1749 words 6 minute read – Let’s do this!

By now it is no surprise that President Trump’s tariffs have introduced uncertainty into the market. The stock market has seen the largest quarterly drop since 2022, partly due to uncertainties tied to Trump’s tariffs. The S&P 500 dropped 4.6 percent in the first quarter, and NASDAQ dropped around 10 percent. Goldman Sachs said there’s now a 35 percent chance of the U.S. economy entering a recession within 12 months, up from 20 percent, with tariffs being a contributing factor. We are watching the tariff changes with an eagle eye with each Market Update – Follow our LinkedIn page to get a weekly dose of the latest and greatest Market Updates and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox Email Marketing@portxlogistics.com

Just 72 days after taking office, President Donald Trump announced yesterday April 2nd sweeping trade policy changes, introducing what he called “reciprocal tariffs” for all countries and declaring it “Liberation Day in America.” Trump’s new tariff regime is designed to boost U.S. manufacturing and create American jobs, but the effects on inflation and the short-term and long-term impacts on the economy remain to be seen. Here are some takeaways from Wednesday’s announcement:

10 percent universal tariffs – Trump imposed a minimum baseline tariff of 10 percent on imports from all countries. The across-the-board levy will take effect on April 5th at 12:01 a.m.

Reciprocal tariffs target countries with barriers – In addition to universal tariffs, Trump also announced additional reciprocal tariffs on U.S. trading partners on the list below. These tariffs will be higher to counter partner nations’ non-monetary trade barriers. The White House announced that the new tariff rates shown in the president’s chart for each country consist of the 10 percent baseline tariff and additional reciprocal levies. These new tariffs will be applied on top of any other existing tariffs. The additional reciprocal rates will take effect on April 9th at 12:01 a.m.

Canada and Mexico omitted from the list – Canada and Mexico have been excluded from the new reciprocal tariff regime. According to senior administration officials, both countries remain subject to the national emergency that Trump previously declared. The original 25 percent tariff on goods from Canada and Mexico, imposed due to concerns over illegal migration and fentanyl trafficking, will remain in effect. The Trump administration had previously granted exemptions for cars and other goods compliant with the U.S.–Mexico–Canada Agreement (USMCA), but these exemptions expire on April 2nd, and no extension has been announced.

Trump said he expects to receive calls from heads of state about how to reduce their tariffs and other market barriers — such as state subsidies or currency manipulation — in the coming days as countries seek to reduce the impact of the reciprocal tariffs.

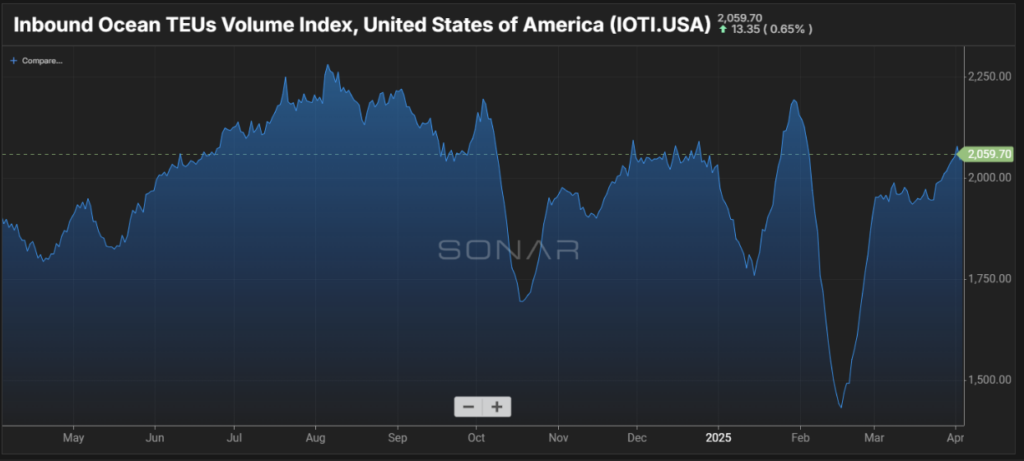

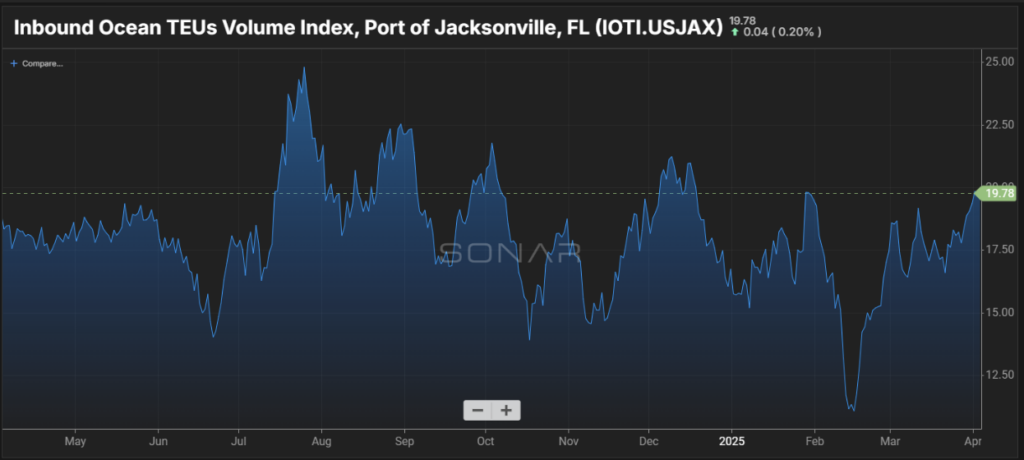

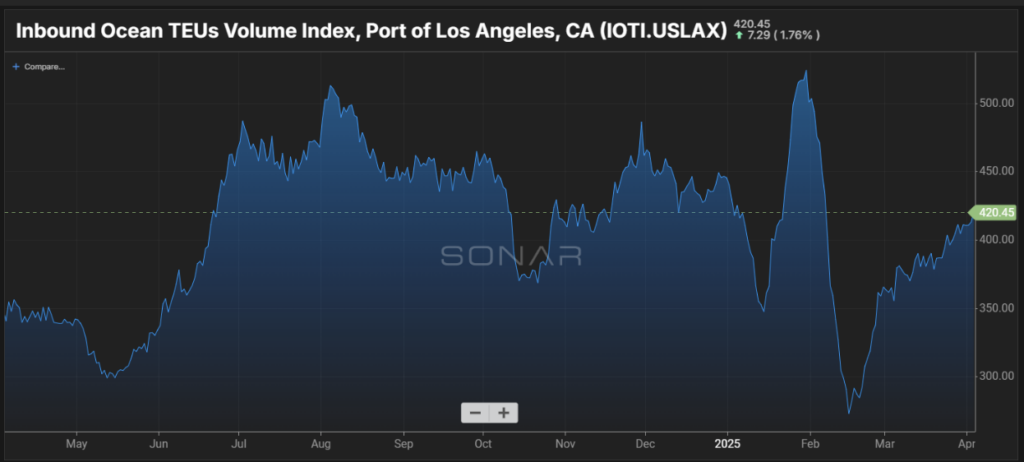

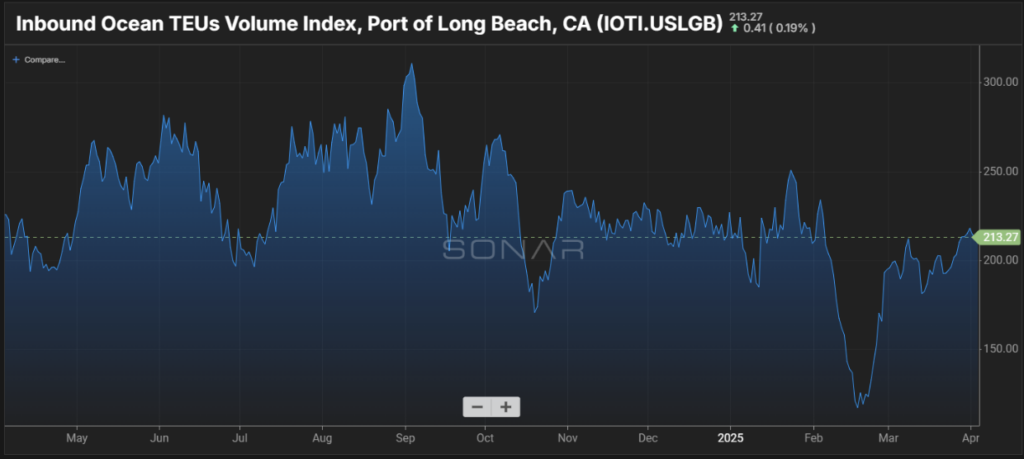

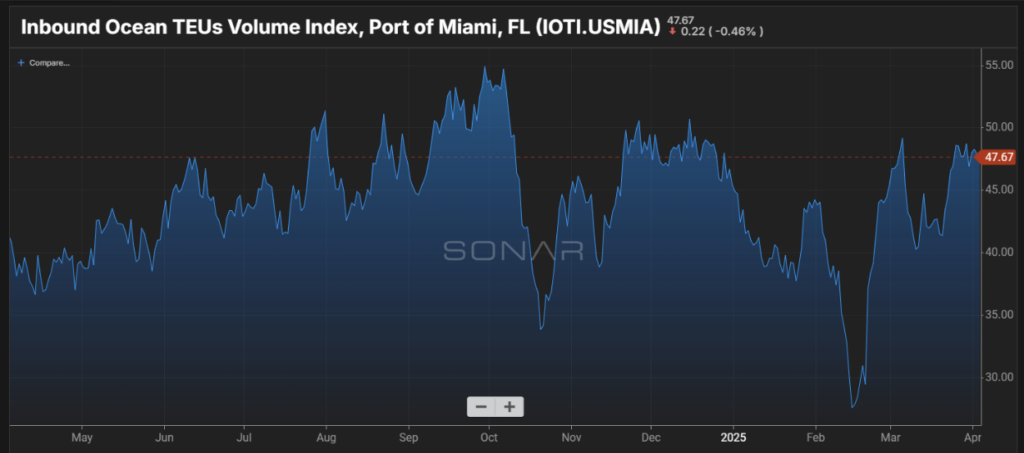

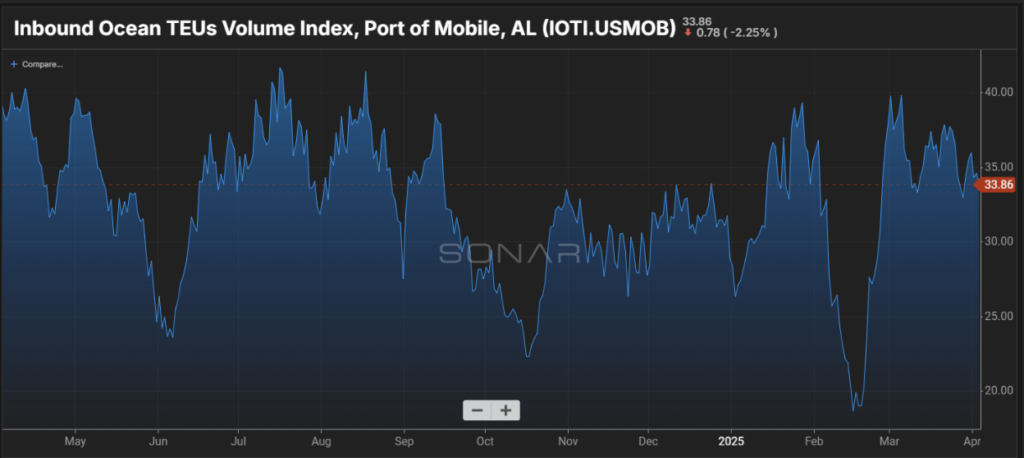

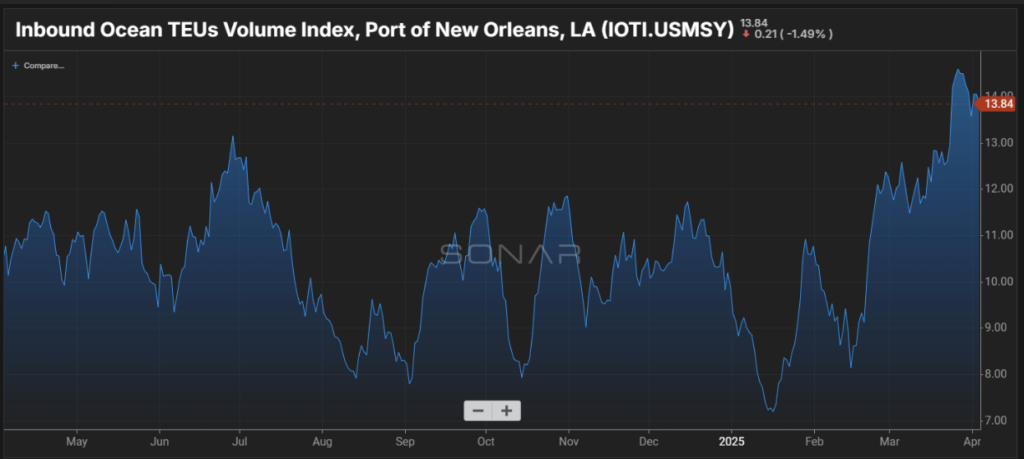

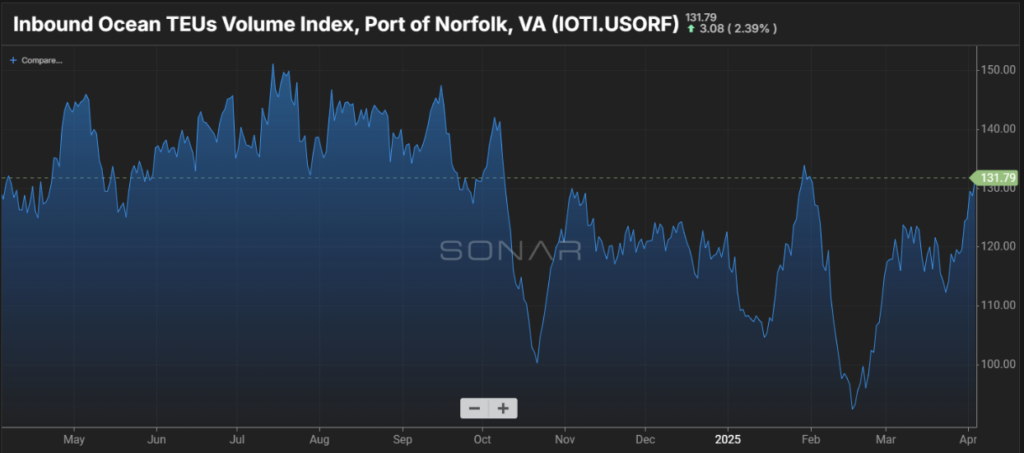

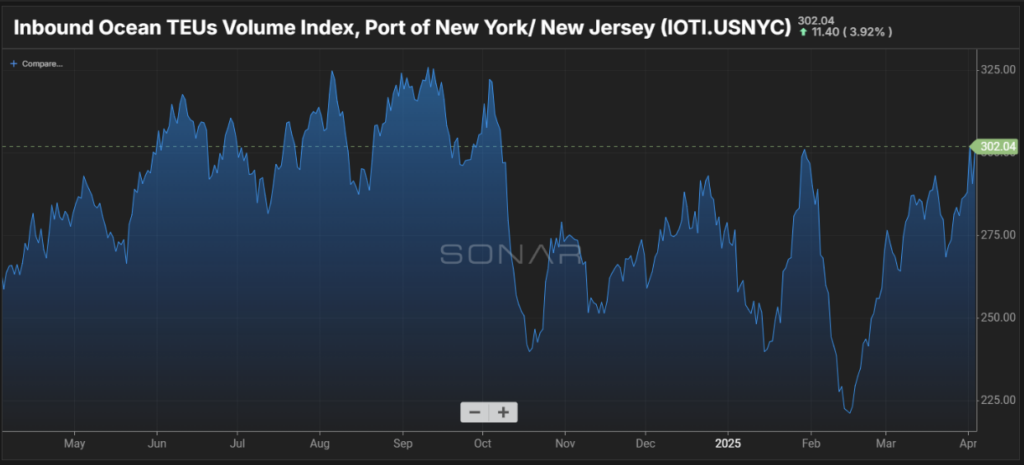

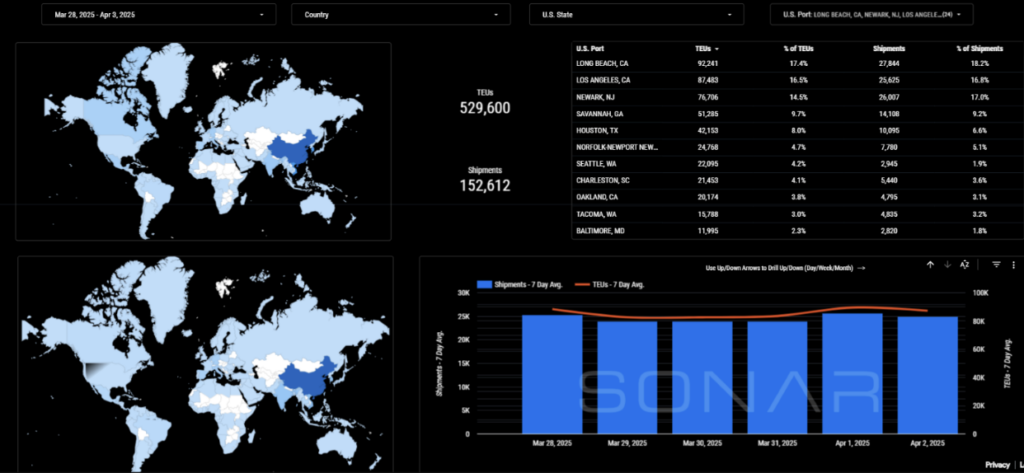

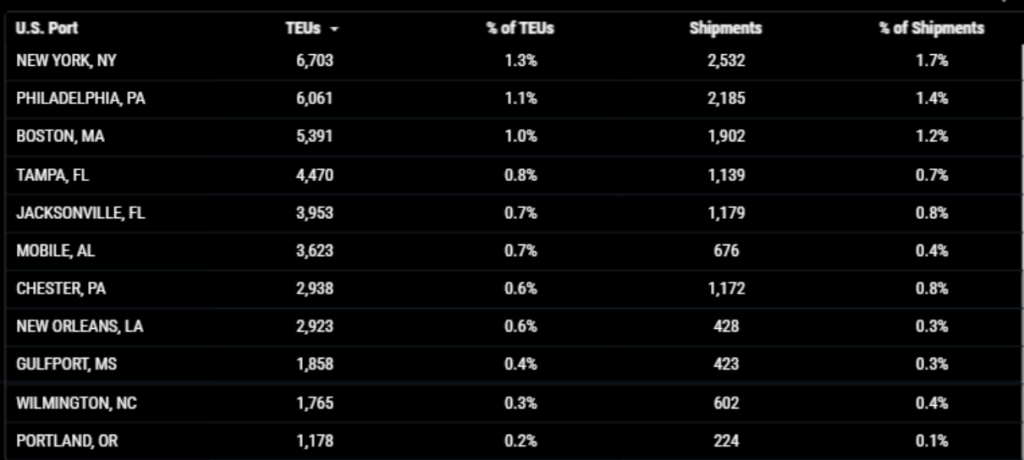

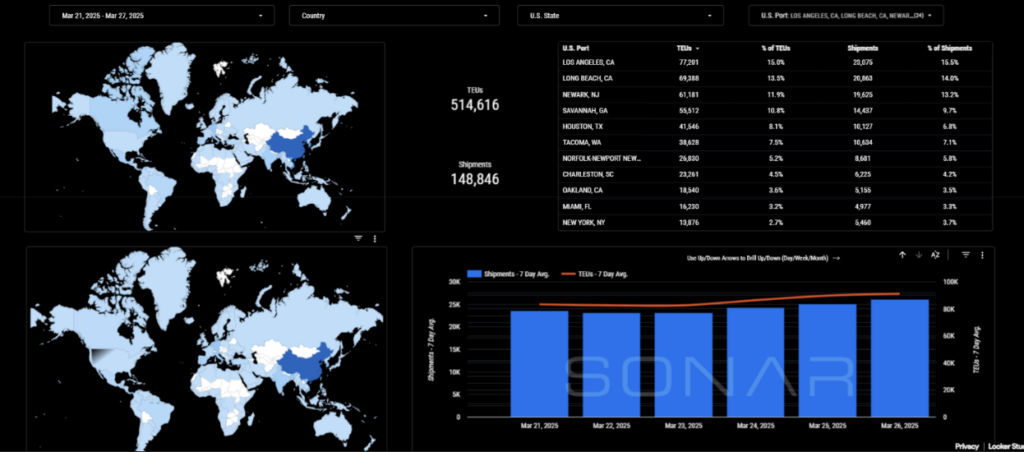

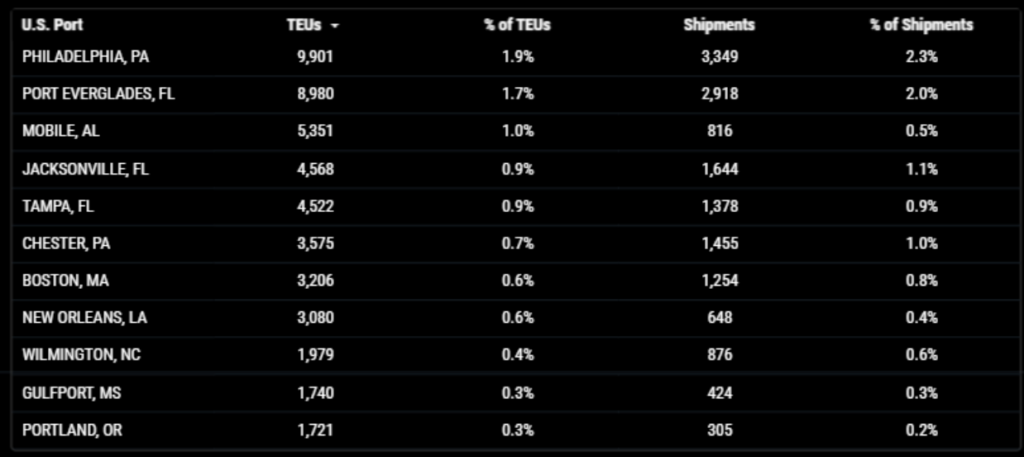

Import TEUs are up 2.91% this week from last week – with the highest volumes coming into Long Beach 17.4%, Los Angeles 16.5%, and Newark 14.5%. There is no expected significant upward pressure on ocean container freight rates. Carriers did push spot rate increases on trades from the Far East to U.S. on April 1st , but these are unlikely to stick as they come off the back of steady market decline since January 1st and subdued demand in February and March. Once the tariff situation becomes clearer and shippers begin to diversify supply chains across regions, it is possible we could see disruption in ocean supply chains and upward pressure on rates, but this may be a little further down the line. Average spot rates from the Far East increased 8% into the US East Coast and 15% into the US West Coast on April 1st, however they are down 43% and 49% since 1 January respectively. The average on-demand spot rate to ship a 40-foot container on the key Far East to U.S. West Coast route was $2,844 on Tuesday, a one-day gain of almost 16%, according to data from freight pricing platform Xeneta. That rate is still lower than a year ago, when the risk of Houthi attacks on Red Sea shipping lanes was a new phenomenon and trading was not distorted by importers seeking to avoid tariffs.

It is a similar scenario for the air cargo market, with analysts not expecting significant increases in rates in the immediate aftermath of the tariffs. Air cargo spot rates currently stand at USD 4.16 per kg from Shanghai to U.S., down from the peak season high of USD 5.75 in the week ending 10 November. Spot rates from Western Europe to the U.S. stand at USD 2.16 per kg, down from the peak season high of USD 3.51 in the week ending December 15th.

On the subject of airfreight – Port X Logistics will be attending MRO Americas 2025 in Atlanta next week April 8th through the 10th. MRO Americas is the face-to-face opportunity that connects Aviation Week Network’s MRO portfolio which includes market leading intelligence & insight, proprietary data, forecast views of future opportunity and risk, forward-looking content on trends, fleet data, transactions, and life cycles, results-driven marketing services and advertising, and digital marketplaces. Members of our Carrier911 team will be present to take meetings and show the many successes and benefits we have to offer your air freight teams. Are you looking to find a more streamlined way to reduce your stress and your need to babysit your urgent airfreight shipments on the domestic trucking side? Let our Carrier911 team be your best solution. We can get your drivers assigned and on site at the airport in most cases within 1 hour. We have access to cargo vans, straight trucks, dry vans and more. Each of our drivers have experience with airport and CFS pickups and have access to retrieving the proper documentation to make these pickups seamless. Don’t forget we provide shareable tracking links and PODs sent at the time of delivery, so you can relax stress free with all of your most critical shipments. Contact the Carrier911 team 24/7/365 info@carrier911.com

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

LA/LGB: The Port of Long Beach’s recently approved 2026-2035 capital improvement program designated over $1.28 billion, about 40% of the total $3.2 billion plan, for the Pier B on-dock rail support facility. The facility will more than triple the volume of on-dock cargo the port can handle annually, from 1.5 million 20-foot equivalent units to 4.7 million TEU by increasing the capacity at the shipping terminals. The project calls for doubling the existing Pier B rail yard from 82 acres to 171 acres, and adding a fueling and servicing depot and an assembly and breakdown staging area. The expanded rail yard also will be connected to on-dock rail facilities and the Alameda Corridor railway, which connects the Port of Long Beach and the Port of Los Angeles. Construction of the rail facility began in 2024, and completion is expected in 2032, port officials said in a press release. If you are looking for immediate capacity, our Los Angeles location boasts a large drayage fleet, a large, secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your containers for transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. Contact the team at letsgetrolling@portxlogistics.com with your new orders today.

Seattle/Tacoma: A local seafood company has big plans for a new facility at the Port of Tacoma. Details have emerged of Tacoma-based Fathom Seafood’s plans for a new 550,000-square-foot cold storage and processing facility at a cost of $280 million. Fathom is involved in live seafood, processing and distribution with a workforce of about 168 employees, according to Mills. The company is joining forces with New Jersey-based private equity investor Saxum Real Estate and Development in its latest venture. The plans propose 450,000 square feet of cold storage, “for all food, not just seafood,” and more than 100,000 square feet of automated processing for seafood. The site would include two buildings, with a rail dock between the two, and construction taking place in phases. The goal is to break ground this summer on, while they’re still working on the building permit. When they get the building permit, then try and take keys on the facility by the end of ‘26,” for the first phase, and then “take the keys” on the second phase the following year. Do you want to learn how shipping through the SEA/TAC ports can benefit your supply chain and if you are looking for an all-star drayage/transload warehouse team? Our Seattle operation has plenty of drayage capacity with the addition of 11 new drivers and a huge amount of warehouse capabilities for ongoing transloading projects. Contact letsgetrolling@portxlogistics.com for capacity and great drayage and warehouse

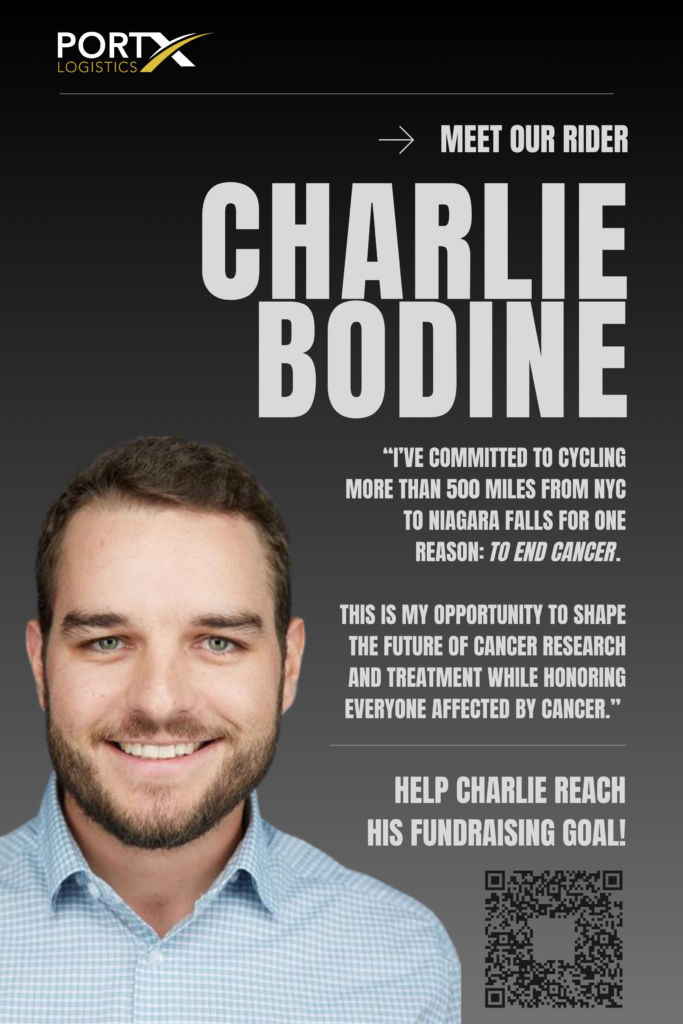

Did you know? Our very own Brand Ambassador Charlie Bodine of our Denver office will be showing off his athletic abilities and repping Port X as our company rider at this year’s Empire State Ride?

For seven days, Charlie will pedal across 500+ miles of New York State, starting in Staten Island and finishing just around the corner from our Buffalo HQ in Niagara Falls.

He’s not just doing it for the ride either, he’s joining the fight against cancer, helping to raise funds for groundbreaking research at Roswell Park, a local but internationally known powerhouse in cancer research.

Charlie, we’re pumped to have one of our own on this incredible ride!

If you want to support Charlie and the cause, stay tuned, we’ll be cheering him on and checking in with him each day of the ride 🎉

To donate or to learn more about the ride, click below!

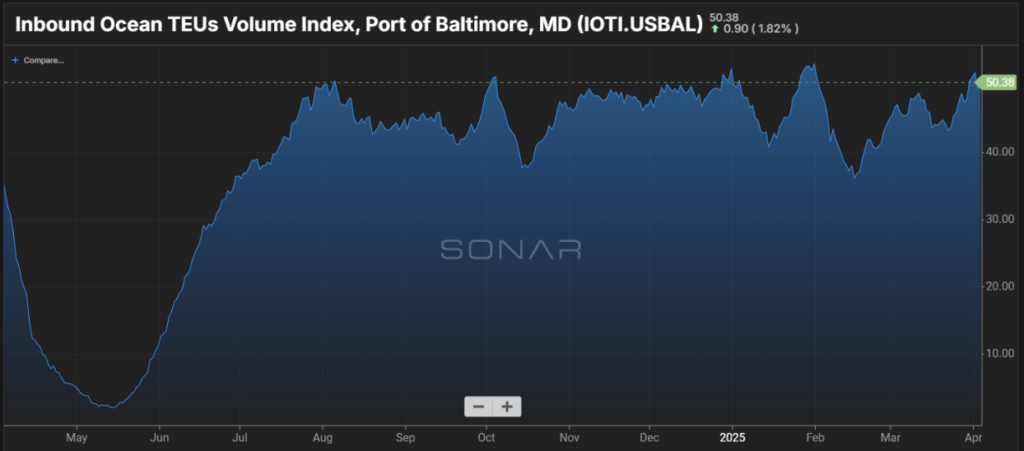

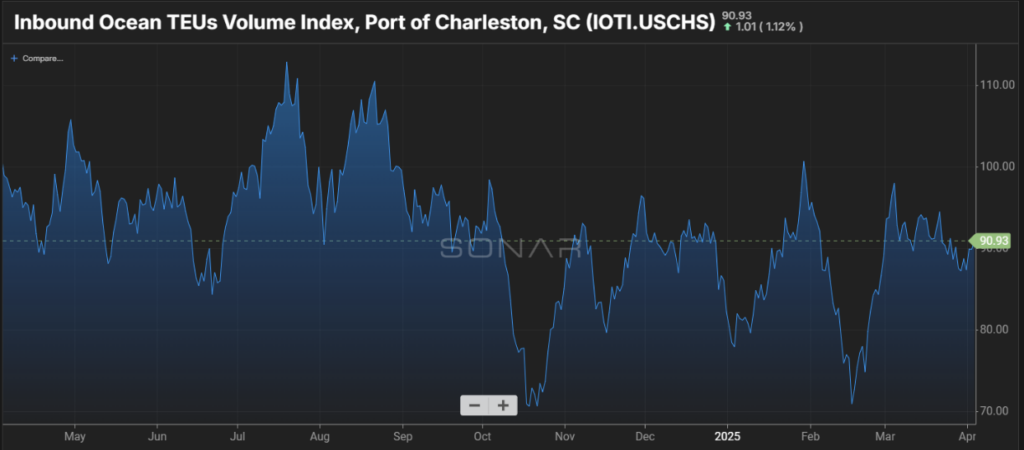

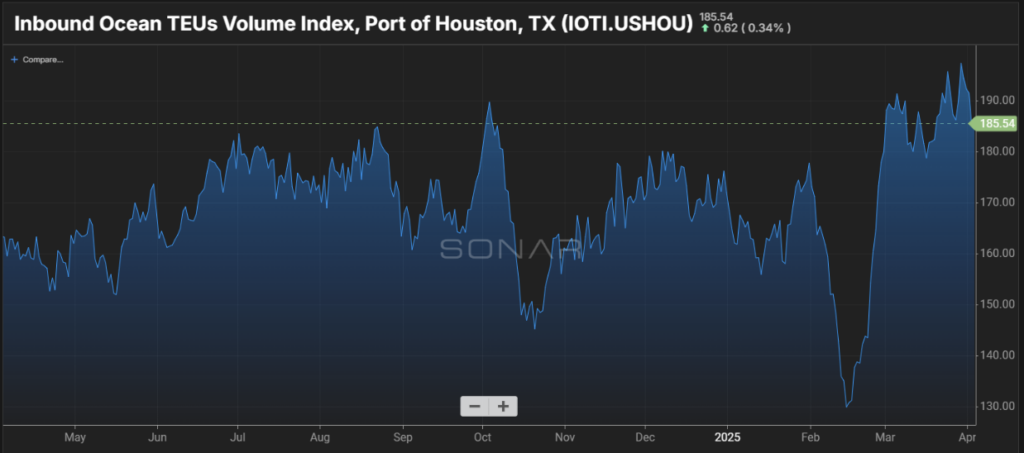

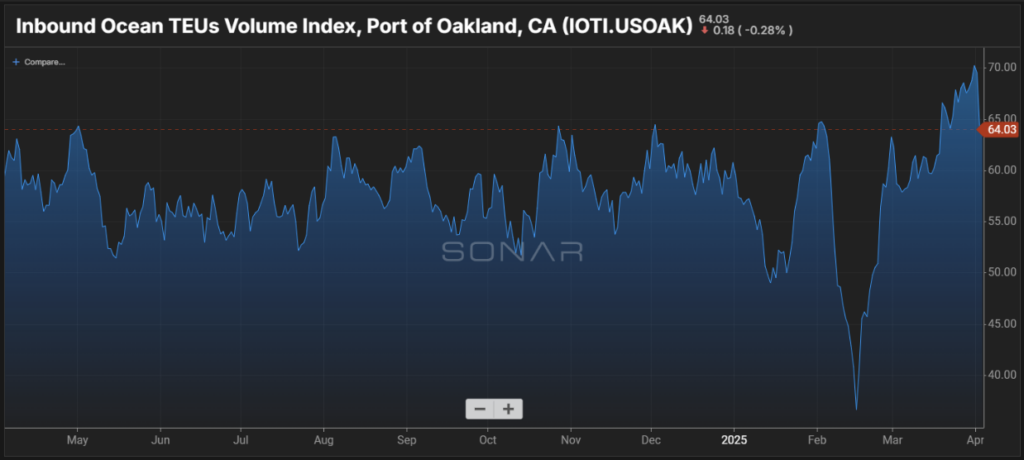

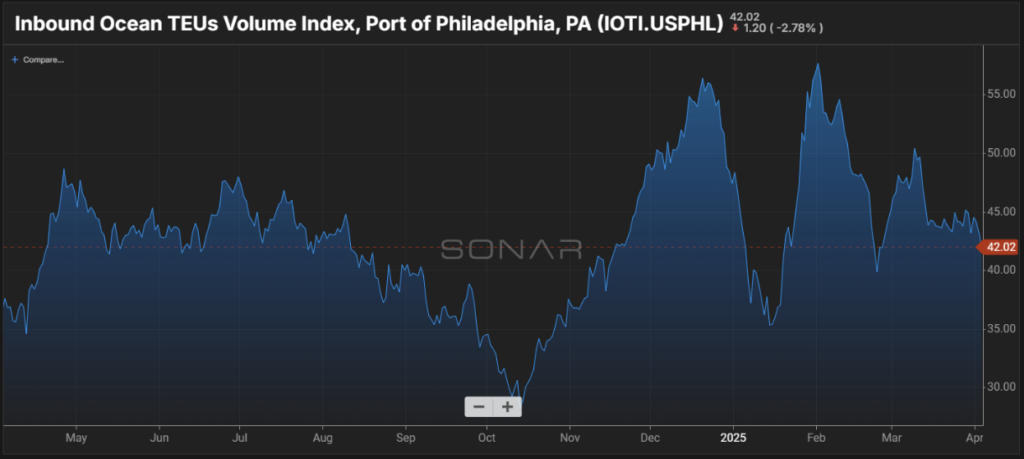

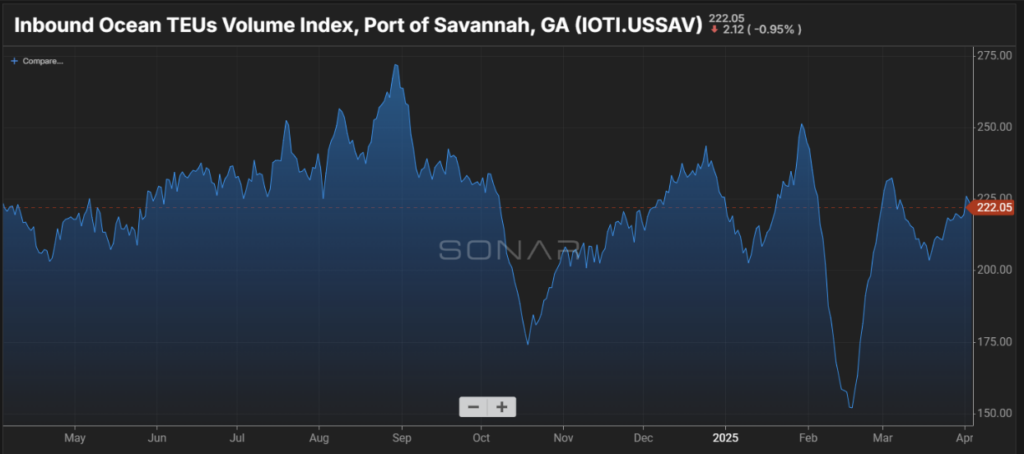

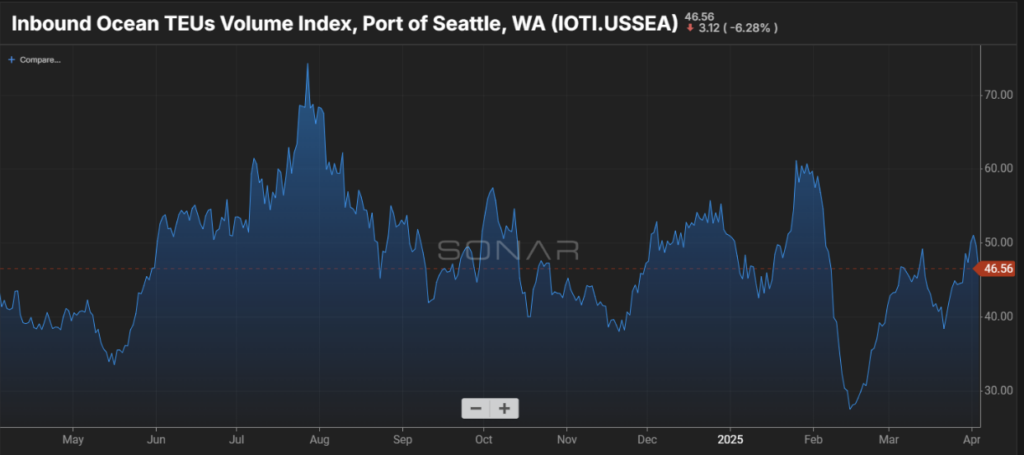

SONAR Images