Port of Savannah

1653 words 7 minute read – Let’s do this!

Tariffs have been delayed, but we can’t get too comfortable. President Trump just bought everyone a little time—signing an executive order Monday that pushes the start date for “reciprocal” tariffs to August 1st. That gives importers and logistics teams a short window to get ahead of the chaos. We’re already seeing shippers scramble to pull freight forward, reroute cargo, and lock in rates before things heat up. And while all eyes are on tariffs, don’t overlook the Big Beautiful Bill—it’s already reshaping the logistics landscape. From phasing out the $800 de minimis exemption to slashing green energy incentives and ramping up customs enforcement, the bill has serious long-term implications for how goods move into the U.S. This isn’t a fix—it’s a breather. And the countdown’s still ticking. Want more updates like this? Follow us on LinkedIn for company news, industry hot takes, and behind-the-scenes logistics content. If you’d rather have this newsletter land straight in your inbox each week, shoot us a note at marketing@portxlogistics.com to get on the list. Let’s get into it.

According to the National Retail Federation (NRF) and Hackett Associates, imports are expected to decline month over month from August through November, as the temporary extension gives way to renewed uncertainty. “The tariff situation remains highly fluid,” said Jonathan Gold, NRF’s Vice President for supply chain and customs policy. “Retailers have brought in as much merchandise as possible ahead of the reciprocal tariffs taking effect.” The Global Port Tracker (GPT) forecast was revised upward for July through October following the surprise tariff delay. While retailers welcomed the breathing room, Gold noted the policy’s unpredictability continues to complicate supply chain planning.

July imports surge, but the second half outlook softens. The latest Global Port Tracker (GPT) update calls for 2.36 million TEUs in U.S. imports this July—up nearly 11% from June’s forecast and surpassing the 2.32 million TEUs logged in July 2024. As it stands, July is the only month in the second half of 2025 currently expected to post year-over-year gains. The GPT compiles monthly import projections using data from 13 major U.S. ports across the East, West, and Gulf Coasts.

Looking ahead, the outlook dims. August imports are projected at 2.08 million TEUs—a 5% upgrade from last month’s estimate, but still 10% below August 2024 levels. September forecasts were nudged up to 1.82 million TEUs, up 2.2% month-over-month, but nearly 20% off from last year. October saw a minimal increase to 1.81 million TEUs, while the first forecast for November puts volumes at 1.7 million TEUs, down 16.2% year-over-year. The soft second-half outlook reflects continued uncertainty across the supply chain, with Hackett Associates’ Ben Hackett citing the disruptive effects of shifting tariff policies and geopolitical instability.

Meanwhile, June imports are expected to come in at 2.06 million TEUs, about 2.5% higher than forecasted last month. Final figures for May landed at 1.95 million TEUs, exceeding projections by roughly 2%. With demand expected to soften beyond July, carriers are scaling back capacity. According to eeSea, August deployments from Asia to the U.S. West Coast are slated to be 6.2% lower than in July.

What does the Big Beautiful Bill mean for Logistics and U.S. Imports?

De Minimis Duty Elimination: Starting July 1, 2027, the new law phases out the long-standing $800 de minimis duty exemption, which has allowed low-value imports (like e-commerce orders) to clear duty-free.

- Result: Businesses shipping frequent, low-value goods will now face duties and potential penalties up to $10,000 per violation

- This impacts freight forwarders, brokers, fulfillment centers, and retailers handling small parcels. Time to review & restructure import procedures.

Stricter Customs Enforcement: The bill also boosts CBP funding, enhancing enforcement capabilities for trade compliance—especially for informal imports.

- Expect more audits, hold-ups, and stricter paperwork for small-scale shipments that previously moved quickly.

- Tip: Coordinate with brokers now to tighten classification, valuation, and documentation processes.

Reduced Green Incentives: Several clean energy and sustainability programs, including green-freight incentives, are being scaled back or sunset.

- This may limit funding for rail modernization, chassis electrification, and other eco-logistics investments.

- Action: If your supply chain plan includes sustainability programs, you may need to secure alternative funding or accelerate current projects.

Boost for Air Cargo & Infrastructure: The bill provides $12 billion for air-traffic modernization and aviation logistics, which is a significant win for airfreight stakeholders.

- Benefits: Faster clearance, better handling, and modernized cargo processing.

- Opportunity: Tighten your air–sea optimization strategies as infrastructure improvements roll out.

Takeaways for Your Supply Chain:

- Start prepping now: Engage brokers & customs early to comply with deminimis changes before 2027.

- Budget review: Factor lost green subsidies into your freight cost models.

- Plan air-logistics upgrades: Expect faster air connectors; re-route high-value goods accordingly.

- Communicate proactively: Inform your clients about how post-2027 imports will change—especially ecommerce logistics.

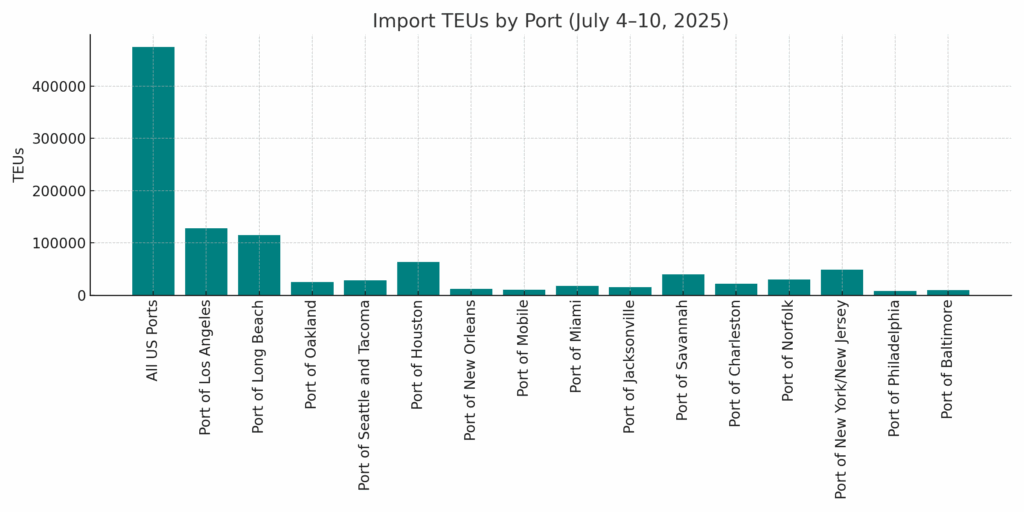

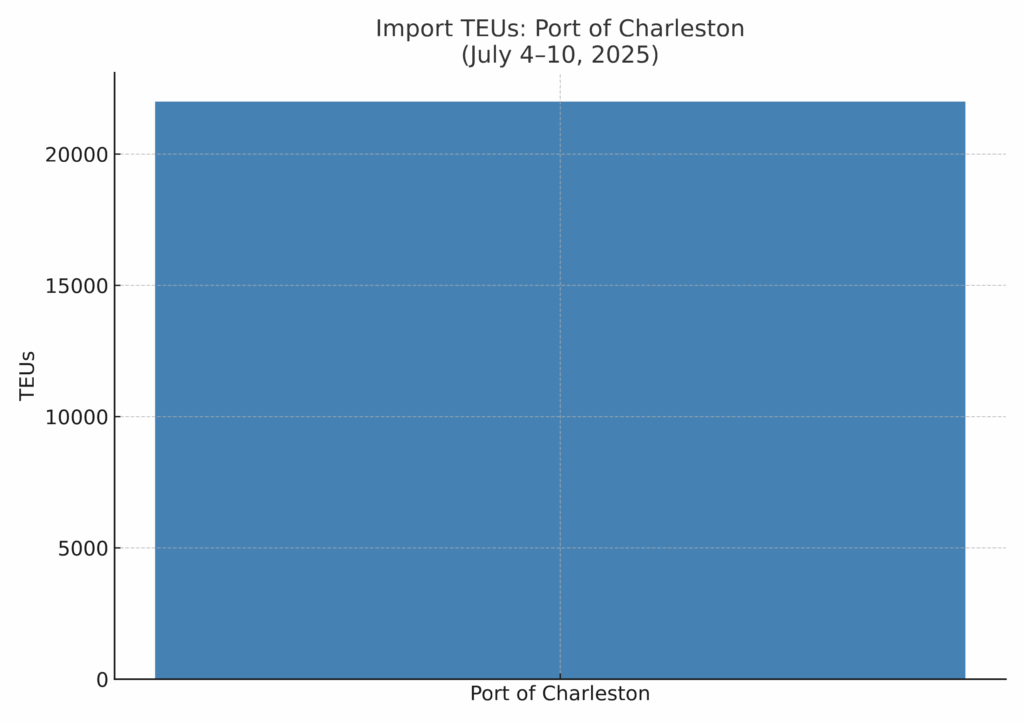

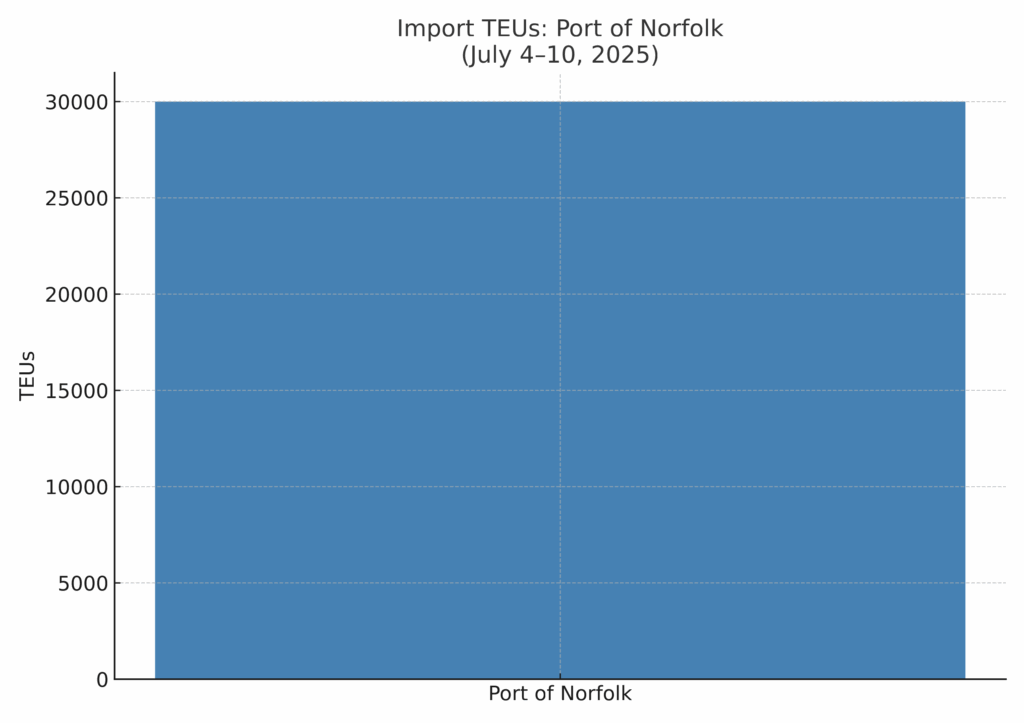

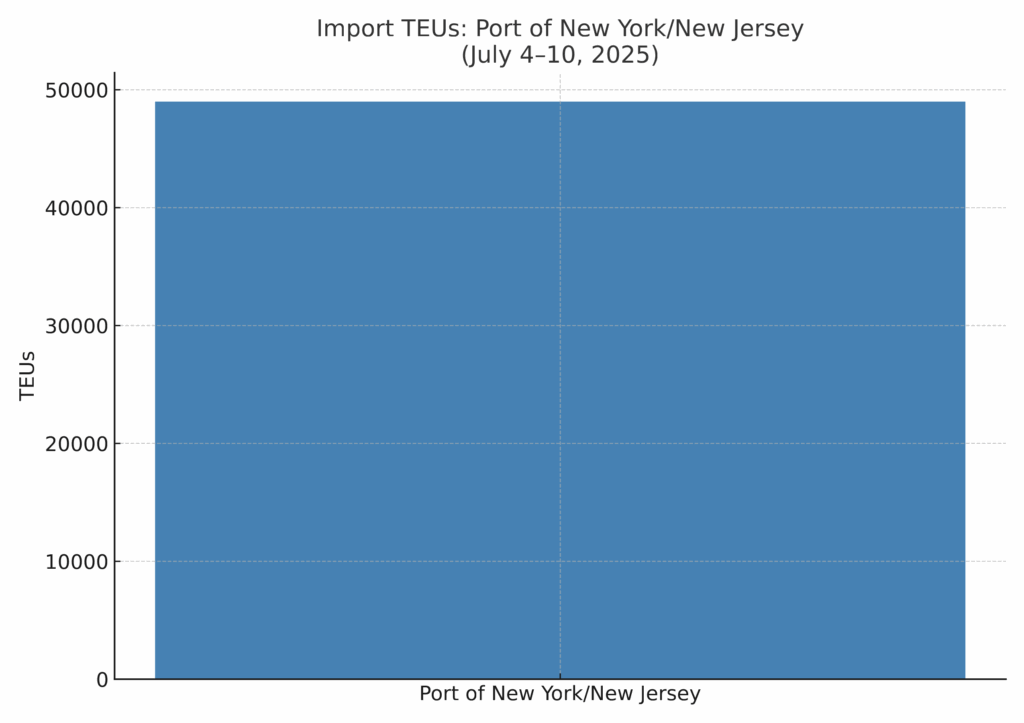

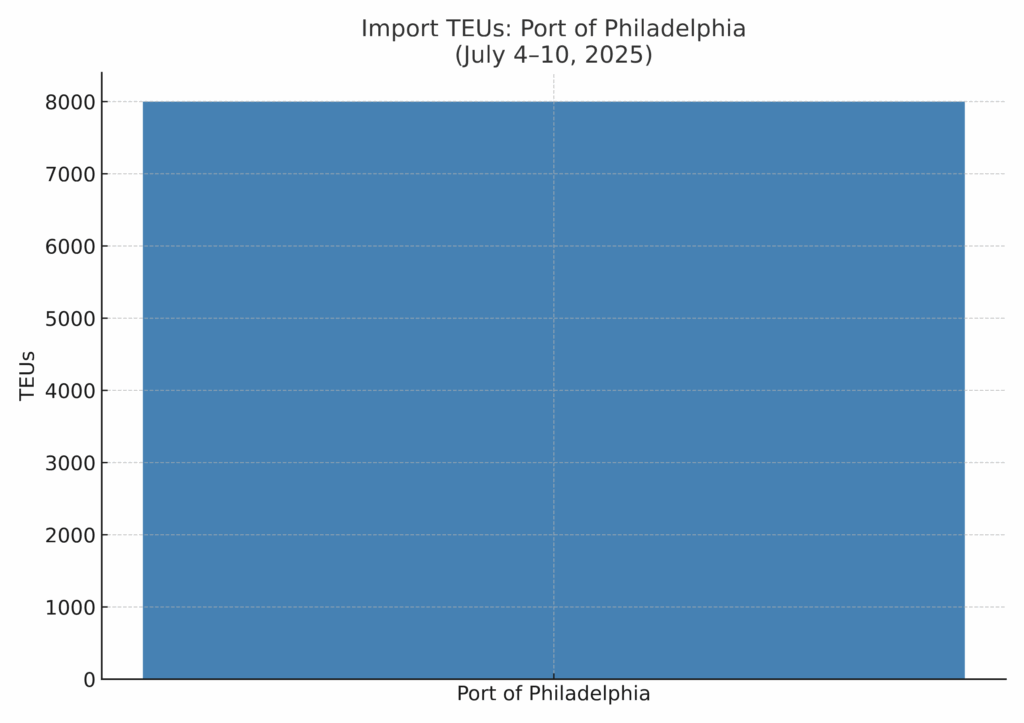

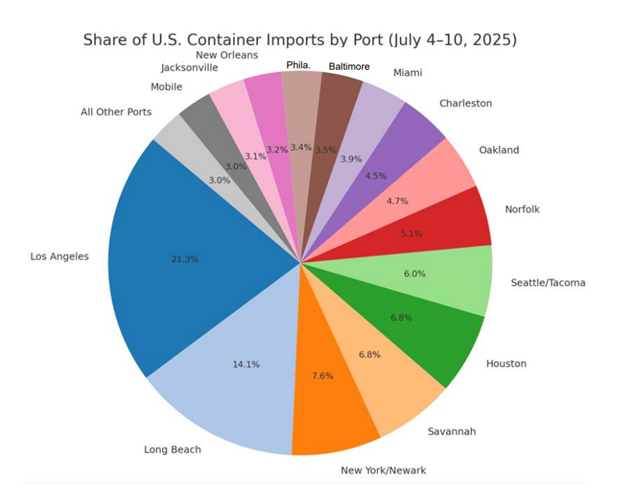

Import TEUs are down 0.63% this week from last week – with the highest volumes coming into Los Angeles 21.3%, Long Beach 14.1% and NY/Newark 7.6%

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

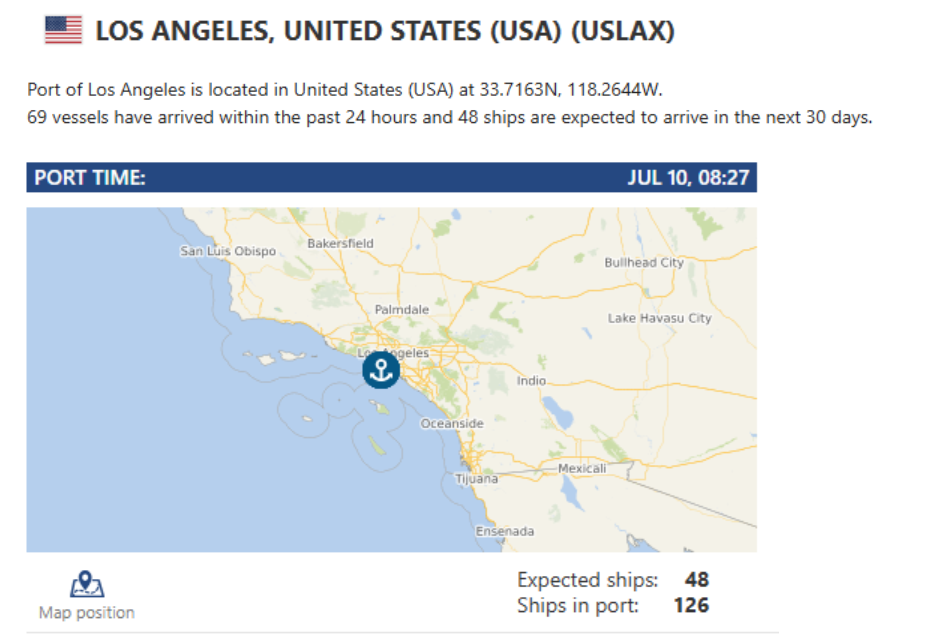

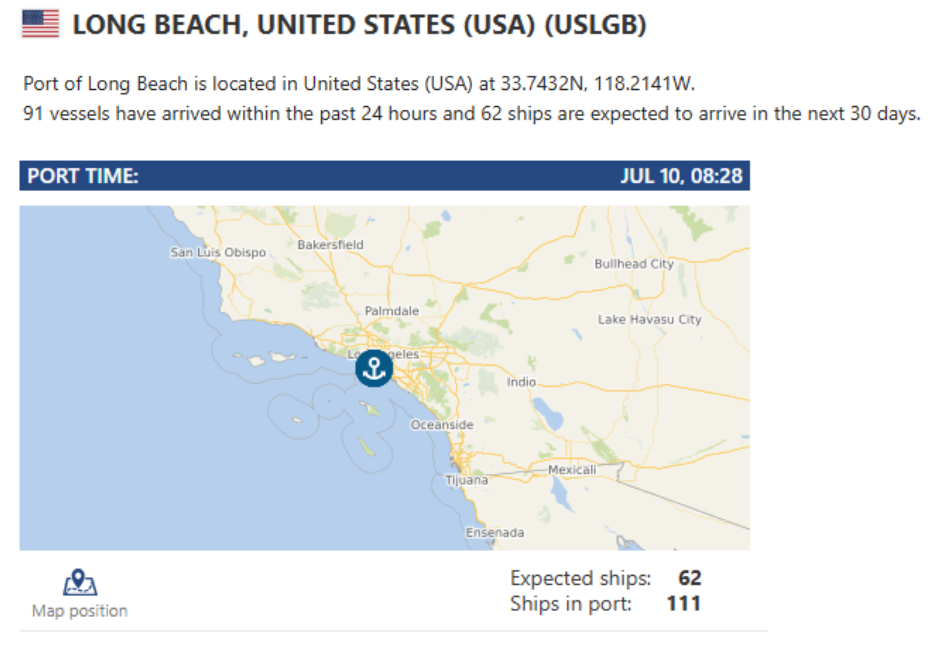

LA/LGB: At Port of LA: Vessel anchors waiting an average of 4 days, import rail dwell steady at 2.7 days, and off-peak gates running as scheduled—even after the July 10 ILWU shutdown—LA continues processing strong call volumes (86 arrivals in 24 hrs, another 48 expected). The Port of Long Beach has maintained steady import activity—containers are dwelling on terminal for 4–8 days, with average gate turn times between 38–53 minutes. Vessels are being berthed immediately upon arrival, though high empty container returns and ongoing chassis shortages continue to present equipment constraints. Overall, operations are fluid and predictable but monitoring terminal capacity and equipment availability remains key. On July 10th ILWU is holding a stop work meeting from 5 p.m. to 3 a.m. During this time, all marine terminal gates at LA and Long Beach are closed, including night Off Peak shifts. We dropped our transload rates for LA/LGB! Our Los Angeles drayage yard and transload warehouse location boasts a large drayage fleet, a large, secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your containers for palletized and floor to pallet transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a NO DEMURRAGE GUARANTEE on all orders that have been dispatched to us 72 hours prior to vessel arrival and are cleared for pickup by the last free day. Contact the team at letsgetrolling@portxlogistics.com for rates and any questions. Let’s talk about being your #1 West Coast transload team.

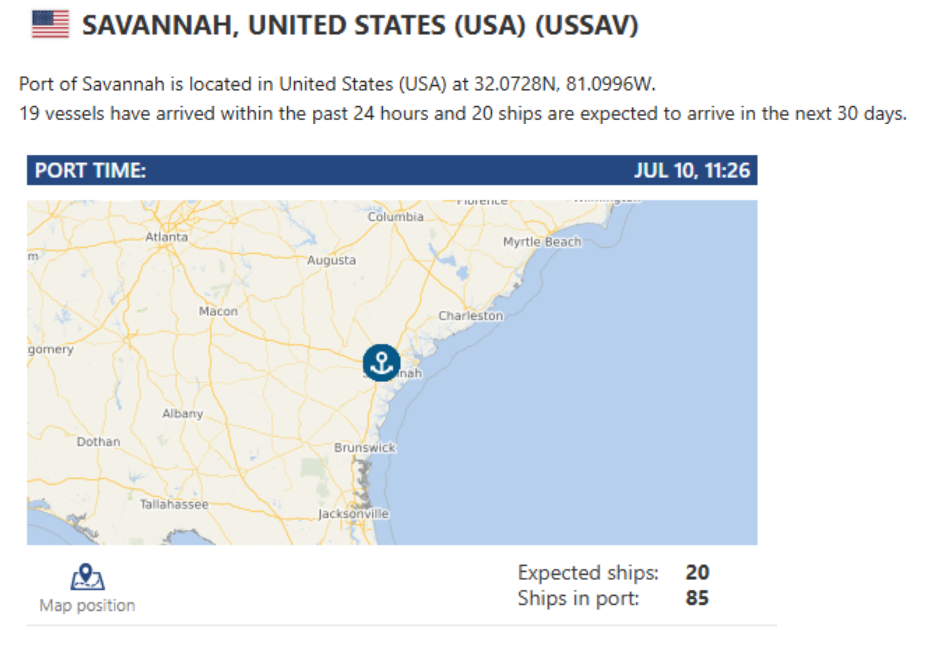

Savannah: Through the holiday week, Savannah has maintained smooth port operations. Vessel berth wait is a manageable 0.7–1-day, terminal gate turns are averaging 33-51 minutes, and import dwell remains at 6.5 days. Most notably, Savannah continues to outperform major ports with a rapid 1-day rail dwell, cementing its top-tier intermodal efficiency. For supply chain planners, this signals rail reliability amid stable terminal performance. Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space AND We have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks at the best rates in all of Savannah letsgetrolling@portxlogistics.com for great rates, immediate transload capacity and supreme customer service.

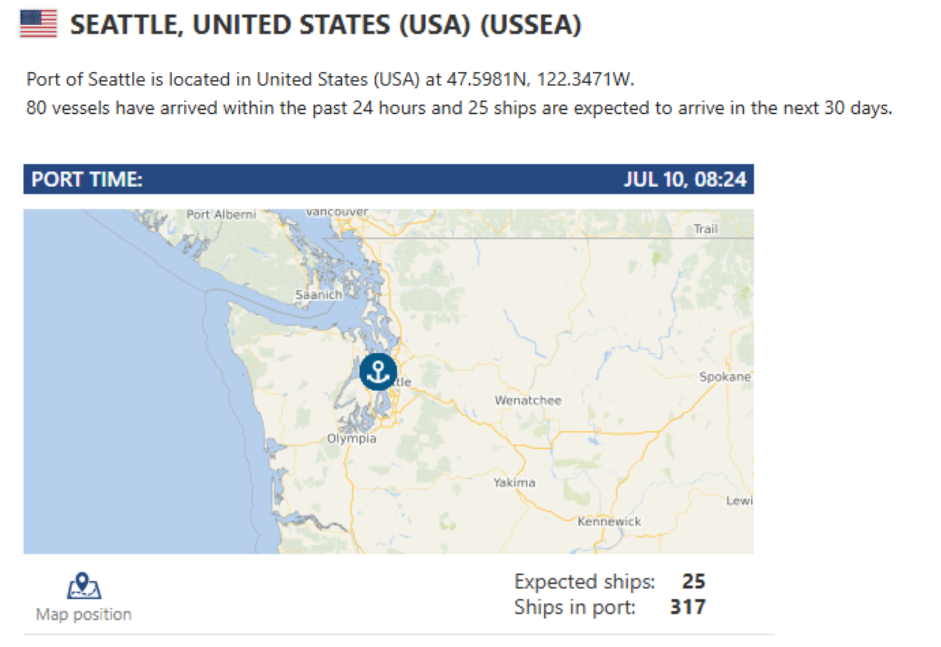

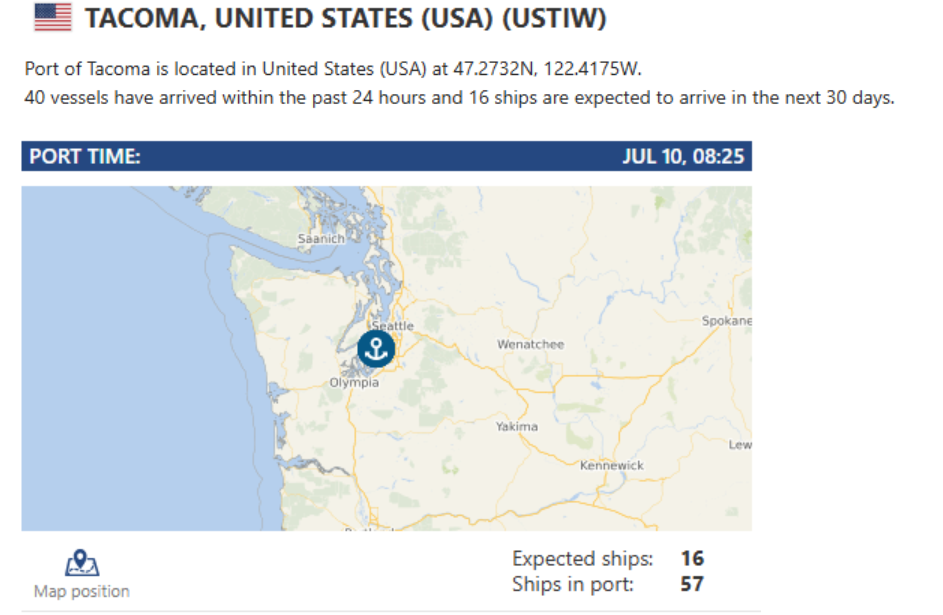

Seattle/Tacoma: Post-holiday, volume has remained smooth through both Seattle and Tacoma terminals. Vessels are being berthed immediately; import rail dwell is flat at 2.3 days (Husky) and 3 days (T18), with 1-day rail dwell at APMT/Maher. Gate turns remain efficient (48–93 minutes), and Husky implemented hoot gates July 7–10th. NWSA also brought Husky’s shore power system online marking the first West Coast terminal to do so this summer. Do you want to learn how shipping through the SEA/TAC ports can benefit your supply chain and if you are looking for an all-star drayage/transload warehouse team? Our Seattle operation has plenty of drayage capacity with the addition of 11 new drivers and a large range of warehouse capabilities for ongoing transloading projects. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse customer service.

Did you know? We are a little over 2 weeks until the 2025 Empire State Ride! our very own Brand Ambassador Charlie Bodine of our Denver office will be showing off his athletic abilities and repping Port X as our company rider at this year’s Empire State Ride? For seven days, Charlie will pedal across 500+ miles of New York State, starting in Staten Island and finishing just around the corner from our Buffalo HQ in Niagara Falls. He’s not just doing it for the ride either, he’s joining the fight against cancer, helping to raise funds for groundbreaking research at Roswell Park, a local but internationally known powerhouse in cancer research. Charlie, we’re pumped to have one of our own on this incredible ride!

If you want to support Charlie and the cause, stay tuned, we’ll be cheering him on and checking in with him each day of the ride. To donate or to learn more about the ride, click below!

https://give.roswellpark.org/site/TR/SpecialEvents/General?px=1702335&pg=personal&fr_id=1990

Import Data Images