Port of Houston

1583 words 7 minute read – Let’s do this!

Fall is here, and the supply chain isn’t slowing down. Schools are back in session, football is kicking off, and for those of us up north, cooler weather is finally breaking through the heat. But while the seasons change, one thing stays the same — global freight keeps us on our toes. This week, we’re diving into the ripple effects of vessel bunching: port congestion, chassis shortages, and rail dwell times. These challenges can disrupt your plans fast — but that’s where we step in. At Port X Logistics, our goal is simple: to make your life easier, no matter what the market throws your way. Want to stay one step ahead? Follow Port X Logistics on LinkedIn for real-time updates and industry insights, or get these updates delivered straight to your inbox every Thursday by emailing Marketing@portxlogistics.com.

Let’s get into it.

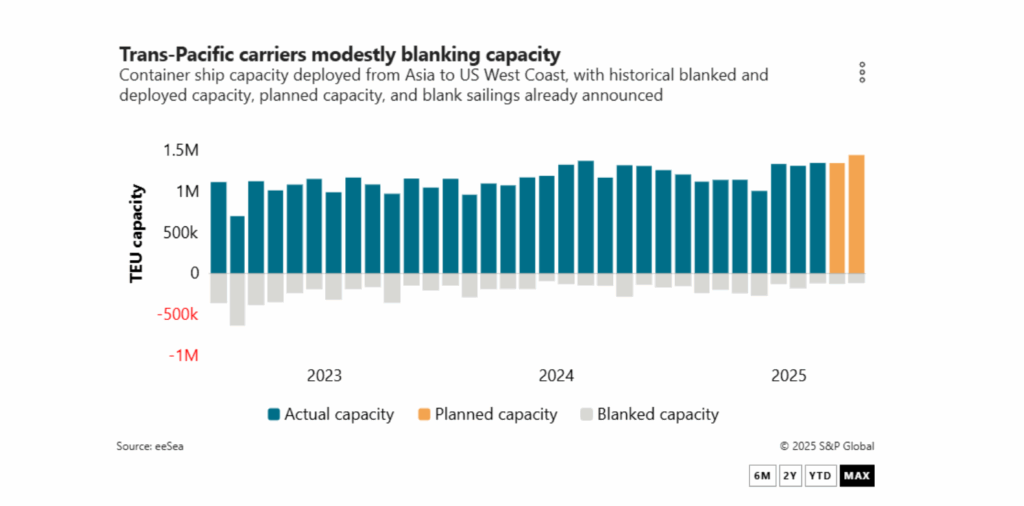

The next few weeks on the trans-Pacific will be important, not only for ocean carriers but also for the downstream logistics sector. As container lines work to realign capacity with softening import demand, drayage carriers and forwarders have a chance to turn shifting dynamics into opportunity. Spot rates ticked upward last week, suggesting that recent blank sailings may be slowing the decline that began in late May. With China’s Golden Week holiday starting October 1st and temporarily reducing production, carriers are making final efforts this year to stabilize pricing. While lines are targeting general rate increases of $800–$900 per FEU, spot rates from Asia to the U.S. West Coast remain competitive at around $2,000. For forwarders and drayage providers, this environment creates an opening to engage customers looking for creative routing, faster inland solutions, and dependable trucking capacity as they balance contract and spot options.

October Capacity Brings Opportunity

Carriers are set to add nearly 100,000 TEUs of capacity in October versus September, according to eeSea data. While blank sailings remain near 8.4% of West Coast tonnage, the added space could translate into steadier cargo flow into U.S. ports. For drayage carriers, this means more predictable volumes to plan around, while forwarders can use the additional flexibility to secure competitive pricing and position themselves as problem-solvers for importers navigating volatile freight costs. The narrowing gap between spot and contract rates also plays to forwarders’ strengths. Smaller and mid-sized importers who locked in spring contracts at $2,000–$2,200 per FEU are now watching spot levels approach those same ranges. This creates an opportunity for forwarders to step in with guidance, helping shippers balance risk, capture savings, and still maintain strong service reliability. For drayage providers, it translates to a chance to win incremental loads as shippers move more dynamically between contract and spot volumes.

Flexibility Wins in a Volatile Market

Although some shippers may be tempted to chase the lowest possible rate, experience shows that reliable partnerships are what keep cargo moving when market conditions shift. Forwarders and drayage carriers are well-positioned to reinforce this message: while carriers may adjust schedules, skip port calls, or increase blank sailings, shippers need consistent inland and last-mile solutions to keep supply chains running smoothly. Even as volumes have dipped, the demand for trusted service providers hasn’t gone away. If anything, shippers navigating cost pressures are leaning more heavily on forwarders to provide transparency and options, and on drayage carriers to deliver predictable, high-quality service at the rails and ports.

Looking Ahead

Golden Week and the fourth quarter will be a test for ocean carriers, but for forwarders and drayage carriers, it’s a chance to prove value in uncertain times. As spot and contract rates converge and capacity shifts, those who remain flexible, responsive, and focused on customer service will be best positioned to capture business — not just through year-end, but into the 2026 contract season.

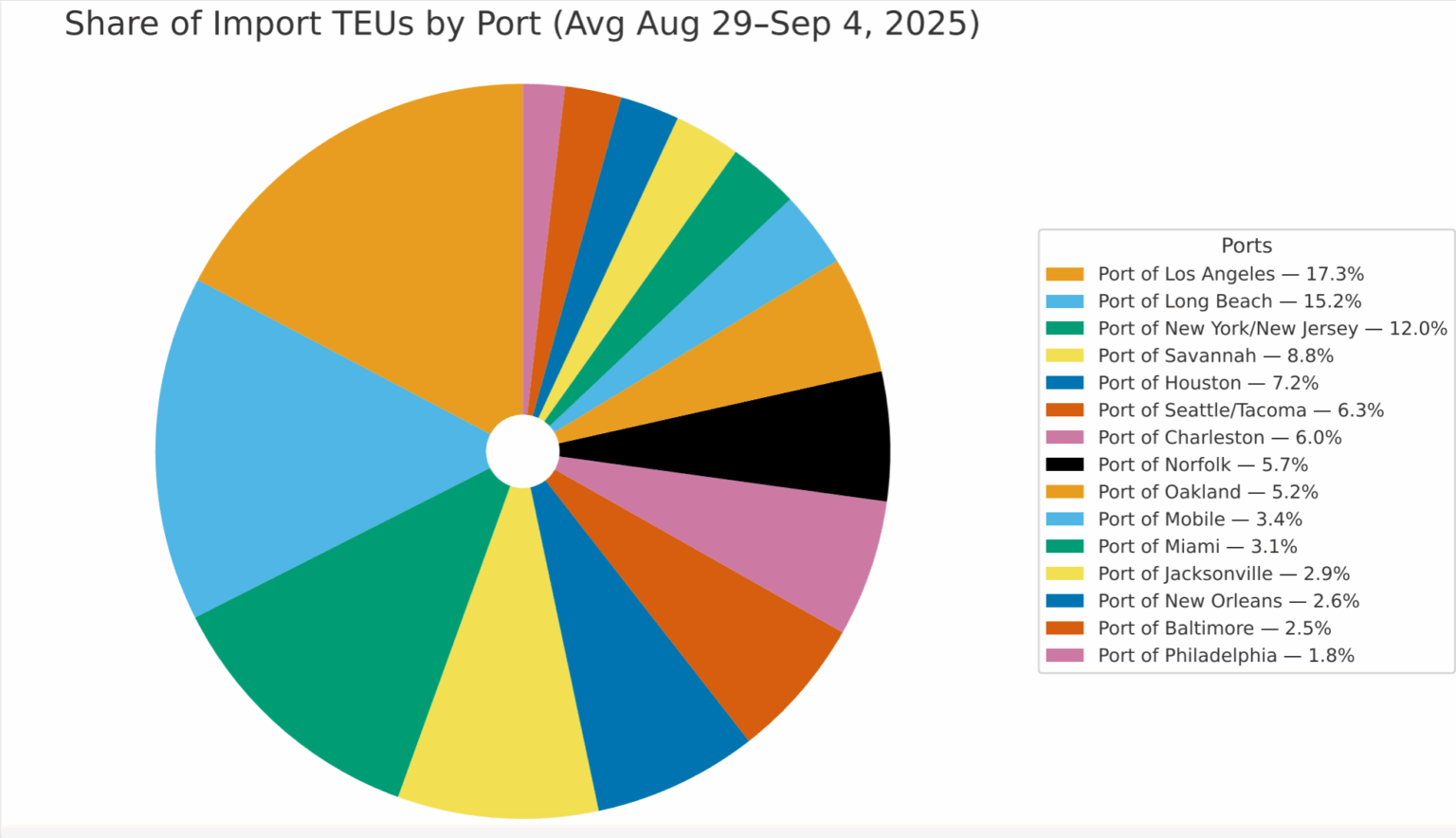

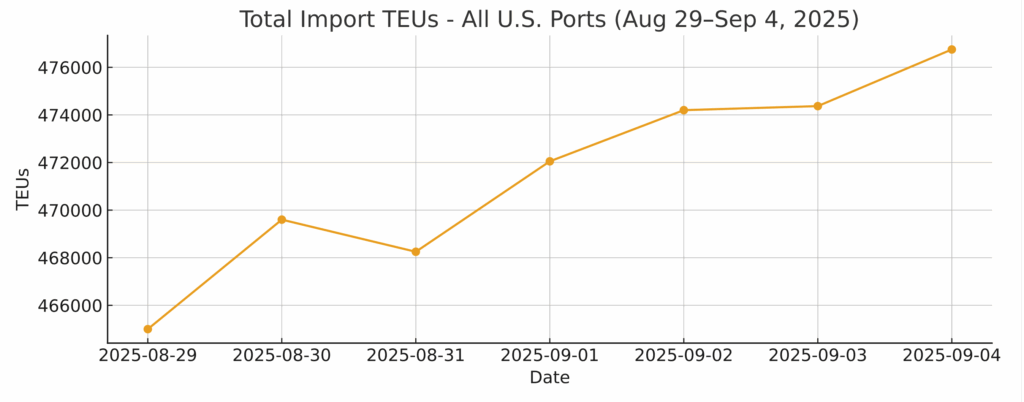

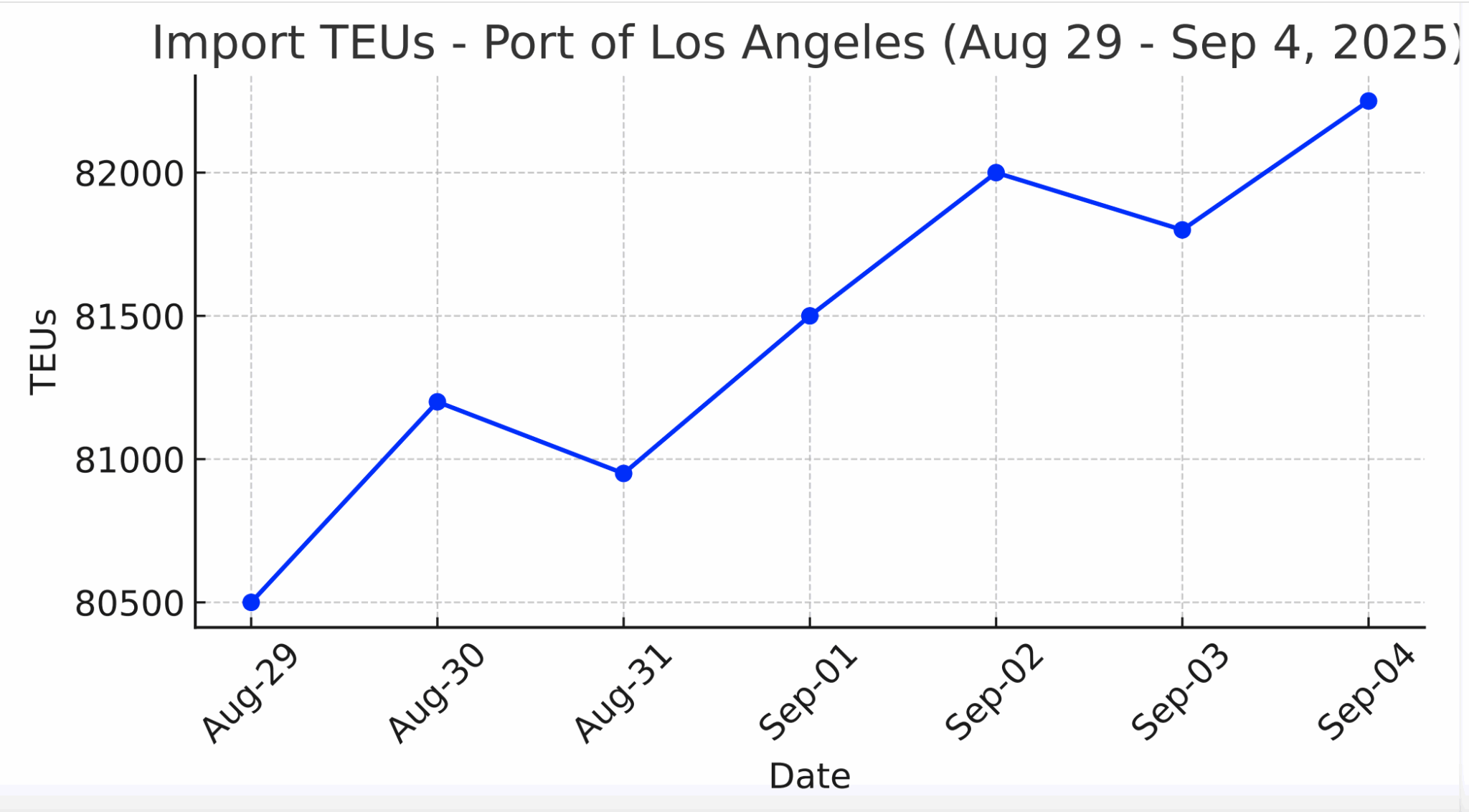

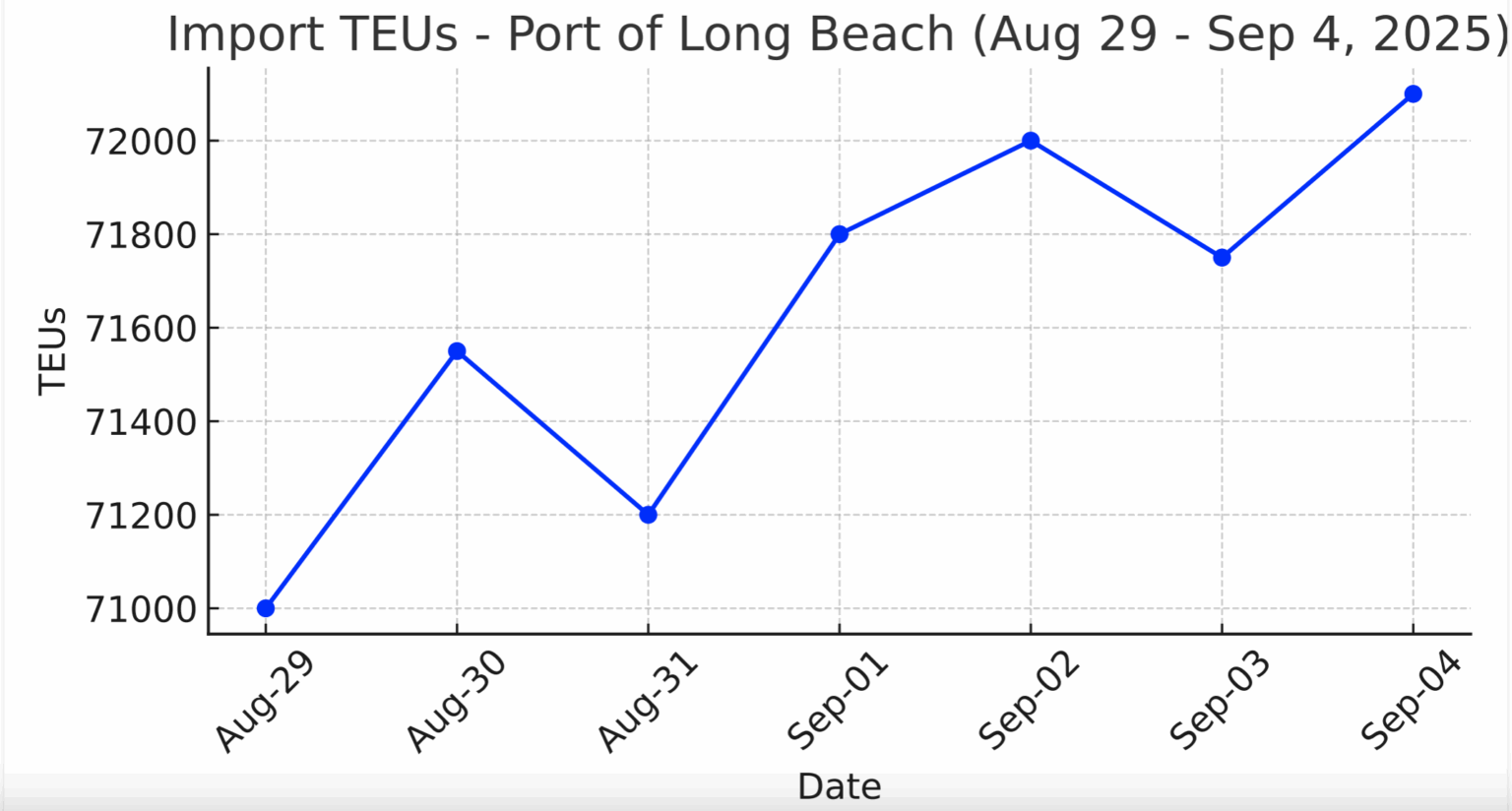

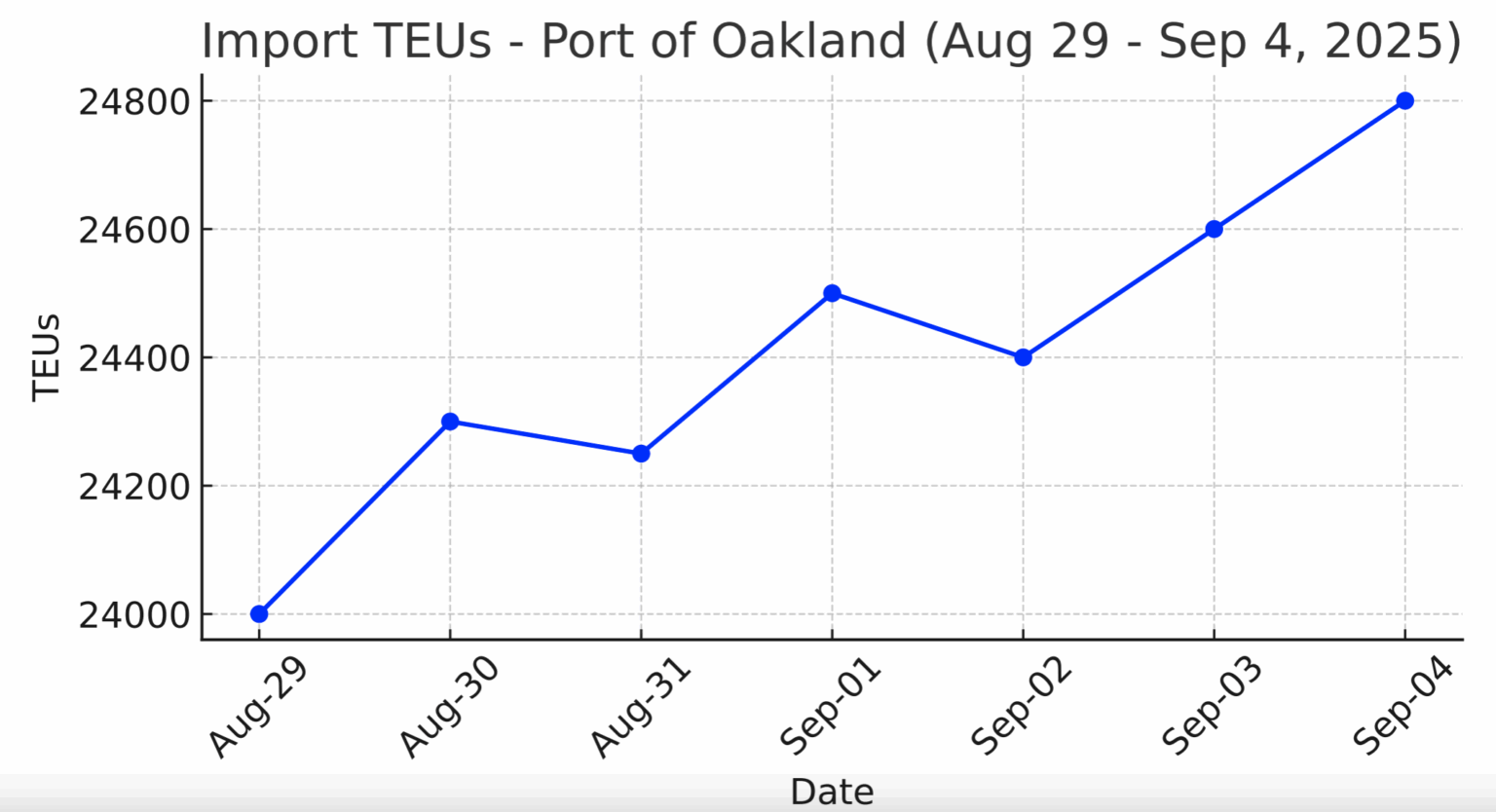

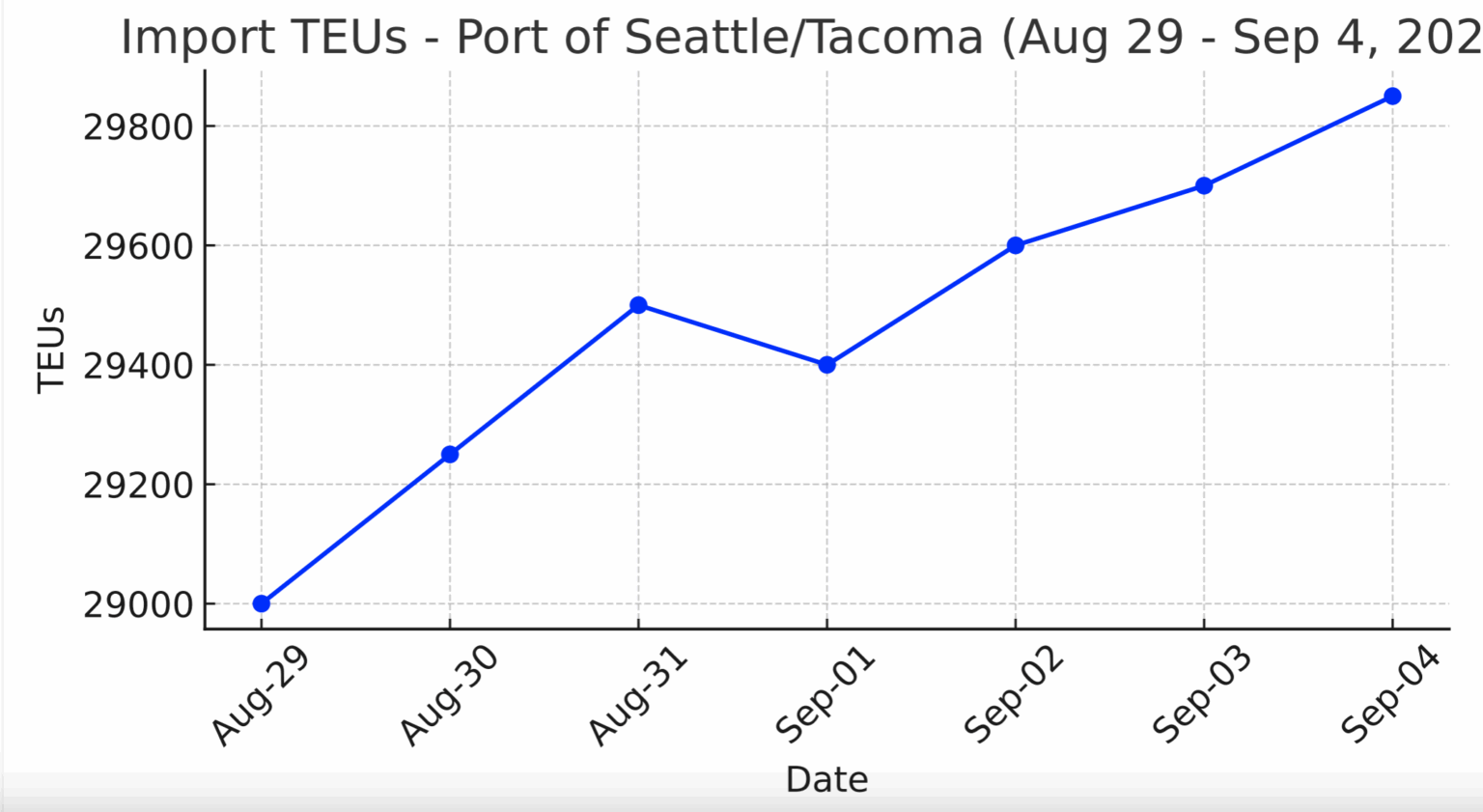

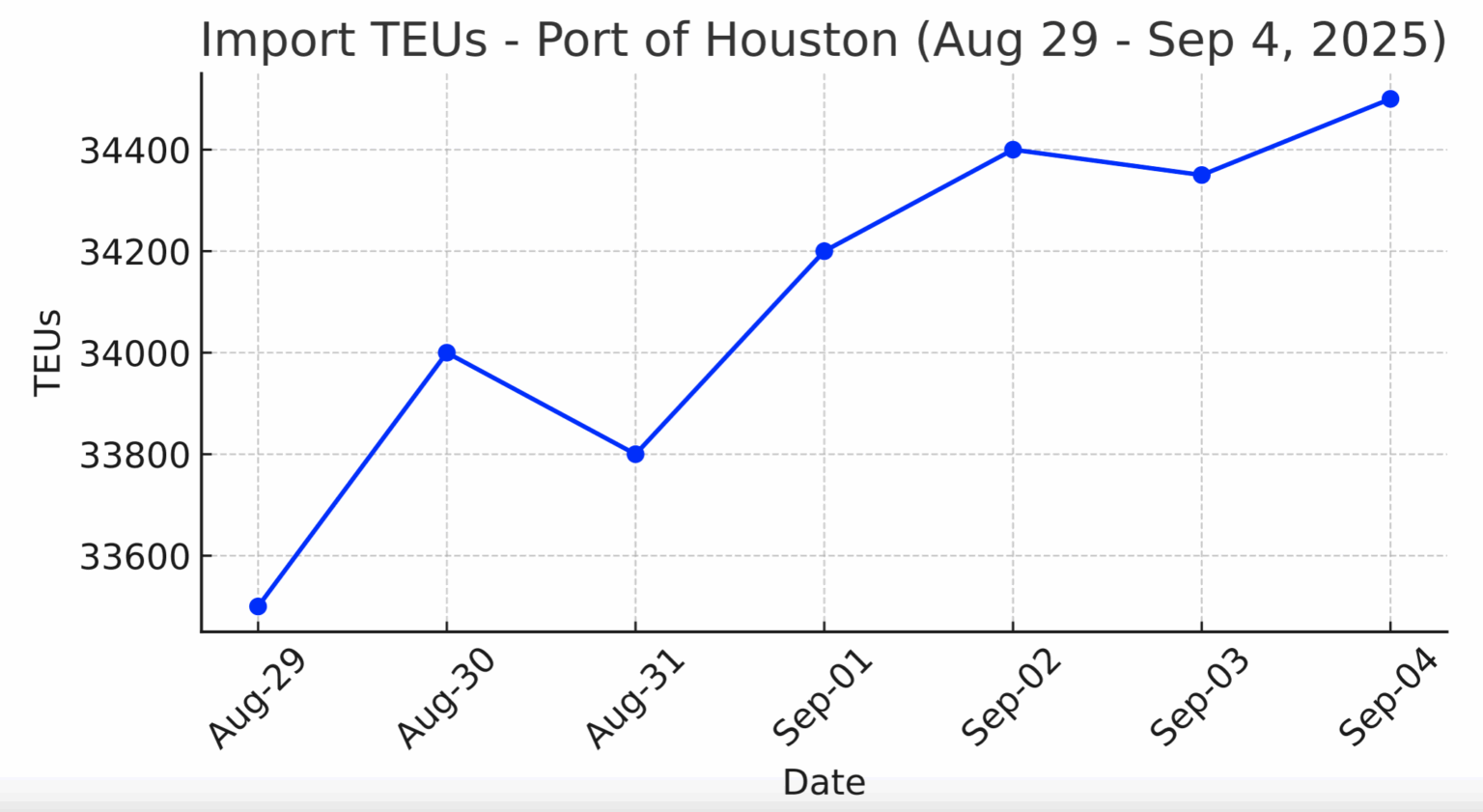

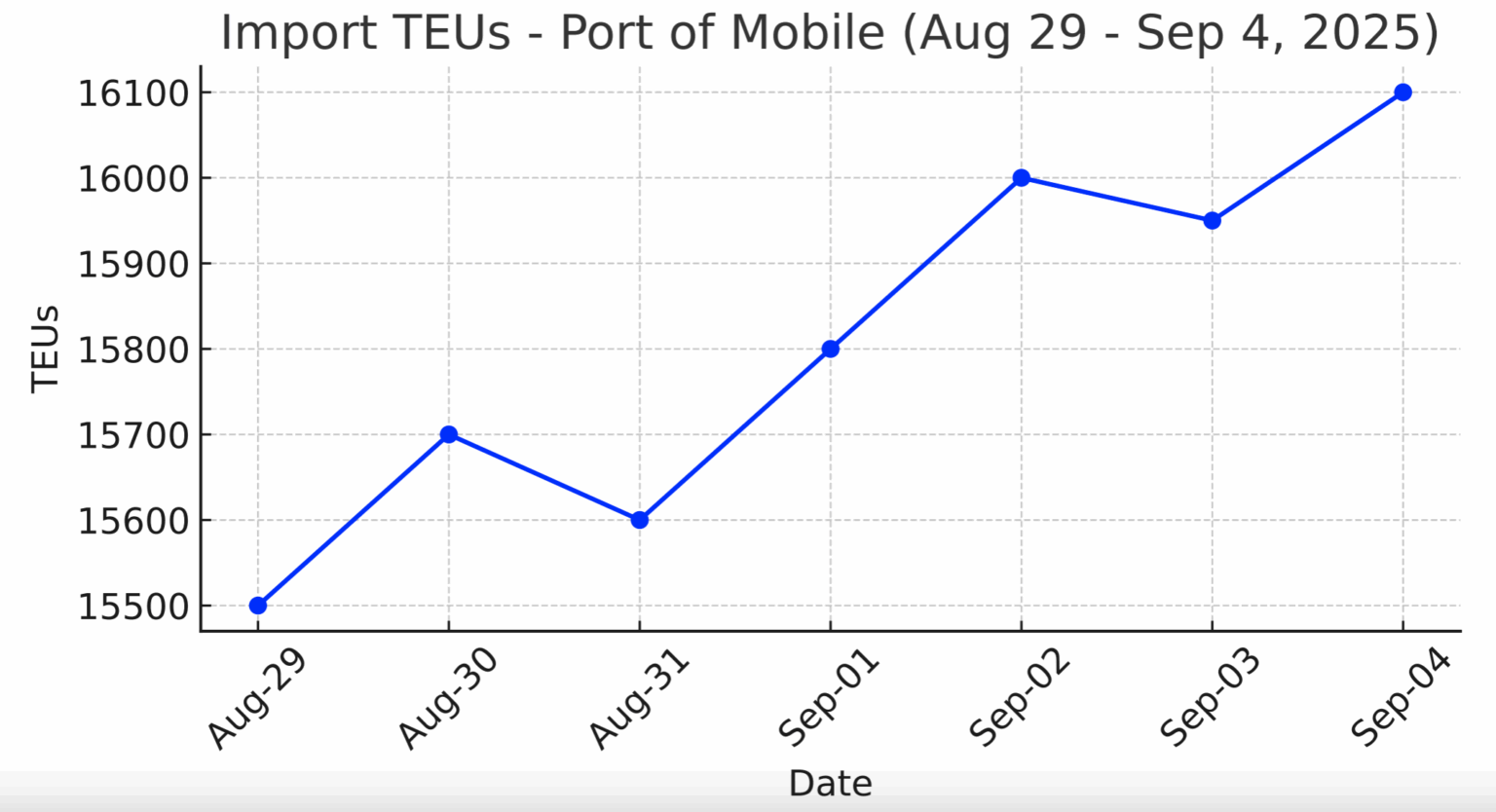

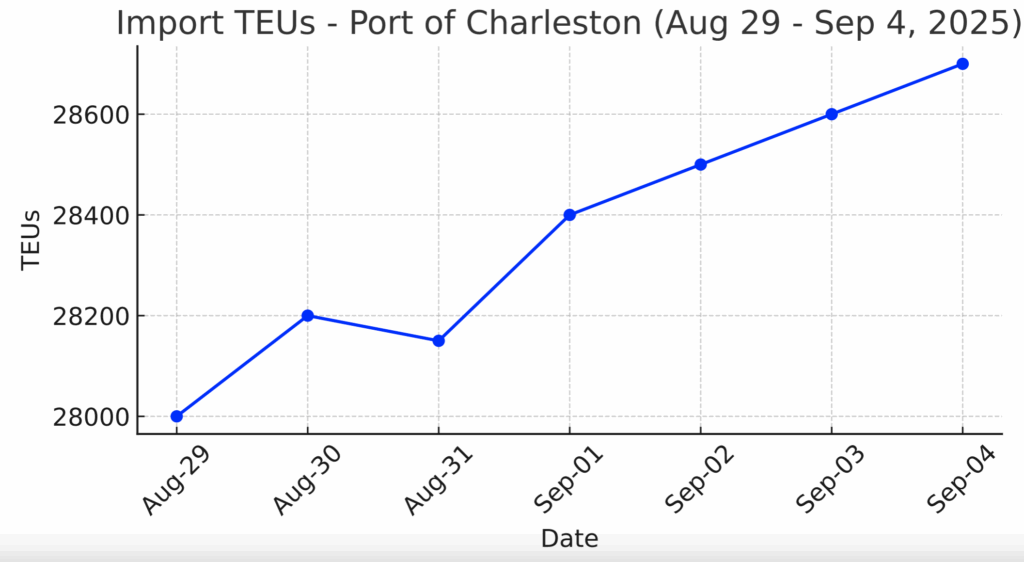

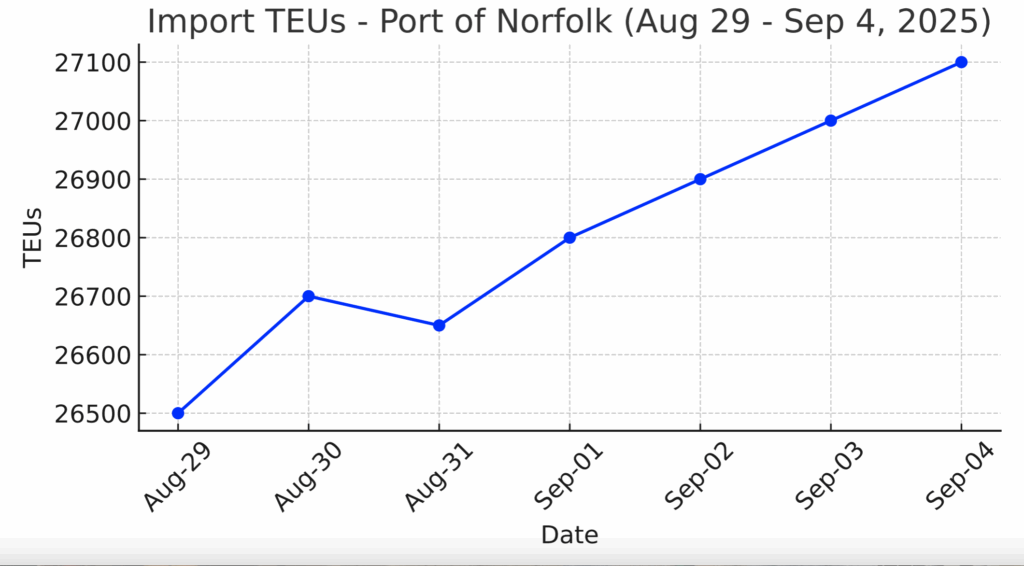

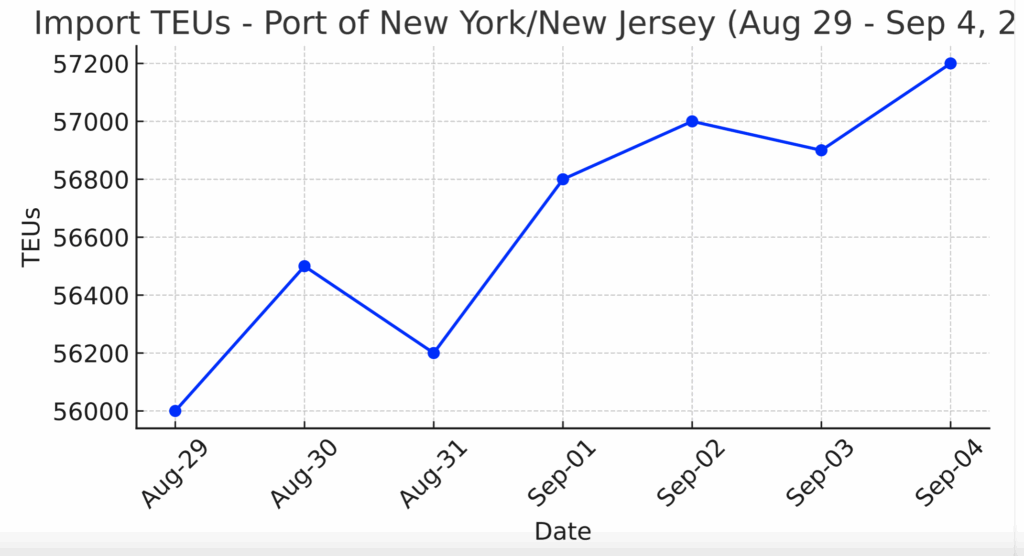

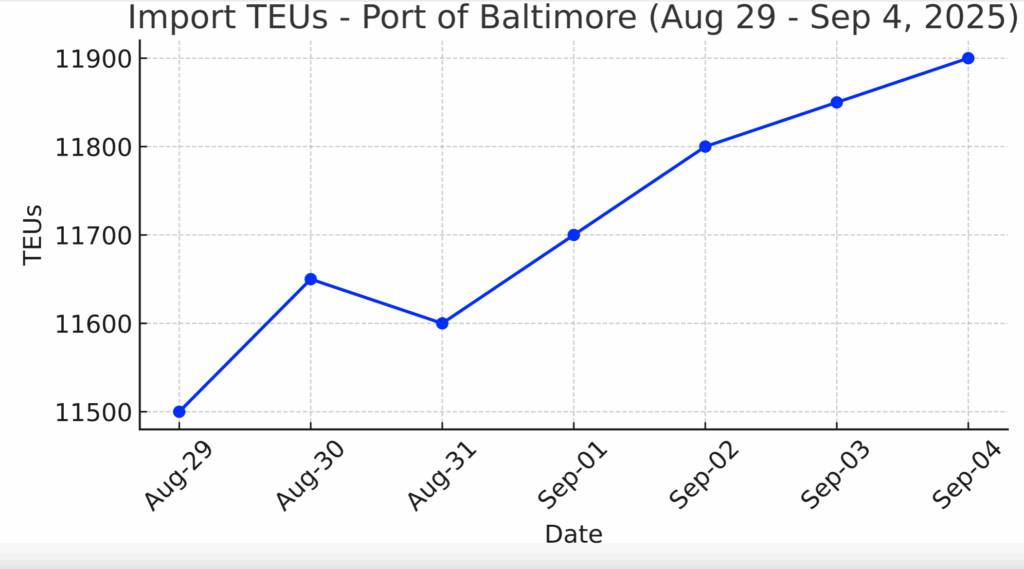

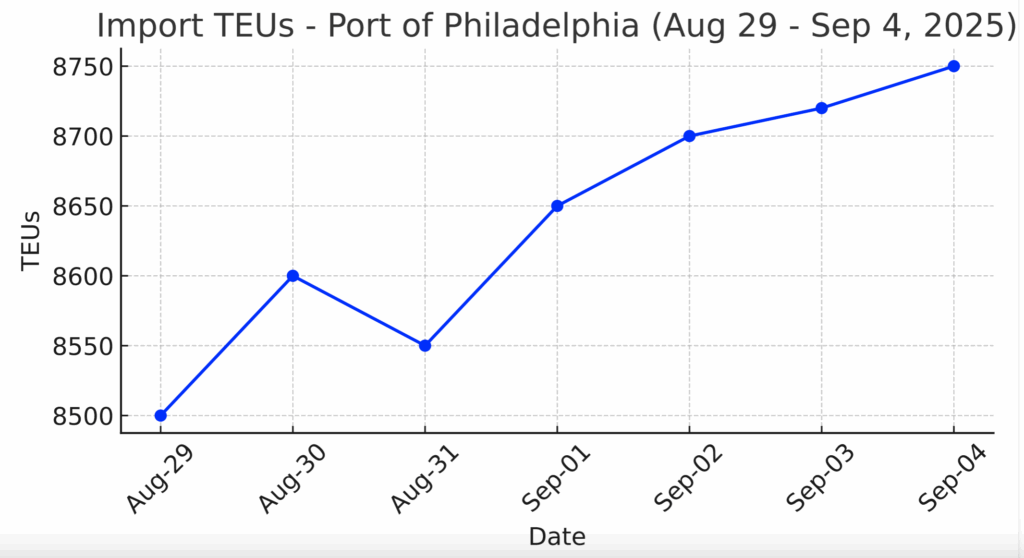

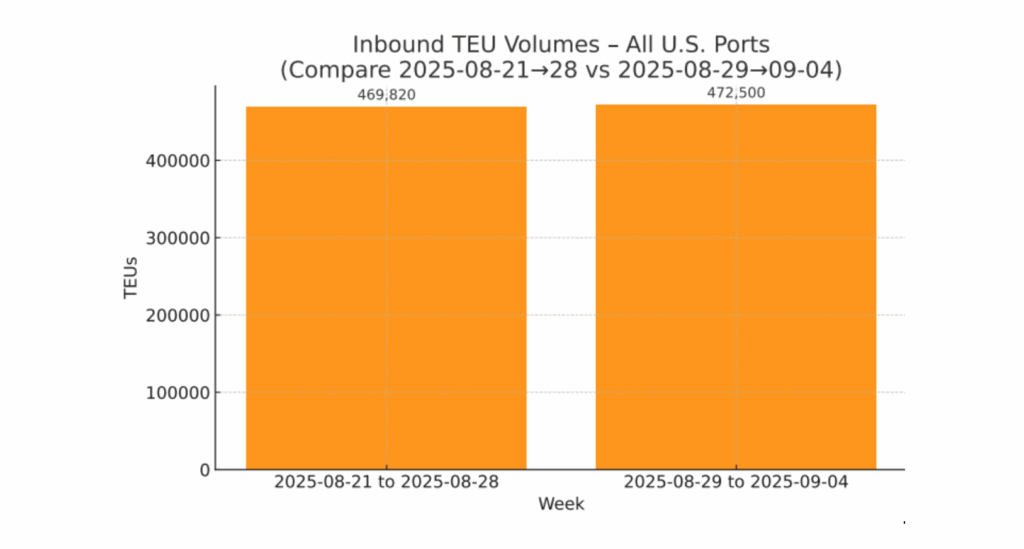

Import TEUs are up .57% this week from last week – with the highest volumes coming into Los Angeles 17.3%, Long Beach 15.2% and NY/NJ 12%. On the trans-Pacific trade, blank sailings remain surprisingly light as we head into fall. Drewry’s Cancelled Sailings Tracker shows that between weeks 36–40 (early September through early October), just 44 of 729 scheduled sailings were cancelled — only about 6% — with most of the pullbacks concentrated on eastbound lanes. Looking ahead to China’s Golden Week in early October, the numbers are even more striking. Current plans show only a 3.8% capacity reduction on Asia–U.S. West Coast services and 4.8% on Asia–U.S. East Coast, well below both 2024 levels (15.4% and 11.9%, respectively) and the pre-pandemic averages (9.3% and 11.4%). In other words, to match last year’s levels, carriers would need to announce roughly 21 more blank sailings to the West Coast and 7 more to the East Coast. Analysts at Sea-Intelligence caution that additional cancellations are very likely as demand signals become clearer heading into October.

With blank sailings running well below historical averages, the risk heading into Golden Week is that too much capacity stays on the water, creating vessel bunching and uneven cargo arrivals once the holiday ends. That kind of surge often translates into port congestion, chassis shortages, and longer rail dwell times. To minimize disruption, importers and exporters should plan for extra buffer time in their supply chains, secure drayage and chassis capacity early, and remain flexible with transload or inland rail options in case carriers adjust schedules or skip port calls at the last minute. Exploring alternative routings through Gulf or East Coast gateways can also provide steadier throughout if the West Coast tightens.

Above all, staying closely connected with Port X Logistics ensures real-time visibility into changing vessel schedules and port conditions, giving customers the tools to keep freight moving even when bunching puts pressure on the network. The bottom line: vessel bunching can’t be avoided entirely, but with the right precautions, shippers can minimize disruption and keep their supply chains running reliably.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Houston: Rising dwell times are signaling tighter terminal flow despite the recent surge in volumes. Import containers at Bayport and Barbours Cut are now averaging about six days on terminal, double the three-day average seen last year — a trend that carriers and drayage providers will want to monitor closely. At the same time, the Port Authority is working to address congestion in the Houston Ship Channel by drafting new barge fleeting policies. The proposals focus on creating safer, more efficient mooring zones and have been shaped with strong community input, setting the stage for changes that could significantly reshape barge operations in the near future. Port X Logistics has Houston covered — 32 trucks strong with long-haul drayage power and a LaPorte transload warehouse built to handle it all, from pallets to heavy lumber to industrial coils. Need support in Dallas? Our network adds another 19 trucks plus yard space to keep freight moving across North Texas. Whatever the load, whatever the lane — we’ve got your back. Contact us at letsgetrolling@portxlogistics.com.

Kansas City: Big changes are rolling through Kansas City – Union Pacific’s brand-new Kansas City Intermodal Terminal (KCIT) is now fully online, doubling capacity compared to the old Neff Yard and cutting truck turnaround times with precision gate tech, expanded tracks, and streamlined yard space right off I-70 and I-435. Effective on September 3rd UP has also shifted domestic container routings from Long Beach’s ICTF to the City of Industry terminal in Southern California—tapping into its expedited “Z” network. The result? Transit times trimmed to just 2.5 days, shaving nearly 25 hours off the LA–KC lane. For shippers, this means faster connections, reduced dwell, and a more competitive option to keep freight flowing between the West Coast and the Midwest. We’re not just in Kansas City — we’re running it. As the largest drayage operation in the region, Port X Logistics puts 100+ power units on the road every day, all GPS-equipped for real-time control. Our 66-door dock in KC, MO is built for speed and flexibility, handling everything from consolidation, cross-docking, and distribution to cargo storage, automotive exports, and specialty projects. Plus, we’re a fully bonded U.S. Customs CFS and Exam Warehouse, giving you seamless solutions under one roof. Whatever you need moved, stored, or cleared, we’ve got it covered. Reach out at letsgetrolling@portxlogistics.com to learn more about our Kansas City services and rates.

Did you know? When time is critical, Carrier911 delivers. With nationwide reach and real-time visibility, we’ll get your freight on the road faster than ever — and keep you and your customers in the loop every step of the way.

How it Works:

🚀 Send us the details. Share your load requirements and get a response within 15 minutes.

🛻 Capacity secured. We tap our nationwide expedited driver network to lock in the right truck, fast.

✅ Quote in hand. Get pricing, pick-up, delivery, and terms sent straight to your inbox.

📲 Book & roll. Approve the quote, and we handle everything — dispatch, pick-up, and live tracking you can share with anyone who needs updates and POD at the exact time of delivery.

With Carrier911, urgent freight doesn’t wait – come meet the team for a free demo, email JConrad@portxlogistics.com and TMccullouch@portxlogistics.com or schedule at portxlogistics.com/tech-demo

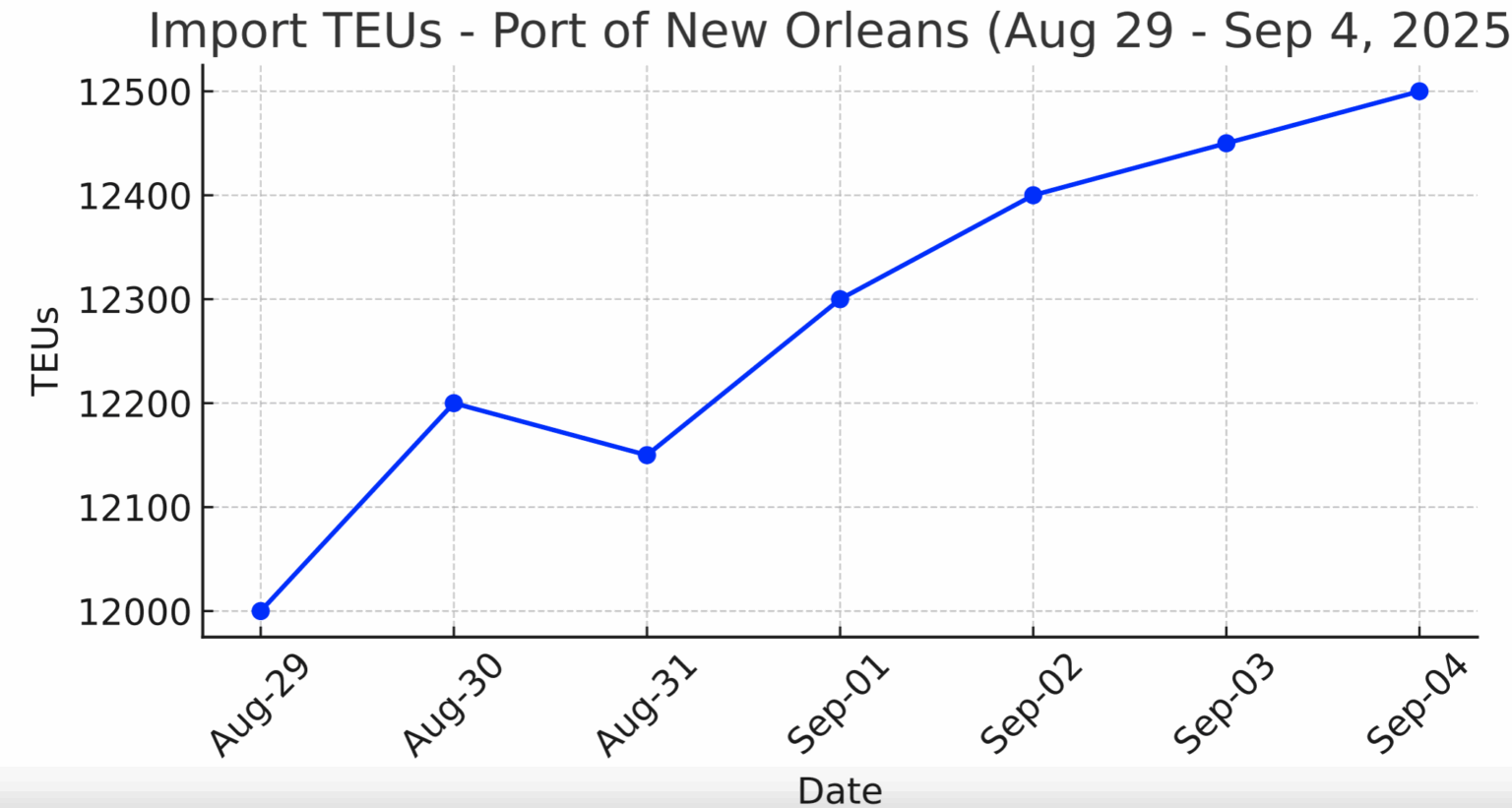

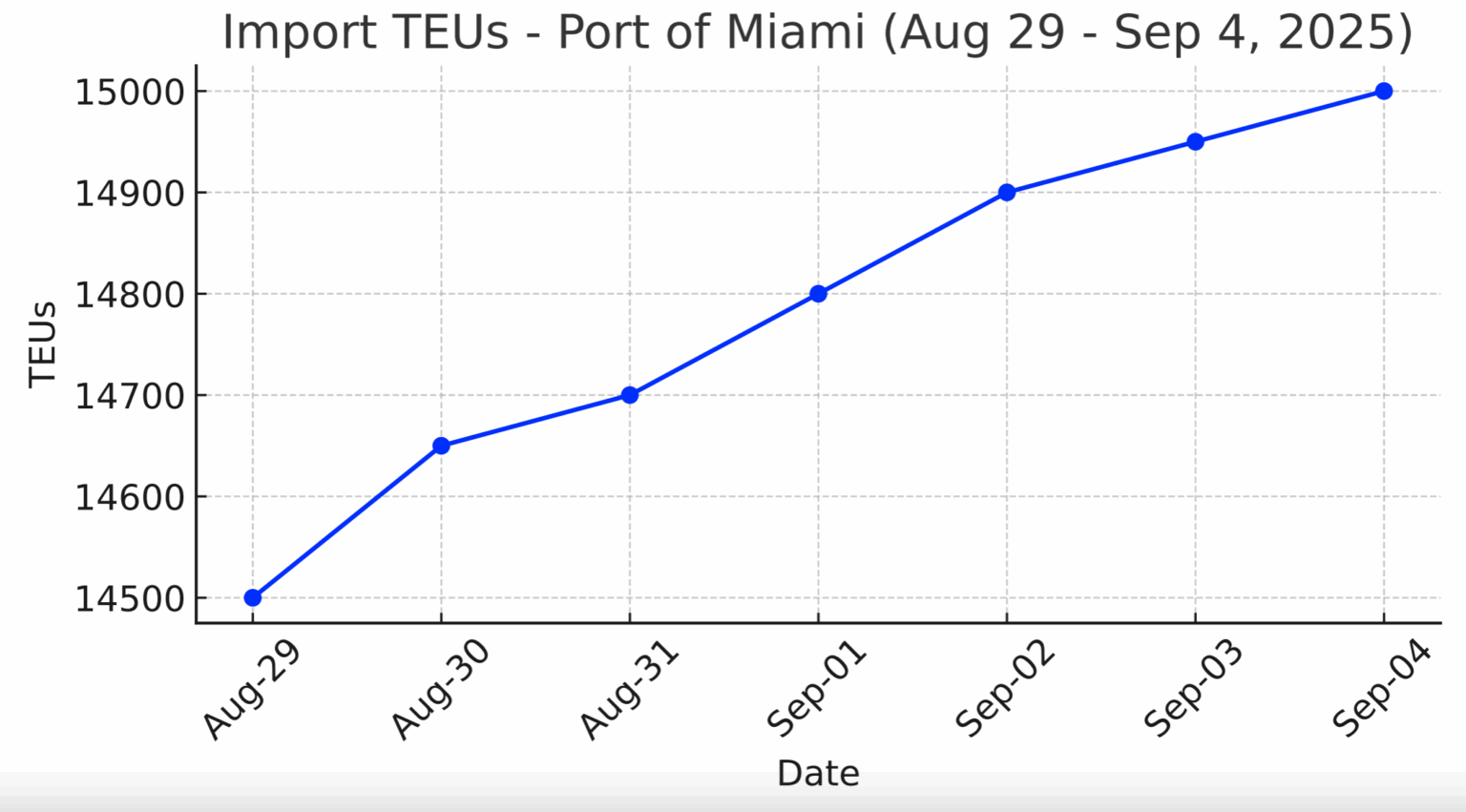

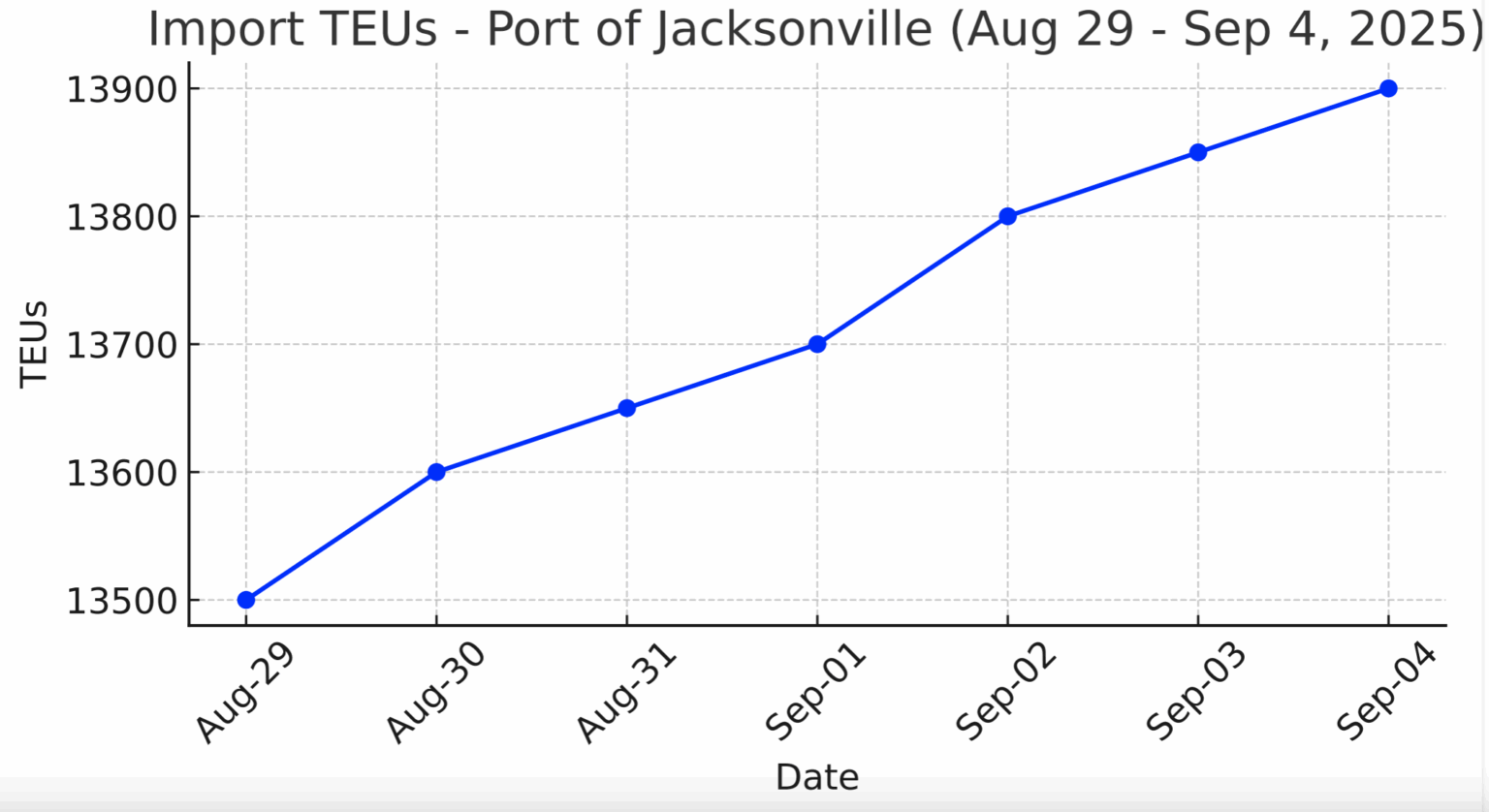

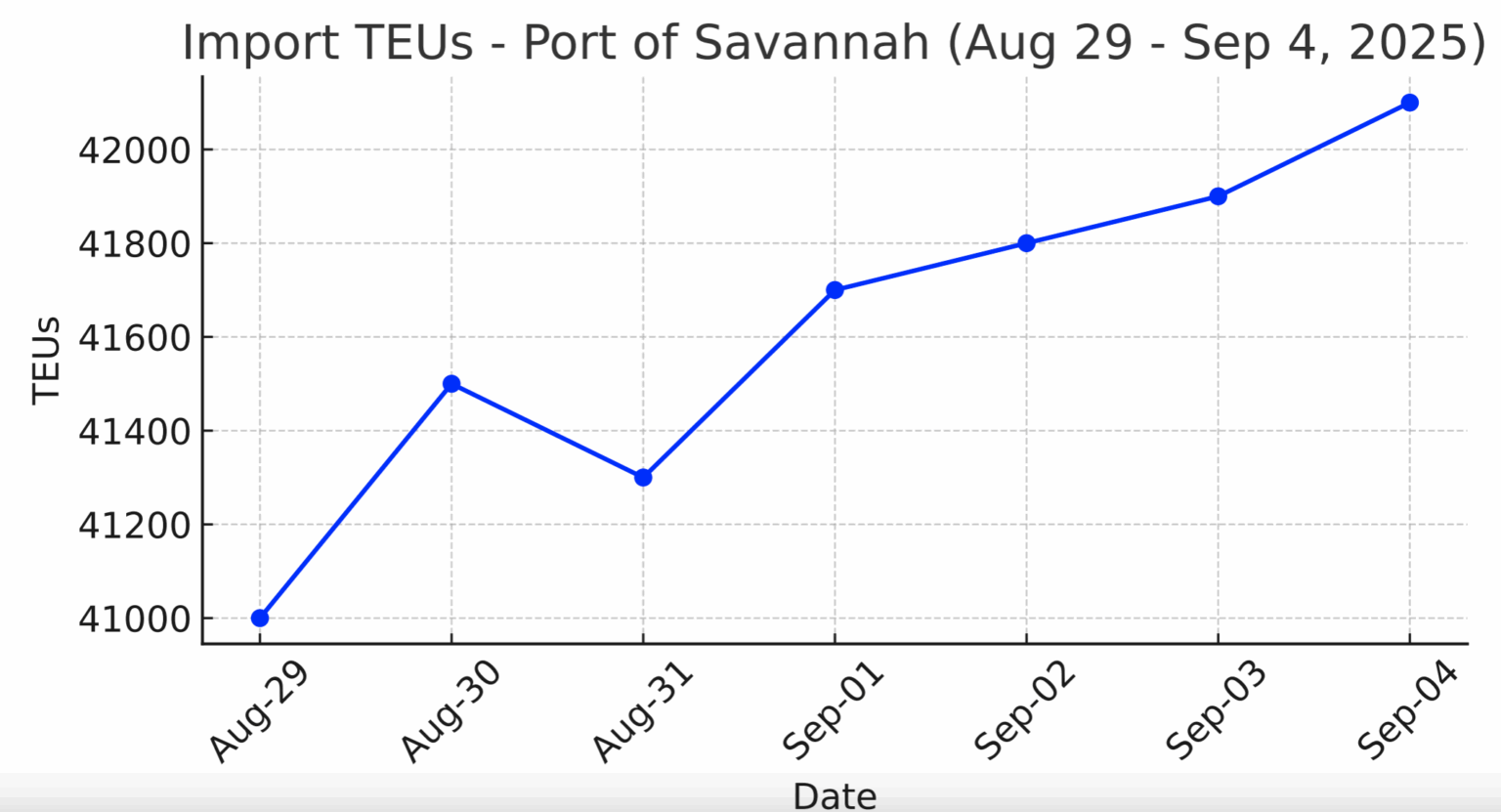

Import Data Images