Port of Tacoma

1539 words 7 minute read – Let’s do this!

Summer is heating up—and so is the global freight landscape. As we step into June, the logistics world is moving fast, and every week brings a new wave of developments that could shift the flow of goods, alter freight costs, or rewire supply chain priorities. Whether you’re planning your next booking, monitoring rates, or just trying to stay one step ahead, timing and insight are everything. In this week’s update, we break down the key forces shaping U.S. container imports, market reactions, and what shippers should watch as we head towards the end of Q2. Don’t forget to follow our LinkedIn page to see other company news and industry related topics and to get on the list for this weekly Market Update Newsletter and future industry related news sent directly to your inbox email marketing@portxlogistics.com.

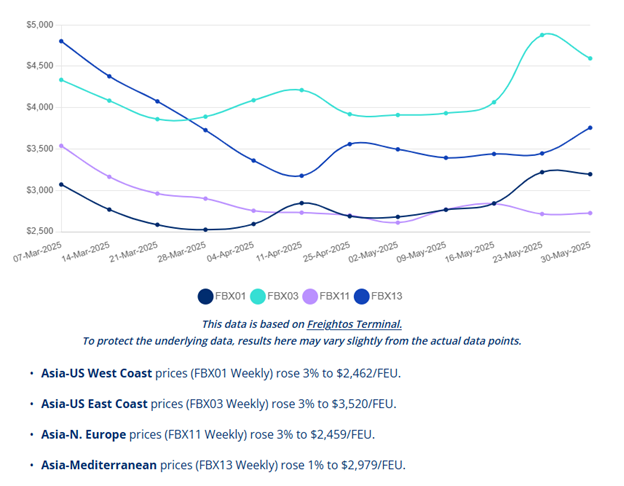

Trans-Pacific rates surge as importers race against the tariff clock – Importers are fast-tracking shipments from Asia following the 90-day pause on China tariffs, driving a sharp increase in Trans-Pacific spot rates. The recent China – U.S. de-escalation in tariffs has triggered a significant rebound in ocean freight demand between China and the U.S., following a sharp decline in volumes due to the 145% tariffs imposed earlier. As a response, carriers have introduced General Rate Increases (GRIs) ranging from $1,000 to $3,000 per forty-foot equivalent unit (FEU), with further hikes planned. If carriers succeed, rates could reach up to $8,000/FEU, aligning closely with the peak rates of the Asia – U.S. West Coast route recorded in 2024. Current transpacific rates have already begun to rise.

The recent resurgence in demand has led to carriers scrambling to reinstate previously canceled sailings and services, which has created some capacity and equipment challenges. The increased demand, along with congestion and weather-induced delays at Chinese ports, is driving container prices higher. In anticipation of looming tariff deadlines, there may be increased pressure on West Coast routes due to shorter transit times, further impacting rates.

Ocean carriers are capitalizing on volatility with multiple General Rate Increases (GRIs) through mid-June, while blank sailings are easing to make room for demand surges. Watch for early July service changes if demand dips. Now is the time to lock in space and rates for late June/early July. If you’re holding out for rate relief, be cautious — uncertainty around tariff reinstatement could keep pressure high. According to the digital booking platform Freightos, rates from China to the U.S. West Coast have jumped 17% to over $3,000 per FEU, with some bookings already hitting $8,000. This surge mirrors pre-peak-season behavior but is unusually early and politically driven.

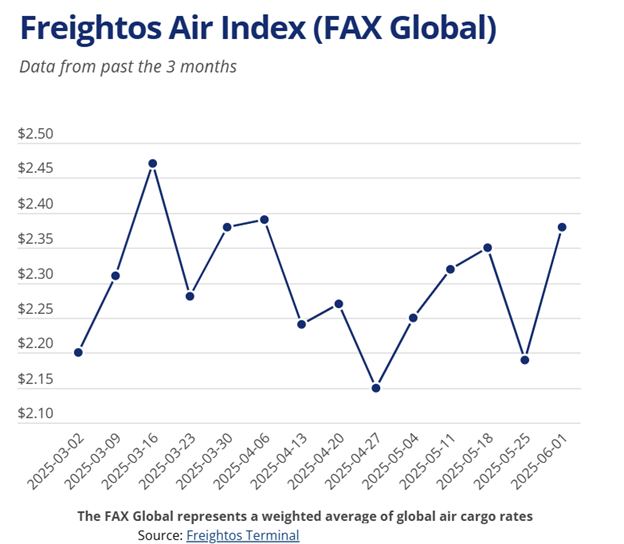

The most significant change to hit the air freight market is the recent U.S. suspension of de minimis eligibility for Chinese goods. This has led to a decline in e-commerce volumes on the Trans Pacific air cargo route and a notable reduction in freighter capacity, especially from chartered freight services. Despite these changes, spot rates have remained steady, with Freightos Air Index showing consistent rates around $5.50/kg, similar to early April levels. Some capacity has shifted to other lanes, which might soon start to affect rates there as well.

Air rates – Freightos Air Index

China – North America weekly prices rose 4% to $5.5/kg.

North Europe – North America weekly prices fell 1% to $1.88/kg.

Our Carrier911 team is composed of crisis management experts who have extensive experience in airfreight logistics. We stand ready 24/7/365 to handle your needs for Aircraft on Ground (AOG) Recovery, Hotshot Trucking, Expedited Transportation, Aerospace, Industrial & Automotive Logistics, Front & Back-End Charter Services, and First and Last Mile On-Board carrier (OBC). Our exclusive-use Sprinters, Straight Trucks, and Dry Vans are ready to meet your needs at a moment’s notice, 24/7, 365 days a year. We recognize that freight emergencies can happen at any time, and our dedicated fleet ensures we can respond swiftly. With Carrier 911, you can relax knowing you have real-time visibility of the driver’s location, day or night. The Proof of Delivery (POD) will also appear in your inbox immediately, guaranteeing timely receipt of your essential documents. For a free demo email info@carrier911.com or schedule a demo at portxlogistics.com/tech-demo/

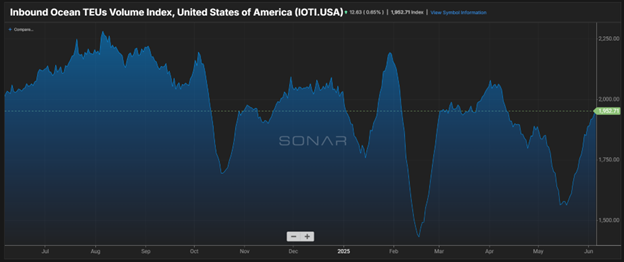

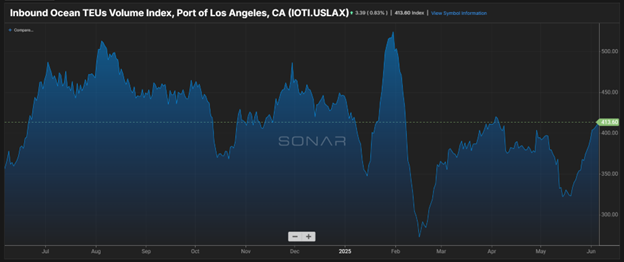

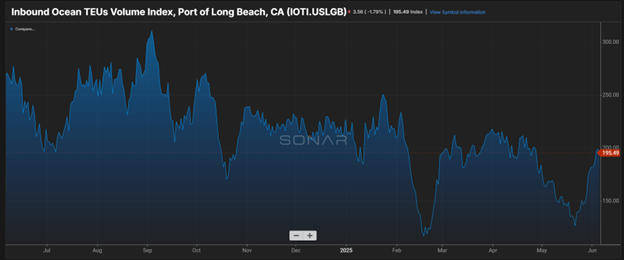

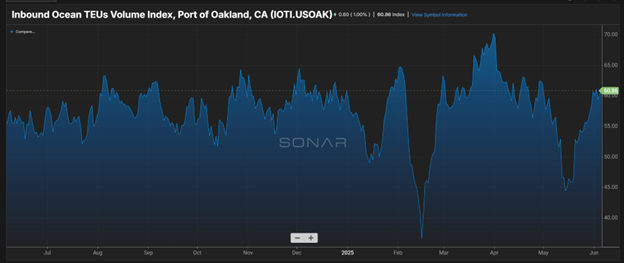

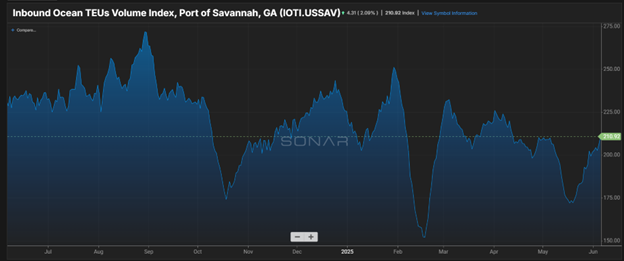

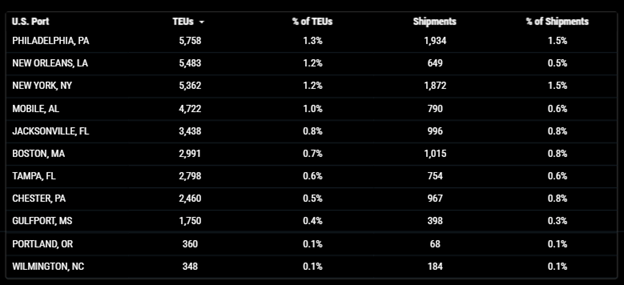

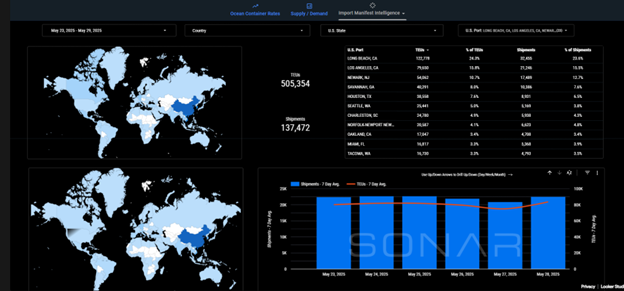

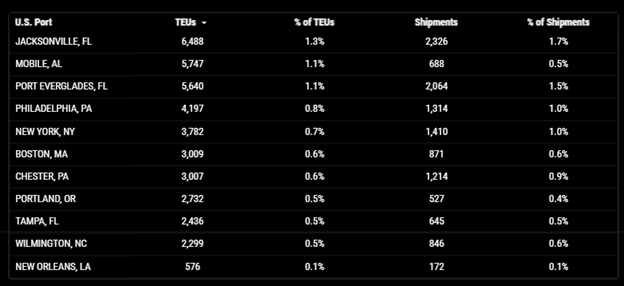

Import TEUs are down 9.62% this week from last week – with the highest volumes coming into Long Newark NJ 16.3%, Los Angeles 12.7% and Savannah GA 10.9%. Despite the overall monthly decline, there was a notable surge in container bookings mid-May. Following the announcement of a reciprocal tariff pause between the U.S. and China, daily TEU bookings increased dramatically—from 23,311 TEUs on May 9th to 48,631 TEUs by May 16th, representing a 108.6% increase in just one week. This spike indicates that shippers responded swiftly to the policy shift, aiming to capitalize on the temporary easing of trade tensions

National Retail Federation (NRF) Forecast: June Imports to Dip Despite Short-Term Surge: The NRF projects a 20.2% year over year drop in container imports for June to 1.71M TEUs—signaling how volatile consumer demand and shipping behaviors remain despite the rate surge.

Trend Watch: Volume Compression Likely in July? Analysts warn that this front-loading may create a short-term spike followed by a lull in late summer. Importers are “borrowing” peak season volumes to beat potential cost increases. Ports may experience June bottlenecks, but July could see softer demand if tariffs resume and inventory levels normalize.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

LA/LGB: Both ports are experiencing moderate congestion; volumes recovering but truck turn times still lagging. Our Los Angeles drayage yard and transload warehouse location boasts a large drayage fleet, a secured yard with plenty of yard storage space and a transload warehouse with immediate capacity to pull your containers for palletized and floor to pallet transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a NO DEMURRAGE GUARANTEE on all orders that have been dispatched to us 72 hours prior to vessel arrival and are cleared for pickup by the last free day. Don’t let all our capacity slip through your fingers, front loading volumes, vessel backups and rail dwells will make LA transloads the hot commodity, contact the team to get on the capacity list, for rates and any questions letsgetrolling@portxlogistics.com

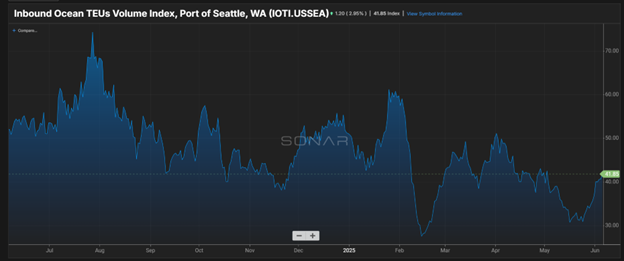

Seattle/Tacoma: The ports recently experienced labor-related delays, which are now tapering off. These delays were primarily due to reduced cargo volumes stemming from increased tariffs and a rise in blank sailings—instances where scheduled ships do not arrive. This situation led to decreased work hours for longshore workers and truck drivers, as there was less cargo to handle. While the immediate labor disruptions are subsiding, the ports continue to face challenges due to the ongoing effects of trade policies and shifting global shipping patterns. The temporary reduction in tariffs has not yet translated into a rebound in cargo volumes, and the ports are working to adapt to these changing conditions. It takes at least a few weeks for policy at the federal level to show up at the ports. That’s why the fallout from the trade war hasn’t been fully reflected in cargo volume data released by the port. Seattle Port Commissioner Sam Cho said, “I don’t know if you’ll see like a huge spike in trade volume because the tariffs disappear.” Do you want to learn how shipping through the SEA/TAC ports can benefit your supply chain and if you are looking for an all-star drayage/transload warehouse team? Our Seattle operation has plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse capabilities for ongoing transloading projects. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse customer service.

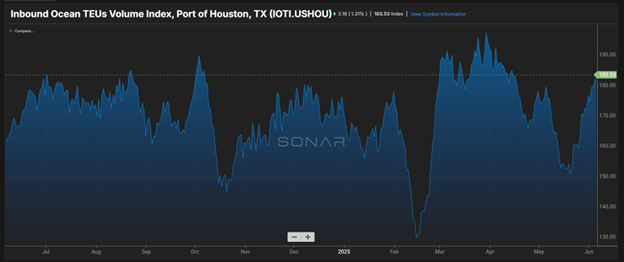

Houston: Steady import flow, but weather and chassis tightness creating minor backlogs. Port X Logistics has drayage assets in Houston 32 trucks with the capability of long-haul drayage and we have a transload warehouse in LaPorte that can transload anything from standard pallets, to heavy lumber and industrial coils. If you need help in the Houston area we got your back, we also have a drayage network with 19 trucks and yard space servicing the Dallas area contact letsgetrolling@portxlogistics.com

Did you know? Port X Logistics has strategically located assets and owner-operators across the U.S. and Canada, allowing us to service every port and rail ramp with efficiency and reliability – all while providing state of the art technology and a great customer experience. Wherever your shipment needs to go, we’re positioned to get it there. For a list of assets contact letsgetrolling@portxlogistics.com

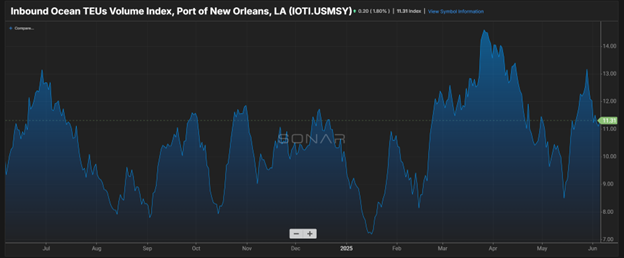

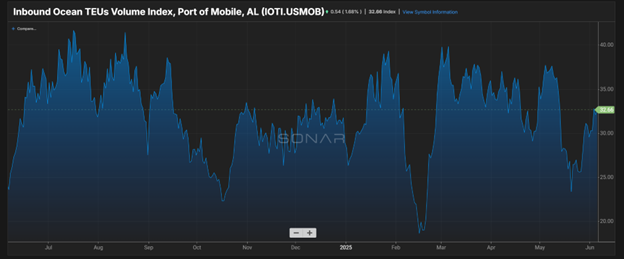

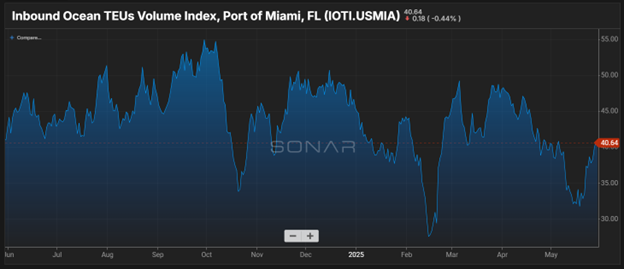

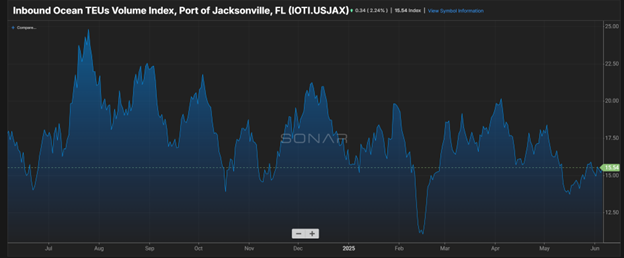

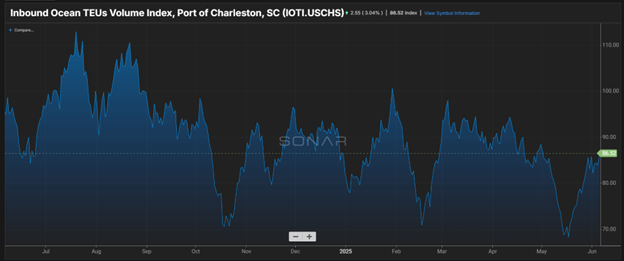

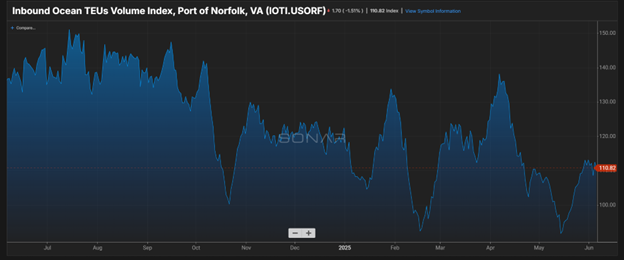

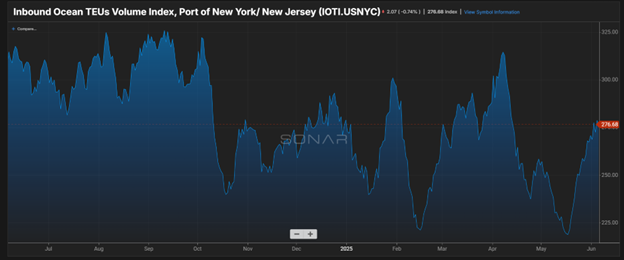

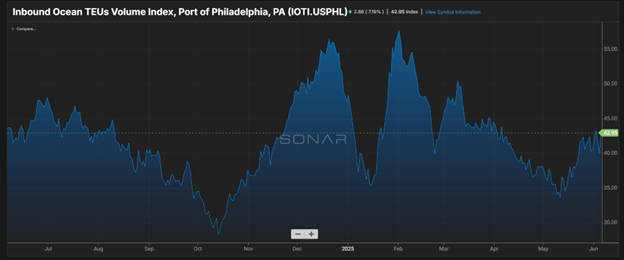

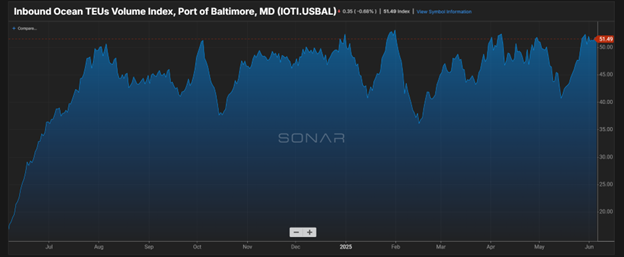

SONAR Import Data Images