Port of Savannah

2079 words 9 minute read – Let’s do this!

The trade winds are shifting again – fast. From the expiration countdown on the U.S. – China tariff truce to the end of the de minimis exemption, the landscape for importers and freight forwarders is being redefined. The White House has rolled out sweeping changes: copper products now face 50% tariffs, Brazil has been hit with a 50% rate of its own, and new trade deals with Pakistan and South Korea are reshaping access and investment flows. Meanwhile, dozens of countries will see reciprocal tariffs go into effect starting August 1st, and all eyes are on whether President Trump will extend the China tariff pause before the August 12th deadline. Want this newsletter delivered straight to your inbox? Shoot us a note at Marketing@portxlogistics.com to get on the list. Follow Port X Logistics on LinkedIn for company updates, logistics hot takes, and behind-the-scenes industry content.

Tariff Turbulence: What’s Changing and When? A wave of tariff actions is set to reshape the freight landscape this August. First up: the long-standing de minimis exemption will officially end on August 29th, eliminating duty-free treatment for shipments under $800. This change applies to all origins, including long-exempt partners like Canada and the European Union (EU), and is expected to create customs clearance delays as Section 321 shipments transition to formal entries. Freight forwarders should prepare DTC clients and small-parcel shippers for increased costs and slower last-mile delivery.

Also hitting this week, the U.S. will impose a 50% tariff on semi-finished copper products starting August 1st, targeting imports such as pipes, wires, rods, and cables—though refined copper is excluded. This move is expected to impact construction, energy, and tech supply chains, particularly sourcing lanes from Chile, Peru, and the DRC. Additionally, imports from Brazil now face a 50% tariff, following a White House order citing trade and political concerns. Forwarders should anticipate compliance reviews and cost-driven routing shifts on Brazil-bound and Brazil-origin shipments.

Trade Talks in Motion: New Deals and Pending Decisions: Amid the tariff shakeup, the U.S. struck a new trade deal with Pakistan, focused on boosting bilateral investment, expanding market access, and developing Pakistan’s oil reserves. While exact tariff terms weren’t disclosed, Pakistani officials confirmed the agreement will reduce reciprocal duties and drive U.S. investment in energy, IT, and infrastructure. Forwarders should watch for increased project cargo and EPC demand in the region, as well as improved speed-to-market for Pakistani exports into the U.S.

Talks with China remain less conclusive. After a two-day meeting in Stockholm, no formal decision was made to extend the current U.S.–China tariff truce, which is set to expire August 12th. The U.S. maintains a 30% tariff on Chinese goods, while China continues applying a 10% levy on U.S. products. A 90-day extension is reportedly under consideration, but President Trump will make the final call after internal briefings. A face-to-face meeting with President Xi is possible by year’s end, but not confirmed.

August 1st Global Tariff Launch: Broad Impacts Ahead: Separately, the administration will begin implementing reciprocal tariffs on dozens of countries starting August 1st, regardless of the outcome of China talks. This includes a proposed 25% rate on Indian imports, as well as finalized deals with South Korea, Vietnam, and the Philippines, who secured lower rates (around 15%) in exchange for investment and trade concessions. The administration is also evaluating a global baseline tariff of 15–20% to simplify enforcement.

Forwarders should flag August 1st and August 29th as critical operational checkpoints, reassess customer exposure across multiple lanes, and prepare for demand shifts tied to energy, metals, and direct-to-consumer e-commerce.

Here is the current pending U.S. Tariff Rates by Country:

Countries with Confirmed Tariff Rates:

- European Union, Japan, UK, South Korea, Vietnam, Indonesia, Pakistan, Philippines:

Secured trade agreements in return for 15–20% tariff rates (generally ~15%) after negotiated concessions

- South Korea: Tariff rate set at 15%, under a deal that also includes $350B in U.S. investments and energy purchases

- India: Facing a 25% tariff on imports, effective August 1; broader measures linked to political and trade behaviors

- Brazil : 50% tariff now in force, with limited exemptions for critical goods like humanitarian items, orange juice, and aircraft parts; become active August 6th.

- China: Baseline tariff maintained at 30%, part of earlier reductions from peak rates; China continues to impose a 10% tariff on U.S. exports. Rate set to revert to full level if talks fail after August 12th.

- Canada: Current rate: 25% on most goods, 10% on energy & potash; USMCA-compliant goods remain duty-free. On August 1st, most nonUSMCA items will rise to 35%

- Mexico: Consistent 25% rate on non-USMCA goods; USMCA-compliant items exempted. No raised rates announced recently

Countries with Pending Tariff Changes (Effective August 1st, unless extended)

As of August 1st, many tariff exemptions are scheduled to either expire or adjust:

- Canada: 25% → 35%

- Brazil: 50% (imposition occurs August 6th)

- India: 25%

- Cambodia: 36% (previously 49%)

- Indonesia: 19% (previously 32%)

- Bangladesh: 35%

- Cambodia: 36%

- Bosnia & Herzegovina: 30%

- Brunei: 25%

- Australia, Israel, Japan, Taiwan, Thailand, Switzerland, the UK, Vietnam: Most to see elevated tariffs (e.g. ~25% for Japan; 10% global baseline otherwise)

Additional Trade Measures & Product-Specific Tariffs

- Steel & Aluminum: 50% tariffs across the board, expanded to include appliances and finished goods

- Auto & Auto Parts: 25% tariff on most imports, excluding USMCAcompliant vehicles & parts

- Copper Products: 50% tariff on semi-finished copper items (pipes, cables, wiring, etc.) effective August 1; refined copper exempt

- Reciprocal Tariffs: A universal 10% tariff applies on goods from all countries not in negotiated agreements, alongside country-specific rates ranging from 11–50%; many countries paused until August 1st

Country / Region | Current Tariff Rate | Notes & Effective Date |

EU, Japan, UK, Korea* | ~15% | Trade deals secured; includes investment terms |

China | 30% | Down from peak; reverts if talks fail (Aug 12th) |

India | 25% | Begins Aug 1st |

Brazil | 50% | In force August 6th; some exemptions apply |

Canada | 25% → 35% | Non-USMCA goods; effective Aug 1st |

Mexico | 25% | USMCA goods exempt |

Indonesia | ~19% | Paused; rising on Aug 1st |

Bangladesh/Cambodia etc. | 30–36% | Scheduled increase Aug 1st |

Steel / Aluminum | 50% | Applied globally across sectors |

Autos & Vehicles | 25% | USMCA-compliant excepted |

Semi-finished Copper | 50% | Starts Aug 1st; refined copper exempt |

*Countries with finalized agreements include the EU, UK, Japan, South Korea, Vietnam, Indonesia, Pakistan, and the Philippines; they generally face tariff rates around 15%

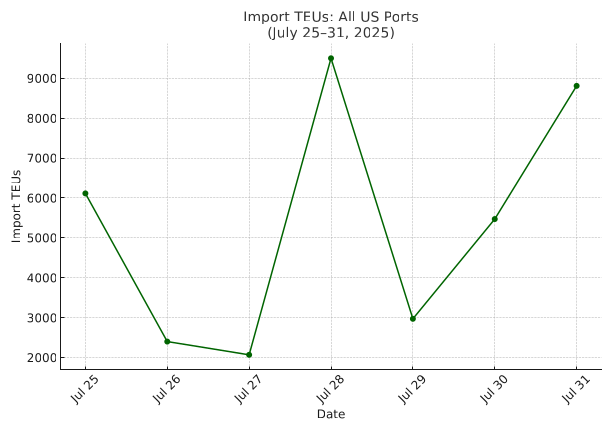

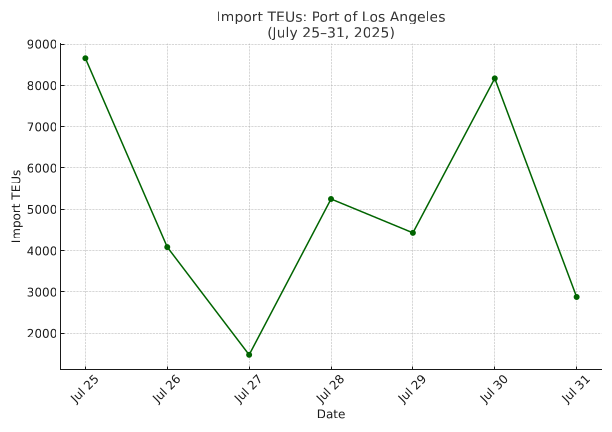

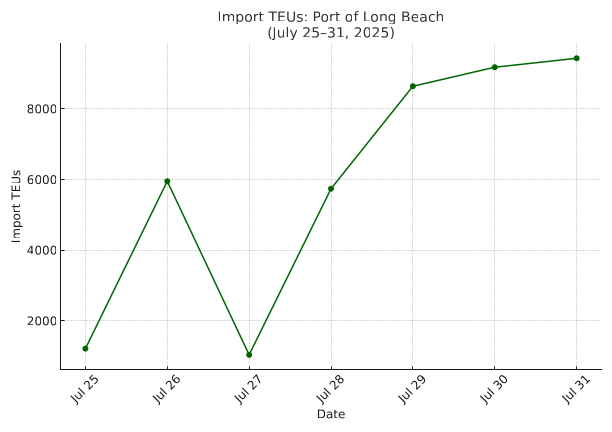

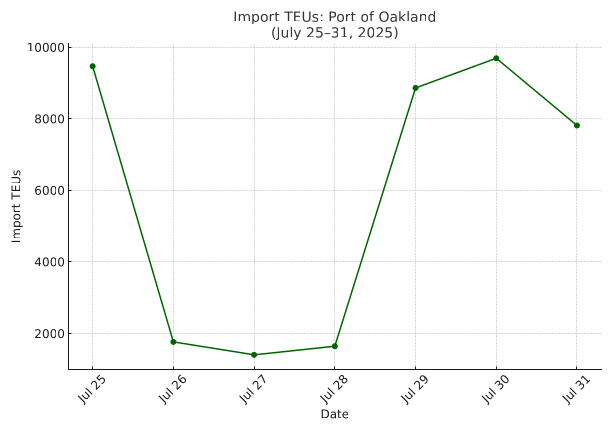

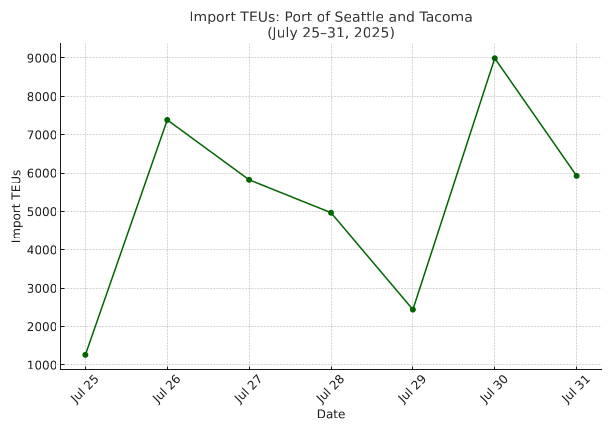

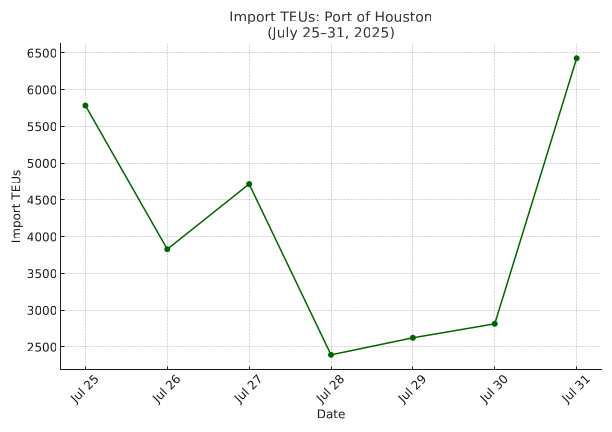

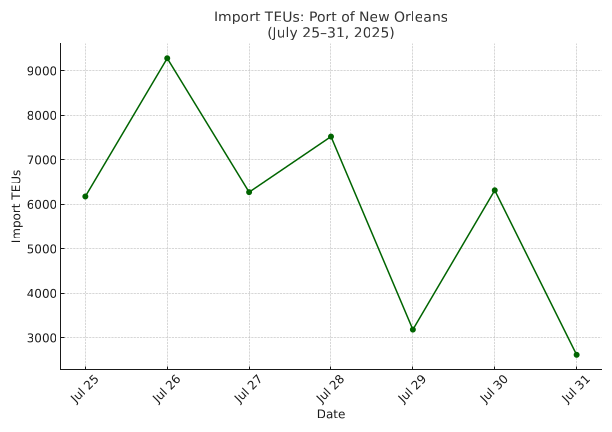

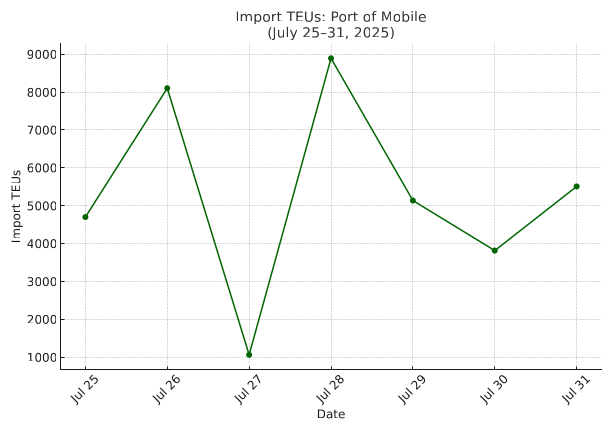

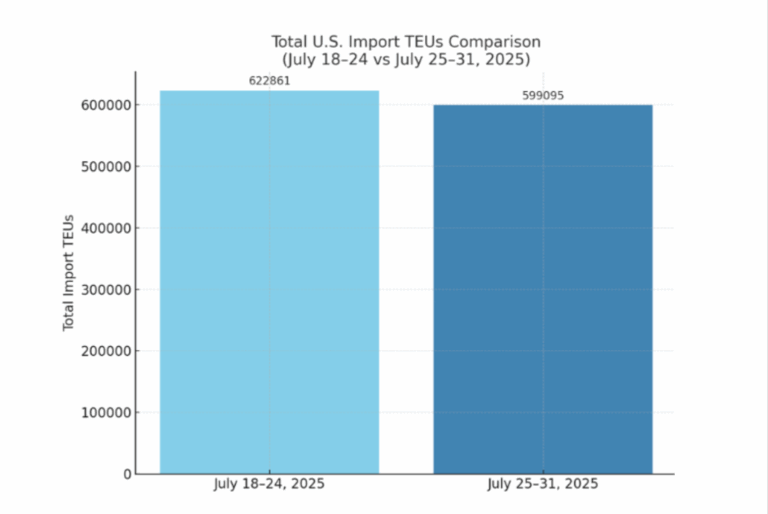

Import TEUs are down 3.8% this week from last week – with the highest volumes coming into Los Angeles 16%, Long Beach 15% and Seattle/Tacoma 8.4%. importers appear to be shifting focus away from chasing deadlines and toward ensuring stable inventory levels through the back half of the year. Retailers and import logistics teams have become more pragmatic, choosing to prioritize supply chain consistency over short-term rate arbitrage. “Tariffs just don’t carry the weight they did a month or two ago,” noted one freight executive. Instead of reacting to every announcement, many importers are leaning into a mindset of: “We can’t control the politics, but we can control our inventory.” That shift in mindset is playing out in the water. Carriers are reducing deployed capacity between Asia and the U.S. for August, though at a slower pace than expected. Spot rates have been declining steadily since late May, and as of late July, China – US West Coast rates have dropped to around $2,000 per FEU—down roughly 70% year-over-year, according to the Shanghai Containerized Freight Index. While general rate increases (GRIs) are still being attempted by some carriers, few expect them to stick given the amount of cargo already landed in the U.S. Even as tariff risks remain—particularly the reversion to higher rates for non-compliant countries on August 1st they’re no longer triggering last-minute surges in import volume. Many businesses, especially in sectors like automotive, have already restructured sourcing. One importer noted they’ve fully exited China and will only ship into the U.S. from countries offering tariff rates under 15%. Meanwhile, frontloading of fall and holiday goods has already taken place, softening expectations for Q4. “There’s just not much urgency left in the pipeline,” said one carrier executive, forecasting a challenging end to the year in terms of volume. That sentiment is echoed by both forwarders and BCOs, who are leaning on a mix of transport modes – standard ocean for base volume, expedited services for time-sensitive product, and air freight only when absolutely necessary. For now, the focus has shifted from dodging tariffs to balancing landed cost with delivery precision. Whether the broader tariff environment stabilizes or resets again in the coming weeks, importers are signaling that resilience and predictability now matter more than strategy built on policy guesswork.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

LA/LGB: Looking ahead to August, freight forwarders and importers should prepare for minor shifts in service plans, with carriers adjusting vessel capacity slightly to stabilize summer flows. While average dwell times remain at 3–4 days, it’s wise to build in buffer time for both transit and final delivery. Rail unloading delays have improved compared to last month, but tight chassis and limited rail equipment availability could still create inland drayage headaches. On the pricing front, softening spot rates may offer some cost relief, though tight space and equipment availability could offset those savings.

We’ve lowered our transload rates for LA/LGB, making it the perfect time to lock in capacity with our Los Angeles operation. Our drayage yard and transload warehouse offer a large fleet, a secure yard with ample storage, and immediate capacity for both palletized and floor-to-pallet transloads. Capacity is available on a first-come, first-serve basis, so early bookings are key. With access to OpenTrack, we can monitor your containers from the moment they’re loaded overseas all the way to U.S. port arrival. Plus, we offer a No Demurrage Guarantee on all orders dispatched to us at least 72 hours before vessel arrival and cleared by the last free day. Reach out to letsgetrolling@portxlogistics.com for rates or questions—we’re ready to be your go-to West Coast transload team.

Seattle/Tacoma: During the last week of July, both ports maintained steady cargo flow benchmarks, with weekly vessel calls and container arrivals aligning close to 2024 averages. According to the Northwest Seaport Alliance, week-over-week volumes remained stable, with no significant deviations from expected performance metrics. However, at Tacoma’s Terminal 18, drivers experienced delays as the terminal’s gate system grappled with network outages, slowing truck processing entry and exit times. Washington United Terminals (WUT) began using a new operating system, which also caused processing delays and a temporary bottleneck in cargo movement. On the capacity front, no service suspensions or blank sailings affecting West Coast loops were reported in late July, according to ocean carrier routing updates. In fact, container traffic (imports especially) has shown year-over-year growth of nearly 17.6% when compared to averages of earlier in July, reflecting increased inbound activity.

Want to find out how routing freight through the SEA/TAC ports could strengthen your supply chain? Our Seattle operation is ready to deliver. With 11 new drivers added to our fleet and robust transload warehouse capabilities, we’re fully equipped to handle your drayage and transload needs. Whether it’s an ongoing project or a one-off move, reach out to letsgetrolling@portxlogistics.com for capacity updates and exceptional service.

Did you know?

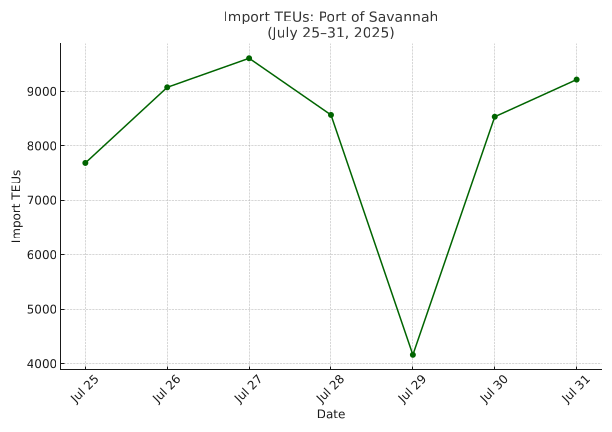

The Garden City Terminal at the Port of Savannah is the largest single-terminal container facility in North America—covering a massive 1,200+ acres. With seamless access just 6 miles from I-95 and 16 miles from I-16, it’s one of the most efficient gateways to the Southeast and Midwest. No wonder it’s a favorite among drayage and intermodal pros. Did you also know that Port X Logistics has boots on the ground in Savannah—with serious muscle.

🚛 12-truck drayage fleet servicing Savannah, Charleston, and Jacksonville

☣️ Hazmat certified

📦 On-site container yard space

🏗 Full-service transload warehouse ready for last-minute cross-docks and urgent transloads—at the best rates in town

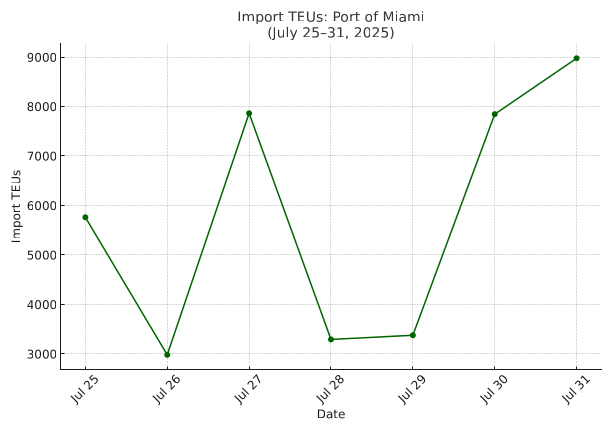

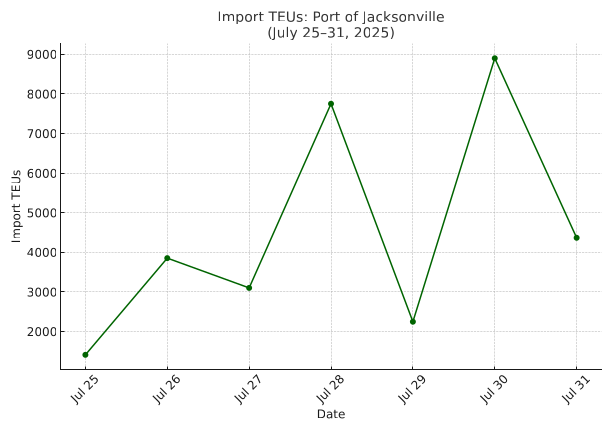

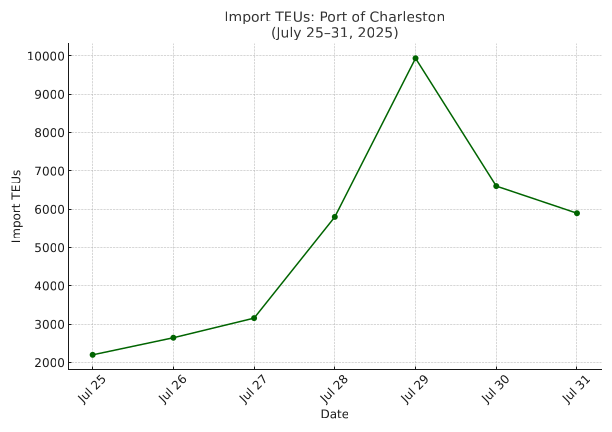

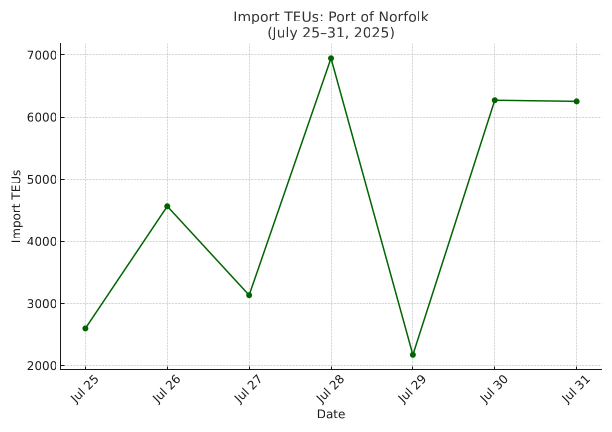

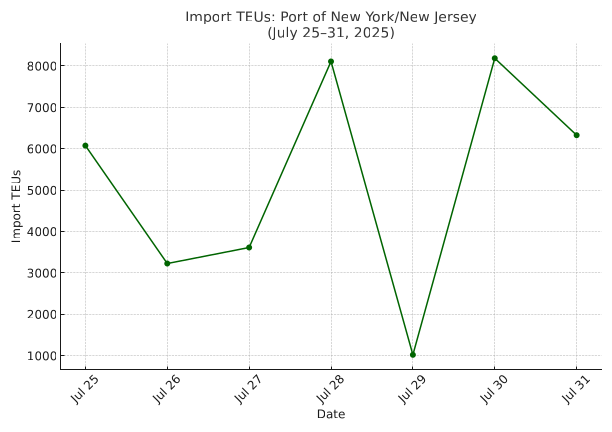

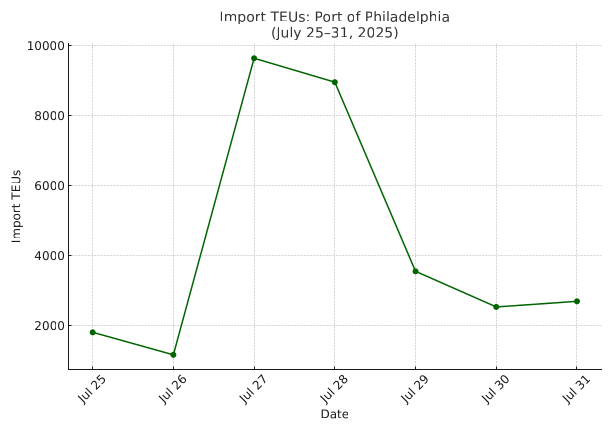

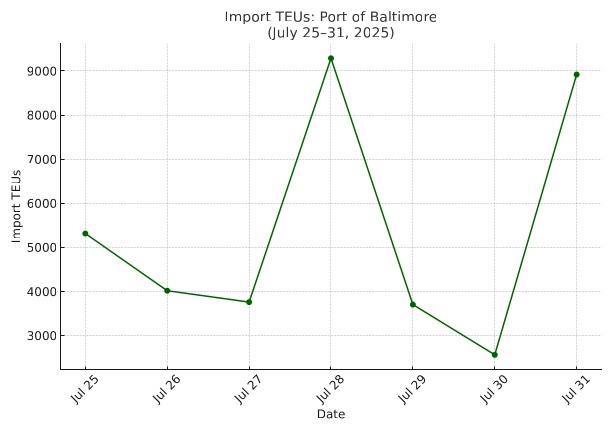

Import Data Images