Port of Vancouver

1568 words 6 minute read – Let’s do this!

Oops! We paused tariffs again – global trade is tiptoeing toward stability…

This week U.S. and Chinese trade officials finalized a 90-day interim framework agreement aimed at stabilizing cross-border trade conditions through the end of Q3. While not a permanent resolution, this temporary alignment provides shippers, importers, and logistics providers with a clearer operating environment for the months ahead. We will go into more into this topic – but reminder! Don’t forget to follow our LinkedIn page to see other company news and industry related topics and to get on the list for this weekly Market Update Newsletter and future industry related news sent directly to your inbox email marketing@portxlogistics.com.

The agreement maintains the existing 55% U.S. tariff rate on a broad range of China-origin goods, including electronics, machinery, consumer products, and certain industrial inputs. In parallel, China will continue applying a 10% tariff on select U.S. exports. There are no immediate changes to product exclusions or duty suspensions. A key element of the framework is the resumption of rare-earth material exports from China, which are critical to U.S. manufacturing sectors such as clean energy, electric vehicles, defense, and advanced electronics. For many supply chain planners, this development helps reduce uncertainty around component availability and strategic sourcing. The agreement also allows for the continued flow of goods under current customs classifications, with no new enforcement actions announced. While technical consultations are ongoing, both sides have committed to maintaining predictable customs practices and export license reviews during this 90-day period.

From a logistics perspective, this framework offers several operational benefits:

- Reduced volatility in ocean and air freight demand related to sourcing shifts or speculative inventory builds

- A more stable environment for contract negotiations and procurement planning, especially for long-lead materials

- An opportunity to reassess routing strategies, particularly for Asia–U.S. traffic that may benefit from steady rate levels and capacity access during peak season

However, supply chain teams should remain agile. The 90-day window extends into early September 2025, after which a final agreement—or escalation—may reshape trade flows once again. Until then, this temporary clarity allows businesses to optimize near-term freight strategies with a better understanding of tariff exposure and sourcing risks.

Key Takeaways:

- Tariff Environment Holds: No increases, but tariff relief is not yet in effect.

- Rare-Earth Exports Resume: Key for manufacturers in energy, electronics, and EV sectors.

- Stable Near-Term Planning Window: Rates, sourcing, and mode optimization possible for Q3.

- Minimal Impact on Port Backlogs so far, but longer-term volumes could shift based on final policy details.

- Watch for Export Control Changes in aerospace and semiconductors—still under review.

Bottom Line:

The framework gives logistics teams a short-term runway to plan without major disruptions. However, with negotiations ongoing, it’s important to remain flexible with sourcing, booking lead times, and contract terms—especially for goods impacted by tariff classifications or requiring dual-use technology clearance.

Observations:

- The new tariff framework has contributed to short-term booking stability, with rate increases driven more by peak-season prep than policy.

- Carriers are holding firm on GRIs (General Rate Increases) ahead of Q3, particularly for high-demand Asia lanes.

- Transloading at West Coast ports remains strong due to inland rail fluidity and trucking availability.

What shippers should do now:

- Review Tariff Exposure – Confirm HS codes for any goods impacted by the 55% U.S. tariff. Temporary relief is not in effect, so landed cost modeling remains critical.

- Plan Q3 Bookings Early – Secure space now for August–September to avoid capacity issues during back-to-school and early holiday pre-loads.

- Stay Flexible on Routing – With inland waterway and barge strategies gaining traction, especially for oversized/heavy cargo, keep options open between West Coast–rail–Midwest and Gulf–barge–Great Lakes routes.

- Monitor Final Agreement Timeline – The 90-day window ends in early September 2025. A final deal—or lack thereof—could drastically impact Q4 strategy

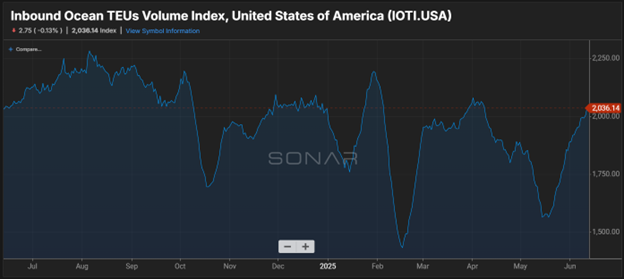

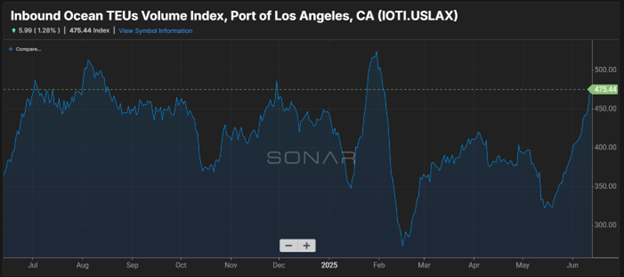

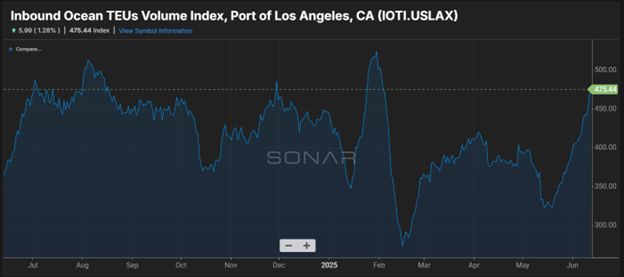

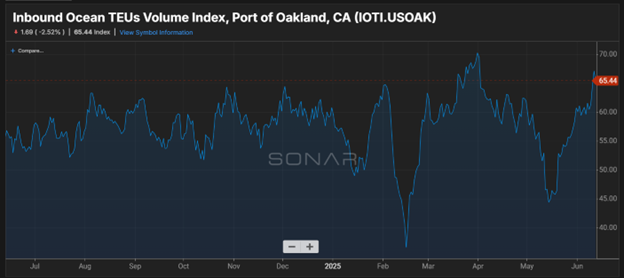

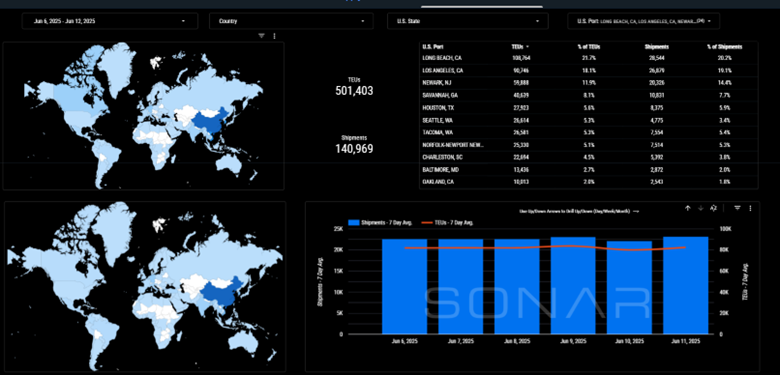

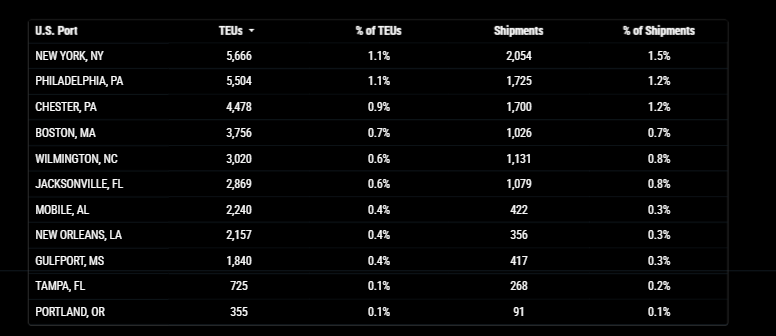

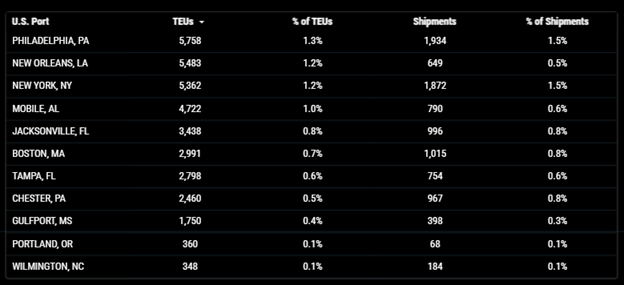

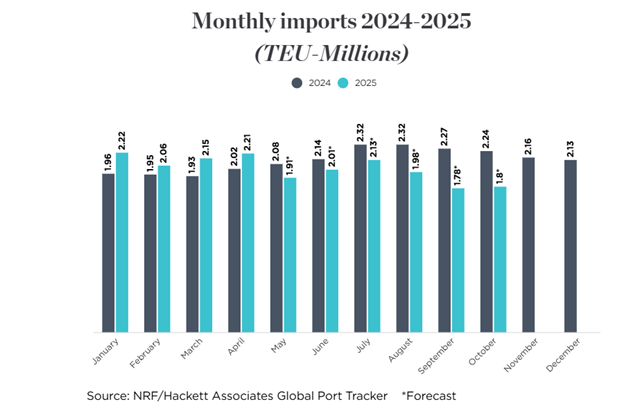

Import TEUs are up 9.77% this week from last week – with the highest volumes coming into Long Beach 21.7%, Los Angeles 18.1% and Newark NJ 11.9%. According to the Global Port Tracker, in a press release on June 9th Import cargo at the nation’s major container ports is expected to see a surge through this summer. “This is the busiest time of the year for retailers as they enter the back-to-school season and prepare for the fall-winter holiday season,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Retailers had paused their purchases and imports previously because of the significantly high tariffs. They are now looking to get those orders and cargo moving in order to bring as much merchandise into the country as they can before the reciprocal tariff and additional China tariff pauses end in July and August. Retailers want to ensure consumers will be able to find the products they need and want at prices they can afford. Unfortunately, there is still considerable uncertainty as to what will happen after the pauses end. We strongly encourage the administration to continue negotiating agreements with our trading partners in order to restore predictability and stability to the supply chain.”

Gold said many retailers suspended or canceled orders after the Trump administration announced a 145% tariff on China in April but resumed imports after tariffs were reduced to 30% and a 90-day pause that will last until August 12th was announced. The higher reciprocal tariffs on other nations have also been paused until July 9th as the administration negotiates with those countries. “Our projections show that May saw a significant reduction in imports as shippers responded to the higher tariff environment,” Hackett Associates Founder Ben Hackett said. “However, tariff reductions will lead to a surge in imports in June through August as importers take advantage of the various 90-day pauses. The peak for the winter holidays will come early this year, making it simultaneous with the peak for the back-to-school season. If higher tariffs are not delayed again, we can expect the final four months of the year to see declining volumes of imports.”

July shows the highest projected volume (2.13M TEUs)—a sharp rebound nearly 20% over the previous May forecast.

June & July forecasts mark the first full surge in U.S. imports since the April tariffs took effect.

After August, volumes are set to decline as tariff pauses end.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Vancouver/Prince Rupert: Vessel berthing delays have increased to around 2 days, reflecting a moderately congested entrance schedule. Average on-dock rail dwell times are around 9 days, up slightly but showing signs of plateauing. The port and rail carriers are working to reduce this backlog. Expect moderate delays for vessel berthing and rail loading ops. High yard utilization may affect container availability—consider booking early. Rising imports reflect strength in Asian and global demand, but inland rail capacity continues to lag. Our team in Canada has years of knowledge and experience with all Canadian ports and we can dray, transload and provide cross border deliveries to and from all Canadian ports. Contact the team at canada@portxlogistics.com for all your Canadian needs.

Seattle/Tacoma: June blank sailings remain stable, indicating no abnormal cancellations, although slot trimming continues. Terminal operations are stable—with no signs of congestion or idle capacity. Inland distribution is slower, so bookings and trucking lanes could be underutilized. Seasonal uptick likely ahead—monitor inland capacity readiness for Q3. No major disruptions anticipated, but inland drayage and rail scheduling may require attention. Do you want to learn how shipping through the SEA/TAC ports can benefit your supply chain and if you are looking for an all-star drayage/transload warehouse team? Our Seattle operation has plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse capabilities for ongoing transloading projects. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse

Houston: Berth wait times: up to 10 hours for Bayport vessels, up to 10 hours at Barbours Cut. Truck gate turnaround: efficient—about 35–36 minutes for single transactions. Dwell times: Loaded import containers dwell 3.6 days before pickup; yard utilization sits around 73–74%. Port X Logistics has drayage assets in Houston 32 trucks with the capability of long-haul drayage and we have a transload warehouse in LaPorte that can transload anything from standard pallets, to heavy lumber and industrial coils. If you need help in the Houston area we got your back, we also have a drayage network with 19 trucks and yard space servicing the Dallas area contact letsgetrolling@portxlogistics.com

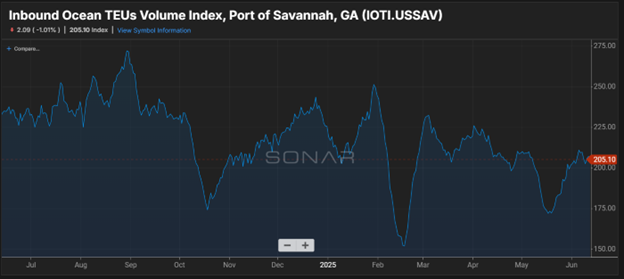

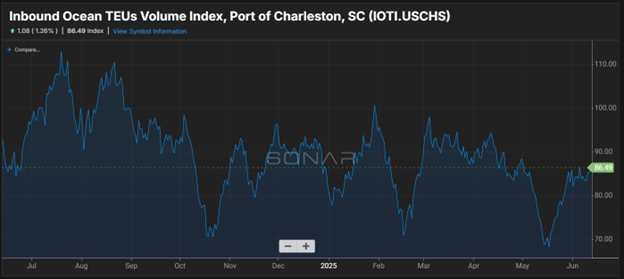

Did you know? Our drayage/transload rates ROCK in Savannah?! We have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks at the best rates in all of Savannah. Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space. Contact Kyle, Tristan and Sam at letsgetrolling@portxlogistics.com for great rates, immediate transload capacity and supreme customer service.

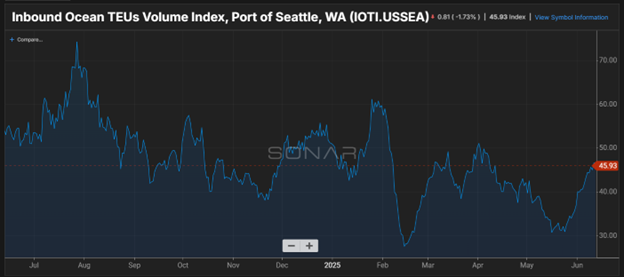

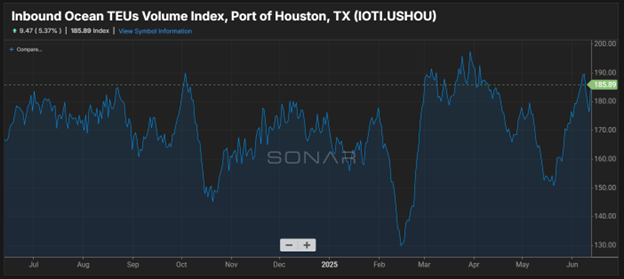

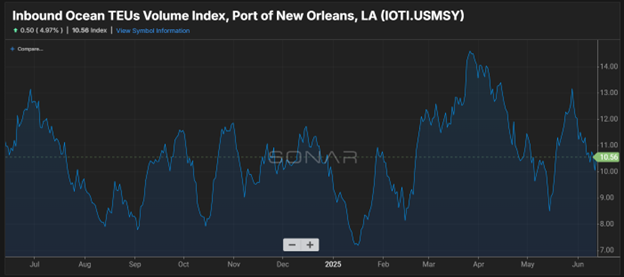

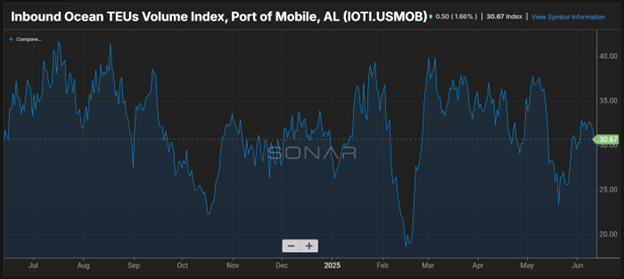

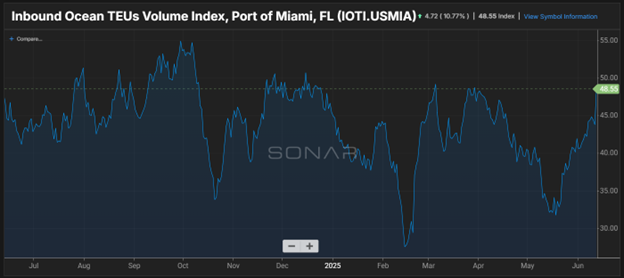

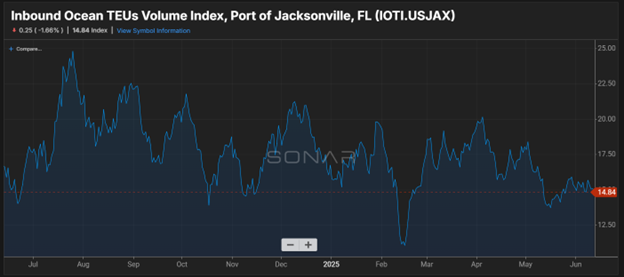

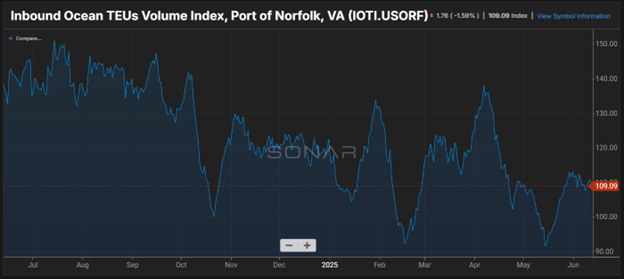

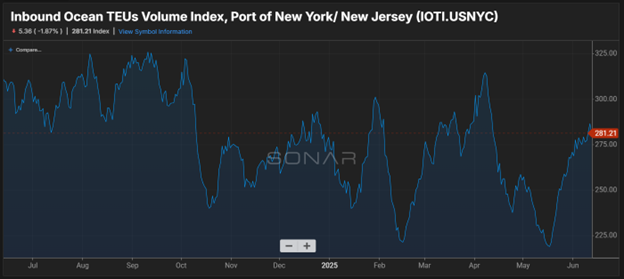

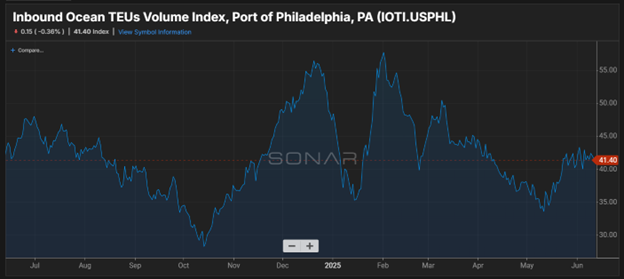

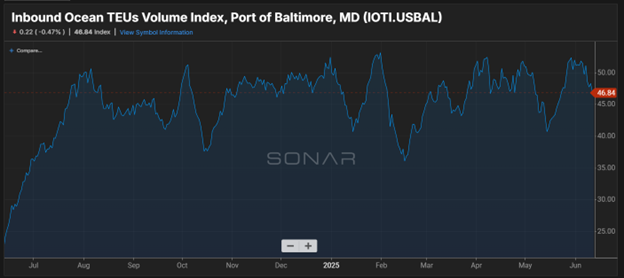

SONAR Import Data Images