1496 words 5 minute read – Let’s do this!

Much like shippers and well, everyone else in this industry, Steamship Line carriers are starting to get a little anxious about tariffs. Let’s jump into this week’s Market Update recap as we push towards the weekend:

China’s largest container carrier on Monday lashed out at a U.S. plan to charge its ships steep fees to dock at American ports. “We firmly oppose the accusations and the subsequent measures,” Cosco Shipping Lines said in a statement. “Such measures not only distort fair competition and impede the normal functioning of the global shipping industry, but also threaten its stable and sustainable development.” The plan for port fees was revealed Friday by the U.S. trade representative following pushback by traders and maritime stakeholders to an initial proposal for millions of dollars in flat port charges. The revised plan sets fees tied to a ship’s size or number of containers carried by a ship, whichever is greater.

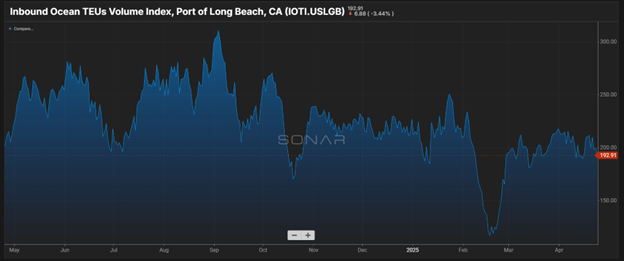

Ocean Alliance’s Bohai service, operated by Cosco Shipping, will cancel a China departure for Long Beach in the first week of May, according to vessel schedules, removing 10,000 TEUs of capacity during that time. Ocean Alliance’s Hibiscus Express and Yangtze services are also expected to blank one weekly departure each from China.

Cosco, the world’s fourth-largest container line, operates some of the biggest vessels between Asia and the United States. It’s likely Cosco will feel the effects not just from the port fees but in fewer calls at U.S. ports as part of the Ocean Alliance with Chinese carrier OOCL and Evergreen of Taiwan.

Ocean carrier Hapag-Lloyd says it pivoted to smaller ships rather than blanking trans-Pacific voyages in order to manage the sharp decline in US import bookings following the Trump administration’s implementation of hefty tariffs against China. Forwarders and non-vessel-operating common carriers (NVOs) said over half of their China bookings were canceled in the aftermath of the tariffs. At the same time, Hapag-Lloyd said bookings from Southeast Asia “are currently going up significantly” after Trump paused reciprocal tariffs against other trading partners for 90 days.

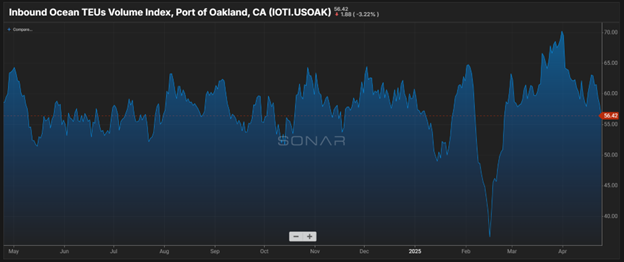

Taiwan-based Evergreen Marine, which operates the Hangzhou Bay Bridge (HBB) service as part of the Ocean Alliance, has canceled sailings for four straight weeks into Los Angeles and Oakland, removing 8,000 TEUs to 12,000 TEUs of weekly capacity.

South Korea, which is serviced on HBB’s call at Busan, reported a 5% drop in exports during the first 20 days of April, following the release of Trump’s reciprocal tariffs.

The tariff negotiation uncertainty is pretty real right now. Stocks fluctuate daily and there is no clear vision for future ocean and trucking rates. There is still a lot of panic for shippers to find solutions to mitigate tariffs on Chinese imports, and we at Port X are here to help talk about it. Contact letsgetrolling@portxlogistics.com to discuss options and to hear about how we can be your easy button – Don’t forget to follow our LinkedIn page to get a weekly dose of the latest and greatest Market Updates and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox Email marketing@portxlogistics.com.

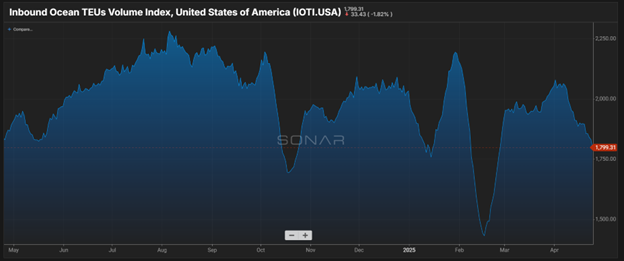

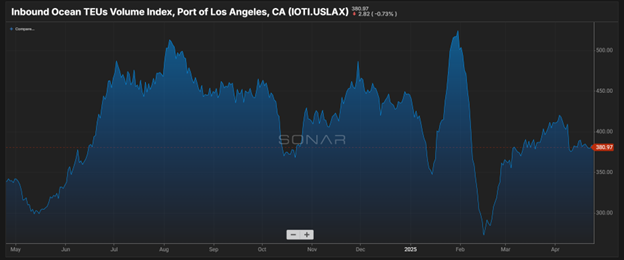

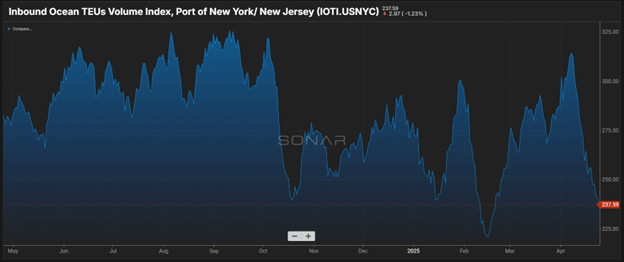

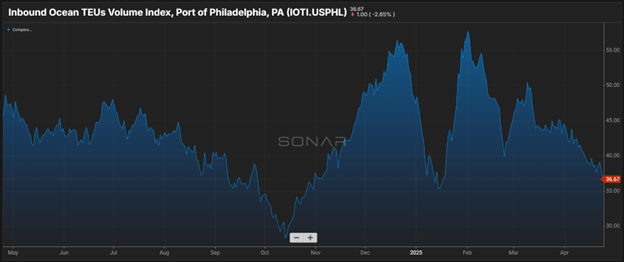

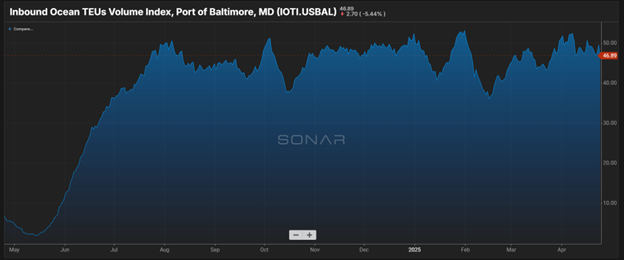

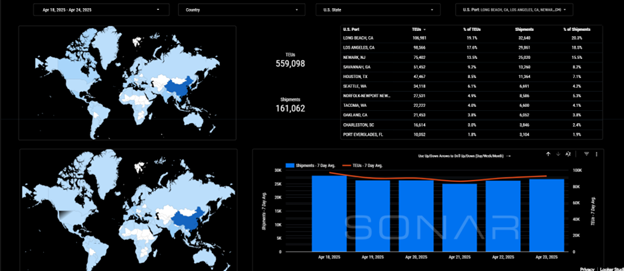

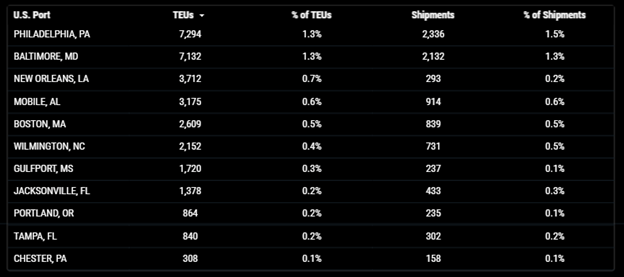

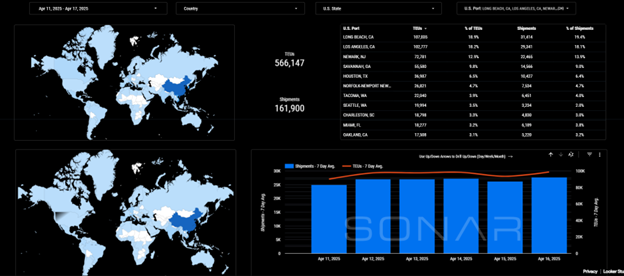

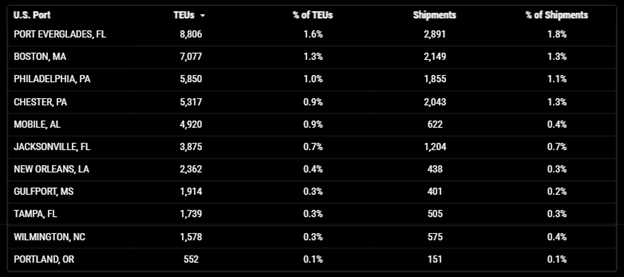

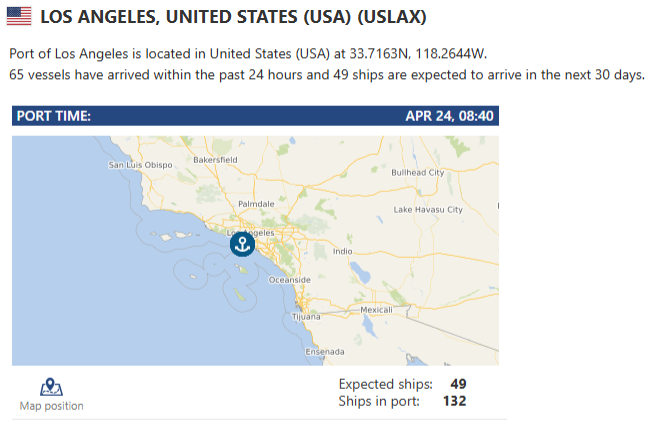

Import TEUs are down 1.24% this week from last week – with the highest volumes coming into Long Beach 19.1%, Los Angeles 17.6%, and Newark 13.5%. Earlier this month, U.S. retailers slashed their outlook for U.S. imports in the second quarter and the second half, warning that volumes would fall by more than 20% on an annual basis in every month from May through August. The Port of Los Angeles’ expectation that container volumes will plunge 14% month over month in week 18 and 38.6% in week 19, respectively, according to the port’s forecasting tool. In the first full week of May, volumes through the country’s largest import gateway are projected to plummet 43% year over year. Forwarders say bookings from Southeast Asia to the U.S. have held up better than those for shipments from China, presumably thanks to the 90-day suspension of significantly higher tariffs on goods sourced from Vietnam and Cambodia. Imports from those countries now face a 10% tariff, rather than the initially announced duties of 46% and 49%, respectively. Weekly bookings for shipments from China have plunged 37% since March 31st, according to a Monday analysis of data from maritime visibility provider Vizion and analytics firm Dun & Bradstreet.

What’s happening at the ports and rails?

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

LA/LGB: Despite the tariff challenges, the Port of Los Angeles continues to engage in environmental and community-focused initiatives. On April 16th, industry leaders gathered at the port to honor exemplary efforts in the “Protecting Blue Whales and Blue Skies” program, celebrating a decade of conservation efforts aimed at reducing ship strikes on endangered whales and improving air quality. The Protecting Blue Whales and Blue Skies program is a voluntary Vessel Speed Reduction (VSR) initiative along the California coast, aiming to mitigate the risks posed by commercial shipping to endangered whales, reduce air pollution, and decrease underwater noise. By encouraging ships to transit at speeds of 10 knots or less in designated areas during specific seasons, the program seeks to create safer conditions for marine life and improve environmental quality. We dropped our transload rates for LA/LGB! Our Los Angeles drayage yard and transload warehouse location boasts a large drayage fleet, a large, secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your containers for palletized and floor to pallet transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. And let’s not forget: We offer a NO DEMURRAGE GUARANTEE on all orders that have been dispatched to us 72 hours prior vessel arrival and are cleared for pickup by the last free day. Contact the team at letsgetrolling@portxlogistics.com for rates and any questions. Let’s talk about being your #1 West Coast transload team.

Houston: Dwell Times: As of mid-April, only about 2% of import containers remained on terminals for 14 days or more, indicating efficient cargo movement and minimal congestion. Both Bayport and Barbours Cut terminals report normal chassis availability, facilitating smooth inland transportation of containers. The Port Houston is closely monitoring global market shifts, especially amid ongoing tariff negotiations between the U.S. and its trading partners. The port’s leadership is prepared to adapt operations in response to any changes in trade dynamics. Port X Logistics has drayage assets in Houston with the capability of long-haul drayage and we have a transload warehouse in LaPorte that can transload anything from standard pallets, to heavy lumber and industrial coils. We have plenty of capacity if you need help in the Houston area – we got your back. Contact letsgetrolling@portxlogistics.com

Chicago: Norfolk Southern’s 47th Street Intermodal Facility: Recent roadwork on 51st Street, adjacent to the terminal, has affected traffic flow. Although the construction concluded on April 18th, residual delays may persist as traffic patterns normalize. Chassis Availability: Chicago continues to face shortages of 20-foot chassis, impacting container pickups and returns. This constraint is contributing to extended dwell times and operational inefficiencies. Terminal Dwell Times: Import rail dwell times in Chicago are averaging around 2 days, indicating relatively smooth operations despite equipment shortages. Our Chicago asset drayage team has full capacity to get your Chicago containers moving. We have 88 trucks, 150 chassis and specialized chassis/equipment including 100 triaxle and spread axles combined and a secured yard space and we are able to secure permits to haul heavy containers. For great rates, capacity and supreme customer service contact the team at letsgetrolling@portxlogistics.com

Did you know? DOT Week also known as the CVSA International Roadcheck is May 13th – 15th . A 72-our event where commercial motor vehicle inspectors conduct inspections on trucks and drivers across North America to ensure compliance with safety regulations. This event happens every year, with the 2025 event scheduled for May 13-15. The Road check focuses on both driver and vehicle safety, with the 2025 focus on tires and false records of duty status. With over 450 trucks and company drivers in our asset drayage fleet, we invest in the best for our trucks, drivers and compliance team to ensure we provide the safest travel for your freight. To hear more about DOT week and choosing Port X Logistics as your drayage partner contact letsgetrolling@portxlogistics.com

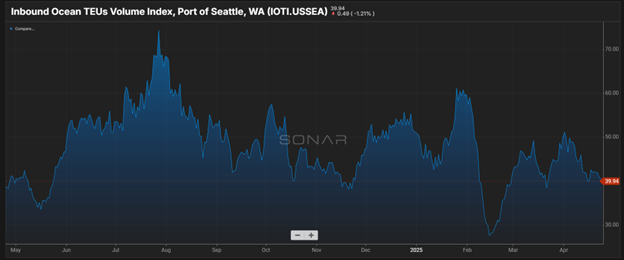

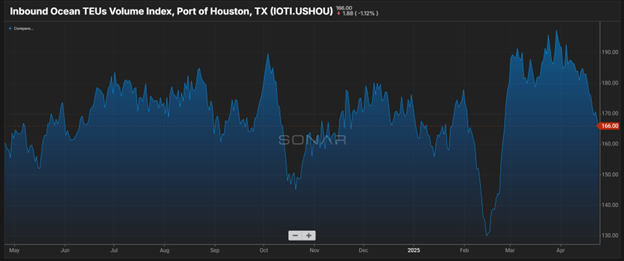

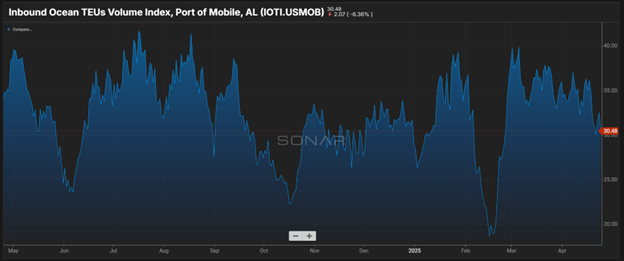

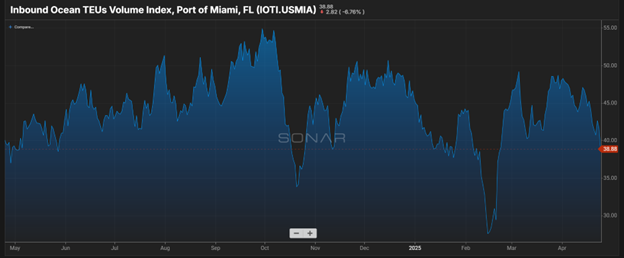

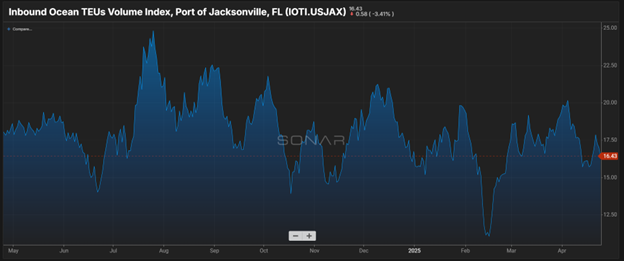

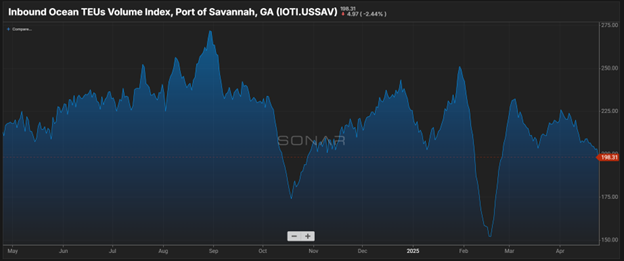

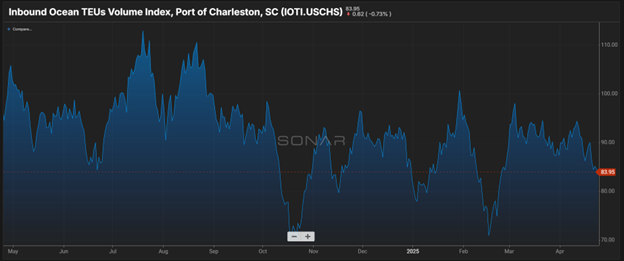

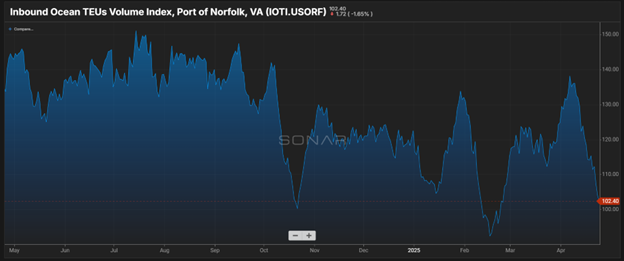

SONAR Import Data Images