Port of Tacoma

2204 words 9 minute read – Let’s do this!

As we close out another week in the industry, the forecast is shifting once again—and it’s not just the weather. With softer-than-expected fall import volumes on the horizon, rate pressure building across the trans-Pacific, and air freight volumes showing signs of life, the industry is recalibrating fast. From Los Angeles to New York/New Jersey, import TEUs are painting a picture of cautious demand, while geopolitical tensions and evolving tariff policies continue to keep everyone on their toes. Stay ahead of the chaos with this week’s deep dive into U.S. port performance, global freight trends, and what it all means for Q4. Don’t forget to follow Port X Logistics on LinkedIn to stay in the loop with timely updates, expert insights, and an inside look at the freight world. Want this newsletter delivered directly to your inbox every Thursday afternoon? Just shoot us a message at Marketing@portxlogistics.com and we’ll get you on the list.

Industry forecasts are signaling a softer-than-expected finish to the 2025 peak shipping season, with import volumes projected to fall as much as 20% year-over-year between September and December. This anticipated decline is driven by a mix of frontloaded shipments in early summer—motivated by tariff uncertainty—and slowing consumer demand as high interest rates, inflation fatigue, and tighter discretionary spending take hold. Retailers and manufacturers alike are signaling caution, opting to scale back Q4 orders to avoid overstock scenarios and excess carrying costs heading into 2026. As a result, ports that previously braced for record peak activity are now seeing blank sailings and lighter booking volumes from Asian origins. The ripple effects are being felt across the supply chain: container rates are softening, drayage demand is leveling off, and transload volumes are tapering. While geopolitical disruptions and weather risks still loom large, the broader outlook suggests that capacity will continue to outpace demand in the near term—forcing carriers to further rationalize services and shippers to recalibrate their inventory and freight planning strategies accordingly.

Ocean Freight Trends

Ocean freight rates remain in retreat as soft demand and bloated capacity continue to weigh down pricing. Spot rates from Asia to the U.S. West Coast have plunged 58% since June 1st, while East Coast rates have dropped 46% over the same period. Despite recent attempts by carriers to impose general rate increases (GRIs), many are now pivoting to capacity control measures—including blank sailings and slow steaming—to protect rate integrity. These tactics may temper further rate drops, but the global ocean market remains oversupplied. Even with some carriers pulling ships off rotation, the balance between capacity and demand is still heavily skewed. Shippers are taking advantage of the current softness, but many are also watching warily for abrupt schedule changes as carriers adjust to avoid further profit erosion.

Geopolitics & Trade Policy

Hapag-Lloyd’s latest downward revision to its 2025 earnings forecast adds another layer of concern for an industry already facing unpredictable trade policy swings. The carrier cited both geopolitical instability and growing uncertainty around U.S. tariff policy as key drivers of its outlook revision. With no long-term visibility on tariff extensions—especially involving the European Union (EU) and China—shippers are left navigating a murky planning environment. Meanwhile, the broader supply chain continues to digest recent policy shifts, including new import duties on Asian electronics and the looming expiration of China tariff pauses. The combination of regulatory churn and global unrest—from European elections to Southeast Asian labor strikes—is adding pressure on logistics teams to stay informed and adaptable.

Air Freight & Market Capacity

Air cargo dynamics are also shifting rapidly. While some routes are seeing reduced freighter capacity due to seasonal softness, the resurgence in summer passenger travel has temporarily increased available belly space—particularly on transatlantic and intra-Asia flights. However, the market remains fragmented. High-tech and automotive exporters are still leveraging air for time-sensitive shipments, while others are pulling back amid ample ocean availability and falling rates. Forwarders are using this window to rebalance their modal strategies, shifting freight between air and sea depending on lead times and regional demand. The volatility in both markets makes it increasingly important to build flexibility into freight planning and keep contingency budgets ready. Got an AOG emergency? We’ve got you. When your aircraft is grounded and the clock is ticking, Carrier911 kicks into gear—fast. We’re your go-to for hot shot domestic air export freight, built for those “drop everything and move now” moments. With our one-click “Easy Button,” you can launch a nationwide network of TSA-certified drivers who are rolling within the hour. We’ve hauled from Wisconsin to O’Hare, Charlotte to Miami, and everywhere in between—overnight, cross-country, no sweat. No more chasing updates. You’ll get live tracking, photo confirmations, and instant PODs so you always know what’s happening – and we can pick up and deliver to Container Freight Stations and Trade Shows too. When time is money and delays aren’t an option, we’re the ones logistics pros call first. Need backup? We’re ready. Hit us up at info@carrier911.com or book a quick demo to see how we make urgent freight feel effortless.

What’s Shaping Supply Chains Now

The consensus across ports, carriers, and forwarders is that peak season likely peaked early this year. July’s strong import surge, driven by tariff front-loading and back-to-school inventory, now appears to be an outlier. August is showing flatter volumes, and forecasts for September through December suggest up to a 20% year-over-year drop in imports. This outlook has prompted ocean carriers to cut capacity in hopes of shoring up rate floors, though demand weakness may blunt those efforts. On the airfreight side, capacity shifts remain highly regional, with belly freight gains masking broader freight reductions. The reality for shippers is that planning must stay fluid. With traditional peak season patterns disrupted and macro risk elevated, logistics strategies must now flex between air and ocean, leverage diverse routings, and keep a close watch on changing geopolitical and regulatory conditions. This is especially critical for NVOCCs and large BCOs that operate across multiple trade lanes. Hapag-Lloyd’s downgrade is a stark reminder that even industry giants aren’t immune to these forces.

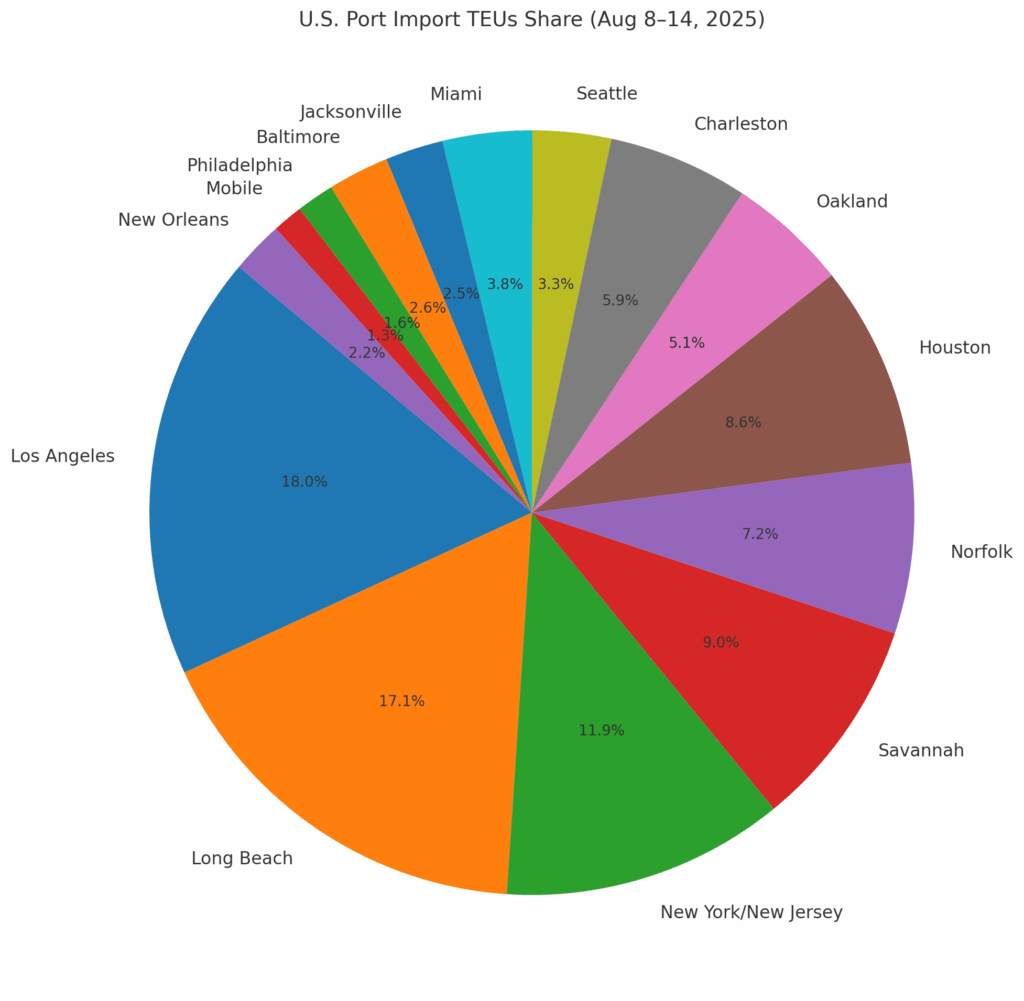

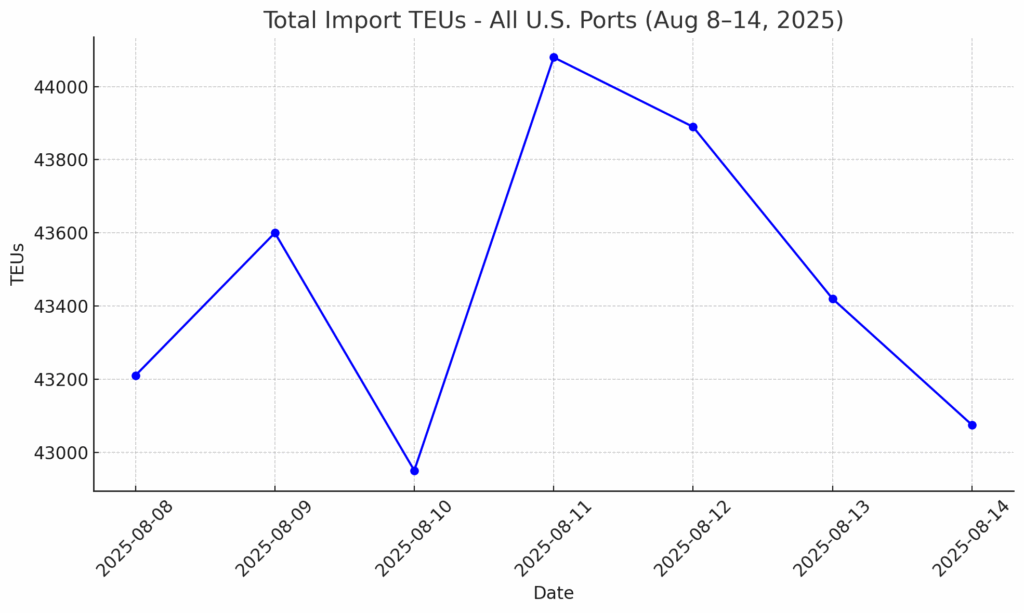

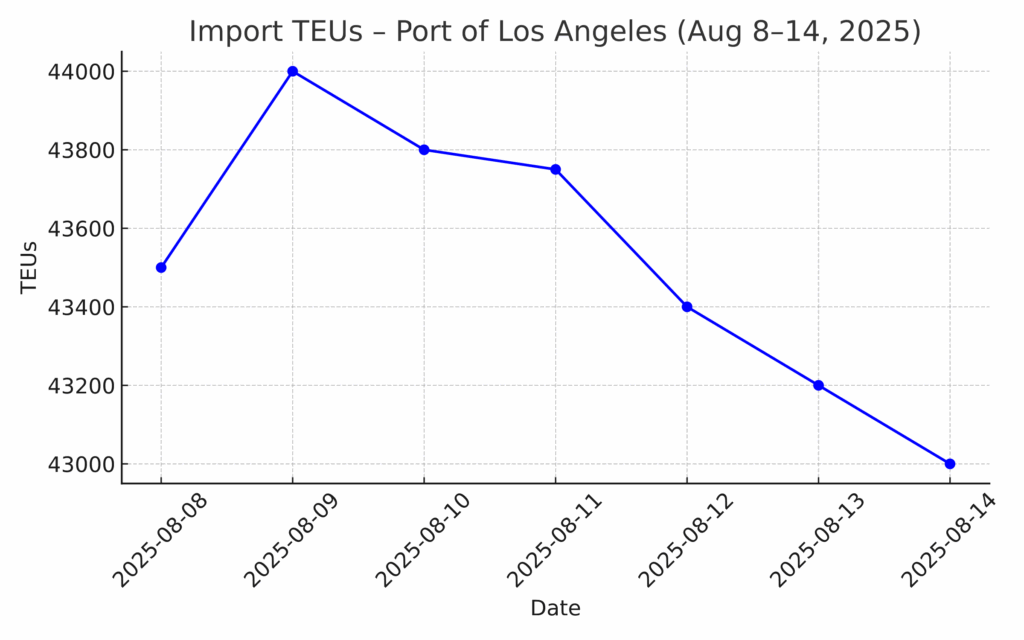

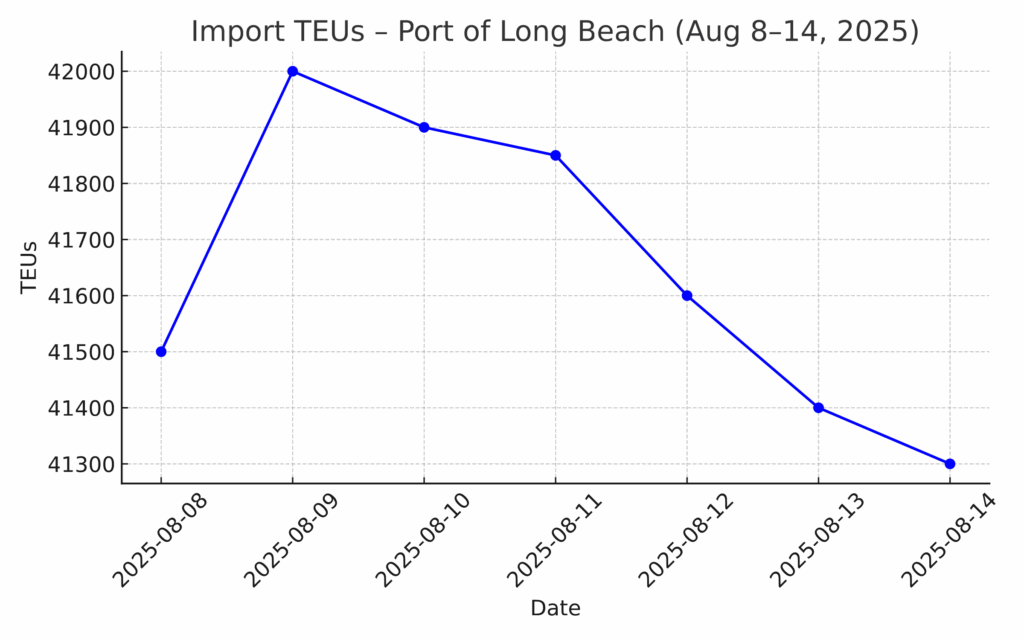

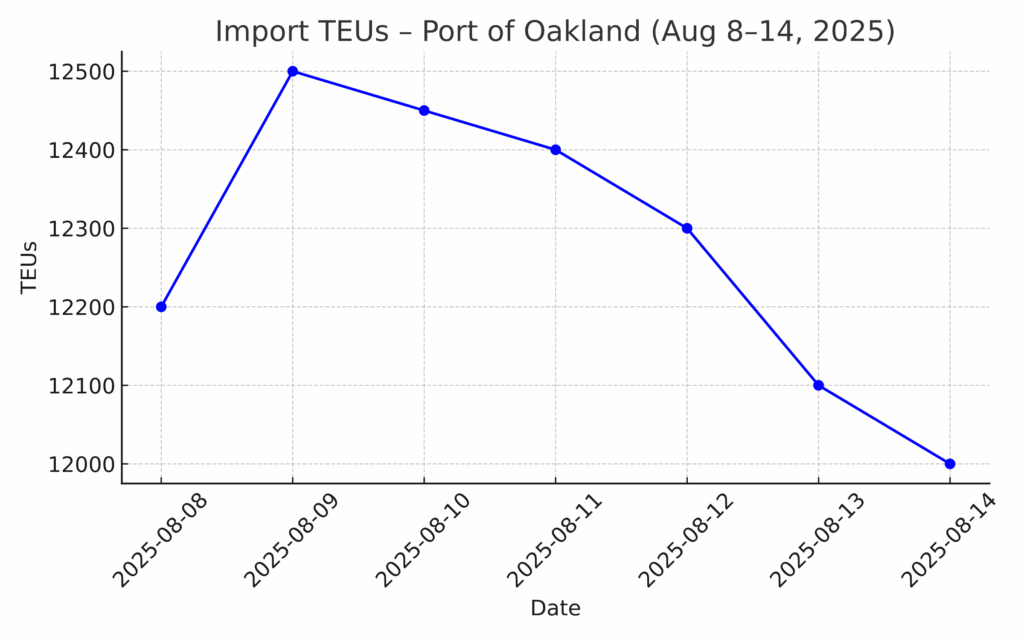

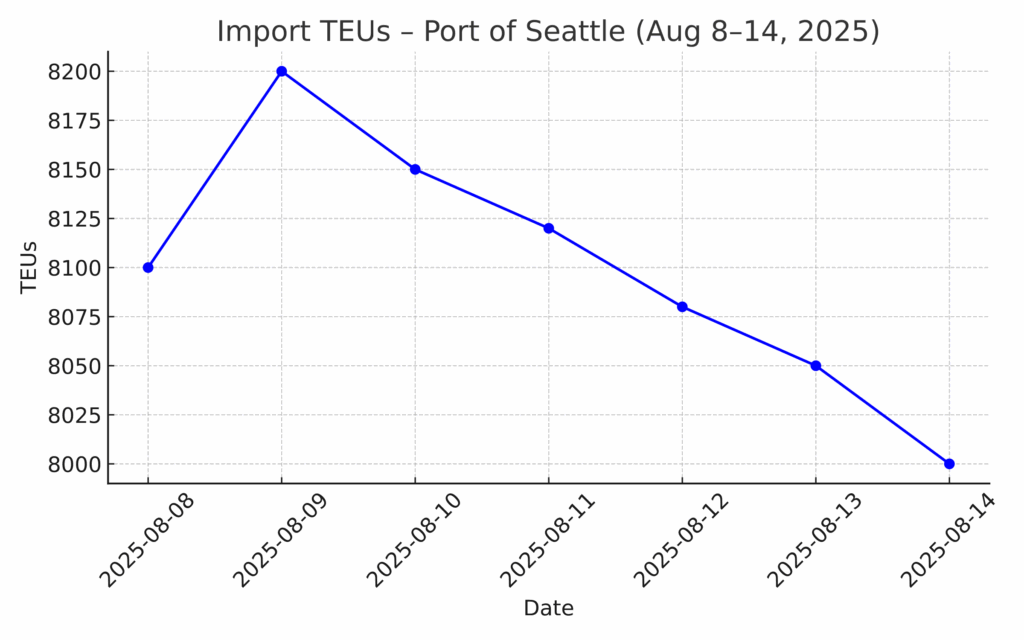

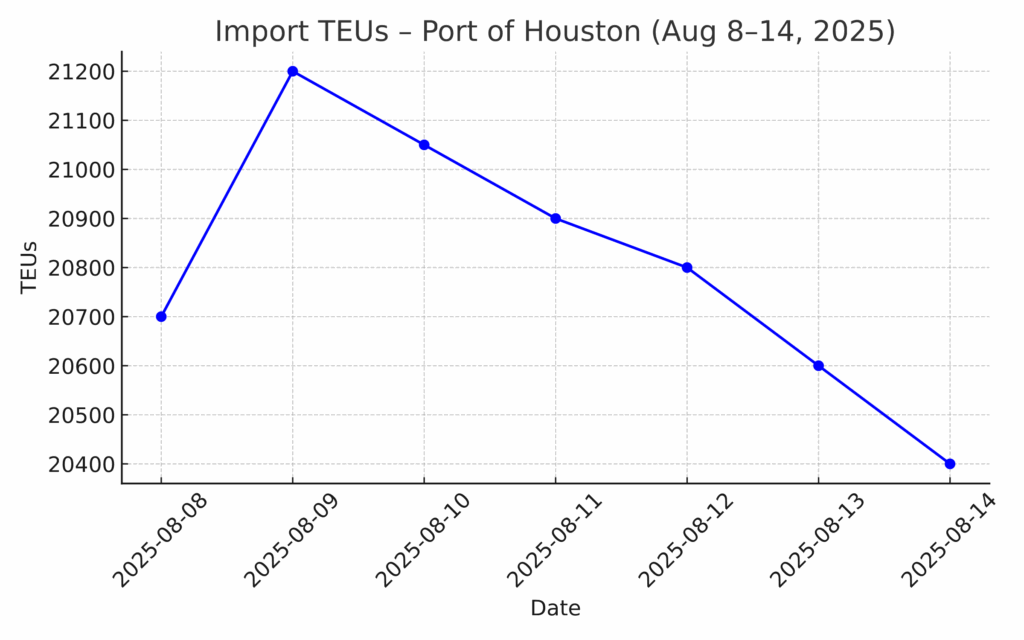

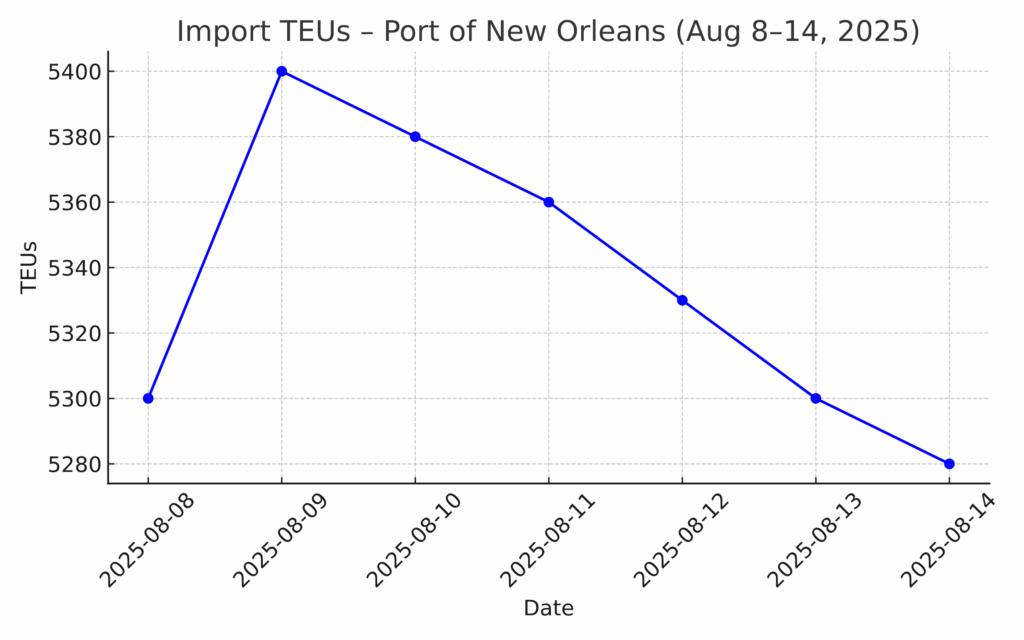

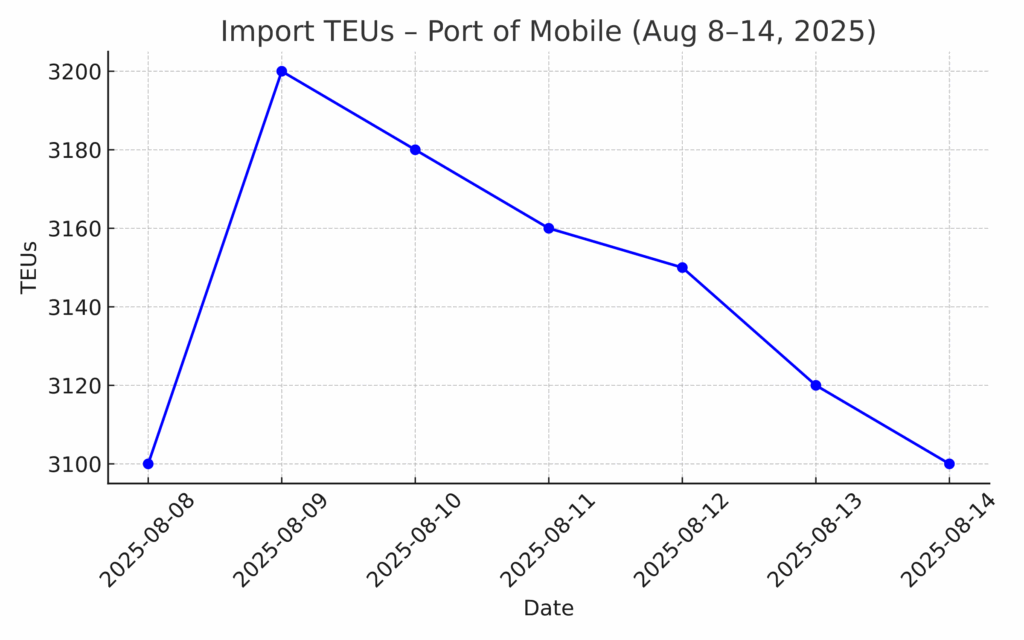

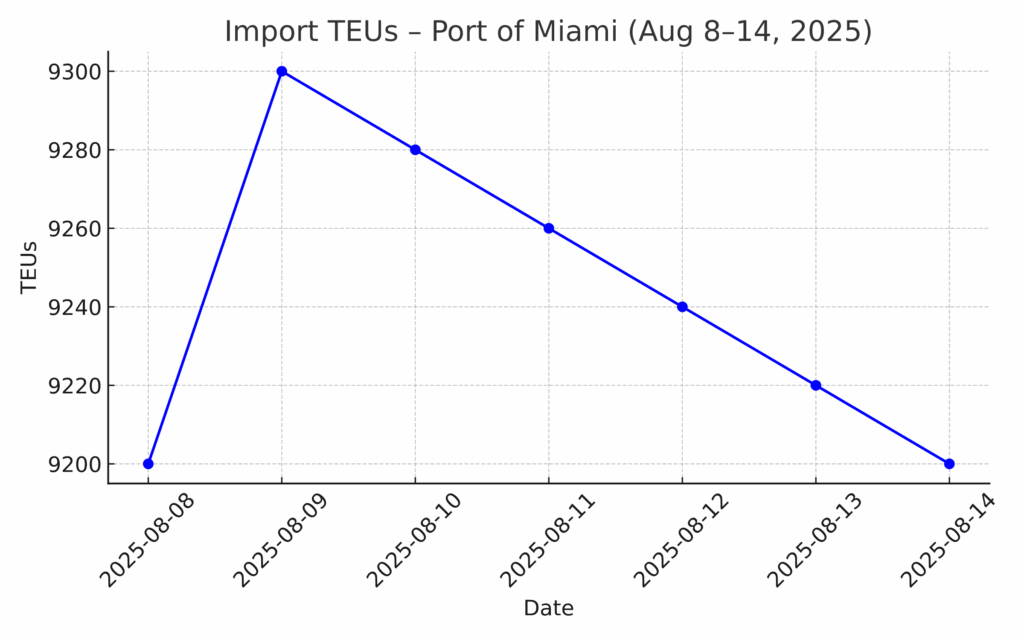

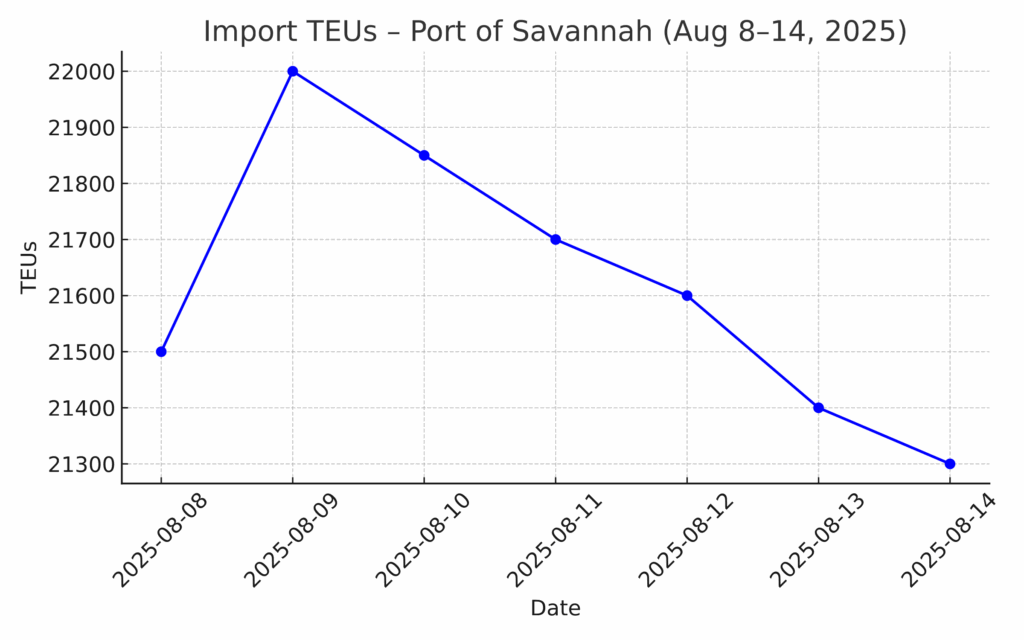

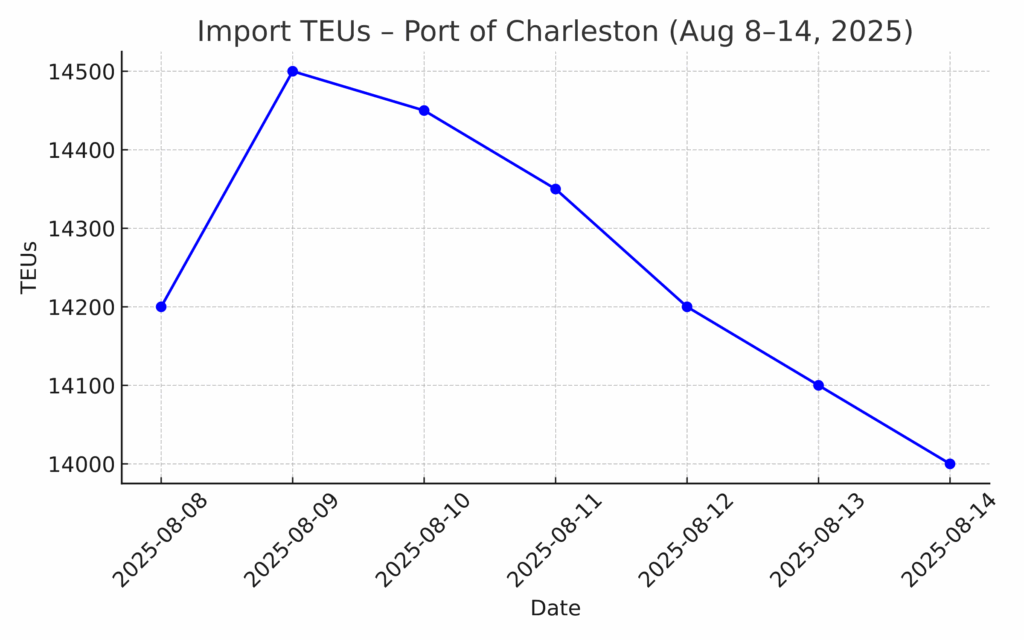

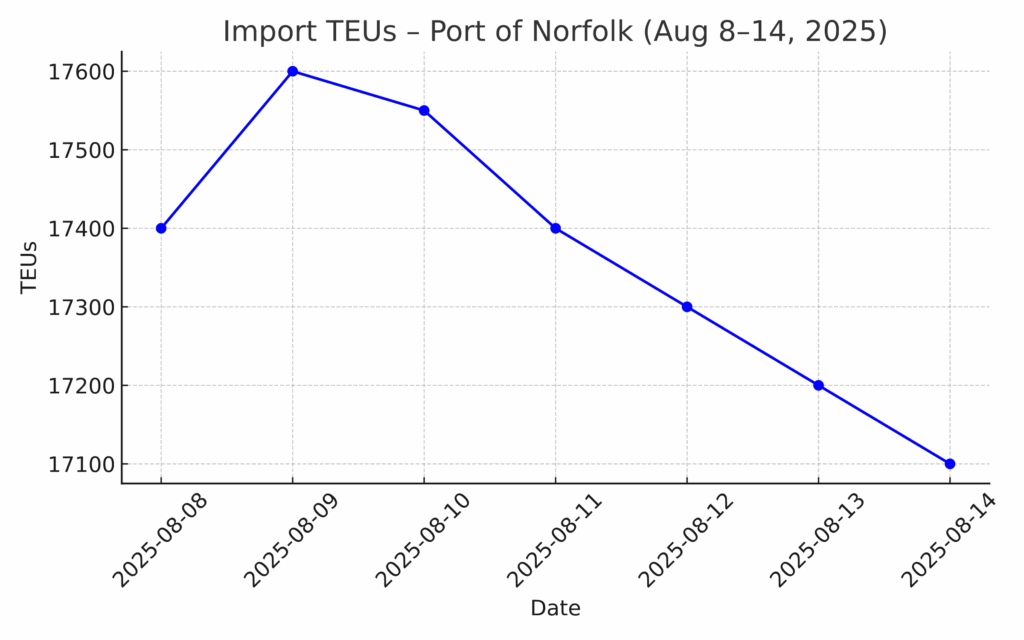

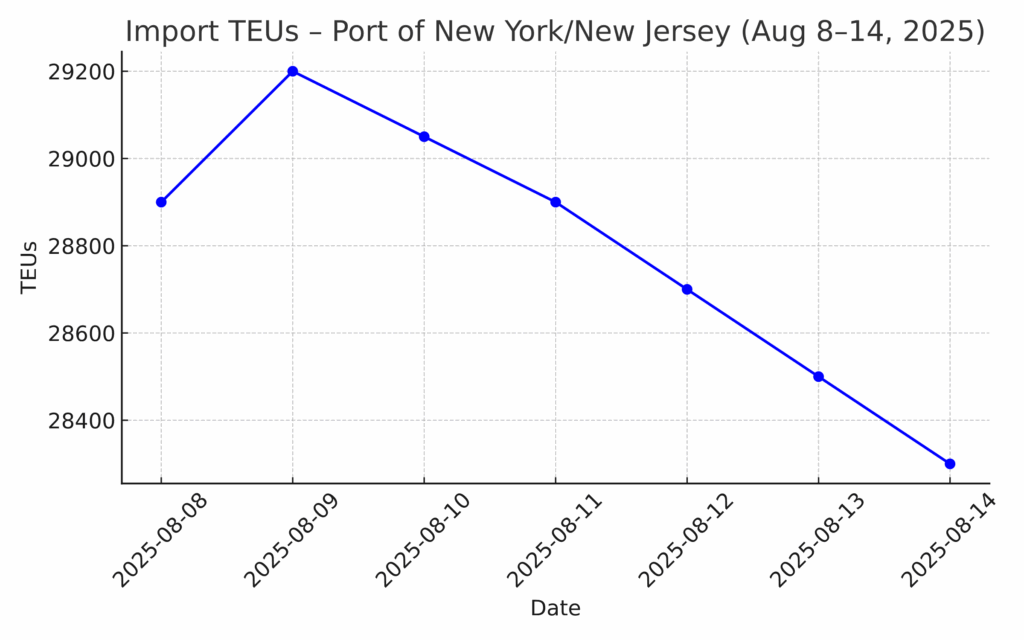

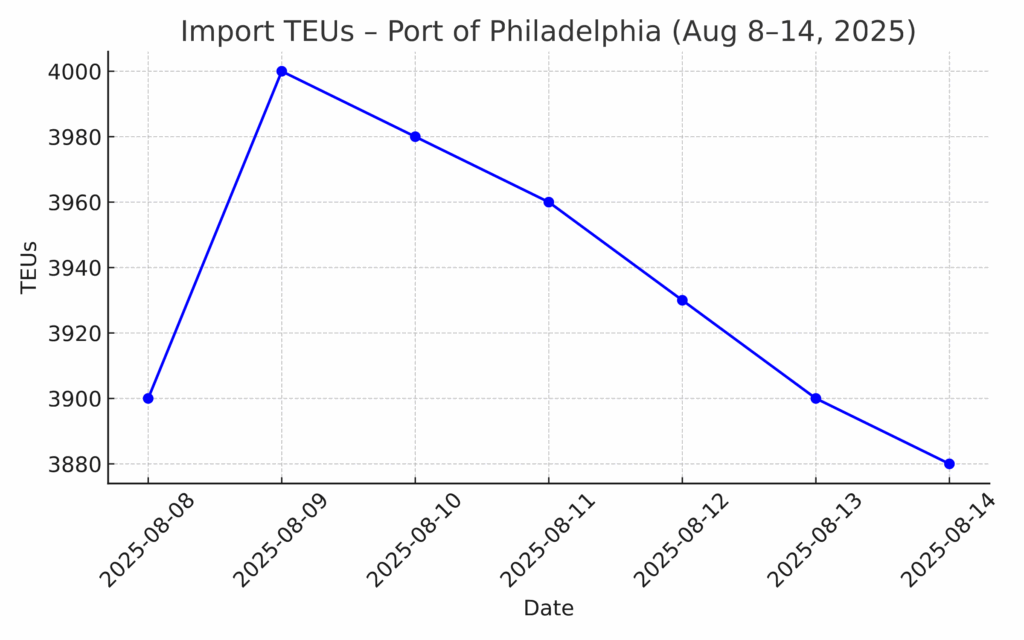

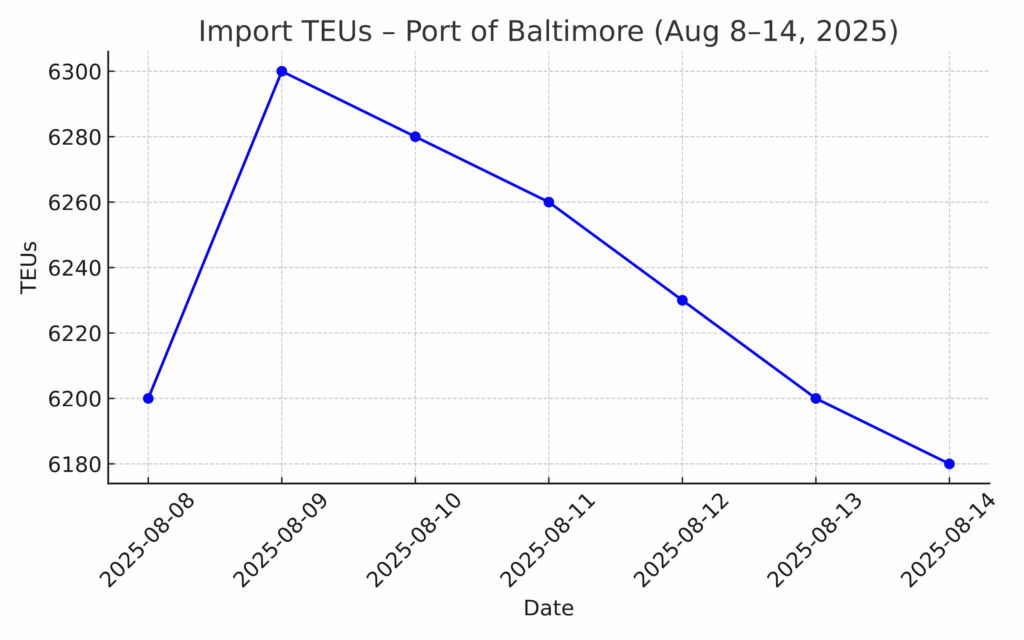

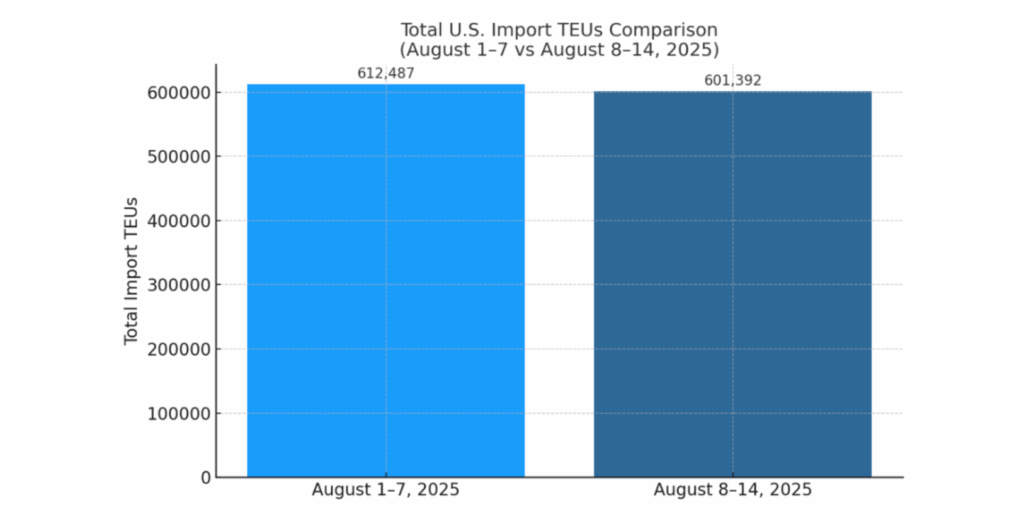

Import TEUs are down 1.18% this week from last week – with the highest volumes coming into Los Angeles 18%, Long Beach 17.1% and NY/NJ 11.9%. Meteorologists are projecting an above-average Atlantic hurricane season in 2025, with estimates ranging from 13 to 18 named storms, including 5 to 9 hurricanes and 2 to 5 major hurricanes (Category 3 or higher). That raises the alarm for potential disruptions across key export and import corridors, particularly ports along the Gulf and Southeast coastlines. Gulf Coast operations—especially Houston and New Orleans—and East Coast facilities in Georgia and Florida are rated among the most exposed. These regions are forecasted to face clustered storm activity that could significantly interrupt vessel arrivals, cargo routing, and inland distribution networks.

The industry-wide consensus underscores an escalating risk: in a worst-case scenario, disruptions could amount to as much as $12 billion in logistical and trade losses. Critical concerns include prolonged port shutdowns, delays in agricultural and perishables shipments, and systemic breakdowns in cold chain and reefer operations if infrastructure fails or power is lost. Even minor tropical systems can have outsized ripple effects. For instance, Tropical Storm Erin is currently strengthening and has a 30% probability of directly impacting the U.S. East Coast next week, prompting early preparedness actions in the Virgin Islands. Beyond port stoppages, hurricanes can strain energy and transportation networks. Points of particular concern include widespread fuel shortages and power outages, especially in the Gulf region where nearly half of U.S. refining capacity resides. A storm similar in severity to Hurricane Harvey could severely impact jet fuel, diesel, and gasoline inventories, complicating everything from warehouse operations to airfreight runs.

Key Takeaways for Logistics, Retail, and Supply Chain Teams

This hurricane season introduces a layer of operational fragility at a time when import demand is already cooling and rates are under pressure. Proactive planning is no longer optional—it’s imperative.

- Inventory buffers at inland distribution centers could protect against short-term port disruptions.

- Alternative routing strategies—such as inland rail or Gulf-overland pathways—can preserve continuity when coastal nodes are at risk.

- Cross-modal flexibility, especially the ability to shift between air and sea freight, will be essential amid atmosphere shifts in capacity.

Fuel resilience planning—like securing backup diesel or establishing flexible contingency contracts—can mitigate operational slowdowns if refineries falter.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Houston: As we head into mid-August, southeast Texas—including the Port of Houston—is facing a volatile weather pattern. A tropical disturbance moving through the Bay of Campeche (Invest 98L) is expected to bring 50–60% chances of scattered afternoon and early evening thunderstorms on Friday and Saturday. These storms may produce brief urban flooding and localized street inundations, though broader flood risks remain low. By early next week, the region will see rising temperatures, with highs expected in the upper 90s, as drier high-pressure conditions suppress further precipitation. While this tropical system is unlikely to develop into a major storm, it serves as a reminder that August marks the start of peak hurricane season along the Gulf Coast. Texas now carries roughly a 41% annual chance of hurricane landfall—notably higher than the historical average. Port Houston’s emergency protocols are well established: in coordination with the U.S. Coast Guard and local agencies, the port can quickly initiate closure procedures, evacuations, or use elevated alerts when weather threats intensify. Weather disruptions can strike fast along the Gulf Coast—but with Port X Logistics, your freight won’t be left out in the rain. Our Houston operation is fully equipped with 32 drayage trucks, including long-haul capacity, ready to keep your containers moving even as the skies shift. We operate a robust transload warehouse in LaPorte that handles everything from standard palletized freight to heavy-duty materials like lumber and industrial coils—ideal for customers who need flexible, storm-resilient solutions. If the storm trajectory tightens or port activity slows, having a plan matters. That’s why we’ve got additional capacity in Dallas, too—19 more trucks and yard space available to reroute or reposition freight quickly if Houston activity becomes disrupted. Need to build storm season resilience into your supply chain? Reach out to our team at letsgetrolling@portxlogistics.com to tap into dependable drayage, transload, and emergency response support across the Gulf.

Kansas City: Union Pacific officially launched its Kansas City Intermodal Terminal (KCIT)—its fourth intermodal facility opened since 2021—on August 7th. This modern terminal, situated near major highways in Kansas City, Kansas, is equipped with precision gate technology, additional tracks, and expanded parking designed to accommodate both domestic and international container traffic. It smoothly integrates consumer goods, grains, auto parts, and refrigerated products into the Midwest rail network. By freeing up highway capacity through increased rail efficiency, KCIT is already reshaping regional freight dynamics. On August 12th, Americold unveiled its massive 335,000 sq. ft. refrigerated import-export hub at the CPKC terminal in Kansas City, Missouri. This game-changer is designed to facilitate single-line refrigerated freight movement across the U.S.–Mexico corridor, utilizing CPKC’s Midwest rail network and existing refrigerated container capacity. At launch, the facility will handle up to 600 reefers per week, significantly accelerating perishables flows such as fresh meat northbound and produce southbound. At Port X Logistics, our Kansas City operation is built to move freight efficiently—and we’re doubling down on export street turns. With 71 company drivers, 89 trucks, and over 100 chassis including triaxle and spread-axle options, we’re fully equipped to handle heavy and specialty export loads. Our two yards provide ample empty container storage, making it easier to align turnarounds with ocean carrier requirements, while our flexible transload warehouse ensures we can stage, sort, and reload cargo with speed. Whether you’re looking to optimize exports or gain a reliable partner in the Midwest, we’ve got the space, gear, and experience to deliver. Ready to move more exports out of KC? Let’s make it happen. Contact letsgetrolling@portxlogistics.com to grab export drayage capacity and street-turn support in this growing hub.

Did you know?

While some major trucking companies and warehouses in the Pacific Northwest are scaling back or shuttering operations, Port X Logistics is stepping up to keep cargo moving efficiently through the Ports of Seattle and Tacoma. With import volumes softening and ongoing disruption in the local logistics ecosystem, now is the time to rethink your strategy. Port X Logistics offers a stable, high-performance alternative—with plenty of drayage capacity, 11 new drivers added, and a robust warehouse operation primed for transloading projects of all sizes.

If you’re looking to build resilience into your supply chain, our Seattle team has the infrastructure, equipment, and customer service to deliver results. Want to explore how shipping through SEA/TAC could benefit your network? Reach out to us at letsgetrolling@portxlogistics.com to connect with an all-star drayage and warehouse team that’s ready to roll when you are.

Import Data Images