1836 words 7 minute read – Let’s do this!

In 19 days Q1 will officially come to an end. So far, the industry has already experienced a new U.S. President bringing tariff changes, a whole lot of winter weather crazy and a successful wrap up of TPM25. There are uncertainties with the tariffs and both the Panama Canal and the Suez Canal that could greatly affect the market – We urge you to follow our LinkedIn page for the latest and greatest Market Updates and to get on the list for this weekly Market Update Newsletter and future industry related news sent direct to your inbox Email Marketing@portxlogistics.com

On Tuesday, the Yemen-based Houthis announced it would continue attacking Israeli ships in the Red Sea region in response to Israel blocking aid to Gaza. Yemen’s Houthi forces have declared an immediate ban on Israeli ships in the Red Sea, Arabian Sea, Bab al-Mandab Strait, and Gulf of Aden, threatening to attack any vessels that violate the blockade. It remains unclear whether the Houthis’ renewal of the blockade will include ships beyond those with Israeli ties, particularly given their history of seemingly indiscriminate and misinformed targeting. This renewed threat will also likely reduce the chances of shipping services returning to the traditional Suez Canal route, as re-routed services have already largely avoided returning to the route during the first phase of the ceasefire. As of now, the maritime security situation remains unstable, with the risk of escalation if the ceasefire deteriorates or if U.S. and UK forces take military action against Houthi positions. Crisis remains in the Red Sea.

The Red Sea crisis continues to have a major impact on container shipping. The diversions around southern Africa are what continues to keep container vessel capacity in short supply. The amount of idle container vessels has been well below 1% since February 2024 and the latest data for February 2025 shows an idle ratio of 0.6%. This is the same low level of idle capacity we saw during the height of the pandemic disruptions and implies that there is effectively no material excess capacity available. This is the foundation for freight rates remaining at a relatively elevated level despite recent declines. The Red Sea crisis appears likely to continue for the medium term, which also lays the foundation for a strong peak season in 2025 — unless demand is negatively impacted by recession or inventory corrections, or a combination thereof. But with new capacity continuing to be delivered, the pressure on the supply/demand balance in 2025 will be less than in 2024, and hence clearly a manageable situation.

In a press release last Tuesday, CK Hutchison Holding said that it would sell all shares in Hutchison Port Holdings and all shares in Hutchison Port Group Holdings, in a deal valued at $22.8 billion. The two units hold 80% of the Hutchison Ports group that operates 43 ports in 23 countries, including two of the four major ports that exist along the Panama Canal. The deal will give the BlackRock consortium control over 43 ports in 23 countries, including Mexico, the Netherlands, Egypt, Australia, Pakistan and elsewhere. The United States is the Panama Canal’s largest user, with about 70% of shipping traffic going through the canal either coming to or from the U.S. Its second largest user is China. You can read the full press release here:

https://www.ckh.com.hk/en/media/press_each.php?id=3431

Even though the trials of the dry past year are still fresh in many people’s minds, there’s also a sense of optimism right now that 2025 will be a good year for ship traffic through the Panama Canal—current water levels in Gatun Lake are the highest they’ve been in the past 5 years.

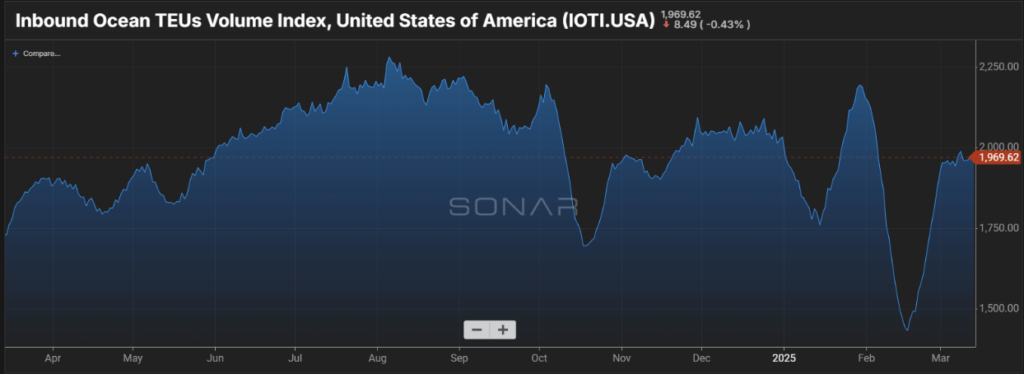

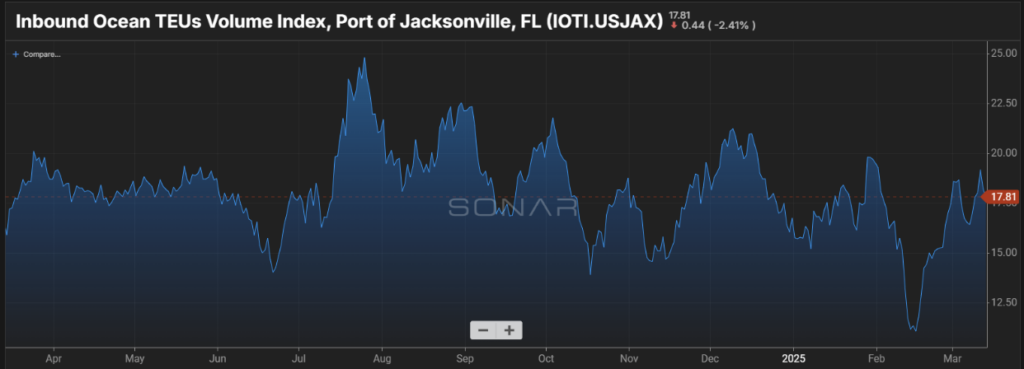

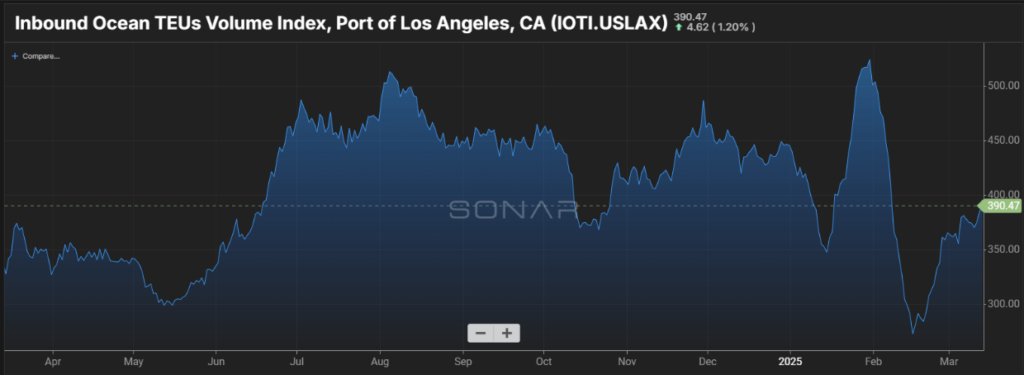

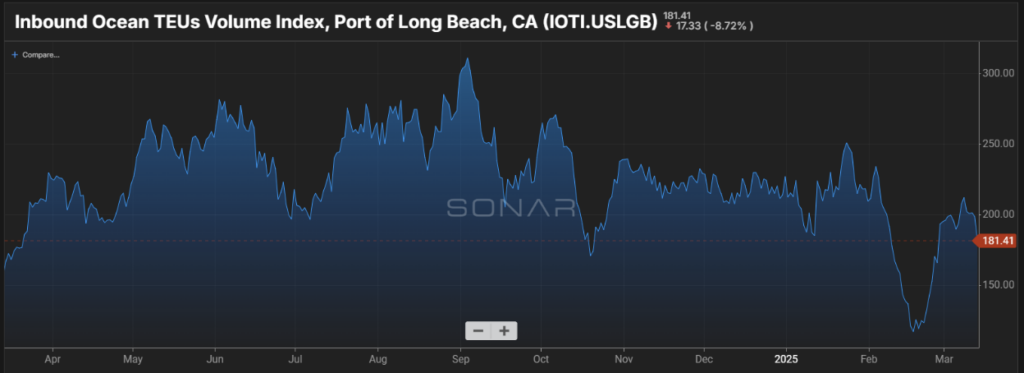

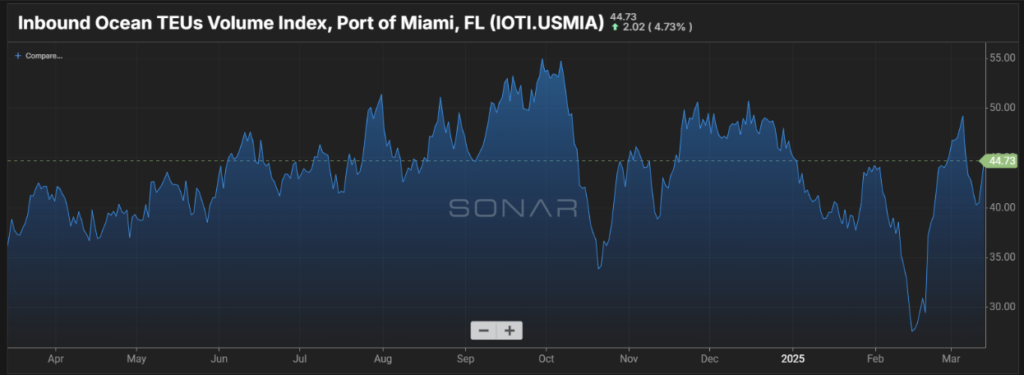

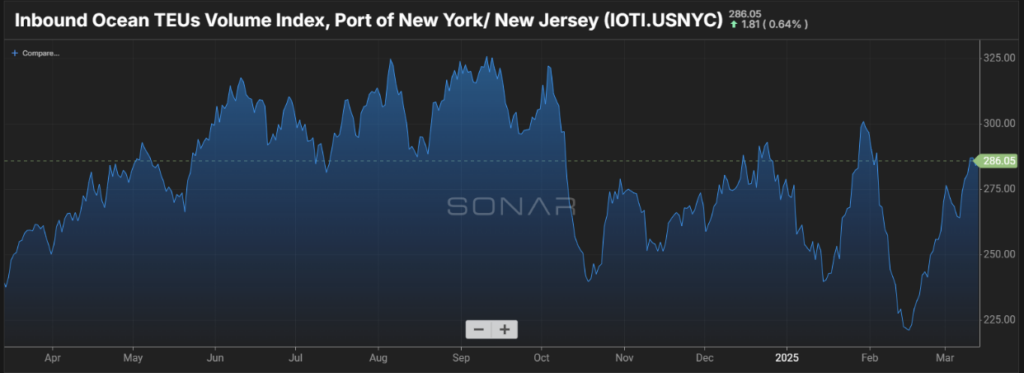

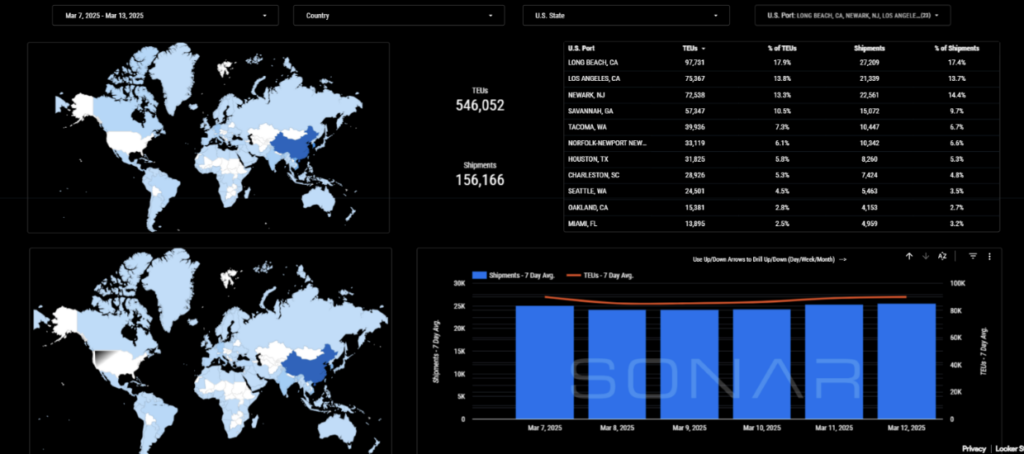

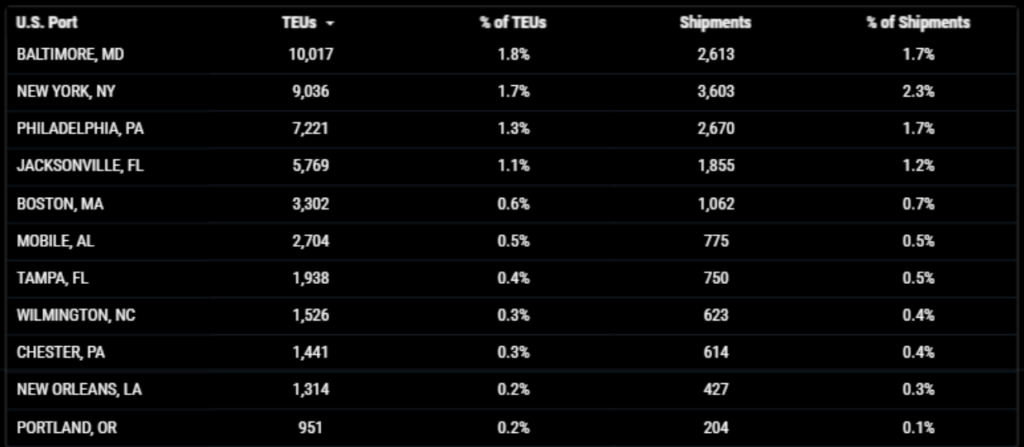

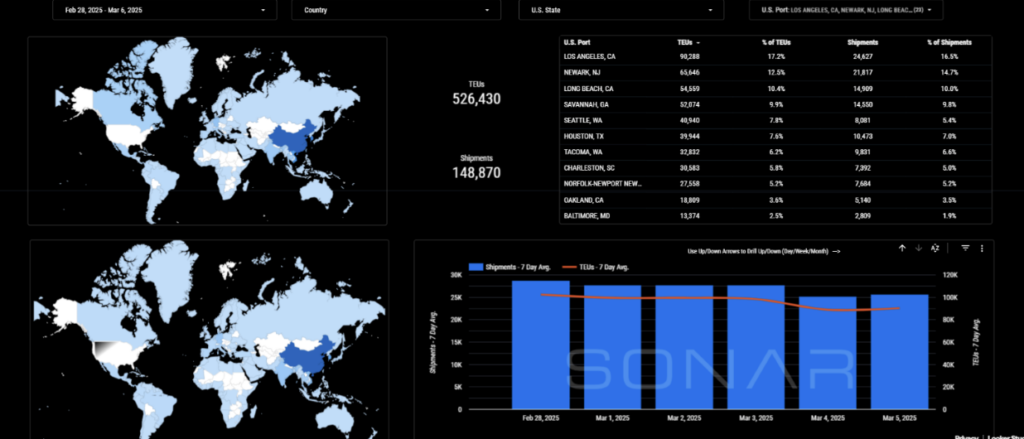

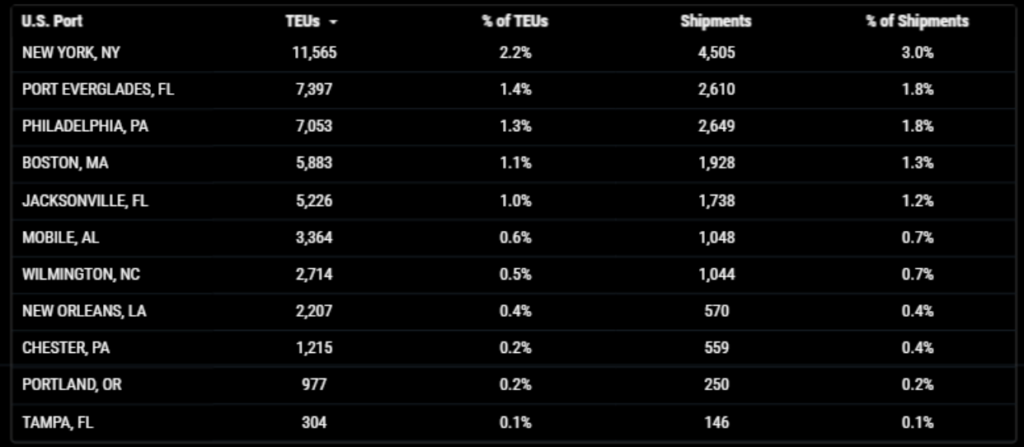

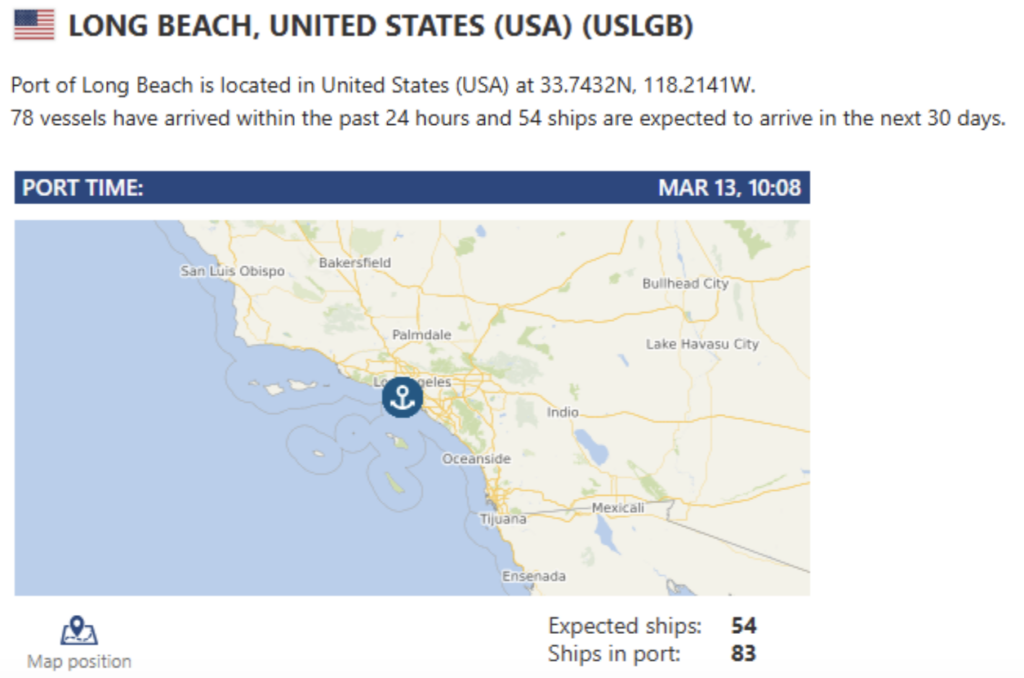

Import TEUs are up 3.72% this week from last week – with the highest volumes coming into Long Beach 17.9%, Los Angeles 13.8% and Newark 13.3%. Retail spending declined on a monthly basis in February amid concern over tariffs, but continued to grow year over year as the economy remained strong according to the CNBC/NRF Retail Monitor, released on Monday by the National Retail Federation (NRF). The February decline came as President Donald Trump announced 10% tariffs on goods from China and 25% tariffs on goods from Canada and Mexico at the beginning of February. The Canada-Mexico tariffs were immediately delayed by a month, then delayed again for most goods until April 2 last week, but the tariffs on China were doubled to 20%. The University of Michigan’s Index of Consumer Sentiment dropped to 64.7 in February from 71.7 in January, marking the second monthly decline after five months of small gains.

Consumer spending dipped slightly again in February due to the combination of harsh winter weather and declining consumer confidence driven by tariffs, concerns about rising unemployment, and policy uncertainty,” NRF President and CEO Matthew Shay said in a release. “Unease about the probability of inflation and paying higher prices for non-discretionary goods has the value-conscious consumer spending less and saving more. But for the moment, year-over-year gains reflect an economy with strong fundamentals.” By the numbers, total retail sales, excluding automobiles and gasoline, were down 0.22% seasonally adjusted month over month but up 3.38% unadjusted year over year in February, according to the Retail Monitor. That compared with a decrease of 1.07% month over month and an increase of 5.44% year over year in January. The Retail Monitor calculation of core retail sales (excluding restaurants in addition to automobile dealers and gasoline stations) was also down 0.22% month over month in February but up 4.11% year over year. That compared with a decrease of 1.27% month over month and an increase of 5.72% year over year in January.

What’s happening at the ports and rails?:

You can find all the information on the below link where we cover port congestion, chassis issues and capacity lead times weekly at all U.S. and Canada Ports and rail heads on our website – click on the link below

CLICK HERE For Port & Rail Updates

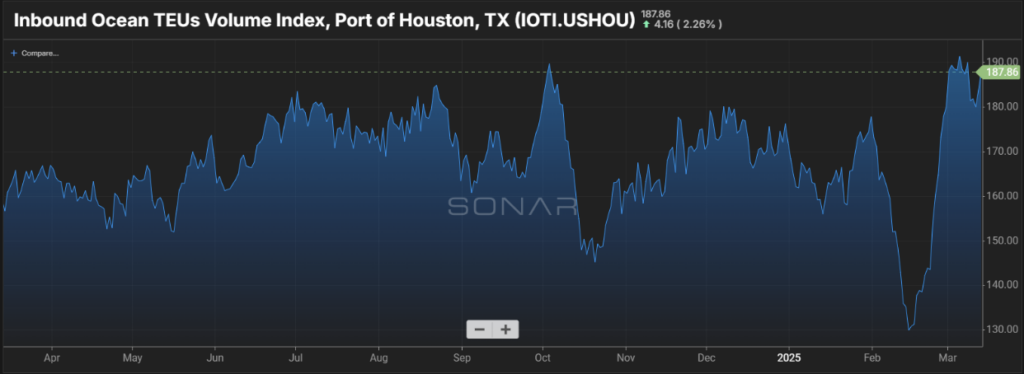

Houston: Dallas-based pipeline operator Sentinel Midstream LLC received approval in February from the U.S. Maritime Administration (MARAD) to move forward with the Texas Gulflink terminal, its deep-water port off the coast of Brazoria County, south of Houston. The joint venture will construct a new Texas City export terminal and connecting pipeline called Texas City Logistics LLC on Galveston Bay, southeast of Houston, primarily for low ethane propane and normal butane. Oneok and MPLX will each invest about $700 million for the export terminal. The Port of Houston Authority has also been awarded nearly $25 million in grants from the Department of Transportation and the Federal Highway Administration to develop a hydrogen fueling station for heavy-duty trucks in the Bayport area.

Summit Next Gen has advanced into the final phase of engineering and project design for the facility on a 60-acre site with an option to purchase another 40 contiguous acres. The final investment decision is expected in mid-2025, with operations to begin in 2027. Port X Logistics has drayage assets in Houston 32 trucks with the capability of long-haul drayage and we have a transload warehouse in LaPorte that can transload anything from standard pallets, to heavy lumber and industrial coils. If you need help in the Houston area we got your back, we also have a drayage network with 19 trucks and yard space servicing the Dallas area contact letsgetrolling@portxlogistics.com

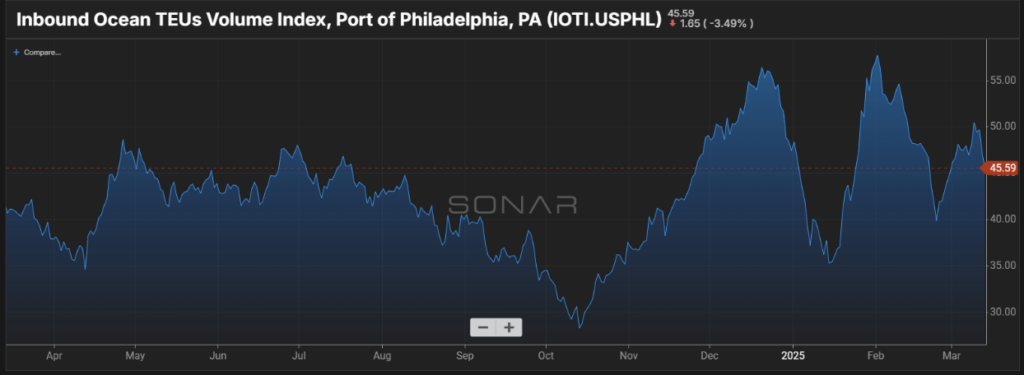

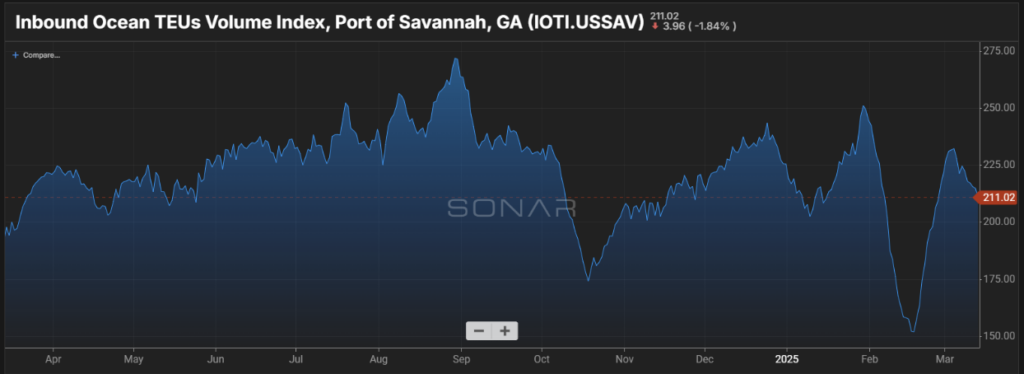

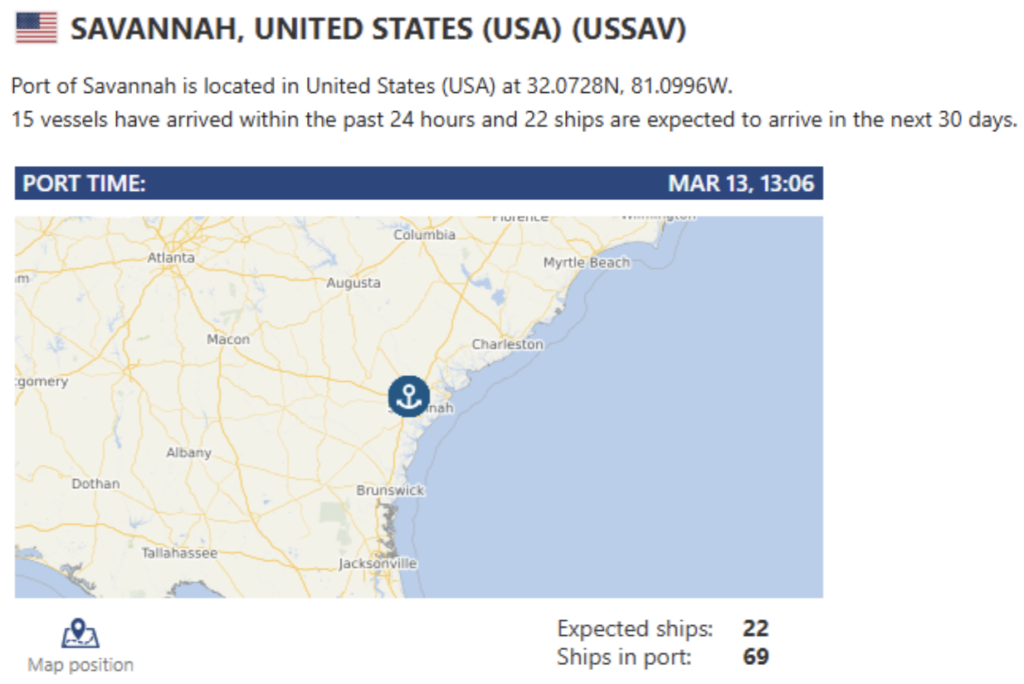

Savannah: The Georgia Ports Authority continues to expand its infrastructure and strengthen partnerships to meet growing demand, with plans to increase capacity at the Ports of Savannah and Brunswick. The expansion is needed to handle growing business – GPA handled nearly 5.6 million twenty-foot equivalent container units (TEUs) last year, an increase of approximately 618,000 TEUs compared to 2023. That made Savannah the fastest growing container gateway on the U.S. East and Gulf coasts. Phase I of the Ocean Terminal yard renovation will be completed in mid-2027; the second phase by mid-2028. This will increase capacity by up to 1.5 million TEUs per year. Our South Atlantic operation also has a drayage fleet of 12 trucks with drayage service to and from Savannah, Charleston and Jacksonville ports including hazmat as well as container yard space and we have a full service transload warehouse in Savannah and can handle any last-minute urgent transloads and cross docks Contact the team sav@portxlogistics.com for great rates and supreme customer service.

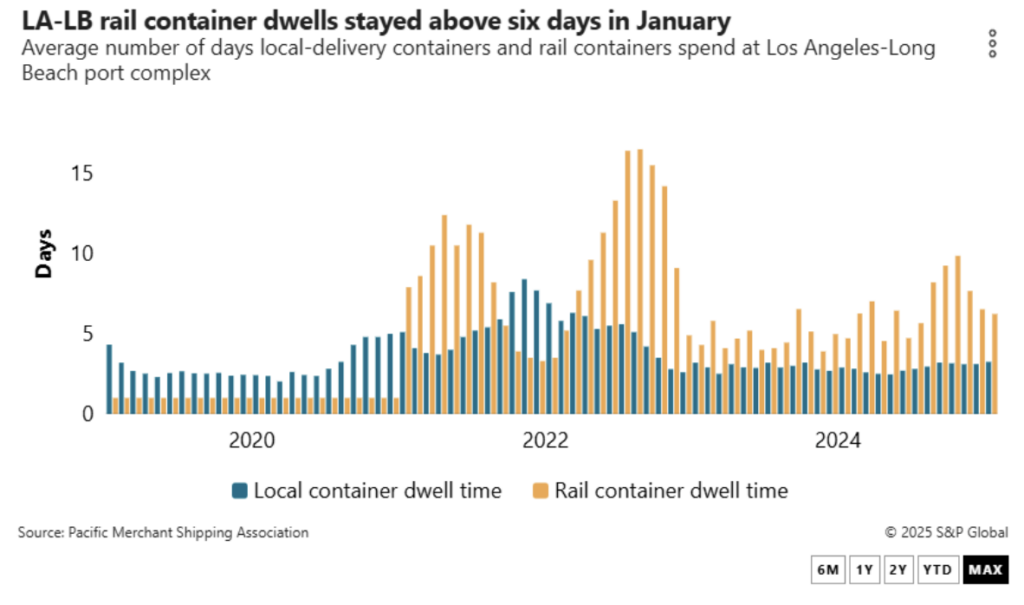

LA/Long Beach: Rail dwell times at LA ports are an average of 6.4 days, 14,741 containers currently on dock; 6,175 containers with a dwell at nine plus days. A topic at TPM25 was how rail dwell times at marine terminals along the U.S. West Coast must come down from last year’s elevated peak season levels to prevent shippers from diverting cargo to the East Coast. Across all the terminals in Los Angeles and Long Beach, average rail dwell times peaked at 9.9 days in October, according to the Pacific Maritime Shipping Association (PMSA). OpenTrack data suggests delays were more severe in Los Angeles than in Long Beach. One reason for the higher dwells is the at-times spotty communication between ocean carriers, terminal operators and railroads. While that has improved over the last five years, gaps remain. If you choose to divert your urgent containers due to long rail dwell and are looking for immediate capacity, our Los Angeles location boasts a large drayage fleet, a large, secured yard with plenty of storage space and a transload warehouse with immediate capacity to pull your containers for transloads. Our capacity is tendered to on a first come first serve basis – We ALSO have access to OpenTrack and can track your containers from the moment they get loaded to the overseas vessel all the way to the U.S. port of arrival. Contact the team at letsgetrolling@portxlogistics.com with your new orders today.

Did you know? We are a premier sponsor again for the 2025 Empire State Ride and if you are in the Buffalo area please join us for a night of ESR fundraising fun! PORT X’S VERY OWN PAT MORRISON WILL BE BEHIND THE BAR AS THE GUEST BARTENDER FOR THE EVENING!!

Port X / Empire State Ride Fundraiser @ Fattey Beer Co.

5 Genesee St. Buffalo, Ny 14203 ~ Thursday April 10th 6pm – 10pm.

$1 from every draft will be donated directly to ESR *Beer/Cider on draft & Beer/Cider/Seltzers/Wine/Non-Alcohol cans/bottles available as well. Events include a 50/50 drawing and basket raffle. Food is available for purchase onsite or can be brought in. For additional information on the event or how you can donate contact marketing@portxlogistics.com

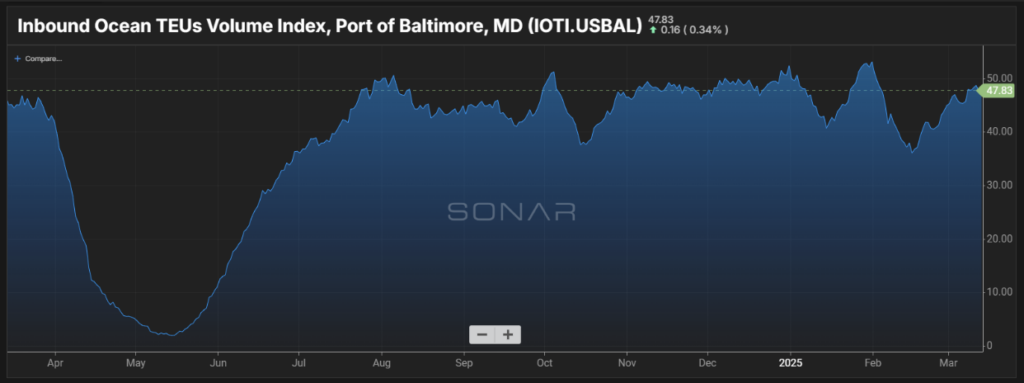

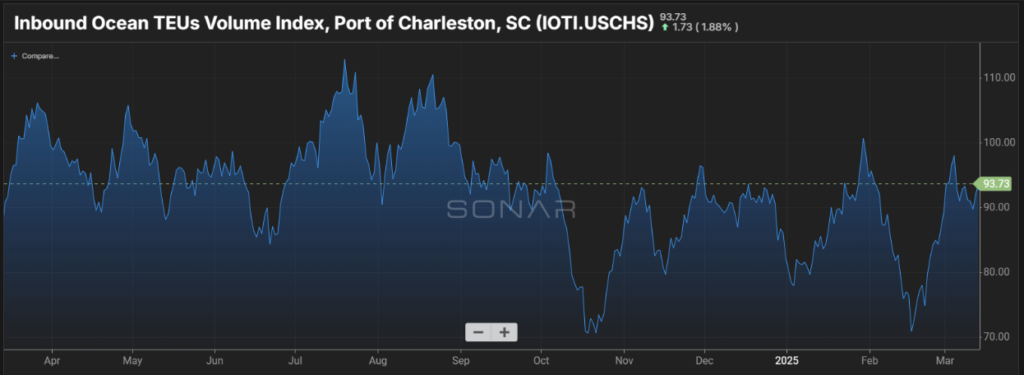

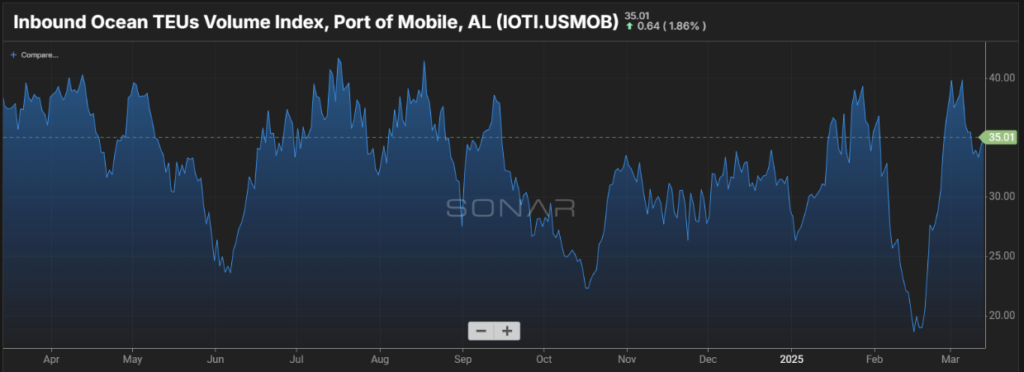

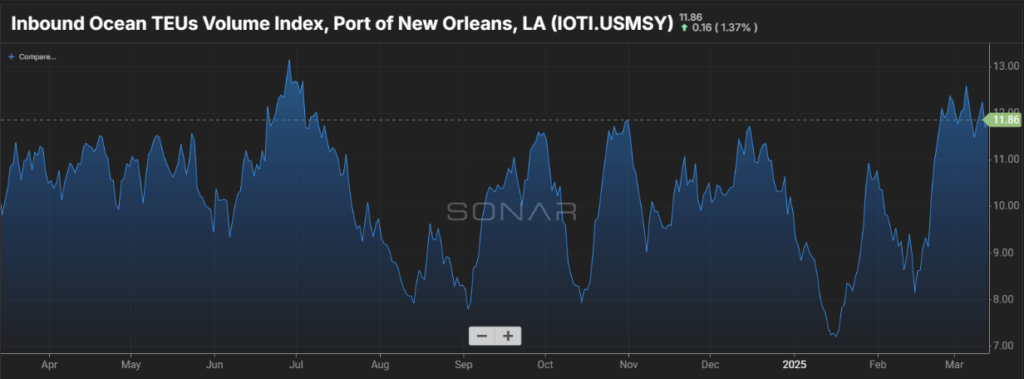

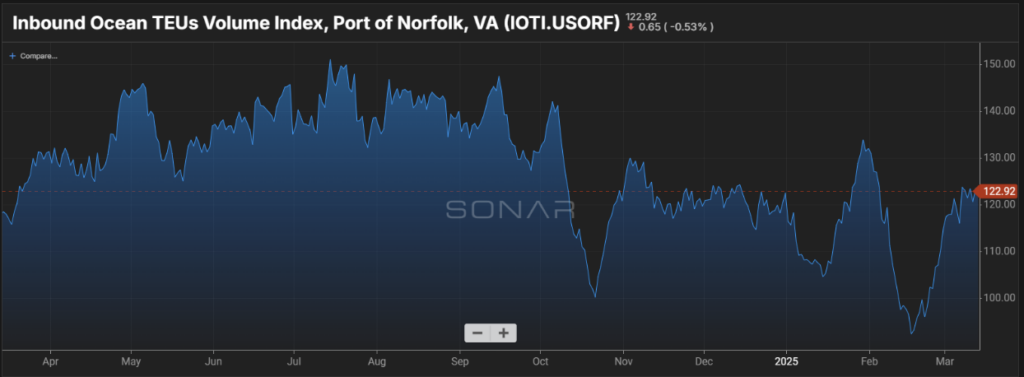

SONAR Import Data Images