Port of Long Beach

Port of Long Beach

1472 words 7 minute read – Let’s do this!

“Ain’t No Sunshine When the Boxes Slow” As the first week of August rolls in, the heat isn’t just in the weather—it’s in the whiplash of the logistics market. Here’s what is going down

Don’t forget to follow Port X Logistics Linkedin page for behind-the-scenes logistics insights, industry hot takes, and service updates that keep your freight moving, and don’t forget to shoot us a note at Marketing@portxlogistics.com to get on the list to send to your inbox every Thursday afternoon.

We’re seeing a notable shift in who controls container bookings on the trans-Pacific trade – and it’s happening at the point of origin. As U.S. tariffs dig deeper into global supply chains, more exporters – especially out of China – are taking the lead on booking ocean freight. Instead of U.S. importers purchasing space Free on Board (FOB), exporters are increasingly arranging shipments under Cost, Insurance and Freight (CIF) or Delivered Duty Paid (DDP) terms. This trend, known as origin-controlled cargo, reflects a broader strategy to absorb the unpredictability of tariffs and freight rates. Forwarders are confirming the change. One major 3PL reports that origin-controlled cargo now makes up over a third of its volumes, up significantly from just a few years ago – and it’s projected to hit 40–45% soon. Smaller U.S. importers may be leaning into DDP shipping terms to shift tariff and duty risk upstream, allowing overseas suppliers to handle freight and customs clearance all the way to final delivery.

Volatility in the freight market also plays a role. When rates are swinging and capacity tightens, retailers with leverage—like Walmart—are more likely to push suppliers toward CIF/DDP terms, helping shield themselves from rate spikes and port delays. In calmer times, they may revert back to FOB and manage transportation directly under their own contracts. Digitalization is adding fuel to the fire. With easy online booking tools from carriers like Maersk, Hapag-Lloyd, and CMA CGM, it’s never been simpler for overseas shippers to book space independently – bypassing traditional U.S.-controlled logistics chains.

While the contract market still leans heavily toward U.S.-based control, that could change. As global brands from Asia—especially Chinese, Japanese, and Korean companies—establish their own sales arms in the U.S. and Europe, they may consolidate freight buying at origin, just as their predecessors in South Korea and Japan did years ago. This isn’t just a tactical shift – it’s a strategic rebalancing of global freight power. And it’s one that U.S. importers and logistics providers need to watch closely.

Tariff Watch: The Clock is Ticking

- With the China tariff pause deadline looming (August 12th), importers are moving up shipments “just in case.”

- Expect preemptive front-loading to spike in the coming week—especially on electronics, tools, and auto parts.

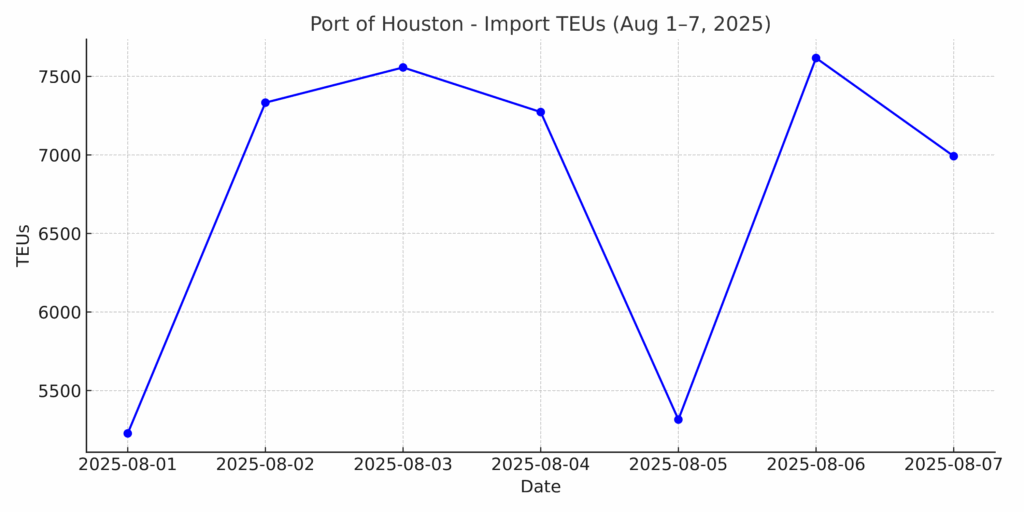

- New 50% tariffs on Brazil-origin steel & copper officially kicked in on August 1st. Expect ripple effects in Gulf port volumes this month.

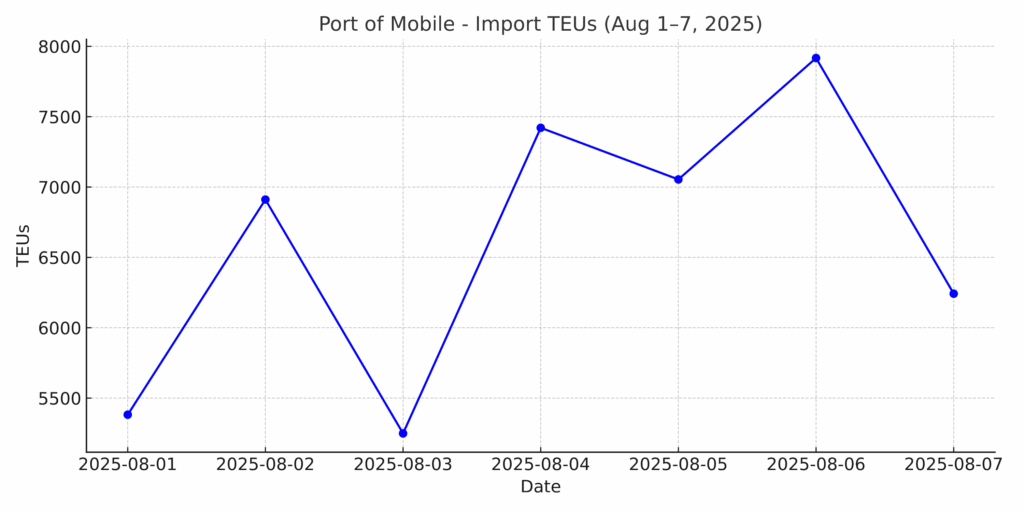

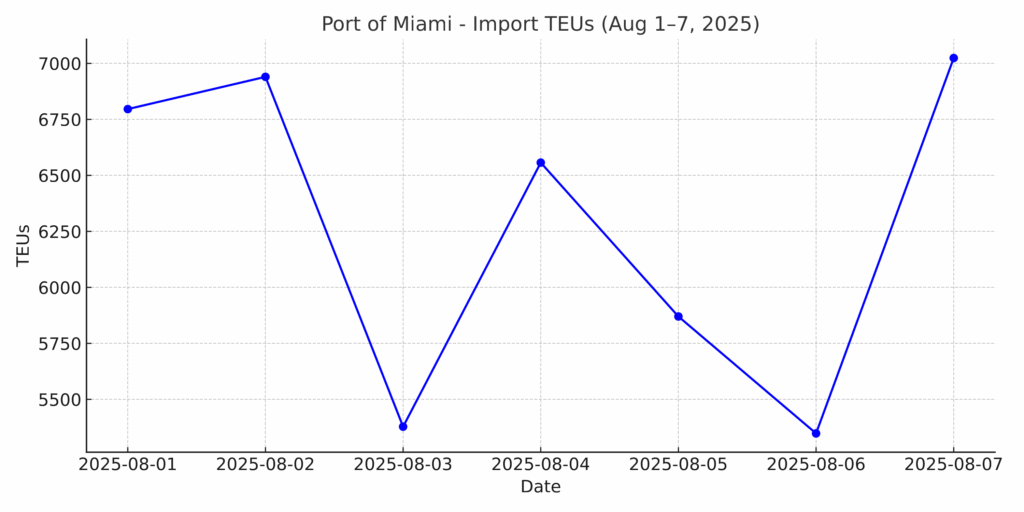

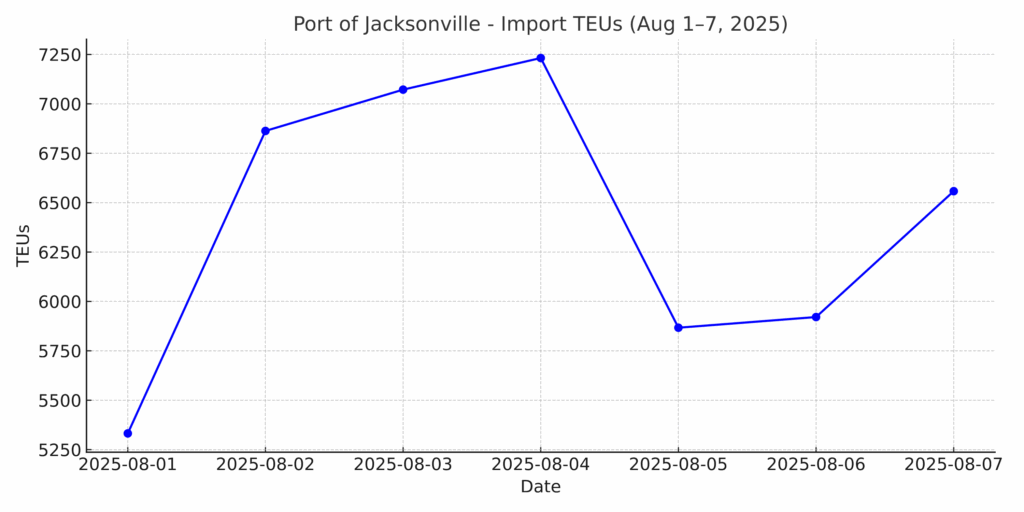

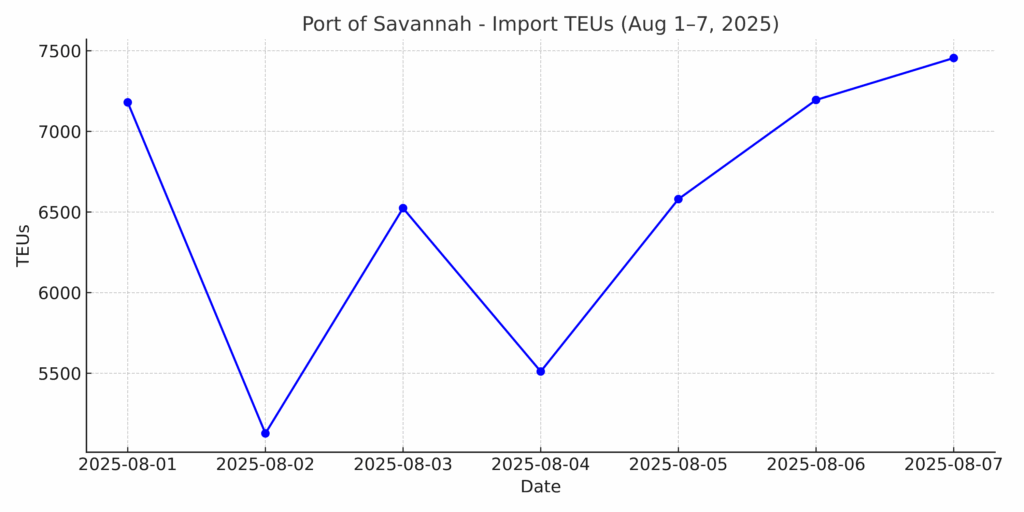

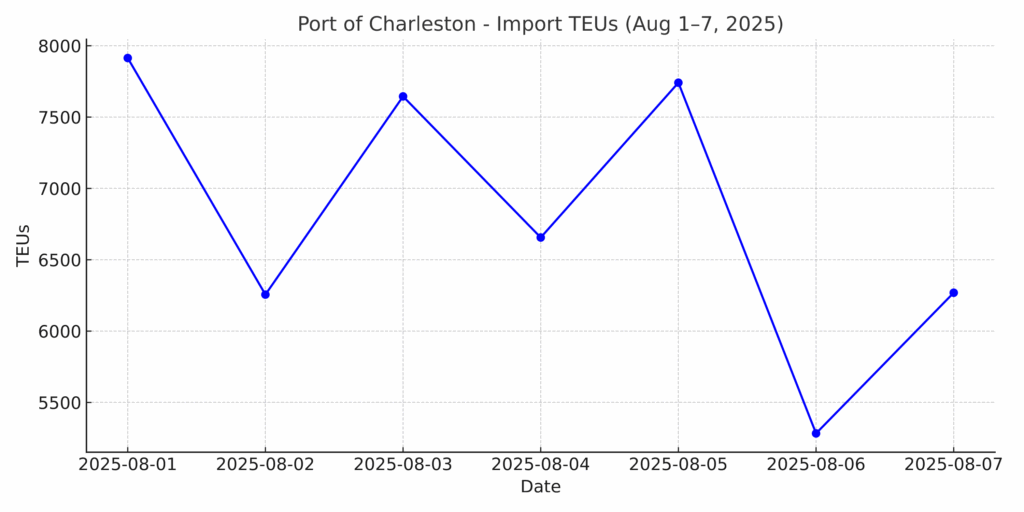

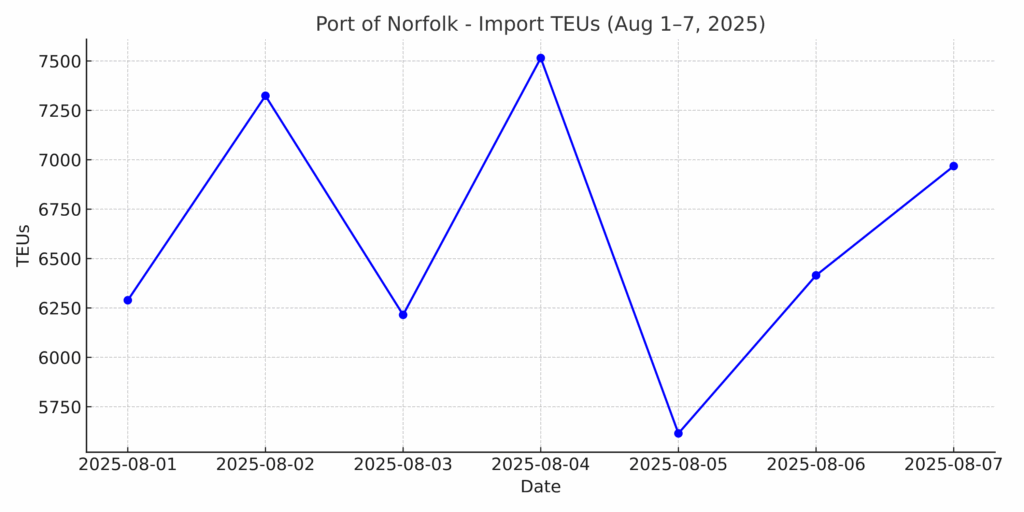

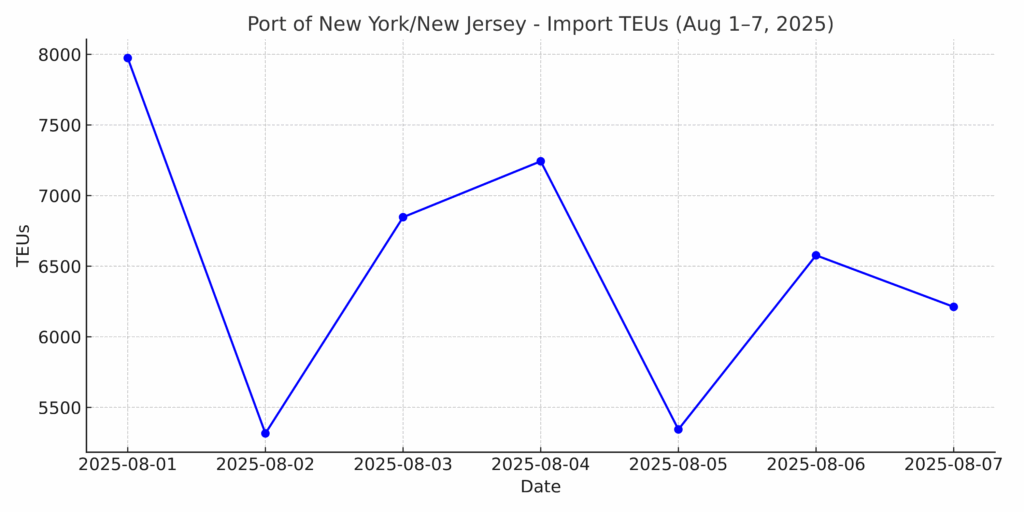

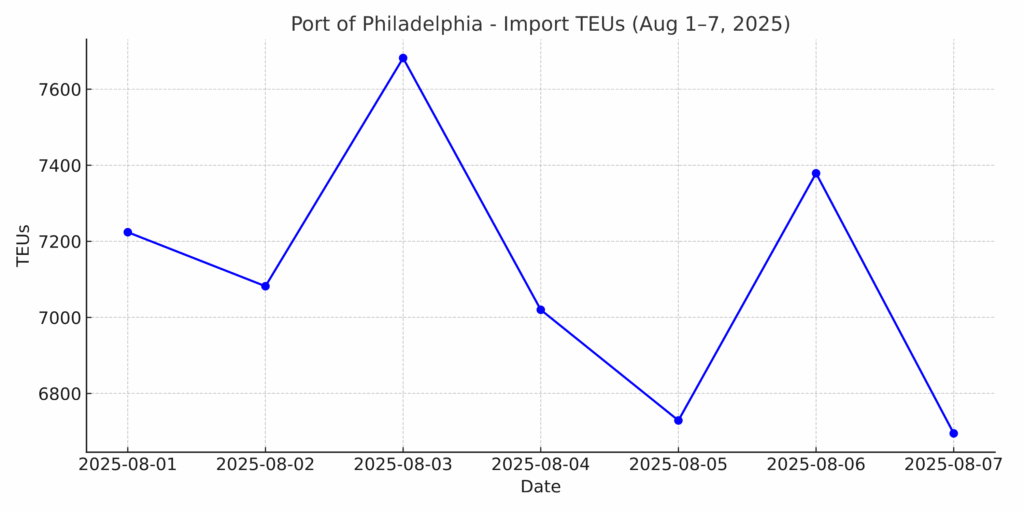

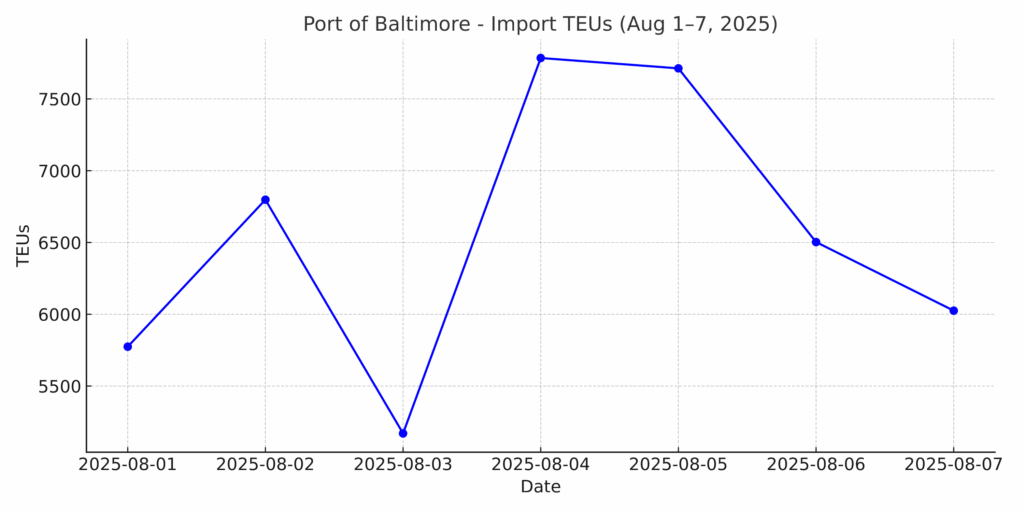

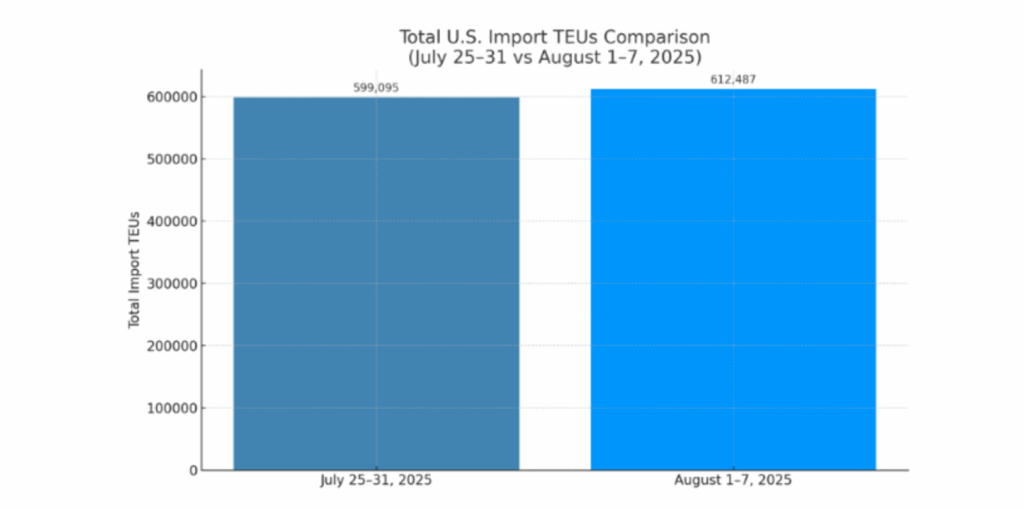

Port Volumes: Slipping into Slow Season?

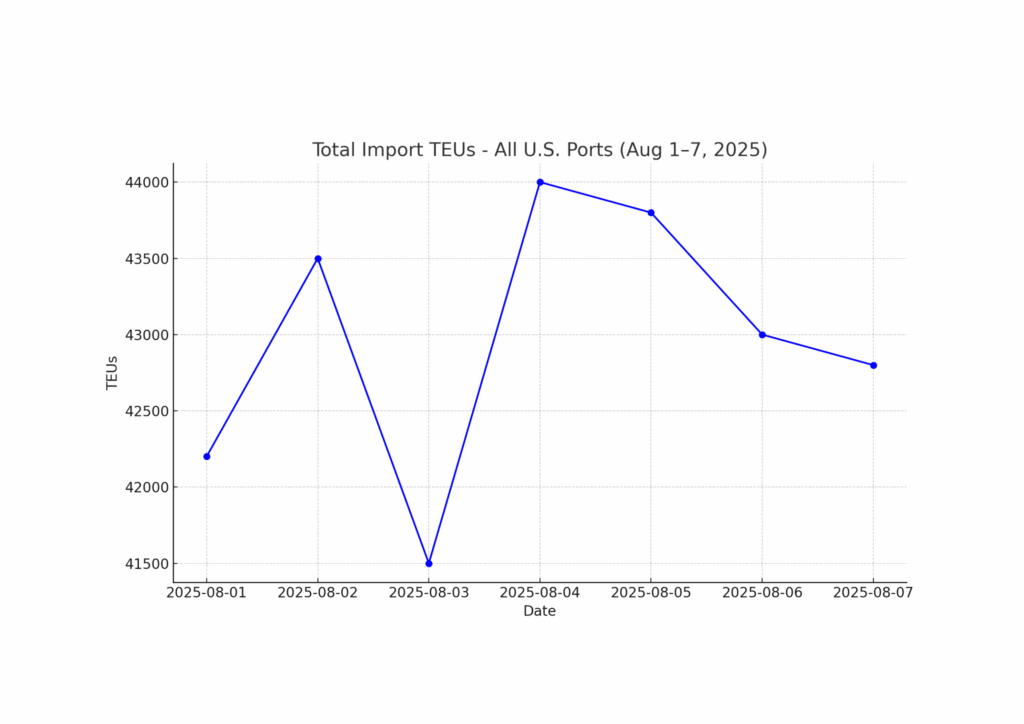

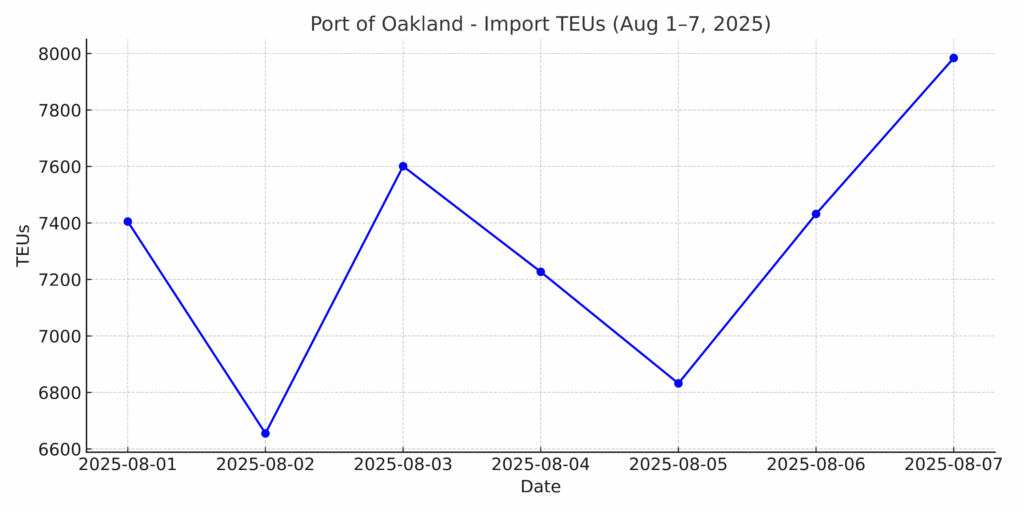

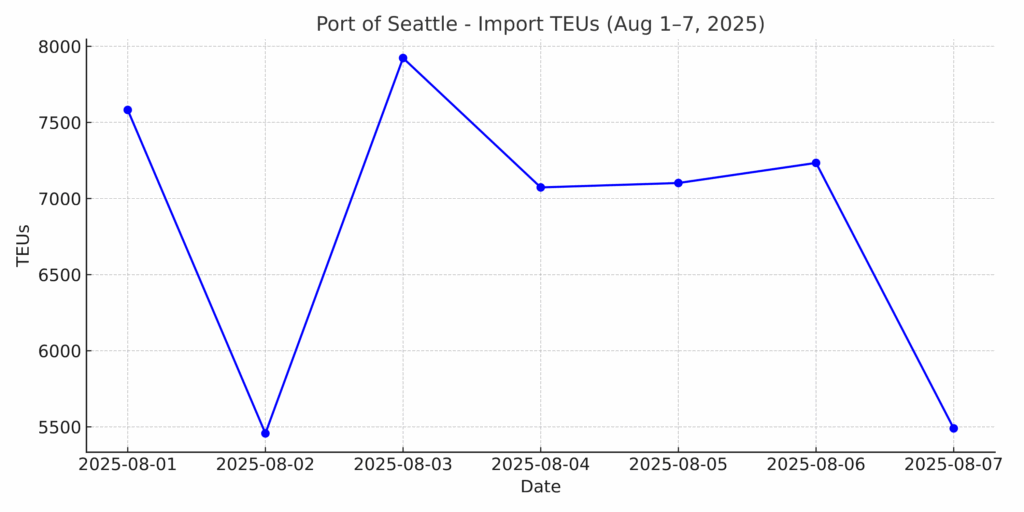

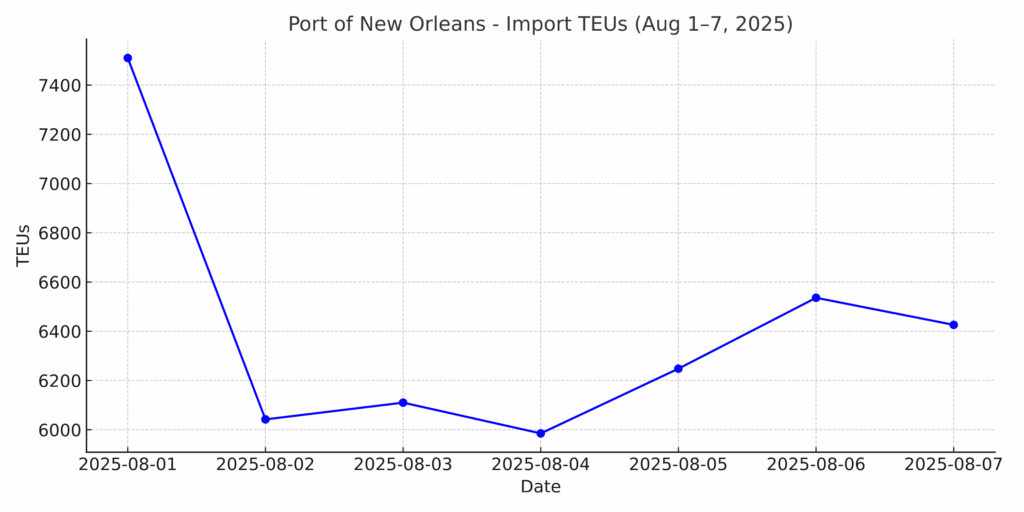

The “peak” in peak season might already be behind us. Import volumes at major U.S. container ports showed signs of softening:

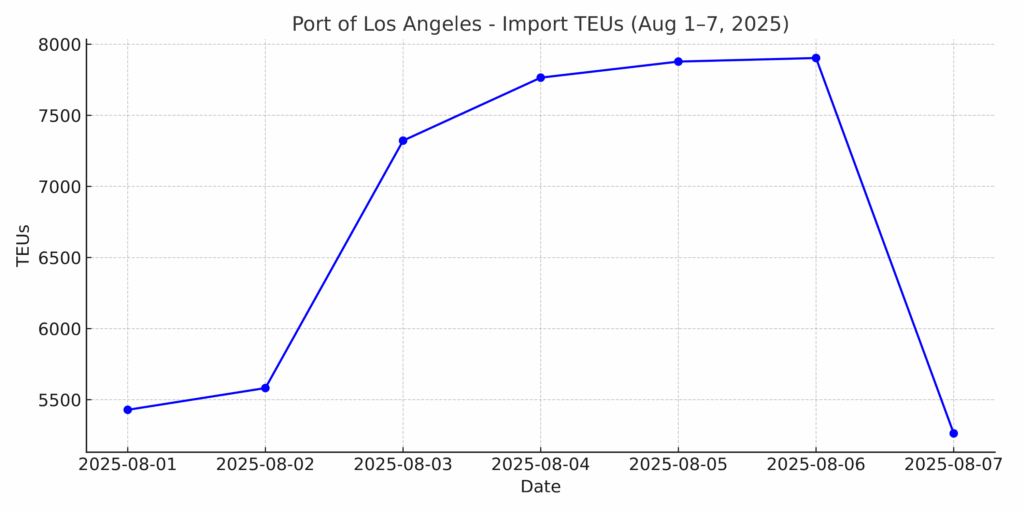

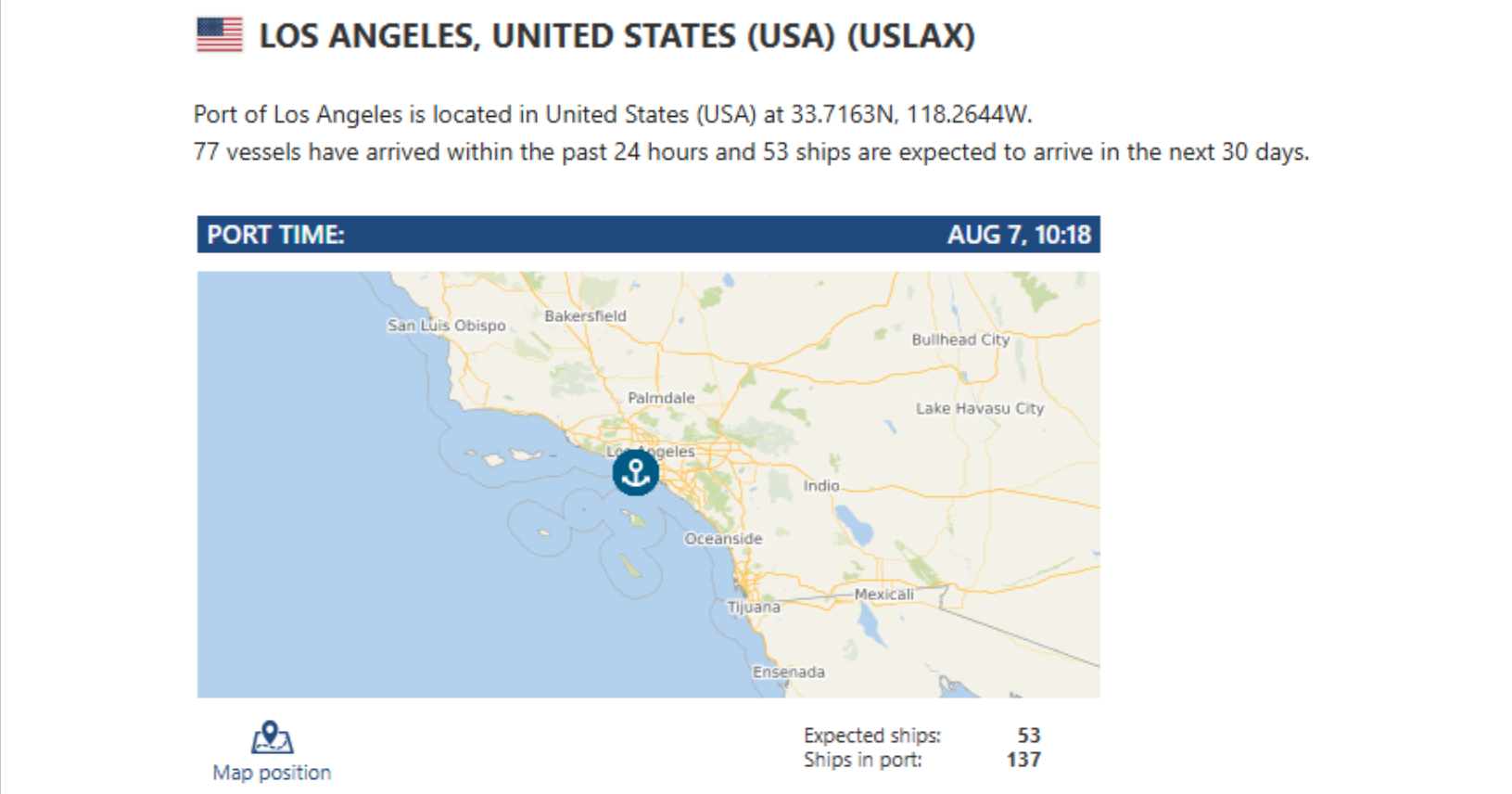

- Port of LA: Weekly import TEUs dipped below 120K, down 6.2% week-over-week and pacing 10% behind July’s peak.

- Port of Savannah: Still busy—but gate congestion has eased slightly, with shorter truck turn times reported early this week.

- Port of NY/NJ: Steady flows, but forwarders report increased blank sailings announced for late August.

Rates & Booking Trends: Softening or Strategic?

- Ocean spot rates from Asia to the West Coast dropped slightly this week after 3 months of gains—but are still 30–40% above last year.

- Carriers are using blank sailings and slow steaming to balance capacity—expect this dance to continue into September.

- Booking windows are tightening. Some NVOs report rollover risk returning for small-volume BCOs without allocation agreements.

Inland Moves & Rail: Headaches That Won’t Quit

While headlines haven’t broken this week, long-standing operational challenges continue to shape the inland container market:

- As rail carriers rebalance networks ahead of late Q3 demand shifts, there’s growing pressure on low-margin intermodal lanes, especially out of the Midwest. Spot rates have shown gradual upward movement, though volatility remains lane-specific.

- In the transload-heavy LA/LB corridor, activity has normalized somewhat compared to July’s peak weeks—but facility utilization still hovers around 80–85%, leaving limited room for last-minute bookings or overflow.

These aren’t new disruptions—but their persistence reinforces the need for proactive planning, and flexible routing strategies heading into the back half of 2025.

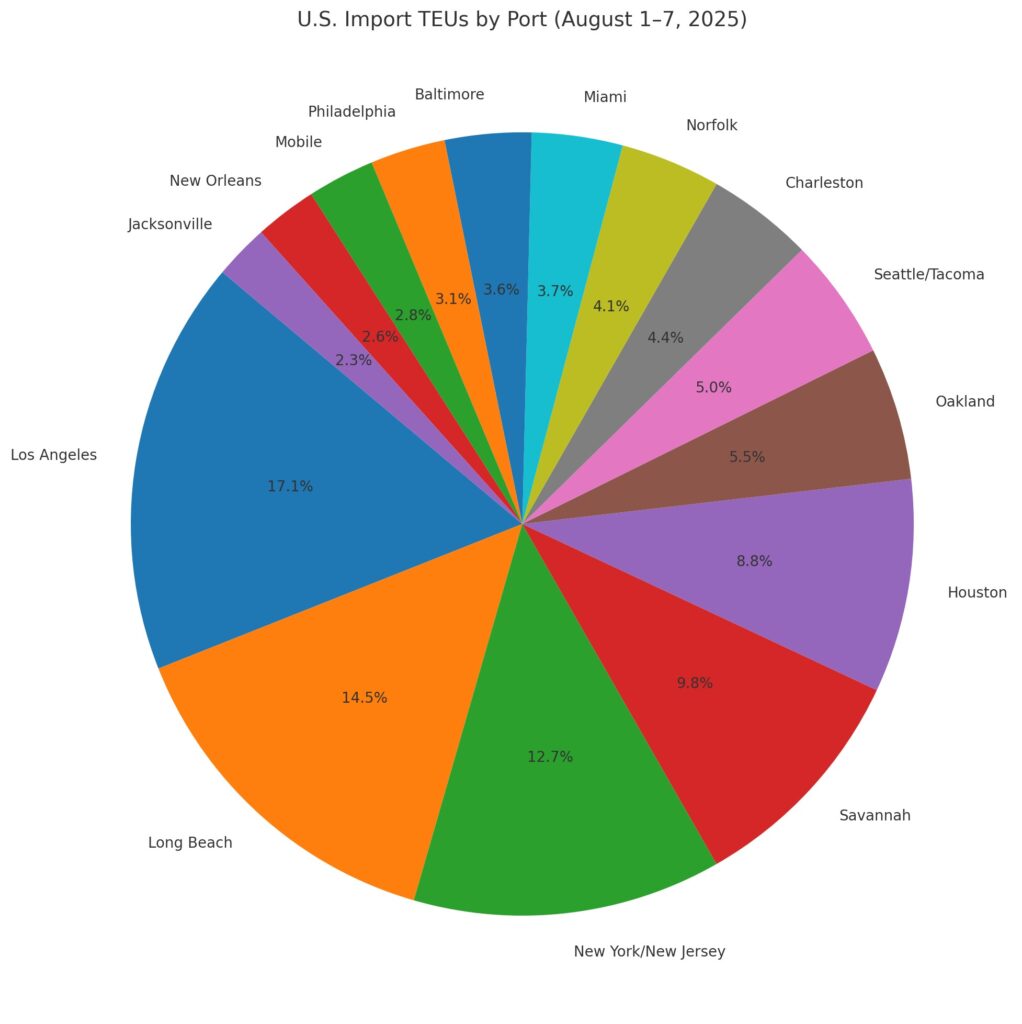

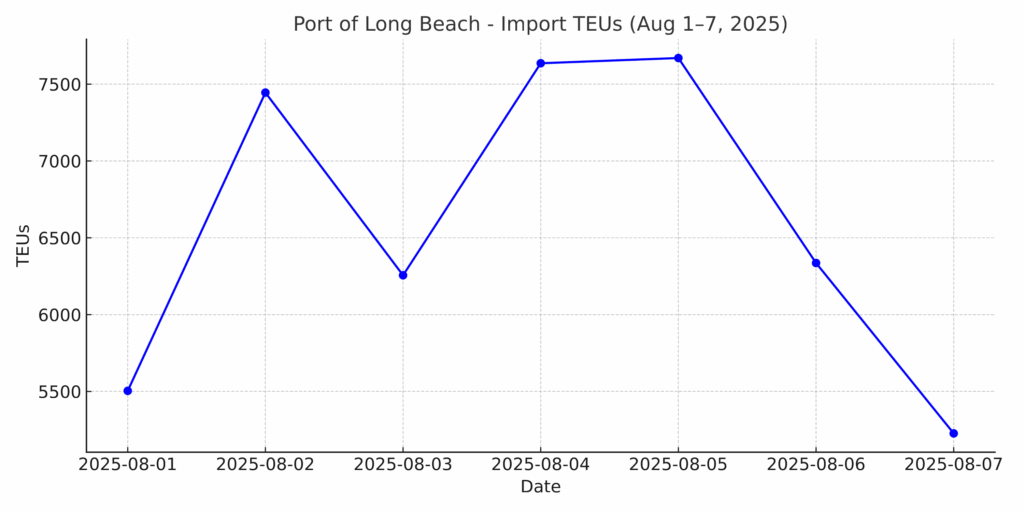

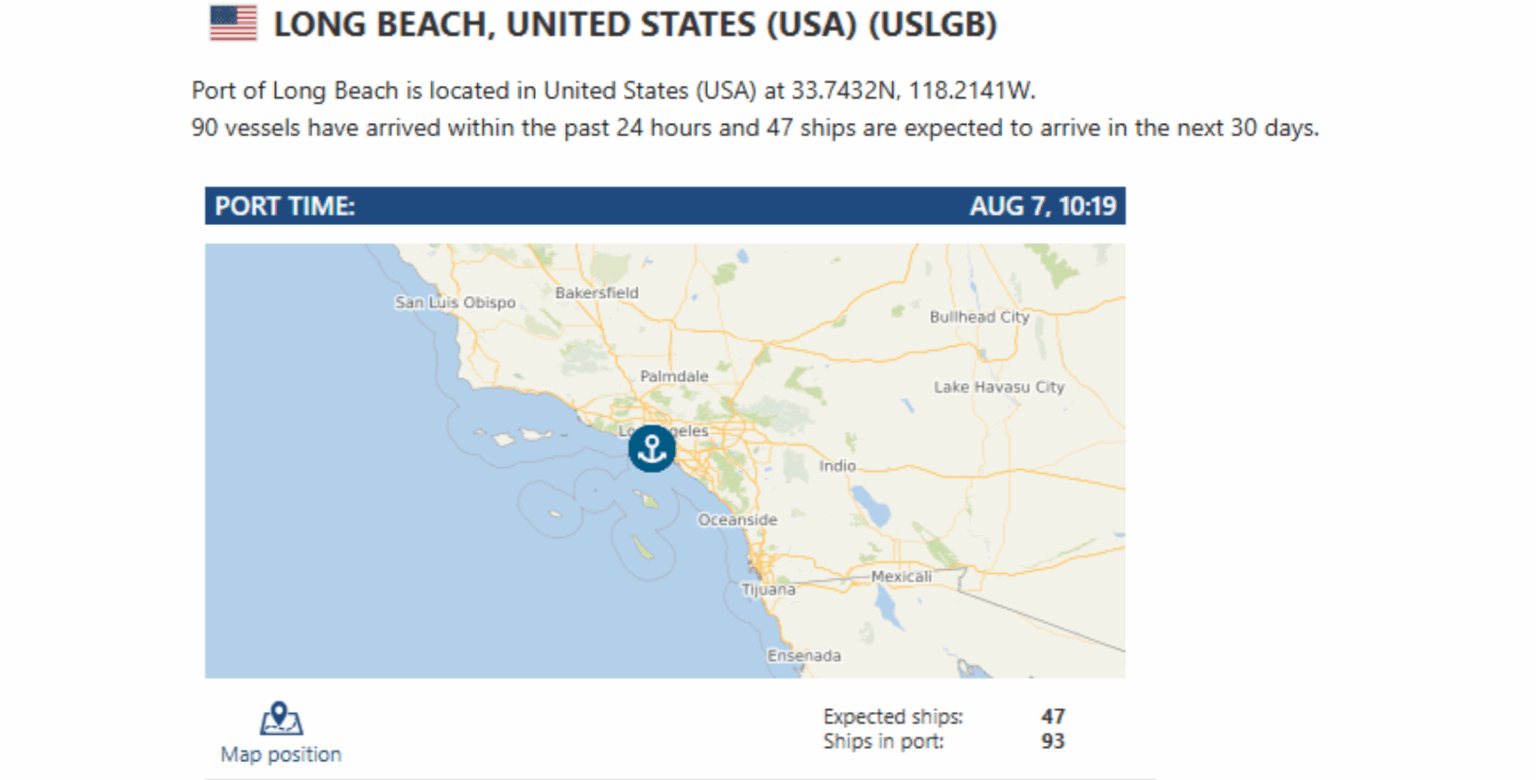

Import TEUs are up 2.235% this week from last week – with the highest volumes coming into Los Angeles 17.1%, Long Beach 14.5% and NY/NJ 12.7%. What to Watch Next Week:

- Tariff decision: All eyes on August 12th – will Trump extend the truce with China, or are 25–50% tariffs back on deck?

- Hurricane season: Tropical systems developing in the Atlantic could begin impacting Southeast port ops by mid-August.

- Retail restocks: Back-to-school and early holiday orders are expected to move inland—watch for a dry van capacity crunch in the Midwest.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

LA/LGB:This week, the Ports of Los Angeles and Long Beach announced promising developments. At Los Angeles, Eco Wave Power took a concrete step toward sustainable operations with the installation of the energy conversion unit for its first U.S. wave energy pilot—marking a pivot from construction into testing. Over at Long Beach, Jacobs won a critical contract to build the Pier B OnDock Rail facility, a key part of a $2.2 billion infrastructure push that will double rail capacity and streamline cargo flows well into the future. We’ve lowered our transload rates at the Ports of Los Angeles and Long Beach, making now the perfect time to secure capacity with our West Coast team. Our drayage yard and transload warehouse offer a large fleet, secure yard with ample storage, and immediate availability for both floor-to-pallet and palletized transloads. Capacity is first-come, first-serve, so early bookings are key. With OpenTrack, we provide end-to-end visibility from overseas origin to U.S. port arrival. Plus, we offer a No Demurrage Guarantee on any orders dispatched to us at least 72 hours before vessel arrival and cleared by the last free day. For updated rates or to book space, contact us at letsgetrolling@portxlogistics.com – we’re ready to be your go-to LA/LGB transload partner.

Savannah/Charleston: The Port of Savannah is riding high after 2025 marked its second-busiest fiscal year ever, handling 5.7 million TEUs—an impressive 8.6% increase over fiscal year 2024. This surge stems from springtime cargo spikes amid tariff-driven import urgency, with consistent volume through May topping 500,000 TEUs per month and a still-strong June at 410,400 TEUs . The Georgia Ports Authority is already bolstering infrastructure—adding the largest ship-to-shore cranes on the East Coast and redeveloping its Ocean Terminal to add 1.5 million TEUs of annual capacity, including a new overpass to separate truck traffic from local neighborhoods. Over in South Carolina, the Port of Charleston wrapped FY2025 with 2.6 million TEUs handled, up 3% year-over-year. Rail connectivity to inland terminals also hit a new milestone, with Greer topping 200,000 rail moves and Dillon moving over 33,800 containers. SC Ports is pressing ahead with infrastructure plans: expect continued expansion with a new berth at Leatherman Terminal and a fully operational near-port rail yard targeted for 2026—increasing regional speed-to-market and intermodal capacity. Port X Logistics isn’t just showing up in Savannah—we’re making waves. With our own 12-truck drayage fleet running Savannah, Charleston, and Jacksonville, plus hazmat creds, yard space on-site, and a fully loaded transload warehouse ready for whatever chaos your supply chain throws at you—we’ve got you covered. Need a last-minute cross-dock or an urgent transload? We’ll make it happen, fast and at the best rates around. Wanna roll through the port with us? We’ve got the inside track. Hit us up at letsgetrolling@portxlogistics.com and let’s keep freight moving in the South Atlantic like pros.

Did you know?

Port X Logistics will be attending Breakbulk Americas 2025? Join Noah Shivley, our GBMF Projects Brand Ambassador at the largest project cargo and breakbulk trade event in the region, happening September 30th – October 2nd in Houston, TX. It’s the place to connect with industry leaders, explore heavy-lift innovations, and move big ideas forward. Grab your ticket and meet Noah there! To schedule a meeting with our team, email marketing@portxlogistics.com

Import Data Images