Port of Los Angeles

1441 words 5 minute read – Let’s do this!

Welcome to this week’s Port X Logistics Market Update. We’re diving into a short-term surge hitting U.S. West Coast ports, what’s driving it, and what it means for rates, lead times, and your supply chain strategy. But first—don’t miss a beat, follow us on Linkedin for more company news, hot takes on industry trends, and behind-the-scenes updates. Want this newsletter sent straight to your inbox each week? Shoot us an email at marketing@portxlogistics.com to get added to the list for future market updates and all things logistics. Let’s get into it.

West Coast ports are getting a much-needed jolt of activity—finally. After a sluggish May and early June, ports like Los Angeles, Long Beach, and Seattle/Tacoma are forecasting a spike in inbound containers over the next few weeks. The reason? Importers are racing to get cargo in ahead of tariff relief expirations set for July 9th and August 14th —key deadlines that could impact duties on goods from China and other trade partners.

At Port X Logistics, we’re already seeing the ripple effects across our transload and drayage ops—and we’re keeping close tabs on how this short-lived surge could affect capacity, lead times, and rates. According to port forecasts:

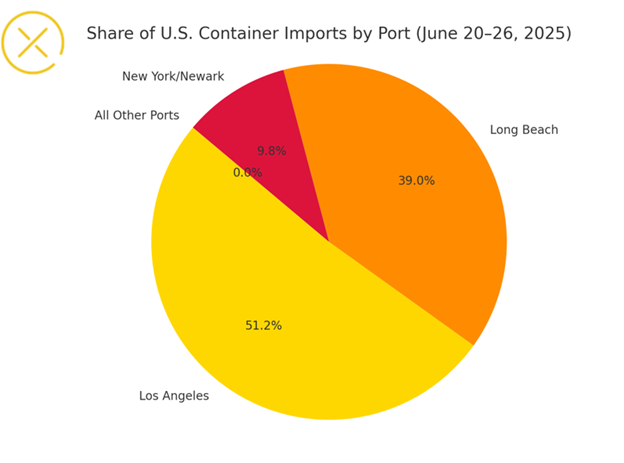

- Los Angeles is expecting 138,519 TEUs this week, before gradually dipping to 101,003 TEUs by the week of July 6th.

- Long Beach projects a big swing—starting at 84,109 TEUs this week, surging to 125,286 TEUs next week, then stabilizing around 114,073 TEUs by July 20th.

- Seattle/Tacoma (NWSA) is forecasting more vessel calls month over month, with 55 ships in June, up from 46 in May.

Ports generally consider 100,000+ TEUs a week to be strong—so these forecasts signal a welcome (if temporary) rebound. For shippers, this mini peak may bring some tightening in transit times and equipment availability – especially at West Coast transload hubs. While major congestion isn’t expected, increased volume could slow dray turns and inland moves.

With import volumes climbing, we could see a brief pause in the trans-Pacific rate decline. Spot rates into the West Coast are down 10% week over week, currently at $2,900 per FEU, per S&P Global’s Platts data. That’s a far cry from $6,040 earlier in June—but a volume uptick could stem further drops.

Still, the “moving target” nature of this market means frequent updates and tighter planning windows. We’re here to help you stay ahead of it. This short-term bump doesn’t guarantee long-term stability—but it’s a window of opportunity. Whether you’re expediting cargo ahead of tariff changes or positioning for back-half demand, Port X Logistics is ready to help you navigate it with agile solutions, real-time tracking, and full-service dray, transload, and final mile support. Let’s move smarter, together.

Some more key items to watch as we enter July: Iran’s parliament voted on June 22nd to close the Strait of Hormuz—though the final decision is pending Supreme Leader approval. UK maritime authorities and major shipping lines (like Maersk & Hapag-Lloyd) confirm vessels are still transiting, but with heightened security precautions and rerouting plans.

Container spot rates to the Arabian Gulf surged +55% month‑on‑month, driven by war-risk premiums. Although this premium mostly affects Middle Eastern routes, it ripples into global freight costs, adding pressure to overall container shipping rates. Tanker activity through Hormuz has dropped significantly; while container ships still go through, insurers have raised rates, and surcharges may be passed along to shippers globally.

While U.S. container import volumes haven’t dropped due to these tensions, import costs are increasing, making it more expensive to bring goods ashore. Any sustained escalation could tighten trans-Pacific supply chains, potentially causing blank sailings or container shortages at U.S. ports.

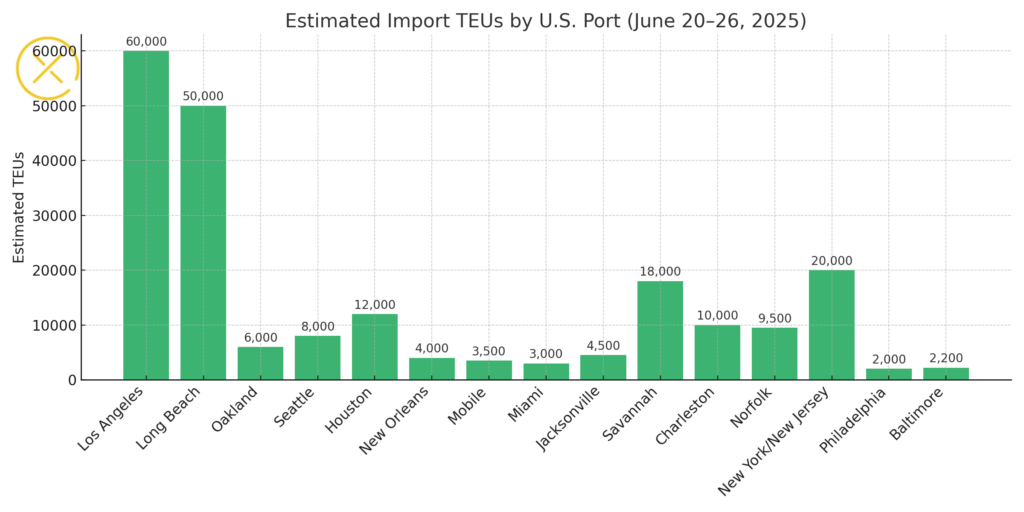

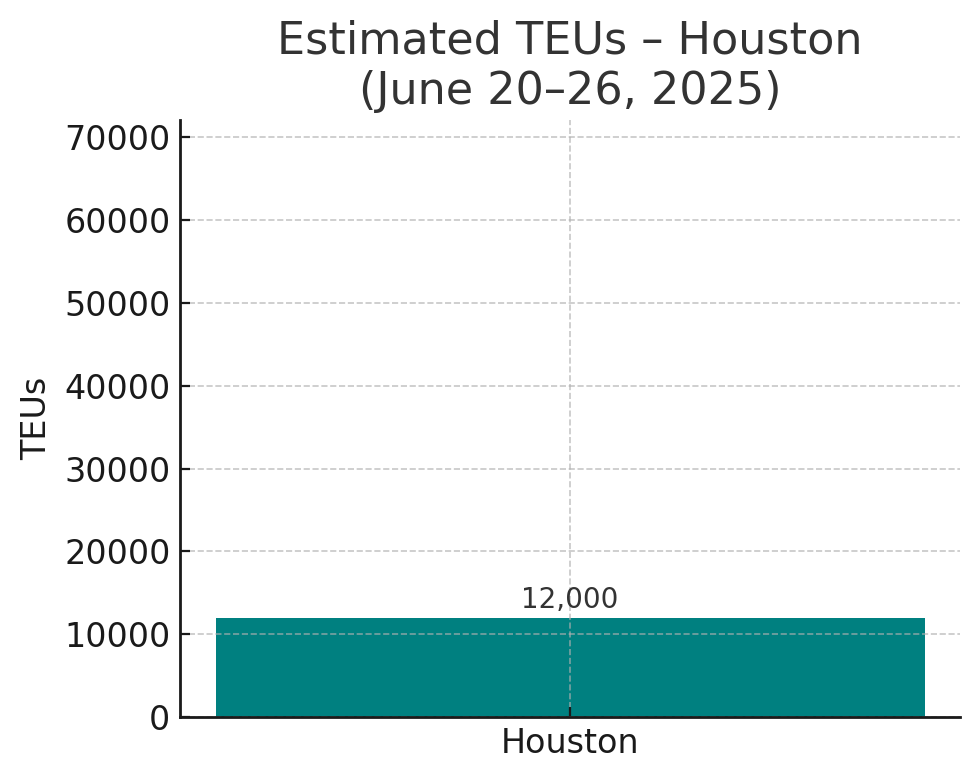

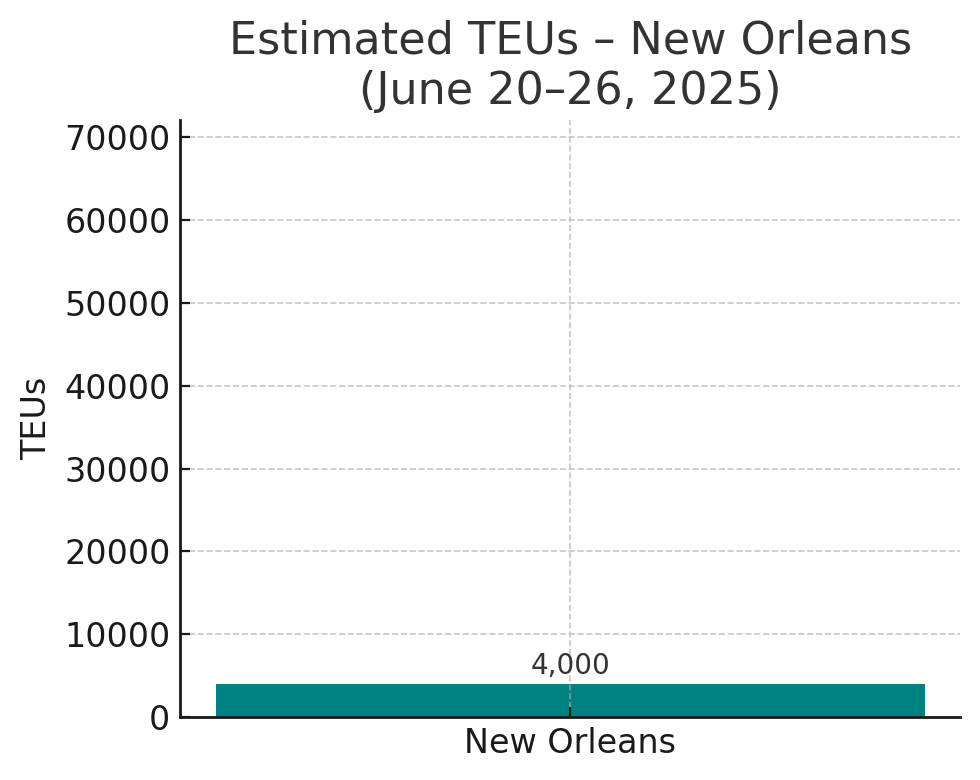

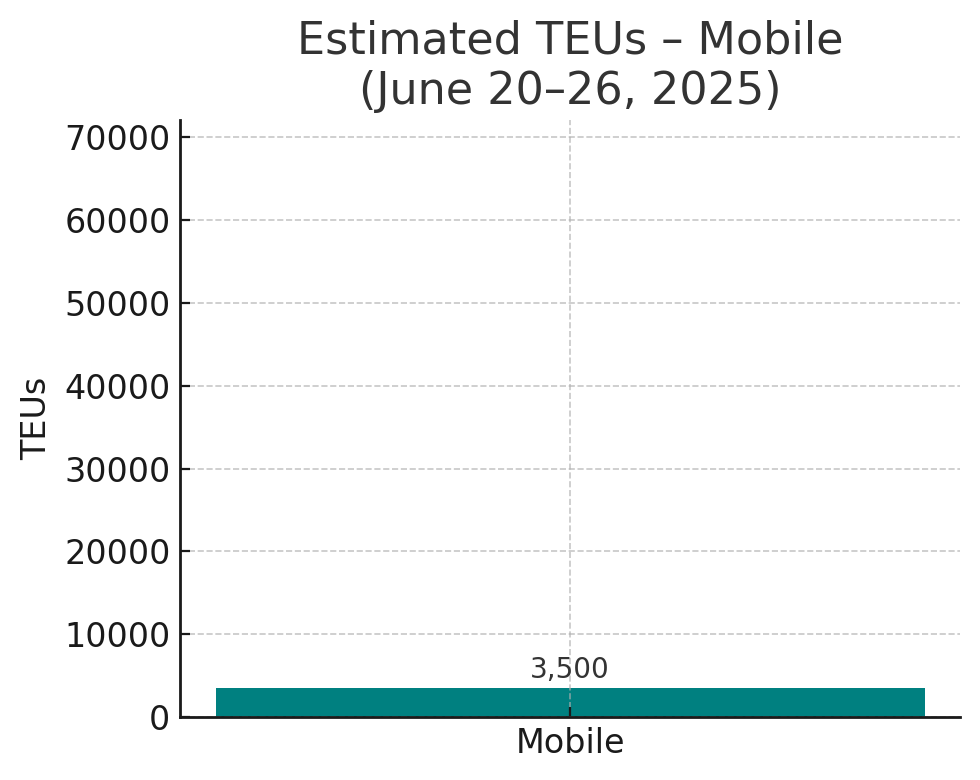

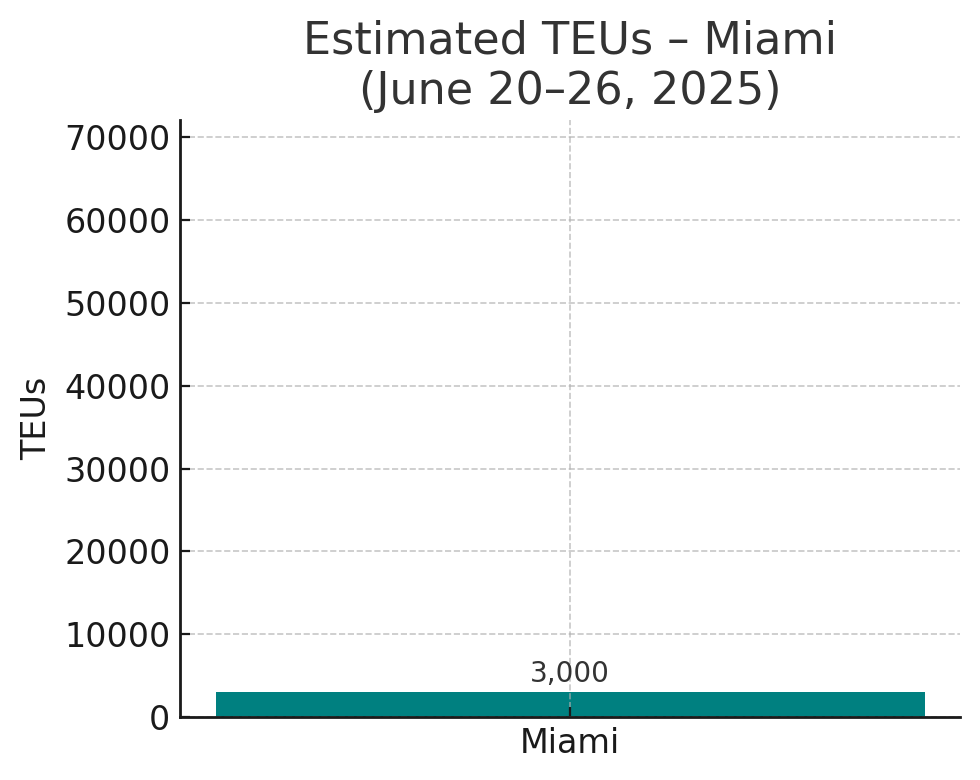

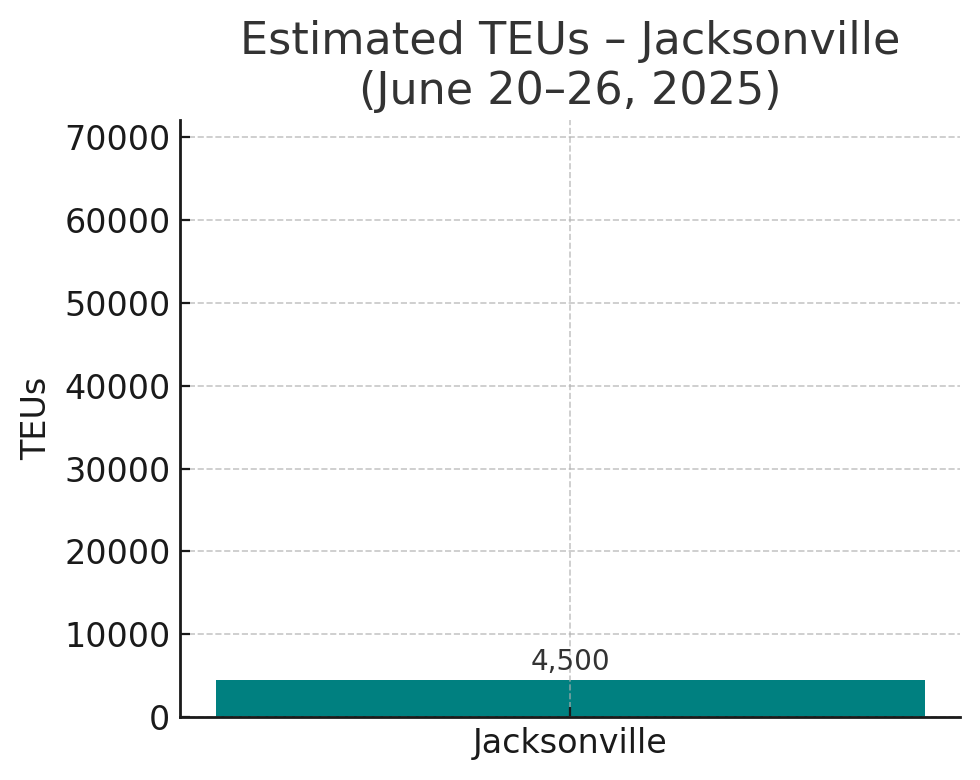

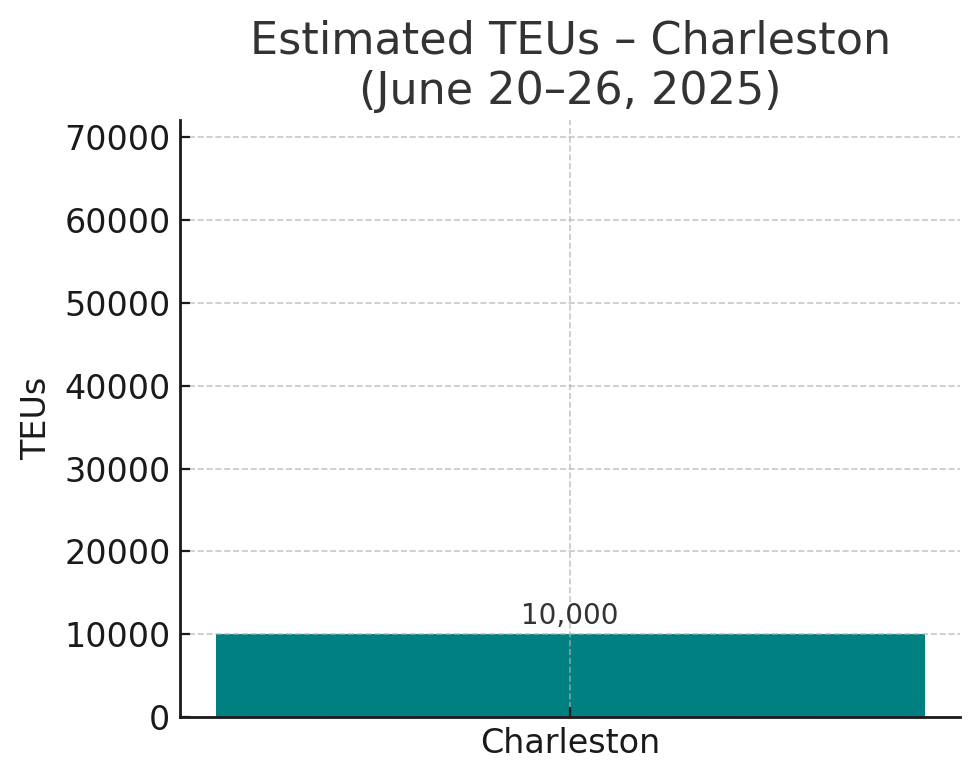

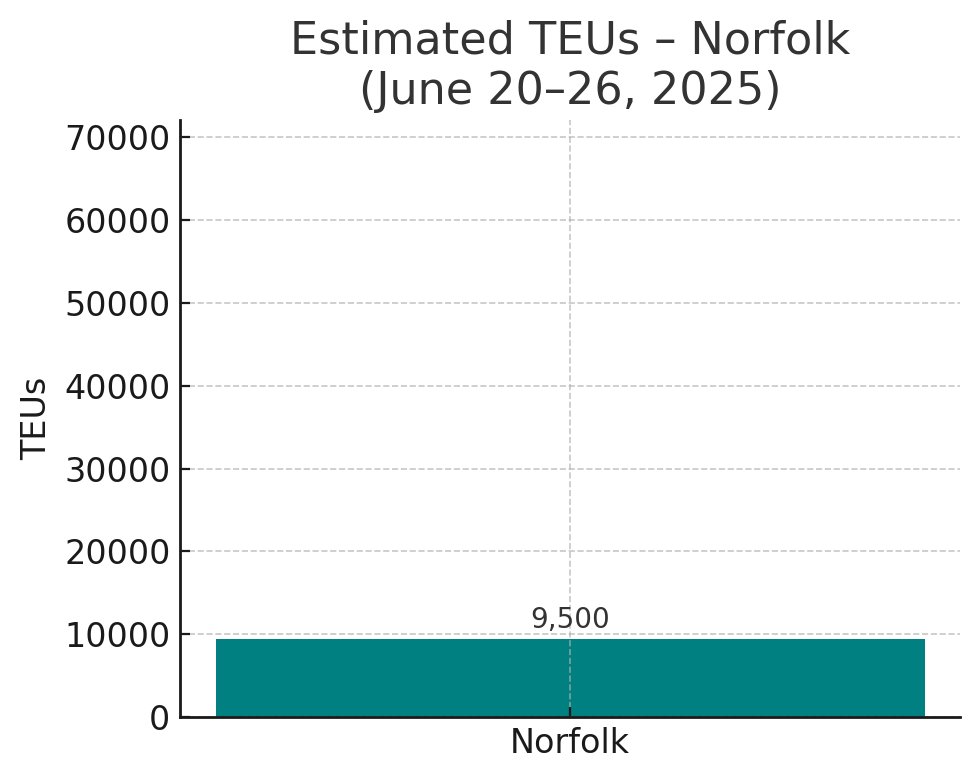

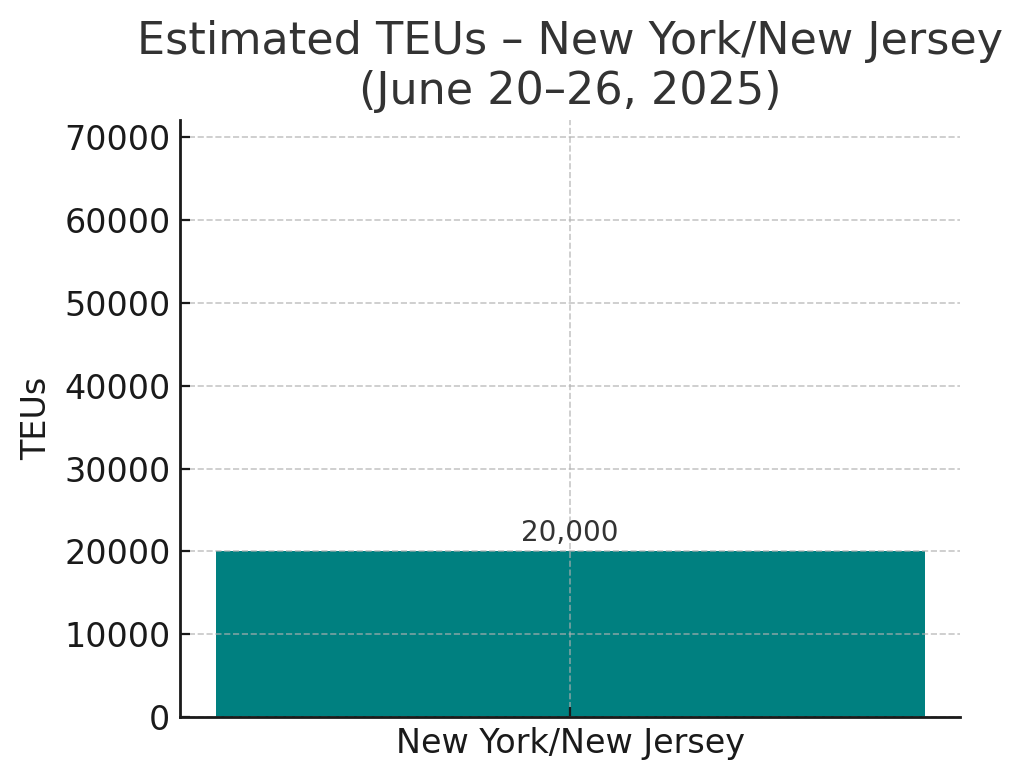

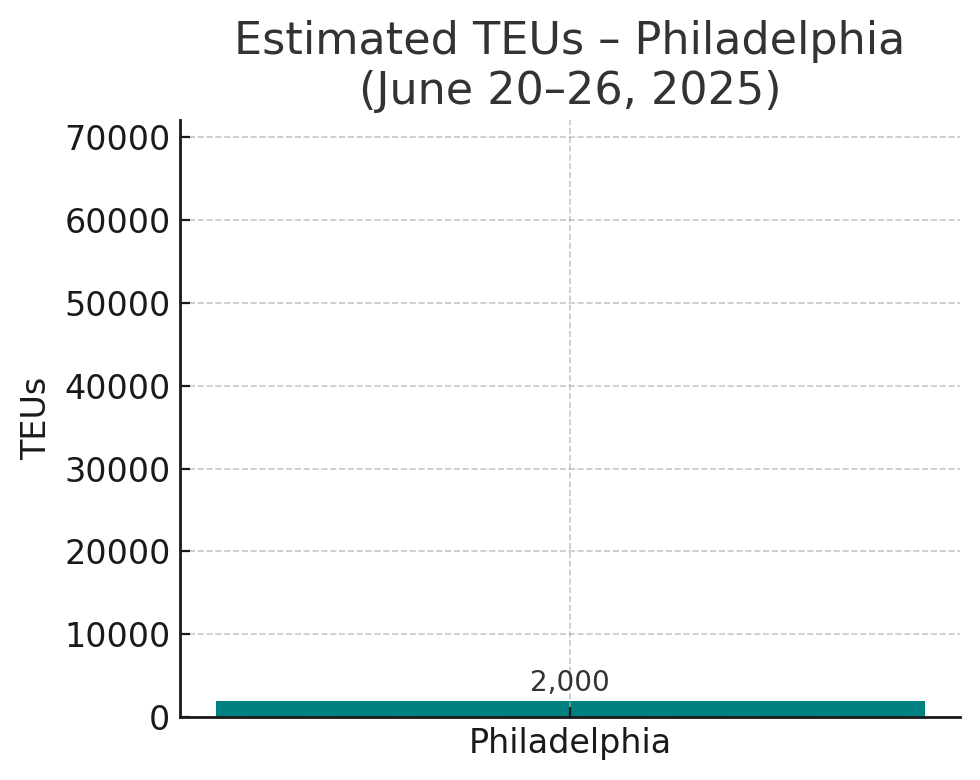

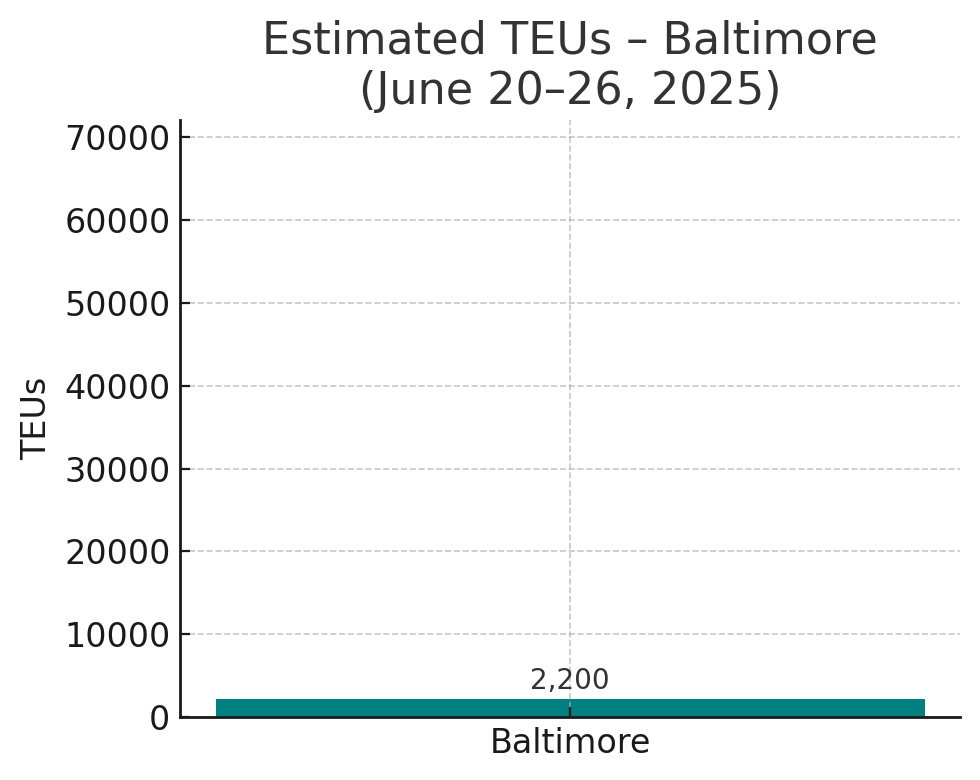

Import TEUs are up 6.21% this week from last week – with the highest volumes shown in the chart below:

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

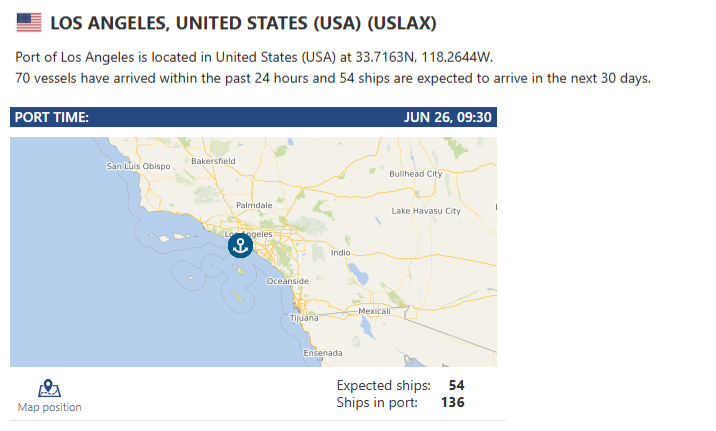

LA/LGB: Berth wait times at the Port of Los Angeles have edged up to approximately 3 days, with four vessels currently anchored offshore. However, a recently introduced digital scheduling platform is smoothing berth queues and cutting emissions—helping to contain the fallout from tariff-related volume drops. If you’re shipping through LA, anticipate possible delays but expect more predictable operations than earlier in the year. Import rail dwell time averages about 9 days from vessel discharge to destination ramp at LA—slightly above Long Beach’s 8 days. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a NO DEMURRAGE GUARANTEE on all orders that have been dispatched to us 72 hours prior vessel arrival and are cleared for pickup by the last free day. Don’t let all our capacity slip through your fingers, front loading volumes, vessel backups and rail dwells will make LA transloads the hot commodity, contact the team to get on the capacity list, for rates and any questions letsgetrolling@portxlogistics.com

Houston: Port Houston will implement new fees next month to force the movement of long-dwelling refrigerated import containers at the port. That comes as dwell times for reefer containers in Houston exceed a week and reefer volumes topped 10,000 TEUs for the first time in three years. The new fees, which begin July 1st and kick in after one week of free time for most cargo, are $51.60 per day per container for one to three days, $77.40 per day for four to seven days, $103.20 per day for eight to 13 days, and $154.80 per day for 14 or more gate days. The new fees will override the existing sustained import dwell fee, which is $45 per day after one week. Port X Logistics has drayage assets in Houston 32 trucks with the capability of long-haul drayage and we have a transload warehouse in LaPorte that can transload anything from standard pallets, to heavy lumber and industrial coils. If you need help in the Houston area we got your back, we also have a drayage network with 19 trucks and yard space servicing the Dallas area contact letsgetrolling@portxlogistics.com.

Chicago: Norfolk Southern (NS) raising storage fees on ocean containers starting July 7th: NS is rolling out temporary increases to storage fees for ocean containers that aren’t picked up on time—starting July 7th . The move is meant to keep terminals fluid as freight volumes are expected to ramp up. Here’s the breakdown:

Day 3 and beyond: $200/day (up from $100)

After Day 6 and beyond: $300/day (up from $200)

These higher fees will stick around until port activity slows down. Domestic intermodal loads won’t be affected—this only applies to international containers sitting past their free time. The message is clear: Don’t delay your pickups, or your wallet might feel it. Our Chicago asset drayage team has full capacity to get your Chicago containers moving. We have 88 trucks, 150 chassis (including 20’!) and specialized chassis/equipment including 100 tri-axle and spread axles combined and a secured yard space and we are able to secure permits to haul heavy containers. For great rates, capacity and supreme customer service contact the team at letsgetrolling@portxlogistics.com.

Did you know? Carrier 911 is ready to be your domestic air export hot shot carrier! Carrier 911 exists for your AOG nightmares, our “Easy Button” technology compresses hours of logistics coordination into minutes — one click/tap activates our entire specialized network. When your $150,000-per-hour downtime clock starts ticking, our TSA-certified drivers deploy in vehicles within 60 minutes of your call. We go above and beyond regular updates — we deliver obsessive real-time tracking, photographic proof at pickup and delivery, and instant POD notifications that eliminate your status-call anxiety. From Wisconsin to O’Hare or Charlotte to Miami, our drivers have conquered the most complicated, middle-of-the-night, cross-state emergencies. And all you have to do is sit back and watch that little tracking dot move across your screen. Let our Carrier911 team be your best solution and book your Carrier 911 demo today and discover why countless supply chain managers trust us when an AOG crisis hits.

Import Data Images