Port of Long Beach

1766 words 7 minute read – Let’s do this!

Buckle up, logistics lovers and possibly tariff haters — your weekly dose of freight facts, port gossip, and supply chain shenanigans has arrived! Whether you’re navigating cancelled bookings, new fees, or just here for the latest tea from the terminals, we’ve got you covered. From coast to coast and warehouse to wharf, we’re hauling in the headlines, updates, and trends that keep your world moving. To get on the list for this weekly Market Update Newsletter and future industry related news sent directly to your inbox email marketing@portxlogistics.com. Don’t forget to follow our LinkedIn page to see other company news and industry related topics. Let’s roll!

President Donald Trump announced on May 6th that the U.S. would halt its bombing campaign against Yemen’s Houthi rebels following an agreement, mediated by Oman, in which the Houthis purportedly promised to cease attacks on American vessels in the Red Sea and Bab al-Mandab Strait. Trump characterized the Houthis as having “capitulated” and stated that the U.S. would “take their word” on ending hostilities. However, the Houthis have not publicly confirmed a formal agreement. Houthi spokesperson Mohammed Abdulsalam emphasized that their stance remains unchanged and that they will continue military operations targeting Israel. This suggests that while there may be a de-escalation concerning U.S.-Houthi hostilities, the broader conflict, especially regarding Israeli-linked shipping, persists.

Given these developments, while there appears to be a tentative pause in direct confrontations between the U.S. and the Houthis, the overall threat to commercial shipping in the Red Sea, particularly for vessels linked to Israel, remains. Shipping companies and international stakeholders are advised to stay vigilant and monitor the situation closely.

Ryan Petersen, CEO of Flexport, said on May 7th, 2025 that ocean carriers have begun implementing emergency surcharges of $800 per container for shipments originating from Pakistan. This announcement was made via his social media platform, X (formerly Twitter), where he frequently shares real-time updates on global logistics developments. The timing of this announcement aligns with broader disruptions in global trade, including new U.S. tariffs and escalating shipping costs, which are impacting supply chains worldwide.

While Petersen’s announcement brought immediate attention to the surcharge, it’s important to note that other shipping lines had previously implemented similar fees. For instance, Hapag-Lloyd announced a General Rate Increase (GRI) of $1,000 per container for shipments from the Indian Subcontinent—including Pakistan—to North America’s East and Gulf Coasts, effective March 15, 2025. Additionally, Maersk has implemented various surcharges in response to global disruptions, such as those in the Red Sea region, affecting shipments from Pakistan. For the most current and detailed information regarding surcharges and shipping rates from Pakistan, it’s advisable to consult directly with specific carriers or freight forwarders

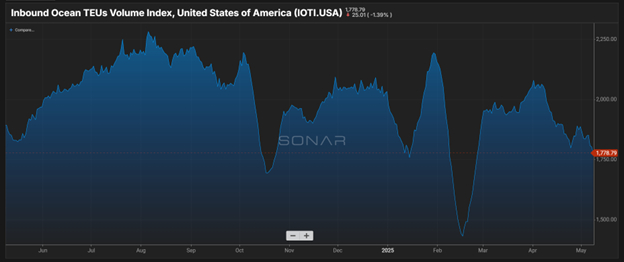

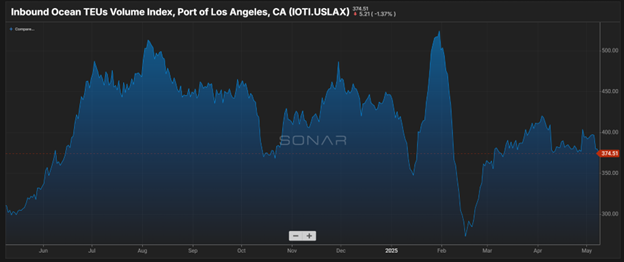

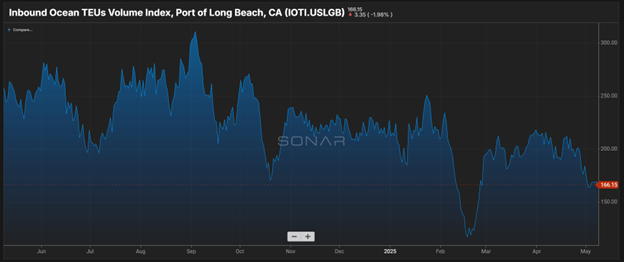

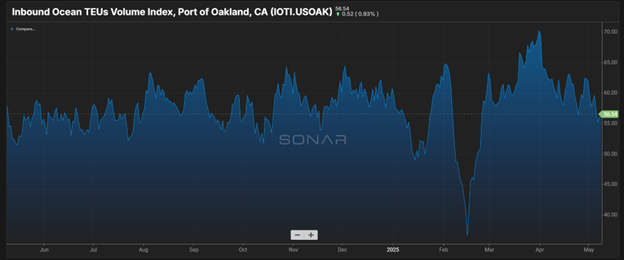

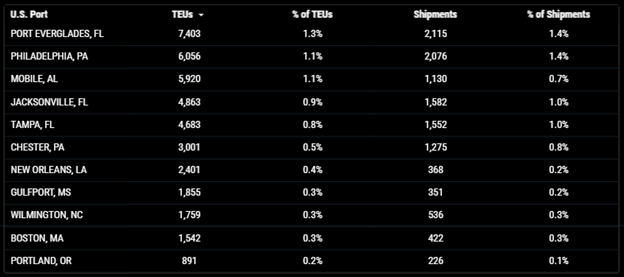

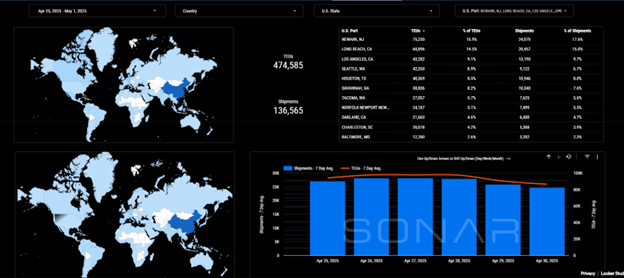

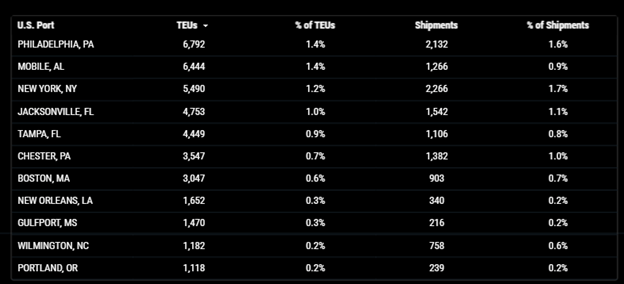

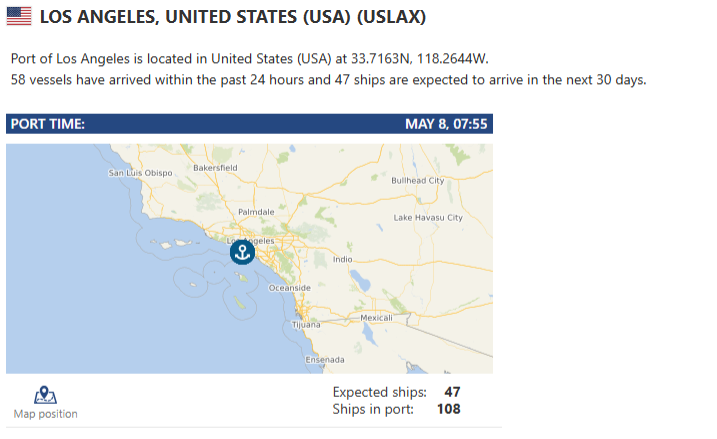

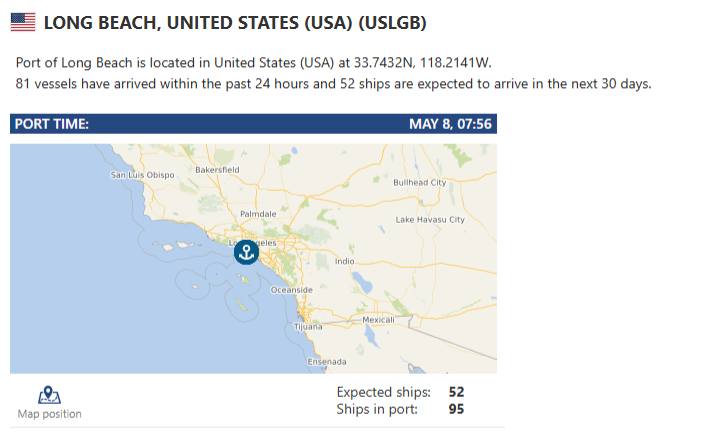

Import TEUs are up 17.1% this week from last week – with the highest volumes coming into Los Angeles 16.4%, Long Beach 14.5% and Newark 13.7%. Forecasts indicate a substantial drop in import volumes. The Port of Los Angeles anticipates a 35% decrease in imports, while the Port of Long Beach expects a 20% year-over-year decline. The industry is witnessing a surge in “blank sailings,” where scheduled shipments are canceled due to decreased demand. This trend is particularly evident on routes from China to the U.S. West Coast. Data shows that cargo bookings from China to the U.S. have plummeted by approximately 40% in recent weeks compared to pre-tariff levels. Overall U.S. import bookings have decreased by over 20% during the same period. The full impact of the tariffs and the resulting import slowdown will become clearer in the coming weeks. Businesses and consumers alike should prepare for potential disruptions in supply chains and increased costs for imported goods.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

Revised shipping legislation aimed at revitalizing the domestic maritime industry calls for creation of a fleet of 250 U.S.-flag cargo vessels, and federal funding to aid shipbuilding development. The bipartisan SHIPS for America Act was reintroduced Wednesday at a press conference by co-sponsors Sens. Mark Kelly of Arizona and Todd Young of Indiana, and Reps. Trent Kelly, also of Indiana, and John Garamendi of California. The legislation, initially introduced in December 2024, aims to strengthen American sealift capacity, rebuild domestic shipbuilding and develop a robust maritime workforce. It will be introduced in two parts in the Senate: The Ships for America Act and the Building SHIPS in America Act. The new Strategic Commercial Fleet Program has a goal of establishing a fleet of 250 U.S.-flagged vessels in international commerce and prioritizes tanker vessels. The program provides support payments for capital and operational costs to encourage the introduction of new U.S.-built, -flagged and -crewed vessels. There are currently 80 U.S.-flag merchant ships. The legislation significantly enhances cargo preference requirements, increasing the percentage of U.S. government cargo that must sail on U.S.-flagged vessels from 50% to 100%. It also requires that within 15 years, 10% of all cargo imported from China must be transported on U.S.-flagged vessels. There are subsidies for U.S. agricultural exports, and a requirement that U.S. ports give U.S.-flagged vessels priority over non-U.S. ships. The legislation addresses the critical need for qualified maritime workers through public service loan forgiveness for merchant mariners, enhanced support for maritime academies and establishment of a Maritime Career Retention Program.

LA/LGB: The Port of Long Beach is already reporting a huge drop in traffic this week with 34 canceled sailings from ocean carriers to Long Beach. “We are at a point of inflection. It’s kind of dire,” Mario Cordero, port of Long Beach CEO said Monday. “What happens here is going to be an indication of what’s going to occur in the supply chain. We have less vessel calls, less cargo now.” The neighboring Port of Los Angeles is also seeing 36 cancellations. Things have not been this slow since the coronavirus pandemic, Cordero said. Will we see the same backlash of congestion, delays and idle ships like we did post pandemic once tariff agreements have been set?

We dropped our transload rates for LA/LGB! Our Los Angeles drayage yard and transload warehouse location boasts a large drayage fleet, a large, secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your containers for palletized and floor to pallet transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a NO DEMURRAGE GUARANTEE on all orders that have been dispatched to us 72 hours prior to vessel arrival and are cleared for pickup by the last free day. Contact the team at letsgetrolling@portxlogistics.com for rates and any questions. Let’s talk about being your #1 West Coast transload team.

Chicago: There was a power outage Wednesday at the UP, causing congestion, and there has been mild congestion at the other rails. Drivers reporting long wait times for lifts at BNSF/LPC. The newer NS appointment system has been smooth. Recent data indicates that the average terminal dwell time in Chicago is approximately 22.3 hours, reflecting the time railcars spend at terminals before departure. Our Chicago asset drayage team has full capacity to get your Chicago containers moving. We have 88 trucks, 150 chassis and specialized chassis/equipment including 100 tri-axle and spread axles combined and a secured yard space and we are able to secure permits to haul heavy containers. For great rates, capacity and supreme customer service contact the team at letsgetrolling@portxlogistics.com.

Did you know? Our Carrier 911 division is making its second conference appearance of the year – We’re excited to be heading to the 2025 CNS Partnership Conference in Miami May 13th to the 15th, hosted by IATA, where we’ll be showcasing our brand new Carrier 911 booth and talking a bit about what makes us the “easy button” for expedited freight.

Representing us on-site are two of the best in the biz: Tom Zeis and Adam Cunningham, ready to walk you through how Carrier 911 solves last-minute, high-stakes freight challenges, without any of the chaos ✔️

If you’re heading to CNS, come say hi, check out the new booth, and learn how we make urgent freight feel easy! To schedule a meeting email marketing@portxlogistics.com.

https://www.iata.org/en/events/all/cns-partnership-conference/

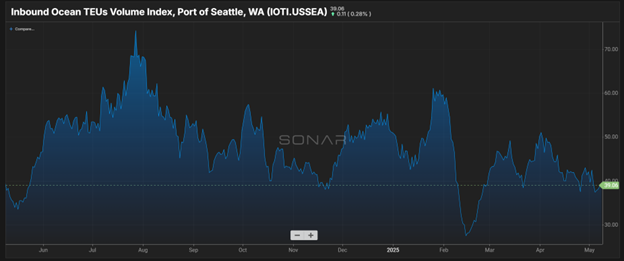

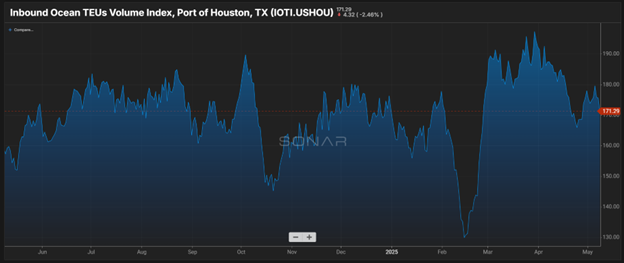

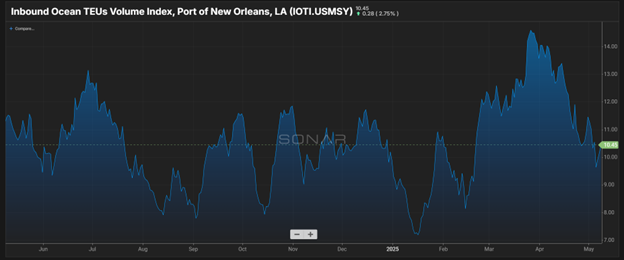

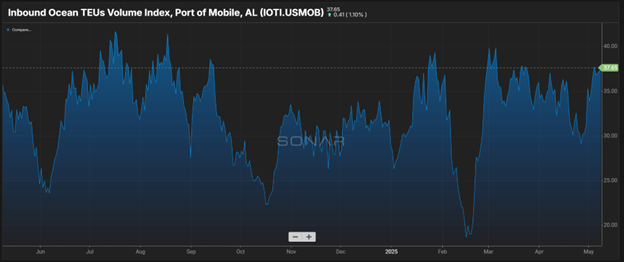

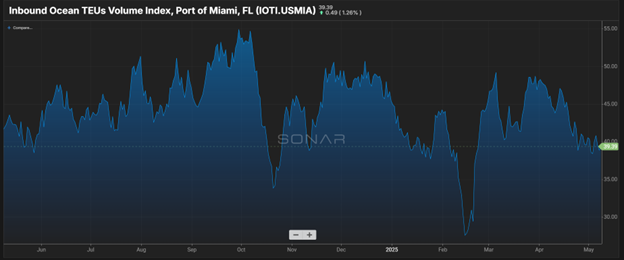

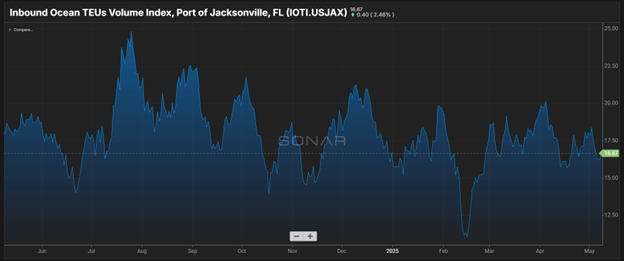

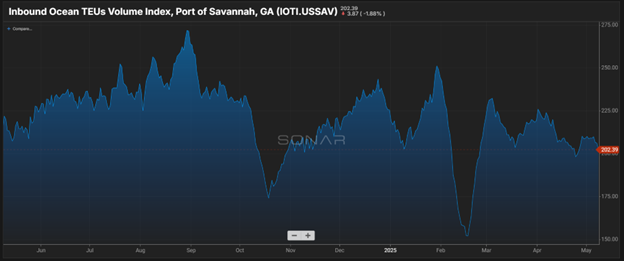

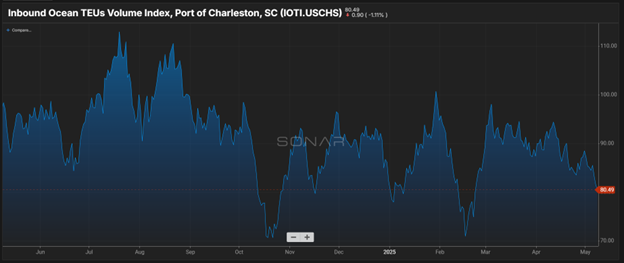

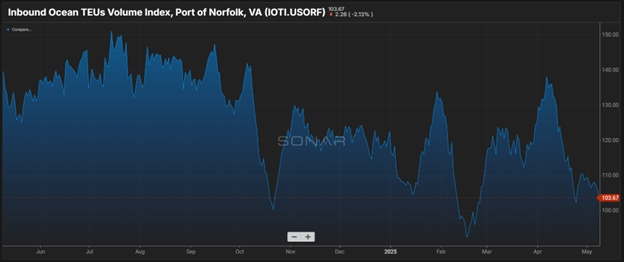

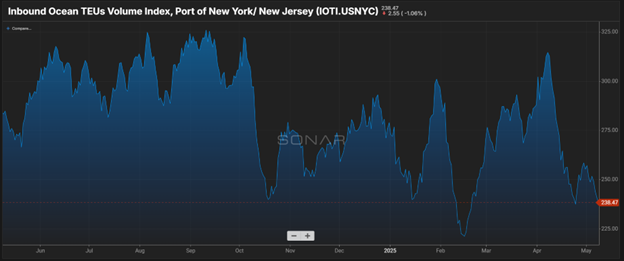

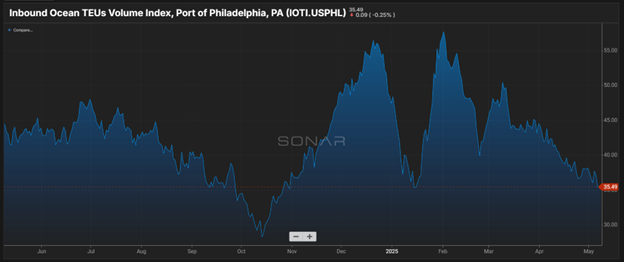

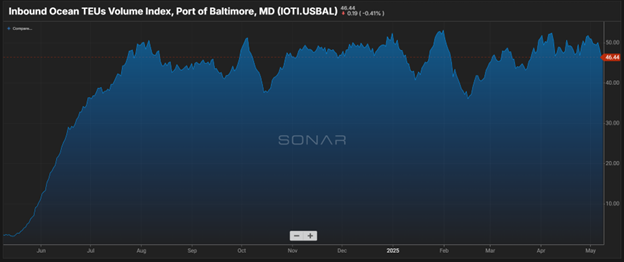

SONAR Import Data Images