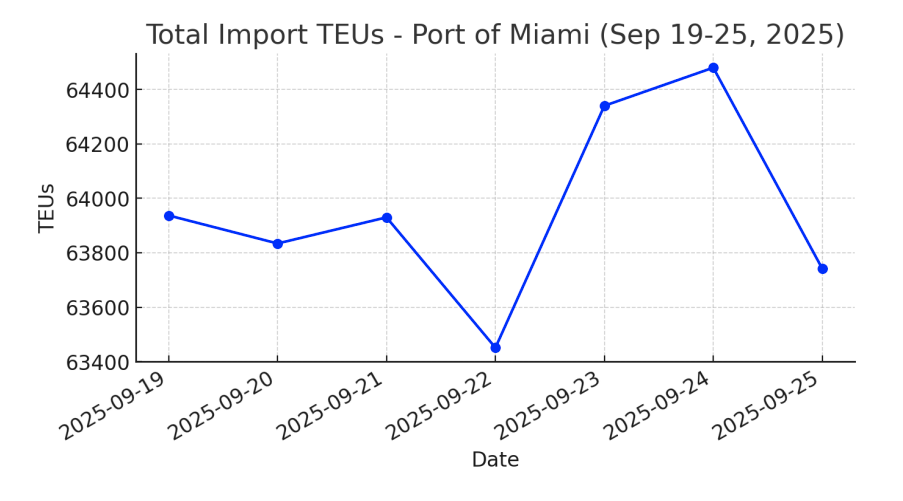

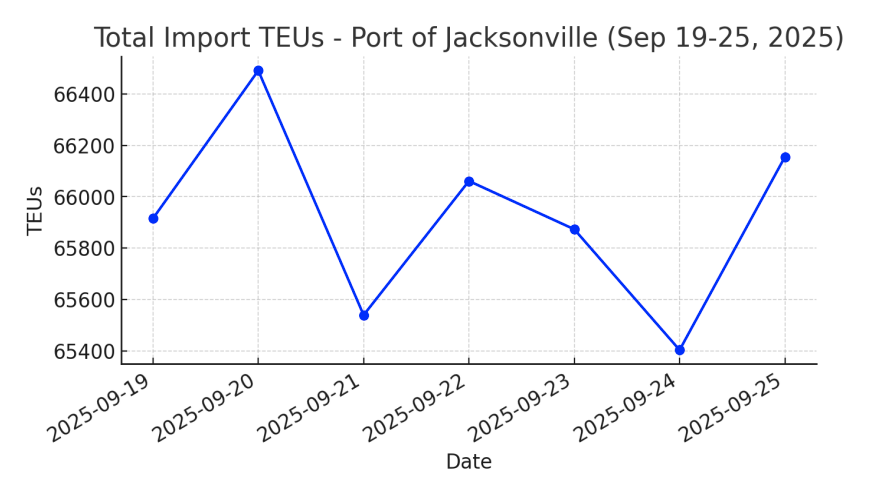

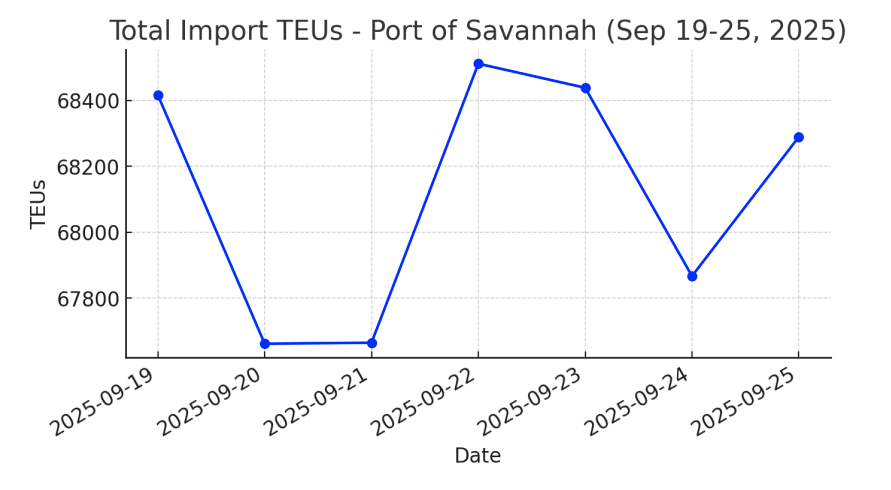

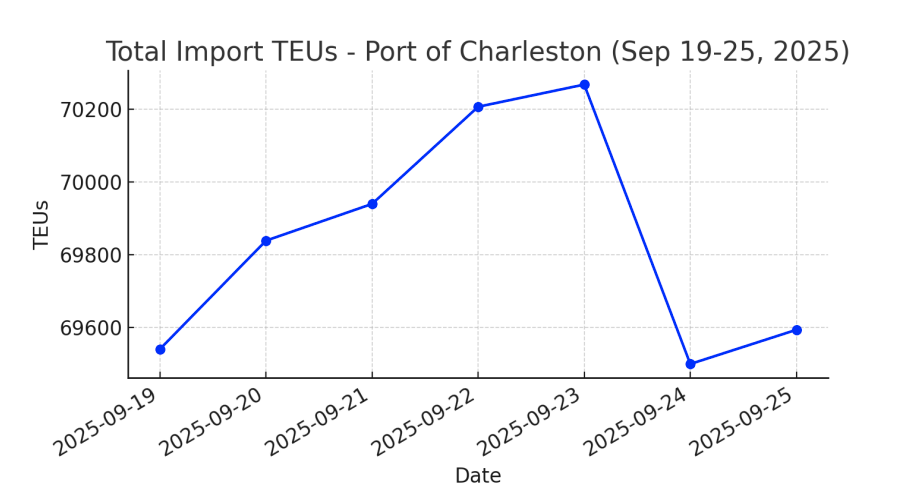

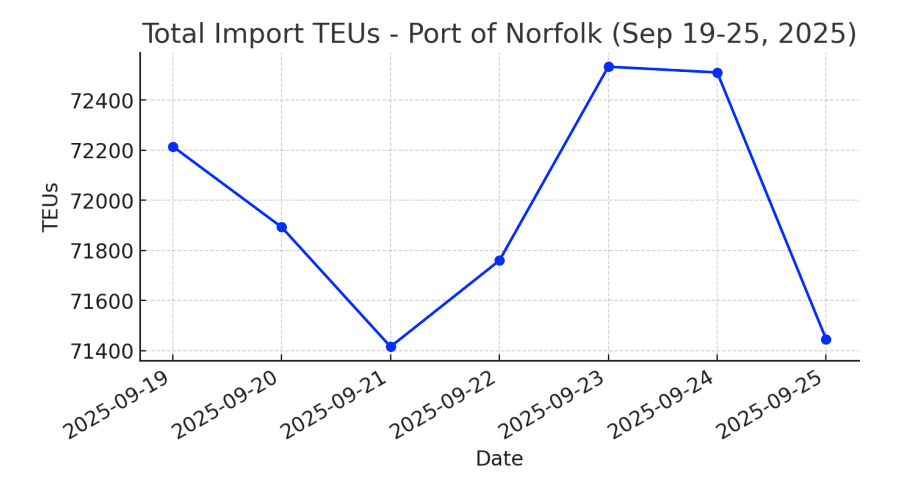

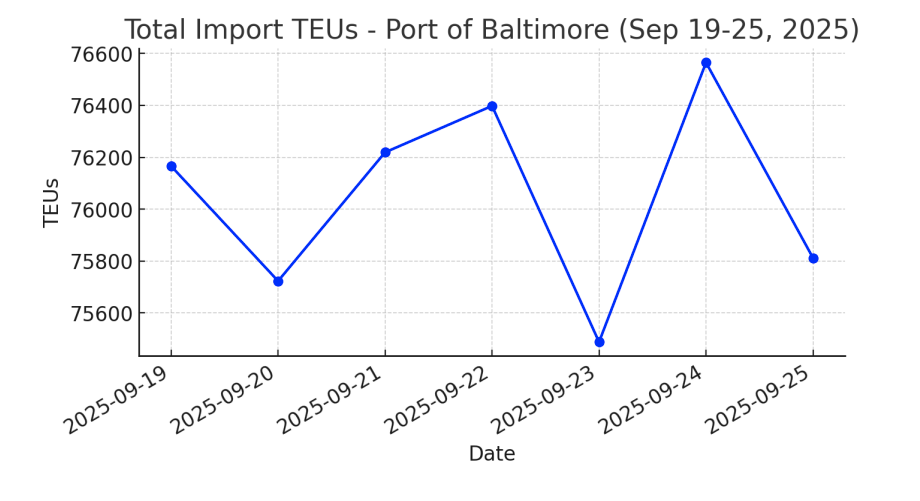

Import Data Images