Port of Charleston

1340 words 6 minute read – Let’s do this!

Asia – U.S. West Coast spot rates surged past $6,000 per box before easing this week. It’s a high stakes balancing act of volume, velocity, and volatility and now’s the time to rethink your Q3 strategy. Whether you’re adjusting lead times, hedging fuel costs, or shifting lanes, smart moves made now will pay off when peak hits. East Coast importers, take note – the tides are shifting fast. With oil nearing $78 and Red Sea disruptions rerouting vessels around Africa, Asia – East Coast transit times are stretching and costs are climbing, at the same time, rates spiked, particularly on the Asia – East Coast lane, as capacity tightened and supply chains strained under geopolitical pressure. If you’re still relying on old playbooks, now’s the time to pivot. Diversify lanes, build buffers, and be ready – because peak season won’t wait.

Need more advice on how to stay current? Follow our LinkedIn page to see other company news and industry related topics and to get on the list for this weekly Market Update Newsletter and future industry related news sent directly to your inbox email marketing@portxlogistics.com.

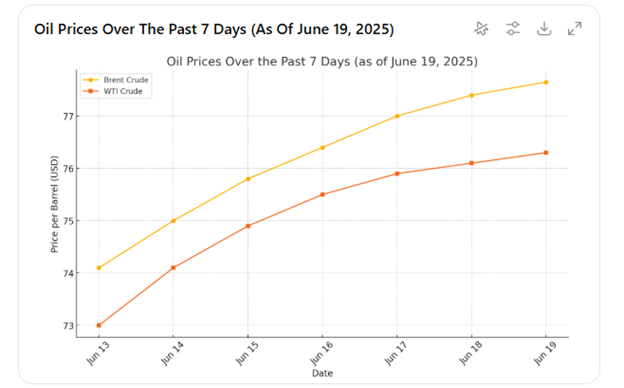

As Brent crude hovers near $77.65 and WTI trails close behind at $76.30, oil is once again in the logistics spotlight. These levels, driven by renewed conflict in the Middle East and tight OPEC+ discipline, are injecting a fresh layer of volatility into global freight and distribution networks. Below, we break down the impact across key sectors and what to watch as we move into Q3.

Logistics & Freight

- Bunker Fuel Costs Rising: Higher oil prices are pushing marine fuel (VLSFO) costs upward, triggering increases in BAF (Bunker Adjustment Factor) surcharges across trans-Pacific and Asia–Europe lanes.

- Rerouting Impacts: Carriers are avoiding the Red Sea and Suez Canal amid ongoing Houthi attacks, opting for the Cape of Good Hope. This adds 10–14 days in transit, driving both cost and schedule volatility.

- Airfreight Squeeze: Jet fuel premiums are nudging air cargo rates higher, particularly on high-tech and fashion corridors from Asia to the U.S. and Europe.

Tip: Revisit rate caps and consider shifting inland rail to hedge against ocean volatility.

Manufacturing & Retail

- Material Cost Inflation: Oil-derived inputs like plastics, adhesives, and synthetic fabrics are seeing upstream cost increases.

- Auto & OEMs: Component pricing and outbound distribution are both under pressure, especially for imports with long lead times.

- Consumer Goods: Retailers may see Q3 margin erosion unless freight contracts and sourcing strategies are reassessed.

Tip: Engage with suppliers now about contingency planning and price-lock options.

Energy & Trade

- U.S. Shale Response: Domestic producers are seeing profit opportunities, but any overproduction risks oversupply by Q4.

- Refiner Margins Shrinking: With crude costs up and end-user demand steady or soft, refiners are navigating a narrowing profit window.

- Emerging Market Exposure: Countries like India face currency pressure and inflation spikes, creating new risk layers for sourcing.

Tip: Monitor diesel and fuel surcharges on cross-border trucking and export drayage lanes.

What to Watch Next?

Factor | Potential Impact | Recommended Action |

Oil nearing $80/barrel | Higher ocean & air freight rates | Review Q3 shipping budgets |

Red Sea disruptions | Transit delays & rerouting | Pull forward key inventory |

Currency devaluation | Import cost spikes in Asia, LATAM | Diversify sourcing away from hot zones |

With peak season approaching, importers should expect volatility—not just from trade and tariffs, but also from oil markets and events in the Middle East. Flexibility, forecasting, and freight partnerships will be critical to staying competitive through the summer. Stay safe, stay nimble.

Here is a chart showing the trend of Brent and WTI crude oil prices over the past 7 days:

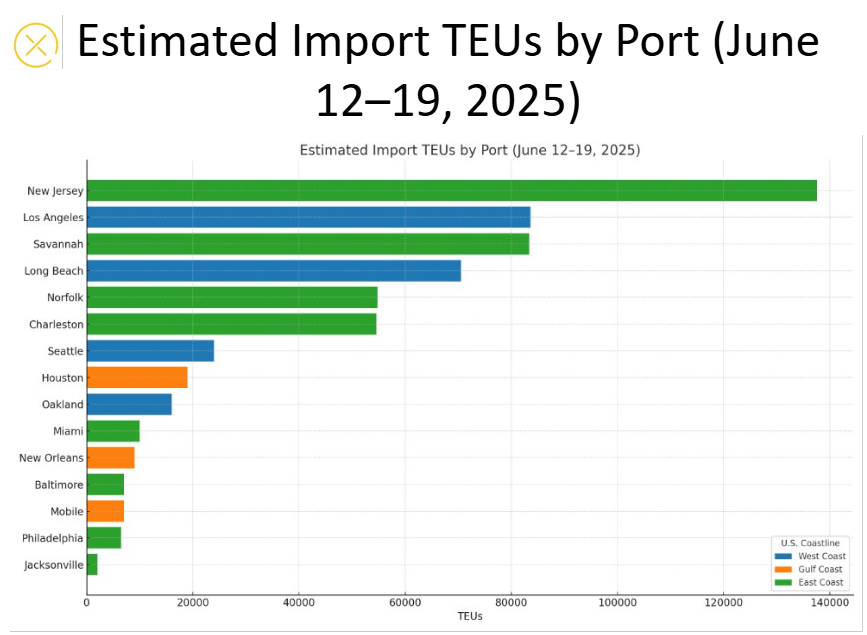

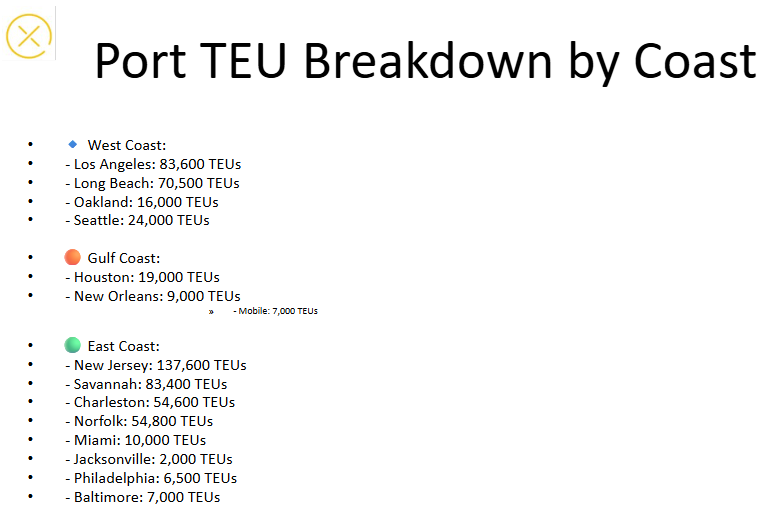

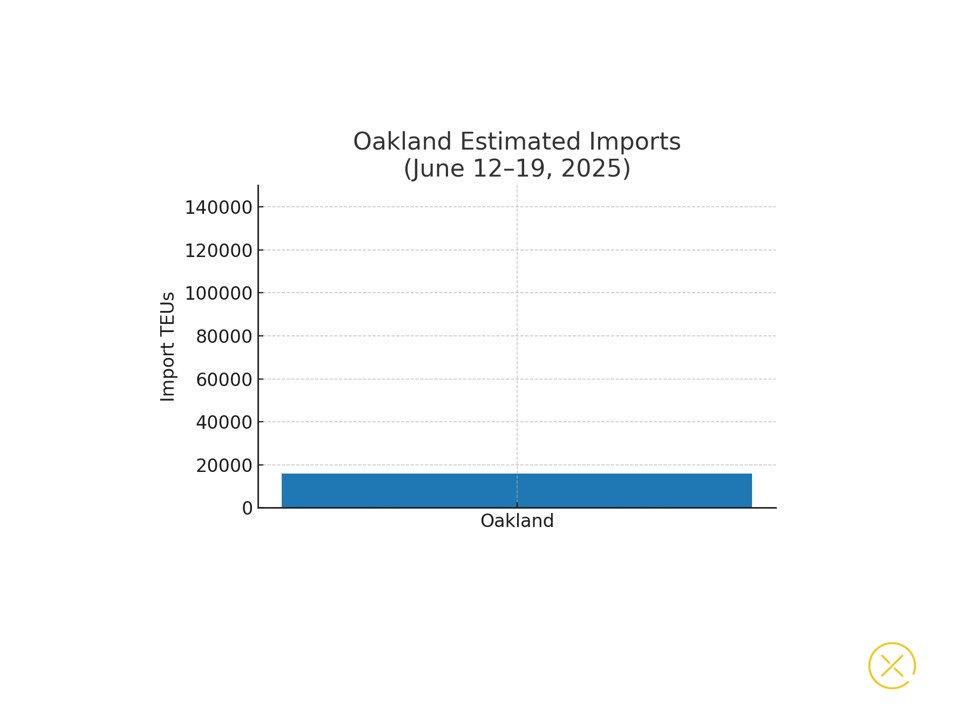

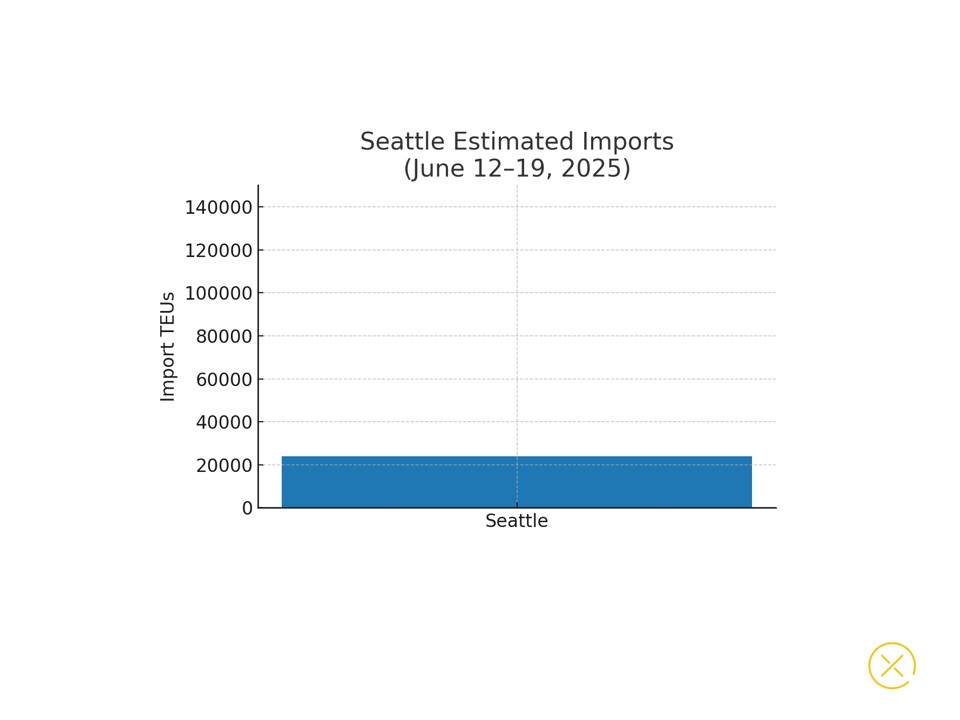

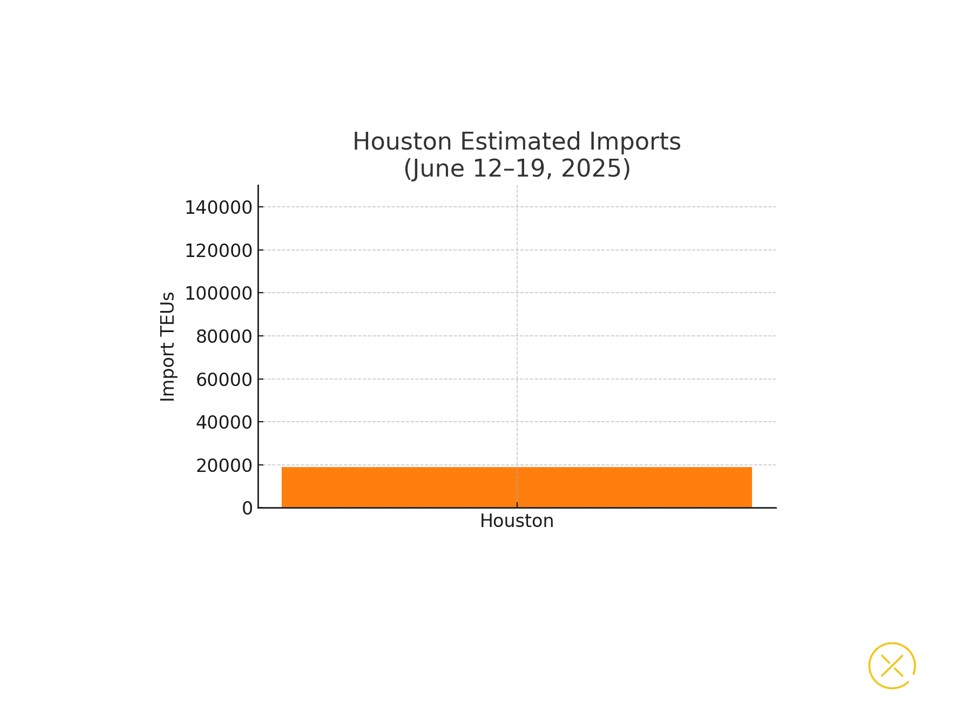

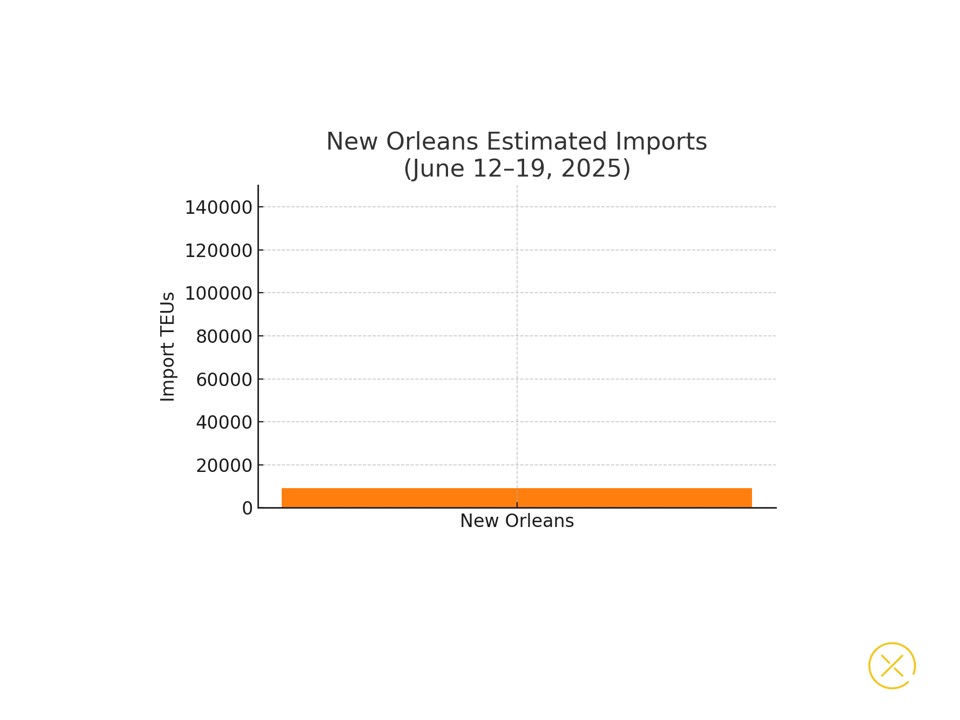

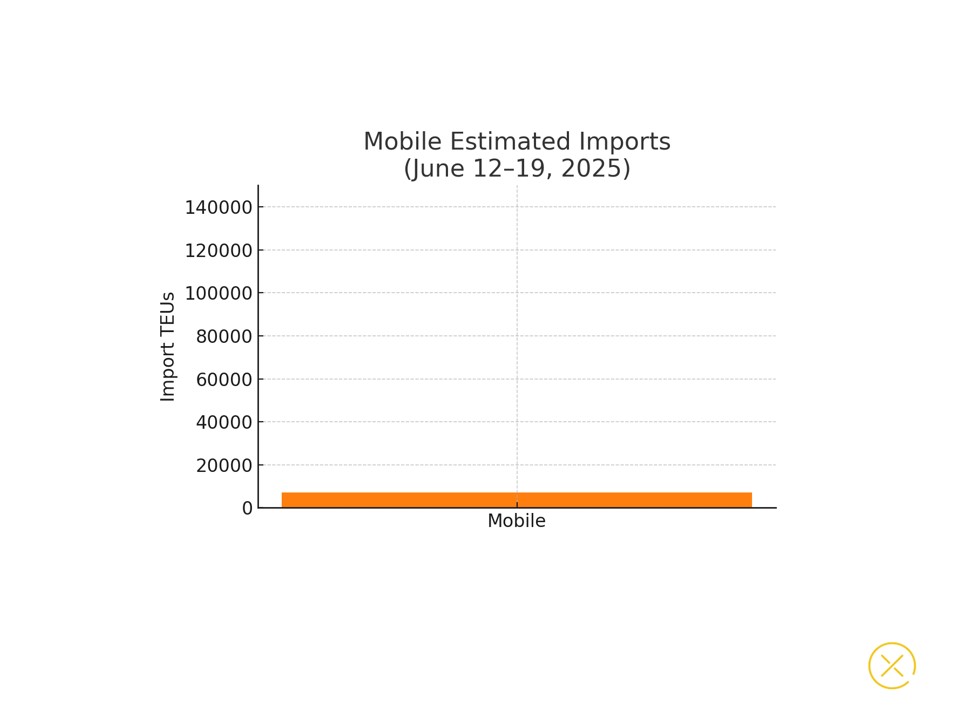

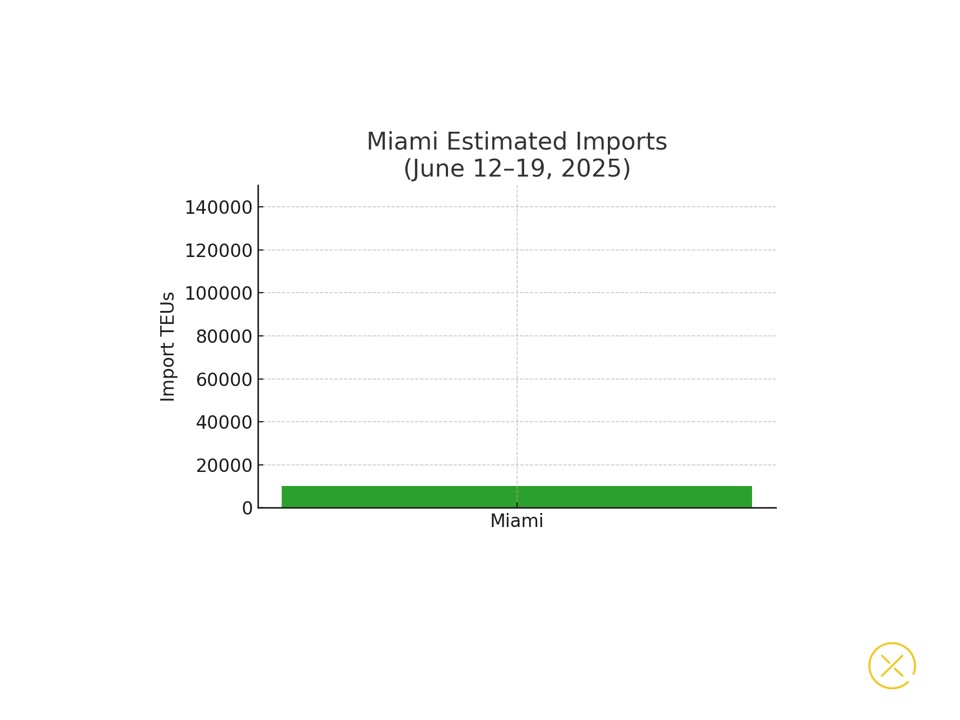

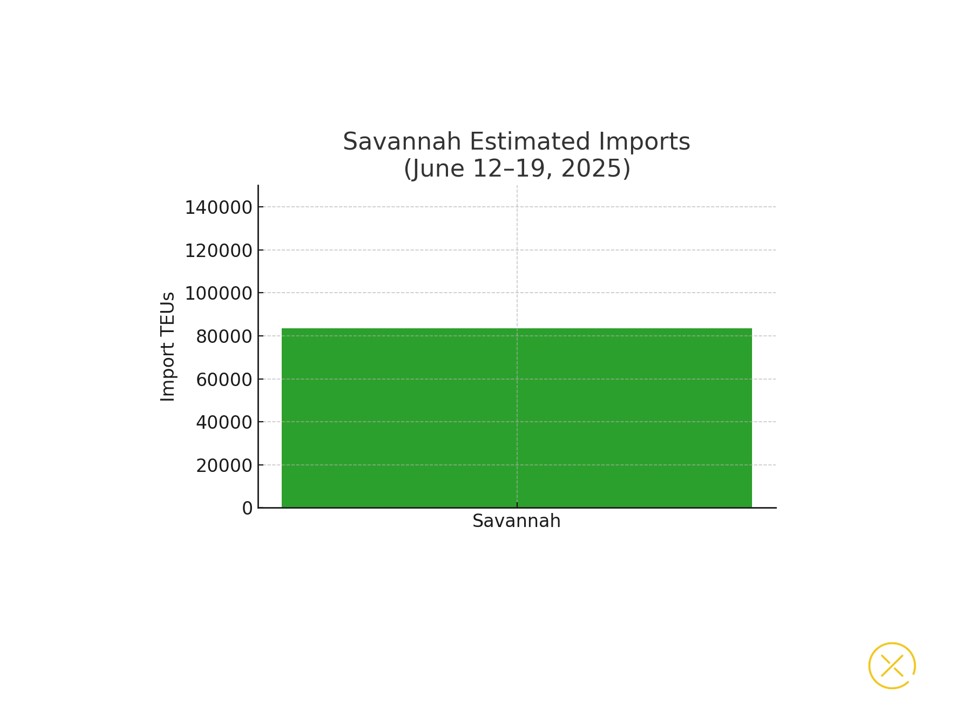

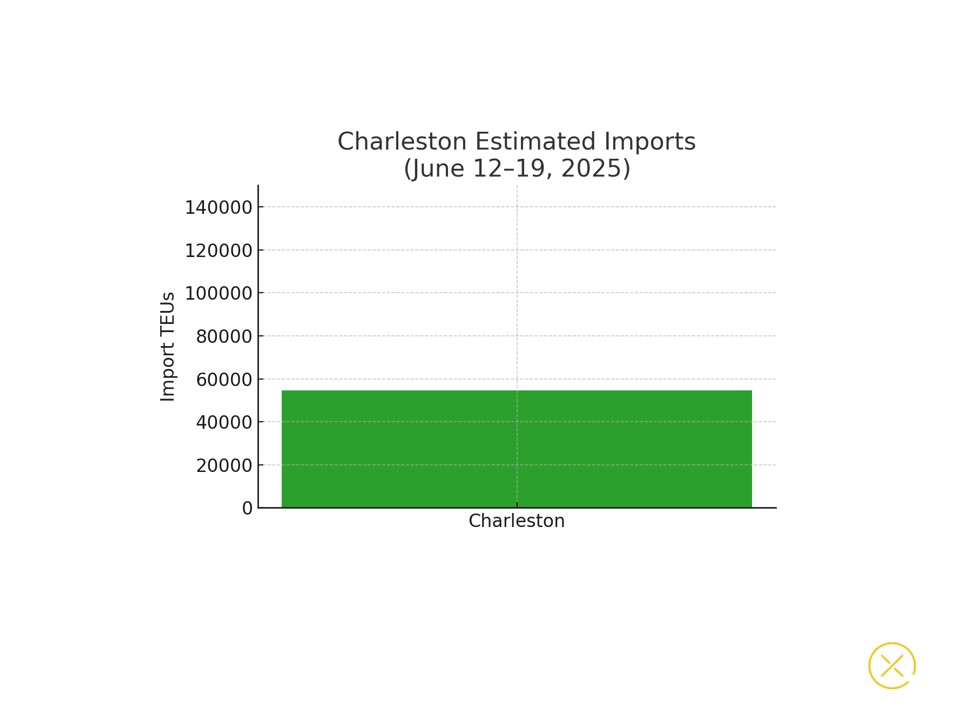

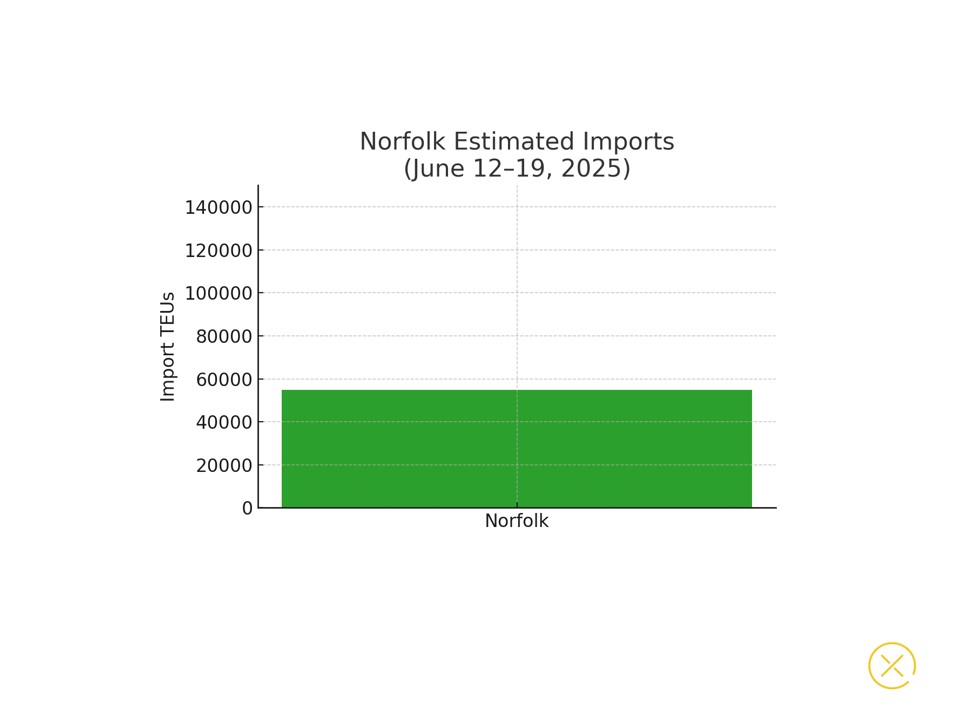

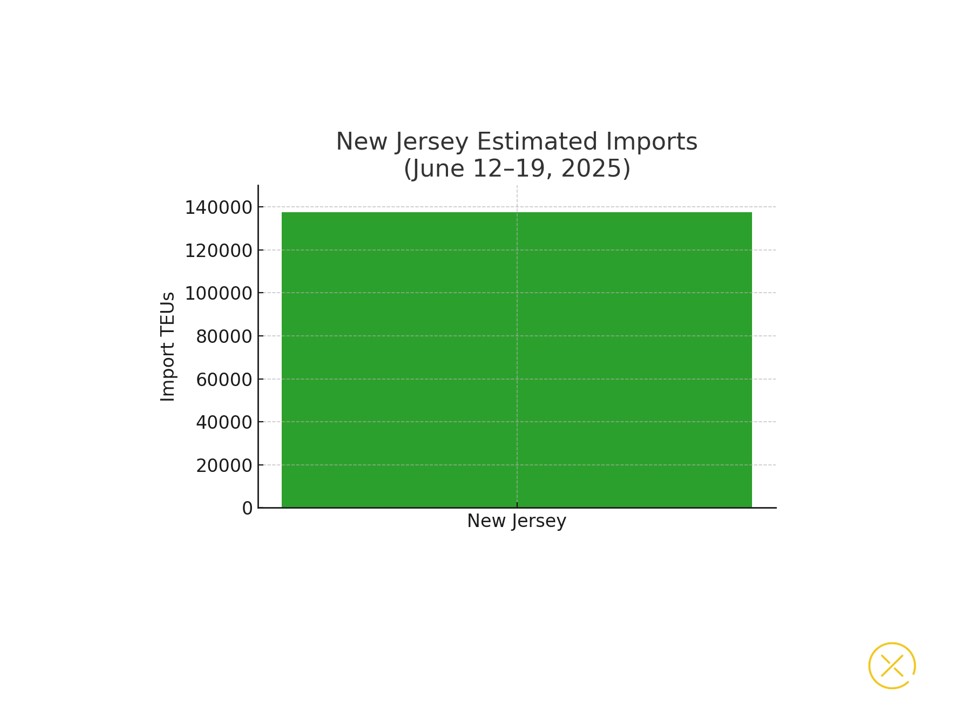

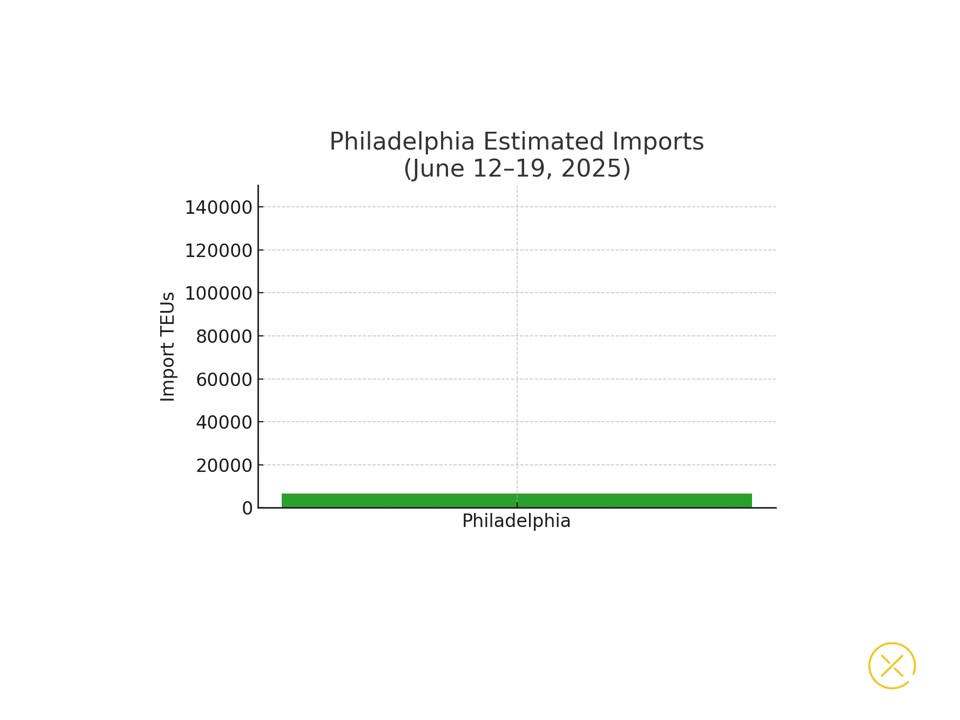

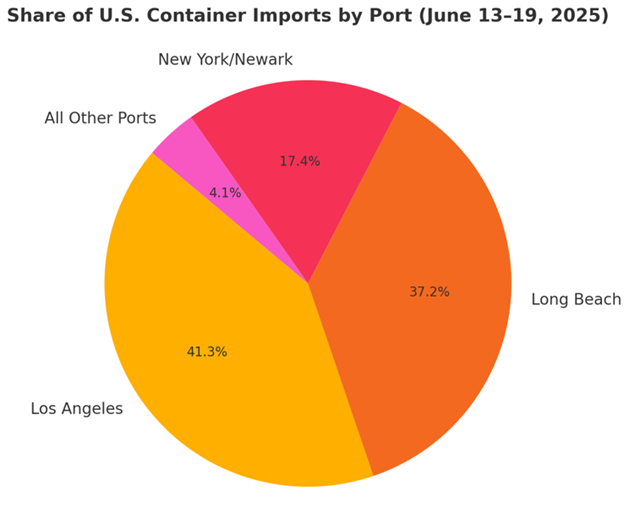

Import TEUs are up 6.34% this week from last week – with the highest volumes shown in the chart below:

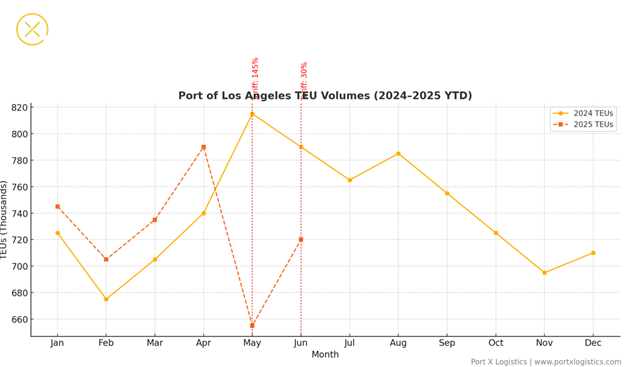

The chart below tracks monthly container volumes (TEUs) at the Port of Los Angeles from 2024 through mid-2025, highlighting the dramatic impact of recent tariff shifts. In May 2025, the U.S. tariff spike to 145% on key Chinese imports caused a steep drop in volumes—down nearly 24% month-over-month—before a temporary rollback to 30% in June triggered a modest rebound. The chart below captures the volatility that importers and carriers alike are navigating as geopolitical pressure, fuel costs, and sourcing shifts reshape the flow of goods through one of America’s busiest ports.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Savannah/Charleston: The waiting time for vessel berth at the Savannah terminal is averaging 18 hours. Average gates turn times are 33 / 51 minutes for single and double transactions, respectively. Import dwell time is 6.4 days. Rail dwell time is 1 day. Average Import dwell time is 8.3 days at North Charleston Container Terminal and Wando Welch Container Terminal. Expect congestion and chassis shortages with extra wait time to secure them. Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space AND We have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks at the best rates in all of Savannah letsgetrolling@portxlogistics.com for great rates, immediate transload capacity and supreme customer service.

Houston: Barbours Cut: average wait time to berth is 3 hours. Bayport: slightly higher, with waits averaging 6 hours—reflecting some terminal-side stacking.

In June, $214.6 million was allocated in the FY 2026 budget for channel upgrades—on top of earlier approvals totaling $131 million for deepening, dredging, and Project 11 enhancements. Port of Houston’s commissioners celebrated final sign-off on Project 11’s dredging segments, which widen critical sections and boost capacity—saving $380 million in future maintenance costs. Port X Logistics has drayage assets in Houston 32 trucks with the capability of long-haul drayage and we have a transload warehouse in LaPorte that can transload anything from standard pallets, to heavy lumber and industrial coils. If you need help in the Houston area we got your back, we also have a drayage network with 19 trucks and yard space servicing the Dallas area contact letsgetrolling@portxlogistics.com

Chicago: Expect double chassis splits for all rail locations when containers are grounded. All terminals reported shortages on 20′ chassis. Our Chicago asset drayage team has full capacity to get your Chicago containers moving. We have 88 trucks, 150 chassis (including 20’s!) and specialized chassis/equipment including 100 tri-axle and spread axles combined and a secured yard space and we are able to secure permits to haul heavy containers. For great rates, capacity and supreme customer service contact the team at letsgetrolling@portxlogistics.com.

Did you know? There is just a few short weeks until the 2025 Empire State Ride and our very own Brand Ambassador Charlie Bodine of our Denver office will be showing off his athletic abilities and repping Port X as our company rider at this year’s Empire State Ride?

For seven days, Charlie will pedal across 500+ miles of New York State, starting in Staten Island and finishing just around the corner from our Buffalo HQ in Niagara Falls.

He’s not just doing it for the ride either, he’s joining the fight against cancer, helping to raise funds for groundbreaking research at Roswell Park, a local but internationally known powerhouse in cancer research.

Charlie, we’re pumped to have one of our own on this incredible ride!

If you want to support Charlie and the cause, stay tuned, we’ll be cheering him on and checking in with him each day of the ride 🎉

To donate or to learn more about the ride, click below!

https://give.roswellpark.org/site/TR/SpecialEvents/General?px=1702335&pg=personal&fr_id=1990

Import Data Images