Port of Houston

1492 words 7 minute read – Let’s do this!

The calm before the tariff storm may be over, as August approaches, a new wave of reciprocal tariffs is set to shake global trade flows – and logistics teams are already feeling the tremors. The U.S. will impose updated tariffs on imports from Japan, Indonesia, and the Philippines beginning August 1st, with a potential 30% tariff on the European Union (EU) and other “Magic 8” partners still hanging in the air. From steel and auto parts to pharmaceuticals, rising rates and regulatory risk are reshaping cost structures and supply chain strategies across the board. With legal battles brewing and uncertainty on the rise, Q3 is shaping up to be anything but predictable. Want this newsletter delivered straight to your inbox? Shoot us a note at Marketing@portxlogistics.com to get on the list. Follow us on LinkedIn for company updates, logistics hot takes, and behind-the-scenes industry content.

Intra-Asia trade lanes are on shaky ground as U.S. tariff negotiations approach key deadlines. Hutchison Port Holdings Trust flagged the risk of fresh chaos if talks with several Asian nations fall through before August 1st. While Japan, Indonesia, and the Philippines reached last-minute deals—with tariffs trimmed to 15–19%—others like South Korea, Thailand, and Malaysia are still staring down steep duties, some as high as 40%. If deals don’t get done, new sector-specific tariffs could throw a wrench into already fragile global trade flows. And China? Talks are set to resume next week in Stockholm, but if there’s no agreement by August 14th, Chinese exports could face a crushing 145% tariff. Bottom line: The intra-Asia market could face serious disruption—just as supply chains are trying to stabilize.

Let’s take a look at Tariff Key Developments in July 2025

Trade Deals & Adjusted Tariff Rates

- Japan: Tariffs on Japanese auto imports have been lowered to 15% under a new deal announced July 23rd. This includes significant investment pledges (~$550 billion) from Japan to the U.S.

- Indonesia & Philippines: Reciprocal tariffs—originally higher—have been reduced to 19% following deals announced mid-July. The U.S. will now impose this rate on imports from these countries, effective August 1st

EU Tariff Escalation Threat

- Trump signaled intent to impose 30% tariffs on European Union and “Magic 8” partners starting August 1st if no deal is reached. The EU is readying counter-tariffs, but has delayed retaliatory moves for now while negotiating

Pharma & Sector-Specific Risks

- Proposed tariffs on pharmaceuticals could reach up to 200%, raising concerns about medicine shortages and supply chain disruptions. Any implementation is likely delayed until after the 2026 U.S. midterm elections

Steel, Aluminum & Auto Tariffs

- Steel and aluminum tariffs remain at 50%; appliances and other durable goods are also included after June expansion.

- Automakers are feeling the pinch—GM cited a $1.1 billion tariff loss in Q2 operating income.

Legal Pushback on Tariff Authority

- A federal court on May 28th blocked tariffs imposed under emergency powers (IEEPA) as unconstitutional; the injunction remains in effect while under appeal

Implications for Logistics & Supply Chains

- Shipping Costs & Route Adjustments: Logistics providers are seeing increased freight costs, with shifts in trade routes as firms adapt to new trade agreements—particularly with Japan, Southeast Asia, and the EU

- Tariff Timing & Planning: Firms must gear up for the August 1st tariff schedule, managing customs filings, tariff classifications, and inventory positioning.

- Risk Prism: Sharp pharma tariffs and ongoing uncertainty in steel/aluminum sectors elevate inventory and sourcing risk, especially for healthcare and manufacturing-related logistics.

- Legal Uncertainty: Court rulings could roll back emergency powers-based tariffs—but for now, tariffs remain—and companies should be prepared for abrupt policy reversals or what to watch next

Date | Event |

|---|---|

July 31st | Appeals court oral arguments on IEEPA tariffs |

August 1st | New reciprocal tariffs effective; EU engagement deadline |

August 12th | China-specific tariff suspension expires |

Recommended Actions for Logistics Teams

- Update cost models for shipments from Japan, Indonesia, and the Philippines.

- Prep EU operations for possible 30% tariffs—monitor negotiations and logistics flexibility.

- Stress-test supply chains exposed to pharma and metallurgical imports.

- Track legal proceedings closely—even small court developments could shift policy overnight.

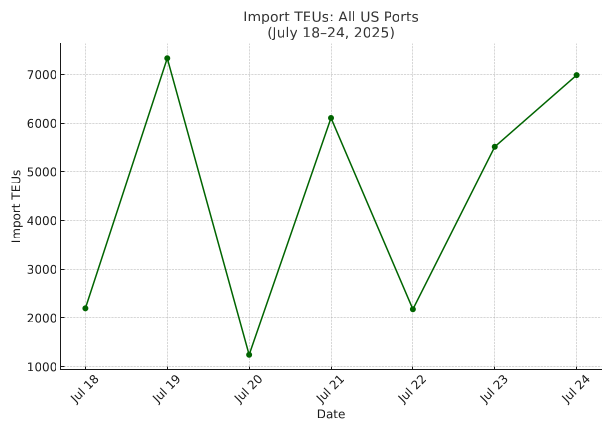

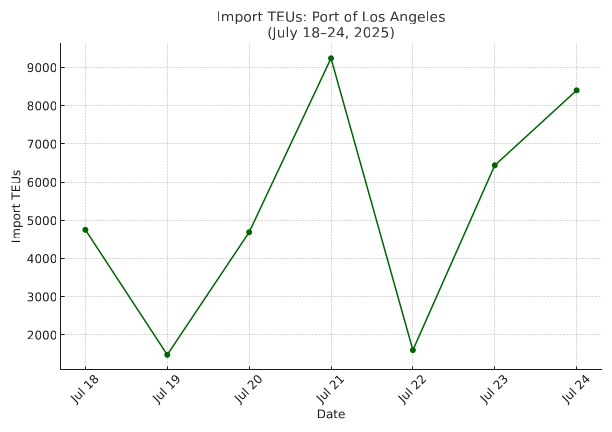

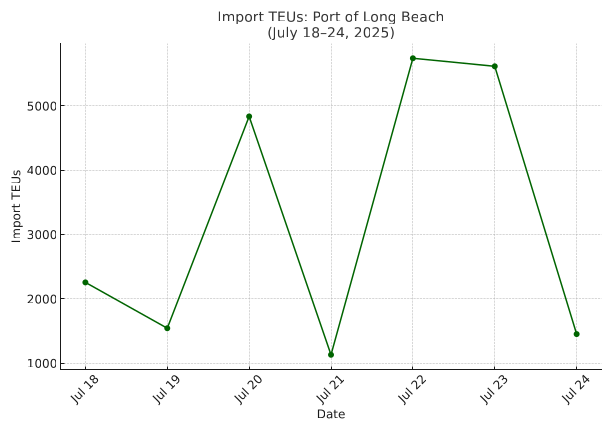

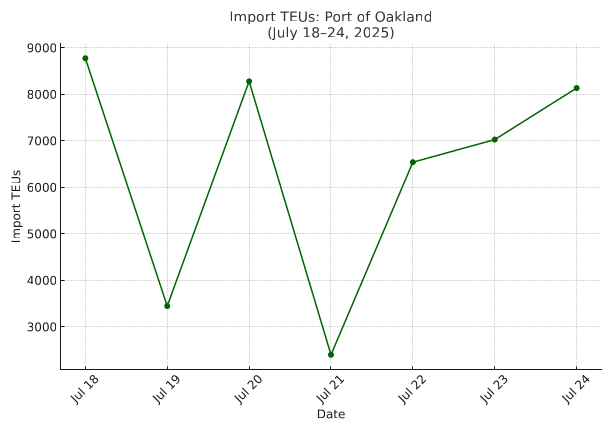

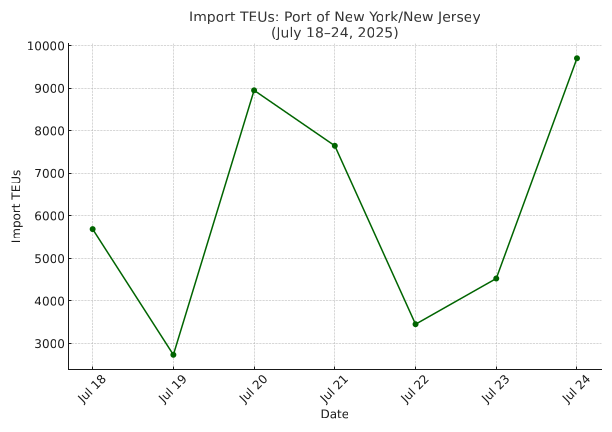

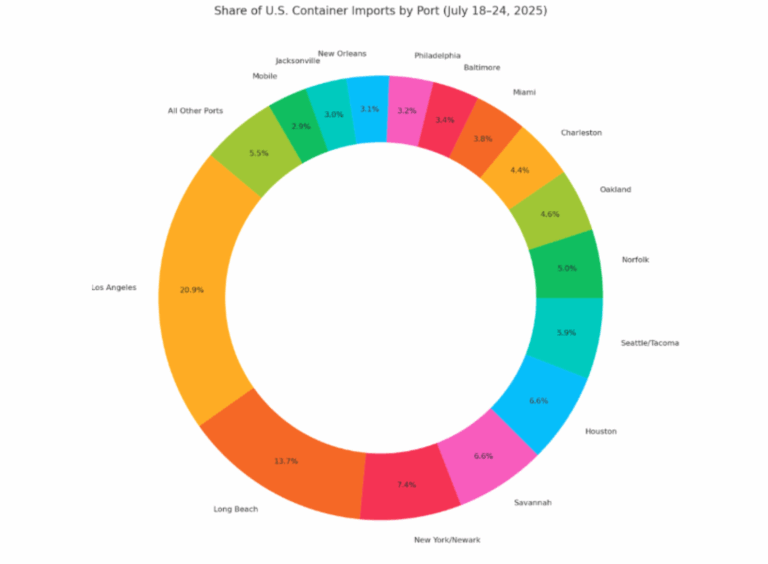

Import TEUs are down 0.948% this week from last week – with the highest volumes coming into Los Angeles 20.9%, Long Beach 13.7% and NY/Newark 7.4% (shown in the chart below). Spot rates hit pause—but the slide might not be over: After weeks of tariff-driven frontloading and rate freefall, trans-Pacific shippers are catching their breath—and so are container spot rates. According to Xeneta, rates from the Far East to the U.S. West Coast held steady at $2,313/FEU as of July 18th, halting a 28% drop earlier this month. East Coast rates are holding a bit higher at $4,314/FEU, despite falling 7% just since July 14th and 26% since the end of June. Since peaking on June 1st, West Coast rates are down 58%, while East Coast lanes have slipped 35%. That widening gap? Now $2,000 between coasts—nearly double the spread seen six weeks ago. The culprit? Carriers are pulling capacity, but not fast enough to counter softening demand. And while the August tariff extension has kept panic at bay, Xeneta’s analysts say the reality is setting in: shippers can’t frontload forever. The long-term trajectory? Still downward. Europe paints a mixed picture: Far East to North Europe lanes saw rates climb 18% since June and 78% since late May, driven by port congestion, labor actions, and low water levels on the Rhine. But Far East to Mediterranean trade is slipping again, mirroring the U.S. rate trends.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Houston: A new reefer import dwell fee is set to take effect August 1st– Houston Port aims to reduce yard congestion by targeting imports that linger too long. Refrigerated imports (reefers) have been clogging the yard—dwell times have exceeded one week, driven by a surge in perishables shipments. To keep space clear, Port Houston is rolling out a tiered surcharge to encourage faster pick-up and reduce congestion. Fee Breakdown (Post 7-Day Free Time):

Days 1–3 over free time: $51.60/day

Days 4–7: $77.40/day

Days 8–13: $103.20/day

14+ days: $154.80/day

Port X Logistics has drayage assets in Houston 32 trucks with the capability of long-haul drayage and we have a transload warehouse in LaPorte that can transload anything from standard pallets, to heavy lumber and industrial coils. If you need help in the Houston area we got your back, we also have a drayage network with 19 trucks and yard space servicing the Dallas area contact letsgetrolling@portxlogistics.com.

Savannah: On July 21st, the Georgia Ports Authority (GPA) issued a formal update to its Marine Terminal Operator Schedule (MTOS) Schedule 5-A, which outlines key tariff changes, fuel surcharge adjustments, and operational protocols effective through August 2025. What It Means for You:

Drayage partners and ocean carriers should review the revised fee structure to avoid unexpected charges. Expect more standardized enforcement of terminal rules and tighter alignment between gate operations and surcharge assessments. The GPA is aiming for smoother throughput and more predictable billing to support trade growth through the Southeast corridor.

We dropped our transload rates for Savannah! Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space AND We have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks at the best rates in all of Savannah letsgetrolling@portxlogistics.com for great rates, immediate transload capacity and supreme customer service.

Did you know?

It is here, Empire State Ride week is about to begin! – our very own Brand Ambassador Charlie Bodine of our Denver office is head to NYC to show off his athletic abilities and repping Port X as our company rider at this year’s Empire State Ride. For seven days, Charlie will pedal across 500 + miles of New York State, starting in Staten Island and finishing just around the corner from our Buffalo HQ in Niagara Falls. He’s not just doing it for the ride either, he’s joining the fight against cancer, helping to raise funds for groundbreaking research at Roswell Park, a local but internationally known powerhouse in cancer research. Charlie, we’re pumped to have one of our own on this incredible ride!

If you want to support Charlie and the cause, stay tuned, we’ll be cheering him on and checking in with him each day of the ride. To donate or to learn more about the ride, click below!

https://give.roswellpark.org/site/TR/SpecialEvents/General?px=1702335&pg=personal&fr_id=1990

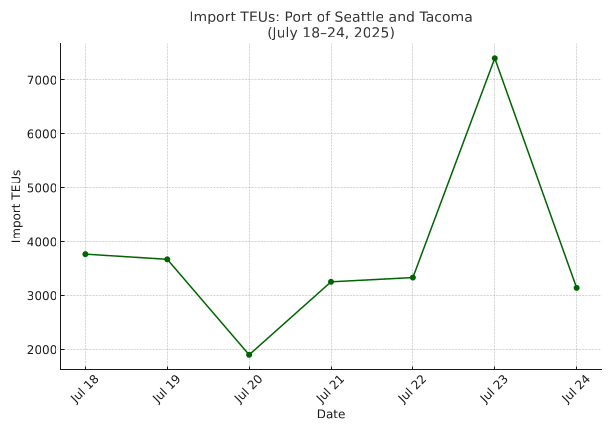

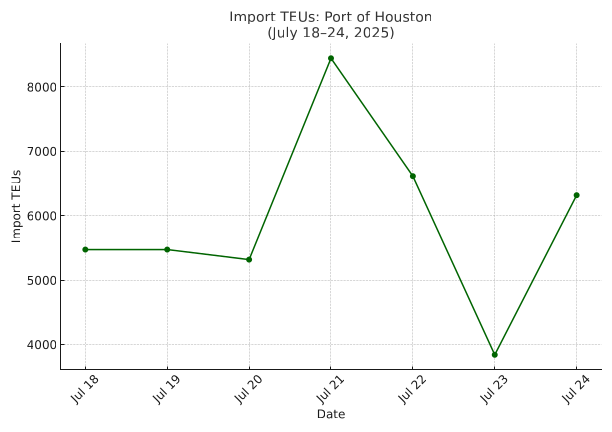

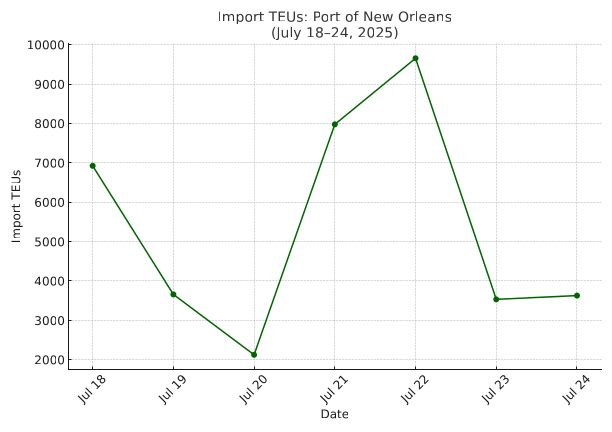

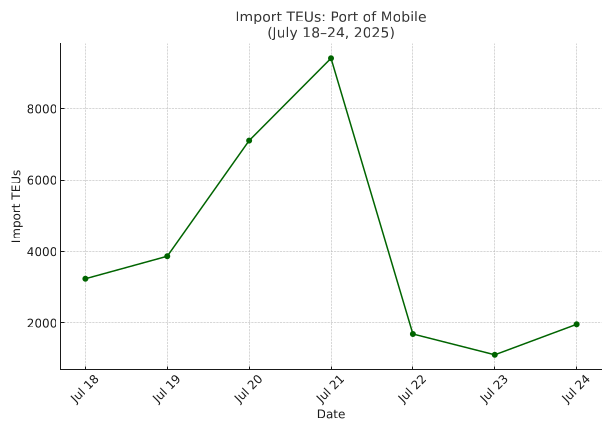

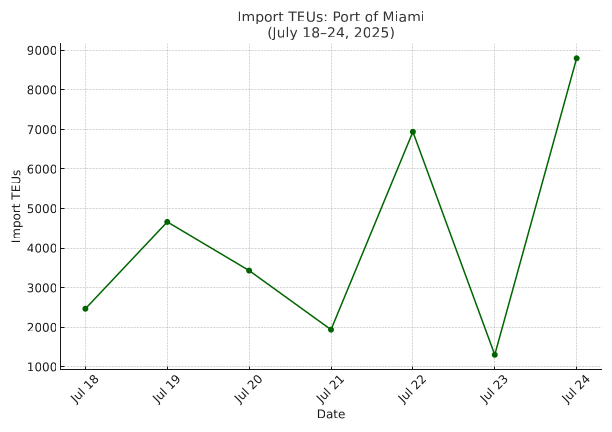

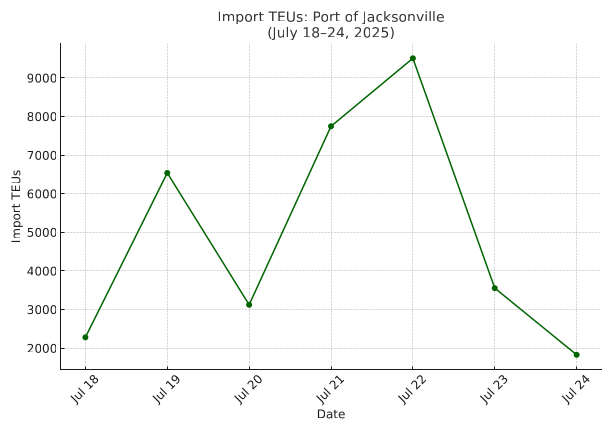

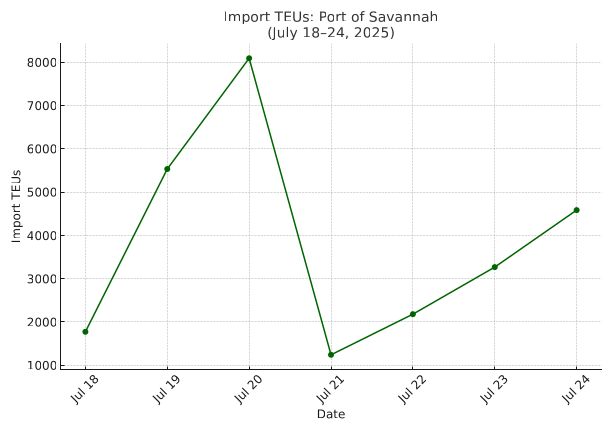

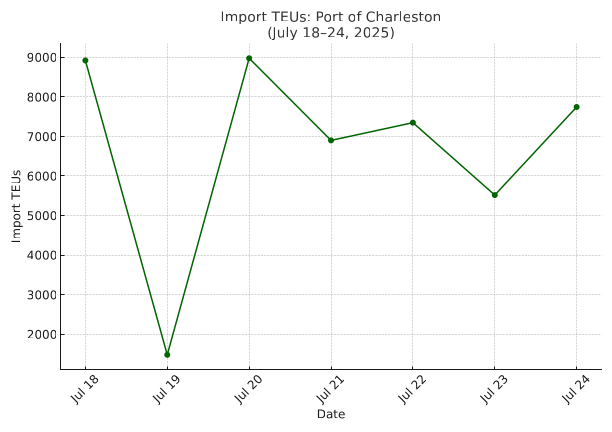

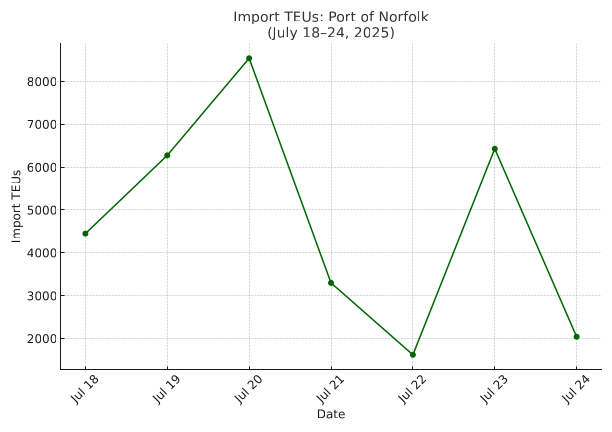

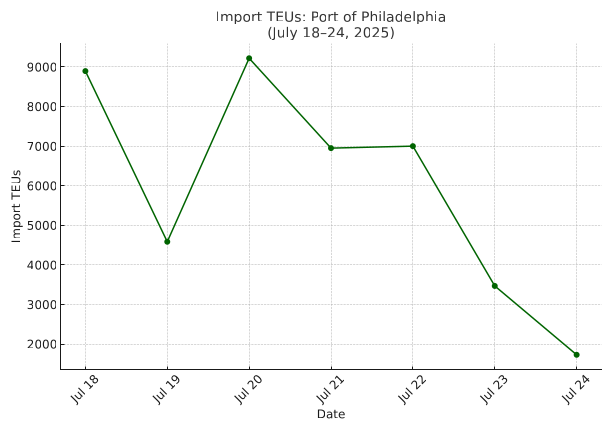

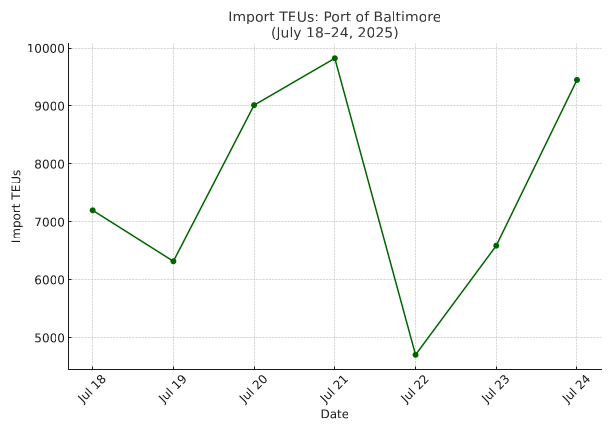

Import Data Images