Port of Seattle

1552 words 7 minute read – Let’s do this!

Happy Game Day, Buffalo fans! As kickoff approaches, we’re lining up this week’s headlines with a mix of tariff drama, vessel policy changes, and West Coast cargo strength. Japan’s exports are feeling the weight of U.S. tariffs, ocean carriers are preparing for new fees on Chinese-built vessels, and Los Angeles continues to post impressive import volumes despite policy shifts. Even in what feels like a slower season, trade rules are rewriting the playbook—and it’s our job to help you stay ahead of every change. At Port X Logistics, we know these developments don’t just make headlines—they ripple through every link in the supply chain. That’s why our team pairs asset-based drayage with flexible transload solutions to keep your freight moving, no matter how the market evolves. Stay tuned, stay prepared, and stay connected. Follow Port X Logistics on LinkedIn for real-time insights, or get these Market Updates delivered to your inbox every Thursday by emailing Marketing@portxlogistics.com

Japan’s exports slipped for the fourth month in a row in August as higher U.S. tariffs cut deeply into auto and technology shipments. Exports to the United States dropped nearly 14 percent year-over-year, with auto exports tumbling close to 30 percent in value and semiconductor equipment plunging almost 40 percent. The trade surplus between the two countries has now been cut in half, reaching its lowest point since early 2023.

Even though Washington scaled auto tariffs back from 27.5 percent to 15 percent this fall, that’s still six times the pre-2018 level. Japanese automakers, which are critical suppliers to the U.S. market, are absorbing most of the costs by lowering export prices, but many are beginning to pass costs on. For U.S. importers, that means fewer Japanese vehicles available and rising prices for those that do make it to port. For exporters—particularly in agriculture and industrial goods—the slowdown matters too, because Japan is one of America’s largest overseas buyers and weaker demand there could ripple back into U.S. export lanes. The bottom line: tariffs don’t just hit Japan—they ripple through the entire supply chain. Whether you’re an importer counting on steady inbound flows or an exporter needing reliable outbound lanes, Port X is here to keep your freight on schedule and your customers supplied.

Ocean carriers are preparing for new fees on Chinese-built, -owned, and -operated vessels calling at U.S. ports beginning October 14th. Major shipping lines have reassured customers that no immediate surcharges are planned, and competition in the market is helping keep rates steady as the policy takes effect. The measure, aimed at addressing global shipbuilding competitiveness, has been refined after extensive industry feedback. Instead of fees on every port call, charges will now apply per voyage, with a six-month adjustment period. Analysts expect carriers will continue adapting their fleets to manage the added costs, as many are already rotating in tonnage from South Korea and other shipyards.

While some sectors are watching closely for long-term effects, the industry has demonstrated remarkable flexibility, adjusting routes and capacity to keep supply chains moving. With steady service levels and proactive planning, container shipping remains well positioned to navigate the changes ahead. As tariffs and new vessel fees reshape global trade, one thing is certain—uncertainty will remain part of the equation. At Port X Logistics, we take that uncertainty out of your supply chain. With asset-based drayage, flexible transload solutions, and real-time visibility, we keep freight moving on schedule and protect you from costly disruptions. No matter how trade policies evolve, our No Demurrage Guarantee and our operations teams use of Open-Track ensures your cargo flows with stability and confidence.

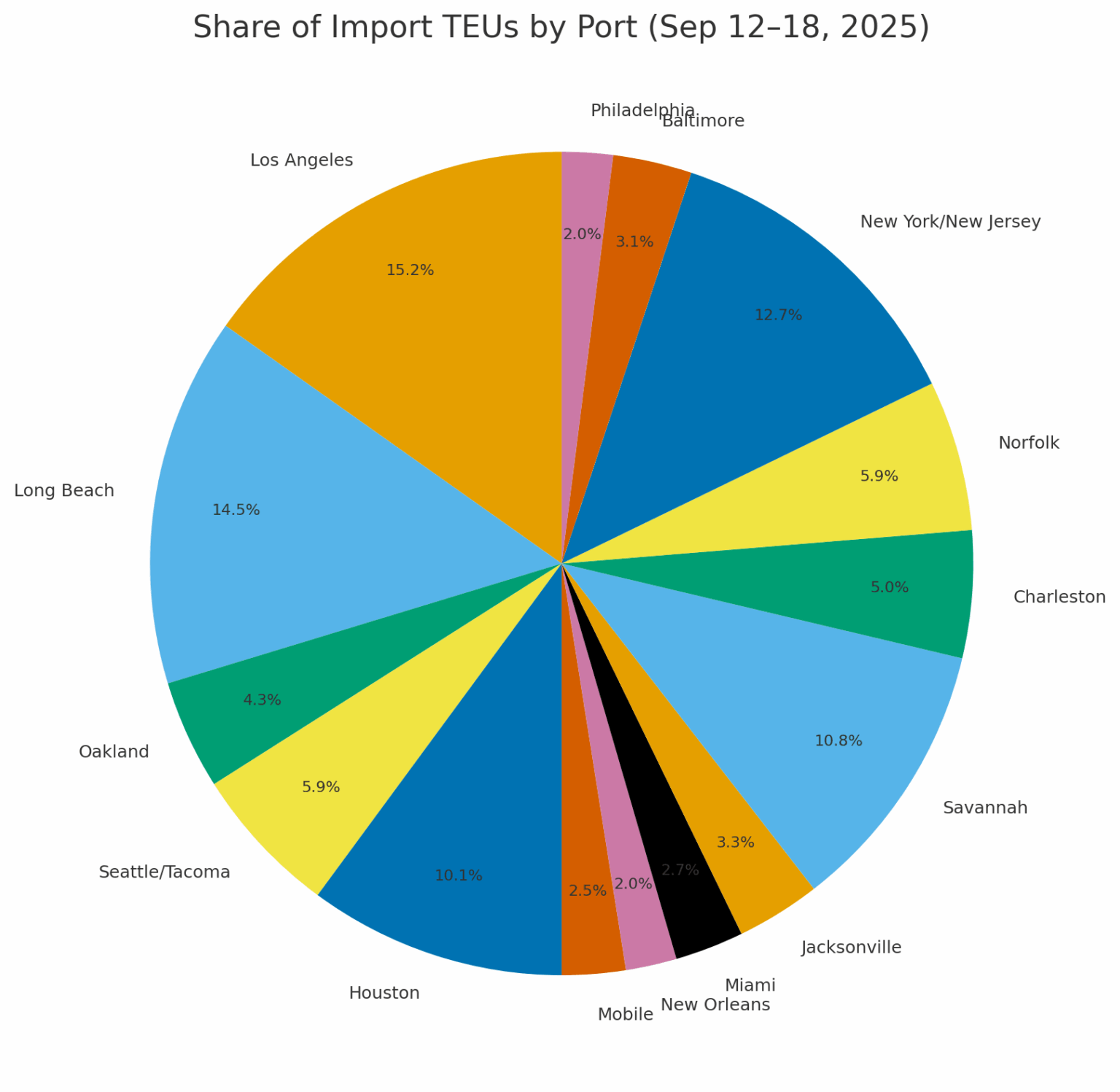

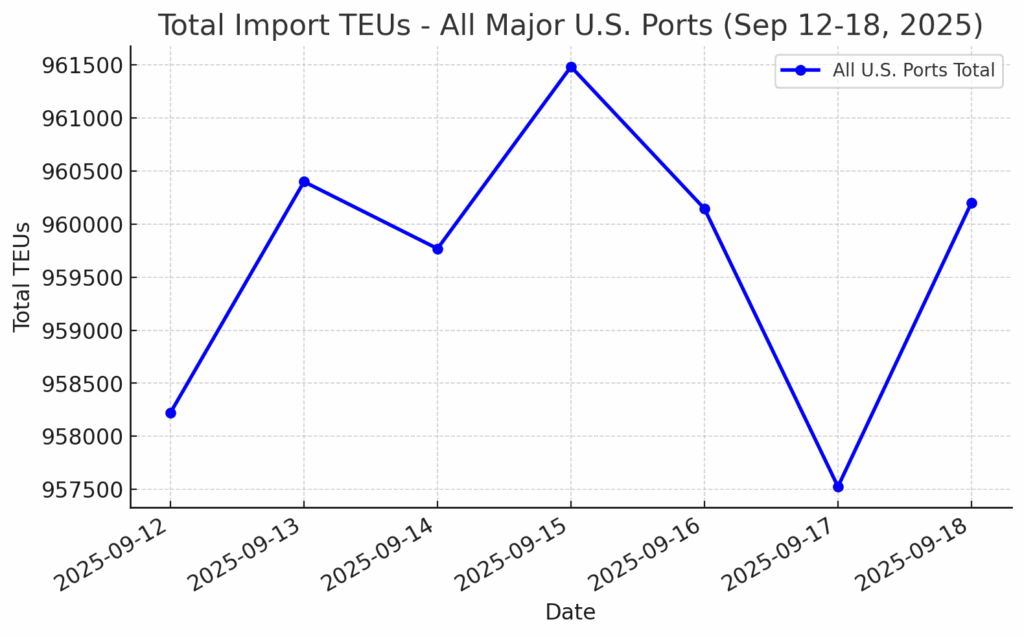

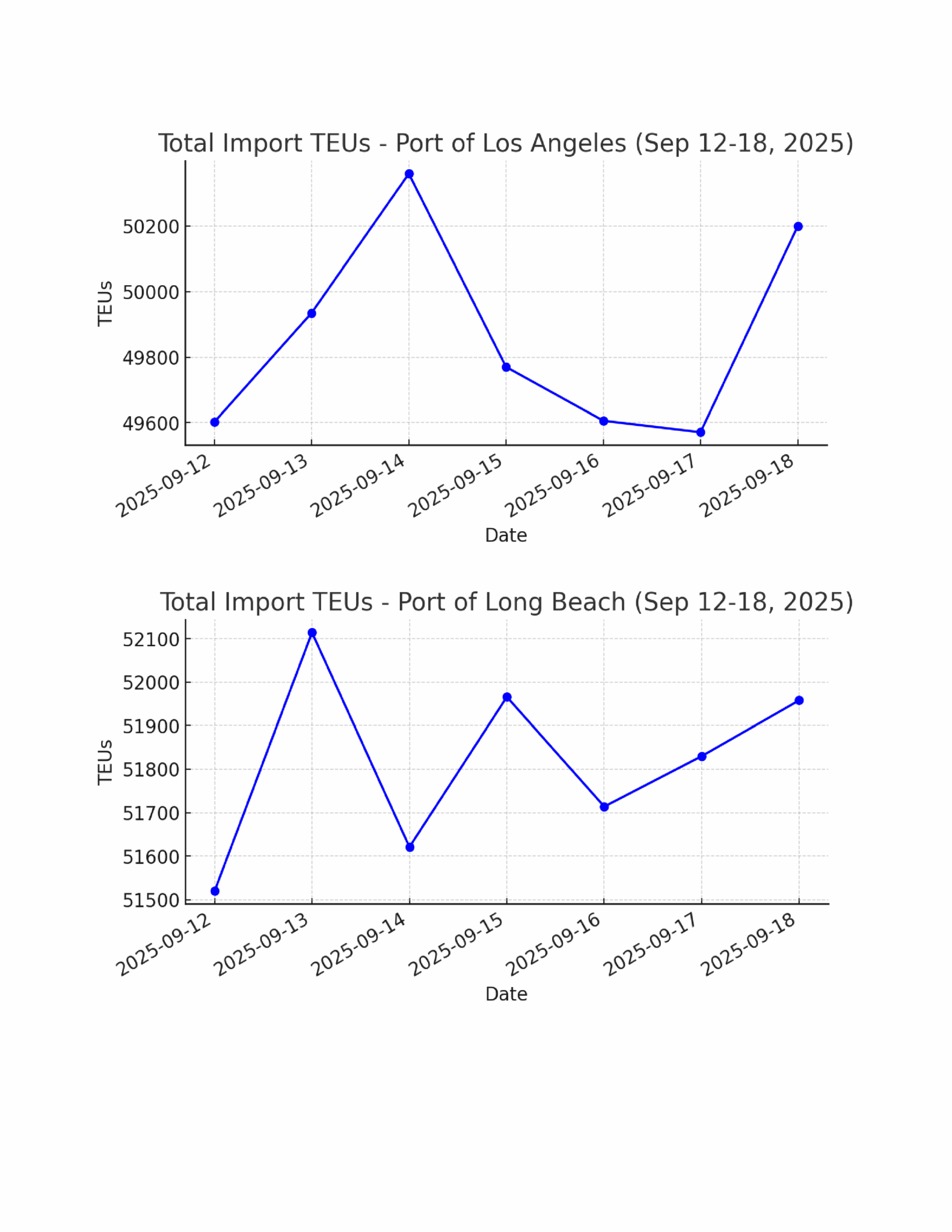

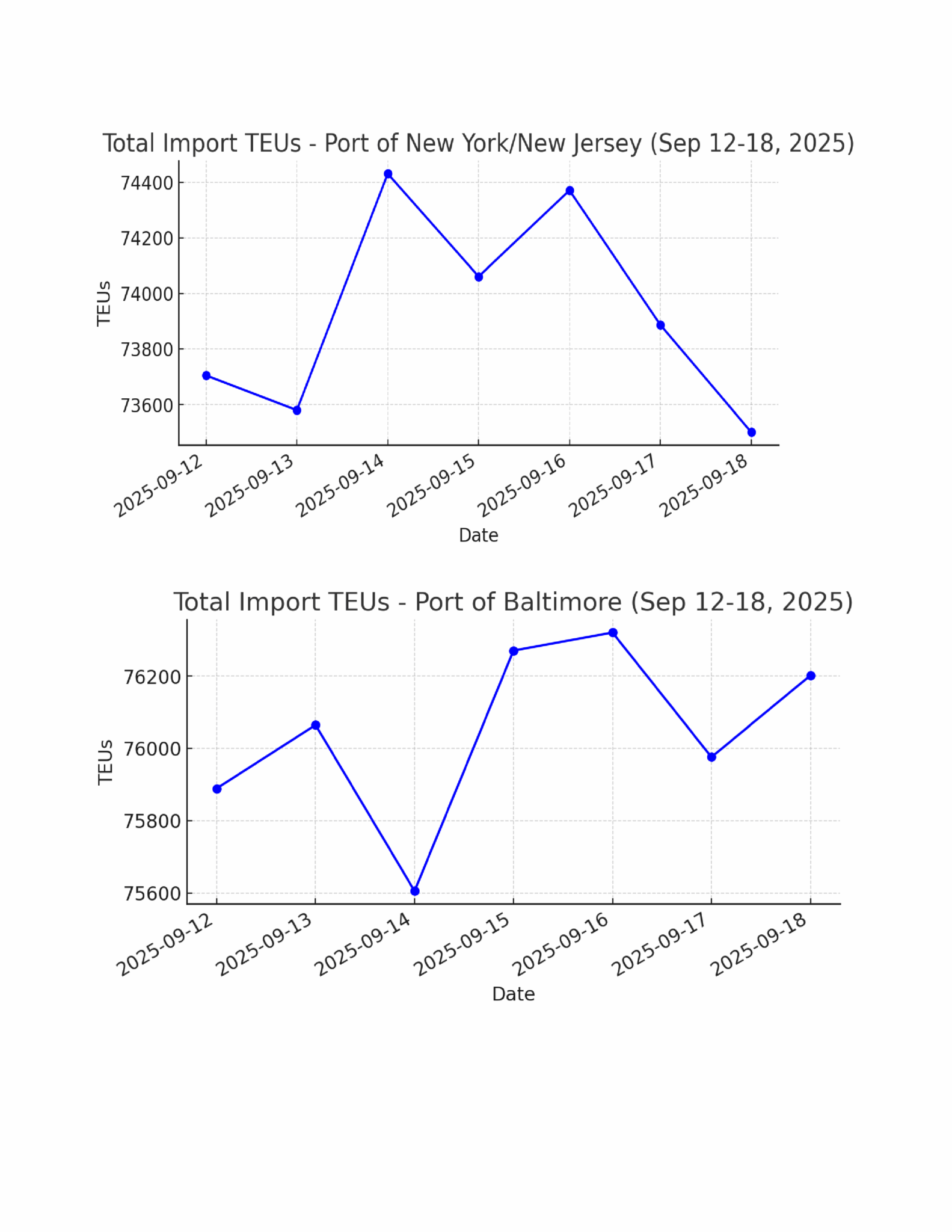

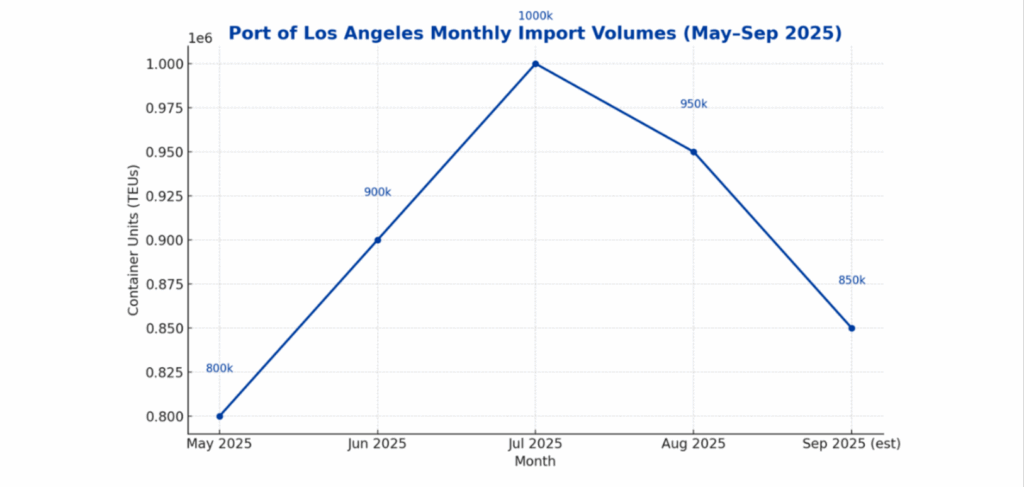

Import TEUs are up 0.43% this week from last week – with the highest volumes coming into Los Angeles 15.2%, Long Beach 14.5% and NY/NJ 12.7%. Imports at the Port of Los Angeles remained strong in August, following a record-breaking July that set a new all-time high. Executive Director Gene Seroka reported that the port moved more than 950,000 containers last month—six percent higher than the five-year average and a continuation of the momentum built in July, when volumes surpassed one million units for the first time since May 2021. The back-to-back performance highlights how resilient cargo flows have been even in a shifting trade environment.

Looking ahead, Seroka anticipates volumes will normalize in September, with projections of roughly 850,000 containers as most retailers and manufacturers have already stocked up for the holiday season. Importantly, August marked the third straight month of year-over-year growth, a strong sign that shippers remain active and supply chains continue to adapt effectively. Recent tariff adjustments and negotiating pauses have helped stabilize flows, allowing many companies to manage inventory with confidence heading into the final quarter of the year.

While legal challenges around tariffs continue, Seroka emphasized that the Port of Los Angeles has maintained fluid operations and efficiency throughout 2025, keeping cargo moving reliably despite policy changes. Larger retailers have also been able to use advanced planning and early stocking to offset cost impacts, ensuring shelves and warehouses remain full. For shippers, the combination of steady port performance, flexible routing, and proactive inventory strategies is helping mitigate uncertainty and keep goods flowing to market.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

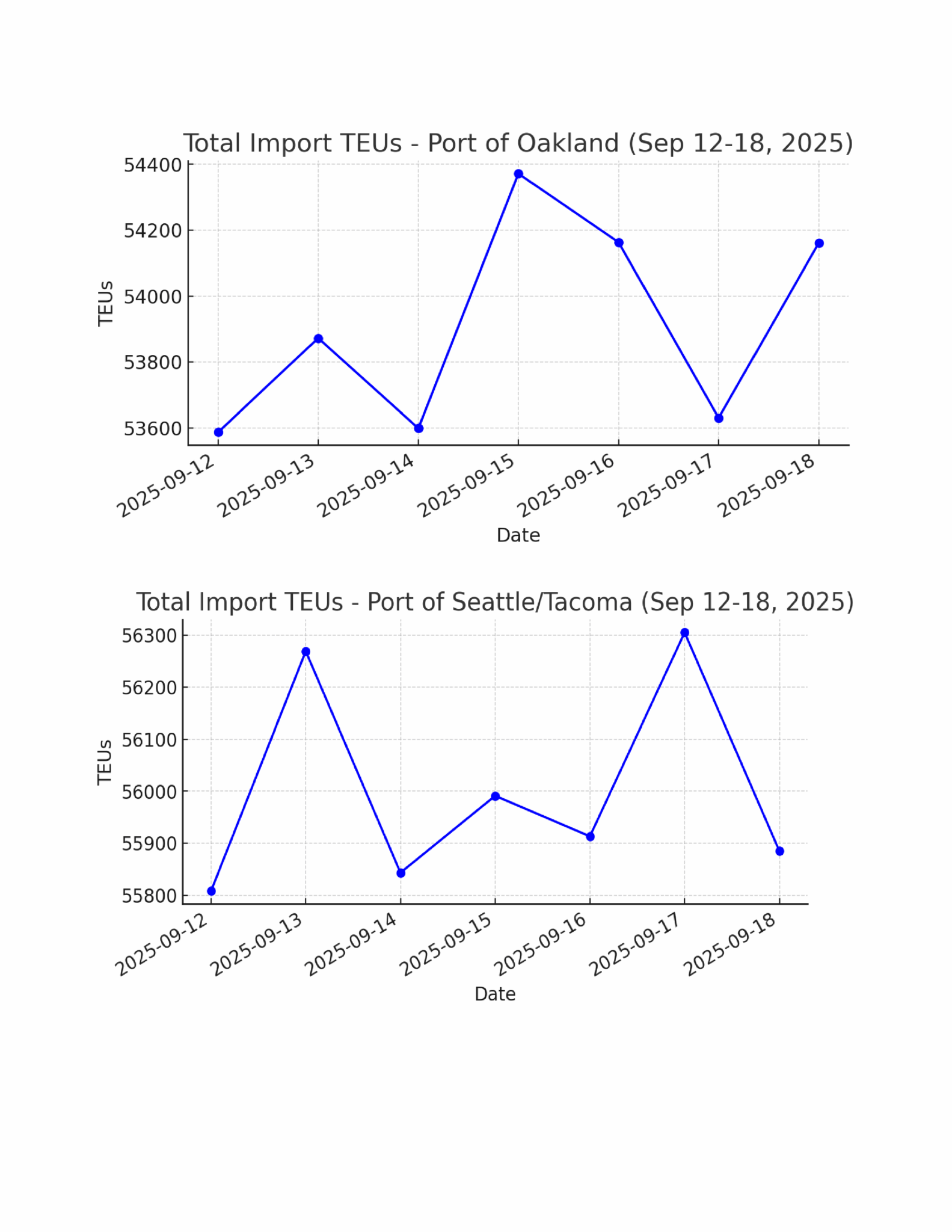

Seattle/Tacoma: Seattle–Tacoma operations are seeing some friction as Terminal 5 undergoes gate changes, with lanes 7–12 permanently closed and traffic shifting to drive-through western lanes during construction of a new complex. Terminal 18 is facing network issues that are slowing gate processing, while rail dwell times average about 2.2 days at Husky and 3 days at T-18. Gate turn times remain slower for double moves, and limited gate hours at Husky are adding pressure. Despite these challenges, terminals remain open and cargo is moving, though with delays and tighter capacity. While others in the Pacific Northwest are pulling back, Port X Logistics is charging ahead. Seattle and Tacoma remain critical gateways, and we’re making sure cargo keeps moving without disruption. With 11 new drivers added, strong drayage capacity, and a warehouse team built for quick, reliable transloads, we’re ready for whatever your supply chain needs. When market conditions shift, resilience matters most. That’s what our SEA/TAC operation delivers—reliable infrastructure, the right equipment, and a service team that knows how to get it done. Want to see how routing through Seattle and Tacoma can give your network an edge? Reach out at letsgetrolling@portxlogistics.com—our team is ready to roll.

Savannah: Georgia Ports has officially launched its new fast-track routing option that allows inbound container vessels to use a lay berth at Ocean Terminal before moving into Garden City Terminal as soon as a berth becomes available. The first ship to use this routing, the CCNI Arauco of the Maersk Gemini Service, was able to begin work at 7:00 PM on Thursday, September 11th — nearly 12-15 hours sooner than if it had waited for the regular berth to clear. This lay berth option, combined with eight ship labor start times, is expected to enable GPA to handle two more vessels per week and cut berth idle time dramatically, from roughly 12-15 hours down to about three hours. Port X Logistics isn’t just in Savannah—we’re driving the South Atlantic forward. Our 12-truck drayage fleet covers Savannah, Charleston, and Jacksonville, backed by hazmat certifications, on-site yard space, and a fully equipped transload warehouse built to handle whatever your supply chain throws our way. Last-minute cross-dock? Urgent transload? Consider it done—fast, reliable, and at competitive rates. When you roll through the port with us, you get the inside track. Reach out at letsgetrolling@portxlogistics.com and keep freight moving like a pro.

Spotlight on Kansas City🚛

Kansas City isn’t just another market for us—we run it. With 100+ GPS-equipped power units on the road daily, the largest drayage operation in the region, and a 66-door dock built for speed, Port X Logistics keeps freight moving—whether it’s cross-dock, storage, distribution, or exports.

We’re a fully bonded U.S. Customs CFS and Exam Warehouse, plus we’ve got export street turn capabilities with nearly every major steamship line—saving shippers time and money.

Whatever you need moved, stored, or cleared, we’ve got it covered. Let’s get rolling ➡️ letsgetrolling@portxlogistics.com

Did you know? Join our Brand Ambassadors Noah Shivley and Tom Zeis at the premier project cargo and breakbulk event in North America, happening September 30th – October 2nd in Houston, TX. This is where the industry’s biggest players come together, where heavy-lift innovation takes center stage, and where big ideas turn into real opportunities.

We’re ready to connect, collaborate, and showcase how Port X Logistics is keeping cargo moving. Don’t miss it—secure your spot, and let’s make it happen in Houston! To lock in a meeting with our team, reach out at marketing@portxlogistics.com.

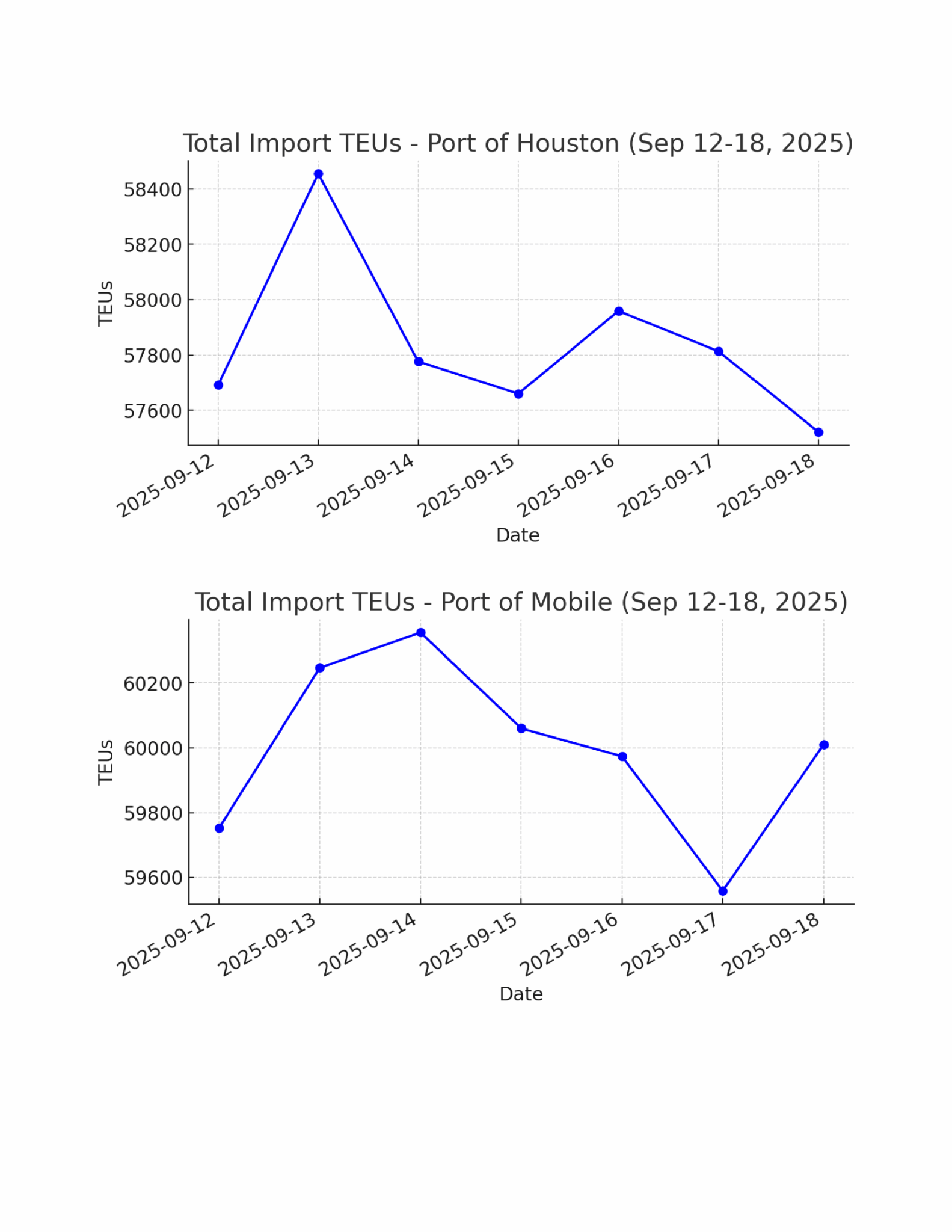

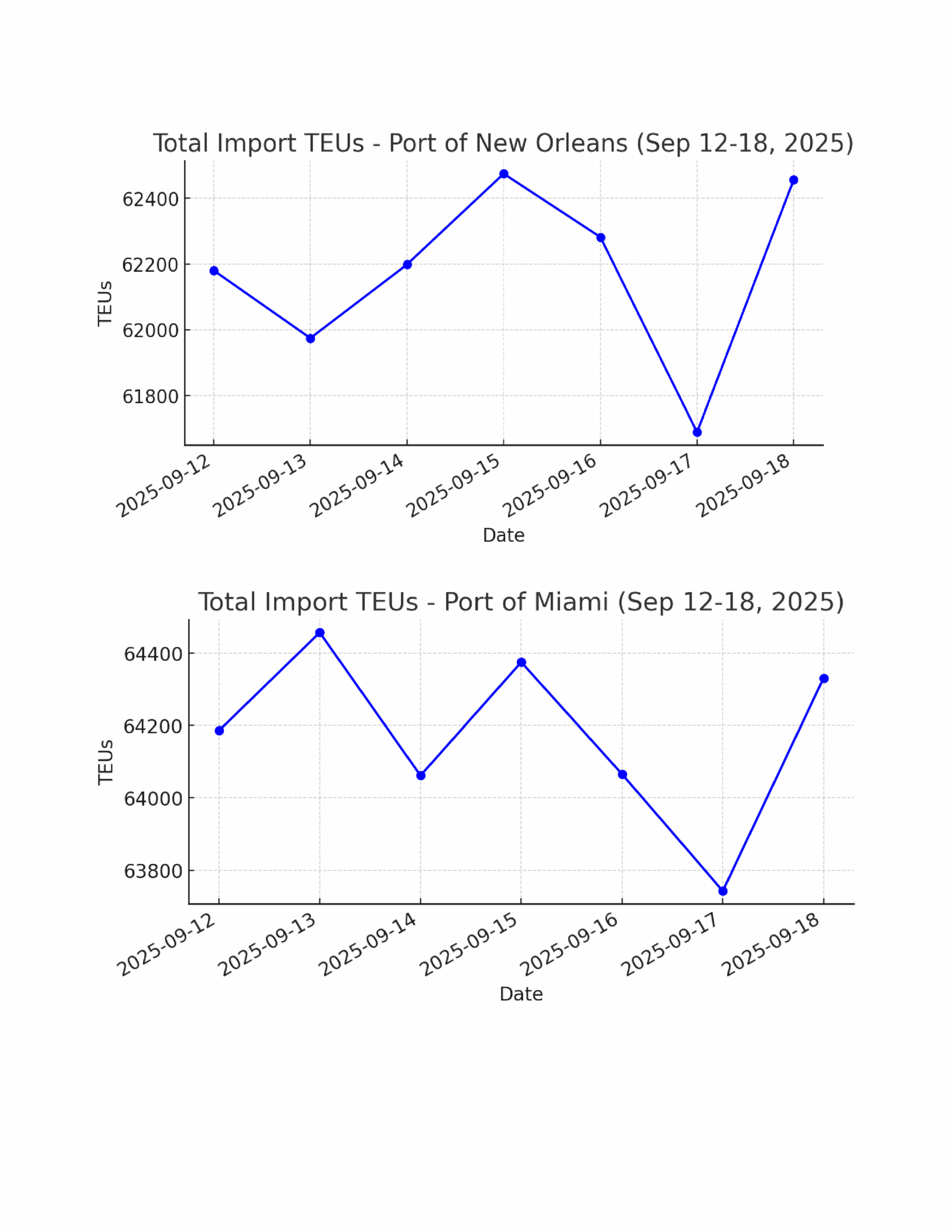

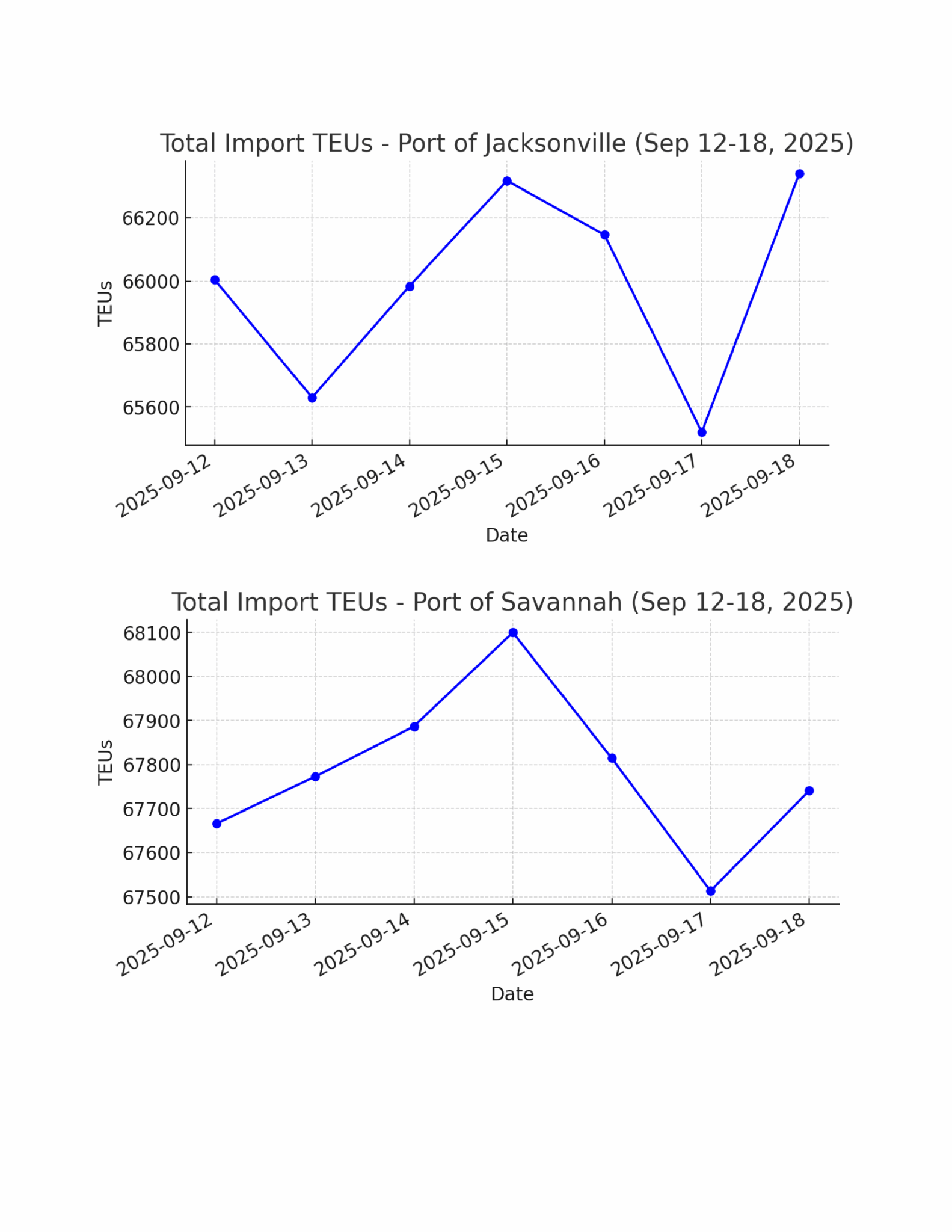

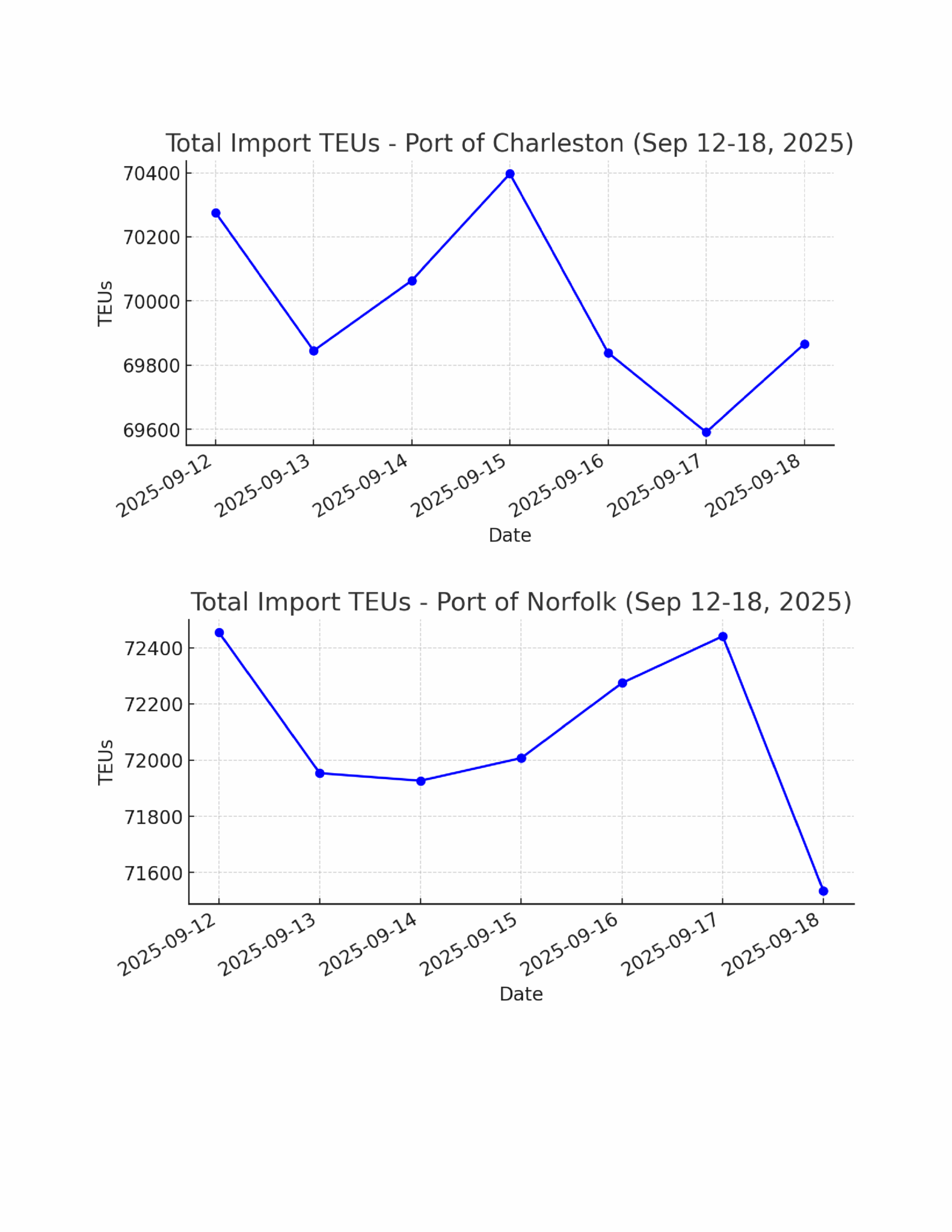

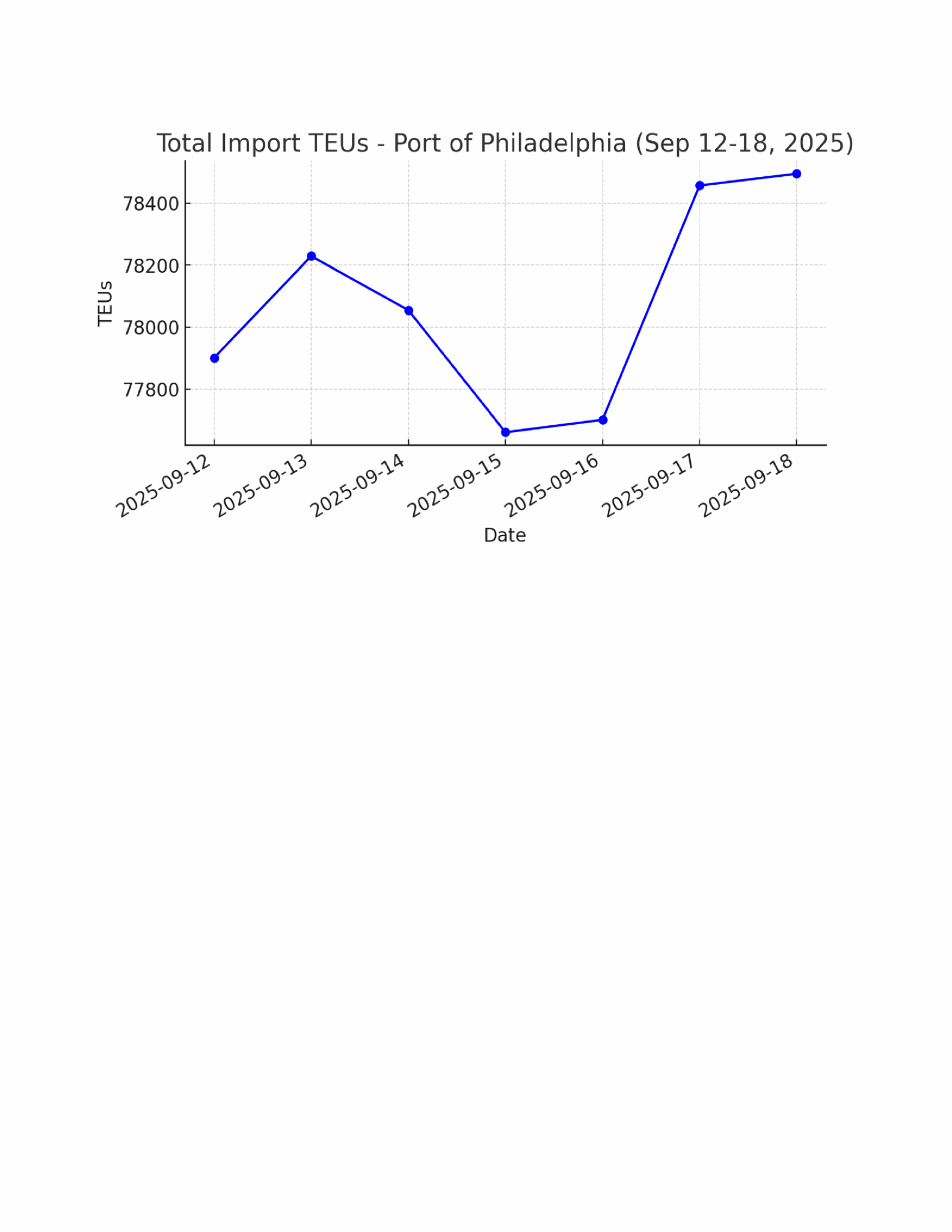

Import Data Images