Port of Savannah

1422 words 7 minute read – Let’s do this!

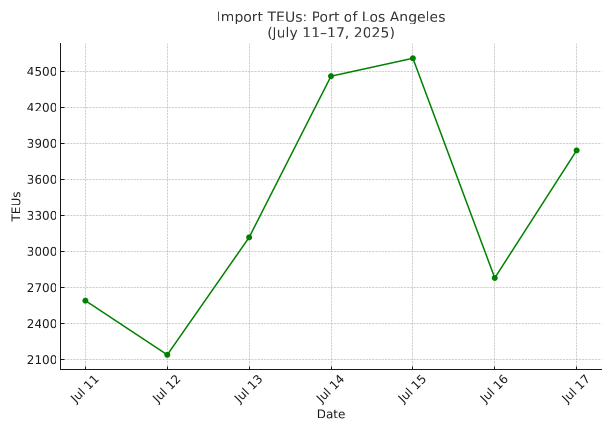

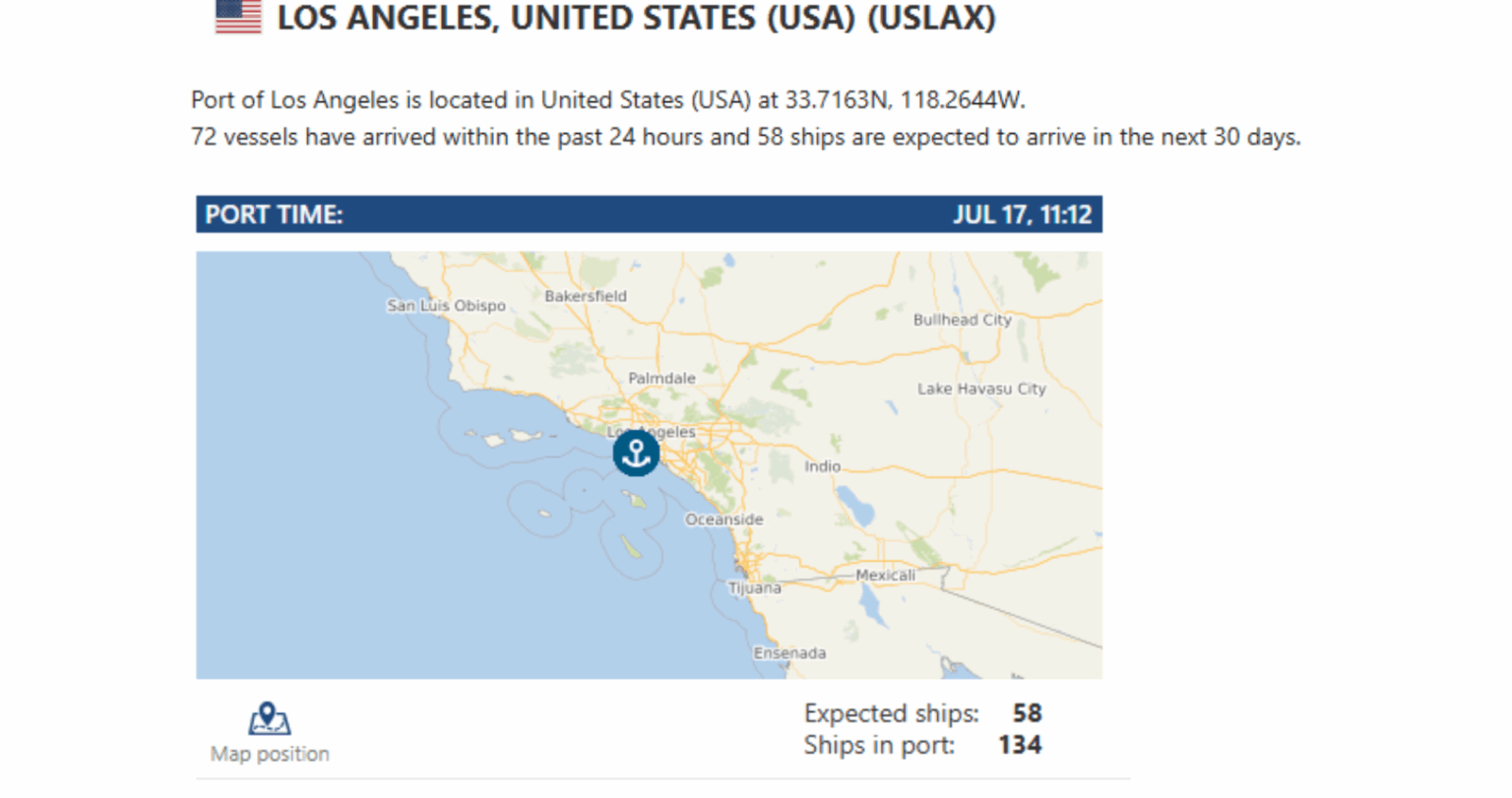

Is peak season already peaking? Just as the summer surge should be kicking into high gear, early signals from the Port of Los Angeles suggest the steam may already be running out. LA’s Port Optimizer projects 128,720 import TEUs for July 13th –19th – up 8.7% from last week and 13.2% higher than the same week last year. Sounds strong… but it’s also the top of the curve.

What comes next? A slide.

- July 20th – 26th : 120,072 TEUs — down 6.7% week over week and 11.5% year over year

- July 27th – August 2nd : Just 78,025 TEUs — a 35% drop week over week and 22.1% below last year

Zooming out: Global container volumes hit a record 16.34M TEUs in May, but exports to North America fell 9.2% month-over-month. Despite that, North American imports are still up 2% year-to-date. So – is this just a mid-summer blip, or an early signal of market correction? Either way, importers and carriers should keep a sharp eye on weekly volume trends as we move toward August – and closer to tariff implementation.

Want this newsletter delivered straight to your inbox? Email Marketing@portxlogistics.com to get on the list. Follow us on LinkedIn for company news, market hot takes, and behind-the-scenes logistics content.

A surge in Houthi-led attacks has forced multipurpose vessel (MPV) operators to reconsider the Red Sea route—just as breakbulk and project cargo demand ramps up. Two recent attacks on MPVs (Magic Sea and Eternity C) have pushed even non-Western operators to divert around the Cape of Good Hope, adding time and cost to voyages. Vessel traffic through the Red Sea has reportedly dropped to just 30 ships per day, according to AAL Shipping.

These detours could tighten MPV availability globally in the short term, shrinking capacity for project and heavy-lift cargo. The move may also disrupt the two-tier freight market that allowed cheaper Red Sea routes for some operators over the past two years. At the same time, shippers rushed orders in Q2 ahead of the now-delayed August 1st U.S. tariff deadline, driving up cargo volumes. But market volatility remains high, with many vessel operators hesitating to commit to time charters. Some shippers say the market is super volatile and unstable making it difficult to budget. Uncertainty is also rising around U.S. trade strategy. Clients are reportedly confused about whether to use Free Trade Zones (FTZs) or bonded warehouses to manage tariff risk—while space in bonded facilities is rapidly drying up.

In some airfreight news, according to World ACD’s weekly air cargo trends, worldwide air cargo demand fell about 3% in the first week of July—driven primarily by a dip in North American volumes due to Independence Day observances—while average global rates climbed about 2% week-over-week. Tariff delays continue to drive reevaluation—we may see additional capacity cuts if ships remain paused. With the new August 1st deadline in place, air cargo capacity remains unpredictable—and rates could remain elevated. When Every Minute Counts, Carrier911 Delivers. Fast. Airfreight on Ground (AOG) emergencies don’t wait—and neither do we. Our Carrier911 team is your go-to domestic air export hot shot carrier, built for speed, precision, and peace of mind. With our “Easy Button” tech, you can activate a nationwide network of TSA-certified drivers in just one click – vehicles roll out within 60 minutes of your call. We’ve moved freight from Wisconsin to O’Hare, Charlotte to Miami, and everywhere in between – through the night, across state lines, under pressure. You’ll get real-time tracking, photo confirmation at pickup and delivery, and instant PODs to kill the status-check chaos. When your $150,000-per-hour aircraft is grounded, we make sure logistics isn’t the reason it stays that way. Trust the team that supply chain pros call when the stakes are sky-high. Book your Carrier911 demo today or reach us at info@carrier911.com to see how we make urgent freight simple.

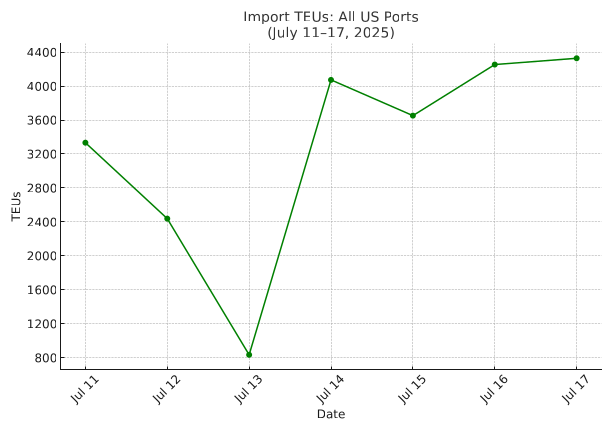

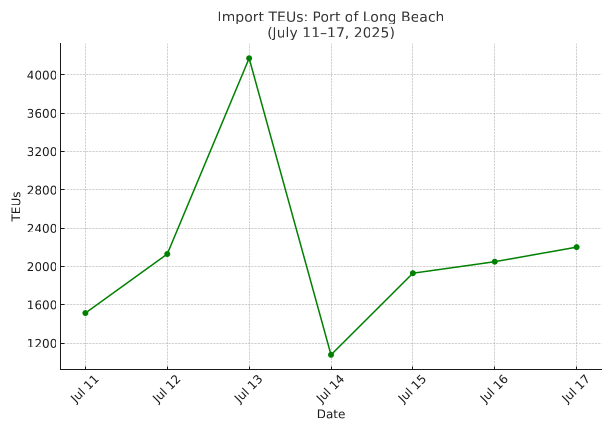

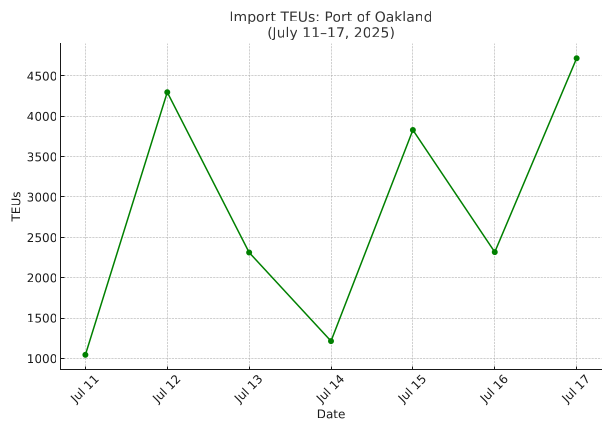

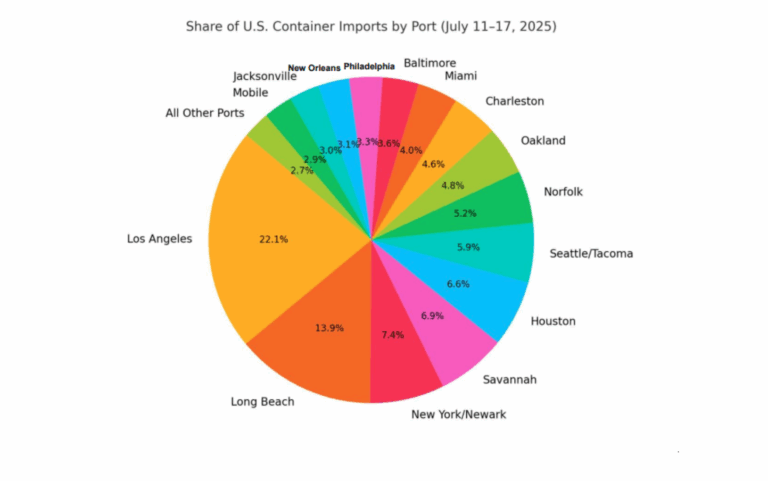

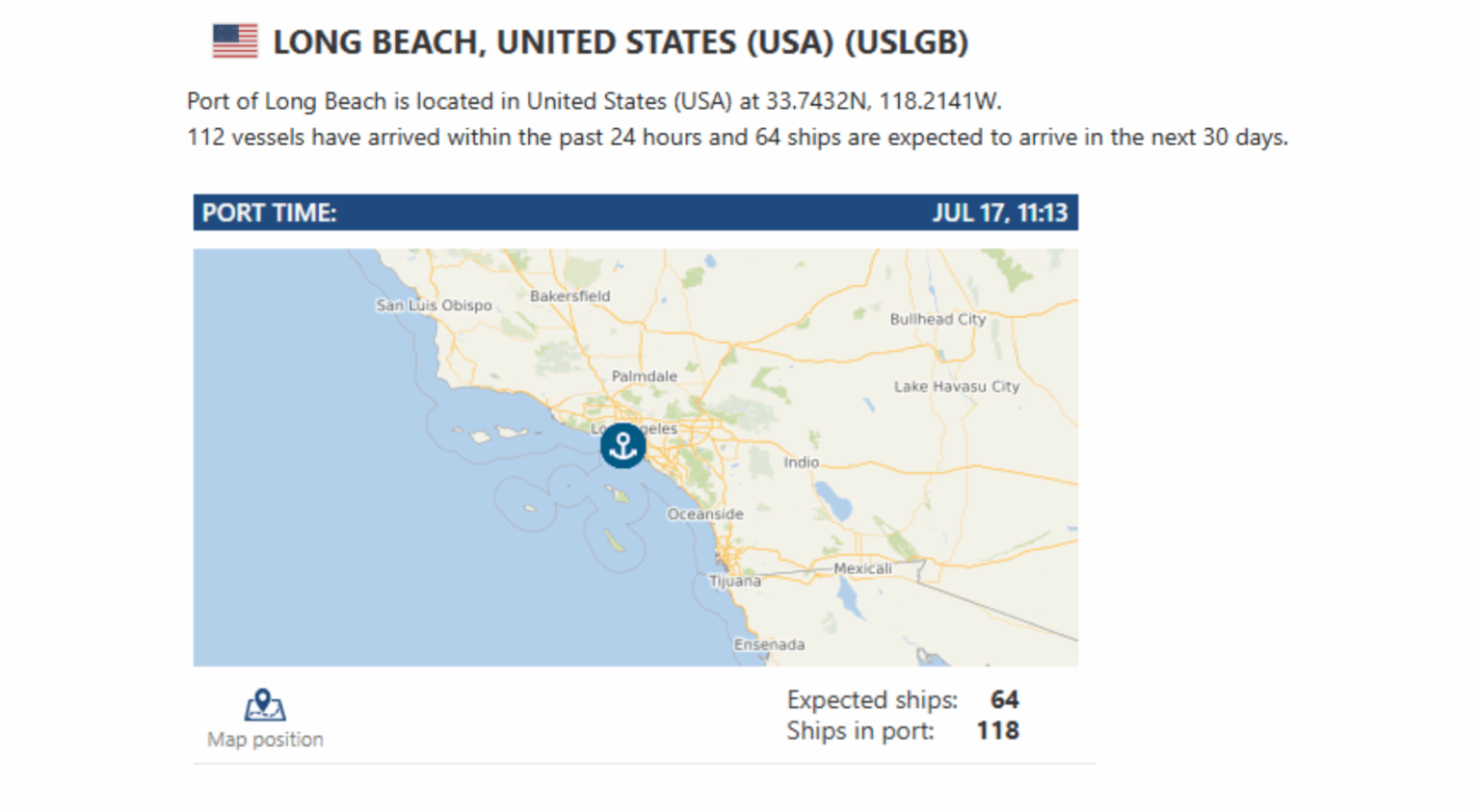

Import TEUs are down 1.92% this week from last week – with the highest volumes coming into Los Angeles 22.1%, Long Beach 13.9% and NY/Newark 7.4%. Tariff-driven volatility is reshaping trans-Pacific trade lanes as importers shift sourcing strategies and carriers rethink their routes. U.S. ocean imports fell 3.5% year over year in June to 2.2 million TEUs, with China-origin volumes plunging 28% to roughly 639,300 TEUs. After a surge of front-loading in April to get ahead of expected tariff hikes, import levels are now sharply retreating. Japanese carrier Kawasaki Kisen (K-Line) has already responded by cutting service frequency and capacity on Asia–U.S. lanes, and is prepared to reroute vessels to Europe, the Middle East, Australia, and Africa if U.S. tariffs escalate further. The company is bracing for a potential $200 million impact in fiscal year 2026 and is awaiting more clarity on trade policy before making additional moves.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

LA/LGB: The International Transportation Service (ITS) terminal at the Port of Long Beach has kicked off a massive $365 million upgrade aimed at boosting container capacity by 50% and enabling simultaneous handling of two 18,000-TEU ships. The project includes filling in a 19-acre slip to unify the terminal layout, upgrading truck gates, and installing a new terminal operating system to cut down turn times and improve flow. When complete in about 3.5 years, ITS will span 277 acres with 3,500 feet of berth and a throughput capacity of 2.6 million TEUs annually. The terminal is also working toward full equipment electrification by 2030. Port leadership says this expansion—and the separately ongoing Pier B railyard project, expected by 2032—reflects a unified push for growth and green efficiency in Southern California port infrastructure. We dropped our transload rates for LA/LGB! Our Los Angeles drayage yard and transload warehouse location boasts a large drayage fleet, a large, secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your containers for palletized and floor to pallet transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a NO DEMURRAGE GUARANTEE on all orders that have been dispatched to us 72 hours prior to vessel arrival and are cleared for pickup by the last free day. Contact the team at letsgetrolling@portxlogistics.com for rates and any questions. Let’s talk about being your #1 West Coast transload team.

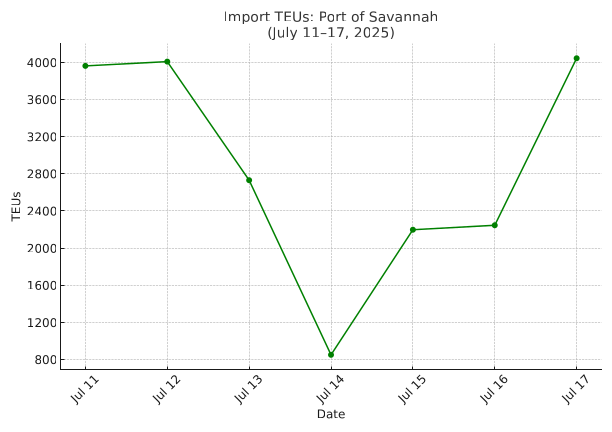

Savannah: Savannah influx since July 11th: anchor delays of 4–6 days, steady berth turns, and 6.4-day import dwell. Rail efficiency shines at 1 day—but major carriers like Hapag-Lloyd and CMA CGM are rerouting, suspending services amid 8–10 day berth delays.”

We dropped our transload rates for Savannah also! Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space AND We have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks at the best rates in all of Savannah letsgetrolling@portxlogistics.com for great rates, immediate transload capacity and supreme customer service.

Did you know? If you are looking for drayage capacity in Kansas City or Chicago? We’ve got it—and then some. Two of our busiest markets are firing on all cylinders and looking for more freight to keep the wheels rolling.

In Kansas City, we’re running 71 company drivers with 89 trucks, and over 100 combined standard, triaxle, and spread-axle chassis to handle your toughest loads. With two yard locations for empty container storage and a versatile transload warehouse, we’ve got space, equipment, and flexibility. We’re actively looking to take on more export street turns—let’s talk if Kansas City fits your network.

In Chicago, our powerhouse operation features 88 trucks, over 150 chassis (including 20’s!), and more than 100 triaxle and spread-axle units. Need heavy haul capacity? No problem—we’ve got the permits and secured yard space to make it happen. We’re ready to take on more import street turns daily.

Let’s get rolling. Reach out to letsgetrolling@portxlogistics.com to grab capacity in these high-demand markets.

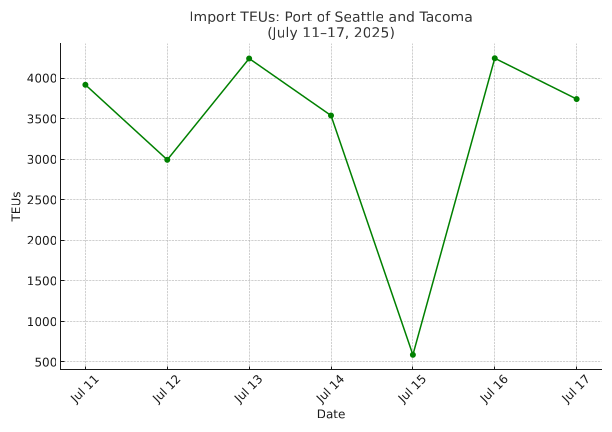

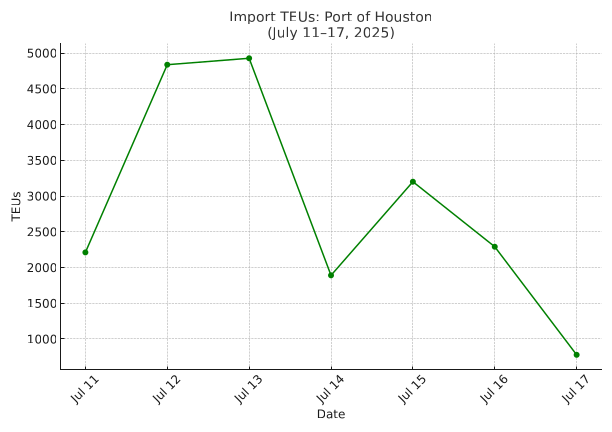

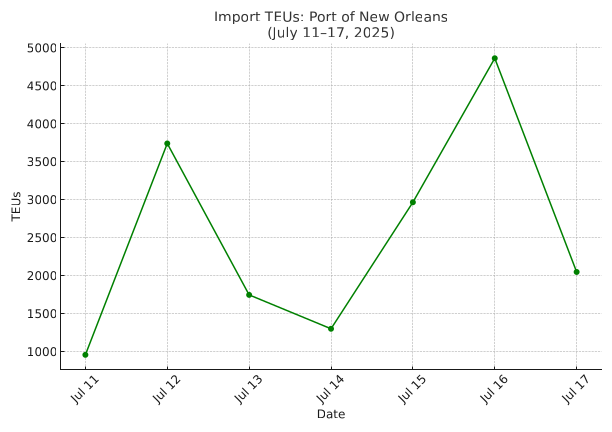

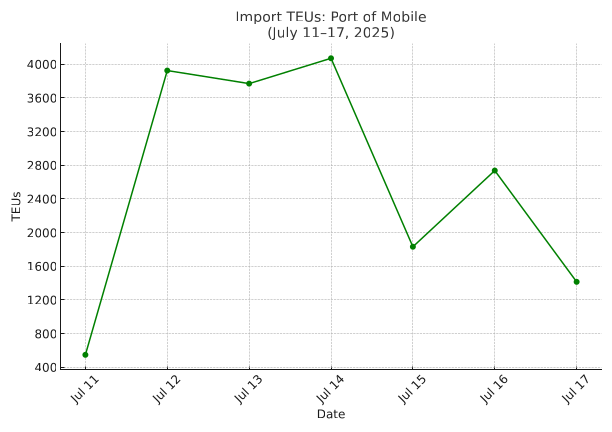

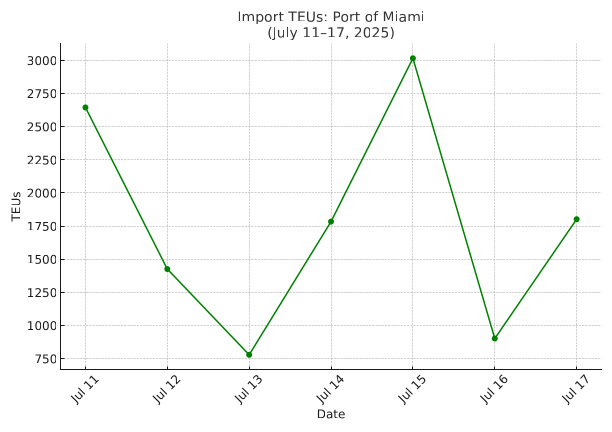

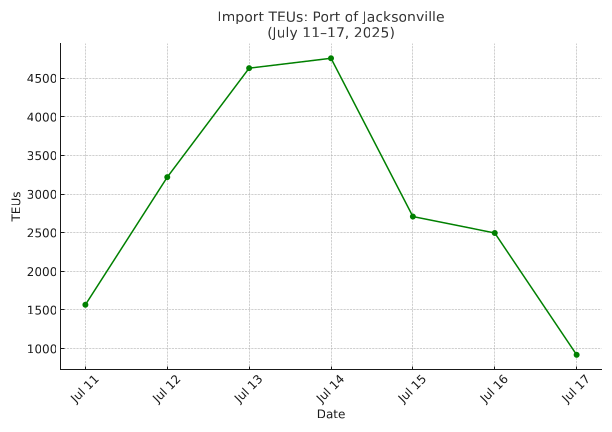

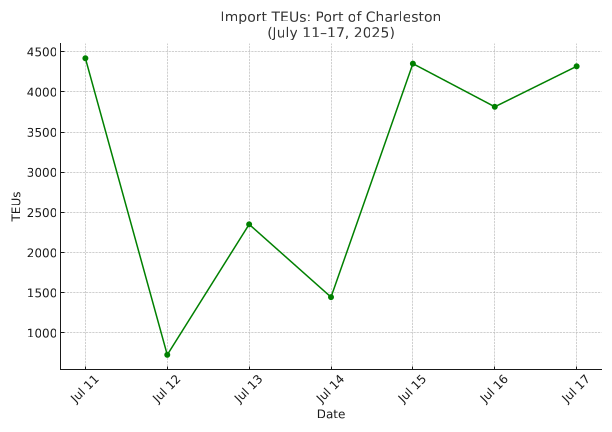

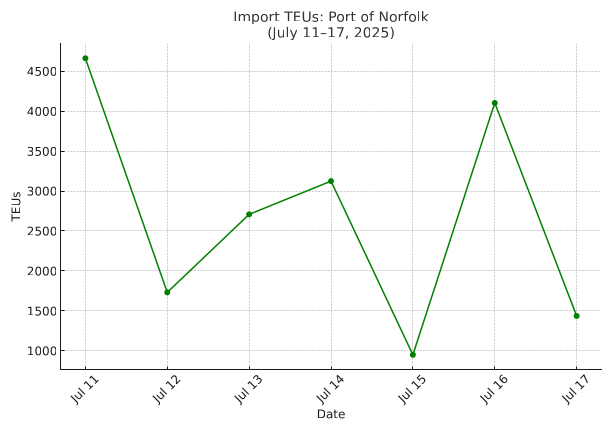

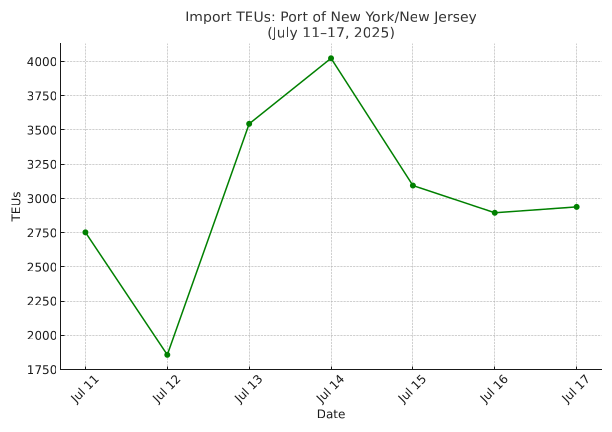

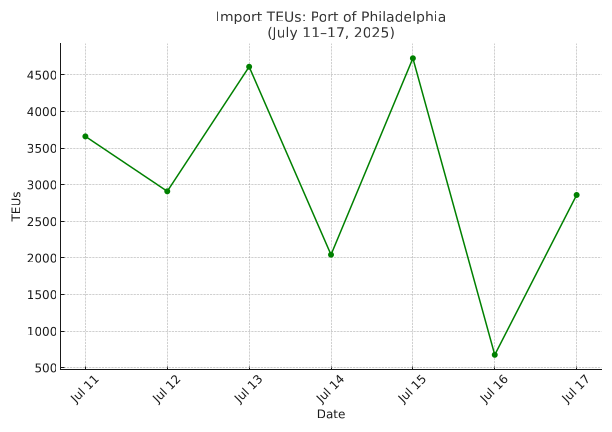

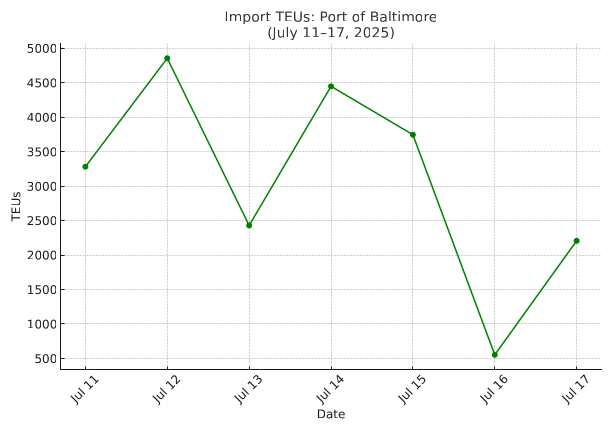

Import Data Images