Port of Los Angeles

1743 words 7 minute read – Let’s do this!

Welcome to May everyone, summer is so close and well, the market is starting to hurt a little bit. But will it change? Let’s talk about that. We are bringing you the weekly updates that affect your supply chain – to get on the list for this weekly Market Update Newsletter and future industry related news sent directly to your inbox Email marketing@portxlogistics.com. Don’t forget to follow our LinkedIn page to see other company news and industry related topics.

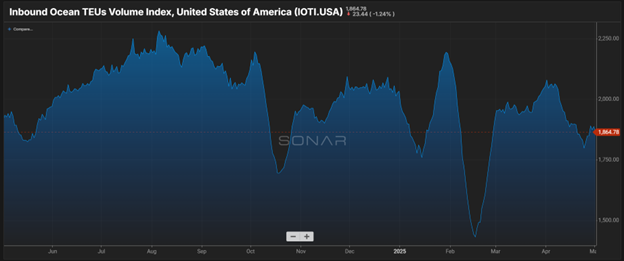

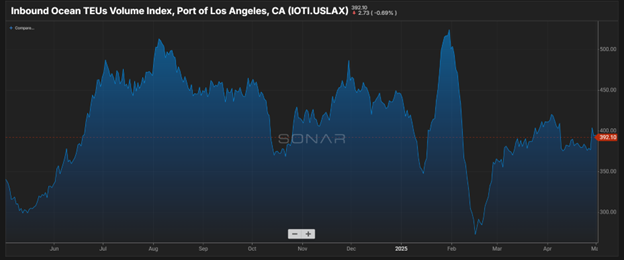

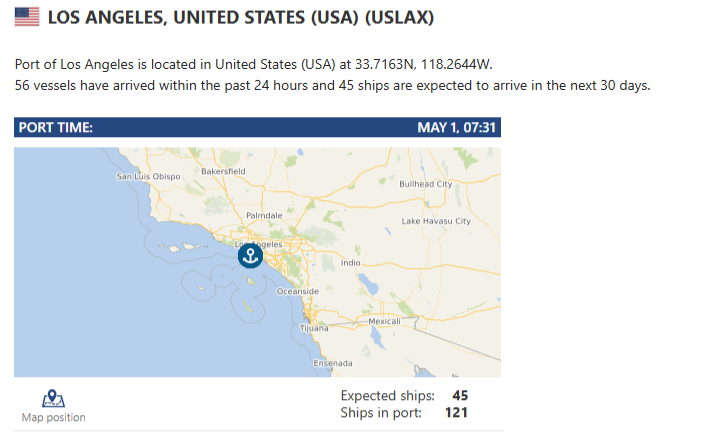

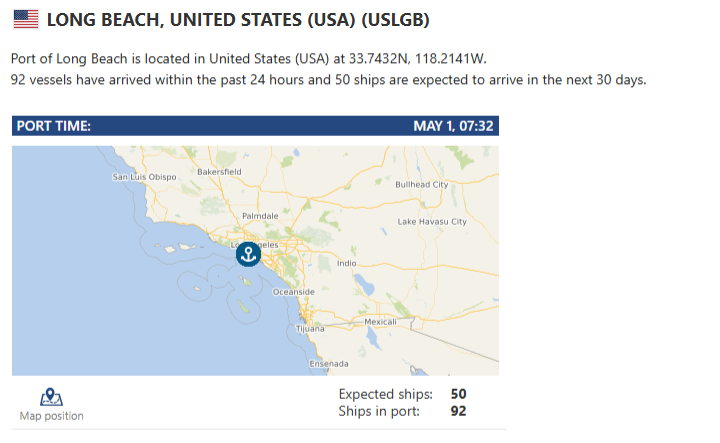

Let’s recap: as of late April 2025, U.S. ports are experiencing a downturn in cargo volumes due to newly imposed tariffs on Chinese goods. The Port of Los Angeles, for instance, anticipates a 35% drop in cargo volumes starting next week, attributed to major American retailers halting shipments from China, which currently accounts for 45% of the port’s trade. This decline follows a 14% increase in cargo volumes during Q1 2025 as businesses rushed to import goods ahead of the tariff hikes. President Donald Trump suggested that a resolution was nearing and that the administration is in talks with Beijing, but there is no sign of a deal yet.

Gene Seroka, the Executive Director of the Port of Los Angeles, said earlier this week that without a trade deal business leaders are opting to increase shipping volumes from other Southeast Asian ports to get the lower 10% tariff rate applied broadly by President Trump as a baseline for most imports. However, regional trade is likely to remain “very light at best” until the U.S. and China can hammer out a deal. The imposed U.S. tariffs on Chinese imports are expected to lead to significant inventory shortages across various retail sectors in the coming weeks. The average tariff rate on Chinese goods has surged to 145%, prompting major retailers like Walmart, Target, and Amazon to halt or drastically reduce orders from China. This sharp decline in imports is already impacting supply chains, with the Port of Los Angeles projecting a 35% drop in cargo volumes starting next week

Industry experts also warn of a looming congestion threat if Asian imports rebound. Container lines have expressed concerns that U.S. ports and their supporting infrastructure, such as warehouses and rail connections, are not better equipped to handle import surges than they were during the pandemic when record volumes drove congestion to historic highs. The infrastructure constraints, combined with the possibility of a sudden increase in imports once trade tensions ease, could lead to significant bottlenecks. This is especially pertinent given that the U.S. ports have not made substantial improvements to handle such surges since the pandemic-induced congestion.

Strategic Considerations

- Infrastructure Investment: To mitigate future congestion risks, there is a need for strategic investments in port infrastructure, including expanding capacity and improving logistics support systems.

- Diversification of Import Sources: Shippers and retailers might consider diversifying their import sources to include countries with lower tariff rates, thereby reducing dependency on specific trade routes that could become congested.

- Supply Chain Flexibility: Building more flexibility into supply chains can help businesses adapt to sudden changes in trade policies and demand surges, minimizing the impact of potential port congestion.

In summary, while current import volumes are down due to tariff-related trade tensions, the potential for future congestion at U.S. ports remains a significant concern. Proactive measures in infrastructure development and supply chain management are essential to address this looming challenge.

China has begun discreetly notifying companies that certain U.S.- made products will be exempt from its steep 125% retaliatory tariffs, meant to shield manufacturers from the consequences of a trade conflict with Washington, according to sources familiar with the matter.

Key U.S. Products Exempted from China’s 125% Tariffs

The exemptions primarily target critical imports essential to China’s technology, healthcare, and industrial sectors. Notable categories include:

- Semiconductors and Chipmaking Equipment: Certain microchips and related manufacturing tools, including products from companies like Intel and Texas Instruments, have been exempted. However, some items, such as memory chips from Micron, remain subject to tariffs.

- Pharmaceuticals and Medical Equipment: Select U.S.-made medicines and medical devices have received exemptions to ensure the continuity of healthcare services.

- Aviation Components: Aircraft engines and essential aviation parts are included in the exemption list, reflecting China’s reliance on U.S. aerospace technology.

- Industrial Chemicals: Ethane, a critical feedstock for China’s petrochemical industry, has been exempted following requests from major processors.

These exemptions indicate China’s strategic approach to maintain access to indispensable U.S. goods while managing the economic impact of the trade war.

With potential disruptions on the horizon, remember Port X Logistics can play a role in helping to improve the flow of your supply chain – We are the Gold Standard in drayage, transloading and trucking. We track your containers from the time they leave overseas, dray your containers from all port locations and transload with plenty of photos provided and load to outbound trucks for the fastest over the road delivery with a shareable tracking app to track drivers all the way to final destination. We have open capacity and planning and operate on a first come first serve basis – If you want more information on how we can plan for to have your future containers diverted at the port and on the road for a speedy delivery with full visibility contact letsgetrolling@portxlogistics.com.

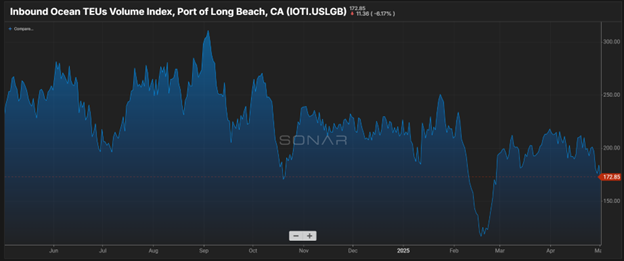

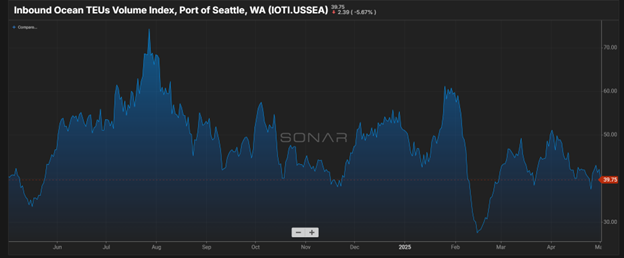

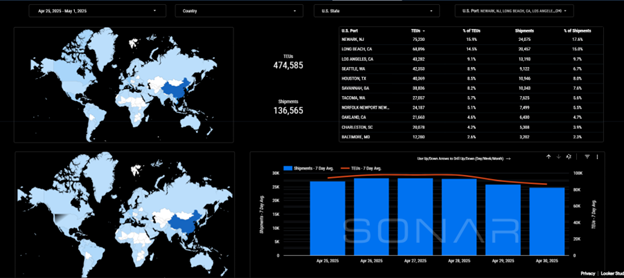

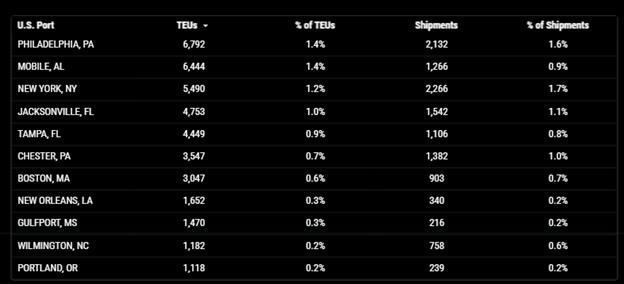

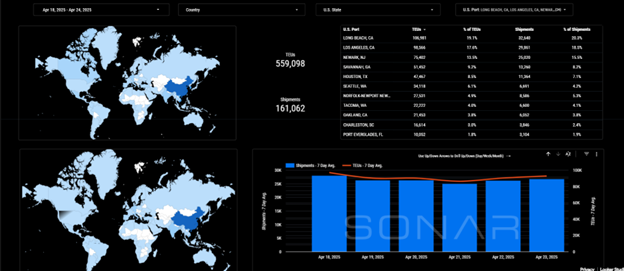

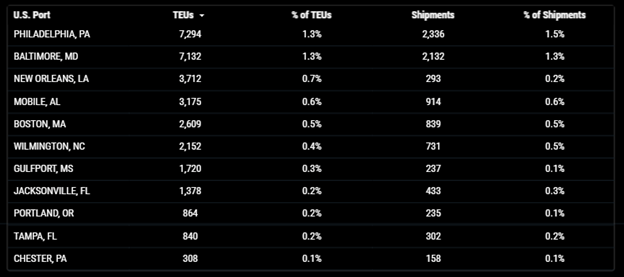

Import TEUs are down 15.11% this week from last week – with the highest volumes coming into Long Newark 15.3%, Long Beach 14%, and Los Angeles 8.8%. According to Census Bureau data, the list of American ports that processed the most containerized imports from China in 2024 was led by Los Angeles, at 22,237,485 million metric tons, or 51%, of the port’s total 43,912,894 tons of global cargo. China accounted for 8,341,200 tons, or 61%, of a total 13,592,209 tons through the neighboring Port of Long Beach, the second-highest total. Newark, New Jersey, was third and the leading East Coast gateway at 7,520,488 tons, 23% share, at a total of 32,995,507 tons. China’s share among other major container ports was 47% through Tacoma, Washington, 37% through Oakland, California, 36% through Seattle, 21% through Charleston, South Carolina and 18% through Norfolk-Newport News, Virginia. The scope of China’s share of all tonnage by commodity, according to the U.S. Harmonized Tariff Schedule (HTS), shows its dominance across top import categories. China’s share, ranked in descending tonnage, is topped by items made of plastic including toys, household goods and personal care items, 46%; residential and office furniture, 46%; nuclear reactors, 41%; electronics ranging from big screen TVs to electric blankets, 40%; iron and steel goods, 47%; and toys and sports equipment, 88%.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

LA/LGB: Despite tariff challenges, the Port of Long Beach remains committed to its environmental goals. Metro Ports, a key operator at the port, has achieved an 85% reduction in carbon emissions by transitioning to renewable diesel (R99) for its operations. This move aligns with the port’s broader sustainability objectives and demonstrates ongoing efforts to reduce environmental impact. Metro Ports has drastically cut its carbon footprint while continuing to grow its operations. The latest emissions study found:

- Total Scope 1 emissions dropped by 85%, from 774 metric tonnes in 2023 to 118 in 2024.

- Fossil fuel-related CO2 emissions fell by 86% as Metro’s reliance on traditional diesel decreased.

- Biofuel CO2 emissions increased as we transitioned to renewable energy sources. Unlike fossil fuels, biofuels release recently absorbed carbon from the atmosphere, making them a much cleaner alternative.

We dropped our transload rates for LA/LGB! Our Los Angeles drayage yard and transload warehouse location boasts a large drayage fleet, a large, secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your containers for palletized and floor to pallet transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a NO DEMURRAGE GUARANTEE on all orders that have been dispatched to us 72 hours prior to vessel arrival and are cleared for pickup by the last free day. Contact the team at letsgetrolling@portxlogistics.com for rates and any questions. Let’s talk about being your #1 West Coast transload team.

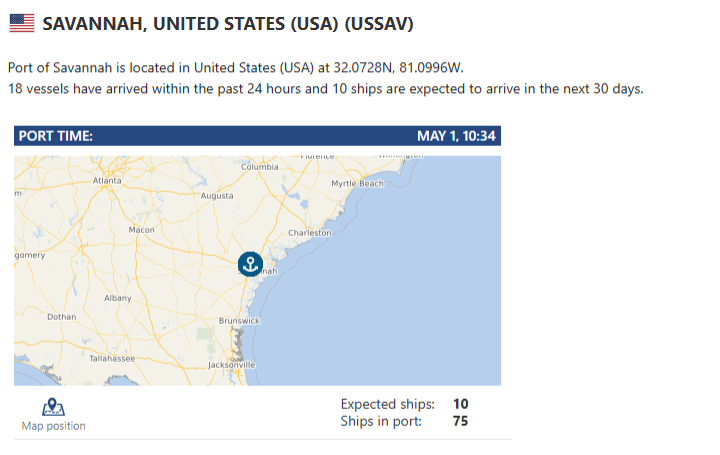

Savannah: Ocean Terminal Expansion: A new 1,650-foot lay berth at Ocean Terminal is set to open in May 2025, allowing vessels to dock and wait for berth availability at Garden City Terminal, thereby improving supply chain velocity. Despite increased activity, the Port of Savannah is currently congestion-free, with only three vessels waiting outside the port as of mid-April. The average import rail dwell time is approximately five days, indicating efficient cargo movement through the port. Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space and we have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks Contact the team sav@portxlogistics.com for great rates and supreme customer service.

Did you know? We are a fully bonded carrier, warehouse and yard in Kansas City! We operate the largest drayage operation in Kansas City with more than 100 power units in service daily and the entire fleet is equipped with GPS units for tight control. Operating a 66-door dock at the Kansas City, MO location, we are capable of handling freight consolidation, distribution, cross-docking, blocking, cargo storage, ramp for automotive loading for export and many other special projects. We are a full-service U.S. Customs bonded Container Freight Station and U.S. Customs Exam Warehouse that offers a wide variety of logistical solutions for whatever you may need. Contact letsgetrolling@portxlogistics.com to hear more about our Kansas City Services and rates.

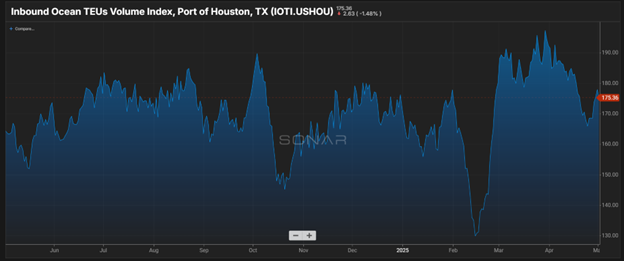

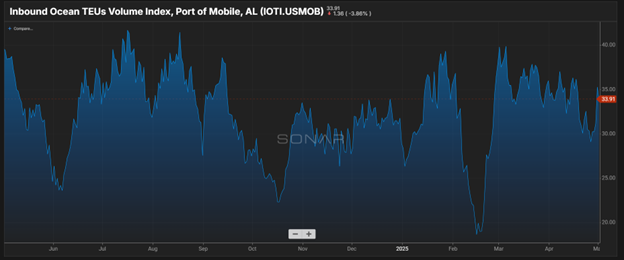

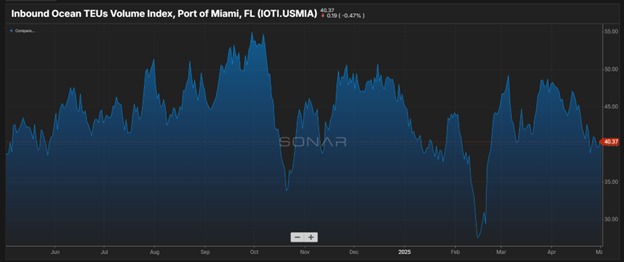

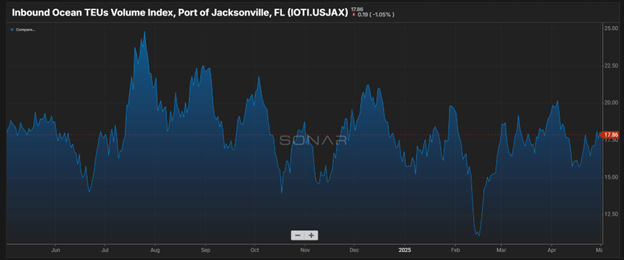

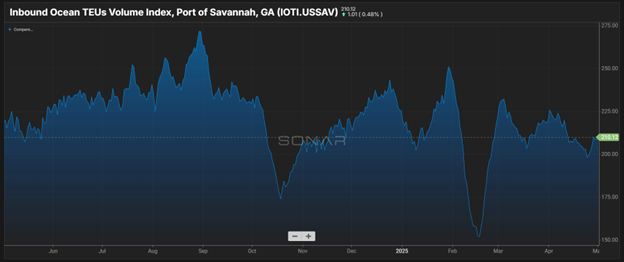

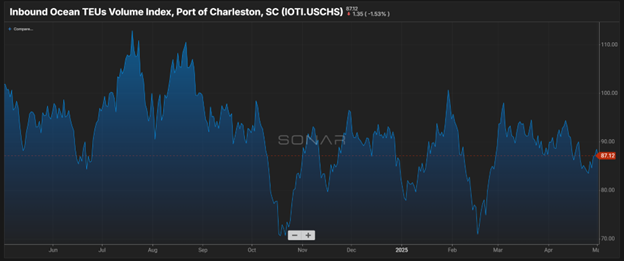

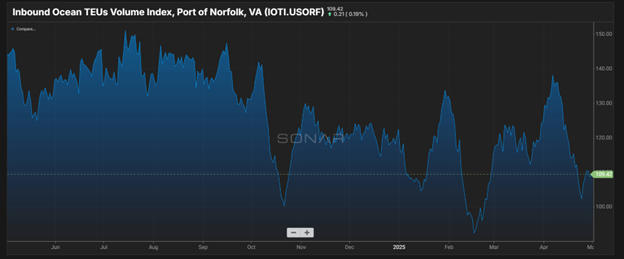

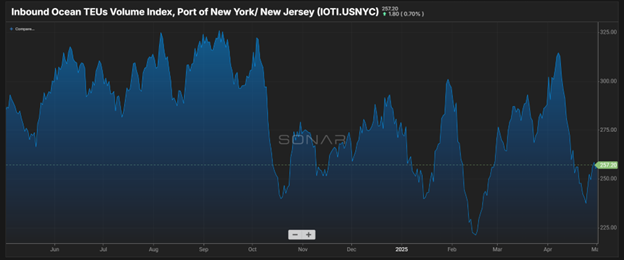

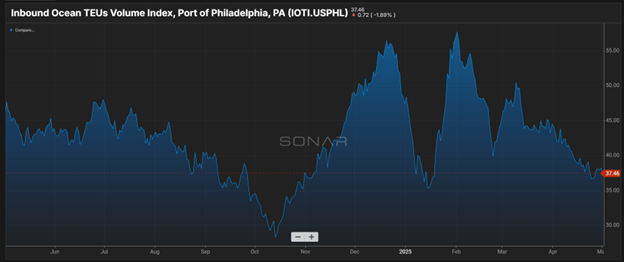

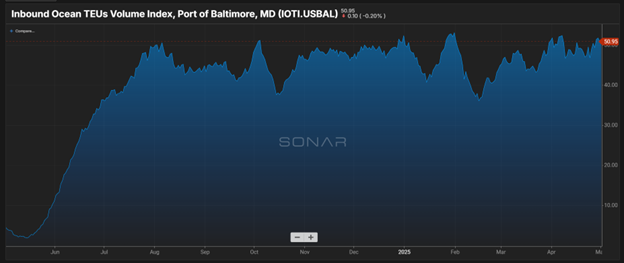

SONAR Import Data Images